About a week ago, Grayscale’s Ethereum Trust (ETHE) was trading at a 23.78% discount to NAV. A discount to NAV occurs when the market price of a closed-end fund or exchange-traded product (ETP) is lower than its net asset value per share. Essentially, the NAV is the per-share value of the fund’s assets minus its liabilities, divided by the total number of shares outstanding.

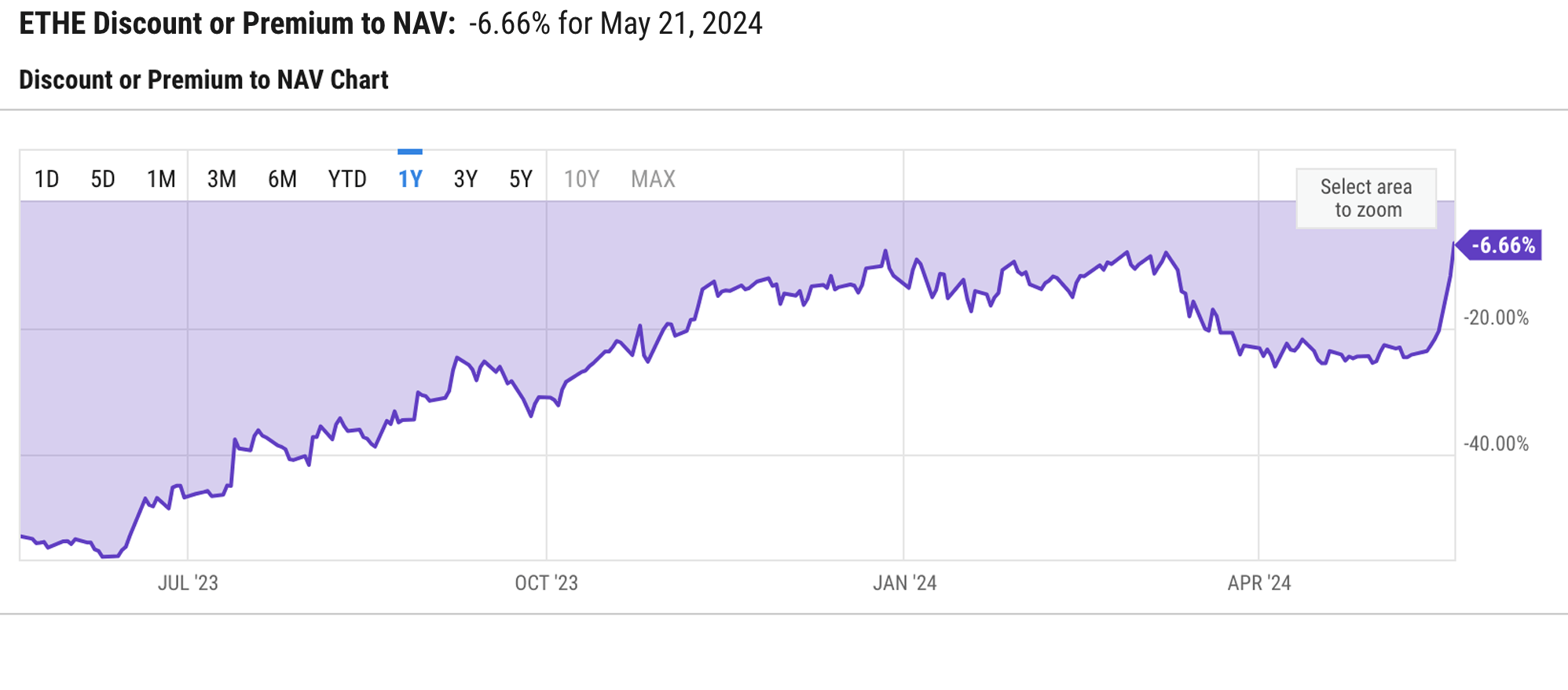

Grayscale’s Ethereum Trust (ETHE) discount or premium to NAV via ycharts.com.

With the anticipation of ETH ETFs being approved, Grayscale’s ETHE fund has seen a significant reduction in its discount to NAV. As of May 21, 2024, the discount has narrowed to its lowest level since 2021 at 6.66%. ETHE currently trades publicly on over-the-counter (OTC) markets but lacks a redemption program, leading shares to trade at premiums or discounts to the underlying ethereum holdings.

Grayscale Ethereum Trust (ETHE) aims to become a publicly traded ETF through a process called “uplisting,” subject to SEC approval. Like its Bitcoin Trust, Grayscale believes its SEC-reporting products, including ETHE, present a compelling case for converting to an ETF structure. Along with the narrowing discount to NAV, Grayscale removed staking features from its ETF proposal on Tuesday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。