Article: @BuidlerDAO

Authors: @Jane @Gimmy

Layout: @Lexi @createpjf

Did You Know About the Article?

Introduction

BounceBit Mechanism Overview

2.1 BounceBit Protocol

2.2 BounceBit Chain

2.3 Tokenomics

Marketing Strategy

Ecological Progress

Further Thoughts on BounceBit

Conclusion

Introduction

BounceBit is a re-staking (Restaking) base layer in the Bitcoin ecosystem. In its design, it collaborates deeply with Binance to create a high-yield CeDeFi component. Additionally, it has built the BounceBit Chain to establish specific use cases for Restaking, integrating into an interesting system. BounceBit's token BB will be listed on Binance on 5/13. According to official information, at the time of writing this article, the TVL has exceeded $1BN.

In terms of investment institutions, BounceBit raised a $6 million seed round in February this year, led by Blockchain Capital and Breyer Capital. In March and April, OKX Ventures and Binance Labs respectively provided strategic investments.

In terms of core concepts, BounceBit's design is fundamentally different from the current Bitcoin L2. It does not design new asset types, nor does it attempt to modify any part of the underlying Bitcoin protocol. Instead, it clearly understands that the core of the Bitcoin ecosystem is the BTC itself, with a huge market value and the best decentralization attributes. BounceBit's approach is simply to leverage BTC itself. Upon reflection and consideration, this seemingly clever approach seems to be a direct hit on the essence.

In the following sections, we will provide a detailed introduction to its mechanism and discuss some of its key designs.

BounceBit Mechanism Overview

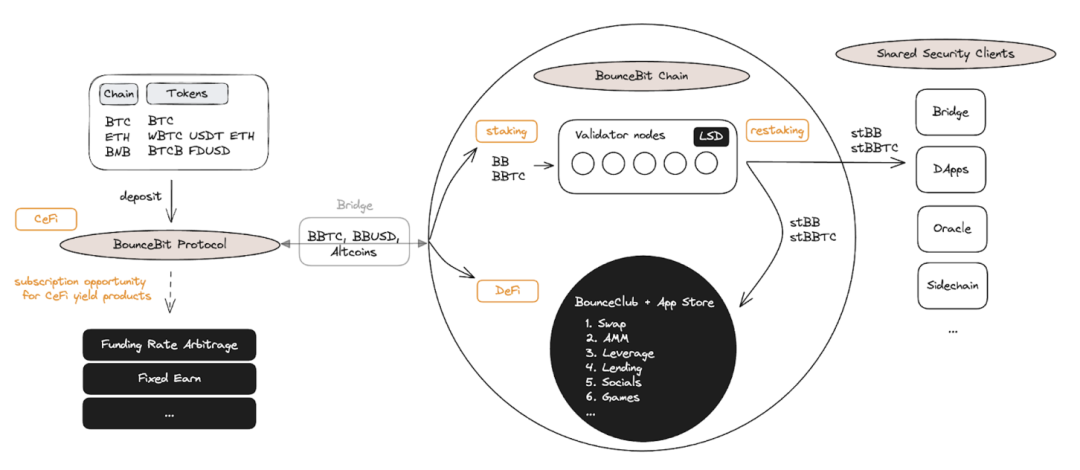

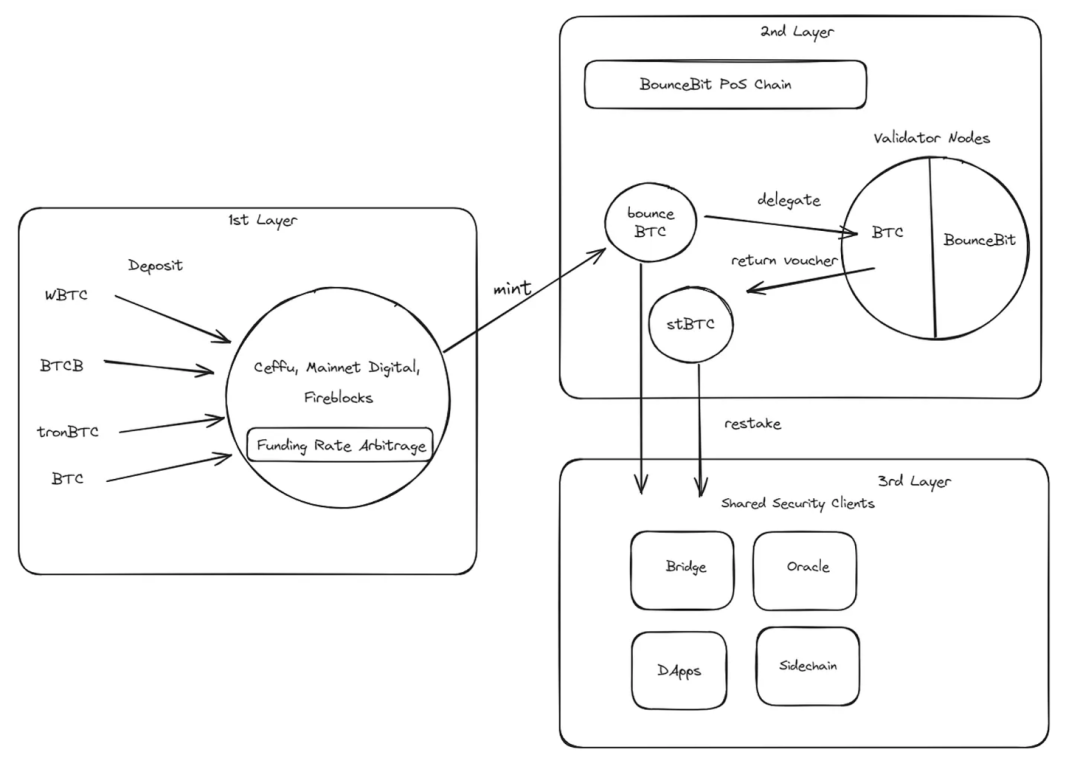

Referring to the architecture diagram above, BounceBit mainly consists of three parts:

- BounceBit Protocol: The CeFi part;

- BounceBit Chain: The Staking and LSD part;

- Share Security Client: The Restaking part.

BounceBit Protocol

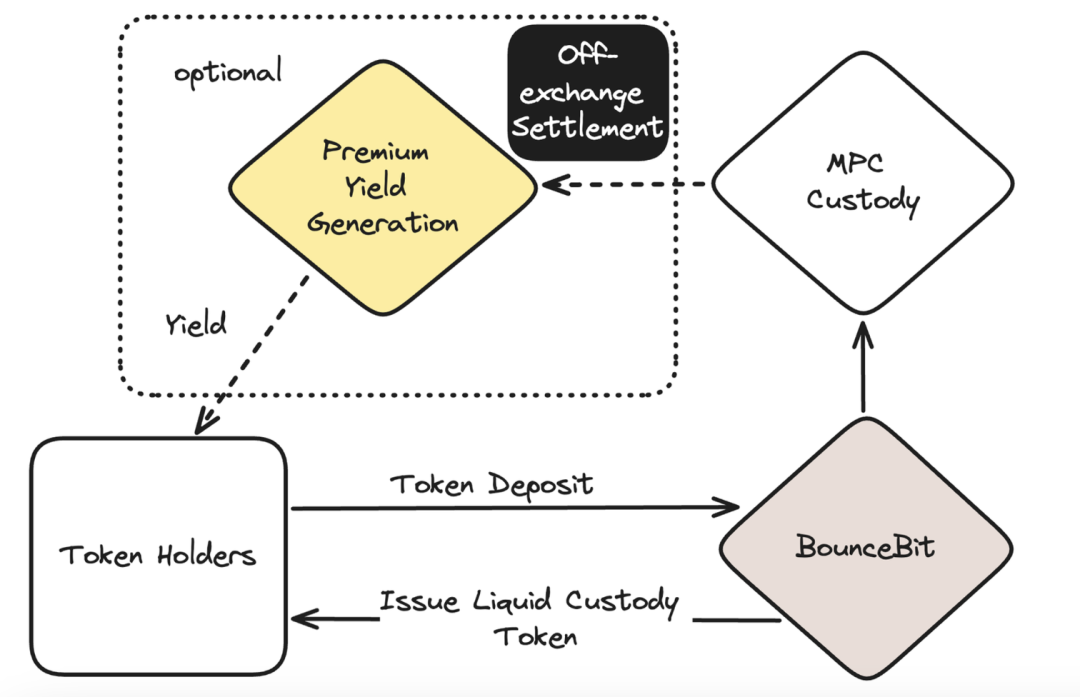

The details of the BounceBit Protocol can be seen in this diagram: Users deposit BTC into the BounceBit Protocol and receive Liquid Custody Tokens (LCT) as a deposit certificate in a 1:1 ratio. For example, depositing BTC will yield BounceBTC (BBTC), and depositing USDT will yield BounceBit USD (BBUSD). According to the official explanation, the currently accepted assets include BTC on Bitcoin, WBTC and USDT on Ethereum, as well as BTCB and FDUSD on Binance Smart Chain.

Subsequently, the BounceBit Protocol will retain all assets deposited by users in a multi-party computation (MPC) custody account (and will not leave). These assets will enter Binance in a mirrored manner and will be entrusted to asset management companies to conduct operations such as funding rate arbitrage to generate profits, which will then be returned to users.

To ensure security, funds between Binance and the custody account are settled off-exchange (OES) in a T+1 manner to isolate the funds.

The specific fund custody service providers here are Ceffu and MainNet Digital. Ceffu, formerly known as Binance Custody, has been the only custody partner that Binance has cooperated with for a long time (recently added a few crypto-friendly Swiss banks). MainNet Digital is a Singaporean service provider that originated from the fund (MainNet Capital).

BounceBit Chain

BounceBit Chain is an independent Layer 1 that adopts a Delegated-Proof-of-Service (DPoS) consensus mechanism and is EVM-compatible.

The core of PoS is that many nodes stake their funds to become stakeholders in this blockchain. By contributing to the security of the overall blockchain through verification, they receive corresponding rewards (to borrow Xu Ming'en's vivid explanation, this is a reward for digital labor).

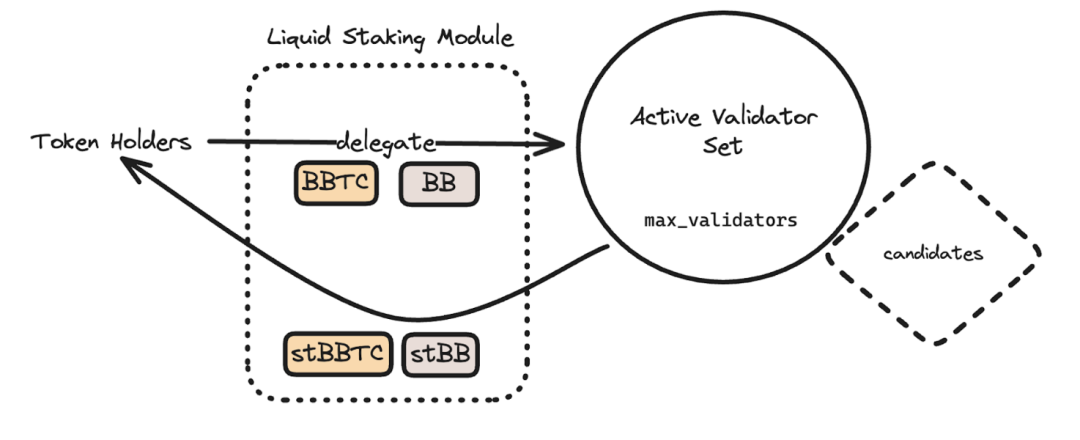

In the design of BounceBit Chain, users can freely choose to delegate their BBTC and/or BB to any specific validation node (Validator Nodes) in the Active Validator Set (AVS) to earn rewards.

Validation nodes can freely set fees (Commission Fee) to compete in the market. In the current setup, within each 24-hour Epoch, there are 50 validation nodes in the AVS (25 accepting BTC staking and 25 accepting BB staking). The number 50 is confirmed by governance, and which validation nodes will be selected into the AVS will be reconfirmed based on performance in each Epoch.

The entire staking process will be executed through the Liquid Staking Module, and the corresponding stBBTC and stBB will be given to users as staking proof (LSD).

This LSD will have two uses:

- To be used in dApps on the BounceBit Chain, imaginable scenarios include: as collateral for CDP stablecoin protocols, as collateral for lending protocols, and providing liquidity on DEX (and earning LP rewards).

- To allow Share Security Clients (SSCs) to lease the security of the BounceBit Chain, such as Bridges, Oracles, Sidechains, etc., which is the Restaking part. The logic here is consistent with EigenLayer. However, there are currently no cases of Clients, and it is expected that early rewards will be given in the form of points, with the expectation of airdrops to users. Whether this will be a story of carrots and donkeys remains to be verified over time.

In summary, the complete architecture and the relationships between the various structures are as shown in the following diagram:

Tokenomics

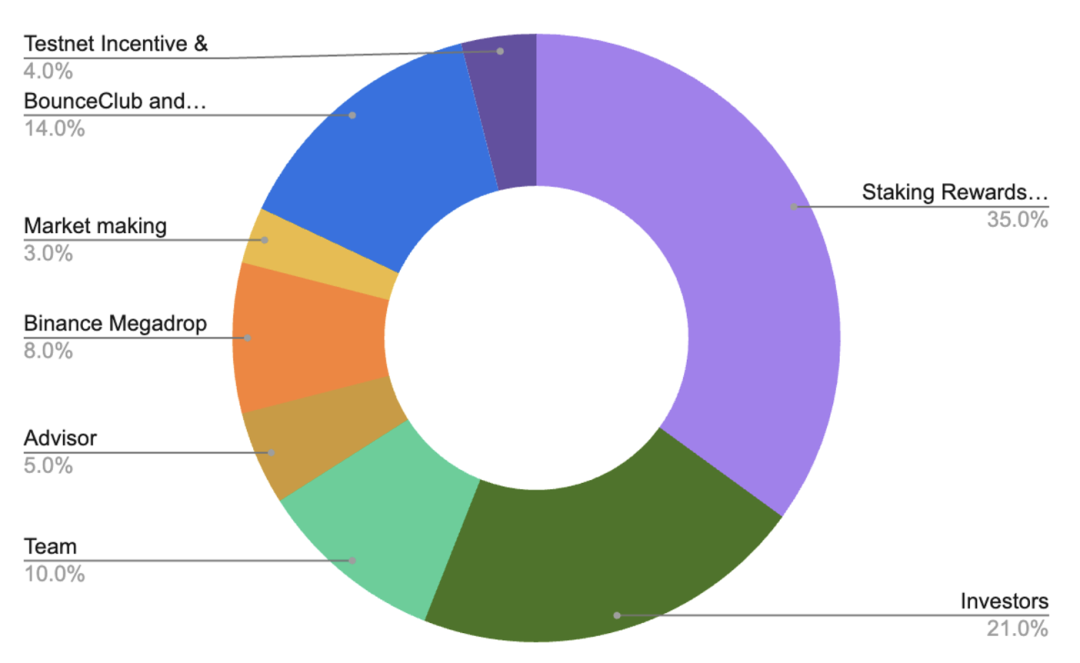

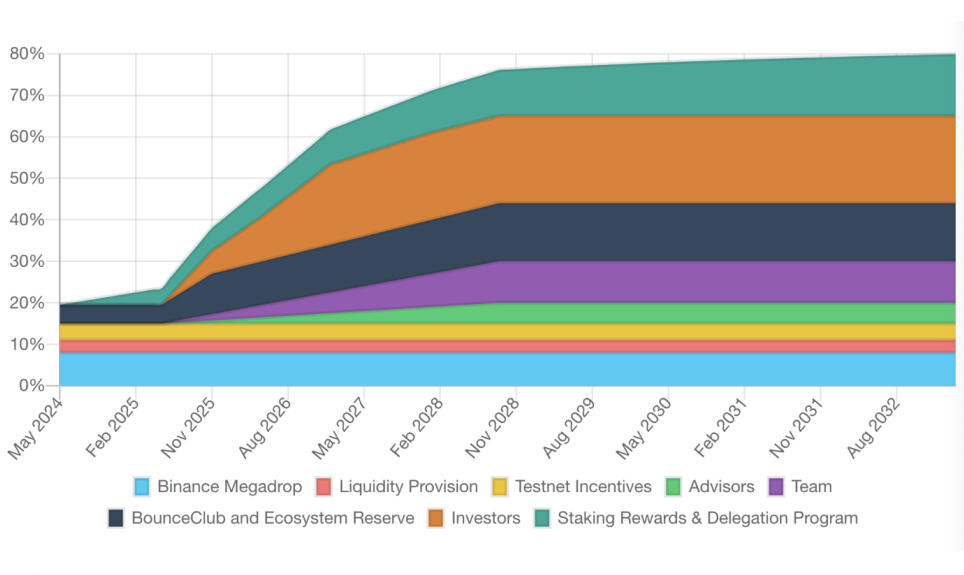

As the native token of the BounceBit Chain, the total supply of BB is 2,100,000,000, with the specific allocation and unlocking schedule as follows:

The TGE (Token Generation Event) for BB is expected to take place in May 2024. The circulating supply at the time of listing will be 409,500,000, accounting for 19.50% of the total token supply.

Two points of note here are:

- The investor allocation is 20%, slightly higher than the common 10% to 15% in Web3.

- The Binance Megadrop accounts for 8% and will be fully released at the TGE.

Combining the fact that 1) BounceBit is the first project of the Binance Megadrop, and 2) it initially supports BNB-formatted Bitcoin (BTCB), we can see that BounceBit has a deep connection with Binance. It can be imagined that this level of airdrop is expected to attract a large number of users and TVL from Binance in the early stages. However, whether sustained development can be achieved after a large number of airdrops depends on whether BB has corresponding actual revenue scenarios to support competitive APY.

Marketing Strategy

In terms of marketing, BounceBit has previously conducted a "Water Margin" reward TVL activity on the testnet, attracted users to participate in the "Journey to the West" of BounceClub, and recently collaborated with Binance for the "Megadrop."

- "Water Margin" is a TVL incentive activity similar to what Blast has done, involving elements such as earning points by depositing TVL, inviting new users, and leaderboards, but with added game elements such as acceleration cards, point bonus cards, team activities, and lucky draws.

- "Journey to the West" allows users to create their own clubs, providing a tool for users to customize the integration of different dApps.

- "Megadrop" is an activity deeply tied to Binance, which not only drives traffic to BounceBit but also provides BNB usage scenarios and locking incentives. The specific rules can be found here, and it is considered a relatively novel and intuitive gameplay.

Overall, marketing is an indispensable part of web3 products, and the BounceBit team seems to be quite adept at it xDD.

Ecological Progress

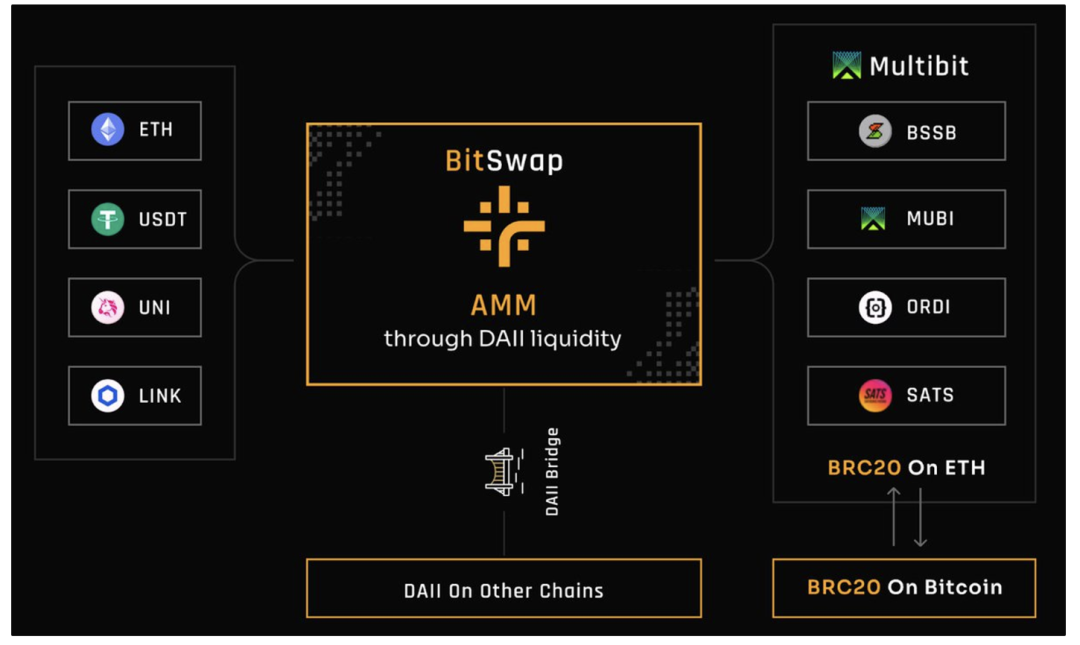

BounceBit's ecosystem already includes some DeFi projects, including BitSwap (DEX), MultiBit (BTC EVM bi-directional bridge), BitStable (stablecoin), and others.

Taking BitSwap as an example, as the first DEX built on BounceBit, it aims to simplify cross-chain transactions and become a liquidity center for BRC-20 assets through cooperation with MultiBit and DAII. Users can exchange any ERC20 tokens (ETH/USDT, etc.) for DAII on BitSwap, and DAII can be paired with other bridged BRC20 assets. Additionally, by integrating MultiBit's CCIP, users can seamlessly transfer bridged BRC20 assets to Bitcoin.

ERC20 –> DAII -> bridged BRC20 –> BRC20

https://twitter.com/BitSwap_xyz/status/1750015734216864145

Further Thoughts on BounceBit

After understanding the basic design of BounceBit, there are several interesting points to discuss:

The Application Scenarios of CeDeFi

Even when entering the relatively decentralized environment of BounceBit Chain, as the name implies, due to its main focus on CeDeFi, users may still face CeFi risk exposure implied by BBTC or BB. However, we should not view centralized exchanges (CEX) or all centralized components as monsters. For example, most dApps currently use upgradeable contracts, where control is actually in the hands of the project (which is why users own the project's token, not equity); or many L2 solutions currently use centralized sequencers. But this does not prevent people from using them.

Decentralization exists on a spectrum, and for novice users, a centralized exchange like Binance is often a safer and more reasonable option than managing their own wallet and trading on DeFi protocols. For large holders, CeDeFi also provides a compromise option to increase income through centralized service providers while ensuring the security of assets.

Income Sources and Sustainability

The income sources and sustainability are the core considerations for any Web3 product. Looking at BounceBit, income can be simply divided into three categories:

a. Income from Binance's asset management on the BounceBit Protocol

Binance's asset management income is currently mainly seen in funding rate arbitrage. Under the premise of correct execution, this strategy can achieve almost Delta Neutral, making it a low-risk and controllable trading strategy.

b. Staking rewards on the BounceBit Chain

Staking rewards on the BounceBit Chain come from on-chain transaction fees and BB token issuance through POS.

c. DeFi income

DeFi income depends on the level of activity in the BounceBit ecosystem's DeFi.

In addition, considering that the BounceBit ecosystem is still in its early stages, the development of the Restaking ecosystem through SSC is a key factor in observing BounceBit's momentum. It is speculated that the team will launch related activities or hackathons to encourage application development, making the Restaking rewards through SSC attractive.

The Value of BTC L1

In the recent period of explosive growth in the Bitcoin ecosystem, inspired by Mezo's design philosophy, we also use a first-principles framework to evaluate any new project: What value does this chain/protocol bring to BTC L1?

If the essence of PoS/DPoS is to protect the blockchain network with decentralized capital, it can be strengthened in two aspects: more capital and more decentralized capital. The second point is difficult to argue, but in terms of the first point, if assets from PoW can also be included, then using PoS as the consensus for a blockchain will provide stronger security. BounceBit's design approach, focusing solely on the asset aspect, to create new use cases for BTC, is straightforward and direct, forming a clear contrast with many other chains in the Bitcoin ecosystem.

Initially, we thought this approach was lazy, as it did not consider how to implement a native EVM or how to use a native UTXO architecture. However, after research and reflection, we believe that this is a direct approach that hits the essence: it clearly tells users that this is a product with centralized elements, and it only uses BTC as an asset on the BounceBit chain. After all, the key is to use BTC in a way that BTC holders can trust, increasing its use cases, with flexible means of implementation.

Conclusion

Undoubtedly, effectively utilizing BTC is a focal point in the BTC ecosystem, and different projects have provided different answers to this challenge. BounceBit's solution is simple and direct, focusing on creating value around BTC returns. Additionally, within less than six months of operation, it became the first project in the Binance Megadrop, demonstrating the team's resource operation and integration capabilities. However, the long-term development of its SSC is the key measure of BounceBit's true success, and we will have to wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。