Original | Odaily Planet Daily

Author | How about

Recently, the overall cryptocurrency market has been on a downward trend. According to OKX market data, at 4 pm today, BTC briefly fell below 57,000 USDT, currently trading at 57,131.1 USDT, with a 24-hour decline of 8.87%; ETH fell below 2,900 USDT, currently trading at 2,859 USDT, with a 24-hour decline of 9.07%.

Under the influence of BTC and ETH, altcoins have also experienced significant pullbacks. At the time of writing, SOL is currently trading at 120.88 USDT, with a 24-hour decline of 10.57%; ORDI is currently trading at 32.21 USDT, with a 24-hour decline of 22.91%; BNB is currently trading at 547.5 USDT, with a 24-hour decline of 8.54%; OP has a smaller decline, currently trading at 2.43 USDT, with a 24-hour decline of 1.58%.

Affected by the overall market downturn, the total market value of cryptocurrencies has also significantly decreased. Data from CoinGecko shows that the current total market value of cryptocurrencies has shrunk to 2.2 trillion US dollars, with a 24-hour decline of 8.56%. The enthusiasm of cryptocurrency users for trading has also significantly declined, with today's fear and greed index reaching 54, and the one-week level changing from greed to neutral.

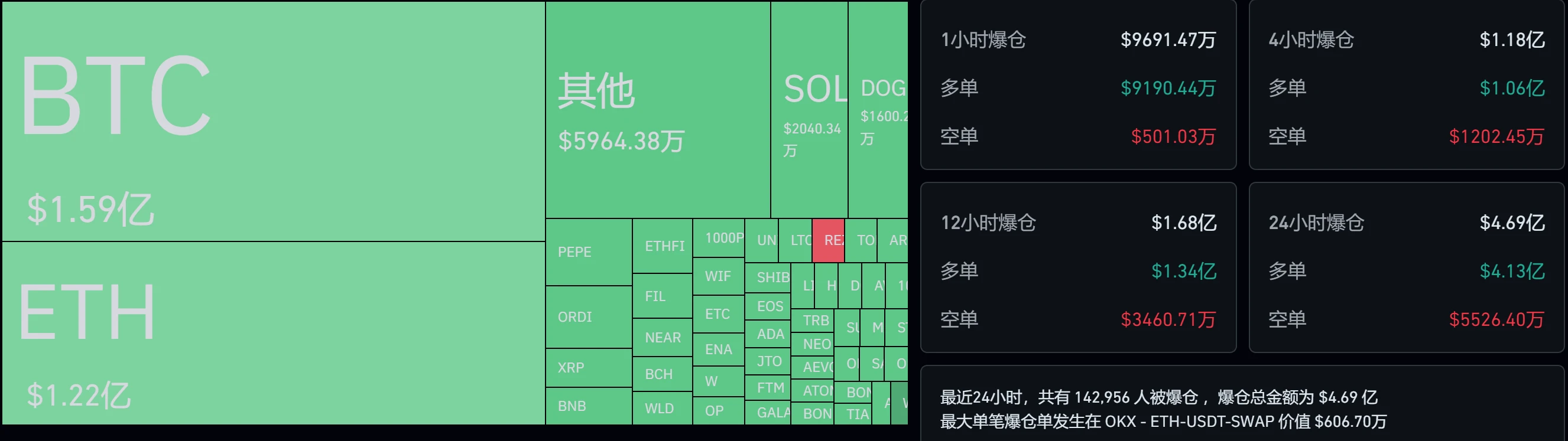

In terms of derivative trading, Coinglass data shows that there have been liquidations of 469 million US dollars in the past 24 hours, with the vast majority being long positions, amounting to 413 million US dollars. In terms of specific cryptocurrencies, there have been liquidations of 159 million US dollars for BTC and 122 million US dollars for ETH.

Reasons: Dim prospects for Fed rate cuts? Disappointing Hong Kong ETF? CZ sentenced to 4 months in prison?

The overall market downturn has been evident since early April, although there was a brief rebound around April 20 due to the Bitcoin halving, the overall situation is still not optimistic.

From a global perspective, geopolitical tensions in multiple regions have led to a general decline in the global market. In addition, the prospects for Fed rate cuts are dim, with several Fed officials revealing that there will be no rate cuts before the end of the year. According to the semi-annual financial stability report of the Federal Reserve, inflation is still considered the top financial risk.

Therefore, the fundamental reasons for the downturn in the cryptocurrency market are the changes in the global geopolitical situation and the dim prospects for rate cuts.

From the perspective of ETFs, the net outflow of the US Bitcoin spot ETF has been 162 million US dollars, with net outflows for 5 consecutive trading days. The main reason for the surge in Bitcoin prices this year is the inflow of funds into the Bitcoin spot ETF and the future prospects brought by the ETF. However, when the funds flow out of the US Bitcoin spot ETF, the downturn in the market is also expected.

However, according to a post by 10x Research, this round of correction is due to the different risk management methods of institutional investors compared to most retail traders. After this correction, the price of Bitcoin is close to the average entry price of holders of the US Bitcoin ETF, which is about 57,300 US dollars.

In addition, the opening of the Hong Kong Bitcoin spot ETF and Ethereum spot ETF did not meet expectations, with only 1/2000th of the trading volume of the first day of the US Bitcoin spot ETF. The amount of funds inflow has not been disclosed, which may set the stage for future developments.

In the early hours of today, the highly anticipated CZ trial was also one of the triggers, but compared to the 3-year imprisonment suggested by the US Department of Justice and prosecutors, a 4-month suspended sentence may be the best solution. The market briefly rebounded, but it still could not affect the overall downward trend.

Finally, from the perspective of the cryptocurrency market itself, it is a consensus that there will be a brief correction after the historical halving market.

The future is still uncertain, with only two expected events yet to be realized

Since last year, there have been many expected events in the cryptocurrency market that have affected market trends, including the US Bitcoin spot ETF, Fed rate cuts, the FTX incident, the SEC's dispute with Binance, the US Ethereum spot ETF, and the halving cycle. As of now, there are still two major uncertain events: the US Ethereum spot ETF and Fed rate cuts.

The US Ethereum spot ETF will face its first fund approval deadline on May 23, which may determine the current market trend. However, the market is not optimistic about this, as multiple institutions and SEC insiders have revealed that the Ethereum spot ETF will not be approved around May 23, so there may be a new round of market changes around May 23.

In addition, the prospects for Fed rate cuts have been mentioned earlier. Currently, the US inflation rate still shows signs of rebound. Although many institutions on Wall Street have stated that rate cuts will come in July, the likelihood of rate cuts this year seems to be decreasing.

In addition to the above two expected events, the Hong Kong Bitcoin spot ETF and Ethereum spot ETF may become potential factors affecting market trends. Although the trading volume on the first day was not outstanding, the ETFs in Hong Kong will cover countries and regions in the Asian time zone, including Southeast Asia and the Middle East, and may become a new source of funds inflow in the cryptocurrency world. Although it has not yet been opened to mainland China, the expectation still exists.

In general, the future market trend is still on an overall upward trend, but with the uncertainty of expected results. Odaily Planet Daily reminds everyone that the recent market fluctuations are significant, so please be mindful of investment risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。