Web3 games are an important part of the Web3 industry and a key catalyst for popularizing Web3 among the public.

Author: Jianshu

Games have always been seen as the key track to unlock the next traffic entry point in the Web3 industry.

At present, the cryptocurrency market is gradually warming up, but still in a volatile and uncertain state. At this time, we will focus on the game track, but after 2-3 years of development, it can be found that Web3 games have shown some new development features. For example, projects are improving towards enhancing gameplay and playability; based on the early "explosive" cases, new types of Web3 games continue to emerge, continuously expanding innovation; projects are gradually evolving towards platformization and ecologicalization, thereby enhancing their ability to resist risks…

Based on this, J Lab has spent nearly two months reviewing and organizing more than 20 research reports, collecting industry data from multiple dimensions. Based on the overall panorama of the industry ecology, it analyzes the new features and talent trends of Web3 games in 2024, aiming to provide valuable reference for industry enthusiasts. Constructive criticism is welcome if there are any inappropriate points!

I. Industry Overview: A Three-Year Review of the Web3 Game Industry from 2021 to 2023

2021-2023 was the first period of vigorous development in the Web3 game industry, with rapid user growth, continuous innovation in business models, and massive influx of capital driving the rapid development of the industry.

1. Market Size: "Explosive" effect drives rapid growth in transaction volume, with users accounting for more than half of the industry

In 2021, Axie Infinity, as one of the most profitable games on Ethereum at the time, exploded in popularity, attracting a large number of users to enter the game track. The number of chain game users increased from 80,000 in early April 2021 to 1.33 million in October, with an average monthly growth rate of over 270%.

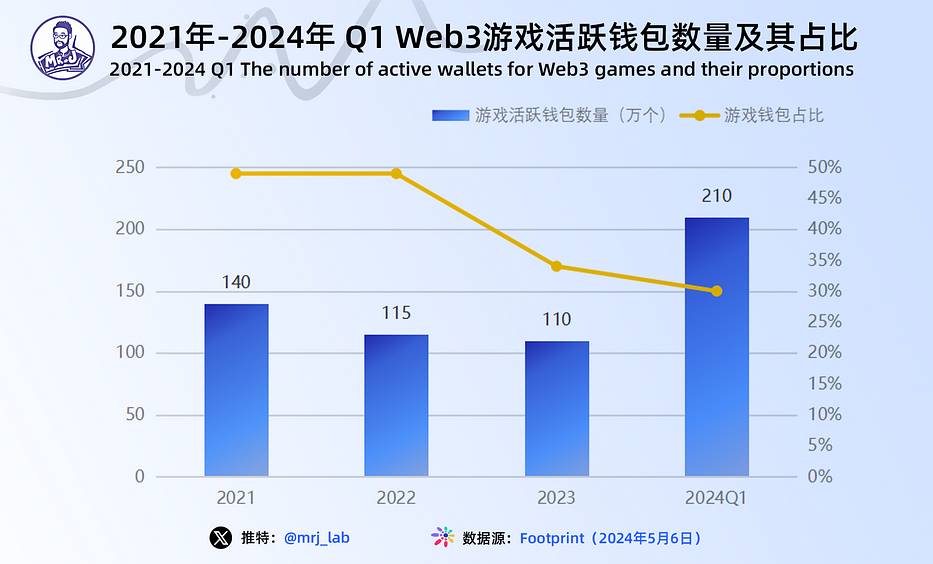

According to DappRadar's data report, the transaction volume of the chain game industry remained relatively stable from 2021 to 2023, with explosive growth in the first quarter of 2024. In 2021, the daily unique active wallets (UAW) for Web3 games exceeded 1.4 million, accounting for 49% of the total wallet usage in the entire cryptocurrency industry, a value that even exceeded DeFi. In 2022, Web3 games attracted 1.15 million active wallets, with a consistent share. With the total usage of cryptocurrency wallet addresses on the rise, the proportion of Web3 game UAW declined in 2023. However, in the first quarter of 2024, the number of daily active wallets reached a historical high, averaging over 2 million per day, with the number of active wallets related to games accounting for 30% of the industry total. Although the proportion has declined, the number has consistently shown a fluctuating upward trend, consistent with the overall increase in the usage of cryptocurrency wallet addresses.

In 2023, there were over 3 billion game users worldwide, with a market size close to $219.68 billion, of which the revenue of Web3 games was $5.2 billion (source: Newzoo’s Global Games Market Report 2023 | January 2024 Update). Although the number of users participating in Web3 games is still insignificant compared to traditional Web2 games, with continued growth and the arrival of the bull market in 2024, the growth potential of the Web3 game market is enormous.

2. Development Process: From "Fi" to focusing on gameplay and playability

The focus of Web3 games has shifted from early emphasis on "Fi" and "material rewards" to now mentioning more about "gameplay" and "playability".

First, let's clarify the connotations of gameplay and playability. Gameplay refers to the process and experience of player interaction with the game system, focusing on the core gameplay and the player's participation, fun, and long-term appeal in the game; playability focuses on evaluating the ease of playing the game and user-friendliness, emphasizing game interface design, operation methods, teaching, and guidance.

In other words, compared to early Web3 games, today's Web3 games are more focused on: long-term appeal to players and user-friendliness. As for why this development trend has emerged, it can be glimpsed from the development process of Web3 games.

According to the development process, Web3 games can be divided into four categories:

Early Web3 games focused on Fi, which can be collectively referred to as GameFi;

X to Earn (X2E) games, where users participate in daily game activities to obtain material rewards;

AAA-grade games that focus on high-quality graphics and playability to attract players;

Metaverse games that build virtual worlds.

GameFi combines the asset allocation principles of DeFi with game elements, initially focusing excessively on financialization, attracting a large number of investors, but lacking depth and playability in game design and graphics, failing to attract real game players. For example, a typical representative game of early GameFi—Axie Infinity, where players only focus on profit rather than the gameplay itself, often leads to a significantly lower user retention rate than regular games. According to Footprint Analytics data, Axie Infinity has now entered a stagnant period, with only about 9,000 active users per day, compared to the peak period of several million active users, with a user retention rate of only about 10%.

Therefore, to develop a successful GameFi ecosystem, it is necessary to go beyond the basic principles of DeFi, develop a complex in-game economy, and prioritize user experience in game design. X2E games have emerged. The X in X2E can be defined as any human behavior, such as gaming or mobility, to generate income through these behaviors. Unlike early games purely profit-oriented, X2E places a high emphasis on community culture and values, usually using meaningful real-life or creative behaviors as core game mechanisms, with the most representative game being STEPN. STEPN gamifies real-life activities through sports, with a more user-friendly game mechanism: encouraging users to participate in sports activities, achieve specific goals, and submit proof through the application, incentivizing users to maintain healthy activities.

AAA games, based on X2E, focus more on the playability and user base of the game, significantly improving game quality. With rich game backgrounds and excellent game mechanisms, IIIuvium has inherent advantages in product quality and player experience.

As a result, the core of the project's user retention strategy has gradually shifted from emphasizing gold farming income to improving the playability and intrinsic quality of the game.

3. Financing: Massive capital influx drives industry boom

From 2021 to 2023, the Web3 game industry attracted a large amount of investment and financing. 2021 can be described as the first year of financing for Web3 games, with traditional venture capital firms, cryptocurrency funds, angel investors, and others actively participating in the industry. In 2022, global Web3 game financing reached a historical high, with financing amounting to nearly $10 billion.

In addition, some Web3 game platforms also began to raise funds by issuing game platform tokens or conducting initial token offerings (ICOs) to support the development and operation of the platform, attracting the attention of investors.

In the Web3 game track, there have been some notable large-scale financing cases that have driven the industry's development. Taking into account the volume of financing, financing results, and media attention factors, J-Lab has compiled some of the Web3 game financing cases in recent years to help understand the changes brought to the industry by the influx of funds. For detailed content, please refer to the table below.

4. Challenges and Risks: Sustainable Development Faces Challenges of Excessive Financialization and Lack of User Experience

From the perspective of the games themselves, although Web3 games have begun to focus on improving gameplay and playability, the high-quality game content on the market from 2021 to 2023 is still lacking. The excessive financialization of games makes it difficult for the industry to cope with market fluctuations and speculative risks. The lack of usability and user-friendly interfaces also limits the participation and adoption of the general public. How to "break the circle" still needs to be explored.

According to Game7 Research data, currently, more than half of Web3 games are developed by independent creators or small teams, while AAA or AA-level productions only account for 6%. Some projects focus too much on the technical and economic aspects, neglecting the excellence of game design, innovation, and diverse content. This may lead to the risk of player attrition and market saturation, limiting the long-term development of the industry. In addition, market competition may lead to the risk of over-investment and fund bubbles. If there are too many similar projects in the market, and user demand and market capacity are limited, it may lead to the failure of some projects and financial losses.

In addition, issues such as blockchain scalability, transaction speed, and fees also limit the smoothness and user experience of Web3 games. In order to compete with Web2 games, Web3 games urgently need to address user experience issues. For example, convenient and fast digital wallets and trading tools are needed to smoothly manage and trade game assets. For the vast majority of Web2 users, participating in Web3 games may still involve a certain learning curve. The lack of usability and user-friendly interfaces may limit the participation of Web2 users and also pose a challenge for games to break through the barriers.

II. Industry Ecology: Panorama of the Web3 Game Industry

From the perspective of the industrial chain, the upstream of the Web3 game industry includes game content creation and R&D infrastructure, the midstream includes all To B service providers, the downstream covers all To C service providers, and the end users are all players and paying users.

1. Upstream - Infrastructure: Game Public Chains Divided into Three, BNB Chain Performs Well

As the most important infrastructure, game public chains are accelerating their layout and presenting a state of diversified development. Currently, the main types of public chains that host Web3 games are: general-use networks, application-specific network frameworks (Appchains), and game-specific chains.

General-use networks refer to public chains that can support large-scale game applications and access. They can be divided into general L1 public chains and general L2/L3 public chains, with general L1 public chains including Ethereum, EVM Sidechains, and Non-EVM Layer1;

Appchains are networks designed and optimized specifically for certain games, applications, or ecosystems, such as Wax, Flow, Immutable X, Oasys, and Hive, which are chains tailored for games. These public chains not only have advantages in scalability and speed, but also have customized optimizations for games, making them more suitable for game development.

Game-specific chains refer to public chains designed specifically for a certain game, such as the Ronin chain for Axie Infinity.

In terms of data, the three types of game public chains have their own strengths in terms of scale, user participation, and transaction levels. The number of on-chain projects can reflect the attractiveness and vitality of the public chain. Currently, the top three total numbers of Web3 games on-chain are BNB Chain (28.9%), Ethereum (22.6%), and Polygon (14.8%), with a total of 66.3%, dominating the Web3 game market.

The number of active users on-chain is an important indicator of user participation. Generally, a higher number of active users indicates a wide user base and an active community for the public chain. Looking at the daily user data, the Web3 game users on-chain are mainly divided among Ronin (27.35%), Polygon (16.92%), Near (12.58%), and Klaytn (8.56%). In terms of performance in the first quarter of this year, Ronin and Polygon have consistently held the top two positions in terms of daily active users for Web3 games.

Transaction volume can indicate the liquidity and activity of asset transactions. A higher transaction volume indicates a large amount of value transfer and trading activity on the public chain. Looking at the overall industry transaction volume in recent years, the transaction volume reached its peak in the third quarter of 2023, then fell and remained below the average level of 2022. Although the market transaction volume of Web3 games saw a significant decline from 2022, the number of transactions did not decrease significantly.

In terms of the proportion of transaction volume, the top 4 chains with the best performance in transaction volume within the track are Wax (76%), Hive (8.2%), Sui (2.8%), and BNB Chain (2.3%). As a public chain designed specifically for NFTs and games, Wax leads by a significant margin, far ahead of the second, third, and fourth places.

Overall, the game public chains are divided into three, with BNB Chain, Avalanche using the EVM Sidechains model, combined with side chains and Layer2, Polygon, and Appchains such as Wax and Hive all showing impressive performance.

BNB Chain and Polygon have attracted a large number of game developers to develop and deploy games due to their good performance, low gas fees, and support for EVM. Especially BNB Chain, with its reliance on the Binance exchange's strong ecosystem and project incubation plan, has performed well in terms of the total number of games, active users, and transaction volume.

Therefore, a game public chain that can be widely adopted in the future must have three elements: high TPS, EVM compatibility; meeting the special needs of games; and having good ecological construction capabilities.

2. Midstream - Game Distribution: More Platforms Seize the Distribution Heights of Web3 Games

Web3 game development is advancing rapidly, and various associated issues have arisen. In order to capture market trends, avoid risks, and better discover and analyze potential good projects, users need to use market analysis tools, community forums, and project evaluation platforms. Project teams need to achieve more accurate user acquisition, marketing and maintenance with more compelling and user-trusted marketing, and how to improve cross-chain operability.

To address this series of issues, more and more platforms are targeting the aggregation and distribution of Web3 games, aiming to bypass traditional Web2 centralized distribution channels (such as Apple, Google Play, etc.) and build a bridge of mutual benefit between game developers and users.

More and more platforms are aiming to become the "Steam of Web3," competing for the dominant position in the distribution of Web3 games. Compared to traditional Web2 games, Web3 game distribution platforms aim to provide users with more power through decentralization, promoting a player-centered and community-driven game ecosystem, and focusing more on user participation.

For example, the recently launched cross-chain game platform, Potral, overcomes cross-chain and payment issues through network integration, LayerZero, and other technologies, connecting games and players from different blockchain networks, allowing players to freely play on a single platform.

Similarly, DeGame aims to be the gateway for Web3 game search, with over 4000 game projects, 1000 chains and tokens, covering almost all major projects and tracks in the Web3 game market. Users can access or participate in these projects through search or clicking.

In addition, in January 2023, Steam announced the ban on Web3 games, providing more opportunities for other game platforms to compete for the dominant position in game distribution. As shown in the table, various Web3 game distribution platforms have gathered game NFT markets, self-developed games, provided APIs or SDKs to developers, integrated DID, gamified marketing activities, guilds, dashboards, and more. Game development platforms and information aggregation platforms have also attracted a large amount of investment, with significant funding for individual projects.

3. Downstream - Game Community: Active Communities Drive User Interaction, Decision Feedback, and Economic Incentives

Unlike Web2 games, communities play a crucial role in the Web3 game ecosystem. In Web2 games, large communities sometimes strongly oppose certain updates or policy changes, but in most cases, game studios rarely respond to this. In the case of Web3, community governance voting mechanisms allow users to directly influence the development of projects. For example:

Developers want to change the reward distribution formula for in-game battles and submit a vote - whether to implement it is decided by a certain percentage of player votes; (a real case from the Cards Ahoy! community vote)

Users in Discord or Telegram communities provide feedback and vote on certain aspects of the suggestions.

The communities referred to here mostly appear in the form of DAOs (Decentralized Autonomous Organizations). Taking Yield Guild Games (YGG) as an example, it was initially established to create a blockchain-based game revenue earning community, allowing more people to earn income through games and promoting the development of decentralization and digital assets. Unlike other game platforms, it uses blockchain technology to track game transaction data, making all transaction data transparent. YGG supports NFT assets and connects the global blockchain player investor community, aiming to provide players with opportunities to earn income through games in multiple blockchain games.

Currently, Yield Guild Games has initiated multiple revenue earning programs, such as Axie Infinity, The Sandbox, League of Kingdoms, etc., and operates and manages them in the form of DAOs. Members can participate in the organization's decision-making and development through contributions of funds, gameplay, community building, and also share various income opportunities planned by the organization.

For Web3 games, communities mean an ecosystem of interaction and cooperation between players and project parties. This economic ecosystem incentivizes player participation and contribution, increasing the sustainability and attractiveness of games.

III. Industry Trends: Inventory of New Changes in the Industry in 2024

Since the second half of last year, the Web3 game industry has shown signs of renewed activity: the industry has frequently received financing and attracted giants from the Web2 game industry. At the same time, multiple games have announced plans for public testing in 2024. This series of dynamics has sparked a high level of interest in the Web3 game market, creating a prosperous scene. Compared to the previous cycle, the Web3 game industry in 2024 exhibits the following characteristics:

1. Characteristic One: Improved Gameplay and Playability of Web3 Games, "Gold farming" is no longer the sole purpose

Today, Web3 games have moved past the hot phase of Play To Earn (P2E), where low playability and poor gameplay were considered major obstacles to the development of Web3 games in this phase.

At present, Web3 games are moving towards high-quality graphics, rich content, and excellent player experience, even moving towards AAA-level production, aiming to attract more Web2 players by improving gameplay. For example, games like BigTime, Illuvium, BLOCKLORDS, Shrapnel, all promote themselves as AAA-level Web3 games.

The driving force behind the improvement of Web3 games mainly comes from two aspects: excessive focus on Fi's unsustainability, and the competitive pressure to break through to Web2.

Unsustainability of excessive focus on Fi. In the early days, Web3 games were excessively focused on Fi, making the term GameFi seem more appropriate. However, the excessive focus on financial attributes did not attract more users to Web3 games. When the bull market dividends are gone, player earnings are not as expected, and the excessive focus on Fi instead accelerated the exodus of Web3 players. As a result, the GameFi track experienced an unprecedented cold winter in 2022, with market value rapidly shrinking, decreasing by 50% compared to 2021.

Competitive pressure to break through to Web2. Currently, Web3 game players can broadly be categorized as overlapping users of Web3 native users and Web2 game players. Projects aiming to attract more active players need to expand the intersection of the two. The former primarily comes for profit, with playability not being their top consideration; the latter has already been "trained" by the traditional Web2 game market for sensory depth and breadth, and is more accustomed to Earn (time/money) to Play, focusing on sensory pleasure. It is difficult to achieve large-scale conversion of Web2 users through strong financial incentives alone. Only by starting from the essence of the game - improving playability and novelty - is it possible to break through barriers and achieve a true "breakthrough" from Web3 to Web2.

2. Characteristic Two: Increasingly Diverse Types of Web3 Games, RPG, Action, Strategy, and Casual Games are Preferred by Developers

Compared to the previous cycle, the types of Web3 games will continue to improve. With the industry's development, game types are becoming increasingly diverse, including but not limited to the following types:

RPG (Role-Playing Game): RPG-type Web3 games are favored by developers. These games typically provide a deep role-playing experience, allowing players to take on different roles and embark on adventures and stories in a virtual world.

Action Games: Action-type Web3 games emphasize player operation and reaction capabilities. These games usually include fast-paced combat and intense action scenes, requiring players to complete tasks and challenges through operational skills.

Strategy Games: Strategy-type Web3 games focus on player strategy and decision-making abilities. Players need to develop strategies, manage resources, build bases or empires, and interact and compete with other players.

Casual Games: Casual-type Web3 games are suitable for relaxation and entertainment. These games usually have simple and easy-to-understand gameplay and a relaxed and enjoyable gaming experience, suitable for fragmented time periods and a wide range of players. ```

In addition to the above-mentioned types, the variety of Web3 games continues to expand and innovate, such as card games, racing games, puzzle games, and more. Compared to traditional Web2 games, the characteristic of Web3 games lies in their use of blockchain technology and encrypted assets, which give virtual assets in the game real ownership and tradability, bringing players a completely new gaming experience and economic incentive mechanism.

The diversity and innovation of Web3 games are still evolving, and with technological advancements and changing user demands, more novel game types and gameplay may emerge.

3. Characteristic Three: Accelerated Evolution of Web3 Game Projects towards Platformization and Ecologization

Web3 games are evolving towards platformization and ecologization to extend their lifecycle and strengthen connections and integration with other tracks. On one hand, from past market performance, each Web3 game has a lifecycle, which is not only influenced by the game itself but also related to the overall trend of the Web3 market. Compared to individual game projects, game platforms and ecosystems have stronger risk resistance, longer lifecycles, greater potential for trial and development.

On the other hand, platforms are the best way to gather resources and bridge the gap between the inside and outside of the game. Web3 game information aggregation platforms are important tools for players to access games, promoting a positive match between the game ecosystem and players. For example, in platforms like IGN (Imagine Games Network), players can find introductions and reviews for the vast majority of games and form judgments about the games. Multi-chain game aggregation platforms can provide one-stop services for project parties, such as game development, smart contract development, NFT minting, and trading platform construction. For example, LootRush provides a quick launch platform for Web3 games and offers NFT leasing to reduce game player costs and earn profits for NFT owners. Similarly, Gala Games allows developers to design blockchain games and allows players to own and transfer in-game loot NFTs, and buy, sell, and trade through a peer-to-peer market.

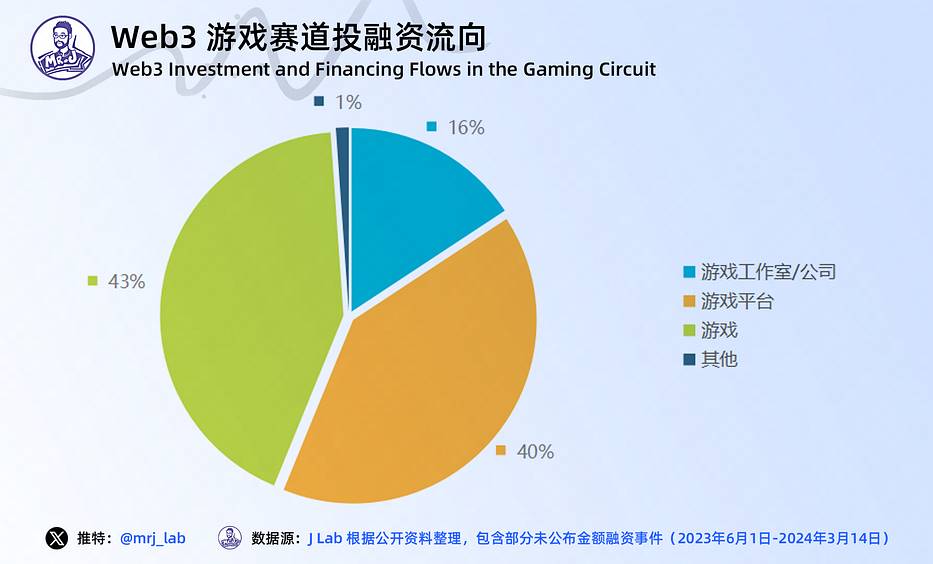

This development trend can also be seen in the investment and financing situation. From the second half of 2023 to the completion date, 56% of the financing flowed to game platforms or game studios (companies), with relatively cautious investment in individual game projects. In the early stages, more than half of the investment and financing mainly flowed to game projects (53%).

4. Characteristic Four: The Community Ecology of Web3 Games May Disrupt the Traditional Game Industry's Profit Distribution Model

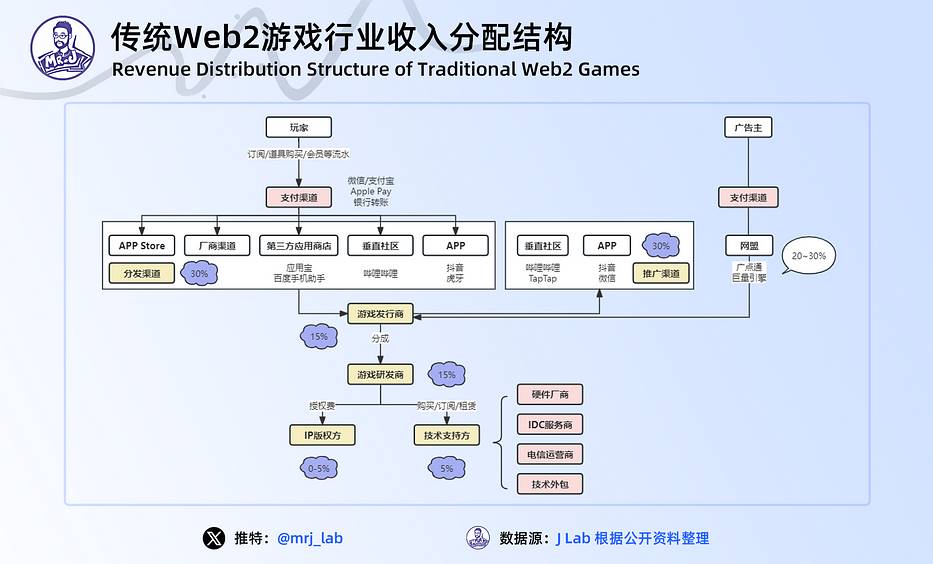

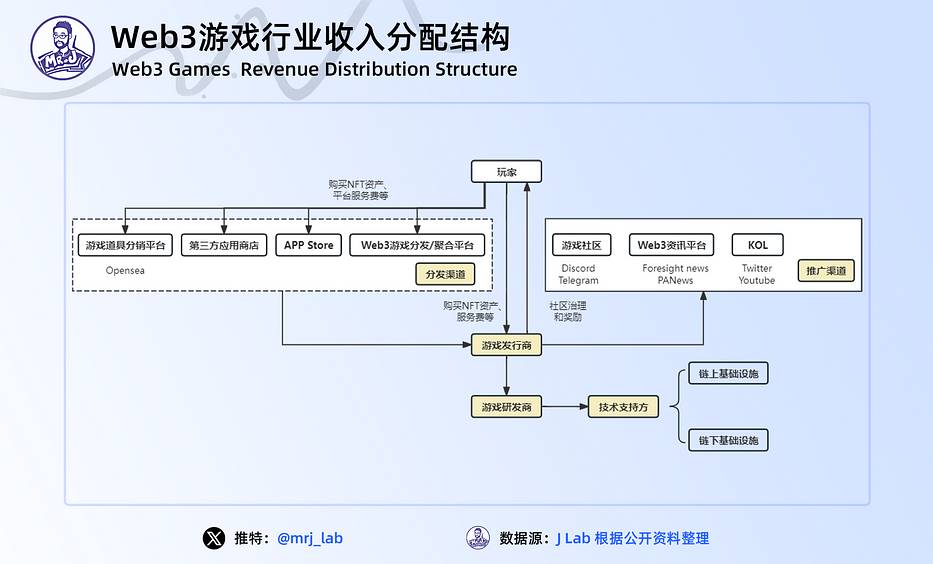

The profit distribution model of the traditional Web2 game industry is relatively centralized, with decision-making power concentrated in the hands of a few top companies. In contrast, Web3 games bring together diverse roles such as players, beneficiaries, and investors, introducing token economics and complex economic systems. This not only reshapes the game's profit model and interaction methods but also places community interaction and decentralization at the core of the game's economic ecosystem.

For example, in mainland China, in the early stages of Web2 game development, R&D, publishing, and distribution were relatively independent business systems. However, as the industry developed and integrated, to improve efficiency and control costs, the leading companies in the R&D, publishing, and distribution systems all tended to expand their business territories upstream and downstream, making integrated development and operation the mainstream direction for the development of leading Web2 game companies. This also means that leading companies monopolize market resources and distribution channels, limiting player choices and concentrating decision-making power in the hands of a few top companies.

In contrast, the income distribution model of Web3 games is more decentralized. Players, publishers, and developers collectively create and distribute income, and the decentralized model provides a fair and transparent income distribution mechanism for players and developers, while also emphasizing the importance of community participation and decision-making.

In addition to a sustainable game economic system, the role of the community in Web3 games is becoming increasingly important. A strong community is a key competitive advantage for Web3 games. The following are the top communities that have grown in the Web3 game industry in recent years, and their scale continues to expand.

Over time, the community can become a powerful entity that can achieve tangible results through collective action. The community encourages collaboration and sharing among players. Players can create content together, participate in game governance decisions, and exchange game strategies and experiences. Community members can support, communicate, and share tips with each other, promoting the development and mutual progress of the game. Community feedback and suggestions for game improvement are also crucial. Game developers can understand player needs and preferences through this feedback, and make timely adjustments and improvements to game features, balance, and user experience, providing a better game product.

IV. Talent Supply: Productivity and Production Relations in the Web3 Game Era

Economist Carlota Perez has systematically explained the "techno-economic paradigm" that drives social development. In her view, there have been five technological revolutions in human history, each of which brings new technology, new key production factors, new infrastructure, and the development of emerging industries. The process of technological revolution driving economic development is the "techno-economic" paradigm, and each historical tide of development can be seen as the renewal of the new paradigm over the old paradigm.

1. Production Capability: Innovative Production Engine in the Web3 Game Technological Revolution

The game industry has always been at the forefront of technological innovation. Modern games are a combination of art and complex technology. After decades of development, an industry path has been formed from upstream basic technology development, to midstream game content development and distribution, to downstream game distribution.

The Web3 technological revolution in the game industry brings new technology, new key production factors, new infrastructure, and the development of emerging industries.

The industrial ecology of traditional games generally includes upstream IP development, engines, and other basic technologies, midstream game developers, publishers, downstream C-end distributors, and end users. The industrial ecology chain of Web3 games is longer and more diverse, involving not only game development, production, and distribution, but also aspects such as on-chain and chain modification, trading and economic systems, and targeting B-end studios.

As an emerging industrial technology, the technological innovation of Web3 games not only reshapes the industrial landscape of games but also brings a rich industrial ecosystem of technological research and development, market transactions, and operational management throughout the upstream and downstream chains.

This innovative game scientific ecosystem is also creating a new productivity system, providing a large number of employment opportunities for regional game markets and creating a new Web3 game production relationship.

2. Paradigm Evolution: Production Relations and Institutional Reform in Web3 Game

The emergence of new productivity not only brings changes in productivity and socio-economic aspects but also triggers profound changes in production relations and social institutions.

Unlike other industries in the Web3 ecosystem, Web3 games represent not only the new productivity of Web3, transforming the production factors and labor processes of the original industry, and constructing a new mode of production; it also inherits the basic elements of the game industry. It can be said that Web3 games are the self-evolution of the game industry, and in the process of evolution from the "old paradigm" to the "new paradigm," the original industrial genes still exist.

Web3 games have the characteristics of decentralization, openness, and practicality, and are reshaping human communities, enterprises, labor, and organizations. Based on blockchain technology and smart contracts, Web3 achieves the decentralization of organizational power, allowing anyone to create a DAO community around their own project and organize user participation. With the help of smart contracts, people voluntarily cooperate around a set of common values. In the work process, the completion of each task is recorded on the blockchain and cannot be tampered with; project income is distributed through tokens, with the token quantity related to voting weight to achieve community governance.

Through on-chain records, token sharing, and collective voting, a distributed system of cooperation and governance has been formed, and DAO has basically achieved "self-sufficiency." This decentralized collaboration model means that Web3 work no longer requires a headquarters, there is no dedicated management layer, and members can work with people from around the world, choosing whether to remain anonymous or not. This is a parallel organization. The decentralized nature of Web3 and the distributed labor characteristics provide opportunities for gig economy work.

Web3 games are considered to be the most capable of creating mainstream applications in the Web3 adoption road, providing players with real ownership and economic incentives, and bringing new possibilities to the gaming industry. However, developing high-quality games is not an overnight process and requires continuous investment, trial and error, and optimization, placing higher demands on the financial and technological capabilities of game developers.

Since 2023, major Web2 game giants in various countries have accelerated their layout in the Web3 business, with development, marketing, and operations teams increasingly integrating with Web3 product and technology teams. In addition, many Web2 game studios already have elements similar to NFTs built into their games, and this transition will be even more natural as they enter the Web3 space.

3. Talent Direction: What Kind of Talent Does Web3 Gaming Need?

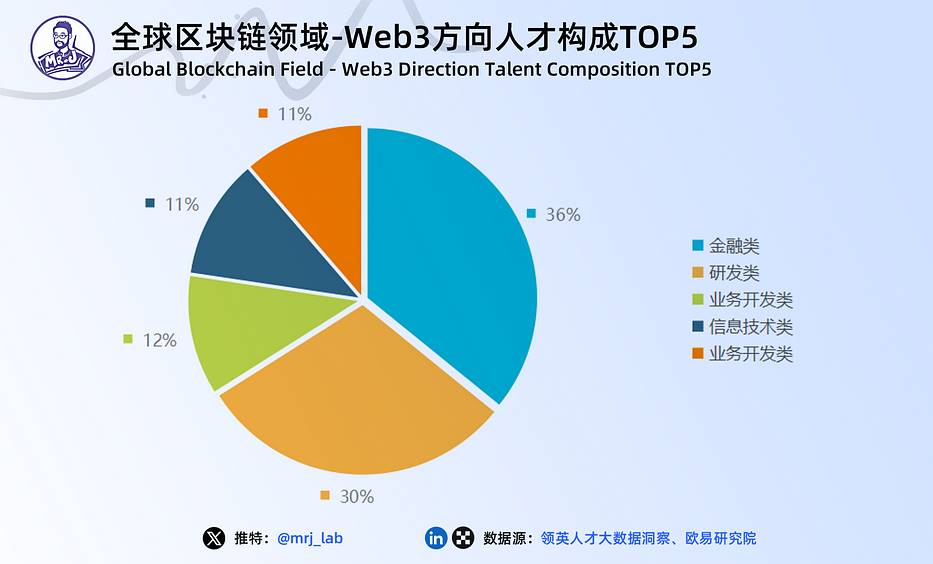

In 2023, OKX and LinkedIn jointly released the "2022 Global Blockchain Talent Report - Web3.0 Direction." From a macro perspective, as of June 2022, the total number of blockchain talents has increased by 76% year-on-year, with the highest growth rates in India, Singapore, and the United States at 122%, 92%, and 62% respectively.

The demand for talent is growing rapidly, with a multiple-fold increase compared to the previous year, and the demand far exceeds the supply, resulting in a huge talent gap. It is worth mentioning that Canada's growth rate reached 560%. The growth rates in India, Singapore, the United States, and China were 145%, 180%, 82%, and 78% respectively. In terms of talent supply, internal mobility is the main form of talent flow. According to the report, from 2021 to June 2022, talent mainly moved between blockchain companies such as Coinbase, Crypto.com, Gemini, and Ripple. External inflow of talent is mainly distributed in the fintech field, such as Goldman Sachs, JPMorgan, and HSBC. In terms of talent demand structure, in the early stages of industry development, a large number of foundational positions are often needed, such as research and development, development, product construction, and talents in finance, research and development, business development, information technology, and sales are still the most sought after types.

Web3 gaming is an important part of the Web3 industry and is a key catalyst for popularizing Web3 among the public. The underlying logic and business system of Web3 will bring changes to the traditional gaming industry. However, the talent system of Web3 gaming is not simply the superposition of gaming and Web3, but an organic integration of the two relationships.

As the Web3 gaming industry enters a mature stage of development, simple gold farming and financial games are no longer able to meet user demands. More exquisite art design, more attractive gameplay design, and a more sustainable economic system are becoming increasingly key to the success of a game. The future Web3 game studio will be composed of individuals who understand both gaming and the Web3 ecosystem.

Research and Development Talent: Web3 games require technically skilled R&D and development personnel, including blockchain developers, smart contract developers, and front-end and back-end developers. They should have solid programming and development skills and an understanding of blockchain and encryption technology.

Game Designers: Web3 games require innovative and attractive game design. Game designers should have a deep understanding of game mechanics and gameplay and should be able to integrate Web3 technology and economic systems into the game to provide a more interesting and sustainable gaming experience.

Art Designers: Exquisite art design is crucial for attracting users and enhancing user experience. Web3 games require art designers with artistic and design abilities who can create stunning game interfaces, characters, and scenes.

Economists and Game Economy Designers: The economic system of Web3 games is one of the keys to their success. Economists and game economy designers should be able to design sustainable and attractive game economic models to ensure the smooth operation of economic circulation and incentive mechanisms in the game.

Product Managers: Product managers play a crucial role in the development of Web3 games. They need to understand market and user demands and translate them into specific product plans and feature designs.

Blockchain Experts: Since Web3 games are closely related to blockchain technology, talents with blockchain expertise and experience are crucial in the Web3 gaming field. They should understand different blockchain platforms and protocols and be able to apply them to build game systems and functionalities.

At the same time, the production, on-chain, and distribution chain of Web3 games will release more talent dividends, providing diverse employment opportunities for traditional Web2 game talents to enter the Web3 space. However, these talents must understand and embrace the spirit of Web3, be able to quickly learn Web3 technology and scenarios, and combine them with gaming experience to transform into the ability to develop Web3 games.

Currently, Web3 gaming is still in a very early stage, and there is no large-scale industry cluster in any country or region in the world. However, the demand for talent is already showing, presenting an opportunity to seize the initiative.

Conclusion

As the early hype gradually subsides, VCs and project parties are returning to rational thinking, no longer pursuing explosive short-term growth, but paying more attention to sustainable development, the rationality of economic models, and long-term user retention.

This turning point has brought new opportunities for Web3 games. Although no one knows when the "winter" of Web3 games will end, everyone knows that the bull market of Web3 games will be brilliant.

In 2024, will Web3 games usher in an "iPhone moment"? We will always look forward to it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。