Intia has both L1 and L2 functionalities.

Author: Deep Tide TechFlow

The secondary trading market is as calm as water, and the enthusiasm for participating in new projects is growing.

As soon as a new project available for interaction appears on the market, a large number of tutorials will be released overnight, attracting everyone to join in. Under the FOMO sentiment, hunters are afraid of missing out on the next big opportunity.

In this fervent atmosphere, the most eye-catching project this week is undoubtedly Initia (@initiaFDN).

In just a few days, the crypto Twitter is filled with tutorials and project introductions about Initia. Some KOLs even joked that they shouldn't have posted tutorials, as the extremely high attention has turned the potential big opportunity into a small one due to intense competition.

Why is everyone so FOMO about Initia? The luxurious investment background is naturally the most attractive point.

In February of this year, Initia received a $7.5 million seed round investment led by Delphi Ventures and Hack VC, with participation from notable angel investors such as Cobie, Nick White, and Smokey.

In the latest financing information disclosed by Rootdata, Binance Lab also participated in the project's financing.

You could say that the current market meme is the focus, but it clearly does not mean that projects with such high financing background would be ignored due to extremely high airdrop expectations.

However, when everyone is focused on top-tier financing backgrounds, Initia itself lacks a detailed and popular introduction of what it is doing.

L1, L2, modularization, full chain… Initia seems to have been labeled with various hot tags, and the combination of multiple concepts can be a bit confusing.

Is this another homogenized project in the intersection of hot narratives, or does it have its own unique innovation?

Upon closer examination, we found that this is not simply a matter of competing in the L1 or L2 space, but more like the adhesive and lubricant for all chains - making friends more, and experiences better.

So, does Initia have a foothold in the fierce infrastructure competition with more chains, more modularization, and more anxiety?

To answer this question, let's take a look at the current issues in the crypto market.

Everyone says they want to build infrastructure. The extensive construction has indeed enriched the entire crypto world's ecosystem, but it has also led to decision paralysis.

The key causes of decision paralysis are L2 and modularization.

L2BEATS data shows that there are currently 52 L2 solutions in the market, with 41 more L2 solutions in development…

Which chain to use? Which Rollup is suitable? How to combine different functional modules to optimize performance or cost? In this fragmented technical ecosystem, every decision could be an adventure.

Clearly, the more chains and modules there are, the more anxiety and worse the experience. You can easily feel the following problems:

Complex management: Needing to manage multiple chains simultaneously, configure RPC for each chain, maintain separate wallets for non-EVM chains, use various bridges, pay gas with different tokens, and rely on multiple browsers for monitoring.

Scattered liquidity: Funds are locked on different chains, making it difficult to move smoothly between these chains, limiting fund efficiency and accessibility.

The intention was to make things easier for users, but it ended up creating a situation where everyone is fighting their own battles.

Therefore, whether from a speculative narrative perspective or from the angle of solving practical problems, it seems that we need a method of interconnection to alleviate the experience anxiety and operational burden mentioned above.

So, you can easily understand what Initia aims to do:

Rather than choosing one from the myriad of chains, it is better to build an ecosystem that can connect and collaborate.

The main hall manages L1, while the independent suites represent L2

So, how exactly does Intia build this interconnected ecosystem? Is it an L1 or an L2?

Simply put, you can understand it as an adaptable, modular Rollup network that spans all chains, and each Rollup can have interoperability, allowing them to access and communicate with each other.

Therefore, Intia has both L1 and L2 functionalities.

A bit confusing?

Let's start from a more common scenario - staying at a hotel.

You have booked a suite at a hotel called Initia. When you arrive to check in, you will definitely go through the following scenarios:

First, you have to go to the front desk to check in. The staff will verify your identity, assign a room, provide room card access, and inform you of the check-in and check-out rules, while ensuring that your room is vacant.

Second, your suite is nice, meeting your need for an ocean view; the guest in the next room has booked a family suite, meeting the children's entertainment room needs… Each person can always ensure that they have a room to themselves, meeting their specific needs.

Third, because the guests in different rooms belong to the same hotel, with the same standards, you can easily visit each other's rooms through room numbers, corridors, and guidance, without any "walls between rooms" issues.

Now you should understand Initia's product design:

First, Initia has an L1, acting as a role similar to the hotel lobby, with a key role in "orchestration," responsible for security, coordination, and resource allocation.

Second, Initia has numerous independent Rollup L2s, acting as different suites, officially named Minitia. A specific application can correspond to a specific L2, such as financial services, gaming, or social networks. They maintain close contact with the L1 layer while also being able to operate independently.

Third, although each Minitia L2 is independent, their design based on common standards allows them to achieve cross-chain interoperability, seamlessly exchanging data and assets. Therefore, the official definition is "a network that intertwines different Rollups."

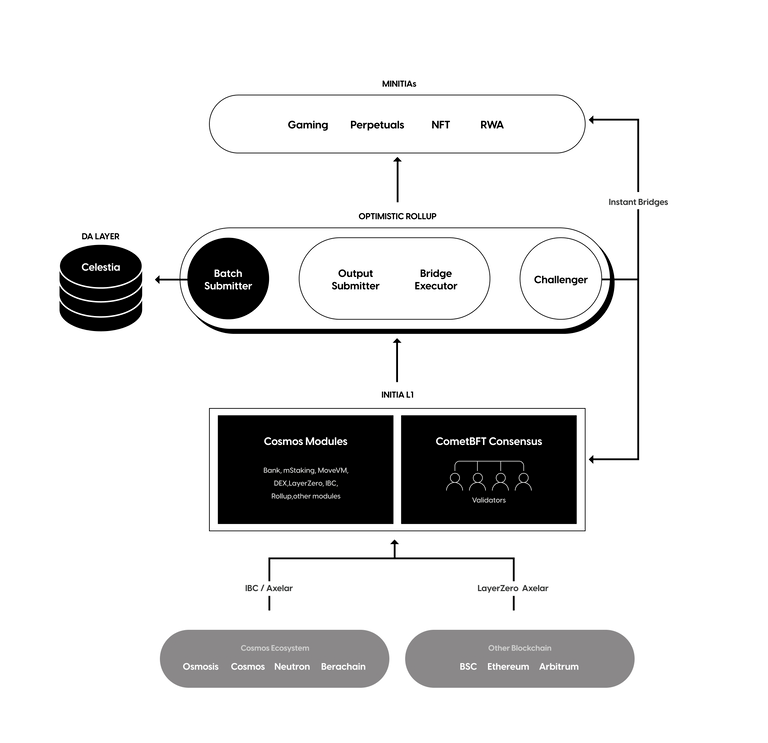

In terms of technical architecture, Initia is based on technologies such as Cosmos, Celestia, and OP-rollup, collectively creating the hotel front desk and suites mentioned above:

- Initia L1: Utilizing Cosmos technology, it integrates multiple core modules such as the banking system (Bank), staking, virtual machines (MoveVM, WasmVM, etc.), decentralized exchanges (DEX), LayerZero, IBC, etc., supporting various blockchain technologies and optimized data processing. Based on the Comet Byzantine consensus, it ensures the security and consistency of transactions and data processing in the network.

Data Availability Layer (DA Layer): Celestia provides data storage and verification services to ensure the transparency and reliability of the network. The Batch Submitter is responsible for submitting transaction data in batches to Celestia to optimize processing speed and cost. The Output Submitter and Bridge Executor assist in processing cross-chain transactions and interoperability, ensuring the safe and efficient transfer of data and assets between different blockchains.

Optimized Rollup: As part of the Optimistic Rollup, the Challenger is responsible for monitoring and verifying all transactions submitted to the chain to ensure their correctness and challenging them when issues are discovered.

Minitias (Independent L2 Networks): Each Minitia focuses on a specific application, and Instant Bridges provide instant bridging services to support the fast and secure movement of assets between Minitias.

- Inter-ecosystem Communication: Through the Inter-Blockchain Communication (IBC) protocol and the Axelar network, Initia can efficiently interact with the Cosmos ecosystem and other blockchains such as BSC, Ethereum, and Arbitrum.

With this technical architecture, Initia can provide a highly modular, secure, and scalable blockchain platform, aiming to simplify the user experience in a multi-chain environment and optimize developers' ability to build applications. This design not only reduces the complexity of operations but also greatly enhances the liquidity and interoperability of the entire system.

Ready-to-use suite facilities

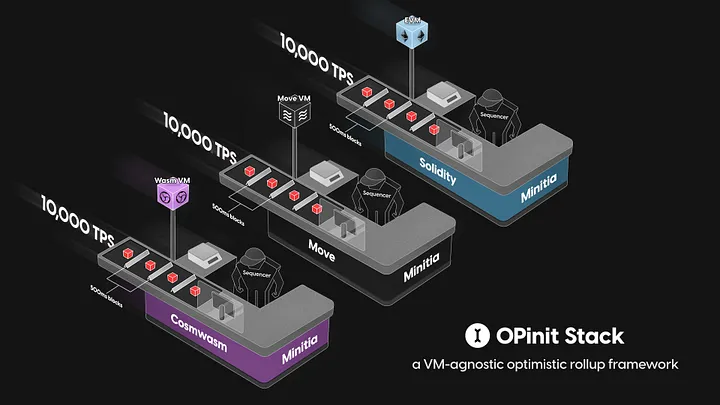

The above design has achieved interconnection between various L2s, but each L2 Rollup of Initia has its own characteristics.

Using the hotel stay example, when you enter the room, you don't have to buy a bed, bring toiletries, or install a wardrobe; the room already has the necessary facilities for you to use directly.

Similarly, each Minitia is a ready-to-use L2 environment with all the necessary facilities for different application needs, becoming an "out-of-the-box" application chain without the need to reinvent the wheel from scratch.

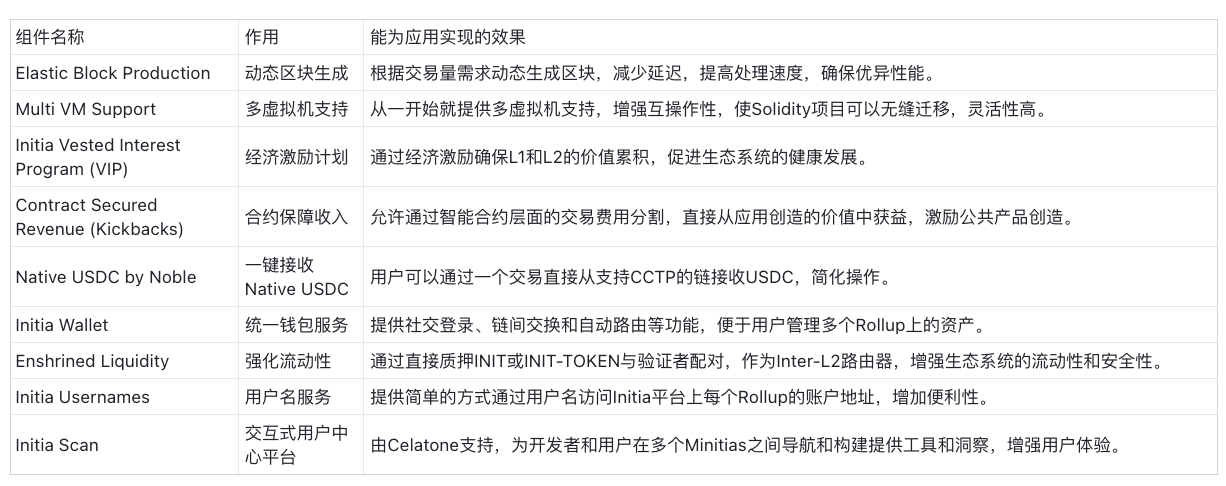

Specifically, its built-in key components are as follows:

Through these ready-to-use facilities, each Minitia of Initia provides the best environment for specific applications. This design not only lowers the entry barrier for developers but also accelerates application deployment and market promotion, allowing developers to focus on innovation rather than infrastructure building.

Notable ecosystem projects and interactions

Currently, although Initia is in the testnet stage, it has already begun close collaboration with ecosystem projects. Some notable ones include:

Blakwing: A modular blockchain focused on achieving non-liquidation leveraged trading of long-tail assets through Limitless Pools. Blakwing has completed a $4.5 million seed round financing and quickly locked in over $50 million in total value locked (TVL). Users can earn up to 89% annualized return rate (APR) by depositing assets.

Lunch App: Aiming to be the central hub for Web3 activities within and outside the Initia ecosystem. The platform reduces friction in using interwoven Rollups through social login and biometric transaction signatures. Users can participate in on-chain activities on all Minitias through a mobile app.

Tucana: An intent-based liquidity layer, DEX, and trader-optimized L2 perpetual contract chain that unifies modular network transactions. Tucana provides lightning-fast trading experience and customized execution logic.

MilkyWay: Developing a modular chain to protect the ecosystem and develop the first LST for Celestia. MilkyWay recently completed a $5 million seed round financing and has over 156,000 milkTIA holders, with a total locked value of $26.5 million.

Contro: As a market maker, Contro solves the problem of low liquidity and high fees. Its gradual limit order book (GLOB) system ensures a fair and scalable market. Users can obtain unique liquidation prices without relying on traditional liquidity providers. Contro will debut in the prediction market, providing fair and scalable on-chain betting.

Civitia: A fully on-chain gamified social experiment where users can acquire land, earn profits, and compete for global dominance. It seamlessly combines elements of SocialFi and DeFi, creating a unique experience.

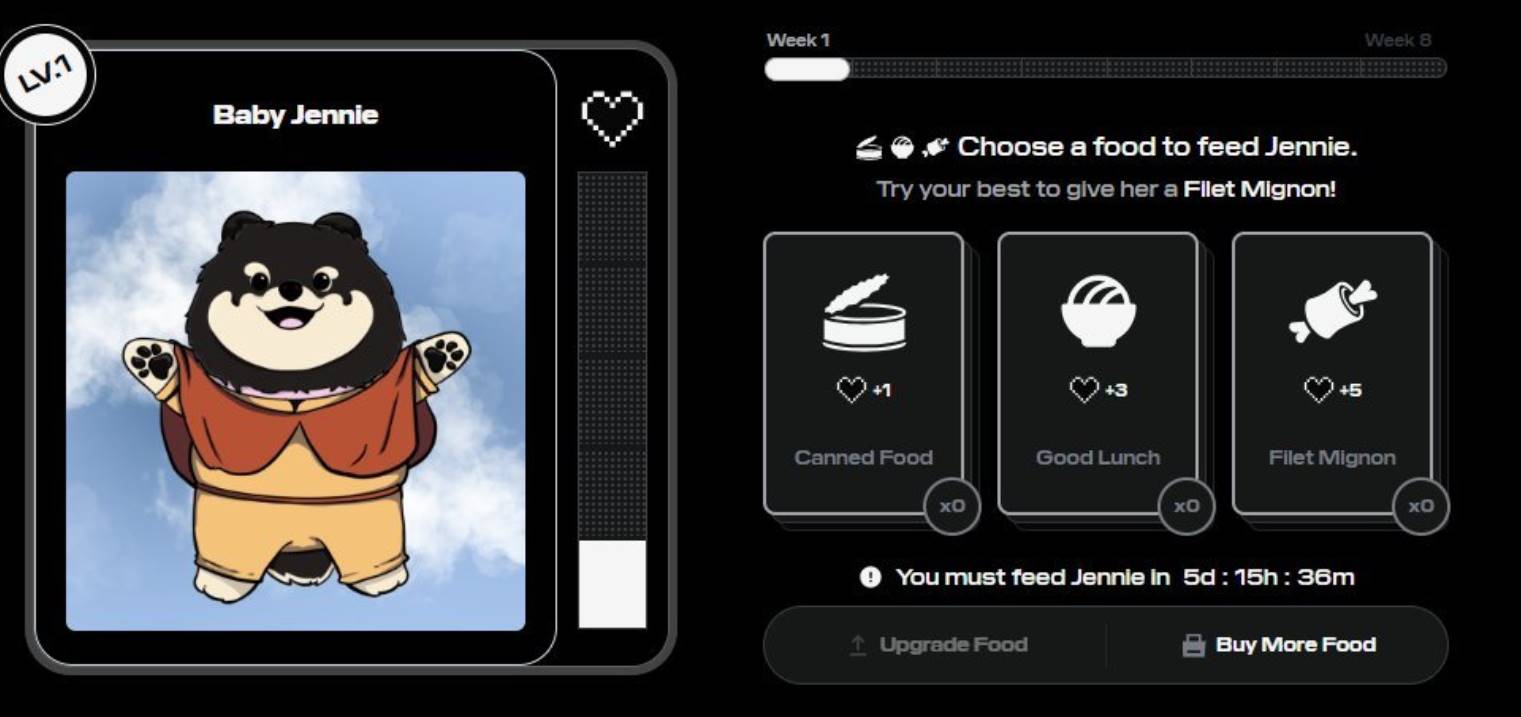

At the same time, with the release of Initia's testnet, users can currently download wallets, claim tokens, stake, and engage in various interactions such as following social media, and there are currently NFTs available to claim after completing tasks.

Interested readers can visit Initia's official Chinese Twitter account and follow the official tutorials for the corresponding operations.

The launch of projects like Initia is bound to attract more airdrop hunters in the midst of the frenzy. However, for projects with luxurious investment lineups and narratives aimed at solving market pain points, making the greatest effort within one's own capacity is still the best choice for achieving the expected returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。