This is truly a story sadder than sad.

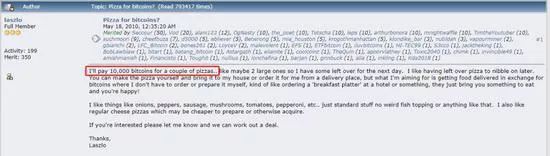

On May 18, 2010, programmer Laszlo posted that he hoped to exchange 10,000 bitcoins for 2 large pizzas. Three days later, cryptography enthusiast jercos spent $25 to buy two pizzas and sent them to Laszlo, in return for 10,000 bitcoins.

Looking back at the environment at that time, perhaps this story wasn't so sad after all:

At that time, it had only been a little over a year since the birth of the first Bitcoin genesis block. Bitcoin was just a tool for cryptography enthusiasts to reward each other and did not have a price anchored to fiat currency. Perhaps no one had thought of using it to exchange for money. The genius programmer Laszlo, by using pizza as a means of exchange, unintentionally gave Bitcoin a pricing, inadvertently advancing the process of virtual digital currency becoming fiat. He also became the first person to purchase goods with Bitcoin, making it into history.

At that time, the competition for Bitcoin mining power was minimal. Laszlo used GPUs instead of CPUs for mining and could receive 1-2 block rewards per hour. At that time, a block reward was 50 bitcoins. On May 17 alone, he received 1,400 bitcoins in rewards. Based on the low cost of Bitcoin mining at the time, this guy may have had a lot of bitcoins, so perhaps exchanging some for pizza wasn't a big deal.

At that time, being able to access virtual digital currency and still being able to earn income through mining, if one had continued to participate in virtual digital currency mining over the past 10 years and made some investments, even if they missed out on Bitcoin, they could have grabbed onto Litecoin, Ripple, Ethereum, and so on. As long as they grabbed onto any one of them, there was a high probability of achieving financial freedom in the eyes of the world.

However, the sad story still happened:

After tasting the sweetness of buying pizza for the first time, Laszlo spent another 40,000 bitcoins on pizza. When the value of Bitcoin rose to $1, he sold all his bitcoins for a new computer.

Today, Laszlo is still a programmer at the Florida online retail company GoRuck, not much different from his profession when he bought Bitcoin 9 years ago.

Jercos, who received the 10,000 bitcoins, did not wait for Bitcoin to reach its peak of $20,000 in December 2017. After the 10,000 bitcoins had increased in value by more than 10 times, he sold them as well.

Surely, friends who entered the market in the past year have sighed with regret. If only they had entered the field of digital currency a few years earlier, they might have already achieved financial freedom. However, after seeing this story of Bitcoin being exchanged for pizza, you should understand a truth: many things are missed, and that's it. Making "if only I had known earlier" assumptions is meaningless.

Similar stories are not unique to the field of virtual digital currency.

You must have heard of Xiao Wang from Beijing, who sold a small courtyard in Beijing for less than 300,000, went abroad to work hard, earned 6 million, and now that he's back home, he finds that the courtyard he sold has skyrocketed to 80 million, and he's immediately hospitalized due to shock.

Or, Li Zekai, the son of Li Ka-shing, who held 20% of Tencent's shares, sold them to the MIH Group in South Africa for $12.6 million in 2001, missing out on over 400 billion.

And so on…

In any investment in appreciating assets with value fluctuations, including gold, jewelry, art, antiques, stocks, real estate, and so on, there are countless regrets like these. The so-called "buy and hold" principle, not blaming love, should be followed once the investment enters the market.

Bill Gates once said, "Real wealth = concept + time." It can be seen that obtaining any wealth requires the test of time, and during this period, the paper gains and losses are the greatest test of your concepts and understanding.

Through the Bitcoin pizza incident, we should at least gain the following insights:

I. Rational investment has limitations, and upgrading cognition is the hard truth

It seems like a group of people are mocking a fool, but in fact, everyone is quite ordinary.

Many people say that if those 10,000 bitcoins hadn't been used to buy pizza back then and had been sold at the peak in 2017, they would have been worth at least $160 million. So, everyone unconsciously speculates on the shadow in Laszlo's heart, feeling that he is a fool, missing out on becoming a millionaire.

However, if Laszlo's life were experienced by most people, probably over 99% of them would have made the same choice. Just like how we envy friends who invested in Bitcoin at $300-500 in the early years, thinking that they are already financially free. In fact, even for friends who entered the field of digital currency in the early stages, the number of people who truly achieved financial freedom is very small. Most people either bought a lot of bitcoins but lost their private keys, or bought bitcoins at a very low price and sold them when the price increased by 10-100 times, or after missing out on Bitcoin, were haunted by the shadow of regret and completely bid farewell to the field of digital currency investment.

In any case, the people who truly made money from investing in digital currency did not rely on rational investment logic, but rather their initial blind faith and incomprehensible madness. If we were to call them winners in life, it would be entirely due to their advanced cognitive abilities and psychological resilience against financial market fluctuations.

Li Xiaolai once joked that his digital currency account could gain 200 million after a night's sleep, and then lose 100 million after another night's sleep. Despite such fluctuations, he was still able to invest based on the value of the currency. The height of his cognition is something that we find difficult to reach.

On February 25 last year, Laszlo spent 0.00649 BTC through the Lightning Network to buy 2 more pizzas. Despite the sad story of missing out on billions, Laszlo said he has no regrets and that the pizza he got was very delicious.

This carefree attitude is quite worthy of our admiration.

II. High-return investment opportunities still exist, but the chance for a low initial capital comeback may be gone

History will not repeat itself, but it will be surprisingly similar.

Many people like to use the pizza incident as an example and advise people around them to hold onto a coin steadily, to avoid causing another tragedy like the pizza incident. In fact, such concerns are somewhat unnecessary. The ten million-fold increase in Bitcoin is a once-in-a-lifetime opportunity. After that, Ripple also once increased by tens of millions of times. In recent years, Ethereum, Litecoin, BNB, and other mainstream currencies have also had extraordinary investment returns.

Taking Binance's platform coin BNB as an example, it went online in July 2017 and experienced a break, dropping to a low of 0.6 yuan. It has now risen to 230 yuan. Although its increase is not as crazy as Bitcoin's, it is another rare opportunity for all of us to obtain wealth appreciation, yet how many people have seized it? In the forum, we will see many people expressing their regret, complaints, and grumbling after missing out. It's just like many people who missed out on Bitcoin back then. Come on, let's mimic the mouth shape: "That person looks so strange, he looks like a dog."

So, will there be another investment opportunity like Bitcoin in the future?

The probability is very low. Because for most people, what they lack is not high-return rates, but the opportunity for a low initial capital comeback. Unlike investing in real estate, secondary market stocks, primary market angel investments, the initial investment in early Bitcoin was minimal. While real estate and stocks may seem to have high return rates, the initial capital required is something that most people cannot afford. For example, 20 years ago, the average price of a house in Beijing was 2,000 yuan, which seems incredibly low by today's standards, but at that time, the monthly salary was less than a thousand yuan. How many people could afford to buy a house?

Now that everyone has a general understanding of Bitcoin, they may want to invest in it, but a price of over 50,000 yuan will make most people hesitate, even if you tell them that Bitcoin could rise to 1 million or even 10 million per coin, very few people would sell their houses or cars to gamble on tomorrow with Bitcoin (even if they did, it is not recommended).

Influenced by the Bitcoin pizza incident, many people now choose to invest in some altcoins when investing in digital currencies, attempting to achieve financial freedom through low-cost investments in altcoins that often see hundredfold or thousandfold growth. Sadly, such projects lack the most basic characteristics of Bitcoin: a scarce and irreplaceable total supply (consensus), and continuous appreciation in circulation.

Many of the hundredfold coins now are not open-source, and their code can be arbitrarily changed. Some are even coins created through manipulative funding schemes, with manipulators behind the scenes. Most people will still end up being "harvested," and after one round of harvesting, they will change their tactics and harvest again using the same scheme, never giving you a chance to escape.

This is the cruel contradiction in investing in digital currencies at the moment: the investment capital for valuable assets is too high, and the deceptive nature of investments in non-valuable assets is too strong.

III. "Zen holding" may no longer be the best choice

Mainstream media is still vigorously promoting the high returns of storing digital currencies, leading to a mistaken belief for most people that investing in digital currencies must be done with a "zen holding" approach, and that buying and selling will only increase the risk of missing out and getting trapped.

Although historical experience tells us that the returns from "zen holding" may be the highest, the original vision of Bitcoin at its inception was for it to be used for circulation. As a peer-to-peer electronic cash system, its use in payment scenarios should be greater than other uses. Laszlo's Bitcoin pizza transaction event gave Bitcoin a stronger circulation attribute, which is definitely a significant contribution in the history of Bitcoin's development.

Of course, due to Bitcoin's block capacity and delayed confirmation characteristics, using Bitcoin for full circulation still faces significant challenges. However, the emergence of sidechains and the Lightning Network is making efforts in this direction. The price volatility of Bitcoin in reality is due to information asymmetry, with early investors with chips releasing them to new investors at current prices, and this process may continue for 3-5 years or even longer.

During this period, early users still have the opportunity to obtain high premiums. When the chips are dispersed to a certain extent, Bitcoin for storage purposes and Bitcoin for circulation purposes may diverge, and Bitcoin may truly become digital gold, while other coins such as stablecoins may become the most circulated chips. At that time, the Bitcoin pizza incident may become a legendary tale. At that time, there may truly be a sense of regret for missing out on an era.

It should be said that the next 3-5 years are the best time to get on board, but it is not simply understood as spending 5,000 yuan to invest in 0.1 Bitcoin. Even if it grows 20 times, so what? However, if you add on technical learning and cognitive improvement in the blockchain industry to your investment foundation, find opportunities in the gaps where blockchain integrates traditional application scenarios, and find security in the soft power of industry recognition improvement, this will be much more meaningful than simply speculating on coins.

For young people who dream of turning their fortunes in the digital currency market, "zen holding" may truly no longer be suitable. Learn a little about finance, grasp the rules of the rise and fall of digital currencies, make reasonable dollar-cost averaging investments during bear markets (low cost, low risk), cooperate to make short-term trades during the transition from bear to bull markets (compound interest, expand capital), and cash out at the peak of the bull market. This is the correct logic for playing the digital currency market.

Daring to buy is a breakthrough in cognition, and being willing to sell is the ability to seize the opportunities of the times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。