Gradually relaxed regulatory policies, the global positioning of Web3 project founders, and strong intellectual property (IP) rights will promote further development of the Japanese Web3 market.

Authors: Jay Jo & Yoon Lee, Tiger Research

Translator: Felix, PANews

1. Introduction

Japan has recently become one of the most dynamic Web3 markets globally and is undergoing rapid changes with strong government support. The Japanese government recognizes the importance of the Web3 industry and has been actively taking measures to revitalize it. Since the Mt. Gox hacking incident in 2014, Japan has taken a conservative stance towards the Web3 industry and implemented stricter regulations. However, this situation is rapidly changing. With Japan starting to relax its cryptocurrency policies from 2023, the potential for further market development is growing.

While the relaxation of regulations has indeed expanded the potential of the Japanese Web3 market and raised people's expectations for the market, true market revitalization goes beyond regulatory adjustments. Market revitalization involves various factors, including:

- Practical application of technology

- Increase in the number of users applying this technology

- Integration across various industries

Although policies have had a significant impact on the market, the true prerequisite for an active market is not solely based on regulatory considerations.

This report aims to comprehensively analyze the current status of the Japanese Web3 industry, including the details of Japan's Web3 revitalization policies, their impact on local Web3 ecosystem participants, and the tangible changes resulting from them. Additionally, the report will also explore the business opportunities in the Japanese Web3 market, assess potential short-term returns, and long-term growth prospects.

2. Market Changes Begin with Industry Revitalization

The relaxed regulations promoted by the Fumio Kishida Cabinet and the Liberal Democratic Party (LDP) may significantly change Japan's Web3 market. With the reduction of regulatory uncertainty and the establishment of clear guidelines to set the "rules of the game," the market will undergo significant changes. This section will explore the impact of three major policies introduced by the Kishida government on the Web3 industry.

2.1. Japanese Corporations Enter Web3

Source: Tiger Research

As previously mentioned in the report, the participation of large Japanese corporations in the Web3 field is particularly noteworthy. At this summit, major corporations such as SBI, NTT, KDDI, and Hakuhodo attended and expressed their expectations and visions for the future of the Web3 industry.

The active participation of large Japanese corporations in the Web3 field plays a crucial role in the development of the ecosystem, as it brings in the substantial capital and research and development capabilities necessary to advance Web3 technology.

For example, the subsidiary of the renowned telecommunications company NTT DoCoMo, NTT Digital, has invested a significant amount of funds in developing Web3 wallets. During the development process, NTT Digital collaborated with a major consulting company, Accenture Japan. Some analysts believe that as a result of this collaboration, some large enterprises have gained the impetus to enter the Web3 market. (Note: The "impetus" refers to the effect of benefiting the poor or disadvantaged groups or regions through consumption, employment, etc., by the priority development of groups or regions, driving their development and prosperity.)

The participation of major Japanese companies is expected to significantly drive the development of the Web3 market. Although the market is in its early stages, the active investments and research efforts of these major participants are crucial for building a solid foundation, not only to enhance the current market but also to lay the groundwork for the emergence and development of more Web3 native companies.

2.2. Green Light for Stablecoin Issuance

Source: Japan Financial Services Agency

- In June 2022, guidelines for stablecoin issuance and brokerage were released.

- In June 2023, an amendment to the "Payment Services Act" allowed fund transfer institutions, banks, trust companies, etc., to issue stablecoins.

The Japanese government's permission to issue stablecoins is an important step in promoting the development of the Web3 industry. This policy change has sparked interest in stablecoin-related businesses, with many companies entering this field as regulations become increasingly clear.

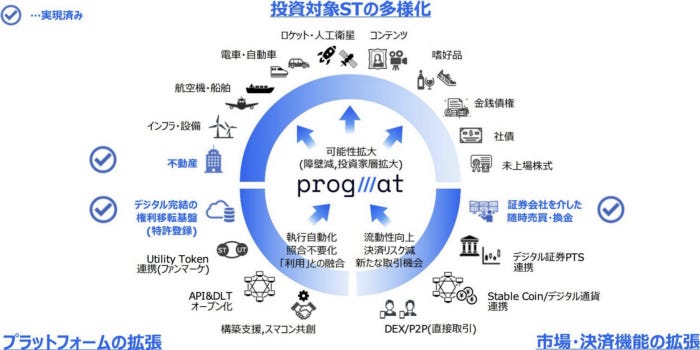

For example, the digital asset platform Progmat is actively exploring stablecoin opportunities. Binance Japan revealed plans to collaborate with Mitsubishi UFJ Bank to launch a new stablecoin. In addition, the issuer of USDC, Circle, is seeking to collaborate with SBI Holdings to expand the issuance of USDC in Japan. Considering the huge potential of the Japanese B2B payment market (valued at approximately $7.2 trillion annually), integrating stablecoins into this market can greatly increase business opportunities.

2.3. Venture Capital Investment in Cryptocurrencies Allowed

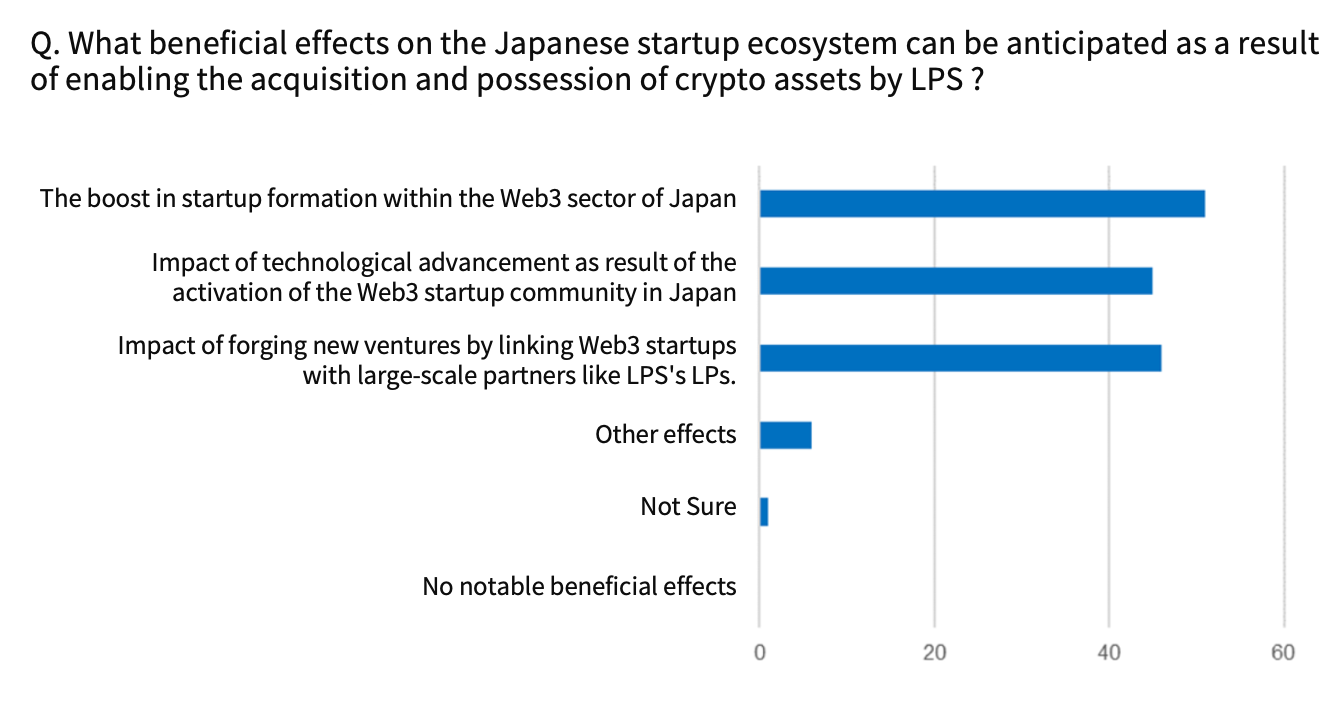

Data Source: JCBA, TigerResearch

- In February 2024, limited partnership companies (LPS) and investment trust funds are allowed to directly invest in cryptocurrencies, and legal entities can raise funds from venture capital funds in exchange for non-stock tokens.

The Japanese Ministry of Economy, Trade and Industry recently voted to allow venture capitalists to directly invest in crypto assets. This is aimed at stimulating investment in Japanese Web3 startups and ensuring that the most promising projects can thrive in Japan rather than moving abroad. The resolution will be submitted to the Diet in June this year.

- In June 2023, it was decided not to levy capital gains tax on tokens held by companies at the end of the year.

- In April 2024, it was decided not to levy capital gains tax when there are technical processing restrictions on tokens issued by third parties.

Japan has made significant progress in relaxing taxation on virtual assets held by Web3 companies. Previously, the high tax rates on crypto assets held by Japanese Web3 companies prompted many companies to relocate their headquarters to countries with more favorable tax systems, such as Singapore and Dubai.

Japan's tax issues have been widely criticized as they have forced Japanese Web3 companies to expand overseas. In response, the Japanese government has gradually relaxed the taxation regulations on virtual assets held by companies. These policy adjustments are expected to encourage the smoother flow of funds into Japan, thereby promoting the growth and development of local Web3 companies and, in turn, activating the market.

3. Is Japan Really "Back"?

It is still too early to draw conclusions.

3.1. Over-taxation of Cryptocurrency Investors

CEX trading volume in March 2024, Source: Coingecko, TigerResearch

Japan is gradually relaxing restrictions on corporate investment in and holding of cryptocurrencies. However, the tax system for individual investors remains strict. Individual investors in Japan face a progressive tax rate of up to 55% on cryptocurrency gains, one of the highest rates in Asia. This heavy taxation significantly hinders retail investment and active trading of cryptocurrencies by individuals.

The taxation policy has led to low enthusiasm among retail investors, which is evident when comparing trading volumes. For example, in March of this year, cryptocurrency trading volume in Japan was 18 times lower than in South Korea.

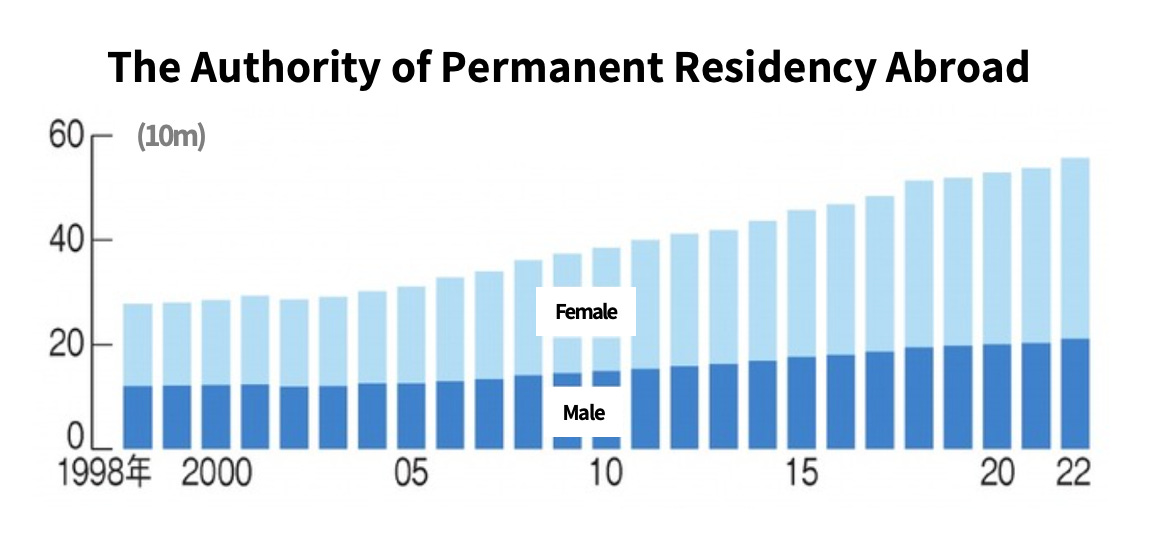

Annual number of permanent residents leaving Japan, Data Source: Japanese Ministry of Foreign Affairs, Tiger Research

To truly foster the development of the Japanese crypto market, efforts to relax regulations need to extend to individual investors outside of corporate entities. Balancing supply and demand is crucial for a thriving market. However, there are currently no signs that Japan plans to relax restrictions on individual investors. The lack of regulatory flexibility has forced many Japanese Web3 startups and developers to relocate to more regulation-friendly environments, such as Dubai, where more business opportunities and liquidity are available.

Data from the Japanese Ministry of Foreign Affairs highlights this trend, showing an increase in the number of Japanese citizens immigrating abroad. Specifically, the immigration rate to the Dubai region has increased by approximately 4% compared to last year. This trend underscores the broader impact of Japan's strict regulatory framework on talent and the entrepreneurial ecosystem. If policies remain unchanged, it could lead to a brain drain in the industry.

3.2. Isolated Market Environment

The Japanese Web3 market presents a "Kolon Island" environment, a term describing a highly localized business ecosystem. This ecosystem is somewhat isolated, with limited scalability to the global market. This stems from the conservative regulatory framework that evolved in response to the Mt. Gox hacking incident in 2014, greatly influencing the development of Japan's cryptocurrency regulatory approach.

A unique aspect of this localized approach is the process of listing virtual assets in Japan. The Japan Virtual Currency Exchange Association (JVCEA) is a government-approved self-regulatory organization that manages the listing of cryptocurrencies through a white/greenlist system.

Japan's Web3 ecosystem is primarily oriented towards meeting local needs. Traditional companies, local governments, and banks primarily leverage blockchain technology to benefit domestic consumers, and entities like Astar Network also focus on the domestic market rather than the global market. This inward approach creates significant barriers for international Web3 companies seeking to enter the Japanese market, limiting industry diversity and stifling dynamic growth and innovation.

Therefore, for the Japanese Web3 industry to achieve significant growth and become a significant player on the world stage, it must break free from this "Kolon Island" market environment. Adopting a more open and global perspective will not only facilitate the entry of multinational companies but also encourage greater diversity of thought and practice.

3.3. Shortage of Tech Talent

Expected shortage of IT talent, Data Source: Ministry of Economy, Trade and Industry

An important barrier hindering the growth of the Japanese Web3 market is the severe shortage of IT talent. This problem is currently worsening: in 2020, Japan faced a shortage of approximately 370,000 IT professionals, and it is expected to double to around 790,000 by 2030.

Even Japan's leading telecommunications companies at the forefront of technology find themselves in the early stages of Web3 industry development, with no significant progress yet. The Web3 industry is inherently a high-tech industry that requires a large workforce and specialized skills to effectively drive innovation and development. Currently, Japan faces a significant shortage of Web3 builders, and there are very few projects dedicated to developing Web3 infrastructure. This shortage not only hinders the industry's innovation capabilities but is also a key factor limiting the development of the Japanese Web3 market.

4. What to Expect in the Future of the Japanese Web3 Market?

4.1. Globalization Capability

Recently, the global capabilities of Japanese Web3 project founders have become a focal point, highlighting a significant shift in their business approach. From the outset, these entrepreneurs have incorporated a global perspective into their strategies, actively seeking international expansion. A key factor in this globalization effort is the improvement of English language skills. This shift was evident at the 2024 TEAMZ Summit, as many Japanese leaders confidently delivered speeches and engaged in discussions in fluent English.

The current vitality of the Japanese Web3 industry is a product of the perspectives of the younger generation and the inherent global nature of the Web3 industry. Many Web3 projects in Japan have considered the global market from the outset. This marks a significant cultural shift, the first since the Meiji Restoration over a century ago, where Japanese entrepreneurs are actively seeking opportunities abroad.

4.2. Investment from Corporations and Institutions

As mentioned earlier, Japan's decision to relax regulations on corporate holdings and investments in crypto assets is expected to drive the development of the Japanese Web3 market. With substantial investments already made, such as the total of 600 billion yen (approximately $5.5 billion) raised by NTT DoCoMo and SBI Holdings for Web3 funds, and the recent announcement by the Government Pension Investment Fund of Japan (GPIF) to invest in Bitcoin, the relaxation of regulations is expected to stimulate capital inflow.

Furthermore, the world's largest pension fund, GPIF, recently announced plans to invest in Bitcoin. While the impact of the new regulations may take some time to materialize, GPIF's move is a positive sign for the Japanese Web3 market.

4.3. Accumulation of Use Cases

Source: JPYC

In the broader global context of the Web3 industry, meaningful applications and outcomes of blockchain technology are often scarce, and the Japanese market is beginning to showcase influential use cases. Notably, the stablecoin JPYC, pegged to the Japanese yen, is being incorporated into the "hometown tax system," a unique form of local financing. Additionally, some local governments in Japan are exploring the use of DAO and NFT technology to revitalize underdeveloped areas.

Data Source: Japan Financial Services Agency

Furthermore, Japan is actively sharing its accumulated expertise and technological secrets internationally. By educating others and exporting innovation, Japan positions itself as a key player in shaping the future of the industry.

Based on these factors, the future development prospects of the Japanese Web3 industry are promising. Despite many Japanese Web3 founders moving to Dubai to seek business opportunities and a more relaxed regulatory environment, there is still long-term optimism about the potential of the Japanese market. Many founders have expressed their desire to engage in the Japanese Web3 field over the next decade, indicating confidence in Japan's future growth.

5. Market Areas of the Japanese Web3 Industry

5.1. Short-term Outlook: Research, Consulting, and Investment Business

Source: Progmat

The rapidly evolving regulatory landscape of the Japanese Web3 industry contrasts sharply with the inherent cautiousness of Japanese companies in the decision-making process. This caution often leads to slow business progress, as companies invest a significant amount of time in thorough market research and project validation before venturing into new areas. Therefore, in the short term, there may be an increased demand for research and consulting services in the Web3 market. The entry of data analysis and research companies like Messari into the Japanese market is evidence of this trend. Japanese research institutions like Hash Hub and Next Finance Tech are becoming increasingly active.

With the relaxation of investment regulations and venture capital firms beginning to hold crypto assets, the investment prospects of the Japanese Web3 market are expected to rebound. In this emerging field, Hyperithm has stood out through various strategic investments, including stablecoin issuer JPYC and Web3-based live streaming company Palmu. These investments demonstrate the development trends and potential of Web3 technology.

5.2. Long-term Outlook: Stablecoins, Web3 Games

Data Source: Progmat

In the long term, stablecoins and Web3 games represent the most promising areas in the Japanese Web3 industry. In particular, the stablecoin market is expected to experience significant growth. With the consolidation of institutional participation frameworks and reduced regulatory uncertainty, expectations for the industry are rising. The yen-based stablecoin JPYC is at the forefront of potential expansion.

Currently in Japan, stablecoins can only be used as a prepayment method for deposits and cannot be used for withdrawals. This limits the widespread application of stablecoins in the financial ecosystem. However, the issuer of the yen-based stablecoin, JPYC, is seeking to obtain an Electronic Payment Instrument Service Provider (EPISP) license, which will enable JPYC to release a new version supporting withdrawals. This version is planned to be released this summer.

The ability to withdraw JPYC is expected to significantly enhance the utility of stablecoins in Japan, making them more versatile and integrated into everyday financial transactions. In the long term, stablecoins may become a viable alternative to all transactions currently reliant on cash or bank deposits.

Although stablecoins are not currently listed on Japanese cryptocurrency exchanges, several exchanges are taking action to obtain the necessary licenses. This development indicates a bright future for the accessibility and practicality of stablecoins in Japan.

OSHI3 Project, Source: gumi

Japan, as the world's third-largest gaming market, is also worth noting for its entry into the Web3 gaming sector. Major gaming companies such as Square Enix, SEGA, and Gumi are actively involved in Web3 projects.

However, the user base for Web3 games in Japan is still relatively small, and market liquidity is limited. The high taxes imposed on virtual asset investors may hinder participation and investment in this emerging industry. Therefore, achieving significant growth in the short term may be challenging. However, Japan has clear advantages that can drive long-term growth and development in the Web3 gaming market. The country's strong gaming industry and rich content creation capabilities provide a solid foundation for the development of Web3 games.

Conclusion

During the participation in the TEAMZ Summit 2024 in Japan, the vibrant development of the Japanese Web3 market was observed. It is evident that this market is still in its early stages but has tremendous growth potential. This potential is driven by several key factors: the proactive efforts of Japanese government authorities to revitalize the industry, the global positioning of Japanese Web3 project founders, and the strong intellectual property (IP) content knowledge. It is expected that these factors will further promote the development of the market.

While challenges such as high taxes for individual investors still exist, the long-term prospects of the Japanese Web3 market are promising. Whether the combined efforts of the Japanese government, businesses, and investors can make Japan a leader in the global Web3 field will be an interesting development to watch. The development in this field is certainly worth paying attention to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。