The rebound in the cryptocurrency market came unexpectedly.

On Monday afternoon, Eastern Time, Bloomberg ETF analyst published an article stating that the probability of SEC approving the spot Ethereum ETF 19b-4 has been raised from 25% to 75% due to the increasing politicization of cryptocurrency investment tools. Several sources revealed that the SEC is requesting exchanges to expedite the update of the spot Ethereum ETF 19b-4 application, which has dispelled the community's pessimism and brought new hope for the eventual approval of the product.

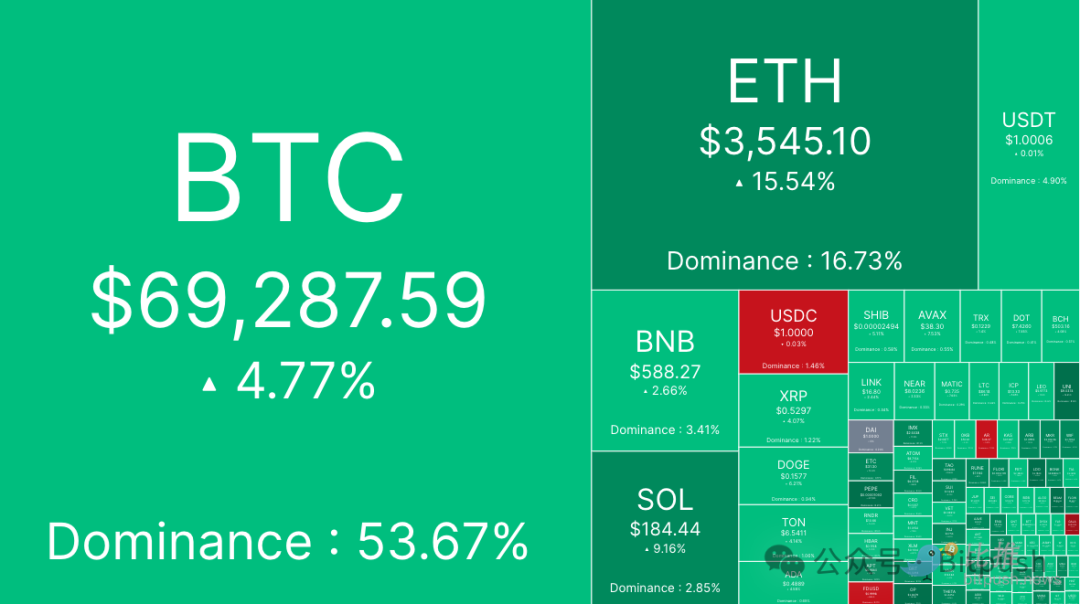

According to data from Bybit, after this news was released, the price of Ethereum surged from $3,143 to a daily high of $3,650, reaching a new high since mid-April, with a 24-hour increase of over 18%.

Bitcoin rebounded to the $70,000 mark for the first time since mid-April, rising $4,000 from the daily low, but it fell back below $70,000 by the time of writing, with a 24-hour increase of nearly 5%.

The altcoin market saw a general rise, with all tokens in the top 200 by market capitalization, except for a dozen, recording gains, and only 5 tokens experiencing a decline of over 2%.

Pyth Network (PYTH) led the gains with an increase of 20.4%, followed by Pendle (PENDLE) with an increase of 20.1%, Reserve Rights (RSR) with an increase of 18%, and Solana rising over 8% in the past 24 hours, breaking through $180. DeXe (DEXE) experienced the largest decline, dropping by 5.4%, while Chainlink (LINK) and 0x Protocol (ZRX) declined by 2.2% and 2%, respectively.

Prospects for Approval of Ethereum Spot ETF?

Bloomberg's senior ETF analyst Eric Balchunas stated on X platform on Monday, "James Seyffart and I are raising the probability of the spot Ethereum ETF approval to 75% (up from 25%), and we heard rumors this afternoon that the SEC may make a 180-degree turn on this (increasingly political issue)."

Another Bloomberg ETF analyst, James Seyffart, also posted his comments on social media platforms. He said, "The approval situation for the spot Ethereum ETF is improving this week. We are raising the probability of the spot Ethereum ETF approval to 75%. However, the deadline for 19b-4 on May 23 (Vaneck's deadline) and we still need S-1 approval. It may take several weeks to several months before we see S-1 approval and the launch of the Ethereum ETF."

According to an anonymous source, at least one potential issuer of the Ethereum spot ETF has been making progress in discussions with the U.S. Securities and Exchange Commission.

Cryptocurrency Stance Becomes a Major Issue in U.S. Elections

Last Thursday, a bill supporting cryptocurrency passed in the U.S. Senate and gained approval from some key Democrats in the institution, indicating a growing political pressure surrounding cryptocurrency.

The Senate voted 60 to 38 in favor of a resolution to overturn SEC Staff Accounting Bulletin 121, which would establish specific accounting standards for companies acting as cryptocurrency custodians. Several legislators from the party of President Biden, including Senate Majority Leader, Democrat Chuck Schumer, voted in favor of the measure.

Balchunas analyzed, "It seems that some political factors in this regard may have changed rapidly." He added that cryptocurrency seems to be becoming a more politicized issue overall in the lead-up to the upcoming U.S. elections. While he said he couldn't be certain, President Joe Biden's administration may want to appear less "hardline" on cryptocurrency issues.

The SEC must decide whether to approve or reject VanEck's spot Ethereum ETF by May 23. ARK 21Shares, Hashdex, InvescoGalaxy, BlackRock, and Fidelity are also awaiting the SEC's decision.

James Seyffart said, "This is what we've heard from multiple sources, and if we are right, we should see a pile of documents in the coming days."

Uncertain Outcome

Jan van Eck, CEO of VanEck, expressed doubts in an interview on April 9 about whether the SEC would approve his company's ETF application in May. Asset management company Grayscale withdrew its application for an Ethereum futures ETF on May 7, and Michael Sonnenshein resigned as CEO on May 20.

David Han, an institutional research analyst at cryptocurrency exchange Coinbase, stated in the monthly outlook report that as cryptocurrency becomes a more prominent issue for voters in the upcoming November U.S. presidential election, the U.S. Securities and Exchange Commission is unlikely to maintain its position of denial. He said, "As cryptocurrency begins to become an election issue, we believe it is uncertain whether the SEC is willing to expend the necessary political capital to support denial."

At the time of writing, the Bitcoin trading price is $69,672, and the upward trend of Ethereum is still ongoing. Later this week, the Federal Open Market Committee (FOMC) will release the latest meeting minutes, and it remains to be seen whether the market can maintain its bullish momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。