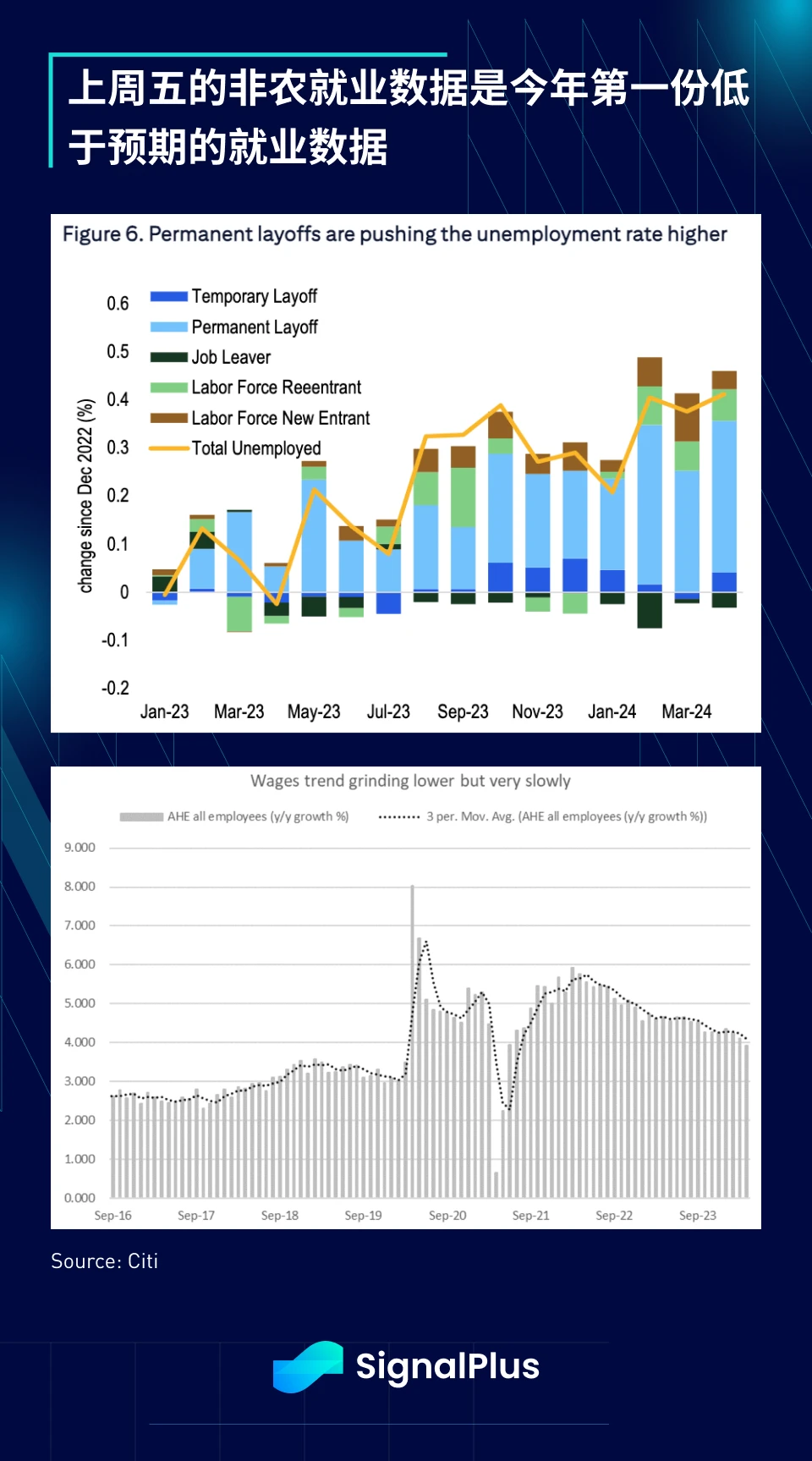

Employment data for the first time this year was lower than expected (without unexpected increases), with a net change in overall employment of +175,000 (previously averaging around 275,000), and the unemployment rate unexpectedly rose from 3.83% to 3.87%.

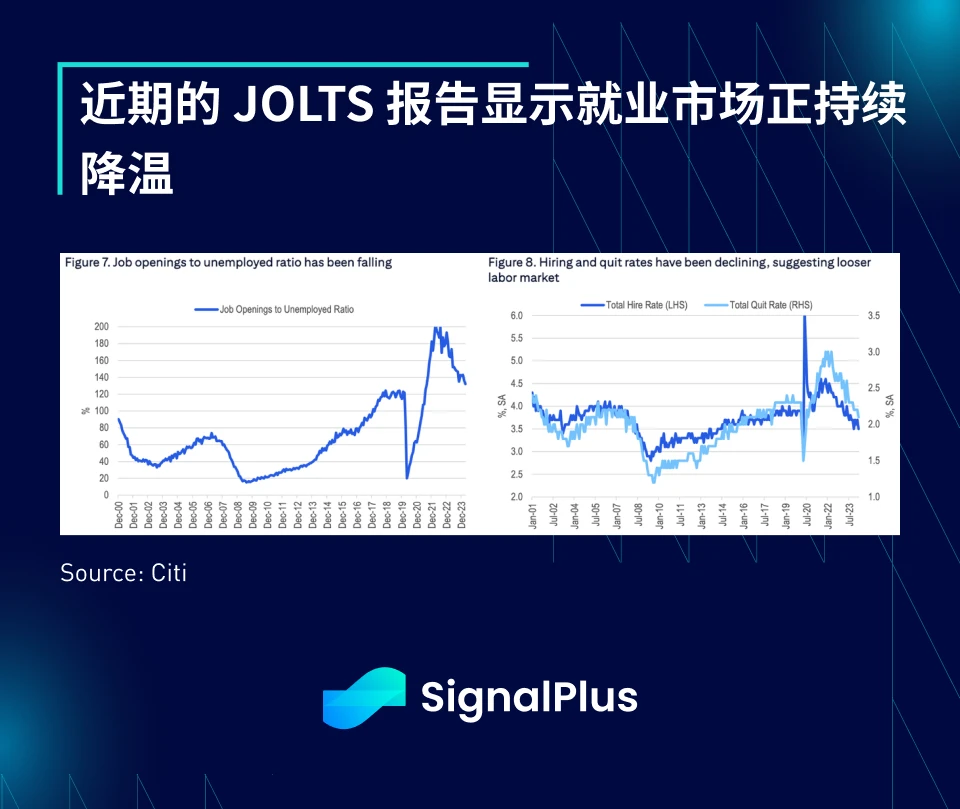

Other higher-frequency labor market indicators are also showing signs of slowing, such as the recent JOLTS report indicating a decrease in the job openings-to-unemployed ratio, as well as low levels of hiring and quits in the private sector.

Furthermore, the hiring trend in small businesses has significantly weakened, and the employment components of ISM and PMI have shown softness, with the proportion of hiring in the service and manufacturing sectors falling to levels typically seen during economic downturns.

Last Friday, we pointed out that the non-farm employment data was more likely to lean dovish, especially considering the Fed's FOMC explicitly stating their increased focus on the softening labor market and willingness to overlook recent inflation. Now, with the soft employment data, the return of rate cut expectations has once again sparked a wave of risk rebound.

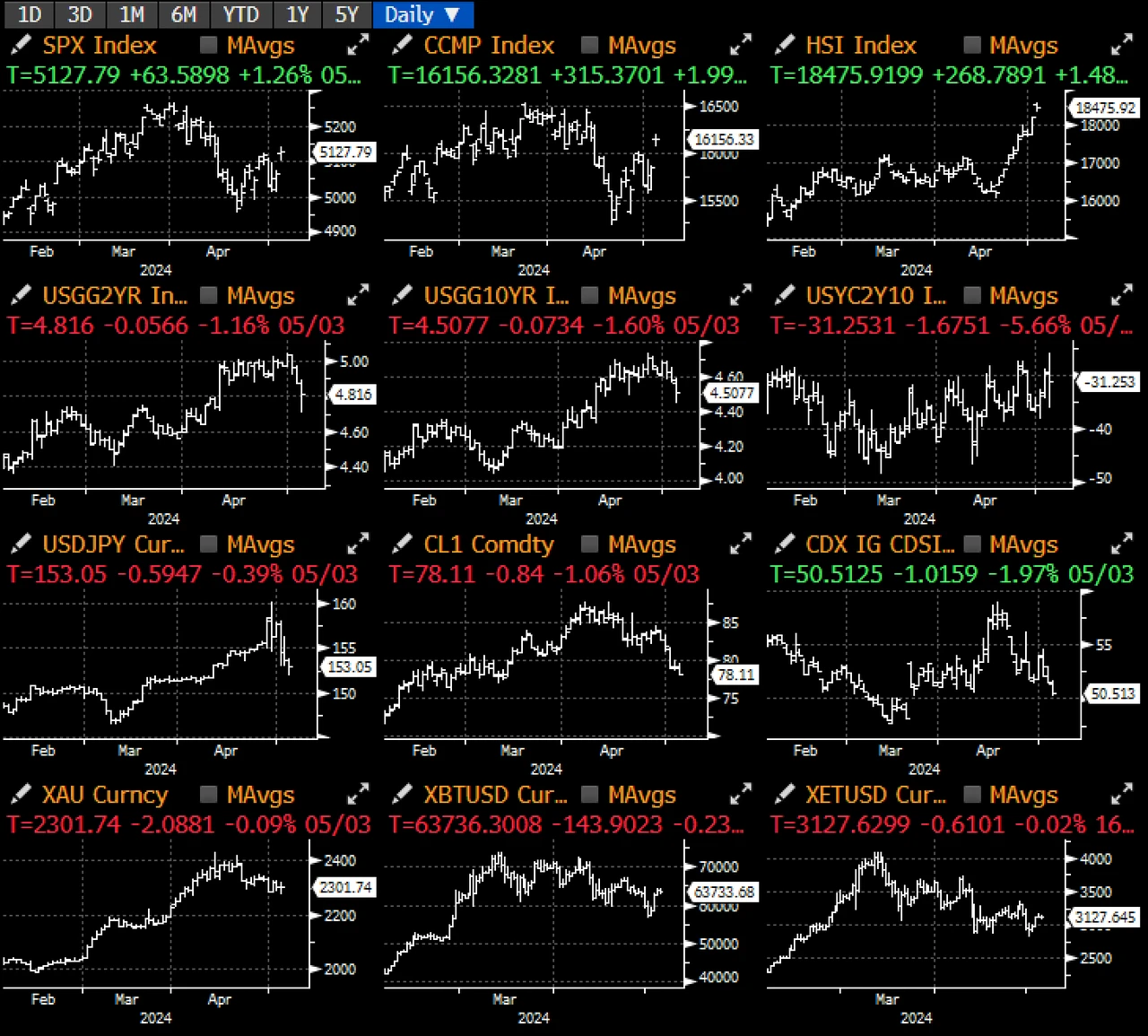

Yields have seen a steep rise, with the 2-year yield falling from 5% to 4.8%, the 10-year yield returning to 4.5%, and the market pricing in nearly two rate cuts this year. In the stock market, tech stocks rose by 2%, SPX closed above 5,100 points, and the USD/JPY fell from last week's high of 159 to 152.5 within 48 hours. In summary, market sentiment has been boosted by the dovish interest rate background, ending last week with a strong risk rebound.

This week, macro data will be relatively light, and speeches by Fed officials may be more important than the data itself. China will release money supply/financing data, and in the U.S., Barkin, Williams, Kashkari, Jerrferson, Collins, Cook, and Bowman will take turns expressing policy views. After weeks of risk cleansing, market positions should be cleaner compared to March, and risk sentiment may have found a recent bottom, at least until data begins to imply more "hard landing" risks. With investors continuing to adjust their portfolios rather than selling stocks directly, the actual volatility of the SPX remains very low. Bloomberg reports that during the current adjustment period, leadership stocks in the SPX have changed, resembling a rotation akin to the "magnificent 7." It is expected that risk assets may have the opportunity to slowly climb from here.

The correlation between cryptocurrencies and macro sentiment is becoming stronger. With market sentiment shifting back to a dovish Fed, declining forward rates, and a strong stock market, despite weak performance in spot gold, cryptocurrency prices saw a significant rebound last Friday, with weekend BTC spot prices breaking through $64,000. Last Friday, U.S. ETF inflows were strong, reaching $378 million, and even Grayscale saw inflows of $63 million. In the current macro environment, we maintain a more neutral view on risk-return, expecting short-term price pullbacks to be more favorable for buying on dips.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto news. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。