Explore the growth, diversity, and usage patterns of the $160 billion stablecoin market.

Authors: Matías Andrade, Tanay Ved

Translation: Luffy, Foresight News

Key Points:

- Market Growth: The stablecoin market has grown from less than $100 billion in 2020 to over $160 billion today, with significant contributions from USDT and USDC.

- Usage and Adoption: Stablecoins are widely used for trading, with the transfer volume affected by blockchain transaction fees. As of April, the weekly adjusted transfer volume exceeded $50 billion.

- Global Utility: USDC on Ethereum shows moderate activity during Hong Kong Stock Exchange (HKSE) and London Stock Exchange (LSE) trading hours. In contrast, USDT on Tron exhibits higher and more evenly distributed trading activity.

Introduction

The US dollar has long been the world's reserve currency. However, as BRICS countries such as China, Brazil, and Russia explore alternative solutions for international trade, and central banks diversify their reserves into assets like gold to replace US treasuries, the dollar's position is being challenged. In contrast, the emergence of stablecoins (digital tokens issued on the blockchain, collateralized by fiat currency, cash equivalents, or crypto assets) is driving the entire financial ecosystem's demand for the dollar and treasuries.

Stablecoins are crucial not only for the United States but also for economies with a scarcity of dollars and emerging markets facing currency instability or limited financial service channels. The market size has now exceeded a staggering $160 billion, providing various stablecoins and infrastructure support for consumer and commercial applications such as cross-border payments, ranking the demand for US treasuries only after the top 15 countries, surpassing most countries in the world.

In this week's "Network Status," we evaluate the growth and usage patterns of stablecoins and conduct an in-depth analysis using our newly developed dashboard.

Overview: Diversity and Expansion of Stablecoins

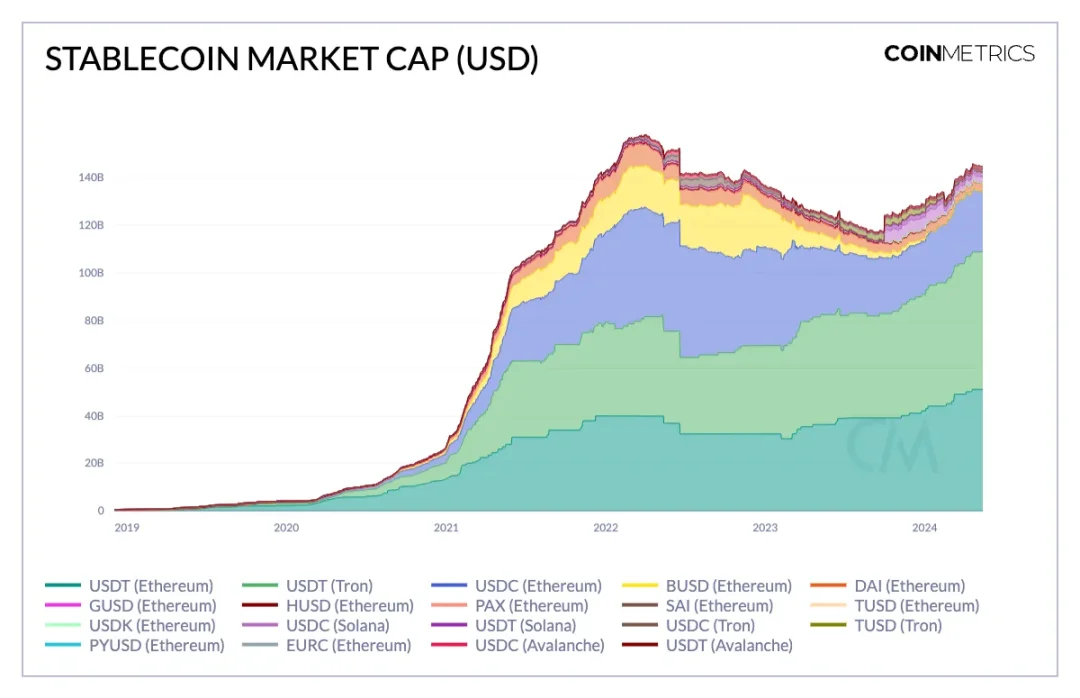

The global influence of stablecoins is gradually expanding, with the total market value growing from less than $100 billion in 2020 to over $160 billion today. Despite experiencing a decrease in stablecoin supply due to liquidity tightening from central bank policies and the chain reaction of the Terra Luna collapse in 2023, the recent surge may reflect a renewed demand for crypto assets, aided by the introduction of a Bitcoin spot ETF in the United States.

The fiat-backed stablecoin USDT issued by Tether continues to dominate, with $510 billion (44%) circulating on Ethereum, $580 billion (52%) on the Tron network, and the rest on Solana and Avalanche. Tether's Q1 2024 report shows a staggering net profit of $4.52 billion, doubling from the previous quarter. This impressive feat highlights the advantage of business models of stablecoin issuers like Tether and Circle, whose tokens are backed by low-risk assets such as US treasuries and cash, while also holding investments like Bitcoin or gold that generate income in the current interest rate environment.

As of March 2024, Tether and Circle hold $100 billion and $740 billion of US treasuries, respectively, as part of their reserves. Tether's treasuries are held by Cantor Fitzgerald, while Circle's treasuries are managed by BlackRock through money market fund management.

Source: Coin Metrics Network Data Pro

Offshore entity Tether has taken advantage of the regulatory ambiguity in the United States, posing a challenge to Circle last year, while USDC had a good start in 2024. USDC's growth seems to stem from deep strategic ties with Coinbase and cross-chain expansion to networks like Solana and Ethereum Layer 2, enhancing its market influence and liquidity. Additionally, the integration of Circle with BlackRock's BUIDL tokenized fund allows investors to convert their shares into USDC, potentially expanding USDC's ecosystem and driving broader adoption.

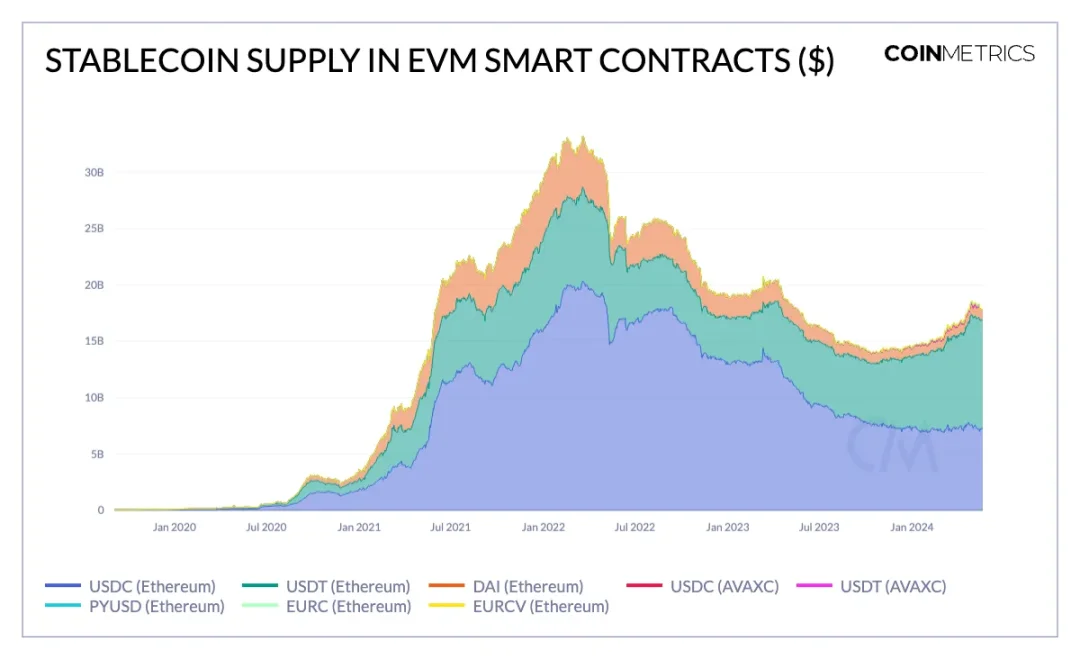

The stablecoin market is still dominated by fiat-backed products like USDC and USDT to meet the widespread demand for assets pegged to the dollar. The success of established issuers has attracted notable newcomers, such as PayPal issuing PYUSD on Ethereum. Cryptocurrency stablecoins collateralized by a basket of crypto assets and real-world assets (RWA), such as MakerDAO's DAI, have also gained attention. Additionally, synthetic or algorithmic stablecoins like Ethena's USDe, which use dynamic hedging strategies to maintain the peg to the dollar without over-collateralization, have emerged. This category also includes stablecoins issued by DeFi protocols, which have become core to their business models, such as Aave's GHO and Curve's crvUSD. These different stablecoins cover a range of reserve support models, each with its unique risk and return characteristics.

Source: Coin Metrics Network Data Pro (Note: This chart does not include stablecoins issued on Ethereum Layer 2)

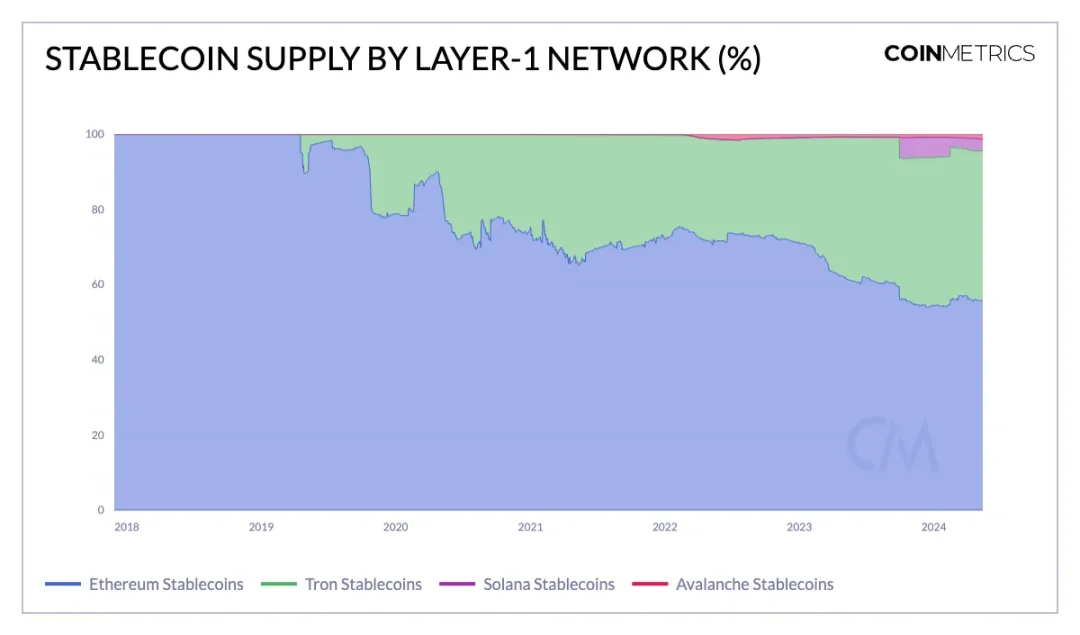

Currently, the largest circulating market for stablecoins (55%, $810 billion circulating supply) is on Ethereum. The most widely adopted and liquid stablecoins have long garnered attention on Ethereum, leveraging its security and the vast developer base around the Ethereum Virtual Machine (EVM) ecosystem, deepening its network effects.

Tron has established a strong position in the stablecoin market, capturing 39% market share, while other stablecoins on networks like Solana and Avalanche are also making progress. Features such as faster on-chain transaction speeds and lower transaction fees make networks like Solana attractive for high-frequency and low-value stablecoin use cases, as revealed in Stripe's recent announcement of a payment system. Similarly, as lower fees drive user activity towards these scalable solutions, Ethereum Layer 2 (such as Arbitrum and Base) has also seen stablecoin growth.

Characteristics of Stablecoin Adoption

While the vibrant growth of stablecoins is evident, there are still questions surrounding the nature of stablecoin usage and adoption. For example, to what extent do stablecoins promote actual economic value? Are stablecoins held as a store of value or used for trading purposes? What are the typical transfer sizes of stablecoins and who do they serve? Although these questions are difficult to answer definitively, the transparency of blockchain data can help us better understand the characteristics of stablecoin activity.

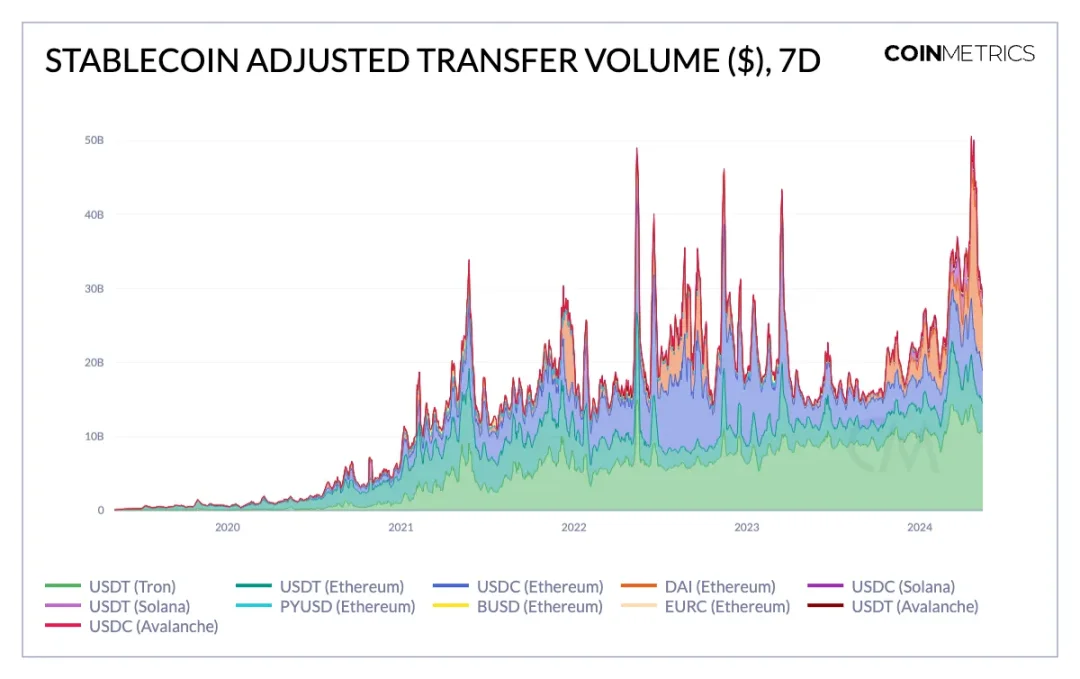

Source: Coin Metrics Network Data Pro

In April, the weekly adjusted transfer volume between different stablecoin addresses exceeded $50 billion. 48% of the activity came from USDT on Ethereum and Tron, while DAI set a record transfer volume of $22 billion on April 19. Although this metric has seen several spikes, it reflects the utility of stablecoins as a settlement method.

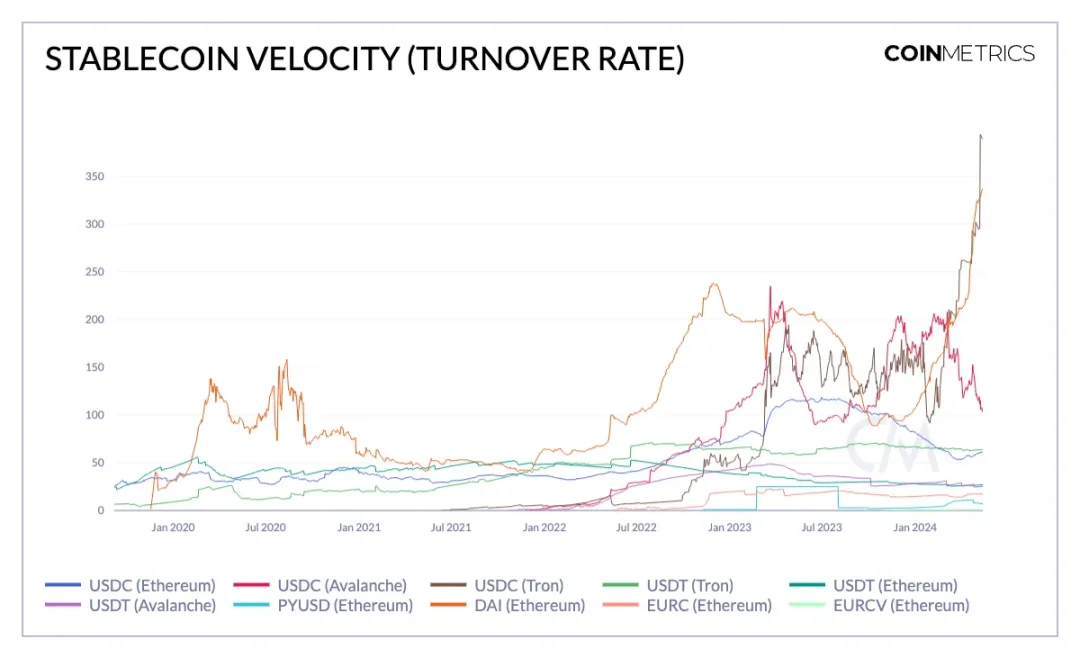

When considering the transfer volume in relation to the circulating supply of stablecoins, we can better understand the circulation speed, or turnover rate, of stablecoins. However, it's important to explain this metric in the correct context. USDC on Tron shows the highest speed, possibly due to Circle's decision to gradually stop supporting it, reducing the supply but increasing transfers of USDC to other blockchains.

Despite a decrease in supply, DAI's usage continues to increase due to its strong on-chain footprint and Dai Savings Rate (DSR), a smart contract that effectively acts as a savings account for deposited DAI, resulting in a peak circulation speed. MakerDAO's governance frequently implements strategic adjustments to drive DAI usage, such as recently increasing interest earned from DSR. The speeds of USDC on Ethereum and USDT on Tron are currently at similar levels, with USDC potentially seeing greater turnover on networks like Avalanche, Solana, and Layer 2.

Source: Coin Metrics Network Data Pro

We can also assess the extent to which stablecoins serve as a store of value or are used on-chain by examining the supply held in smart contracts and externally owned accounts (EOA). For example, while EOAs hold $41 billion of USDT (Ethereum), the amount stored in smart contracts has more than doubled since January 2023, reaching $9.6 billion. In fact, the value of USDC in smart contracts now exceeds $2.3 billion. This indicates that stablecoins are increasingly playing a role in facilitating transactions on decentralized financial applications and other public chain infrastructure, in addition to serving as a store of value or hedging against inflation.

Source: Coin Metrics Network Data Pro

The median transfer value of stablecoins helps understand the typical transfer size. This metric is highly influenced by the fees and transaction capacity of the issuing blockchain. For example, USDC and USDT on Ethereum have the highest median transfer values, averaging $500 per transfer. On the other hand, the median transaction size of USDT on Tron is $230, and stablecoins on Solana show the smallest transfer values, indicating a prevalence of high-frequency, low-value transfers due to Solana's low transaction fees of just $0.01.

Temporal Characteristics of Stablecoin Activity

One of the most important value propositions of stablecoins is their global utility, enabling 24/7 value transfer. Our previous analysis of the geographical advantage of stablecoins showed that North America and Western Europe tend to use USDC, while USDT's trading volume is mainly in Asia, Africa, and Latin America. However, using Coin Metrics ATLAS's 1-hour trading data, we can also discern time patterns in activity, revealing the most active periods.

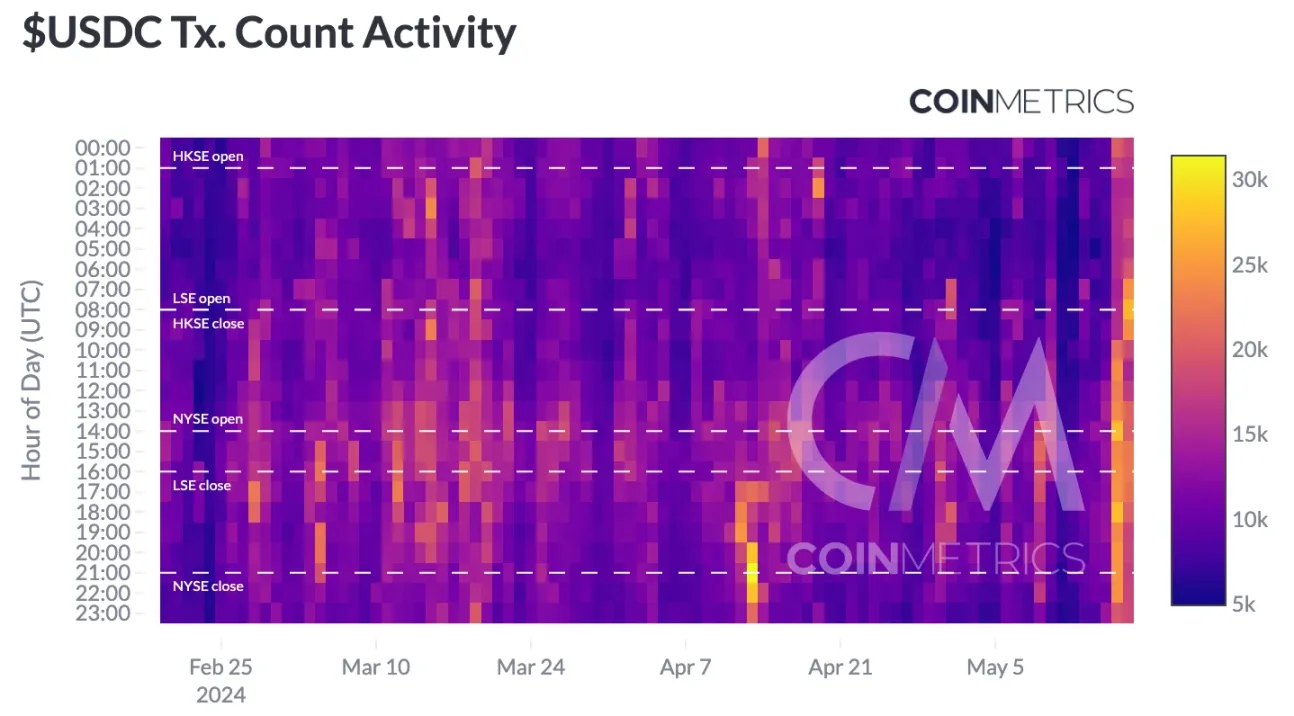

Source: Coin Metrics ATLAS, Coin Metrics Stablecoin Dashboard

The heatmap shows the hourly trading activity of USDC on Ethereum and USDT on Tron over the past 3 months, overlapping with major stock market trading hours. USDC activity appears relatively dispersed, with moderate activity during Hong Kong Stock Exchange (HKSE) and London Stock Exchange (LSE) trading hours. The most prominent peaks occur at the opening and closing of the New York Stock Exchange (NYSE), indicating its stronger influence in the US market.

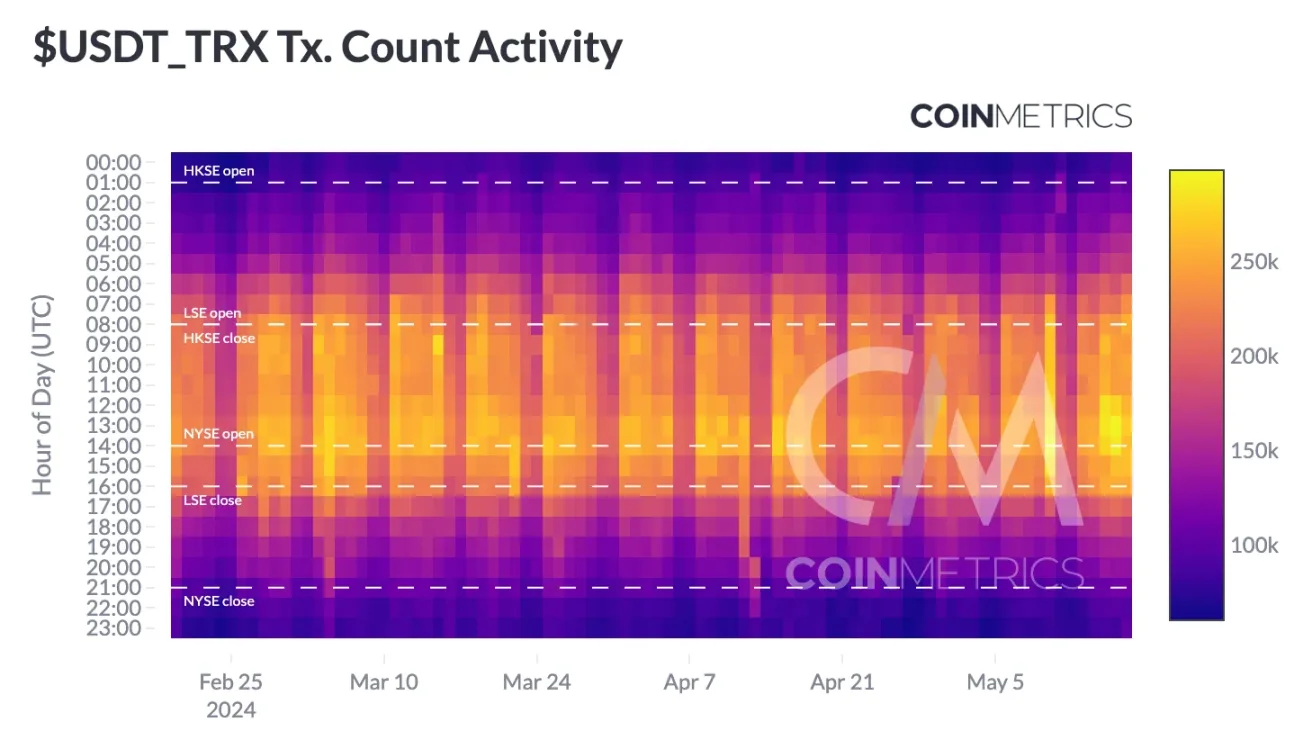

Source: Coin Metrics ATLAS, Coin Metrics Stablecoin Dashboard

On the other hand, the trading activity scale of USDT on Tron is significantly larger and appears more evenly distributed. The concentration of USDT's trading activity gradually increases from the opening of the Hong Kong Stock Exchange to the closing of the New York Stock Exchange, with both stablecoins showing higher concentration of trading activity in the past week.

Role in Centralized and Decentralized Trading Markets

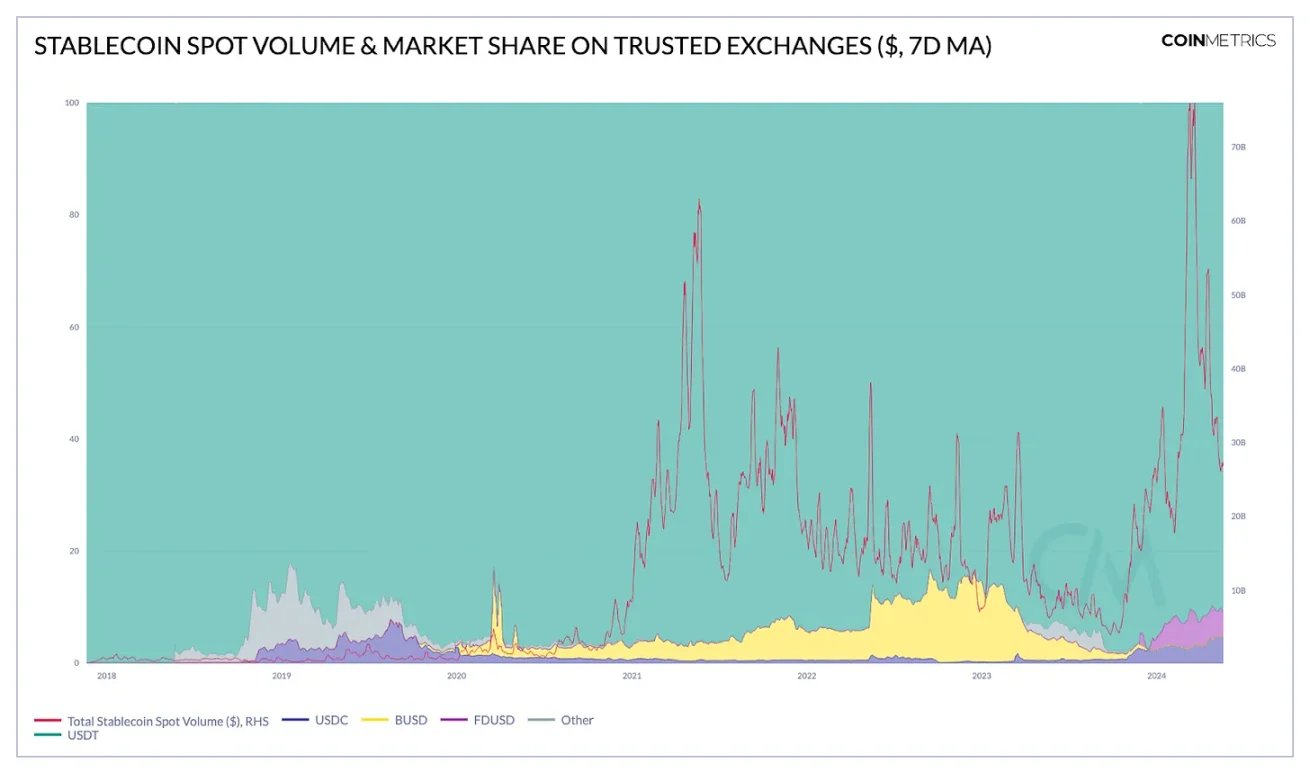

As the primary base currency for digital asset trading, stablecoins play a significant role in traditional spot and derivative exchanges as well as decentralized exchanges (DEX). In March 2024, the spot trading volume of stablecoins on reputable centralized exchanges increased by $75 billion. Currently, USDT accounts for 90% of spot trading volume, while USDC and FDUSD each account for 5%, and BUSD's market share has decreased.

The stablecoin First Digital USD (FDUSD) issued by Hong Kong digital asset custodian First Digital Trust Limited has gained significant market share and liquidity on Binance. With the launch of Coinbase International Exchange, the market presence and liquidity of USDC-related trading pairs in the spot market have increased from 0.6% in October to nearly 5% today.

Source: Coin Metrics Market Data

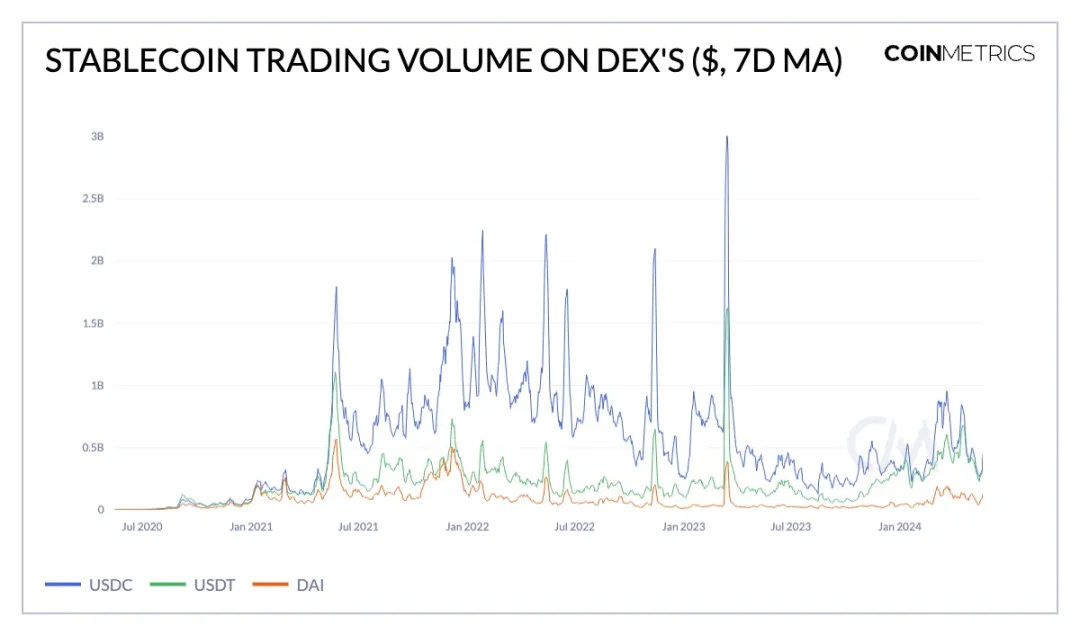

Although stablecoin trading volume is lower than traditional fiat, it is an important component of DEX liquidity pools, Layer 1, and Layer 2 trading activity. The ETH-USDC market of Uniswap v3 and the 3Pool stablecoin liquidity pool of Curve Finance facilitate a considerable portion of on-chain trading. Compared to traditional exchanges, USDC holds a 45% market share in DEX, while USDT's share has recently risen to 42%.

Source: Coin Metrics DEX Market Data

Conclusion

Stablecoins are becoming an integral part of the global financial system, facilitating transactions and serving as a store of value tool. Their adoption patterns are influenced by blockchain transaction fees, highlighting their utility in cross-border payments and DeFi applications. As stablecoins continue to evolve, their importance in the financial sector will continue to grow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。