This unlocking will not only give more people the opportunity to participate in the future staking of Pyth, but may also allow more users to participate in the requirement of full staking at a lower cost.

Author: DiamondHands

May is a month of large unlocks. In addition to the recent one-year unlock of $SUI, the unlock of $PYTH has also attracted attention.

The impact of unlocks on token prices is unpredictable. Some say there will be a surge before the unlock, while others think it will be priced in early.

I'm sorry, this article will not make any judgments about the impact of $PYTH unlocks on token prices, but it will tell you what key information is worth paying attention to behind the unlock and the potential long-term impact on the PYTH project.

Unlocking 21.25%, where do the tokens come from

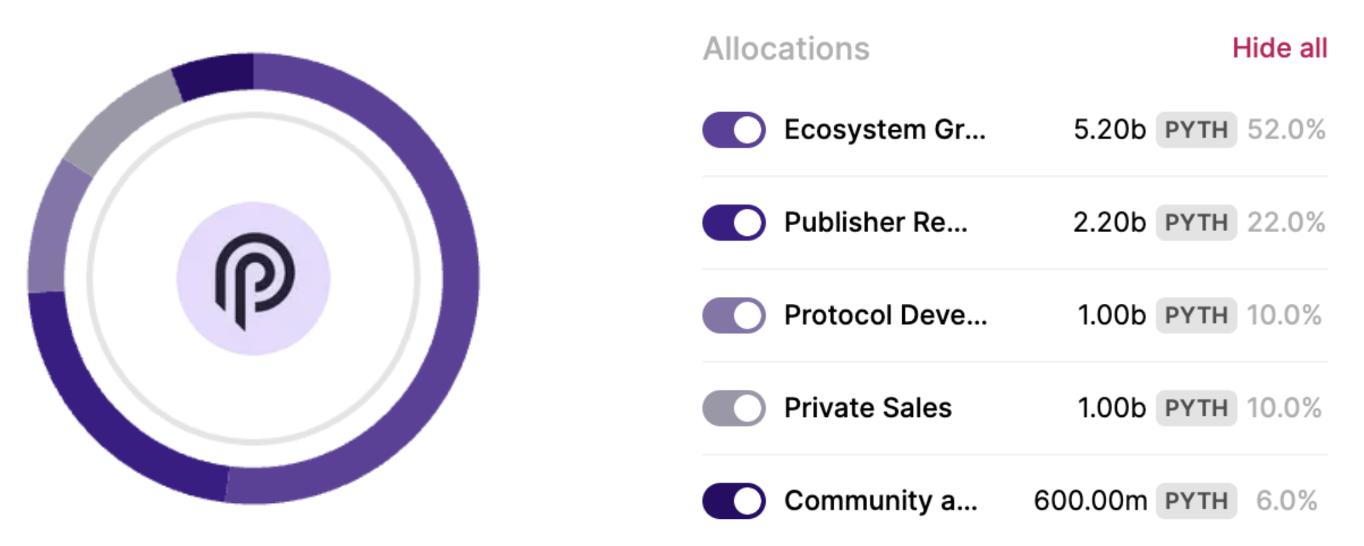

First, let's review the token distribution of $PYTH:

Maximum supply: 10,000,000,000

Initial circulating supply: 1,500,000,000 (15%)

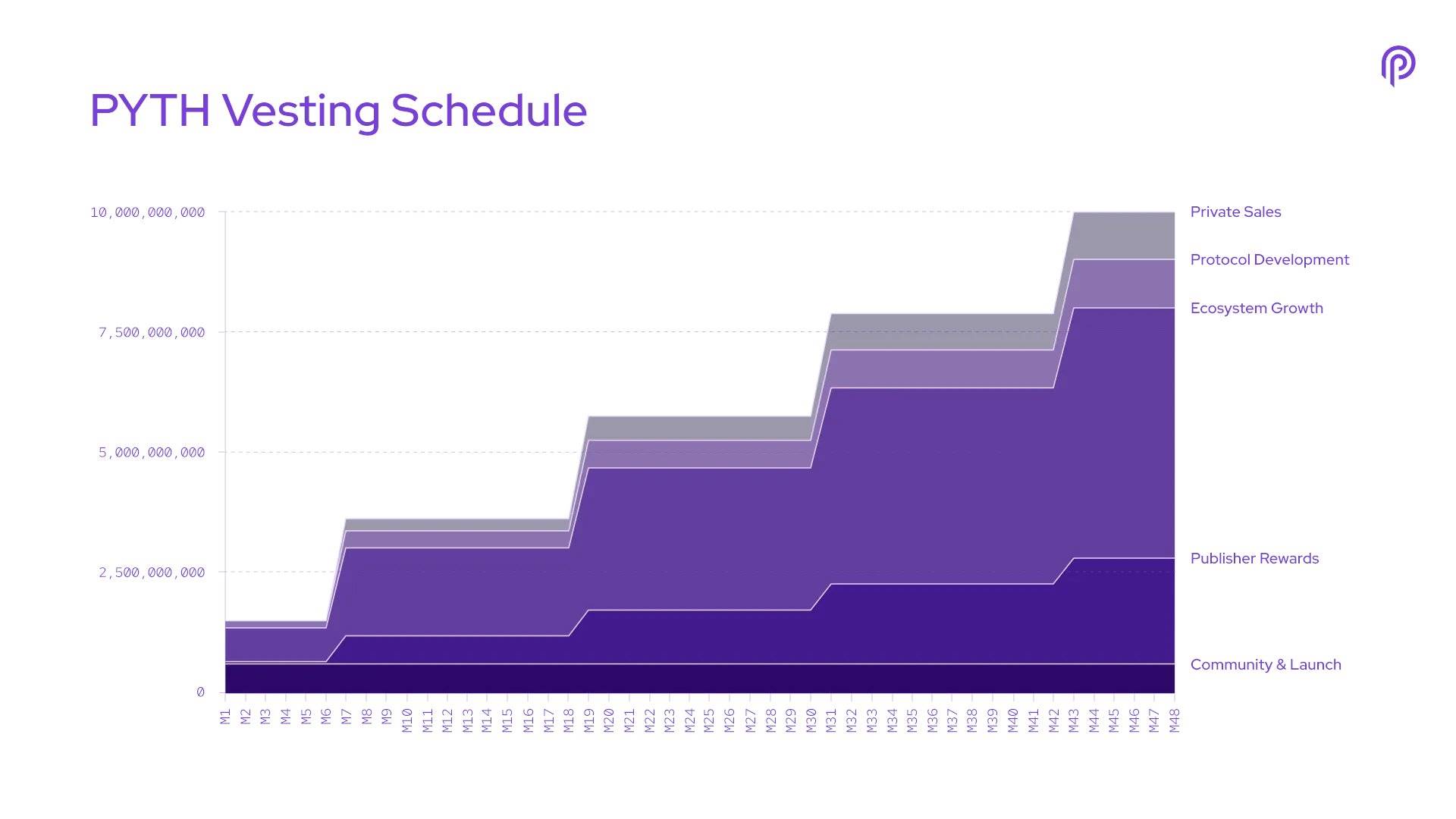

Lock-up period: 85% of PYTH tokens were initially locked, and the locked tokens will gradually unlock after 6 months, 18 months, 30 months, and 42 months after the initial token launch.

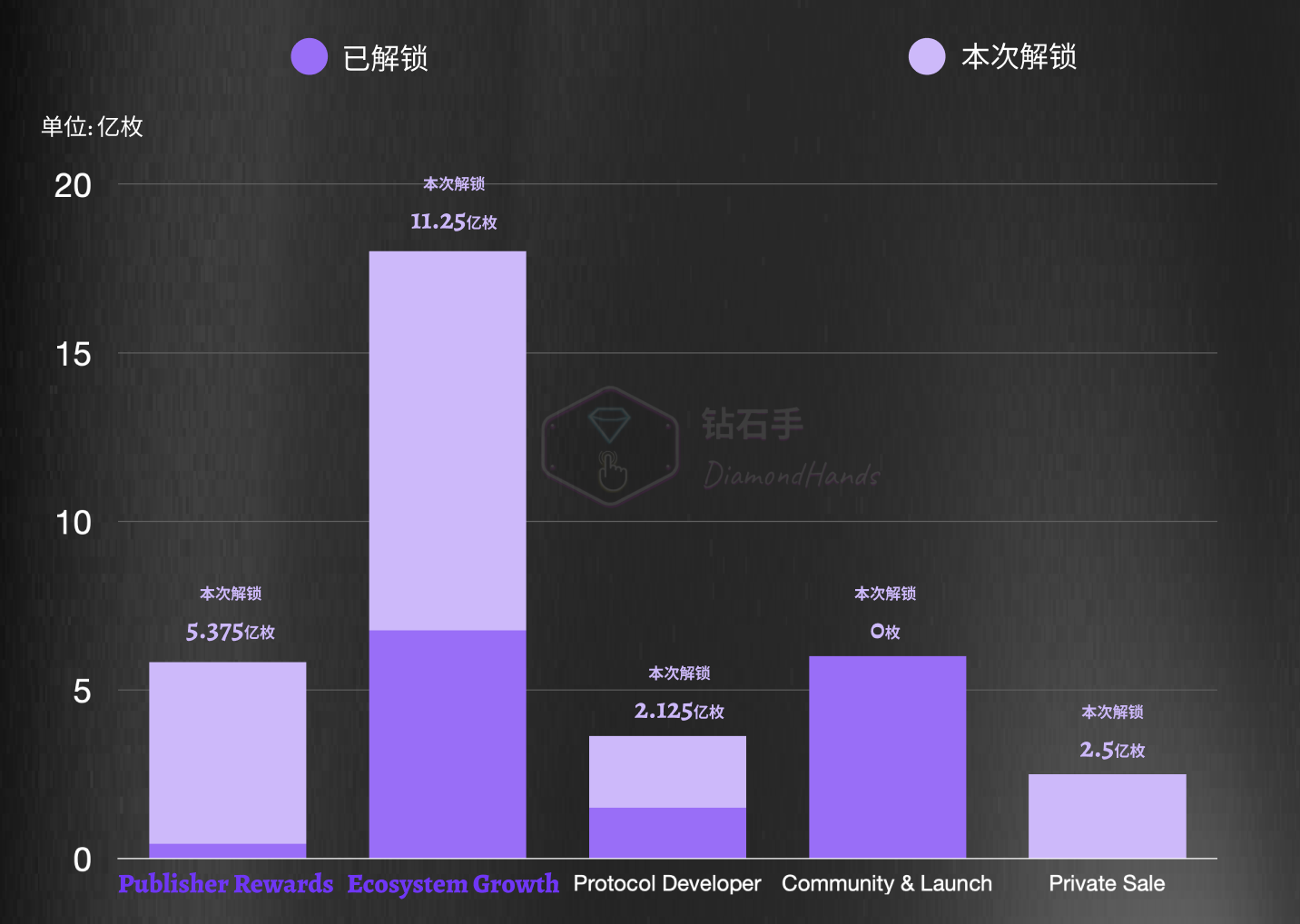

Out of the 10 billion tokens, this time an additional 21.25%, or 2.125 billion tokens, will be unlocked. Therefore, our core focus is on how these 2.125 billion tokens are allocated.

Publisher Rewards, accounting for 22% of the total, approximately 5.375 billion tokens will be newly unlocked.

This portion of token allocation is reserved for the data providers or "publishers" of the Pyth Network, responsible for publishing price data to the Pyth protocol. The "Publisher Rewards" token allocation consists of reserved tokens for various reward mechanisms and bonus plans to encourage data providers to publish accurate and timely price data.

Ecosystem Growth, accounting for 52% of the total, approximately 11.25 billion tokens will be newly unlocked.

This portion is a strategic token allocation reserved by the Pyth Network for contributors, including community contributors, developers, educators, researchers, strategic contributors, and early data publishers. This allocation aims to recognize and reward individuals and organizations that have made core contributions to driving the expansion and vitality of the Pyth Network.

Protocol Developer, accounting for 10% of the total, approximately 2.125 billion tokens will be newly unlocked.

These tokens have been allocated to core contributors such as Douro Labs, who focus on building decentralized data service products for the protocol.

Community & Launch, accounting for 6% of the total, will have no new unlock this time.

This portion of PYTH tokens is allocated for the initial launch phase and related community activities and plans. Currently, all 6 billion PYTH tokens have been fully unlocked on the first day of release.

Private Sale, accounting for 10% of the total, approximately 2.5 billion tokens will be newly unlocked.

These tokens will be allocated to VC of the Pyth Network, and currently all 10 billion PYTH tokens are locked and will be gradually unlocked according to the above unlocking schedule.

Therefore, we can see that the two main sources of this unlocking are Publisher and Ecosystem Growth.

Pyth Ecosystem Grants, PYTH Moving Towards a New Ecosystem

It is easy to see that the Pyth team has recently been working hard on the Ecosystem part, and the overall message is that the largest unlock comes from Ecosystem Growth, but this part is controlled by the Pyth DAO treasury and will not create sell pressure.

In terms of action, on May 16th, the official announcement of the Pyth Ecosystem Grants Program was made, which will provide 50 million PYTH grants to eligible community members to encourage them to share their ideas and insights about the Pyth Network with the broader Web3 community.

The grant program is divided into three categories: community grants, research grants, and developer grants. Although the initial amount is not large compared to the unlock amount, when extended to six months or more, the team's efforts in the Ecosystem Growth part seem more like a strategic reserve for the future. The release is there, but the specific circulation will depend on the future ecological situation.

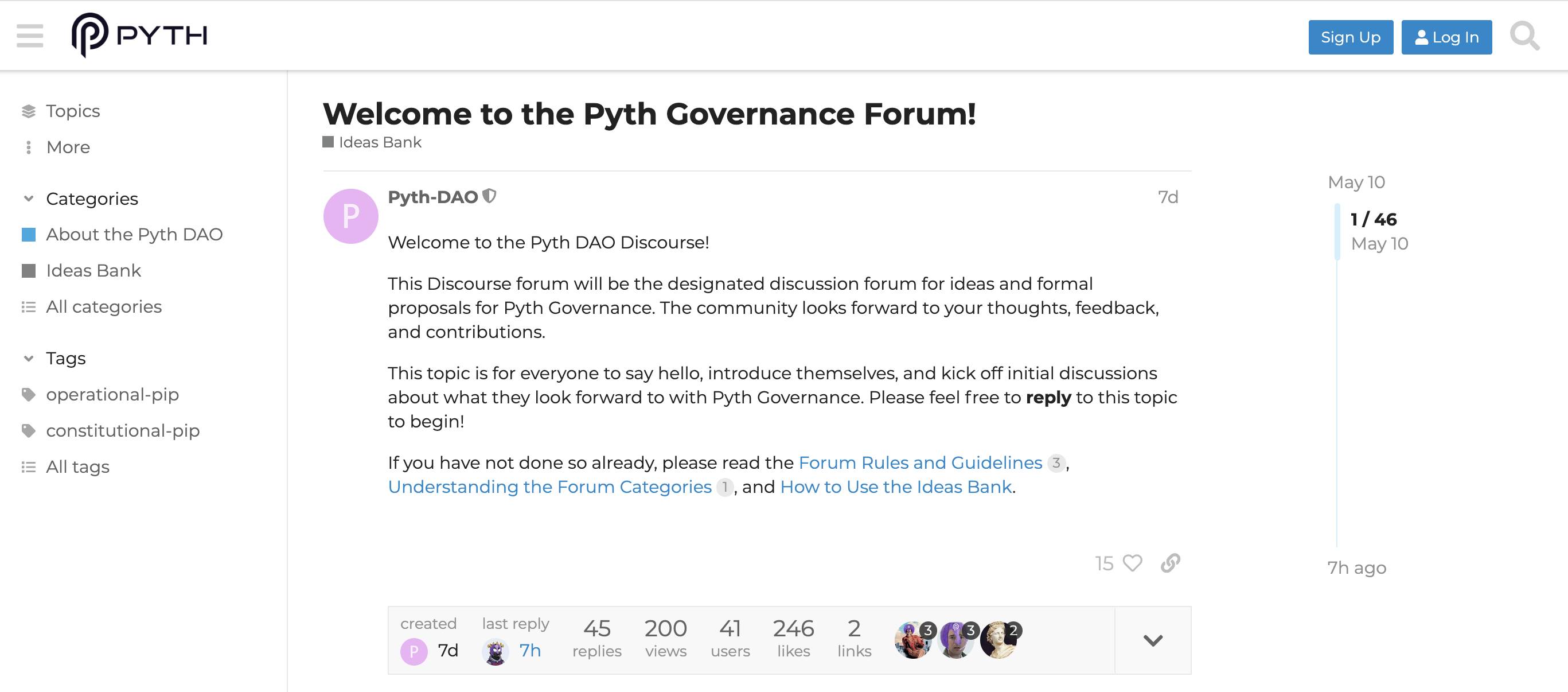

This is also Pyth's effort towards a larger community and a larger ecosystem. At the same time, Pyth has also launched the Pyth Forum for the community, which is also a crucial step in driving the Pyth DAO.

In addition, the Publisher part currently has a total of 100 Publishers, who provide price feeds to the protocol and receive rewards, making them important participants in the ecosystem. According to the white paper, in order to participate in the ecosystem, Publishers also need to stake their $PYTH, so the tokens in this part may not all create sell pressure, but the specific situation remains to be observed.

So overall, in the newly released 21.25 billion tokens, theoretically more than 60% will not immediately circulate, and their usage will depend on the plans of the treasury and ecosystem participants.

The utility and future ecosystem of $PYTH

From the initial "Stake for Airdrop" to now "Stake at least 1000/2000" or even more to receive Airdrop, the less circulation, the higher the cost of staking.

Therefore, this unlocking will not only give more people the opportunity to participate in the future staking of Pyth, but may also allow more users to participate in the requirement of full staking at a lower cost.

So besides staking, what other functions will $PYTH have?

This is also the key to the Pyth Forum, because from the community feedback, the team does not want to centrally drive more use cases, but rather wants users to participate and propose better proposals together.

Currently, the most discussed is that, in addition to Staking for Airdrop, there can also be Staking for Yield.

From the community discussions, there may be three potential sources of income in the future:

1-APY income

Similar to Chainlink staking with a 4%+ yield, $PYTH can also have a similar model.

2-Staking with Publishers for profit sharing

For example, Pyth's Publishers will receive $PYTH rewards, and whether users can receive a portion of the rewards through staking.

For more details about Pyth's mechanism, please refer to: Pyth Network: Setting a Benchmark for DeFi Oracles with Permissionless, Low-Latency, High-Fidelity Data

3-Profit sharing with the Pyth Network protocol itself

Many people say that oracles are a good track, they can issue tokens, and the protocol can make money. So when Pyth is profitable through the Protocol, can it also allocate certain rewards to stakers, which will be discussed in the Forum.

After six months of operation, Pyth has integrated with 350+ applications, launched 500+ price feeds, and operates on 55 chains.

Undoubtedly, this unlocking will bring some selling pressure. Whether the selling pressure is controllable mainly depends on the three core parts mentioned above. In the long run, the flow of more tokens will also allow more users to become Pyth Stakers, making the community stronger.

Pyth Network will continue to move towards Pyth DAO.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。