friend.tech provides an interesting concept in the field of SocialFi.

By Greythorn

● Introduction

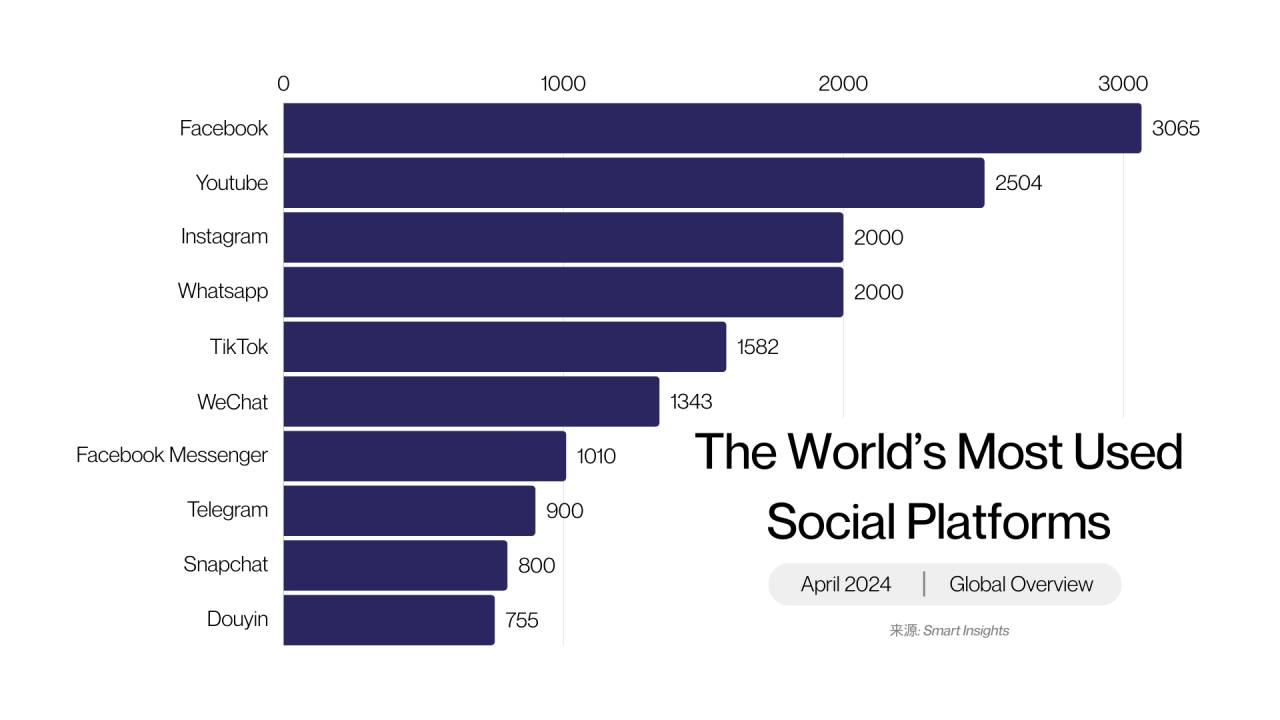

According to the 2024 global social market report, the social media industry has experienced significant expansion, with its market value expected to grow from $219.06 billion in 2023 to $251.45 billion in 2024, at a compound annual growth rate of 14.8%. Approximately 62.3% of the global population uses social media, spending an average of over two hours per day.

Source: Smart Insights

Decentralized social media (DeSoc) offers a fresh perspective by innovating the monetization of creator content and managing online relationships, promising to improve privacy, security, and most importantly, giving creators complete control over their data and its monetization.

Although the concept of decentralized social media is not new, it only began to gain significant attention in 2023 with the evolution of Web3 technology. Introducing friend.tech, a decentralized blockchain-based social network aimed at pioneering this emerging market. The platform sets itself apart by addressing common issues in centralized networks, such as company ownership of user data, limited privacy options, and the risk of content censorship.

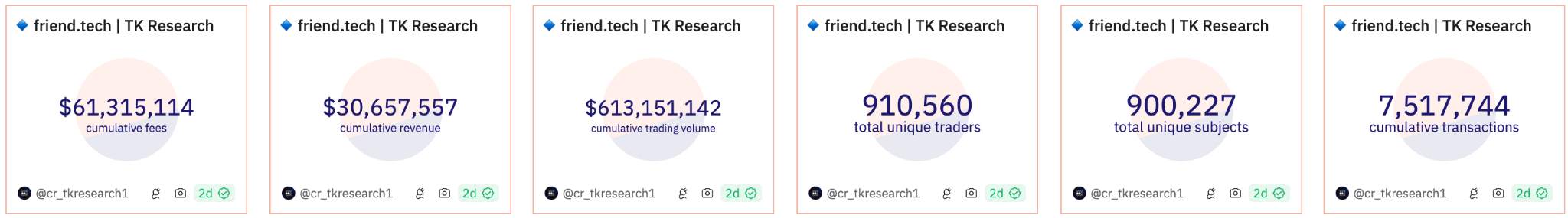

In 2023, friend.tech not only achieved significant growth but also generated revenue comparable to some top protocols, providing creators with the freedom to monetize their work on their own terms.

Source: DuneAnalytics

In today's article, we will delve into the platform, examine its controversial token issuance, compare it with its competitors, and assess its potential and related risks in 2024.

We have previously reported on friend.tech before 2023. You can read the full article here.

● Project Overview

friend.tech is a decentralized social platform built on the second-layer network "Base Chain" launched by Coinbase. It is closely integrated with X to obtain users' Web2 identities, allowing users to potentially profit from this identity. On this platform, every user can be tokenized, and their influence can be directly priced by the market.

It is one of the most successful Web3 dApps in SocialFi, achieving the highest-ever revenue-to-net-deposit ratio, generating over $2 million in revenue in the first month, with a net deposit of $33 million.

The core of the project is based on the concept of fan economy. To start using it, users need an invitation code/inviter and to deposit 0.01 ETH, which is the primary currency for purchasing shares of other users within the app. These shares represent a portion of the user's influence. When someone purchases shares, they gain the ability to start a one-on-one chat with the person they invested in. This setup allows users to directly and personally connect with their favorite influencers. Additionally, these tokens, called "keys" or "shares," used for ticketed chats, can be traded, allowing users to potentially profit from the growing popularity of content creators.

For KOLs, they earn a 5% fee each time someone buys or sells their shares (Key), providing financial incentives. To increase their income, KOLs need to boost their Key trading activity. An additional 5% goes to the friend.tech finance department, totaling a 10% fee for each buy/sell transaction.

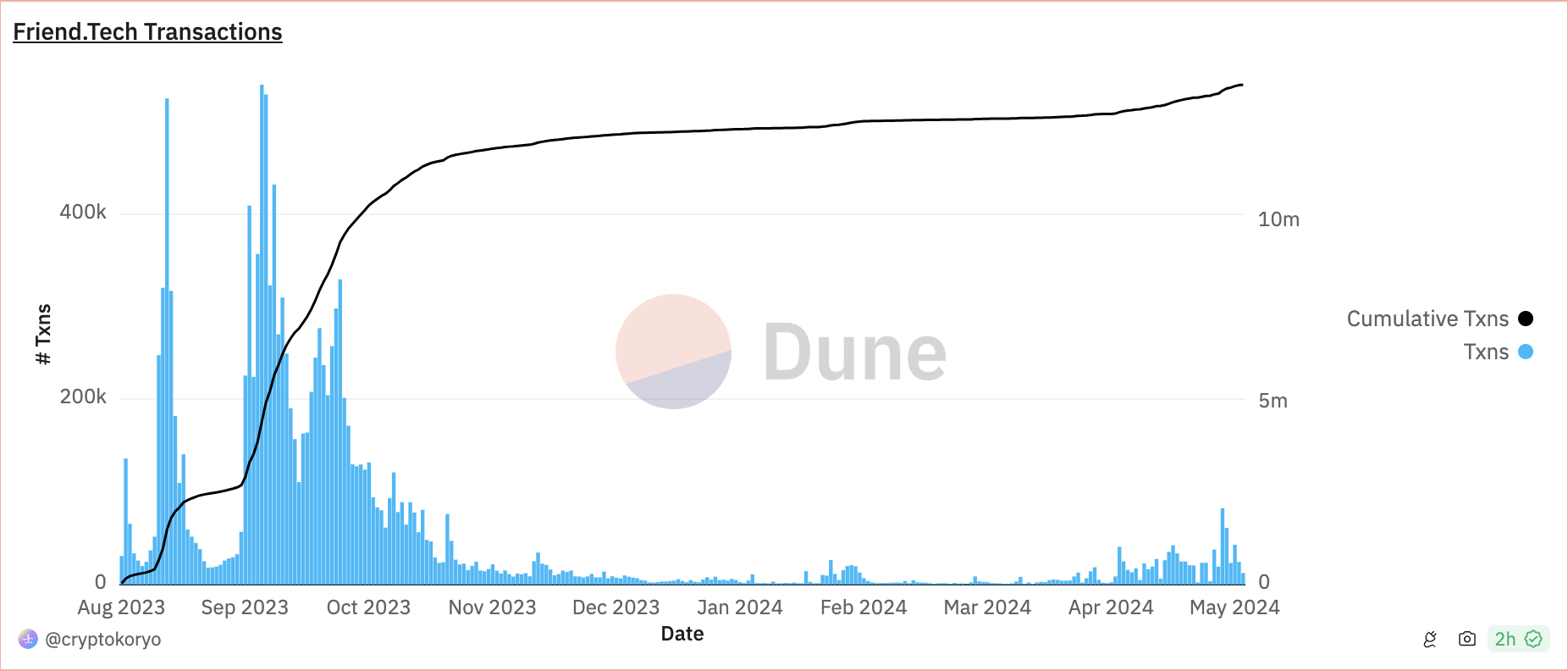

As we have noted, decentralized social media protocols garnered significant attention last year but have recently experienced a decline.

Source: Dune Analytics

On-chain data shows a significant decrease in daily activity on friend.tech since reaching its peak on September 13, with 539,810 transactions recorded on that day. Since then, interest in the platform has evidently waned.

However, despite this decline and some criticism, there is much discussion among friend.tech users about a potential revival. This excitement is driven by the anticipation of an upcoming airdrop, the announcement that users will have full control over their tokens, and the upcoming release of version 2, all of which have received a positive response from the community.

Let's delve into the differences between Friend Tech V1 and its updated version V2.

Friend Tech V1 Overview:

Friend Tech V1 is an innovative decentralized social platform that connects crypto influencers with their followers. By creating their own Key, users can potentially profit from buying and selling KOLs' "Keys," garnering significant attention. This model was particularly popular during the bear market, helping the platform see a significant increase in users and activity. The platform generated approximately $13 million in fees from a high trading volume of $130 million and paid out around $6 million in income to its users.

However, this model has its drawbacks, primarily due to the high fees involved. With a 10% fee for both buying and selling shares, users find it challenging to profit unless they sell their shares at a price far above the purchase price. This high turnover to realize profits has led to inconsistent user experiences and ultimately become a barrier for new users to join the platform.

Friend Tech V2 Overview and Uniqueness:

Friend Tech V2 was released on March 3, 2024, introducing several new features and changes. Notably, users can now obtain their $FRIEND tokens, marking a significant update. However, this release received criticism due to the lack of clear information and guidance, especially regarding new elements like "Clubs."

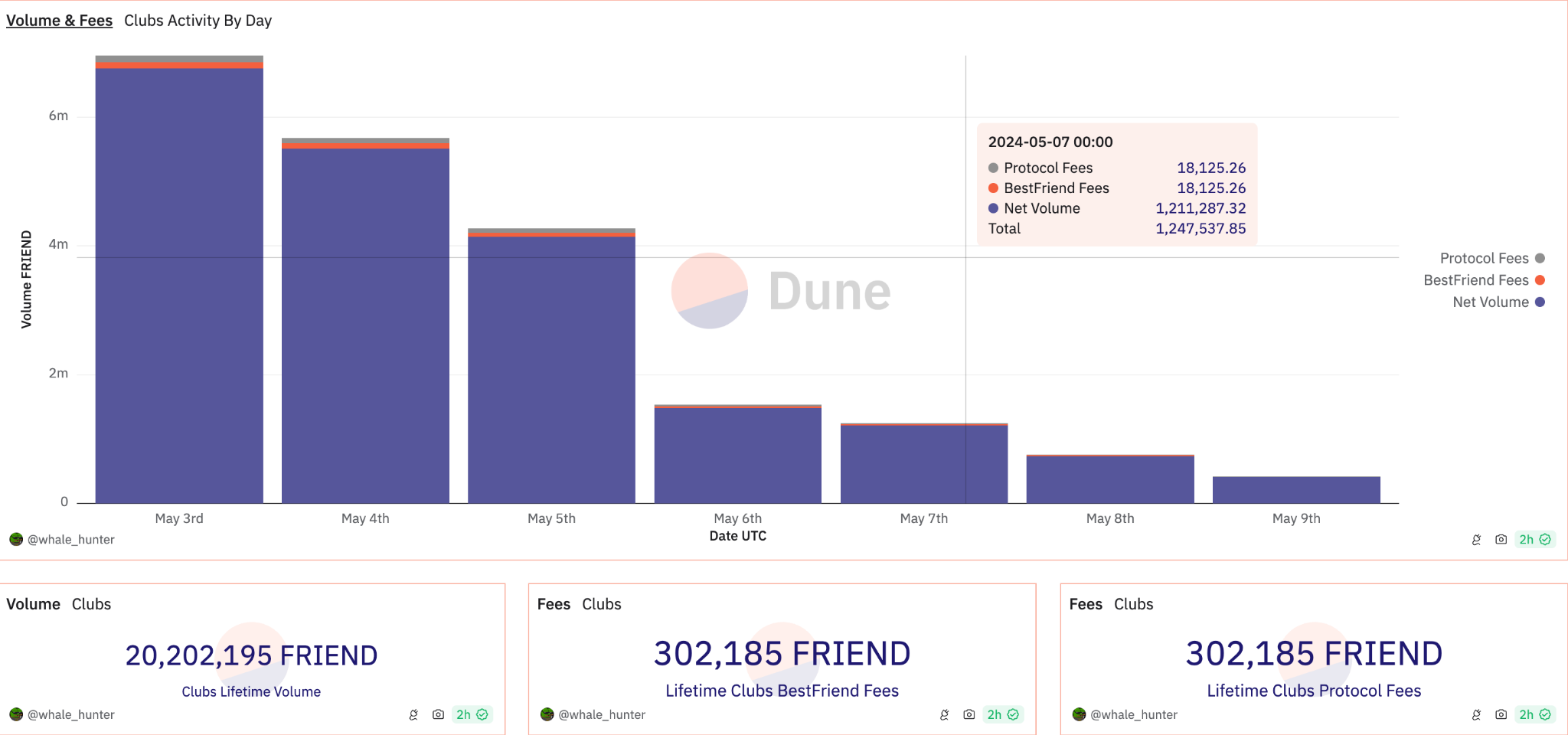

Clubs are a major addition in V2, serving as group spaces owned and managed by Key holders. Clubs have their governance, including voting to elect a club manager and appoint moderators. All transactions within the clubs use $FRIEND tokens, and each transaction incurs a 1.5% fee. This enables the introduction of referral fees and more flexible trading terms among club members.

However, the implementation process and user experience were not smooth. Users were confused about how to claim their airdrop, join clubs, or even find the clubs they had set up, as the platform did not provide clear instructions or interface prompts.

In summary, V1 focused on rapid growth and revenue through high fees, while V2 aims to enhance user governance and interaction through clubs, but faces challenges in execution and clarity, which may impact its long-term viability.

● Team, Infrastructure Support, and Strategic Partnerships

friend.tech was developed in August 2023 by two anonymous individuals with a controversial history in the crypto community, 0xRacerAlt and shrimppepe. Members on the X platform pointed out that these developers were also involved in an unsuccessful NFT project. Further scrutiny by Kalland revealed that 0xRacerAlt deleted several tweets linking to this NFT project and held an official position in the Kosetto Discord. These findings raised concerns about their reliability and the potential for similar issues related to friend.tech.

In August 2023, friend.tech received seed funding from Paradigm, although the amount was not disclosed, and collaborated with the venture capital firm to create online social interaction tools.

Rumors on X indicate that friend.tech completed its Series A funding, valuing the company at $50 million. This funding round included token certification, implying the possibility of their eventual token issuance, which indeed happened.

● Controversies

friend.tech originated from a developer named Racer, who initially practiced in TweetDAO, a decentralized social media project. This platform allowed users to publish tweets from a shared account by holding native NFTs called "TweetDAO Eggs." Despite initial viral success, it eventually faded, leading to the closure of its main Twitter account and website.

Following TweetDAO, Racer launched Stealcam with a co-developer named Shrimp, a Web3 platform where users could mint and purchase images as NFTs that remained hidden until purchased. However, due to the difficulty in maintaining profitable returns for creators, the developers eventually rebranded Stealcam as friend.tech. friend.tech was launched in May 2023, aiming to attract Web3 influencers and creators seeking more effective monetization of their content, adopting a supply-and-demand-driven economic model.

However, friend.tech initially sparked controversy due to its vague privacy and data security issues. The platform required users to download an app without readily available privacy policies. This lack of transparency raised concerns among users about how their personal data was being handled, although some of these concerns have since been partially addressed.

Additionally, the platform's sustainability has also faced severe criticism. Initially, friend.tech rapidly grew due to its influencer-centric strategy, but as the initial excitement waned, doubts about its long-term viability deepened. Critics pointed out that the platform's overreliance on influencers is a key vulnerability. Without active participation from key figures, the platform's value could decline.

This is the reason for the strategic shift in the V2 update, transitioning from an influencer-centric model to a more community-focused model. However, questions remain about the level of participation from influential users and the actual value they bring when inactive.

Furthermore, friend.tech is striving to differentiate itself and retain users in competition with X, Farcaster, and other decentralized competitors such as Lens.

On the positive side, friend.tech now benefits from having its own token, opening up opportunities for trading and speculation. The project has over 160,000 followers on its social media platform X and is actively promoted by influential figures like Hsak and Ansem, who encourage others to try the app. This promotion clearly benefits them economically, but also indicates potential upside for the project.

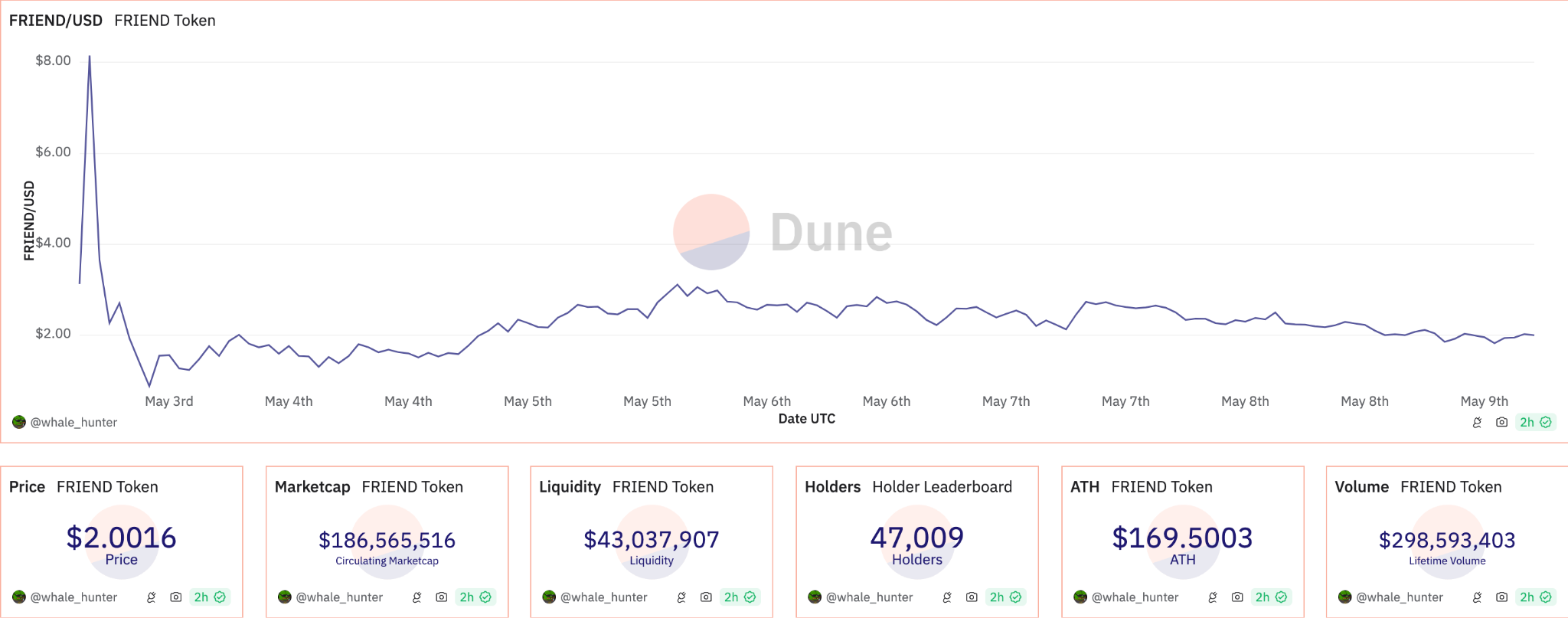

At the time of writing, friend.tech's market cap is $184 million, matching its fully diluted valuation. Considered an attractive risk-return investment by many on-chain traders, given the project's profitability at a fundamental level, $FRIEND's participation by prominent investors like Paradigm further enhances the project's credibility.

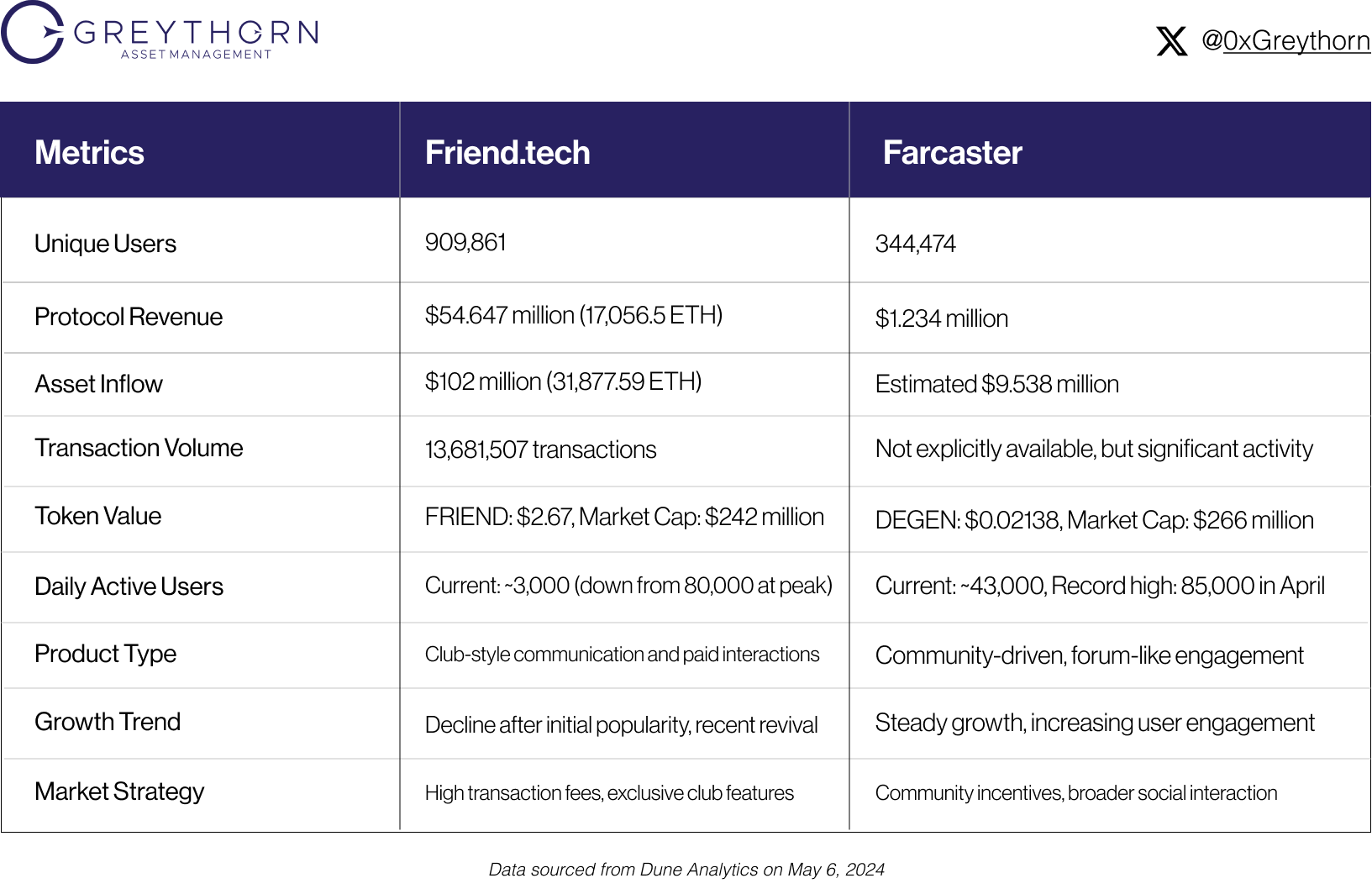

● Competitive Analysis: friend.tech vs Farcaster

friend.tech initially gained strong support through high fees and offering special club features, which was very successful at first. However, its popularity has declined, raising concerns about how to maintain long-term user interest. In contrast, Farcaster does not have its own token and uses the DEGEN token widely accepted in its ecosystem. This approach has helped Farcaster build a loyal community similar to traditional internet forums, leading to steady growth in user numbers and daily activity.

In summary, while friend.tech made a lot of money in its early days, the fluctuating user numbers make its future uncertain. Farcaster focuses on building a strong community with the DEGEN token, which seems to potentially lead to more lasting success. This is because it has loyal users and a versatile ecosystem. As both platforms continue to evolve and respond to user demands, their success in the competitive SocialFi market will depend on their adaptability.

● Tokenomics

The $FRIEND token is at the core of friend.tech V2, serving not only as a currency but also as a key incentive for community participation. Its current market cap and fully diluted valuation are $185.26 million. A total of 92.63 million tokens were fully distributed to the community in the token generation event.

The tokenomics are designed to promote participation; users can claim tokens by interacting with the platform—following ten people earns 10%, with the remaining 90% requiring club membership. This ensures that token distribution supports active ecosystem participation.

$FRIEND can only be traded within friend.tech's own system, which uses a native exchange feature with a 1.5% fee. This promotes liquidity and ensures the platform benefits from fee revenue, but also requires users to trust the platform's stability.

The Club feature on friend.tech functions like a mini-government, allowing users to manage and customize their clubs, from setting names to economic parameters. This structure supports decentralized governance, with club leaders and moderators elected by key holders, reflecting transparency similar to a DAO.

While maintaining a user interface similar to V1, the introduction of the $FRIEND token and clubs adds a new level of participation and monetization. Transactions within clubs incur a 1.5% fee, which is distributed between liquidity providers and the platform, helping maintain the ecosystem's financial health and rewarding active participants.

Source: Dune Analytics

● Bullish Fundamentals

According to Dune Analytics data, Friend Tech has seen a significant increase in user adoption and activity following recent controversial airdrops and the v2 upgrade.

Source: Dune Analytics

● Despite its lower market cap, especially compared to other projects and meme coins with less revenue generation, $FRIEND is attractive to potential price appreciation for on-chain traders. While not currently listed on major exchanges, investors should closely monitor any potential listings on top exchanges, which would significantly increase the token's accessibility.

● friend.tech is considered one of the two most popular apps on Coinbase L2, with its competitor Farcaster valued at $1 billion.

● The app generated $50 million in revenue in its V1 phase, indicating the team has the potential to expand its addressable market with V2, not just within the crypto Twitter community. With ample funds for marketing, infrastructure improvements, and other initiatives, Friend Tech's prospects remain promising.

● Bearish Fundamentals

● Despite the platform's initiatives, the crypto community still has concerns about the potential for system abuse and the risk of pump-and-dump schemes.

● When new Web3 apps like friend.tech promise significant returns and strong community participation, influencers often quickly get involved. However, the project's vague objectives and the founders' history of failures should caution users about its long-term viability.

● It lacks a clear roadmap or whitepaper, making it difficult to outline a clear long-term vision.

● Conclusion

friend.tech offers an intriguing concept in the SocialFi platform space, allowing users to invest in their "friends" by purchasing social tokens or keys. These keys grant access to exclusive content, private chat rooms, and clubs, primarily targeting users and the corresponding influencers they follow. The pricing mechanism for these keys is complex, with exponential price increases as supply and quantity increase. While friend.tech presents better bullish fundamentals after releasing its V2 version, it also faces bearish factors, including concerns about downward liquidity and potential pyramid dynamics.

The current valuation of friend.tech may appear attractive to many on-chain enthusiasts, potentially driving up its price. However, we remain cautious about its long-term sustainability.

● Disclaimer

This presentation is prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be considered general information and not investment advice or financial advice. It is neither an advertisement nor an invitation or offer to buy or sell any financial instruments or participate in any specific trading strategy. In preparing this document, Greythorn has not taken into account the investment objectives, financial situation, or specific needs of any person receiving or reading this document. Before making any investment decision, recipients of this presentation should consider their individual circumstances and seek professional advice from their accountant, lawyer, or other professional advisors. This presentation contains statements, opinions, forecasts, estimates, and other materials (forward-looking statements) based on various assumptions. Greythorn has no obligation to update this information. These assumptions may be correct or incorrect. Greythorn and its officers, employees, agents, advisors, or any other person mentioned in this presentation make no representations about the accuracy or likelihood of achievement of any forward-looking statements or any assumptions on which they are based. Greythorn and its officers, employees, agents, and advisors make no warranty, representation, or guarantee about the accuracy, completeness, or reliability of the information contained in this presentation. To the extent permitted by law, Greythorn and its officers, employees, agents, and advisors are not liable for any loss, claims, damages, expenses, or costs arising from or related to the information contained in this presentation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。