EigenLayer has issued tokens, but it seems that it would be better not to issue them. (Attached tutorial for bypassing geographical blockade to check airdrop)

Author: Alex Liu, Foresight News

EigenLayer announced the launch of the token EIGEN and will conduct a "Stakedrop" airdrop last night. Currently, EIGEN is priced at 9.94 USDT on AEVO, corresponding to a FDV of nearly 16 billion USD. Users who participate in EigenLayer directly through re-staking and holders of LRT can now check the airdrop quantity on the official claim website, while participants in DeFi protocols such as Pendle will have to wait for the second phase.

EigenLayer's long-awaited airdrop has finally arrived, but it has brought unexpected controversy.

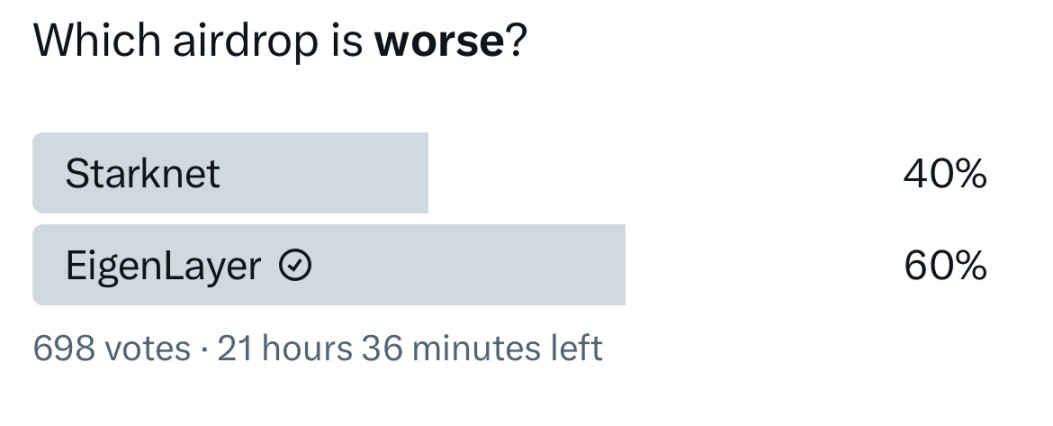

Voting in the community on who has the worse airdrop

Highly Anticipated Project

If you were to ask what the most anticipated project of the year is, EigenLayer, which single-handedly sparked the "re-staking" craze, is undoubtedly the answer for many. While alt L1 platforms like Solana continue to be popular and meme coins like Dogecoin are flying high, LRTfi, based on EigenLayer, has stabilized the Ethereum ecosystem, attracting a large amount of TVL and leaving users hopeful for future excess returns, thus keeping funds and confidence in Ethereum.

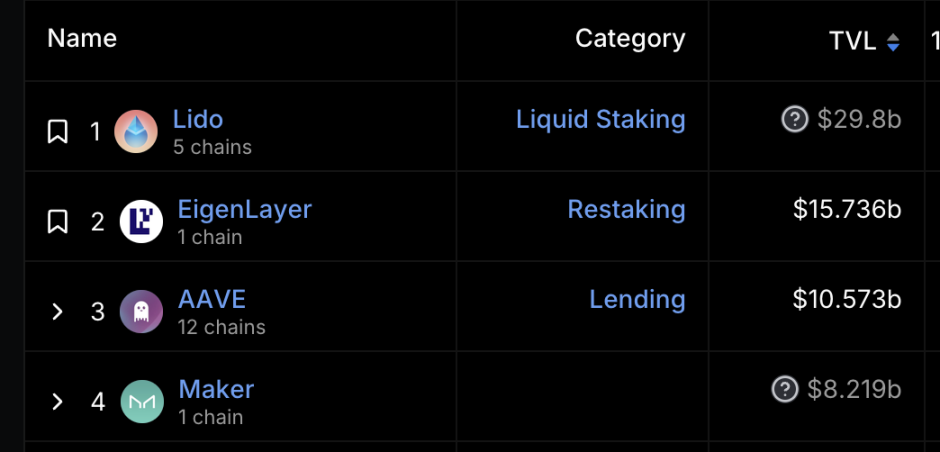

According to DeFiLlama, EigenLayer has nearly 16 billion USD TVL, ranking second in the entire chain

Many believe that "EigenLayer will have the largest airdrop this year, or even in history."

However, during the process of the official announcement and launch of the airdrop claim website, the Eigen Foundation X account, domain name, airdrop claim website domain name, and the whitepaper for the Eigen token were successively revealed, many people became increasingly disappointed, even angry. What exactly happened?

Due to continuous insults from dissatisfied users regarding the airdrop, the comments section of the live broadcast with the founder of EigenLayer on Bankless was closed

Disappointing Results

Distribution: More for VCs and the team, less for users

From the first open deposit in June last year to the snapshot on March 15th this year, all re-staking participants who have collectively invested nearly 16 billion USD in EigenLayer will share 5% of the total token supply in the first season of "Stakedrop." Meanwhile, the combined share of early contributors and investors (i.e., VCs and the team) amounts to a surprising 55%.

A news flash containing token distribution details

The 40-plus-page whitepaper provided such tokenomics, where the first season's airdrop share not only fell below the expectations of some users but also below market pricing (after the announcement, LRT on Pendle experienced a sharp decline). The community seems to be unconvinced—many users have expressed that they only received a minimum of 10 EIGEN tokens, and there is a majority of community members who feel that the token quantity is lower than expected.

"Non-transferable" tokens

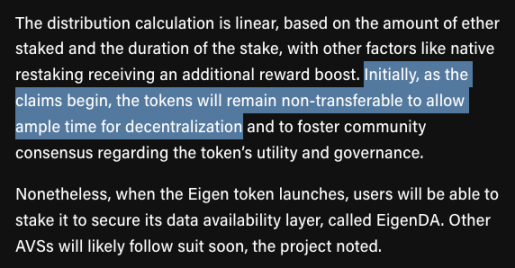

Yes, it has been officially announced that 90% of the tokens in the first season of "Stakedrop" can be claimed directly by EigenLayer's stakers and LRT holders on May 10th. But it seems to be of no use? This is because the tokens cannot be transferred at this time, meaning they cannot be sold. The document states: "To ensure sufficient time for decentralization, the tokens will remain non-transferable."

Relevant section in the document

Apart from further fueling dissatisfaction in the community, Ethena, which previously conducted a large-scale airdrop, wrote: "Our tokens are transferable, we love you." This seems to be a sarcastic response to the matter.

Tweet from Ethena Labs

It is worth noting that some people have explained on behalf of EigenLayer that the temporary non-transferability of the tokens is to confirm the share of DeFi users in the first quarter before officially launching in the second phase. Therefore, the validity of criticism on this point remains to be debated.

Do these people seem to know the snapshot time?

Whenever a project conducts an airdrop, whether there are insiders or so-called "insider trading" will always become a hot topic. This is because it relates to the two most crucial standards of an airdrop: fairness and transparency. And this time, there seem to be some rather peculiar "coincidences."

The snapshot date for the first season was March 15th, and just a day after the snapshot, during a recent significant drop, the "legendary trader" GSR withdrew wBETH worth 7 million USD.

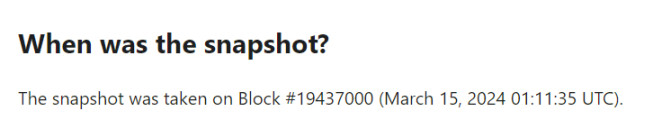

Snapshot date

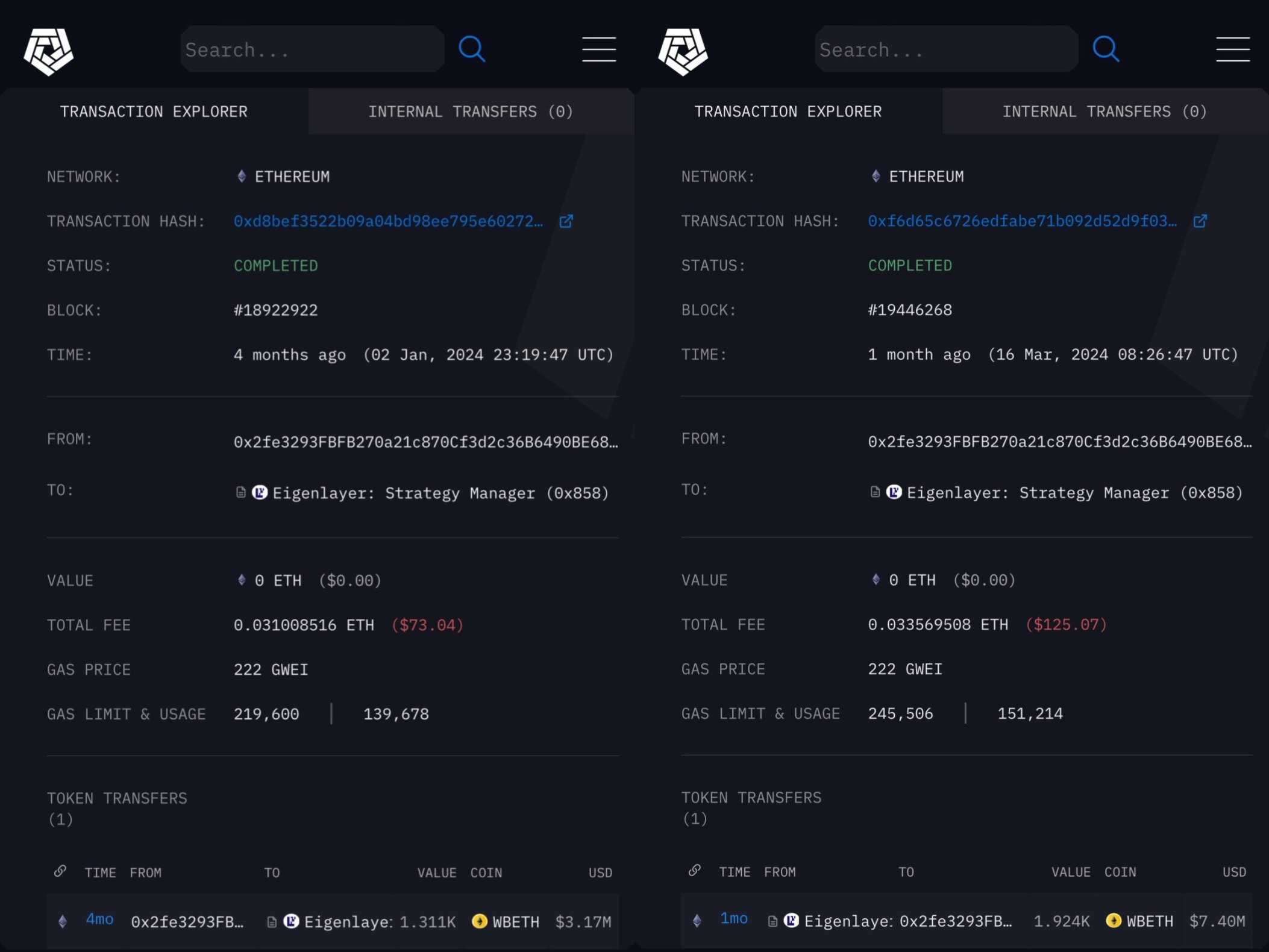

Withdrawal record of GSR

This is not an isolated case. On January 2nd, a wallet newly funded by Binance deposited about 4000 wBETH, approximately 13 million USD, into EigenLayer. Over the next 3 months, it accumulated nearly 3.5 million Eigen tokens. On March 16th, the day after the snapshot, it withdrew all of them.

Deposit and withdrawal records of the wallet

Do these people have insider information as "insiders"? Some in the community believe so, and they are very angry.

Strict geographical blockade

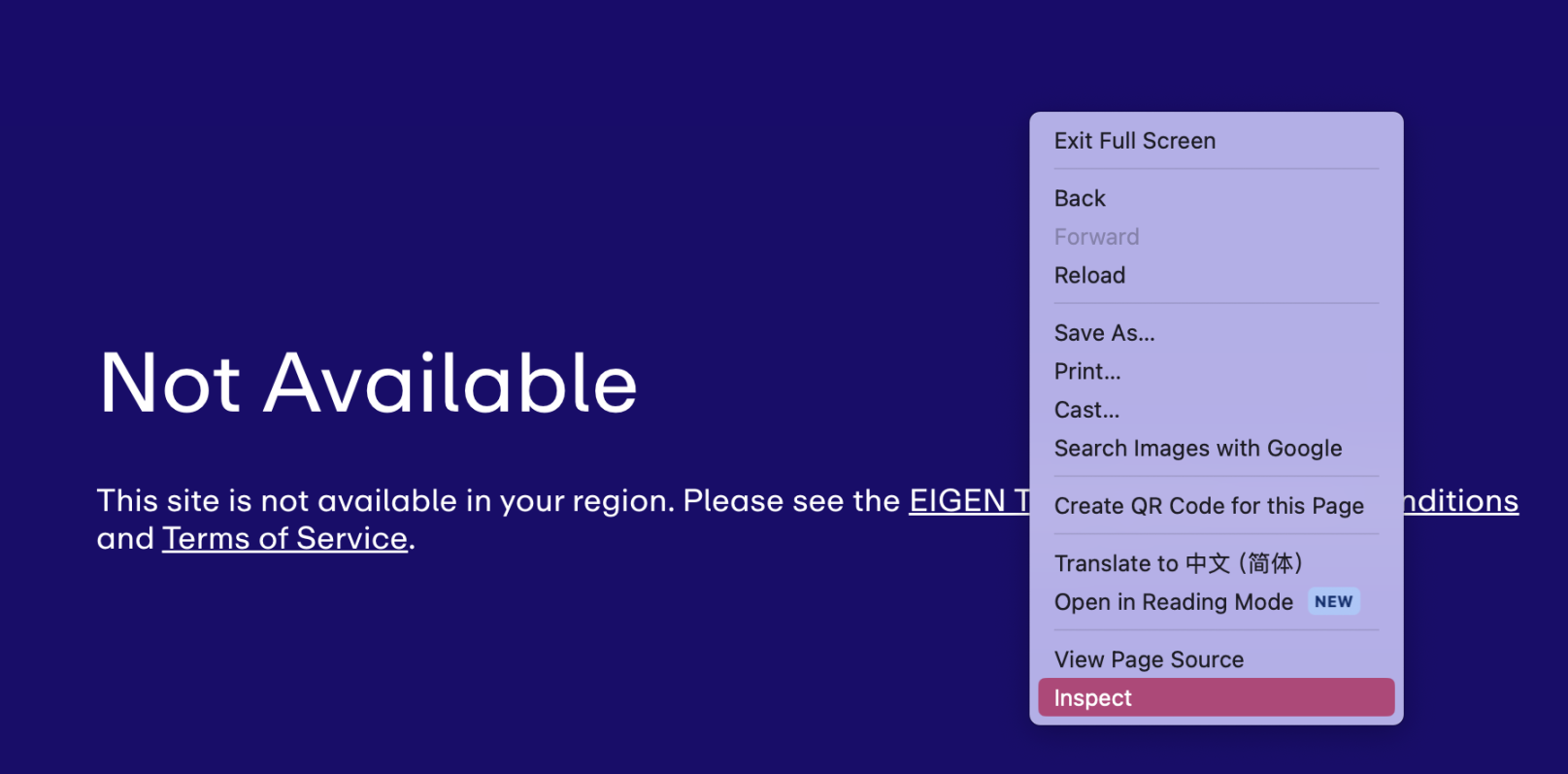

Restricted geographical location, unable to access the airdrop page

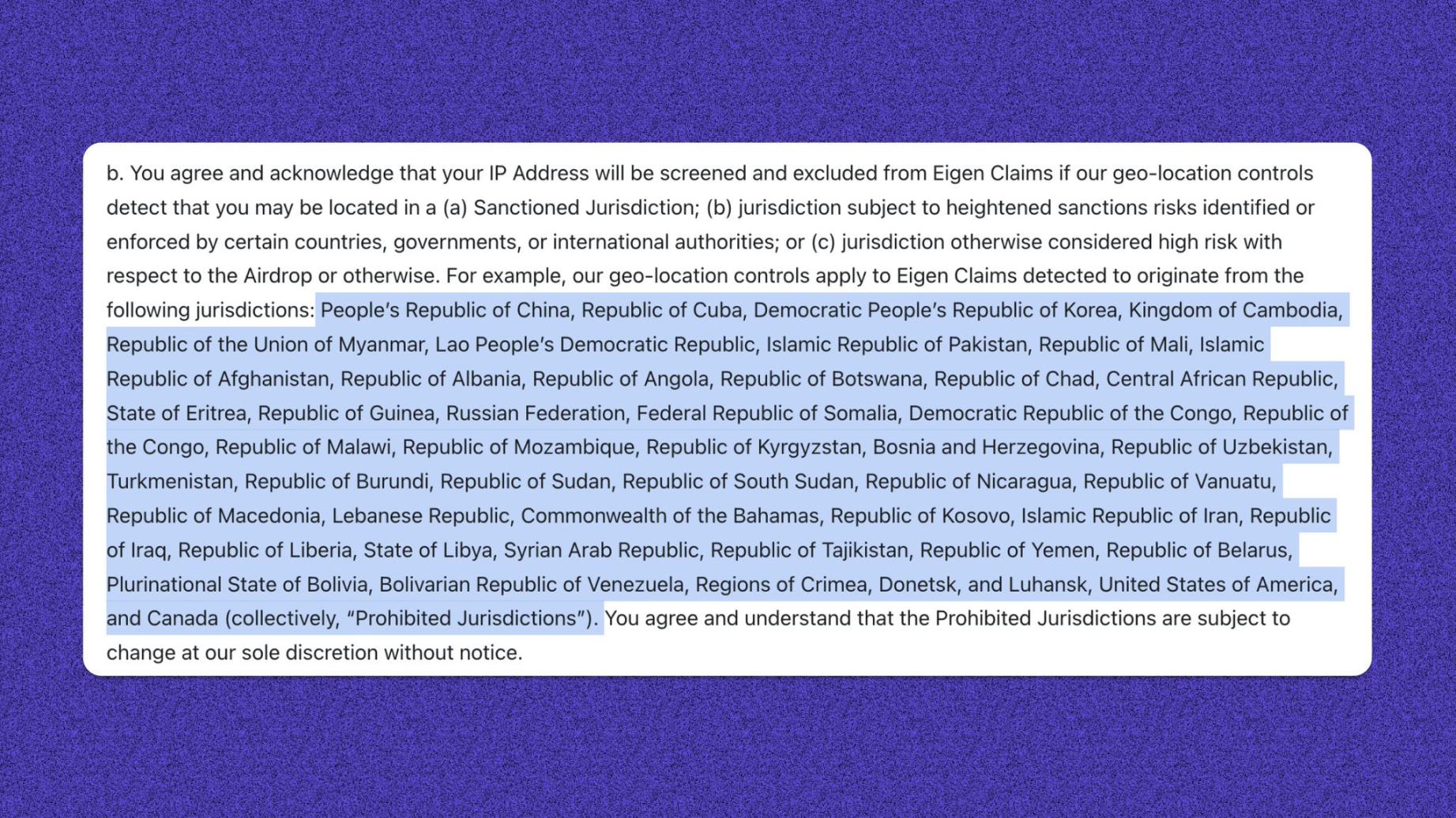

Restricting airdrop eligibility based on geographical location is not uncommon, but it usually only prohibits the United States and its surrounding territories and a few sanctioned countries. EigenLayer's list of restricted countries is exceptionally long, with China being the first on the list.

Long list of countries prohibited from claiming the airdrop

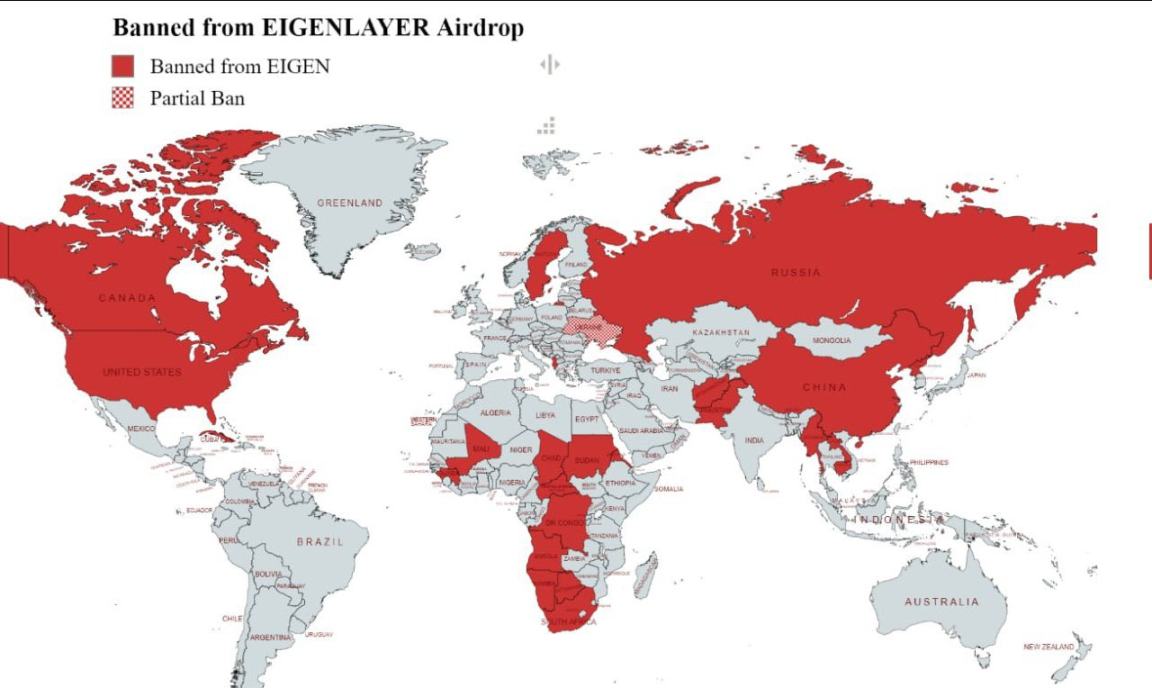

The red areas are the regions banned by Eigen

Moreover, in the past, geographical blockades were often just superficial measures. By using a VPN from another country, you could still claim tokens normally. However, EigenLayer is different; it is really serious about this. From personal experience, previously foolproof proxies were actually detected and blocked for the first time. It was quite a hassle to bypass the geographical blockade and check the allocation. (Tutorial at the end)

Another point of controversy in the community is: if it has such powerful geographical detection and blocking capabilities, why wasn't it used when the protocol opened for deposits? Why was it only activated when claiming rewards? Is it because they didn't like it?

User complains that the United States is not a "restricted location" during "deposit"

Tutorial for Bypassing Geographical Blockade to Check Airdrop

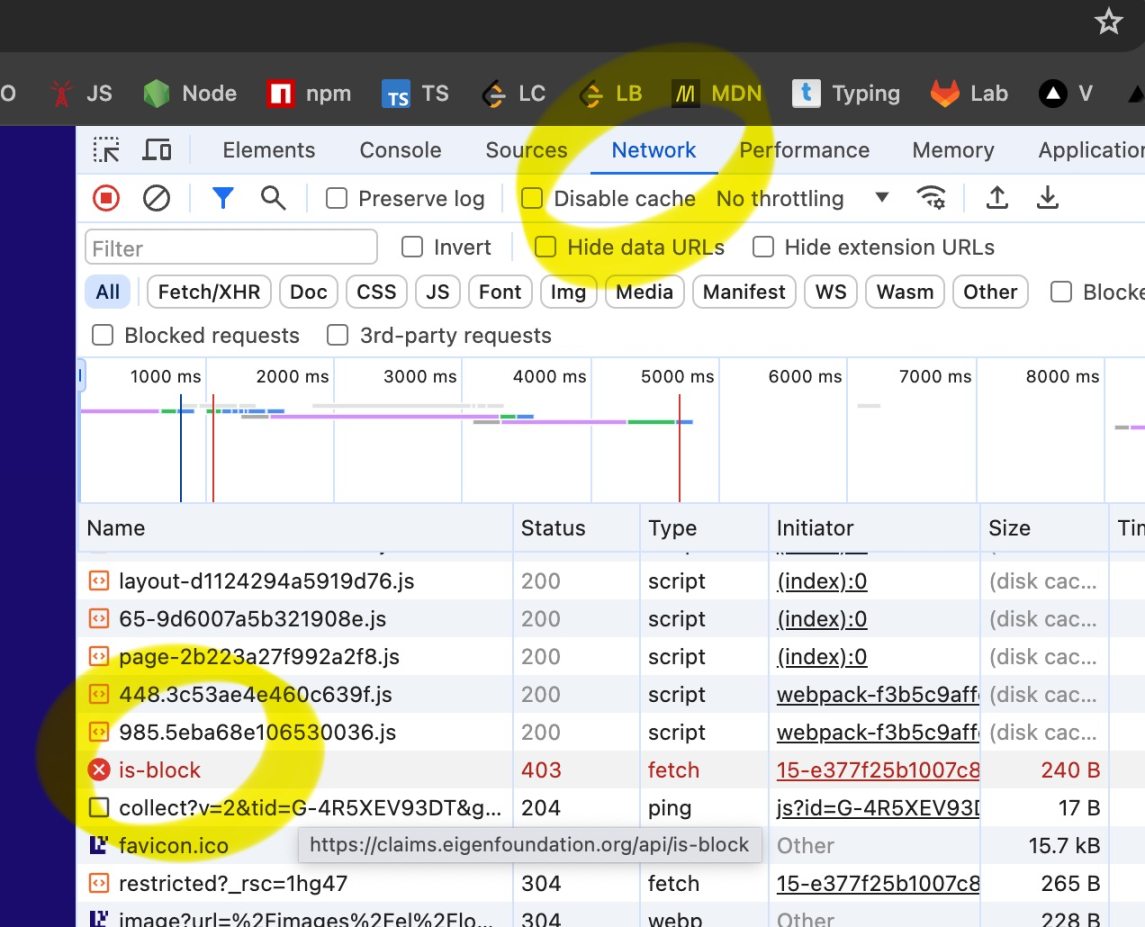

- Open an Incognito Tab in a browser, enter the URL to access the page, right-click and select "inspect" or press the F12 key to open the debugging interface

- Delete the /restricted from the page link and refresh. In the Network section, find "is-blocked"

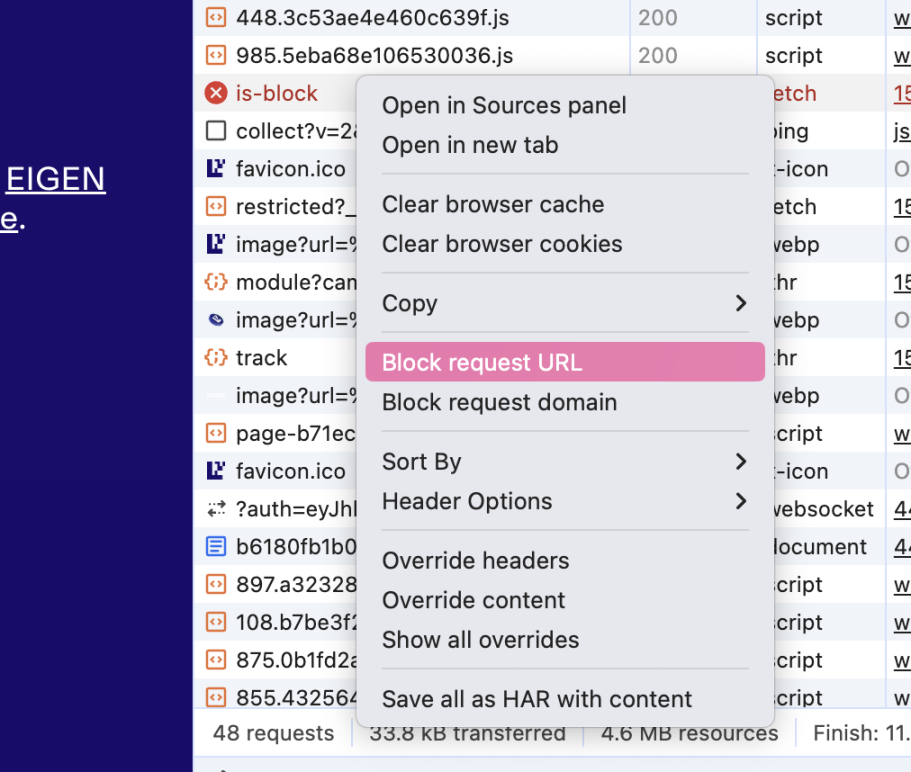

- Right-click and select "Block request URL"

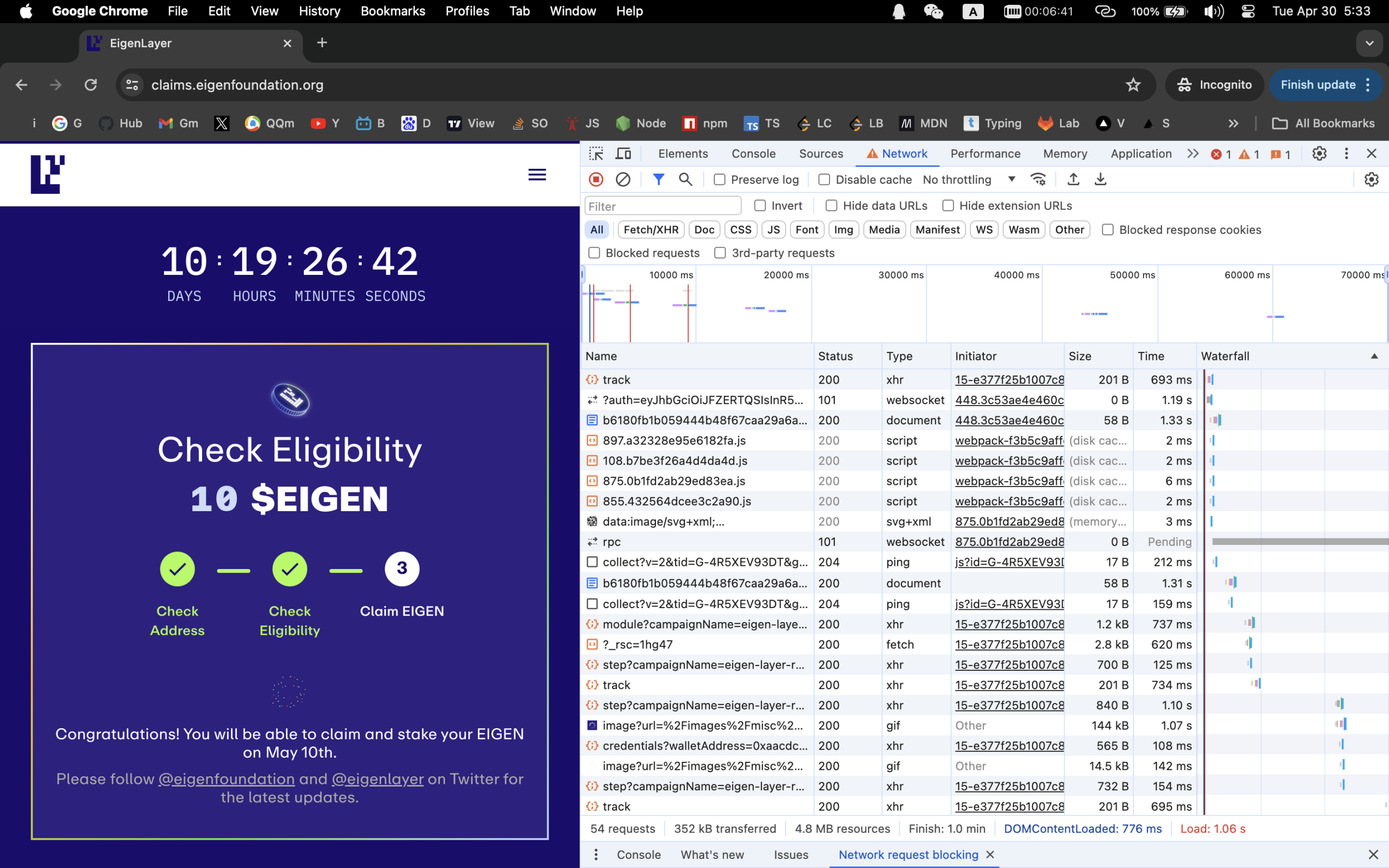

- Delete the /restricted from the page link, refresh, and you will be successful. Follow the prompts to check the allocation

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。