Safe performed strongly in the first quarter of 2024, with key indicators reaching historic highs.

Authors: Mihai Grigore, Seth Bloomberg

Translated by: Plain Blockchain

Key points:

Safe is one of the preferred solutions for smart contract wallets, storing over $100 billion in assets and having over 8 million deployed smart accounts.

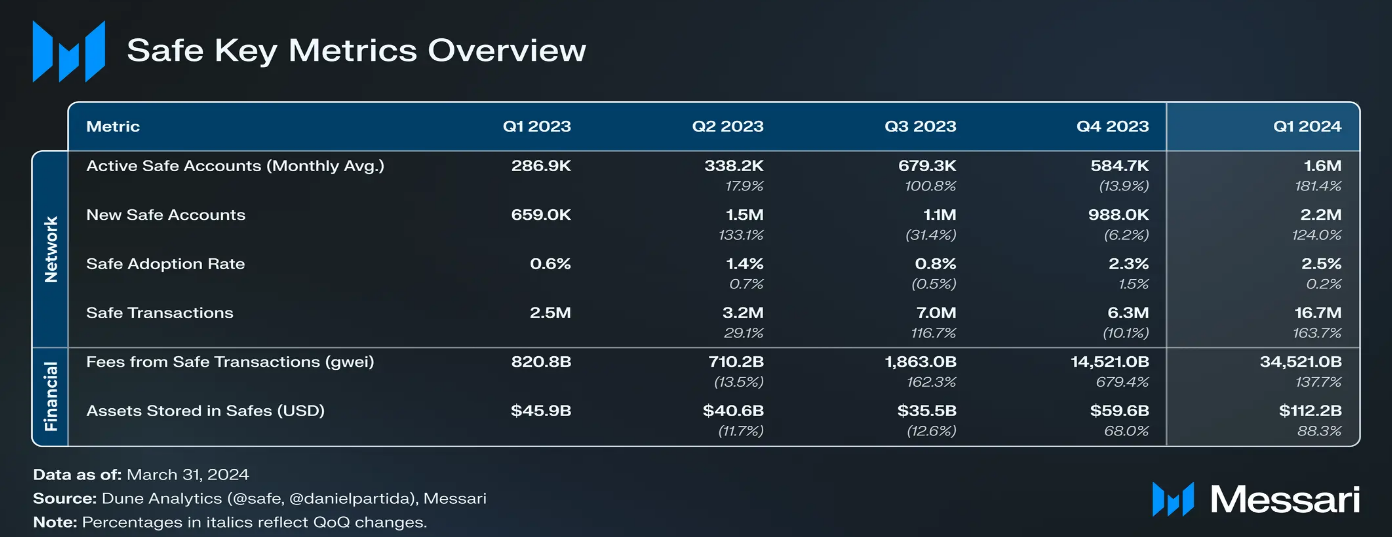

In the first quarter of 2024, Safe reached historic highs in most usage indicators. Safe users continue to derive value from the core wallet product, with 1.6 million monthly active accounts in the first quarter of 2024 across over 10 networks (an increase of 181% compared to the previous quarter).

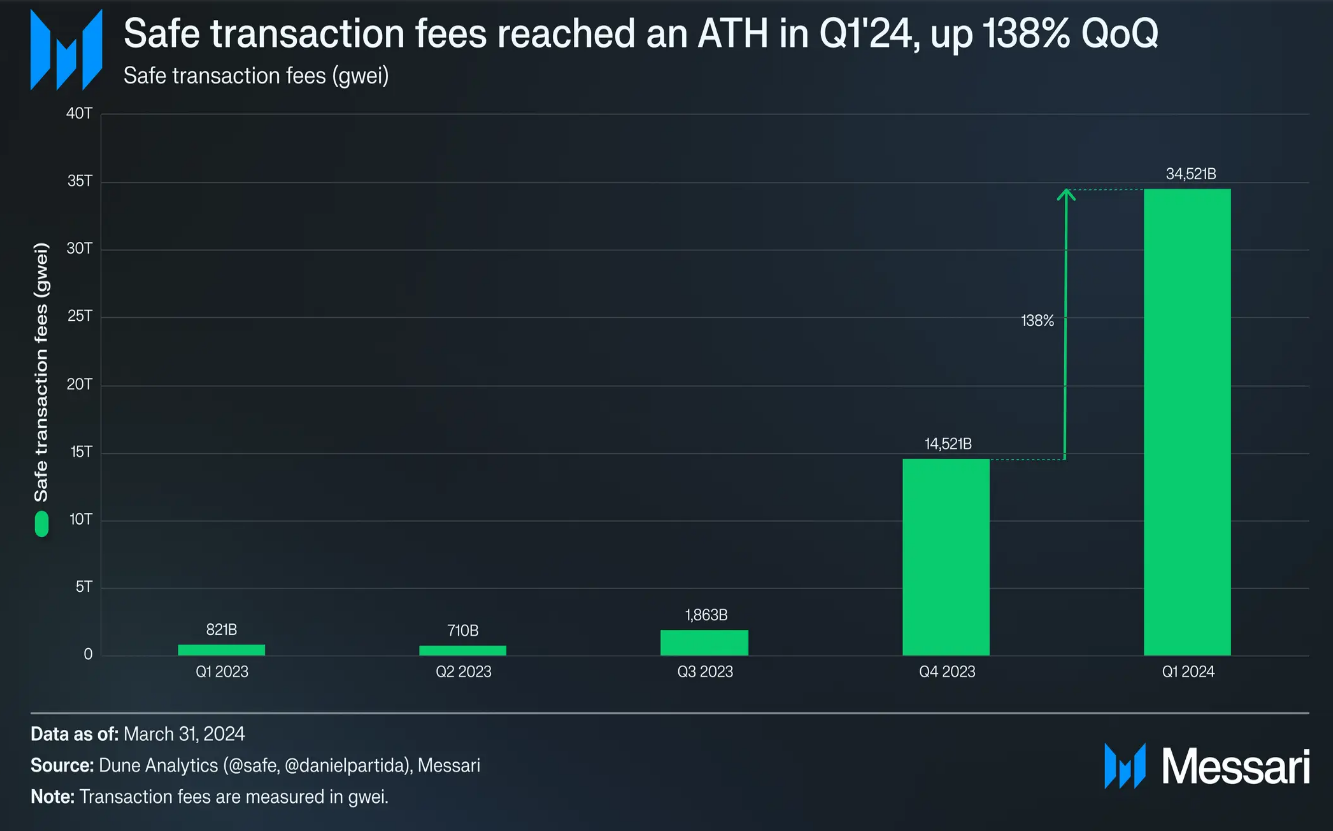

In the first quarter of 2024, the total proportion of transactions initiated by Safe smart accounts reached 2.5% (an increase from 2.3% in the fourth quarter of 2023). At the same time, gas fees generated by Safe reached over 34,500 ETH in the first quarter of 2024 (an increase of 138% compared to the previous quarter).

The Safe community voted to allow SAFEToken transferable starting from April 23, 2024. Meanwhile, a successful proposal introduced a strategy to enhance the utility of SAFEToken by combining ecosystem activities with token utility.

SafeDAO financial management was entrusted to karpatkey after a community vote.

1. Basic Knowledge

Safe is a popular smart contract wallet solution, storing over $100 billion in assets and having over 8 million deployed smart accounts. Formerly known as Gnosis Safe, Safe aims to create standards for ownership through smart accounts.

Safe is primarily used as a multi-signature wallet, allowing individuals to securely self-custody funds and organizations to effectively manage their financial operations. According to Messari's wallet landscape analysis, Safe is a wallet infrastructure aggregator, in addition to providing smart contract wallets. Therefore, Safe is both:

Safe{Wallet}: The primary product in the form of a smart wallet solution (i.e., Safe's user-facing smart contract wallet).

Safe{Core}: The infrastructure protocol that supports Safe's wallet solution and other projects (such as Worldcoin).

The Safe{Core} protocol adopts a vendor-agnostic approach, allowing any developer to contribute to the protocol. Additionally, a key consideration for the Safe{Core} protocol will be fee design and implementation.

The Safe community voted to allow SAFEToken transferable starting from April 23, 2024. Meanwhile, a successful proposal was made to enhance the utility of SAFEToken by combining ecosystem activities with token utility.

2. Key Indicators

1) Networks

Safe's usage can be measured by observing its accounts and transaction activities across multiple networks. As of the first quarter of 2024, Safe has been deployed on over 10 networks, including Optimism, Polygon, zkSync, Arbitrum, Avalanche, Base, BNB Chain, Celo, Ethereum, Fantom, and Gnosis Chain.

2) Active Accounts

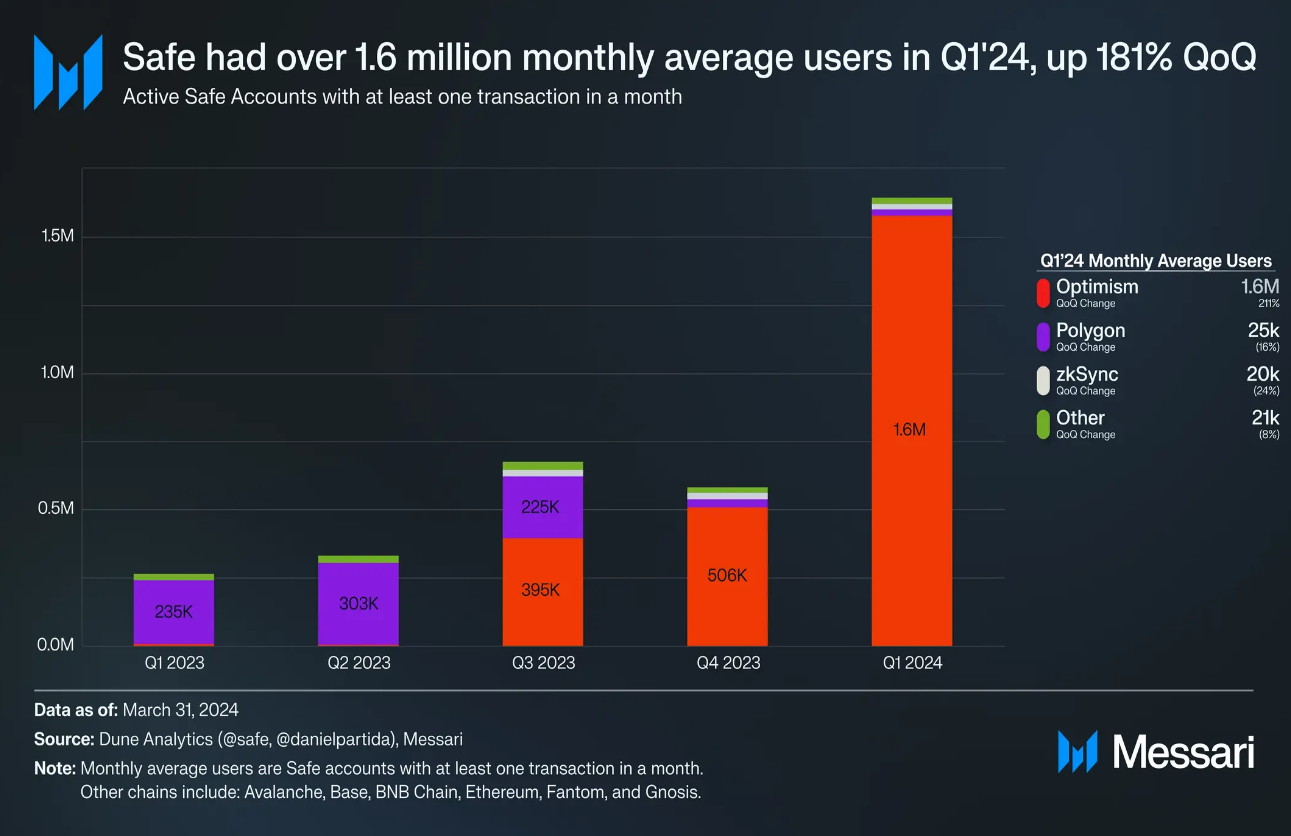

Active accounts refer to the average monthly users of Safe smart accounts with at least one outgoing transaction per month.

In the first quarter of 2024, Safe's monthly average users exceeded 1.6 million, representing an 181% increase compared to the previous quarter, when the monthly average users were nearly 600,000. In the first quarter of 2024, the monthly average users of Safe on Optimism surged to 1.58 million (a 211% increase), accounting for an astonishing 96% of Safe's monthly average users in that quarter. Polygon and zkSync accounted for 1.5% and 1.2% of Safe's monthly average users in the first quarter of 2024, respectively.

The increase in Safe accounts on Optimism can mainly be attributed to the Worldcoin protocol's decision to migrate to the OP Mainnet in the second quarter of 2023. Subsequently, Worldcoin deployed Safe smart accounts for its World App users on the OP Mainnet. As of March 31, 2024, a total of 2.85 million Worldcoin smart accounts have been deployed on Safe.

With the latest announcement of the World Chain Layer2, it remains to be seen whether the number of active Safe users on Optimism will continue to grow in the coming quarters. It is worth noting that the Dencun upgrade implemented EIP-4844, significantly reducing the transaction costs of Layer2. According to recent analysis by Messari, lower transaction costs may, in turn, alleviate the high usage costs associated with smart wallets.

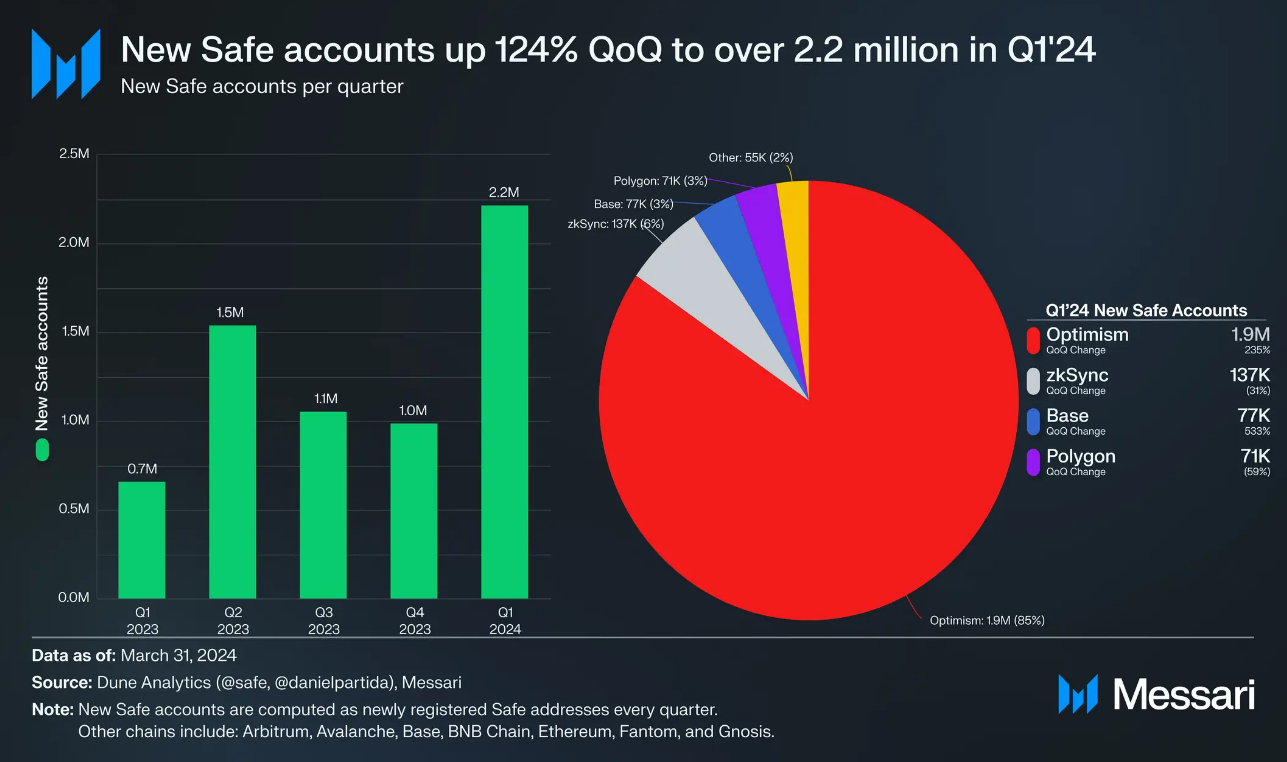

3) New Accounts

In the first quarter of 2024, the number of newly created Safe smart accounts exceeded 2.2 million, representing a 124% increase compared to the previous quarter, when the number of new accounts was 1 million. In terms of specific chains, Optimism accounted for 85% of the newly created Safe smart accounts in the first quarter of 2024, totaling 1.9 million accounts, an 18% increase. In the first quarter of 2024, over 99% of the new Safe smart accounts deployed on Optimism were from Worldcoin in that quarter. Meanwhile, zkSync and Base accounted for 6% and 3% of the newly created Safe smart accounts, with 137,000 and 77,000 accounts, respectively.

The number of new Safe smart accounts on Polygon in the first quarter of 2024 was 71,000, representing a 92% decrease compared to the second quarter of 2023, when it was 847,000. The growth difference between Optimism and Polygon can be explained by Worldcoin's migration from Polygon to the OP Mainnet ecosystem in the second quarter of 2023.

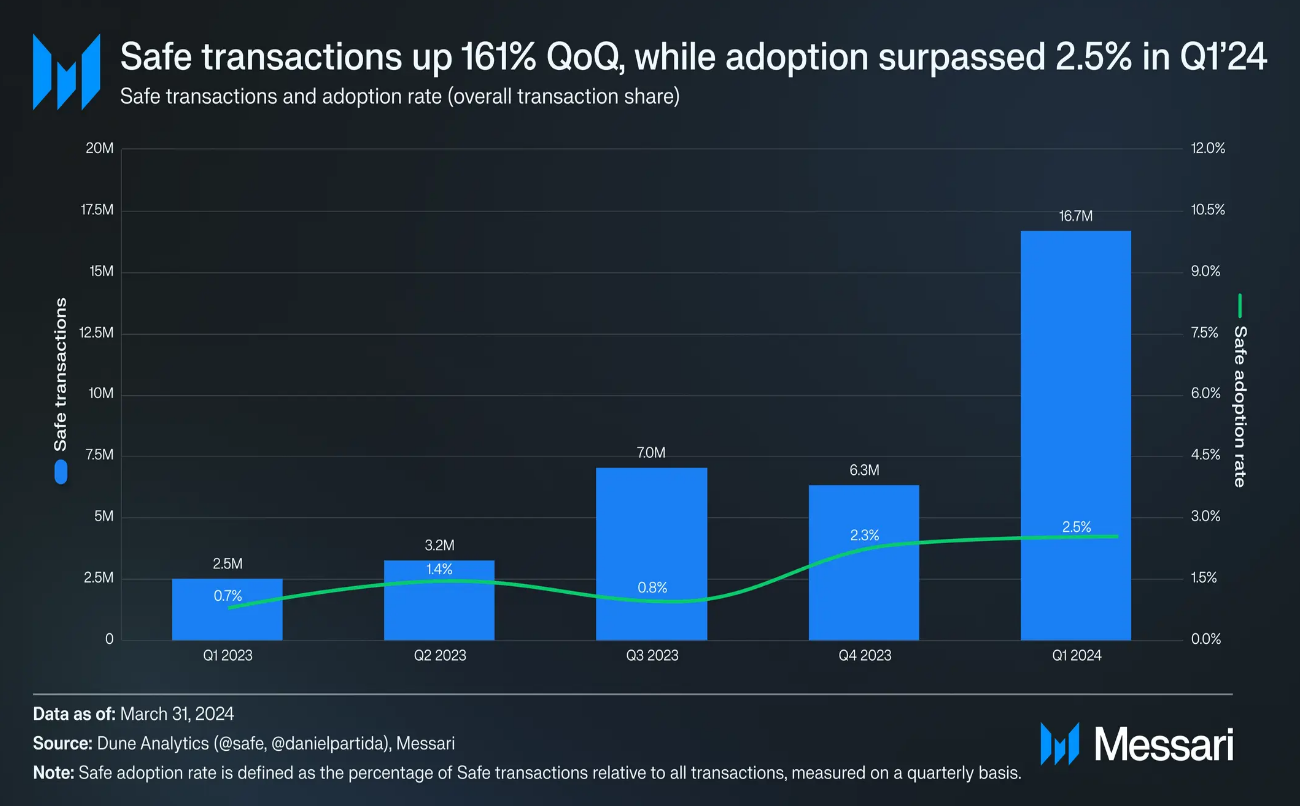

4) Adoption Rate

With the growth of active Safe users, the number of transactions involving Safe smart accounts (Safes) increased by 161% from 6.3 million in the fourth quarter of 2023 to nearly 17 million in the first quarter of 2024. To provide a comparison, in the first quarter of 2024, Safe transactions accounted for 2.5% of all transactions, a fourfold increase from 0.65% in the first quarter of 2023.

Now, the vast majority of Safe's on-chain activities occur on Layer2 scaling solutions, with Optimism accounting for 93% of all Safe transactions, followed by Gnosis and zkSync, each accounting for 2%. According to Messari's wallet market analysis, infrastructure aggregators like Safe are expected to further benefit from the influx of new crypto applications.

3. Financial Situation

Currently, Safe does not generate any revenue from its smart contract wallet or its general product suite. However, gas fees originating from the Safe smart contract wallet can serve as a proxy for the related value of Safe in its multiple deployments. In this sense, a key consideration for the Safe{Core} protocol will be fee design and implementation. Meanwhile, a successful proposal introduced a strategy to enhance the utility of SAFEToken and potentially generate revenue by linking ecosystem activities with token utility.

1) Transaction Fees

In the first quarter of 2024, the gas fees used on the Safe trading platform increased by 138%, reaching over 345 billion gwei, equivalent to 34,500 ETH, consistent with the growth in transactions involving Safe. General activities have migrated from the Ethereum mainnet to scaling solutions such as Optimism, while introducing EIP-4844 and World Chain Layer-2. Therefore, Safe may see a reduction in the average cost per transaction in the coming quarters. However, the anticipated decrease in the average cost per transaction may continue to be offset by the growing user base on these low-cost Layer-2 chains.

2) Assets Stored in Safe

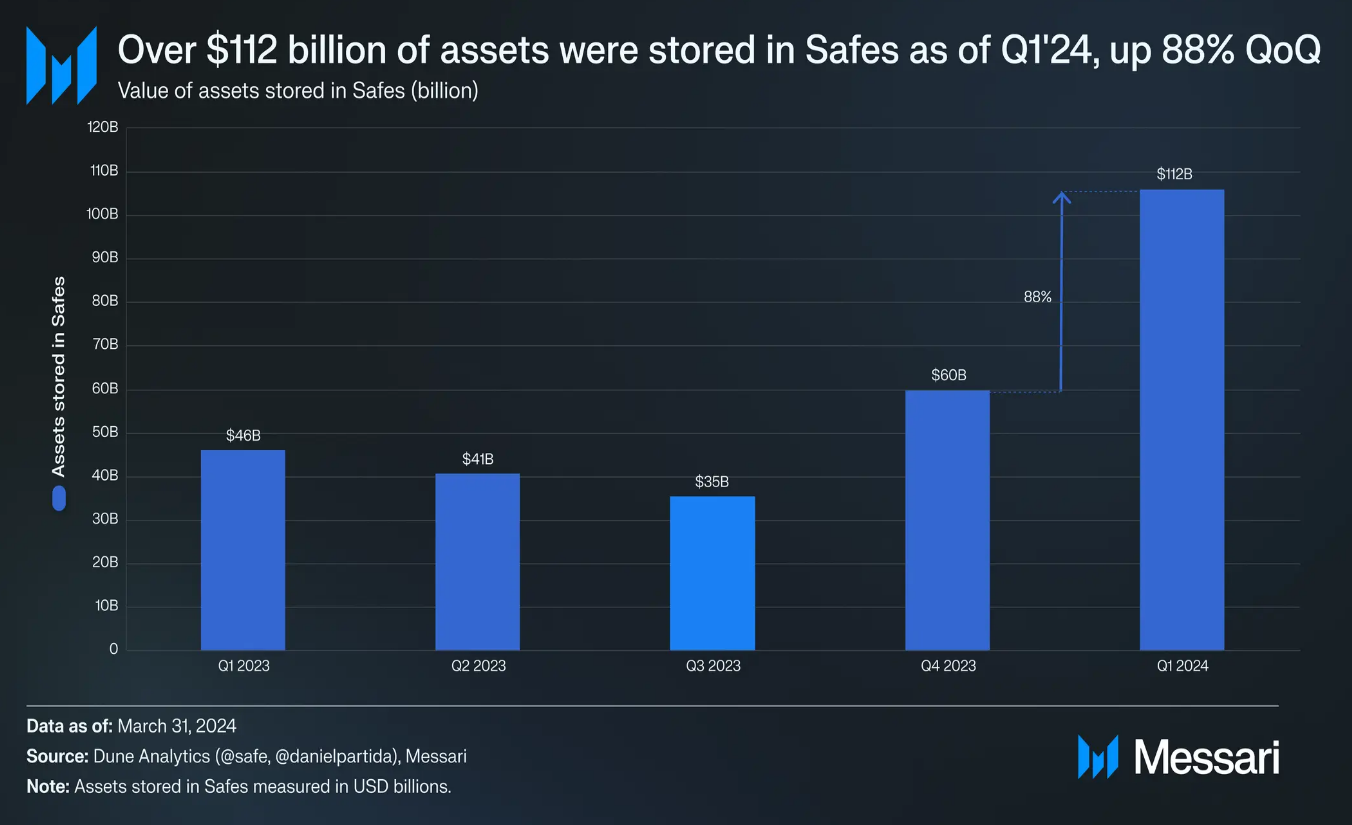

Another way to measure the economic value of Safe accounts is to consider assets under management (AUM). For Safe, the dollar value of assets stored in Safe smart accounts serves as a suitable proxy for AUM.

As of the end of the first quarter of 2024, the total value of assets stored in Safe exceeded $112 billion, representing an 88% increase. For comparison, it was reported that the asset under management of Robinhood Securities in the first quarter of 2024 reached $119 billion, which is comparable.

In terms of distribution on different chains, Ethereum ranks first, with assets stored in Safe smart accounts reaching $88 billion (83%), followed by Optimism and BNB Chain at $9 billion (9%) and $4 billion (4%), respectively.

It is worth noting that while Optimism accounted for 93% of the transaction share and 96% of monthly active users in the first quarter of 2024, its share of assets stored in Safe is only 9%. Conversely, Safe smart accounts on Ethereum store larger amounts of assets with lower transfer frequency compared to Layer-2.

4. Qualitative Analysis

1) Major Developments

Safe{RecoveryHub}: Introduced Safe{RecoveryHub}, allowing users to set up account recovery functionality for wallets on Ethereum, Arbitrum, Optimism, Polygon, and Gnosis Chain. Various recovery options will be gradually introduced, starting with self-custody recovery, and eventually introducing third-party recovery through partnerships with Sygnum and Coincover in the first half of 2024.

The self-custody recovery feature allows users to set a "recovery agent" who can initiate the account recovery process and set recovery review windows and transaction expiration deadlines, during which users can reject the recovery.

Launched on Blast: The Safe protocol can now be used on the Blast network through the Brahma protocol. Blast is the latest member of the 10+ networks where the Safe protocol is deployed, including Ethereum, Polygon, Optimism, Arbitrum, Gnosis, Base, zkSync, Fantom, Avalanche, and BNB Chain.

2) Key Governance

SAFEToken Utility (SEP 21)

The Safe ecosystem proposal (SEP 21) was approved on March 18, 2024, outlining the strategy to enhance the utility of SAFEToken according to SEP 3:

Expand the SafeDAO ecosystem and link ecosystem growth with token utility.

It is important to note that the current actual use of SAFEToken is mainly for governance, allowing token holders to vote on SafeDAO matters. The upcoming Safe activity plan aims to reward active users of Safe smart accounts through sponsored transactions, seasonal NFTs, and potential SAFEToken benefits. Its ultimate goal is to increase active user engagement and token distribution. It is worth noting that SEP 21 states that developers using Safe smart accounts should not be required to use SAFEToken. This is to avoid hindering adoption.

To enhance the utility of Safe smart accounts, SEP 21 emphasizes account abstraction as a core development and the implementation of multiple abstraction layers, such as network, username, payment, and security abstraction. Future explorations of token utility will involve community feedback, fund decisions of SafeDAO, and potential approval of new utility features.

SEP 21 also emphasizes the need to consider the impact on various stakeholders (including users, developers, and token holders). The goal of SEP 21 is to align strategic focus with the broader objectives of the Safe ecosystem.

Transferability of SAFEToken (SEP 22)

This successful proposal allows SAFEToken to be transferable starting from April 23, 2024. Unlocked tokens will continue to be held in the unlocking contract, so they will still not be transferable after the unlocking of SAFEToken. The proposal was made after completing all milestones specified in SEP 3.

In the upcoming Safe activity plan, SAFEToken will continue to be used for governance in SafeDAO and provide additional benefits, as outlined in SEP 21. Through SafeToken Utility Sprint 1 approved in SEP 23, further exploration of other utilities of SAFEToken is currently underway.

SafeToken Utility Sprint 1 (SEP 23)

This successful proposal requests to provide 50,000 USDC to create and fund a working group responsible for researching and designing content related to three to five use cases of SAFEToken: DeFi modules, staking.

The proposal will be divided into the following three stages:

Listing potential use cases.

Categorizing based on resource requirements and value potential.

Selecting and detailing the top five for development.

Financial Manager (SEP 24)

This successful proposal selected karpatkey as the financial management service provider for SafeDAO. As part of the task, karpatkey will be responsible for managing the financial affairs of the joint fund pool of SafeDAO and GnosisDAO. As a service provider for SafeDAO, karpatkey's responsibilities include:

Financial management,

Integration of the SAFE protocol,

Risk management,

Research.

The joint fund pool contains 5% of SAFEToken. karpatkey will utilize this fund pool to create a liquid Safe market on the Gnosis Chain, using up to 2.5 million SAFEToken to incentivize SAFE DEX liquidity on the Gnosis Chain.

Additionally, the proposal states that the joint fund pool will provide liquidity for Safe on both Ethereum and Gnosis Chain. In the future, karpatkey may diversify the fund pool, using the assets for staking or other means to generate asset returns.

The protocol specifies that the duration of the agreement is indefinite, and SafeDAO can terminate the agreement through another governance vote. A fee of 2% per year will be charged based on the asset under management, paid on a monthly basis.

Delegated Voting (SEP 16)

This successful proposal requests 60,000 USDC to increase governance participation by building an updated delegation registry and snapshot strategy.

The plan includes the following three key features:

Delegated Voting: Accounts can delegate their voting weight to any number of other accounts and define the proportion of voting weight each delegated account should receive.

Passing Delegation: Accounts can delegate not only their own voting weight but also the weight delegated to them.

Delegation Time Limit: Accounts and Snapshot spaces can choose to set a time limit for each delegation.

Enhanced Modular Safe Accounts (SEP 13)

This successful proposal requests funding of 60,000 USDC within 15 weeks to provide a platform for developers to build, deploy, and verify modules through on-chain audits and offer users a convenient way to explore and enable these modules. The ZenGuard plan aims to attract module developers and auditors, provide a module browser Safe App, and work on developing an SDK to facilitate integration and automation.

Governance Analytics Dashboard (SEP 12)

This successful proposal requests 50,000 USDC to support infrastructure costs and in-depth governance report development from February to July 2024. Aligned with the strategy to increase governance participation, the plan will provide analysis reports on voting patterns, participation rates, and voting power distribution. It aims to facilitate wise decision-making within the SafeDAO community.

Governance Amendment (SEP 11)

This successful proposal amends the governance process of SafeDAO in Season 1, Sprint 4. The amendment includes the introduction of partial delegation, revisions to the voting mechanism for OBRA initiatives, adjustments to the voting schedule, an extension of the soft launch for Season 2, and clarification on OBRA initiatives with implementation dependencies.

The introduction of partial delegation, developed in collaboration with Gnosis Guild, aims to increase voter turnout by allowing larger token holders to delegate a portion of their voting weight to increase voter participation. The revised voting mechanism for OBRA initiatives aims to effectively manage budget constraints by adopting a ranking system for approved initiatives.

5. Important Events

1) Multis Acquisition

Safe announced the strategic acquisition of Multis, a versatile financial software designed for cryptocurrency businesses. According to the announcement, the acquisition will help Safe "solve the complexity of cross-chain interactions through network abstraction, with the ultimate goal of enabling users to easily manage assets on different blockchain networks." The senior leadership team of Multis has joined the Safe ecosystem foundation, and former Multis CEO Thibaut Sahaghian will serve as the Director of Network Abstraction for the Safe core team.

2) Partnership with Base

Safe announced a partnership with Base to provide modular tools for developers building smart accounts on Base. To support developers incurring gas fees when utilizing Safe's smart account infrastructure, Base will provide (up to) 1 ETH of gas fee credit during the initial 12-month rollout period of the planned Safe x Base. Developers can fill out the gas fee credit form.

6. Summary

Despite the difficulties most smart contract wallets face in seeking mainstream adoption, Safe remains an exception. As a leading smart contract wallet system, Safe users continued to derive value from the core wallet products in the first quarter of 2024, with the total assets stored in Safe exceeding $112 billion, comparable to Robinhood's asset under management, which reached $119 billion in the first quarter of 2024.

In the first quarter of 2024, Safe set historical highs in most usage metrics. Safe users continued to derive value from the core wallet products, with the number of active accounts reaching 1.6 million in the first quarter of 2024 (an 18% increase). Additionally, the percentage of transactions originating from the Safe smart contract wallet reached 2.5%, hitting a historical high. Wallet infrastructure aggregators like Safe are expected to benefit from the influx of new crypto applications.

The Safe community voted in favor of making SAFEToken transferable starting from April 23, 2024. Meanwhile, a successful proposal introduced a strategy to enhance the utility of SAFEToken by linking ecosystem activities with token utility.

Note: This report was commissioned by Safe. All content was independently written by the author and does not necessarily reflect the views of Messari or the commissioning institution. The commissioning institution does not influence editorial decisions or content. The author may hold cryptocurrencies mentioned in this report. This report is for reference only and does not constitute investment advice.

Source: https://messari.io/report/state-of-safe-q1-2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。