The USDe strives to provide a scalable decentralized stablecoin, with its stability guarantee and long-term operational mode superior to before, but still requires market observation.

Author: Tiena Sekharan

Translated by: Blockchain in Plain English

1. What problem is USDe trying to solve?

In a world where most cryptocurrencies are difficult to prove their utility, stablecoins are an asset class that has found product-market fit:

(i) They serve as a bridge between cryptocurrencies and traditional finance (TradFi).

(ii) The most liquid trading pairs on centralized exchanges (CEXes) and decentralized exchanges (DEXes) are priced in stablecoins.

(iii) They facilitate instant peer-to-peer payments, especially cross-border payments.

(iv) They can serve as a store of value for those forced to hold weak currencies.

However, the current design of stablecoins presents some challenges:

Stablecoins backed by fiat are not decentralized.

The most widely used stablecoins are backed by fiat and controlled by centralized institutions. They also have the following drawbacks:

(i) They are issued by easily audited centralized entities.

(ii) The fiat supporting them is held in banks that may go bankrupt, with opaque deposit accounts that can be frozen.

(iii) The securities supporting them are held by regulated entities, with opaque processes.

(iv) The value of these stablecoins is limited by rules and laws that may change based on the political environment.

Ironically, as the most widely used token in the asset class aimed at promoting decentralized, transparent, and censorship-resistant trading, it is issued by centralized institutions and supported by assets held in traditional financial infrastructure, which are susceptible to government control and confiscation.

USDe aims to address these issues by providing a decentralized stablecoin solution to achieve transparency, resistance to censorship, and independence from traditional financial systems.

2. Problems USDe aims to solve

Stablecoins backed by cryptocurrencies lack scalability.

Before obtaining support from real-world assets (RWAs), MakerDAO's DAI is a relatively decentralized stablecoin that can be verified on-chain.

DAI's collateral is volatile assets like ETH. To ensure safety margins, locking 110-200% collateral is required to mint DAI. This makes DAI's capital efficiency low and scalability poor.

1) Algorithmic stablecoins are unstable

Algorithmic stablecoins like Terra Luna's UST have advantages in scalability, capital efficiency, and decentralization, but their significant failures have shown that they are unstable, leading to a multi-year bear market in the entire cryptocurrency market.

USDe by Ethena Labs attempts to address these identified challenges. I will evaluate below whether it has achieved this goal.

2) What is USDe?

USDe is a scalable synthetic dollar supported by an incrementally neutral investment portfolio of long-term spot and short-term derivative positions, usable in DeFi protocols, without relying on traditional banking infrastructure.

How does USDe maintain its peg to the dollar?

USDe's supporting assets include:

Long-term spot collateral: Liquid staking tokens (LSTs) such as stETH, rETH, BTC, and USDT.

Short-term derivative positions: Using the same collateral.

The specific workings are as follows:

In jurisdictions where KYC (Know Your Customer) has been conducted, institutions can deposit LSTs, BTC, or USDT with Ethena Labs to mint USDe.

For example: Assuming 1 ETH = $3000. A whitelisted user mints 3,000 USDe by depositing 1 ETH, and Ethena Labs uses the deposited ETH as collateral to open hedging positions on the derivatives trading platform.

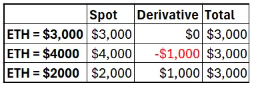

Initially, the supporting assets for 3000 USDe are:

- 1 ETH worth $3000

- 1 short ETH futures contract worth $0 (with a strike price of $3000) (temporarily ignoring funding rates or basis differences for the short position)

If the price of ETH rises by $1000, the supporting assets for 3000 USDe are:

- 1 ETH now worth $4000

- 1 short ETH futures contract now worth -$1000

If the price of ETH falls by $1000, the supporting assets for 3000 USDe are:

1 ETH now worth $2000

1 short ETH futures contract now worth $1000

The value of the portfolio supporting USDe remains at $3000.

3) How can USDe provide over 25% yield?

USDe has two sources of yield:

Staking yield - LSTs serving as collateral will generate staking yield in the form of (i) consensus layer inflation, (ii) execution layer trading fees, and (iii) MEV. It should be noted that BTC can also be used as eligible collateral to mint USDe, but it is important to point out that BTC does not generate staking yield.

Basis differences and funding rates - Basis trading is one of the most well-known arbitrage strategies. Futures typically trade at a premium. Therefore, buying spot and selling futures at a premium and capturing the difference (i.e., basis difference) as profit. As for perpetual contracts, when the price of the perpetual contract is higher than the underlying asset, traders holding long positions need to pay funding rates to traders holding short positions.

Not all USDe earns yield

Please note that not all USDe defaults to earning yield. Only stUSDe is eligible to earn yield. Users in qualifying regions must stake USDe to be eligible for the allocated yield. This increases the yield because the yield is generated on all minted USDe but only distributed to those staking.

Assuming only 20% of USDe is staked

Total USDe minted: 100

Staking yield: 4%

Funding rate: 3%

Total protocol yield: 7%

stUSDe yield: 7/20*100 = 35%

USDe ≠ UST

The high yield has raised suspicions about the similarity between USDe and Terra Luna's UST.

I hope the above explanation can clarify that this comparison is incorrect. UST is a Ponzi scheme that distributes returns to old investors using new investors' funds. The yield generated by USDe is real and can be understood mathematically. There are risks involved, which we will discuss below, but for those capable of managing risks, the yield is genuine.

3. Has USDe solved the stablecoin trilemma and provided scalability, decentralization, and stability?

1) Scalability

Since USDe's support includes both spot and derivatives, we need to consider the scalability of both.

Spot: In comparison to DAI, USDe's advantage in scalability is that it does not require over-collateralization. However, USDe only accepts ETH, BTC, and USDT as collateral, while DAI accepts several other cryptocurrencies and even real-world assets (RWAs). Stablecoins backed by fiat, like USDT, have an advantage in scalability because the market value of BTC and ETH is relatively small compared to the $30 trillion treasury market.

Derivatives: If Ethena Labs were limited to decentralized exchanges (DEXes), scalability would be limited. Instead, it chooses to utilize centralized exchanges (CEXes), which provide 25 times the liquidity.

USDe will have its limitations in scalability, but there is still enough room for growth based on its current market value.

2) Decentralization

Unlike stablecoins backed by fiat like USDC and USDT, USDe does not rely on closed systems of traditional banking infrastructure to custody the collateral supporting it. The LSTs, USDT, or BTC supporting USDe can be transparently observed on the blockchain.

Regarding derivative positions, transparency would be higher if only decentralized exchanges (DEXes) were used. However, as mentioned above, Ethena Labs has deliberately chosen to use centralized exchanges (CEXes) for scalability. By using over-the-counter settlement providers, the centralization and counterparty risk of CEXes can be mitigated. When establishing derivative positions with centralized derivative trading platforms, ownership of the collateral does not transfer to the trading platform but is held by the over-the-counter settlement provider, allowing for more frequent settlement of unrealized gains and reducing the risk exposure to exchange insolvency.

While collateral positions can be transparently observed on the blockchain, the actual value of the derivatives is not. People need to rely on Ethena Labs' disclosure process to track hedging positions across multiple trading platforms. The value of derivatives can be highly volatile and often deviates from theoretical prices. For example, when the price of ETH is halved, the price of short positions may rise, but not enough to offset the extent of the ETH price drop.

3) Stability

Cash arbitrage strategies have been a long-standing strategy used in traditional finance, capturing price differences by longing spot and shorting futures. The derivative markets for top crypto assets have matured enough to support this tested strategy.

However, how stable is stable enough? If USDe is intended to be used as a "medium of exchange," maintaining a 1:1 peg to the dollar for only 98% of the time is not sufficient. It needs to maintain its peg even in the most volatile markets.

The reason the banking system is so highly trusted is because we know that one dollar with Bank A is the same as one dollar with Bank B, and the same as the physical dollar bill in your wallet, "always and everywhere."

I believe the cash arbitrage model cannot support this level of stability.

To mitigate market volatility and negative funding rates, USDe has two protective measures:

Staking yield as the first layer of protection, providing support for the dollar peg.

If staking yield is insufficient to cover negative funding rates, the reserve fund serves as the second layer of protection, providing additional support for the dollar peg.

If even after the reserve fund is depleted, higher negative funding rates persist, the peg may break.

Historically, funding rates have been positive most of the time, with an average of 6-8% over the past 3 years, including the bear market in 2022. Quoting from the Ethena website: "The longest consecutive days of negative funding rates is only 13 days. The longest consecutive days of positive funding rates is 108 days." However, this does not guarantee that funding rates will remain positive.

4) Ethena Labs is like a hedge fund

Ethena Labs is like a hedge fund managing complex portfolio risk. The returns are real, but users not only face the risk of market volatility but also the ability of Ethena Labs to effectively manage the technical aspects of running a delta-neutral investment portfolio.

Maintaining delta-neutral positions in a portfolio of spot and short-term derivatives is an ongoing activity. When USDe is minted, derivative positions are opened and then continuously opened and closed to realize gains:

(i) Optimizing different contract specifications and capital efficiency offered by trading platforms;

(ii) or switching between inverse contracts collateralized by coins and linear contracts collateralized by dollars;

(iii) Derivative prices often deviate from theoretical value. Each trade execution incurs trading fees and may suffer from slippage losses.

People need to trust the experienced team at Ethena Labs to responsibly manage the portfolio.

5) The real limitation on scaling may be the lack of incentives to mint USDe

The goal of any hedge fund is to attract assets under management (AUM). For Ethena Labs, attracting AUM means attracting more people to mint USDe.

I can understand why someone would want to "stake" USDe. The returns are convincing despite the risks. But I don't understand why someone would want to "mint" USDe.

In traditional finance (tradfi), when someone needs cash, they pledge their property or stocks instead of selling them because they want to retain the potential for their prices to rise.

Similarly, when you mint (borrow) DAI, you know that when you burn (repay) DAI, you will receive the original collateral.

However, when someone mints USDe, they do not have the right to receive the original collateral equivalent to the minted USDe value. Instead, they receive collateral equal to the value of the minted USDe.

Assuming 1 ETH = $3000, and you minted 3000 units of USDe. If you decide to redeem it after 6 months, and by then the value of ETH has risen to $6000, you will only receive 0.5 ETH. If the value of ETH falls to $1500, you will receive 2 ETH.

This is equivalent to selling your ETH today. If the price of ETH rises, you will be able to buy less ETH in the future with the same money. If the price of ETH falls, you will need to buy more ETH in the future.

The returns generated are obtained by those who are able to stake USDe. The only benefit for those who mint USDe is the possibility of receiving an airdrop of ENA Tokens.

Without clear incentives to mint USDe, I don't understand how they have attracted a market value of over $2 billion.

I want to point out that regulatory uncertainty may be the reason for their design not to provide returns to all minted USDe. Returns would classify USDe as a security, leading to various troubles with the U.S. Securities and Exchange Commission (SEC).

4. Conclusion

USDe is a feasible attempt to solve the stablecoin trilemma. However, the temptation to push it as a stable token with risk-free returns to the retail market must be stopped.

Before the emergence of Bitcoin, there were several attempts at digital currencies, including eCash, DigiCash, and HashCash. While they may have failed, they made significant contributions to cryptography and digital currencies, and many of their features were eventually incorporated into Bitcoin.

Similarly, USDe may not be perfect, but I believe its characteristics will be incorporated into the eventual emergence of a more powerful synthetic dollar.

Source: https://medium.com/coinmonks/usde-solution-to-the-stablecoin-trilemma-or-a-way-for-a-hedge-fund-to-profit-da854422be23

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。