"Weekly Editor's Picks" is a "functional" section of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, the Planet Daily also publishes many high-quality in-depth analysis content, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, from the perspectives of data analysis, industry judgment, and opinion output, to bring new inspiration to you in the encrypted world.

Last week coincided with the May Day holiday, so this issue will summarize the content of the past two weeks. Now, let's read together:

Investment and Entrepreneurship

Macroeconomic Factors Affecting the Cryptocurrency Market in 2024

In recent times, there have been many unexpected geopolitical events outside the United States, leading to a rapid increase in global risk aversion, with both gold and the US dollar showing safe-haven properties.

In the medium to long term, the US debt crisis has not been resolved. In the two months before the election year, due to the uncertainty of the votes and specific policies, risk assets tended to show a volatile decline in history. The US economy has shown strong domestic demand and repeated inflation, with the expectation of economic recession significantly decreasing from last year.

Impact of Hong Kong Cryptocurrency Spot ETF from the Perspective of Supply and Demand

Demand side: Not allowing mainland RMB investors to purchase, the incremental funds may be limited, leading to lower trading volume.

Supply side: The in-kind redemption method increases the supply of ETF shares, enhancing the initial scale.

Considering the overall supply and demand, pay attention to the discount rate to grasp investment opportunities—ETF discount → stronger selling pressure → possible redemption → negative impact on the cryptocurrency market; conversely, assuming ETF premium → stronger buying pressure → possible subscription → positive impact on the cryptocurrency market.

The Hong Kong cryptocurrency ETF also has an important value for investors: it has added a circulation path for the conversion of cryptocurrency assets into tradable financial assets.

A Quick Look at 10 Potential Tokens Held by a16z, BlackRock, and Coinbase

Compound (COMP), Ispolink (ISP), 0x (ZRX), LCX (LCX), Orchid (OXT), UMA protocol (UMA), Synthetix (SNX), Realio (RIO), MOG COIN (MOG), Blur (BLUR).

Hack VC: Ten Suggestions for Project TGE

Users and TVL often follow the 80/20 rule (i.e., the top 20% of users can account for over 80% of TVL), so obtaining large deposits should be a focus when increasing TVL.

Adhering to best security practices is crucial.

Before the mainnet goes live, it is important to assess the product-market fit, and it is recommended to launch a "private mainnet" (different from the testnet) to allow real users with real capital to use the product service together to confirm the product-market fit. These users are limited to invitees (such as investors, friends, and the team), so as not to mess up marketing activities due to a small group of private users.

Start-ups are advised to delay the launch of their tokens until they have created significant actual value with the protocol. This is similar to Web2 start-ups before IPO, which often do not rush to go public before establishing a solid business.

Avoid selling tokens to retail investors (for legal/regulatory reasons), and a potential solution is an IEO. Setting a more attractive entry price for investors through IEO will also reduce risks.

Pay attention to the token vesting schedule when designing ownership time.

Allocate a budget for listing on exchanges.

Raise funds before token launch. Seek legal advice, but do not let it dictate all business decisions.

Choose the right timing to monetize through a "fee switch."

Also recommended: "Capital, Regulation, and Airdrops, the New 'Impossible Triangle' of the Cryptocurrency Industry".

Airdrop Opportunities and Interaction Guide

The Long-standing Pain of the Points System: A Review of the Rise and Fall of the Points Model

Before the popularization of the points system, the size of funds was not the main measure in project interaction and airdrops at that time. The points system has become a game for large holders, and it has also brought about a toxic TVL. The specific exchange rules for points and airdropped tokens are still determined by the project party, and points do not imply profit commitments. The long-standing pain of the points system may lead to the end of the points system era with the next large-scale points project backlash.

Bankless: The Dilemma of Points Programs and High FDV Airdrop Models

Currently, there is an oversupply of venture capital in the cryptocurrency industry. Projects face tens of billions of unlocks without new participants. Regulatory compliance has severely tilted the fulcrum of the public and private markets toward the private market. The points are unfair, and the market order is chaotic. The "points" meta has become too obvious to sustain. Both the SEC and scammers are working hard for this, and both are trying to use it for their own profit.

Bitcoin Ecosystem

Unveiling the Veil of the Bitcoin Ecosystem: Bitcoin Ecosystem Knowledge Pyramid

A dictionary of basic knowledge about Bitcoin.

CoinShares: BTC Miner Economics in the Post-Halving Era

Due to non-monetary use cases, projects based on the Bitcoin network (such as on-chain markets, collectibles, and multi-layer platforms) have experienced a recent surge in trading demand. These projects have also paved the way for other new revenue strategies, such as Miner Extractable Value (MEV) and transaction accelerators, which leverage significant changes in the Bitcoin trading market.

In the next halving period, transaction fees are likely to become the main source of miner income. It is also very likely and reasonable that the upcoming growth in transaction demand may offset nearly half (~43%) of the impact of the halving on fee income.

Bitcoin Renaissance: Analog Tendency and Retroism in the Digital World

After fifteen years of development in the blockchain industry, it is returning from the POS+Account route led by Ethereum to the POW+UTXO route led by Bitcoin.

Bitcoin's reference to the real world—cash—constitutes a form of analogy. POW unifies the security foundation of the digital world and the real world on energy; while UTXO provides independent and non-interfering digital bodies.

The real world implies a certain solidity, which is the foundation of the birth of ethics and morals (privacy, human rights, freedom, responsibility, sublimity). This may be the reason for the digital world's return to the retro in the real world.

Ethereum is function-oriented. Good developers should not think about how to quickly transfer the existing world on Ethereum, but should think about how to build new rules and a new world on this solid land. This may be the biggest innovation of this bull market.

Cregis Research: Analysis of Bitcoin Layer2 Track

The article introduces Lightning Network, Stacks, Rootstock, Liquid Network, BEVM, B²Network, Dovi, Map Protocol, Merlin Chain, Bison, BitVM, and RGB.

I suggest pairing with "When will asset extraction and mainnet launch be open? A quick look at the latest trends in popular BTC L2" for reading.

I recommend "Is there still an entry opportunity? A review of the 1st to 9th Rune projects launched last week".

Ethereum and Scalability

Consensys: 4 Reasons Why Ethereum is Not a Security

First, the SEC's historical position on Ethereum; second, the CFTC's classification of commodities; third, decentralization and open protocols; fourth, the irrelevance of the shift in consensus mechanisms.

Understanding Vitalik's New EIP-7702 Proposal: The Ultimate Prescription for Account Abstraction?

Account abstraction allows users to use smart contracts as accounts to add more functionality and security.

EIP-7702 modifies EIP-3074 to make it more concise and compatible with EIP-4337, so we won't end up with two independent account abstraction ecosystems, and EIP-5003 is seen as the next step for permanent migration. It is highly compatible with all the account abstraction work done for EIP-4337 so far, "the contract code that users need to sign can actually be the existing EIP-4337 wallet code".

Once this change takes effect, existing EOA can execute any smart contract code. Through additional EIPs, EOA can also be permanently upgraded to run specific code.

In time, this may completely change the way we all interact with Web3 applications.

The EIGEN token is not meant to replace ETH but to complement it.

ETH is mainly used for staking and network security as a general-purpose work token. ETH staking supports the reduction of objective faults (e.g., validators being penalized for incorrect validation).

The subject staking and dispute resolution mechanism of EIGEN complements ETH's on-chain staking mechanism by addressing subjective disputes and faults that ETH cannot handle, unlocking a significant amount of previously impossible AVS on Ethereum, with strong cryptographic economic security.

This may open the door to innovation in areas such as oracles, data availability layers, databases, AI systems, game virtual machines, intent and order matching, MEV engines, prediction markets, and more.

Understanding EigenLayer System: What are LST, LRT, and Restaking?

Restaking is a secondary derivative of the PoS mechanism. Technically, Eigenlayer uses the value of restaking to maintain the economic security of AVS, implementing "easy to borrow, easy to lend" through staking and forfeiture mechanisms.

This multi-layer leverage of restaking may lead to faster upward movement and higher peaks in this bull market phase, as well as more severe downward movement and broader chain reactions in this cycle's bear market, with a greater impact.

EVM+ is an advanced mode designed to further develop the Ethereum Virtual Machine to better adapt to the rapidly changing crypto space. In this mode, as Web2 innovations and productivity gradually integrate into Web3, practical technologies such as AI, DePIN, and DeFi security are also rapidly integrating into crypto applications.

Artela adds "native extensions" at the base layer, builds on the Cosmos SDK, and makes many improvements at the engine level. Secondly, Artela is compatible with EVM, and the innovation is the introduction of Aspect Programming to achieve on-chain extensions. In addition to EVM, Artela also adds a second WASM-based virtual machine to support multiple programming languages (assembly script, rust, C, C++), and access more on-chain resources. Therefore, EVM is suitable for general smart contracts, while Aspect VM is suitable for specific application extensions.

Multi-Ecosystem

In-depth Discussion of Solana's Fee Market and the Future of MEV

Solana's fee market is optimized for high performance and aims to avoid the problems seen in Ethereum. However, despite Solana's market potentially being more efficient than Ethereum's, it still needs to go through a similar MEV revolution (validators beginning to leverage their privileged positions). Solana does not need to go the route of Ethereum's proposal builder separation (PBS), but it needs to determine a comprehensive approach to stabilize its fee market in the long term.

The specialization of the fee market allows bargaining and auctions for block space to occur at a higher level, far from consensus and execution. Therefore, validators can fulfill their duties without worrying about optimizing the best results for accumulated block space value. Most of the value will be captured by a large number of validators.

An Overview of the Development Trend of Liquidity Staking on Solana

Although the staking rate exceeds 60%, only 6% (34 billion USD) of staked SOL comes from liquidity staking.

The market share of Solana LST (liquidity staking tokens) is more balanced than Ethereum.

LST market share rankings: jitoSOL (46%), mSOL (23.5%), bSOL (11.2%), INF (8.2%), jupSOL (3.6%). The most important factors for the success of liquidity staking tokens are liquidity, DeFi integration/partnerships, and expansion to support multi-chain.

Liquidity staking is the untapped potential of Solana DeFi, which could increase its TVL to 15-17 billion USD.

Inventory of On-chain Tools on Solana: Essential Tools for SOL Meme Players

Viewing websites and on-chain asset dashboards GMGN.ai, asset management dashboards and visual on-chain browsers AlphaVybe, on-chain data dashboards and token analysis tools Step Finance; some Telegram bot channels for tracking on-chain addresses and popular trend coin notifications.

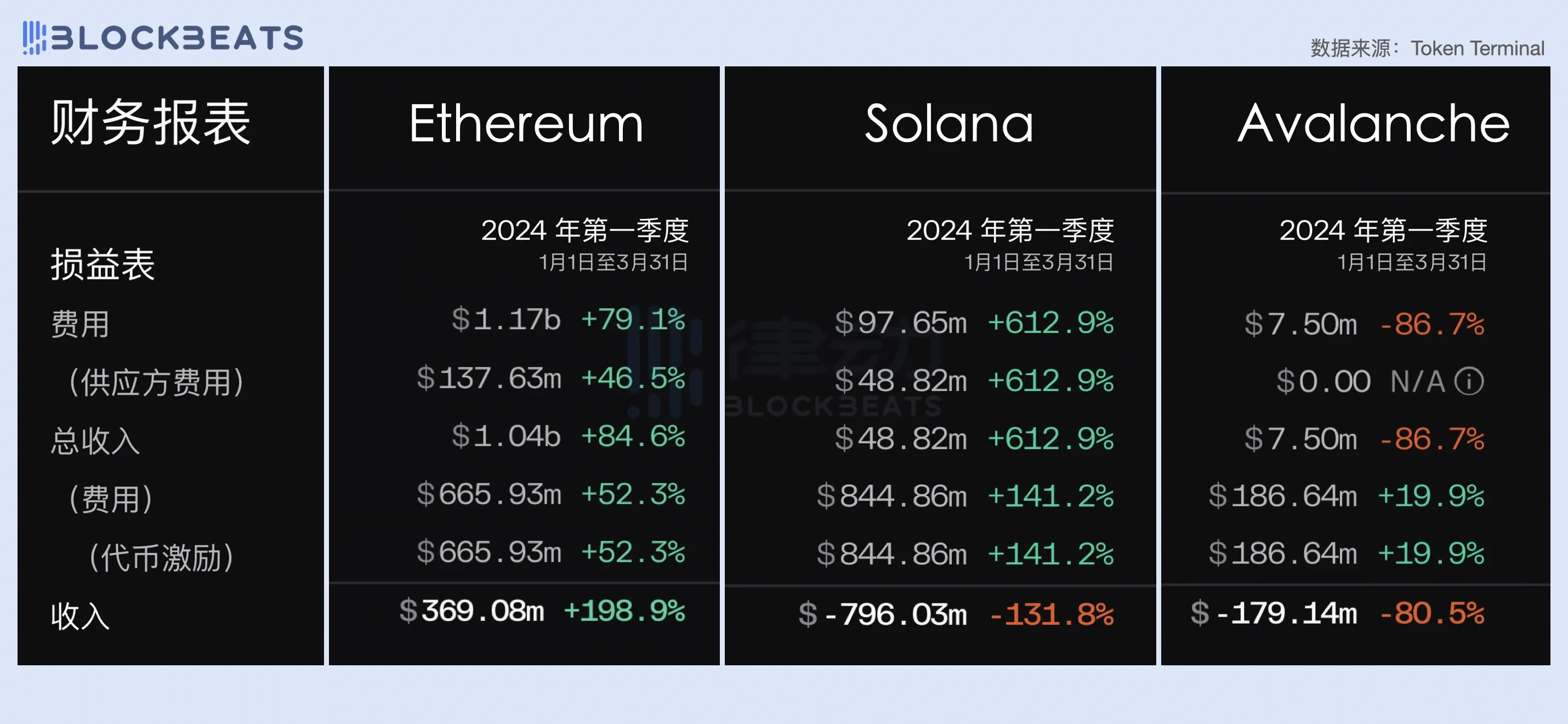

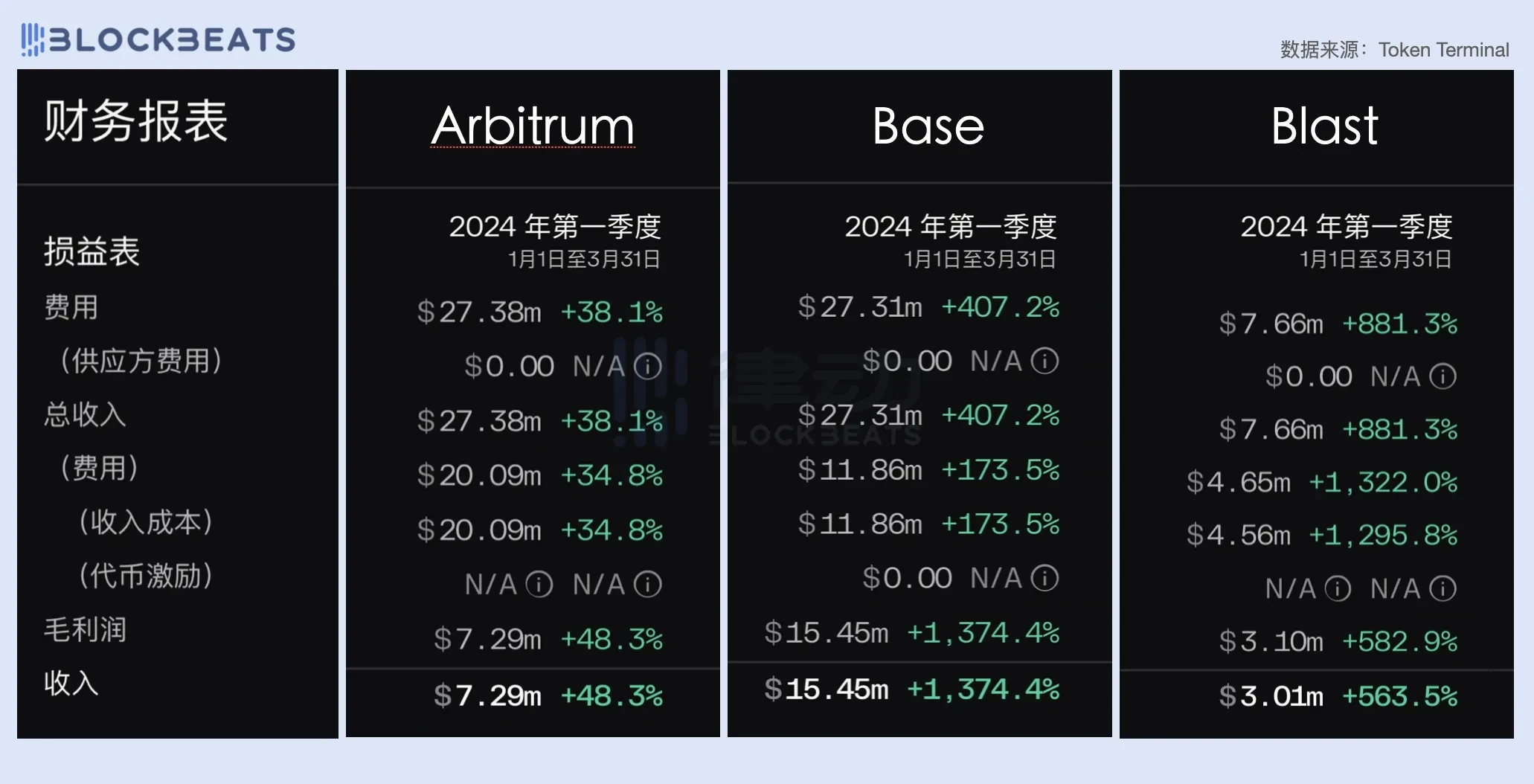

Q1 2024 Public Chain Financial Report: How are the public chains performing in terms of revenue?

Ethereum is still the most revenue-capable general-purpose public chain in the current crypto world, but overall, public chains are burning money like crazy.

The high operating costs and high revenue uncertainty make public chain entrepreneurship particularly difficult, which is why the top 10 market cap list in the crypto field has seen such frequent and drastic iterations over the past 10 years.

However, with the emergence of the modular trend led by Celestia and the development of RaaS infrastructure such as Altlayer, the industry is gradually exploring an opportunity for entrepreneurship that is more deterministic than public chains - L2.

DeFi

The New Wave of Interest-Bearing Stablecoins: Mechanisms, Features, and Use Cases

The new interest-bearing stablecoins generate income from three different sources: real-world assets, Layer 1 token staking, and perpetual contract funding rates.

Ethena offers the highest yield but also the highest volatility, while the Ondo and Mountain protocols restrict the use by U.S. users to reduce regulatory risk for interest income distribution.

Lybra's model redistributes ETH staking income to stablecoin holders, making it the most decentralized model, but it faces incentive issues.

In terms of the number of holders and DeFi use cases, Ethena's USDe and Mountain's USDM are leading in stablecoin adoption.

Grayscale Report: "Public Chains and Tokenization Revolution", Who Benefits the Most from RWA?

Many digital commerce use cases are transitioning from closed platforms hosted by centralized intermediaries to open and decentralized platforms based on public blockchain infrastructure, and tokenization is just one of many blockchain adoption trends.

Given the scale and scope of the global capital markets, it could be a significant trend if public chains can match borrowers and lenders (or asset issuers and investors) and decentralize existing fintech intermediaries, which should increase the value of public chain tokens.

SocialFi

Comprehensive Interpretation of friend.tech V2: Core Features, Platform Economy, and Token Potential

The paid group Club is the biggest highlight of friend.tech V2. friend.tech also plans to launch new features such as Keydrops, Memeclubs, and Pinned Rooms.

Amid the recent controversy over token airdrops, friend.tech distributed 100% to the community, and the token launch was relatively successful, giving FRIEND practicality for payments within the Club.

friend.tech has not yet enabled token transferability, meaning CEXs cannot list the FRIEND token, and the only ways to obtain FRIEND are through claiming airdrops or buying FRIEND with ETH on the friend.tech platform. Users can also provide liquidity by combining FRIEND and ETH to earn rewards.

Web3

LD Capital: Analyzing dappOS, the Flourishing Development of Intent-Centric Infrastructure

Key points for achieving intent include focusing on results rather than processes, executing delegation, and verifiable results. dappOS applications include unified accounts, intent assets (similar to intentUSD in Yu'ebao), and real-time dApp contract interaction.

Meme

Measuring the Value of Meme Coins: Dual Metrics of Finance and Social

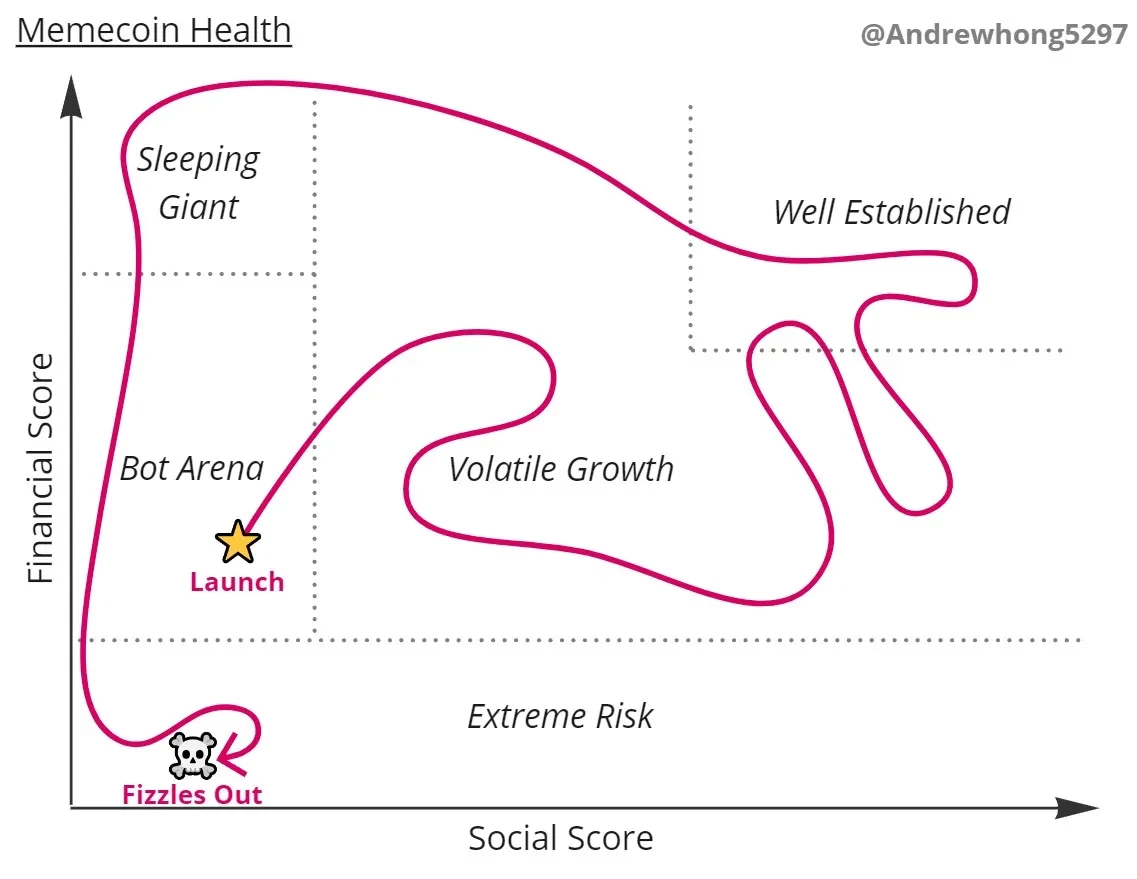

A successful Meme coin typically goes through the following stages: most Meme coins should be trapped in the "Bot Arena," with some appealing Meme coins in the "Volatile Growth" segment, and possibly one or two reaching "Well Established" Meme coins. During this process, some may lose social power and become "Sleeping Giants," while others may lose financial support (liquidity) and become "Extreme Risk."

Social scores include throwers, receivers, throw counts, channels, and activity levels; financial scores include FDV, price, daily growth, weekly growth, monthly growth price changes, liquidity, trades, swaps, total trading volume.

Also recommended: "a16z crypto: Roasting Meme Coins", "The Debate Behind Meme Coin Value: Community's Reverse Education for VCs", "A Brief History of Meme Coins: In-Depth Analysis of Historical Evolution and Future Trends".

Weekly Hot Topics Recap

In the past week, CZ was sentenced to four months; CZ: Thanks for everyone's support, will focus on a new chapter in life after the sentence ends; Foreign media: CZ has had multiple discussions with OpenAI CEO and expressed interest in participating in AI and biotech investments; WSJ: Binance's monitoring team leader was fired after pointing out that DWF Labs was suspected of market manipulation; DWF Labs: Media reports' accusations are unfounded, committed to supporting over 700 partners; He Yi: Binance is not targeting any funds, but has been monitoring the MM market.

The Hong Kong Stock Exchange has officially launched the trading of Bitcoin and Ethereum spot ETFs for Huaxia, Bosera, and Jia Shi (source); The Hong Kong Securities and Futures Commission (SFC) has approved the listing of virtual asset spot ETFs, but it does not imply support or encouragement for public investment; The Hong Kong Monetary Authority (HKMA) has identified crypto assets (especially stablecoins) as one of the focal points for 2024; The HKMA has established the Ensemble project architecture working group to support the development of tokenization in Hong Kong (source); Wintermute is collaborating with OSL and HashKey to provide liquidity for Bitcoin and Ethereum ETFs in Hong Kong (source).

FTX has submitted a revised restructuring plan, stating that almost all customers will receive full refunds. Insiders: FTX estate will auction the third batch of locked SOL (source); Additionally, in terms of policy and macro markets, DTCC: Companies will not be able to use cryptocurrency investment tools as collateral starting from April 30 (source); The U.S. SEC has issued a Wells notice to Robinhood regarding its U.S. crypto business. Robinhood CEO stated that they had already held 16 meetings with the SEC before receiving the Wells notice (source, source); The U.S. SEC has postponed the decision on the Invesco Galaxy Ethereum spot ETF application (source); Coinbase is facing a new lawsuit for alleged investor deception (source); Block is under compliance investigation for its business dealings with sanctioned countries and terrorist organizations (source); The U.S. Department of Justice has rejected Tornado Cash developer Roman Storm's motion to dismiss the criminal charges against him (source); Dutch authorities have arrested a suspect in the ZKasino fraud case and seized over 11.4 million euros in assets (source).

In terms of opinions and statements, Trump announced that he will accept cryptocurrency donations for his presidential campaign; A Fidelity executive stated that pension plans are beginning to explore investment opportunities in the crypto space; The CEO of Grayscale stated that Grayscale will focus on Ethereum spot ETF products; The founder of Uniswap stated that founders and VCs need to stop valuing early-stage unreleased projects at over $1 billion; Binance CEO wrote about the details of the "executive detention" incident; Vitalik proposed the concept of multi-dimensional gas pricing on Ethereum to improve network resource utilization efficiency; Arthur Hayes stated that changes in U.S. monetary policy will bring a large amount of USD liquidity, alleviating downward pressure on the crypto market, and Bitcoin will fluctuate between $60,000 and $70,000 until August; Standard Chartered Bank stated that the price of Bitcoin may drop to around $50,000; Jack Dorsey believes that the price of Bitcoin could reach at least $1 million by 2030; Justin Sun stated that Restaking and staking businesses will be split into independent brands and operating entities in the future, and will seek external financing; SBF accepted his first media interview since August last year, claiming his innocence and trading bags of rice in prison (source).

Institutions, major companies, and top projects: Former Sequoia China partner Cao Xi has invested $24 million in BNY Mellon's Bitcoin ETF through his Lixi Capital; Ethereum Gas hits a three-year low; The Uniswap mobile app has integrated with Robinhood Connect; BNB Chain launches Airdrop Alliance Program Chapter 2; Ethena releases its 2024 roadmap, aiming to integrate DeFi, CeFi, and TradFi with USDe; meson.network conducts a user airdrop for its mining system testing; NFTfi opens up airdrop applications; Renzo opens applications for the first season of airdrops and ezPoints Season 2; friend.tech opens applications for the FRIEND airdrop and releases v2 version; Kamino launches the KMNO token and announces the details of the KMNO staking incentive mechanism; NFTFI opens up airdrop applications; LayerZero completes Snapshot #1 and requires the self-reporting of witch addresses, and strictly prohibits employees from participating in its airdrop applications; ZeroLend opens applications for the ZERO airdrop and launches the staking service; MODE opens up applications for the airdrop; Morpheus opens applications for the MOR token and trading; Puffer Finance mainnet goes live; Bitcoin L2 network BOB launches the first phase of its mainnet; The new token economic model for EOS is set to be deployed on the mainnet by the end of May, with EOS staking rewards to be launched by the end of June.

In the NFT and GameFi sectors, Animoca Brands co-founder initiates the ApeCoin Ventures proposal, proposing to create a $10 million fund in collaboration with ApeCoin; Blur launches Blast, planning to distribute 2 million gold points to traders as rewards.

In terms of security, Shen Yu: The cloud input method used by as many as a billion users may have leaked input content, please take immediate action to reduce the risk; Cosine: Using the system's built-in input method is a good practice to reduce the attack surface, and mnemonic phrases/private keys should not be exposed to the internet; SlowMist CISO: Beware of Telegram phishing links that may lead to the risk of account takeover… Well, it's been another eventful two weeks.

Attached is the link to the "Editor's Picks of the Week" series portal.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。