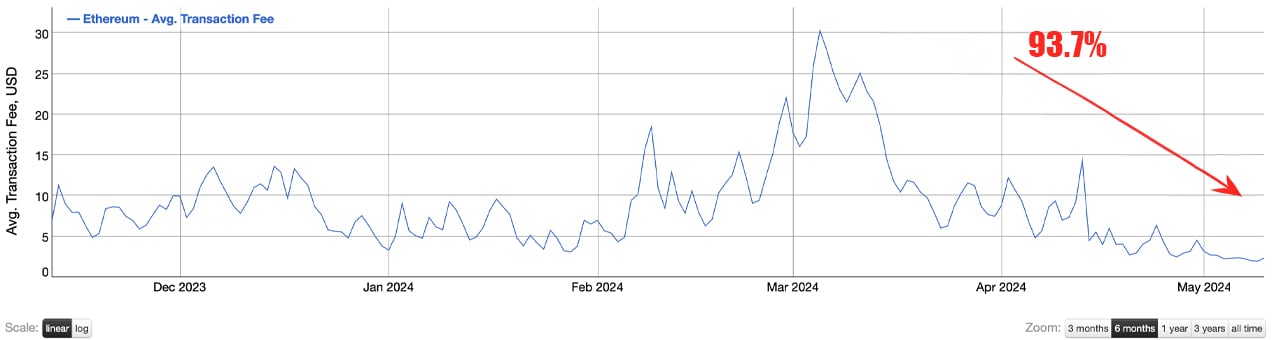

Transacting on the Ethereum blockchain has become significantly more affordable this week, with the average cost now at approximately 0.00065 ETH, or $1.91 per transaction, as reported by bitinfocharts.com. Additionally, executing a basic ETH transfer currently costs between 4 and 7 gwei, or $0.18 to $0.37 per transfer, according to data collected by etherscan.io’s gas tracker.

Ethereum average transaction fee.

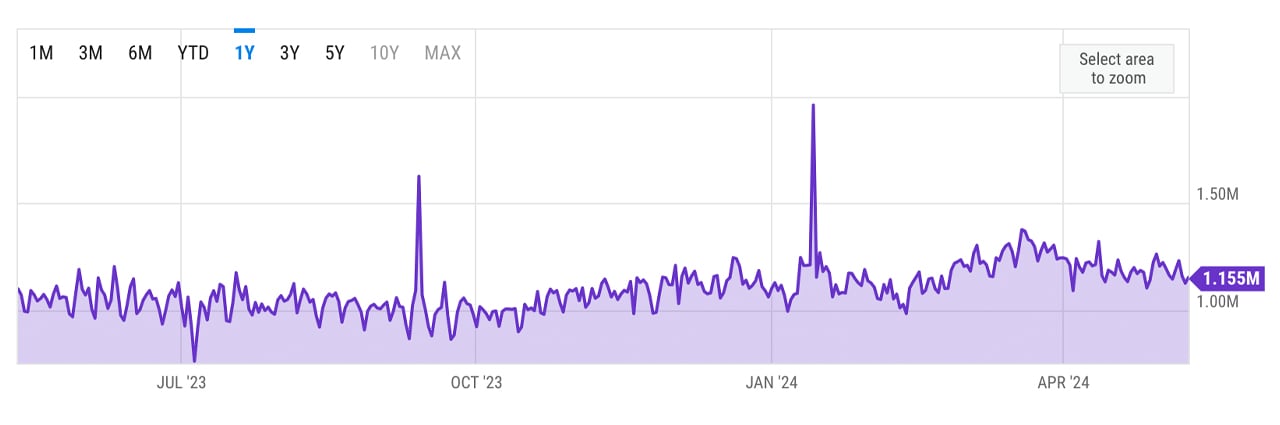

This weekend, engaging in a decentralized exchange (dex) swap on Ethereum can cost an estimated $4.16 and $7.28, while conducting an NFT sale may range from $7.03 to $12.31. Over the last 50 days, Ethereum has averaged just over one million transactions daily. The busiest day was March 22, 2024, recording 1.324 million transactions, while the slowest was April 4, 2024, with 1.091 million transactions. The average daily transaction count over this period stands at approximately 1.212 million.

Ethereum confirmed transactions per day.

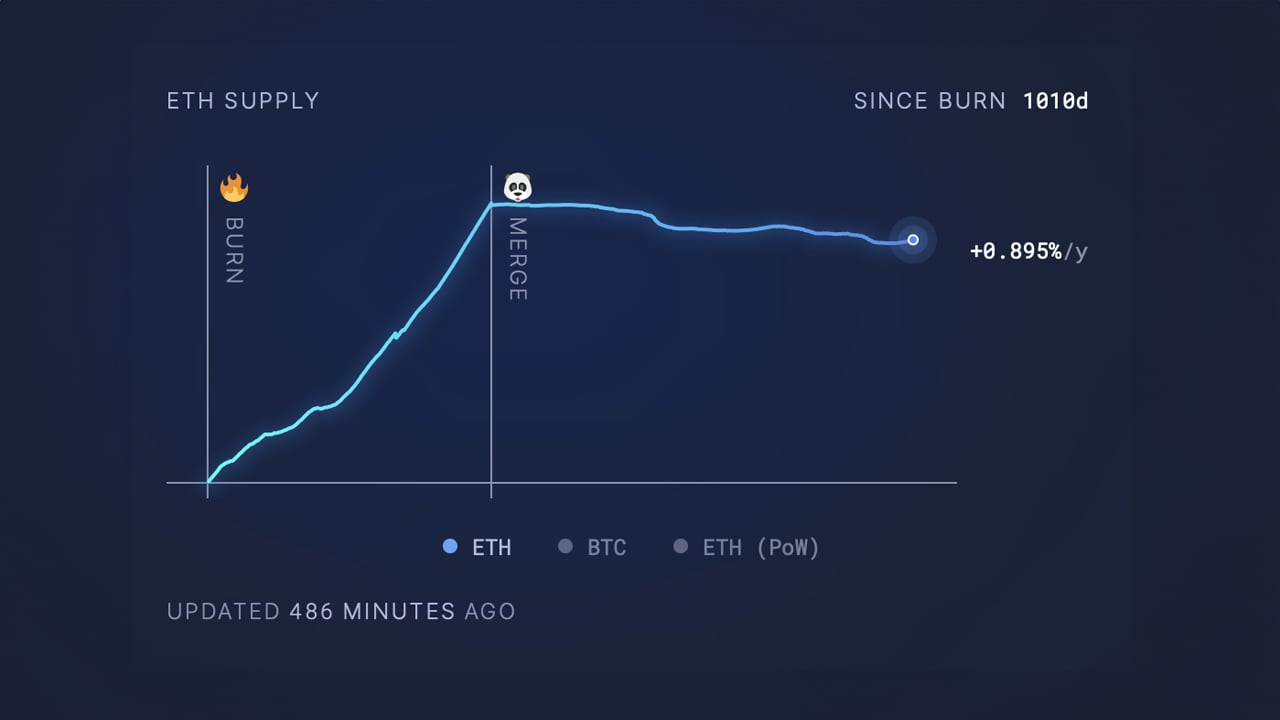

According to figures from ultrasound.money, Ethereum is currently experiencing an inflation rate of 0.895% annually. However, had Ethereum not shifted from a proof-of-work (PoW) system to a proof-of-stake (PoS) framework, the annual issuance rate under PoW would have been 3.923%. On top of the issuance rate, it has been 1,010 days since the London fork on August 5, 2021.

Ethereum inflation rate according to ultrasound.money.

The London upgrade essentially introduced Ethereum Improvement Proposal (EIP)-1559. This amendment changed the gas fee structure from a first-price auction model to a more stable base fee that is burned, eliminating it from circulation forever. Since this implementation, 4.29 million ETH, valued at $12.51 billion, has been burned to date. As Ethereum undergoes its inflationary stage, the notably lower transaction fees, while advantageous for users, present financial challenges for ETH validators.

These reduced fees influence the economic incentives tied to network security. In comparison, Bitcoin has seen over 100 exahash per second (EH/s) of hashpower depart since the last halving due to its falling hashprice. This highlights the intricate balance between ensuring user affordability for adoption purposes and maintaining adequate compensation for validators as Ethereum evolves its monetary policy and transaction cost structure.

How do you think Ethereum’s reduced transaction fees over the past 68 days will impact the network’s usage and the broader crypto ecosystem?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。