原文标题:《Cobo 稳定币周报 NO.11:稳定币之夏升温,Airwallex 引发关于稳定币效率优势的争论》

稳定币之夏正在升温,其热度不仅来自增长数据,更来自两种截然不同的市场声音。本期周报将从这两个方向,感受稳定币的发展势头。

一边是来自传统金融科技领域的审慎观望。金融科技公司 Airwallex 创始人近期提出对稳定币「效率优势」的讨论,认为现代支付系统已相当高效。这种视角可能低估了稳定币的创新本质——稳定币的价值不仅在于交易速度或成本,更在于它作为可编程货币的特性,使结算、分润和权限控制能直接嵌入资产本身。这类讨论恰恰反映了新技术开始触及传统系统边界的信号,也是创新周期中的自然现象。

另一边,则是看得见的落地动作。Stripe 通过收购 Privy,正打通稳定币支付从后台到前台的最后一公里;Shopify 则开始为商家接入 USDC 支付;而 X 平台与 Polymarket 的合作,更是将加密资产引入「超级应用」的内部经济循环。重点早已不是发行稳定币本身,而是围绕它构建最强大的生态与分发体系。

在新兴市场,这场竞争更为直接和残酷。Tether 推出专用链 Plasma,希望减少对 Tron 的依赖。但 Tron 已凭借超 50% 的 USDT 流通量和极低成本,成为「街头美元」的事实标准。于是问题变成了一个纯粹的创业公司难题:你如何说服一个已经深度依赖现有网络的用户群体,去迁移到一个新的、未经大规模验证的系统上?这本身和技术关系不大,是信任门槛,也是加密支付真正的机会所在。

可以说,稳定币作为一种新兴产物,还处于发展阶段,它当前的状况具有大多数新技术在早期阶段的典型特征:一部分人在用它构建未来,另一部分人则觉得它还不够完善,而与此同时,在世界的另一端,它正在以一种出乎意料的方式解决着最基本的问题。这是一个巨大的「schlep」,也是一个巨大的机会。

市场概览与增长亮点

稳定币总市值达$251.08b(2511 亿美元),周环比增长$1.42b(约 14.2 亿美元)。市场格局方面,USDT 继续保持主导地位,占比 62.14%;USDC 位居第二,市值$60.8b(约 608 亿美元),占比 24.22%。

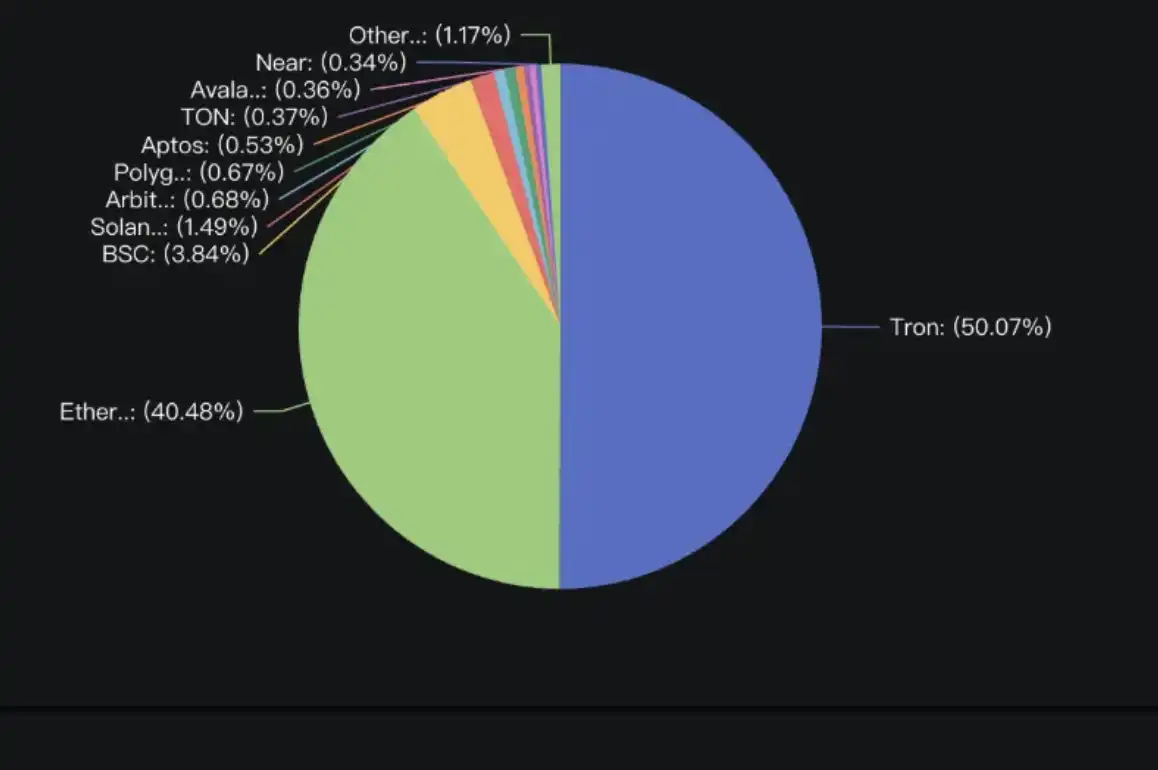

区块链网络分布

稳定币市值前三网络:

· 以太坊:$124.632b(1246 亿美元)

· 波场 (Tron):$79.039b(790 亿美元)

· Solana:$11.113b(111 亿美元)

周增长最快的网络 TOP3:

· XRPL:+37.82%(RLUSD 占比 94.32%)

· Unichain:+24.84%(USDC 占比 49.8%)

· Filecoin:+20.19%(USDFC 占比 99.45%)

数据来自 DefiLlama

收购 Privy,Stripe 打通稳定币落地的最后一公里

全球支付巨头 Stripe 确认收购加密钱包提供商 Privy,这并非一次简单的并购,而是其多年布局的收官之作,清晰地揭示了 Stripe 在稳定币领域的终局战略。若将 Stripe 收购 Bridge、推出稳定币账户、再到如今拿下 Privy 这几步连起来看,一幅垂直整合支付全链路的蓝图已然成型。从底层的结算引擎,到中台的企业账户,再到前端的用户钱包,Stripe 已将所有关键组件尽收囊中。

这一系列动作的核心,是利用其广泛分布的全球数百万商户网络,来解决稳定币「最后一公里」的落地难题。想象一下,当任何持有 USDC 的用户都能在海量的 Stripe 商户处无缝消费,而商家收到的却是自己熟悉的本地法币时,稳定币作为支付手段的价值才真正得以释放。而实现这种「无感」体验的关键,正是 Privy 所代表的「隐形」技术。

Privy 的「嵌入式钱包」(Wallet-as-a-Service)的产品特性让开发者能轻松集成非托管钱包,用户无需管理助记词等复杂操作,体验与传统网络账户无异。这与 Stripe 为开发者简化复杂性的使命完美契合。

回顾人类技术史,新技术的普及往往需要一个强大的「桥梁」来简化复杂性。Stripe 正在扮演稳定币通向主流市场的关键桥梁角色。当一个巨大的商业网络向稳定币敞开大门,强大的飞轮效应将被启动:更多的应用场景吸引更多的用户持有稳定币,庞大用户基数促使更多商业体接入。

通过将加密轨道的复杂性彻底「隐藏」在熟悉的 API 之后,Stripe 标志着稳定币采用模式的根本转变——从加密原生公司主导的「技术驱动」,转向成熟支付服务商引领的「市场驱动」。

这一次,加密主流采用可能真的来了。

稳定币专用区块链 Plasma:USDT 的独立宣言

尽管稳定币已被验证为加密行业产品市场契合度最高的「杀手级应用」,但围绕 USDT 等核心资产构建的专用链级基础设施仍属稀缺。Plasma 是少数例外之一——一条为 USDT 而生、专为稳定币支付场景设计的高性能区块链。

Plasma 的架构围绕一个核心目标:将稳定币支付体验推至极限——零手续费、无额外代币需求,用户仅凭 USDT 本身即可完成支付与转账。这种设计让 USDT 成为链上的「一等公民」。其背后是 Tether 与 Bitfinex 的资金与资源加持:专属通道、定制协议、比特币级别的安全锚定机制,以及全链统一的原生稳定币 USDT₀——这是一种围绕 USDT 实现底层抽象的链上资产。

与之形成对比的是 Circle 的路径。它通过 CCTP 跨链协议支持 USDC 在以太坊、Solana、Arbitrum 等多链间流转。但每一次桥接后的使用体验,仍受限于目标链的性能、成本与交互门槛。Circle 更像是加密多链生态的「适配者」。

Tron 的护城河:比想象中更深

然而,Plasma 面临的最大挑战并非来自 Circle,而是必须与 Tron 进行一场不对等的正面对决。

全球流通的 USDT 中,超过 50% 运行在 Tron 网络上。在「街头美元」的世界里,TRC20-USDT 就是事实标准。这种主导地位来自于 Tron 在发展关键期采取了极致的低成本策略:通过质押少量 TRX 获取「能量」,几乎实现免费转账。对新兴市场的小额、高频支付场景而言,这是理性选择。这种策略在数年时间里培养了庞大的用户群体和根深蒂固的使用习惯,使 Tron 早已成为东南亚、拉美、非洲、东欧等地区场外交易商、P2P 商户、小型贸易商进行资金流转的默认网络。

全球流通的 USDT 中,超过 50% 运行在 Tron 网络上

「Good Enough」的残酷现实

Tron 的核心用户并非追求最新技术的 DeFi farmer,而是需要简单、可靠、便宜工具的「街头美元」使用者。对这个需求,Tron 的技术已经足够好——速度够快,成本够低,钱包足够易用。

这些业务网络很多建立在线下的人际信任之上。一个新区块链想要取代 Tron,不仅要提供更好的技术,更要取代已经形成的错综复杂的社会和商业信任网络。用户没有强烈动力去承受学习新钱包、记录新助记词、更换收款地址等迁移成本。

即便 Plasma 在技术上全面超越 Tron,也无法轻易复制后者花费数年在特定市场积累的庞大网络效应、深度商业渗透和牢固用户习惯。除非能提供 10 倍以上的综合体验提升,否则很难让这个已经高效运转的庞大生态系统「Move On」。

战胜 Tron 的关键在于 Plasma 能否在其主导的新兴市场建立本地信任。Tether 试图摆脱对 Tron 依赖,标志着稳定币基础设施正面临「通用适配」与「垂直专用」的选择。但真正的考验在于,能否从这位根深蒂固的王者手中赢得真实用户和交易量。

当 Airwallex 这样的顶级金融科技开始评估稳定币的价值

随着稳定币发行商巨头 Circle 在纽交所敲钟上市,「稳定币热」在金融界进一步升温。曾经被视作加密圈内的专业工具,正逐步切入清算、流动性、企业支付等核心金融场景。稳定币不仅在重塑成本结构,也开始挑战传统清算体系的中介模式——这自然引发了市场的广泛讨论。

近日,金融科技公司 Airwallex 创始人 Jack Zhang 对稳定币的实际应用价值提出了思考。他指出,在 G10 主流货币区,现代金融科技已将跨境支付效率大幅提升,稳定币的「更快、更便宜」优势在某些场景下可能并不明显。特别是当需要将资金转入传统银行系统时,额外成本可能抵消部分优势。在他看来,稳定币的优势可能更多体现在新兴市场的「美元化」需求上。

这一观点有其合理性,但可能低估了稳定币带来的范式转变。稳定币真正要重塑的,不仅是支付接口的响应速度,而是背后那套地理封闭、时间受限、流动性层层转包的清算体系。当我们将「成本」概念扩展到账户管理复杂度、资金在途造成的资本占用、以及节假日带来的运营不连续性,一个全球统一、7×24、以美元为本位的清算层的价值,就远超出单纯的交易费用比较。

更重要的是,稳定币最具创新性的特点在于其「原生可编程性」。

将稳定币与传统金融科技解决方案在「支付体验」上简单对比,类似于早期智能手机与功能机的比较。智能手机的革命性不在于它是一个「更好的电话」,而在于它是一个连接互联网的计算平台,由此催生了全新的应用生态。同理,稳定币不仅是「更高效的货币」,更是一种「可编程的价值载体」。这意味着,结算逻辑、财务分润、实时融资都可以内嵌在资产本身,简化了中介环节和审批流程。这种创新方向,传统金融科技即使不断优化,也难以完全实现。

当金融领域的专业人士开始认真研究如何与这套新系统融合时,这本身就是市场给出的最诚实的信号,稳定币是未来,是下一代价值互联网的「智能手机」。真正的未来在于理解并整合新旧范式的优势,无论是传统金融机构还是创新金融科技公司,都需要思考如何在这一变革中找到自己的定位。

宏观趋势

分析称 Tether 若上市估值或达 5150 亿美元,CEO 称考虑比特币和黄金储备增长「甚至偏保守」

要点速览

· Artemis 联合创始人兼 CEO Jon Ma 分析称,若按照 Circle 目前 69.3 倍 EBITDA 的估值倍数计算,Tether 上市市值可能达到 5150 亿美元,将超越可口可乐和 Costco 成为全球第 19 大公司

· Tether CEO Paolo Ardoino 回应称这是「美丽的数字」,但考虑到公司不断增长的比特币和黄金储备,该估值「可能有点保守」

· Tether 2024 年净利润达 130 亿美元 (70 亿来自国债和回购,50 亿来自比特币和黄金持仓的未实现收益),预计 2025 年 EBITDA 约为 74 亿美元

为什么重要

Circle 成功上市为稳定币发行商估值提供了市场参考,尽管当前 69.3 倍 EBITDA 的倍数被认为「疯狂且难以持续」。Tether 的潜在估值反映了市场对稳定币业务模式的高度认可,特别是在高利率环境下产生的可观利息收入。与传统金融机构不同,Tether 通过持有比特币和黄金作为储备的一部分,为公司创造了额外增长潜力。Ardoino 的回应也暗示 Tether 可能在考虑上市路径,这将为整个加密行业带来更多机构认可和监管明确性,进一步推动稳定币在全球金融体系中的主流化

资本布局

Anduril 创始人 Palmer Luckey 将投资稳定币初创公司 Atticus,最低估值 15 亿美元

要点速览

· 秘密运营的稳定币金融初创公司 Atticus 正进行新一轮融资谈判,估值在 15 亿至 20 亿美元之间,由美国国防科技公司 Anduril 联合创始人兼 CEO Palmer Luckey 领投

· Atticus 由 Owen Rapaport 和 Jacob Hirschman 创立,目前尚无官网,现有投资方包括 Haun Ventures,其合伙人 Diogo Monica 是美国首家获联邦许可的加密原生银行 Anchorage Digital 创始人之一

· 若完成融资,Atticus 将成为今年首家新的稳定币「独角兽」公司,标志着稳定币与传统金融的日益融合

为什么重要

投资者正押注稳定币即将全面走向主流。Palmer Luckey 作为 VR 巨头 Oculus 创始人和国防科技公司 Anduril 领导者的参与,显示了传统科技和国防行业资本对稳定币行业的强烈兴趣。

Adyen 前高管联合创立稳定币支付公司 Noah,融资 2200 万美元

要点速览

· Adyen 前全球销售执行副总裁 Thijn Lamers 联合创办稳定币初创公司 Noah 并担任总裁,这位行业资深人士从投资人转变为联合创始人,代表传统支付巨头高管「用脚投票」支持稳定币技术

· Noah 旨在构建基于稳定币的全新全球支付清算网络,提供企业级 USDC 支付解决方案和开发者 API,创建绕开传统银行系统的 24/7 可编程价值流转网络

· 公司已支持 50 种货币转换和 70 个国家间实时资金转移,交易量超 10 亿美元,获得 LocalGlobe 领投的 2200 万美元种子轮融资

为什么重要

Lamers 从 Adyen 转向 Noah 代表了支付行业的范式转变。如果说 Adyen 的使命是「整合并优化旧的轨道」(通过一站式平台整合全球碎片化支付系统),那么 Noah 的使命是「设计并建造新的轨道」。这一人才迁移暗示传统支付系统优化已趋近极限,而基于稳定币的新金融基础设施才是未来十年最具增长潜力的领域。Noah 不仅提供技术,还带来合规专业知识和商业网络,这正是稳定币支付从理论走向主流采用所必需的要素。随着行业从早期颠覆阶段进入成熟建设阶段,Lamers 这类资深人士的加入为稳定币支付赋予了前所未有的商业可信度,表明这一技术已准备好成为下一代全球金融基础设施的核心组成部分

Circle 股价持续暴涨,两家 ETF 产品已在筹备中

要点速览

· Bitwise 和 ProShares 于 6 月 6 日同时提交了与 Circle(CRCL) 相关的 ETF 申请,抢占这一热门资产市场

· ProShares 计划推出的 ETF 产品旨在提供 Circle 股票日度表现的 2 倍收益,利用杠杆策略放大投资回报

· Bitwise 的 ETF 采用覆盖式期权 (covered call) 策略,通过持有 CRCL 股票并出售看涨期权来产生额外收入

为什么重要

Circle 股价在 IPO 后继续疯涨,周一再上涨 9%,自上周上市以来股价已接近翻两番。两家知名 ETF 发行商迅速提交相关产品申请,反映机构投资者对主流稳定币发行商的强烈兴趣。这也标志着加密货币公司与传统金融产品的进一步融合,为普通投资者提供了通过熟悉的 ETF 工具间接参与加密货币生态的新途径。投资者对 Circle 的热情不仅源于 USDC 作为第二大稳定币的市场地位,还因为稳定币业务模式在加密货币行业中展现出相对稳健的收入来源和增长潜力

OpenTrade 完成 a16z crypto 参投的 700 万美元融资,为高通胀国家提供稳定币收益解决方案

要点速览

· 英国金融科技公司 OpenTrade 完成 700 万美元战略融资轮,由 Notion Capital 和 Mercury Fund 领投,a16z crypto、AlbionVC 和 CMCC Global 参投,六个月内融资总额达 1100 万美元

· OpenTrade 运营「收益即服务」(yield-as-a-service) 平台,专为金融科技应用、交易平台和新兴银行设计,使其客户能为终端用户提供高达 9% 的美元和欧元稳定币收益

· 西班牙 Criptan 和哥伦比亚 Littio 等金融科技公司已接入 OpenTrade 后端系统,为拉丁美洲和欧洲高通胀国家用户提供稳定币收益服务

为什么重要

OpenTrade 为遭受通货膨胀困扰的新兴市场提供了金融避险工具。在许多高通胀国家,本地货币持续贬值侵蚀居民财富,而传统美元账户往往受到限制或手续繁琐。OpenTrade 的 B2B2C 模式通过赋能当地金融科技公司,实现了稳定币收益服务的快速分发。该公司六个月内筹集 1100 万美元的速度,显示投资者对稳定币在经济不稳定地区应用前景的强烈信心。这一服务不仅为个人提供了抵御通胀的途径,也为实物资产支持的 DeFi 收益创造了新市场,同时为当地金融科技公司提供了差异化竞争优势

Tether 以 8200 万美元入股黄金投资公司 Elemental Altus,加强贵金属储备策略

要点速览

· Tether 投资部门以 1.216 亿加元 (约 8920 万美元) 收购公开上市贵金属投资公司 Elemental Altus 约 33.7% 的股权

· CEO Paolo Ardoino 表示此投资反映了 Tether「对黄金基本面的信心及其在金融市场中的关键作用」,将为 Tether Gold 和未来基于商品的数字资产基础设施提供战略支持

· Tether 将增加黄金敞口称为「双支柱策略」,与其持有的超过 10 万枚比特币 (价值 107 亿美元) 并行

为什么重要

此次投资标志着 Tether 正积极多元化其稳定币 USDT 的支持资产组合,拓展至实物资产和贵金属领域。随着美国稳定币监管框架即将出台,发行商需要确保其支持资产的合规性和多样性。摩根大通今年早些时候曾暗示,为符合拟议的监管要求,Tether 可能需要出售部分比特币持仓。通过增加黄金敞口,Tether 不仅提升了资产组合的稳定性,也为未来可能推出的商品支持数字资产奠定基础。此举显示 Tether 正在战略性地平衡其加密资产和传统保值资产的配置,以应对不断变化的监管环境并增强 USDT 的信任度

监管合规

蚂蚁国际计划申请新加坡、香港和卢森堡稳定币牌照,布局跨境支付与财资管理

要点速览

· 蚂蚁国际 (Ant International) 计划申请香港、新加坡和卢森堡的稳定币发行牌照,将在香港《稳定币条例》8 月生效后立即提交申请

· 蚂蚁集团去年处理了超过 1 万亿美元的全球交易,其中三分之一通过其基于区块链的 Whale 平台完成。蚂蚁目前已与包括汇丰、巴黎银行、摩根大通和渣打在内的 10 多家全球银行签署合作协议

· 此举旨在加强蚂蚁的区块链业务,为其跨境支付和财资管理服务提供支持,该业务因阿里巴巴电商平台和外部客户的大量交易而显示增长潜力

为什么重要

蚂蚁国际积极布局稳定币业务反映了全球科技金融巨头进军数字资产领域的趋势。自 2020 年 IPO 被叫停后,蚂蚁一直在开发新业务推动增长,而国际业务成为其重要发展方向。蚂蚁国际已建立独立董事会,为分拆和潜在 IPO 铺路,据彭博社报道,该部门 2024 年创造近 30 亿美元收入,连续两年实现调整后盈利。与此同时,全球稳定币行业已发展至约 2430 亿美元规模,监管机构正积极制定规则以应对稳定币崩盘和洗钱风险。蚂蚁的 Whale 平台支持全球银行和机构的多种代币化资产,使用同态加密等隐私计算技术并支持多方验证,这使其在企业区块链市场上具有竞争优势。继 PayPal 等金融巨头之后,蚂蚁国际进军稳定币领域标志着传统金融与加密技术融合的进一步深化,可能为全球支付和财资管理带来重大变革

韩国执政党提议允许企业发行稳定币,法案已提交国会

要点速览

· 韩国执政的民主党提出新政策,允许符合资格的企业发行自己的稳定币,已向国会提交《数字资产基本法》

· 根据提案,企业需满足股本要求并通过储备金保证退款,旨在提高加密货币领域的透明度并鼓励竞争

· 此举发生在全球稳定币行业兴趣激增之际,部分原因是美国在稳定币监管方面取得进展

为什么重要

李在明总统所在政党提出的这项法案标志着韩国加密监管的重大转变,有望将韩国定位为亚洲稳定币创新中心。允许企业发行稳定币可能导致支付领域出现更多竞争,特别是考虑到韩国已有的先进数字支付基础设施。此举也反映了全球监管环境正在向接受而非限制稳定币发展的方向转变,可能进一步推动机构采用。

香港稳定币新规,小团队如何在巨头主导市场中寻找机会

要点速览

· 香港稳定币监管沙盒已培养了京东、圆币等「尖子生」项目,这些早期进入者已领先新入场者两年,掌握了完整的系统开发、合规流程和风控体系

· 香港条例对稳定币发行方设置高门槛,包括 2500 万港币注册资本、本地实体公司、持续盈利能力等,加上储备资产 100% 等值、严格分离托管机构等要求,基本排除了草根创业者

· 香港稳定币政策采取「试点先行」策略,每年可能仅批少数牌照,且政策随时可能调整,对中小企业和初创团队形成极高的入场和持续经营风险

为什么重要

香港稳定币规则正引领全球监管趋势,虽然牌照发行将由大型金融机构和科技巨头主导,但围绕稳定币的服务生态却给中小团队提供了丰富机会。创业者应转向「卖铲子」战略,专注五大合规赛道:支付基础设施 (PayFi)、合规工具供应、跨链桥接服务、稳定币资产管理和储备资产管理。这些领域对专业性和技术要求高但资本门槛相对较低,能让中小团队在不与巨头直接竞争的情况下分享稳定币市场红利。随着香港稳定币监管框架成熟,这些生态位将成为连接传统金融与 Web3 世界的关键桥梁

市场采用

Stripe 与银行洽谈稳定币应用,支付巨头加码稳定币业务

要点速览

· 支付巨头 Stripe 已与多家银行展开初步讨论,探索银行机构潜在的稳定币应用,显示数字资产正在全球资金流动中扮演越来越核心的角色

· Stripe 近期推出多款稳定币相关产品,包括允许金融科技公司快速为客户启动稳定币关联卡项目的平台,目前全球稳定币流通量约 2430 亿美元

· 今年早些时候,Stripe 以 11 亿美元收购稳定币平台 Bridge,现有约 100 名员工在全球范围内从事稳定币和加密业务,并计划在旧金山、纽约、都柏林和伦敦扩大招聘

为什么重要

支付行业正迅速拥抱稳定币,将其从纯粹的加密交易工具转变为常规支付手段。Stripe 总裁 John Collison 表示「未来大量支付交易将通过稳定币完成」,这项技术有望大幅降低跨境支付成本和时间。与此同时,PayPal、Visa 等支付巨头也在推进稳定币业务,银行技术提供商如 FIS、Fiserv 和 Jack Henry 正在考虑如何帮助客户使用该技术。在全球监管态度日趋明朗的背景下,英国、美国和欧盟都在推进稳定币立法,Collison 警告,如果伦敦金融城在监管框架上不加快步伐,将在稳定币整合竞赛中进一步落后

德意志银行探索稳定币和代币化存款,多方案并行考虑

要点速览

· 德意志银行正评估多种稳定币方案,包括发行自己的代币或加入行业联合倡议,同时考虑开发自有代币化存款解决方案用于支付

· 欧盟统一监管框架已就位、美国稳定币立法正在国会推进,全球银行积极探索如何利用这类代币和底层区块链技术提升效率

· 德银已战略投资跨境支付结算公司 Partior,参与 BIS 和央行组织的 Agorá项目,并与瑞士区块链公司 Taurus 合作开发机构客户数字资产托管服务

为什么重要

大型金融机构对数字资产领域扩张信心增强。虽然许多努力已持续多年但大规模实际应用仍不多,如今行业开始出现客户采用的早期迹象——摩根大通 Kinexys 网络平均每天处理超过 20 亿美元的交易,而去年该网络的交易量增长了 10 倍。桑坦德银行已有计划为零售客户提供稳定币及加密货币服务,德银旗下 DWS 集团正与荷兰做市商 Flow Traders 和加密基金 Galaxy Digital 合作发行欧元代币。ING 集团 CEO 也认为「欧洲稳定币在数字世界结算中有重要角色」,反映传统金融机构正加速数字资产战略布局

法国兴业银行推出美元稳定币 USDCV,同时部署于以太坊和 Solana

要点速览

· 法国兴业银行加密部门 Société Générale-Forge 宣布推出美元稳定币 USD CoinVertible(USDCV),同时在以太坊和 Solana 区块链上发行

· 纽约梅隆银行 (BNY Mellon) 将担任该稳定币的资产托管方,USDCV 交易预计将于 7 月启动,但不向美国用户开放

· 此次发行是继 2023 年 4 月推出符合 MiCA 监管的欧元稳定币 EURCV 后的自然延伸,旨在提供 24/7 全天候法币与数字美元或欧元之间的无缝转换

为什么重要

法国兴业银行作为欧洲顶级金融机构发行稳定币,标志着传统银行业积极拥抱区块链金融创新的趋势加速。USDCV 和 EURCV 的用例涵盖加密交易、跨境支付、链上结算、外汇交易和现金管理等多个领域,展示了稳定币作为多功能金融工具的潜力。法国兴业银行选择同时在以太坊和 Solana 上部署,反映了机构对高性能区块链的需求。

科技巨头苹果、X、Airbnb 和谷歌探索采用稳定币,降低交易成本

要点速览

· 据 Fortune Crypto 报道,苹果、X(前 Twitter)、Airbnb 和谷歌正与加密公司展开初步对话,探索整合稳定币以降低交易成本、实现更经济的国际支付

· 这些公司加入 Meta 和 Uber 等已在评估采用美元锚定资产的科技巨头行列,背景是监管环境改善和投资者对稳定币需求增长

· X 平台周五宣布 Polymarket 成为其「官方」预测市场合作伙伴,这一去中心化预测平台 5 月交易量达 10.6 亿美元,活跃交易者超 26.7 万

为什么重要

科技巨头对稳定币的兴趣反映了传统企业对区块链支付解决方案的态度转变。X 与 Polymarket 的合作将预测市场直接嵌入社交媒体平台,使事件驱动的投注更易病毒式传播,满足高频小额投注的资金需求,加密原生资产方案正好适合互联网场景。随着 Circle 成功上市,稳定币正迅速从投机工具转变为主流支付基础设施。Musk 打造 X 成类似微信的「超级应用」计划正加速落地,这些趋势标志着稳定币和加密应用正从专业市场拓展到更广泛的社交媒体和电子商务领域,可能成为未来去中心化社交金融生态的关键基础设施

Plasma 与 Aave 达成合作伙伴关系,打造无许可借贷基础设施

要点速览

· Plasma 与 DeFi 龙头 Aave 建立战略合作伙伴关系,Aave 将成为 Plasma 网络首日上线合作伙伴,同时支持 Aave 的稳定币 GHO

· Aave 作为全球最大的流动性协议,已促成超 400 亿美元贷款,占 DeFi 总流动性的 20% 以上,为全球用户提供无需银行、无需许可的借贷服务

· Plasma 正与 Aave 创始人 Stani Kulechov 及 Avara、AaveChan 和 Horizon 团队合作,向全球机构和服务不足的用户分发 USD₮金融基础设施

为什么重要

这一合作标志着 DeFi 基础设施向更广泛用户和机构扩展的重要一步。通过整合 Aave 的无许可借贷功能和 Plasma 的可扩展性,双方旨在解决传统金融体系未能服务的数十亿人口的借贷需求。借贷作为金融服务的基础功能,在全球范围内仍有大量人口无法获得,而 Aave 的去中心化协议通过消除银行和中介机构,提供了普惠金融解决方案。

美国第五大银行 US Bancorp 研究稳定币业务,加密托管服务迎来复苏

要点速览

· 美国合众银行(U.S. Bancorp)CEO Gunjan Kedia 表示,该行正在「研究和观察」其在稳定币领域可能扮演的角色,并考虑通过合作伙伴关系推出自己的稳定币

· 该银行 2021 年推出的机构加密托管业务在拜登政府监管严格期间发展缓慢,但在特朗普政府亲加密政策下已重新活跃起来

· US Bancorp 可能为稳定币提供基础设施服务,包括持有支持资产和提供托管服务,目前已有多个试点项目进行中

为什么重要

作为美国第五大银行,US Bancorp 对稳定币的研究表明传统金融机构正加速布局数字资产领域。与拜登时期 SEC 对加密行业的严厉执法不同,特朗普政府已基本撤销了过去针对加密行业的监管行动,并承诺停止未来对该行业的监管措施,这为机构投资者重新进入加密市场创造了有利环境。随着四大稳定币市值达到创纪录的 2230 亿美元,以及美国参议院推进稳定币监管法案 GENIUS Act,大型银行开始重新评估其在这一快速增长市场中的定位。不过,Kedia 指出,尽管稳定币交易量数据看起来很吸引人,但目前 90% 的交易仍局限于加密货币之间的交易,表明稳定币尚未真正渗透到传统金融领域。随着监管框架的逐步明确,US Bancorp 等传统金融机构进入稳定币市场可能标志着数字资产与传统金融系统融合的重要里程碑

Shopify 接入 Coinbase Base 网络支持 USDC 稳定币支付

要点速览

· Shopify 于 6 月 12 日在 Coinbase 的以太坊 Layer 2 网络 Base 上为首批商家推出 USDC 稳定币支付功能,计划年内向所有使用 Shopify Payments 的商家开放

· 商家可接受链上 USDC 支付,同时无需承担外汇交易费即可收到本地货币结算,Shopify 还计划为使用 USDC 支付的客户提供 1% 现金返还

· 该计划基于 Coinbase 和 Shopify 共同开发的新开源支付协议,支持延迟扣款、税费计算和退款处理等标准功能,并直接集成到商家现有订单履行系统

为什么重要

这一集成标志着稳定币支付正加速进入主流电子商务。随着稳定币供应量同比增长 54%,其应用已从加密货币交易扩展到支付和国际汇款。通过选择 Base 网络的低成本、高速和安全交易环境,Shopify 为全球数百万商家提供了接入加密支付基础设施的途径,有望显著降低跨境商务成本并提高效率。此举可能加速稳定币在零售支付领域的普及,为全球电子商务带来加密原生的支付基础设施革新

Conduit 与 Braza Group 推出巴西跨境支付稳定币外汇互换服务

要点速览

· 加密支付基础设施提供商 Conduit 与巴西 Braza Group 合作,推出使用稳定币进行巴西雷亚尔、美元和欧元之间实时外汇互换的服务

· 该服务将支付处理时间从传统 SWIFT 渠道的数天缩短至几分钟,显著提高跨境交易结算效率

· 稳定币在跨境支付领域日益流行,行业预测显示该领域到 2030 年将实现显著增长

为什么重要

此合作展示了稳定币如何解决传统跨境支付系统的效率瓶颈。巴西作为拉美最大经济体,其跨境支付市场规模庞大,但传统外汇系统处理时间长达数天,费用高昂。通过稳定币技术实现的实时外汇互换不仅大幅提升交易速度,还可能降低企业和个人的跨境支付成本。随着全球稳定币支付基础设施不断完善,类似的解决方案有望在更多新兴市场推广,为国际贸易和汇款提供更高效的替代方案

金融基础设施巨头 DTCC 考虑整合稳定币技术

要点速览

· 据 The Information 报道,美国存管信托与清算公司 (DTCC) 正在开发稳定币项目

· DTCC 最近在博客中指出稳定币用例正在增加,包括「用于企业跨境资金管理和支付系统」

· DTCC 的数字资产业务由全球数字资产主管 Nadine Chakar 领导,该公司此前已推出基于区块链的 AppChain 代币化抵押品管理平台

为什么重要

作为每年处理数千万亿美元证券交易的 SEC 注册机构,DTCC 进军稳定币领域将对传统金融基础设施与数字资产的融合产生深远影响。这一动向与美国财政部长 Scott Bessent 预测的趋势一致——他在参议院听证会上表示,美元支持的稳定币市场有望在未来三年内突破 2 万亿美元。与此同时,包括法国兴业银行和美国银行在内的金融机构也正在研究发行美元挂钩代币,这在很大程度上受到 GENIUS 法案进展的推动,该法案将在美国标准化稳定币监管。DTCC 作为后台基础设施提供商的参与,可能为机构投资者采用稳定币技术扫清重要障碍,加速传统金融与区块链技术的整合

新品速递

Flipcash 在 Solana 上推出全球零费用数字现金应用

要点速览

· Flipcash 是由 Kik 创始人 Ted Livingston 创立的支付应用,前身为 Code,实现了物理现金体验的数字化,用户可通过展示虚拟现金码让对方扫描完成即时转账

· 该应用支持全球范围内的即时转账,提供自动货币兑换功能,无手续费无价差,可通过视频通话或分享链接方式跨地域使用

· Livingston 从此前的 Kin 加密货币转向使用 USDC 稳定币,所有余额以受监管的美元稳定币持有,用户可随时通过 190 多个国家的交易平台提现

为什么重要

Flipcash 代表了稳定币支付在消费场景的重要创新尝试,特别是考虑到 Ted Livingston 此前在 Kik 项目中的经验教训。从自有加密货币转向使用 USDC 稳定币的战略转变反映了行业的成熟和务实态度。Flipcash 在 Solana 区块链上构建,结合了现金的简便性、隐私性与数字支付的全球覆盖,同时通过稳定币资产利息收入实现可持续运营模式。这种无中间环节、无国界、无手续费的支付体验特别适合跨境场景,如旅行结算和海外汇款。作为经验丰富的创业者的新项目,Flipcash 展示了稳定币如何实现传统金融难以提供的无摩擦全球支付愿景。

Tether 推出非托管钱包开发工具包 WDK,瞄准自主 AI 与机器人金融需求

要点速览

· Tether 发布开源自托管钱包开发工具包 (WDK),旨在构建先进的移动和桌面钱包体验,提供完全自主权的比特币和 Tether 代币钱包解决方案

· WDK 特别强调为 AI 代理和机器人提供金融自主性,使其能够管理自己的资产、执行交易,无需人类干预

· 该工具包采用 P2P 集群技术同步节点和广播交易,Tether 承诺 WDKv2 版本即将推出,将提供完善的文档、支持和示例

为什么重要

Tether 推出 WDK 标志着稳定币基础设施向更去中心化方向发展的关键一步。作为市值最大的稳定币发行商,Tether 此举可能对整个加密钱包生态系统产生深远影响。WDK 特别关注人工智能代理的金融自主性,展示了 Tether 对未来 AI 驱动经济的前瞻性布局。通过提供开源、可配置的钱包基础设施,Tether 不仅扩展了其生态系统,还为开发者提供了构建抗审查、去中心化金融应用的工具。社交视频平台 Rumble 已开始基于此架构构建钱包,表明这一技术可能在主流应用中获得采用。WDK 的推出进一步强化了 Tether 在稳定币市场的领导地位,并可能加速非托管钱包在未来金融体系中的普及

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。