The data on Tuesday became clearer. In the past 24 hours, all trading activities have been in the main trading time zone in the United States, so the data can better reflect a complete trading day. As I mentioned last weekend, the current data is similar to a bear market, meaning that the fluctuation of #BTC on the chain is as low as in a bear market, but it does not represent the trend of the coin price.

Today, as we enter a complete workday, it is still evident that the liquidity of BTC is not high, even lower than last week when it was below $60,000. This indicates that even though the price of BTC has returned to above $64,000 during the main control time in the United States, more holders are still indifferent to the price of BTC.

From the data, it can be seen that investors with holdings above $55,000 account for less than 10% of the total daily circulation, indicating that early profit-making investors still have no interest in the current price. Investors with a holding cost above $65,000 account for 20% of the total circulation, which is also a relatively low figure.

More investors still hold positions between $57,000 and $62,000, as well as between $64,000 and $65,000, with these short-term traders being the main drivers of the current BTC price trend. More BTC is still concentrated in the $63,000 to $66,000 range, with the stock of BTC at these two prices already exceeding 800,000 BTC, providing relatively strong support.

Currently, the stock of #BTC in the main chip range of $63,500 to $68,500 is close to 2 million BTC, an increase of nearly 200,000 BTC compared to last week. More investors still prefer to hold in this range, and those who already hold in this range are not eager to exit.

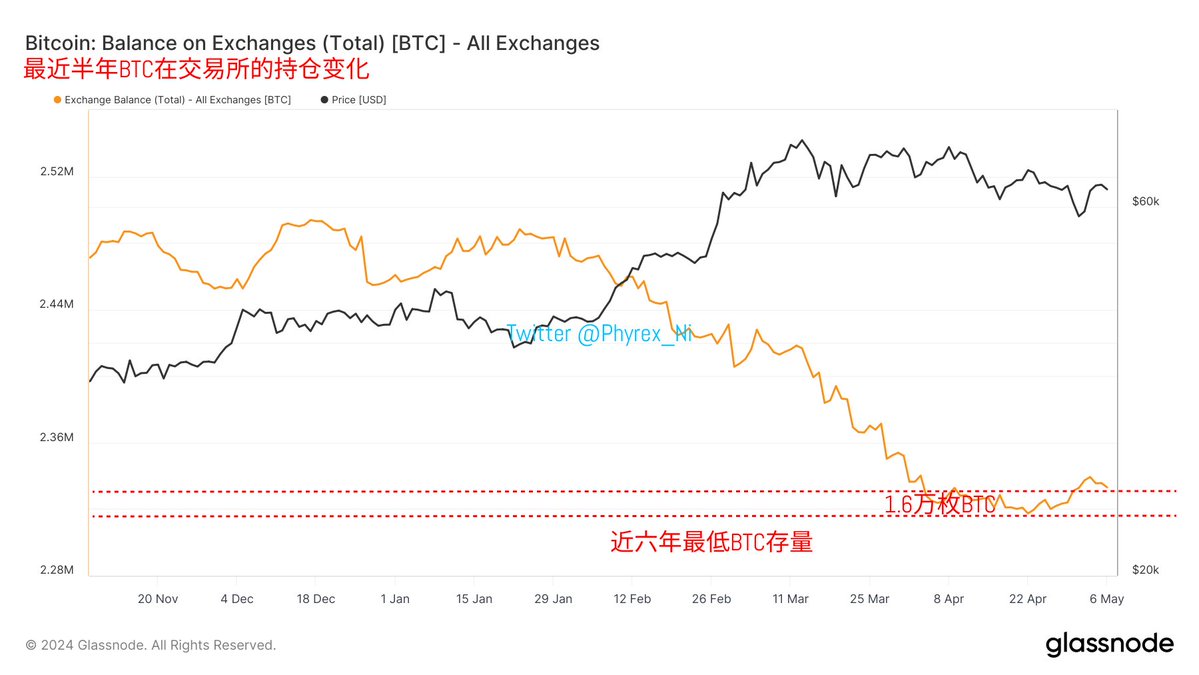

Looking at the BTC held by exchanges, the recent purchasing power of spot ETFs represents the purchasing power of American investors. Therefore, more BTC continues to be reduced from exchanges. Currently, there is still a space of 16,000 BTC from the lowest stock level in nearly six years. Compared to the same period yesterday, there was a decrease of approximately 1,000 BTC, indicating signs of a recovery in purchasing power at this level.

However, it needs to be confirmed that the market is still controlled by information. The main sentiment at present is at least two interest rate cuts by the Federal Reserve. If there is a change in this area, it is likely to drive the trend of BTC and the overall coin market prices. Therefore, it is still important to pay close attention to macro data, especially information related to the Federal Reserve's interest rate cuts.

The data has been updated, and the link is: Data Link

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。