The article comprehensively discusses the concept of RWA from multiple perspectives, elaborating on how blockchain realizes the tokenization of assets and its wide application in financial services, while also pointing out the regulatory and technological issues that need to be addressed for its popularization.

Author: Kevin Do

Translation: Plain Blockchain

Real-world assets (RWA) is a topic that you may have seen a lot of discussion about online. It is an interesting topic and also a part of the puzzle in the cryptocurrency market.

Real-world assets (RWA) is a trend with enormous potential in the market, and undoubtedly, it will become a very hot topic in the near future.

The combination of real-world assets (RWA) and blockchain technology is a significant technological advancement that is driving finance to become more open, transparent, and interconnected, which can be considered a revolution.

So, what are real-world assets (RWA)? How do they work? I will delve into the topic of RWA so that everyone can better understand. (Throughout the article, I will use the abbreviation RWA). This will be a longer article, and I hope everyone will enjoy and read it through.

We must first understand the concept of RWA. Real-world assets (RWAs) refer to physical or tangible assets with intrinsic value in the real world. This includes financial instruments such as loans and insurance contracts, as well as assets like commodities and real estate. RWA is the tokenized version of these assets on the blockchain, making them easier to use for online transactions and investments.

What potential does RWA have in the cryptocurrency world?

Liquidity: Tokenization can transform previously illiquid assets (such as real estate) into divisible and easily tradable tokens, thereby increasing market liquidity.

Accessibility: RWAs on the blockchain lower the minimum investment amount and entry barriers, allowing more people to invest in high-value assets.

Transparency and Security: Blockchain provides an immutable ownership and transaction history ledger, making asset management more secure and transparent.

Financial Product Innovation: RWA opens the door to cutting-edge financial products, such as fractional ownership and asset-backed loans, which can bring a more dynamic financial market.

1. What sets traditional real-world assets (RWAs) apart from tokenized RWAs?

1) Traditional RWAs

Definition: Traditional RWAs include physical assets such as machinery, real estate, or commodities like gold and oil. These resources are used in economic activities and have intrinsic value.

Ownership and Transactions: Ownership is typically recorded in central databases or through paper certificates. These assets are often traded through multiple intermediaries, increasing transaction costs and delays.

Liquidity: Compared to digital assets, traditional RWAs typically have lower liquidity. The process of selling these assets may be delayed and complex due to the need for physical assessments, legal checks, and finding willing buyers.

2) Tokenized RWAs

Definition: Tokenized RWAs are digital representations of traditional real-world assets based on blockchain. Each token represents a share, stake, or ownership of the underlying asset.

Ownership and Transactions: Ownership of tokenized RWAs is represented by digital tokens on the blockchain, providing immutability and transparency. This makes transactions simpler, faster, and requires fewer intermediaries.

Liquidity: Tokenization increases the liquidity of RWAs by allowing fractional ownership and eliminating barriers to entry for investors. For example, investors can purchase tokens representing a portion of real estate, rather than the entire asset.

For example:

Imagine a commercial building worth $10 million. In the past, such a building would typically be purchased or sold as a whole, often involving a large amount of capital and many participants such as banks, brokers, and lawyers.

Through tokenization, this building can be represented by one million tokens, each worth $10. Investors can purchase any number of tokens, each representing a portion of the ownership of the building. This simplifies the transaction process and allows a wider audience to take advantage of investment opportunities.

2. What types of assets are suitable for tokenization?

1) Real Estate

Real estate is one of the most popular tokenized assets, offering users the opportunity to own commercial and residential properties. This asset class has the potential to gain higher liquidity, opening up investment opportunities and simplifying the management of rental income and other revenue through smart contracts.

2) Commodities

Commodities include gold, oil, and agricultural products, among others. The benefits of tokenization include more transparent pricing and easier access to markets that typically have high entry barriers.

3) Artwork

This category includes sculptures, paintings, and other valuable artworks. Through art tokens, ordinary individuals can own and profit from more artworks. Additionally, artists can still retain ownership and profit from partial sales.

4) Intellectual Property

This includes software code, copyrights, and patents. Tokenization can facilitate the licensing and commercialization of intellectual property. Artists can choose to sell a portion of the rights to their work to raise funds and maintain a certain level of control over their creations.

The advantages of asset tokenization include increased liquidity, reduced transaction costs, and easier access to investment opportunities.

However, currently, RWAs lack clear regulations, may have cybersecurity risks, and require a robust technical system to securely handle these asset transactions.

3. How does RWA work?

Tokenization is a blockchain technology that addresses the transfer of ownership of physical assets to digital tokens.

Each token represents a portion or share of the asset, making the asset easier to trade, transfer, and manage.

Consider the following scenario: You own a house worth $400,000. Through tokenization, you can generate 400,000 tokens, each worth $1, representing the ownership of the house. These tokens can be bought and sold or traded on a blockchain platform.

1) The Importance of Blockchain Technology in the Tokenization Process

Tokens are issued, tracked, and traded on a decentralized, transparent, and secure ledger provided by blockchain technology.

Efficiency of Blockchain: Blockchain ensures tamper-proof and secure transactions. The public ledger records every transaction, ensuring transparency. It reduces costs, improves efficiency, and eliminates intermediaries.

Practical Applications of Blockchain Technology: In 2023, the Ethereum blockchain processed over a million transactions daily without any interruptions. On public blockchains, thousands of nodes validate each transaction, making record alterations nearly impossible. A report by Deloitte indicates that eliminating intermediaries in financial transactions could save up to $20 billion annually. To better understand the tokenization process of RWA, let's look at a more practical example:

There is a commercial asset worth $100,000. To legally tokenize and trade it, the legitimacy of the asset needs to be established.

During the token creation process, 100,000 tokens worth $1 each will be generated.

In this scenario, assets were selected and built on the Ethereum blockchain for token issuance and management (including Ethereum, Solana, BSC, and other blockchain options).

The assets were then distributed to investors using Initial Token Offering (ITO).

After the distribution is completed, these tokens can be traded on the secondary market.

If the asset value rises to $200,000, each token will be worth $2 in the trade.

This process increases the liquidity of illiquid assets and democratizes investment opportunities.

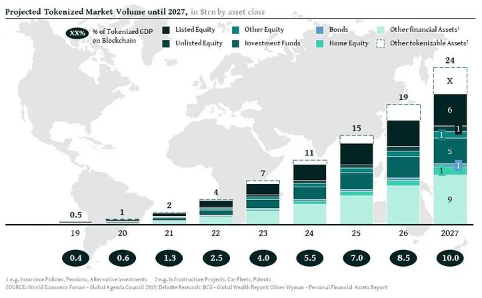

According to a report by Deloitte, with the popularization of cryptocurrencies and the opening of new channels for real-world assets (RWA), the tokenized asset market could reach $24 trillion by 2027.

World Economic Forum

Due to the decentralized nature of tokens and proportionate ownership, small investors now have more opportunities to participate in the market, increasing liquidity. This portion of assets can be traded more easily on the secondary market compared to traditional stocks.

2) Efficiency and Transparency of Transactions

Blockchain technology is particularly useful in industries such as real estate and supply chain management, as it provides an immutable, transparent ledger for all transactions.

Many organizations have analyzed the effectiveness of blockchain technology as follows:

A study by Santander FinTech estimates that by 2022, distributed ledger technology could save $15-20 billion annually in financial services infrastructure costs.

PwC's research indicates that by 2022, companies using blockchain technology could save up to $20 billion annually.

According to a study by McKinsey, the use of blockchain can improve trade finance efficiency by approximately 30%.

Research by the World Economic Forum suggests that by 2025, blockchain could create up to 21 million new jobs.

According to Capgemini's research, blockchain technology could save up to $10 billion annually for the insurance industry by 2025.

Deloitte's research indicates that the securities industry could save up to 60% in clearing and settlement costs by implementing blockchain technology.

According to IBM's research, the use of blockchain technology could reduce fraud detection costs in the healthcare industry by up to 50%.

PwC's research suggests that blockchain technology could reduce compliance, audit, and reconciliation-related costs by up to 50%.

Blockchain technology has the potential to reduce the typical real estate transaction time in the United States from the current 30 to 60 days to just a few hours.

In the near future, the efficiency provided by blockchain in tokenizing RWA will lead to many incredible results.

The trend of heavily tokenizing assets and items (including valuable real estate, exquisite artwork, and even exotic assets such as wine or rare collectibles) is on the rise.

By 2023, websites like Securitize will have tokenized assets worth over $500 million, including equity and real estate.

On websites like Masterworks, investors can spend $20 to purchase shares of famous artworks.

The above data highlights the many benefits of implementing RWA Tokens. But what issues are causing trouble and hindering the development of RWA?

4. Issues in the Development of RWA

1) Regulatory Uncertainty Regarding Tokenized Securities

The U.S. Securities and Exchange Commission (SEC) filed lawsuits against multiple companies in 2023, revealing the legal risks associated with offering unregistered digital asset securities.

The World Economic Forum claims that regulatory uncertainty may slow down the adoption of digital assets, potentially limiting market growth by up to 20% annually.

Clear regulatory guidelines are crucial for the flourishing development of RWA in the cryptocurrency field. Tokenized securities are still being classified and regulated by regulatory authorities.

Due to this, legal and compliance barriers are crucial.

2) Technical Flaws and Potential for Fraud

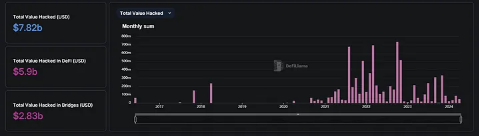

As blockchain technology is still relatively new, many hacker attacks and technical vulnerabilities are inevitable.

Some hacker incidents that shocked the crypto community:

In 2022, a hack on the Ronin network resulted in a total loss of $625 million.

According to Chainalysis data, fraud and hacker attacks in 2022 led to the theft of approximately $3.8 billion worth of cryptocurrencies.

According to data from Defillama, hackers have stolen $7.82 billion in assets since 2016. (This is a significant amount)

While blockchain increases transparency, it also brings new risks. Mitigating these vulnerabilities and protecting investor assets requires investment in building secure infrastructure. This is a completely new market, and a significant portion of investors are not familiar with RWA or cryptocurrency trading. The increased interest from cryptocurrency investors is evidence of their willingness to take risks. However, understanding the advantages and risks of RWA in cryptocurrency is crucial for investors.

I will list the important RWA Tokens for each asset category at the end. The history and future prospects of each RWA market. The tokenized real estate market is still relatively new, but many organizations expect it to reach $14 billion by 2027. Trade finance and supply chain management involve numerous intermediaries and complex procedures. Blockchain can simplify these processes, reduce fraud, and increase transparency. Trade finance and supply chain management are complex processes involving numerous intermediaries. Blockchain can increase transparency, reduce fraud, and simplify these processes.

The compound annual growth rate (CAGR) for blockchain-based trade finance solutions is expected to be 20% from 2022 to 2030, with a market valuation of approximately $9 trillion in 2021.

The global art market is expected to reach $65 billion in 2022.

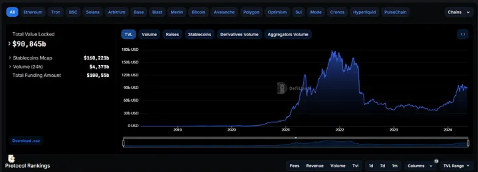

As of May 2024, the total locked value (TVL) of the Defi market is $90.8 billion, with the RWA network accounting for $6.57 billion. Integrated RWA projects are expected to dominate the market share, and TVL is expected to reach $10 billion in 2025.

Defillama - Defi TVL total

Defillama — RWA TVL

I previously mentioned the role of Decentralized Finance (DeFi) in RWA Tokens. The following platforms, namely Centrifuge and MakerDAO, have made the process of tokenizing RWA simpler:

Centrifuge allows companies to tokenize invoices or real estate, which can then be used as collateral for loans.

Borrowing and Lending: DeFi protocols allow the use of RWA as collateral for loans. An example is using tokenized real estate to obtain financing on platforms like "Aave" or "Compound".

Yield Farming and Staking: Tokenized RWA can be staked in liquidity pools to generate interest or used for yield farming. This provides a second source of income for asset owners. The effectiveness of RWA projects depends on regulatory compliance, especially in terms of Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance.

Different countries have various regulations for tokenized assets: the U.S. Securities and Exchange Commission (SEC) has strict regulations defining security tokens.

To provide a comprehensive framework for crypto assets (including RWA), the EU is developing regulations for regulating the crypto asset market, known as MiCA. We can clearly see the huge potential of this market.

5. Promising RWA Projects

In conclusion, I listed some RWA projects that I believe have potential for the future.

In my experience investing in cryptocurrencies, tokens with reasonable market value attract whales and sharks, rather than low market value projects.

Ondo Finance ($ONDO): Finance/Structured Products - Ondo Finance aims to develop structured financial products that offer high returns and stable opportunities. It provides a range of investment options to meet different risk preferences, aiming to bridge the gap between traditional finance and DeFi.

Pendle ($Pendle): Finance - Pendle is a financial asset specifically designed for tokenizing and trading future yields.

Polymesh ($POLYX): Finance/Blockchain Infrastructure - Secure tokens are used in regulated financial markets, and Polymesh is designed for them.

Centrifuge ($CFG): Finance/Real World Assets (RWAs) - Centrifuge connects decentralized finance (DeFi) with tangible assets such as invoices.

Goldfinch ($GFI): Finance - Goldfinch focuses on real-world lending and offers a decentralized credit protocol.

Creditcoin ($CTC): Finance - Creditcoin utilizes blockchain technology to enhance trust in credit history and lending markets.

Propy ($PRO): Real Estate - Propy uses blockchain technology to make property ownership and transactions more convenient.

AllianceBlock Nexera ($NXRA): Finance - AllianceBlock Nexera connects decentralized finance (DeFi) with traditional finance.

CANTO ($CANTO): Blockchain Infrastructure - CANTO provides a platform and tools for decentralized applications (dApps) as part of its DeFi infrastructure.

Polymath ($POLY): Finance/Blockchain Infrastructure - Polymath simplifies the creation, issuance, and management of security tokens.

LEOX ($LEOX): Finance/DeFi - LEOX is a decentralized finance company focused on various financial services.

Stobox ($STBU): Finance/Tokenization - Stobox offers tokenization services, allowing securities and assets to be digitized.

LandX Governance Token ($LNDX): Real Estate/Agriculture - LandX connects investments in agricultural land with blockchain-based governance.

Realio ($RIO): Real Estate/Finance - Realio integrates blockchain technology with real estate investment, enhancing transparency and liquidity.

Wadzpay ($WTK): Payments/Finance - Wadzpay aims to update payment systems using blockchain technology to make transactions faster and more secure.

Original article link: https://www.hellobtc.com/kp/du/05/5197.html

Source: https://medium.com/@dothanhvinh17/real-world-assets-rwa-in-2024-everything-you-need-to-know-about-the-hottest-investment-trend-adcb68f59b34

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。