Article: Yash Agarwal

Translation: DeepTechFlow

A month ago, Vibhu, the founder of DRiP, sparked a much-needed debate in a statement: Solana needs L2 and Rollup.

The reason for this is that due to the rise in SOL price and network congestion, DRiP has been leaking a significant amount of value to the base layer (about $20,000/week). The increase in activity on Solana has led to:

- Advantages: Enhanced liquidity, capital, and trading volume (attributed to composability)

- Disadvantages: Rising infrastructure costs, poor user experience, congestion

However, DRiP mainly uses Solana as infrastructure, distributing millions of NFTs to thousands of wallets weekly, and therefore does not benefit much from high composability. The growth in Solana's TVL and capital inflows has almost no impact on DRiP, which is mainly troubled by high infrastructure costs and other disadvantages.

Vibhu pointed out, "The diminishing returns of composability." He also noted that Solana application developers are privately discussing their desire for Rollup, citing reasons such as:

- Increased transaction throughput, reduced block space competition, and lower fees

- Better control over the economic value generated by their business

In the past few months, Solana has experienced multiple congestion events, from airdrops like JUP to ORE mining and peak Meme coin trading. While some may argue that Firedancer can solve all these issues, let's be realistic: the timeline is still uncertain and cannot currently scale to more than 10x. Nevertheless, the fact remains that among all major chains that have undergone various tests, Solana is considered the only true monolithic chain left.

Should Solana remain monolithic or become modular? Will Solana evolve like Ethereum, adopting decentralized L2 and L3 solutions? What is the current landscape of application chains and Rollup on Solana?

To answer these questions and summarize the entire debate, this article will explore all possibilities, discuss various projects, and evaluate their pros and cons.

This article will not delve into technical details but will take a more market-oriented and practical perspective to discuss various scaling methods, providing an overview.

In short, we will discuss:

- Solana and congestion

- Making Solana modular

- Solana application chains and examples

- Solana L2 and Rollup (RollApps) and examples

- Infrastructure supporting Rollup and application chains

Solana and Congestion

Let's address the elephant in the room first: the Solana network has been very congested recently (mostly resolved now), due to activities such as airdrops, high volume Meme coin trading, leading to high ping times, a high proportion of failed transactions, and increased network fees due to priority fees. Despite these issues, Solana has maintained a speed of processing about 1-2k TPS per second, more than all EVM chains combined. I would say this is a good problem for a blockchain to have, and it has put Solana's monolithic stance to the test.

The Solana Foundation recently released a blog post urging projects to take immediate action to enhance network performance, including:

- Implementing priority fees, crucial to avoiding delayed or lost transactions.

- Optimizing the usage of Compute Units (CUs) through a penalty system, using only the necessary portions.

- Implementing priority-weighted Quality of Service (QoS) to allow applications to prioritize user transaction processing.

However, all these measures can only improve transaction completion rates to a certain extent and cannot guarantee a smooth user transaction experience. An immediate solution to this problem is the highly anticipated new transaction scheduler, planned for release in version 1.18 at the end of April. It will be rolled out alongside the current scheduler but will not be enabled by default, allowing validators to monitor the performance of the new scheduler and easily revert to the old scheduler in case of any issues. This new scheduler aims to more efficiently and economically fill blocks, improving the inefficiency of the old scheduler. Read this article for a deeper understanding of the new scheduler.

Anza (a derivative entity of Solana Labs) has been continuously working to address network congestion issues, which have been identified as related to QUIC implementation and the behavior of Agave (Solana Labs) validator clients when handling a large number of requests.

Despite strong advocacy for a modular approach, Solana Labs/Anza (core maintainers of the Solana protocol) remains focused on optimizing throughput and latency at the base layer. Some potential improvements include:

- Comprehensive reform of the fee market and raising the base fee (currently set at 5,000 Lamports or 0.000005 SOL)

- Implementing exponential write lock fees for accounts, gradually increasing fees over time to avoid spam

- Optimizing CU (Compute Unit) budget requests through a penalty system

- Strengthening the overall network architecture

Even with these improvements in vertical scaling (single chain), we cannot rule out the possibility of Solana adopting horizontal scaling (Rollup). In fact, Solana can be a hybrid of both, serving as an excellent base layer for Rollup with extremely low block time latency (about 400 milliseconds), which would greatly benefit Rollup, such as achieving super-fast soft confirmations from sequencers. The best part is that Solana has historically been quick to adapt to changes, which may make it a more efficient Rollup layer than Ethereum.

Update: Anza has now released some patches to help alleviate ongoing network congestion and further enhancements will follow in v1.18.

Making Solana Modular

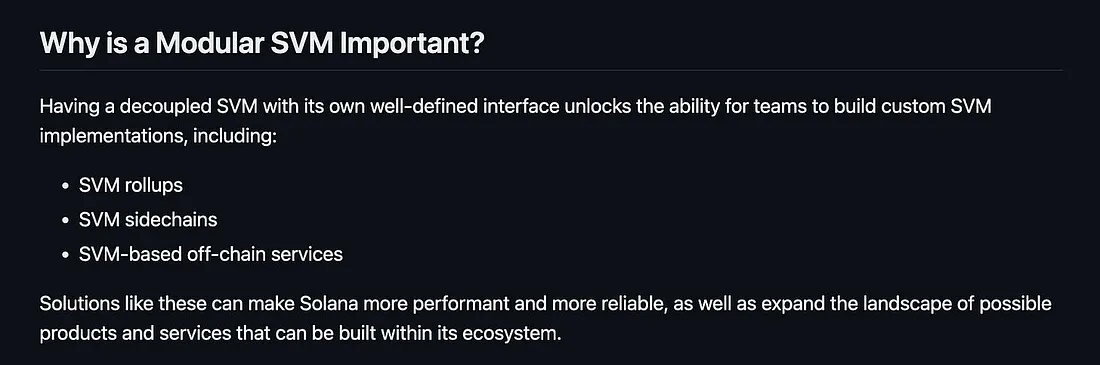

Efforts to make Solana modular have begun. As indicated in a post by Anza DevRel, Solana validators and SVM (the environment for processing transactions and smart contract/program execution) are closely coupled and maintained by Anza. However, the validator client and SVM runtime will be decoupled in the coming months. This separation will facilitate forking SVM and easy creation of 'Solana application chains'.

For Rollup, benefits may come from optimizing Solana's Data Availability (DA)/blob layer, although this may happen in later stages.

Anza engineer Joe C has also announced plans to modularize SVM, where the transaction processing pipeline will be taken out from the validator and put into SVM. This will enable developers to run their own implementations of SVM independently of any validator operations.

The isolated SVM will be a collection of completely independent modules. Any SVM implementation can drive these modules through well-defined interfaces, further reducing the barriers for SVM-compatible projects as it greatly reduces the overhead required to build custom solutions. Teams can implement only the modules they are interested in while leveraging modules from established implementations such as Agave or Firedancer.

In short, Solana will be more plug-and-play, making Solana application chains and Rollup easier.

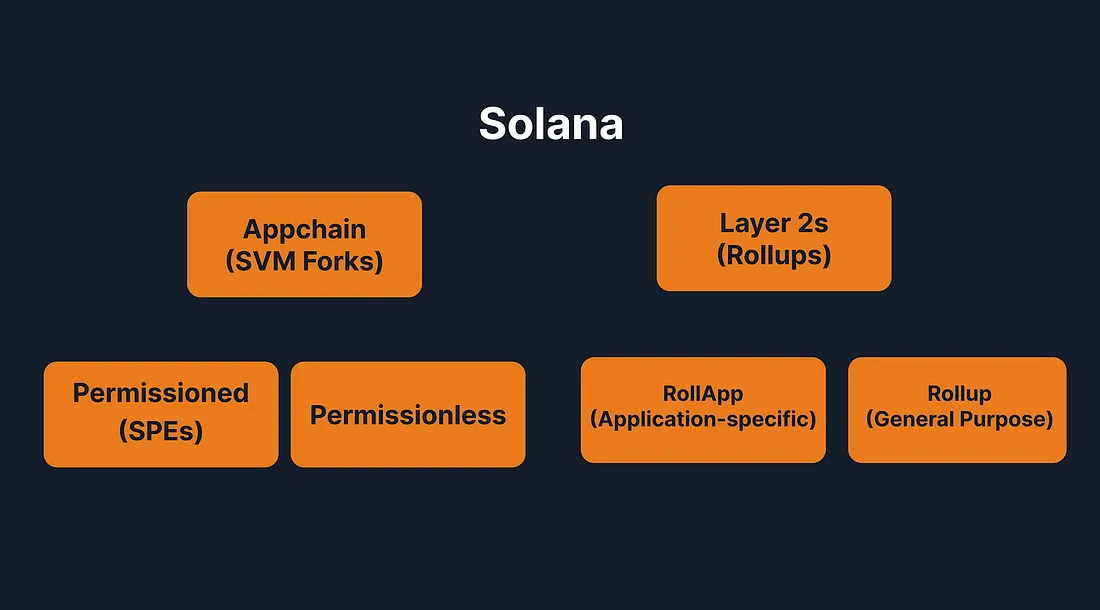

Overall, there are two directions to consider: Layer-2s/Rollup and application chains. We will explore each of these directions.

Solana Application Chains

Also known as SVM forks, these are essentially forks of Solana chains specialized for specific applications. Pyth is the first Solana application chain, but the concept gained attention when Rune, the founder of Maker, proposed developing a Maker application chain (for governance) based on the Solana (SVM) codebase. He chose SVM because of its strong developer community and technical advantages, surpassing other virtual machines, aiming to fork the best-performing chain to better meet consumer needs. While no action has been implemented yet, this move has sparked urgent discussions about Solana application chains.

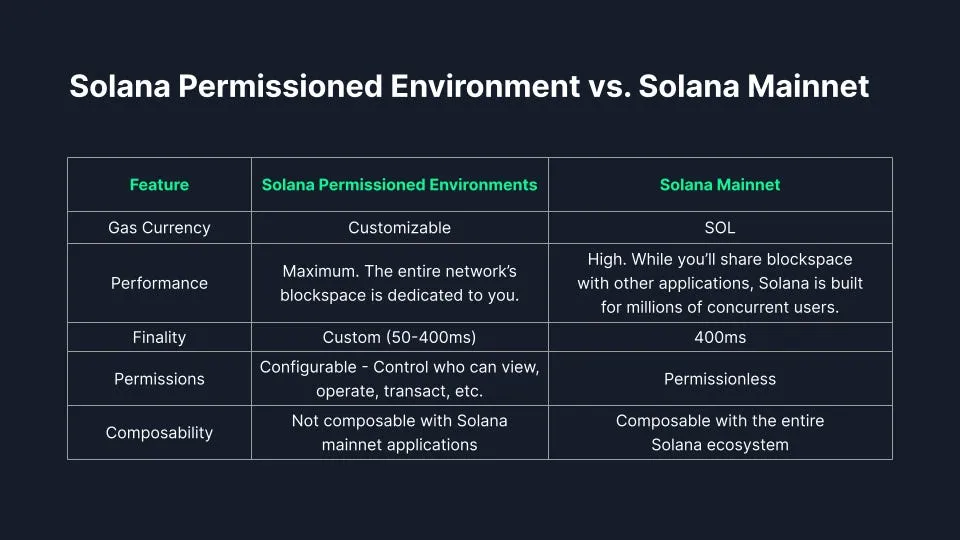

Broadly, it can be divided into two types:

- Permissionless: Anyone can join the network, similar to the current Solana mainnet

- Permissioned: Packaged by the Solana Foundation as "Solana Permissioned Environments (SPEs)" for institutional use, allowing entities to build and maintain their own chain instances supported by SVM.

Pyth: The Ancestor of Solana Application Chains

At one point, Pyth accounted for 10-20% of all transactions on the Solana mainnet. However, it does not require composability, so they simply forked the Solana codebase. This allowed them to leverage Solana's 400-millisecond fast block time for high-frequency price updates. Pythnet is the first network to adopt SVM as its application chain.

Pythnet application chain is a permissioned fork of the Solana mainnet, serving as the computational base for handling and aggregating data provided by data publishers in the Pyth network.

Why the shift for Pyth?

- It does not require composability, allowing it to escape mainnet congestion

- It needs a permissioned environment for data publishing

Cube Exchange is another example, a hybrid CEX deployed as a sovereign SVM application chain (with a full off-chain order book and settlement on its SVM application chain).

Some examples of Solana application chains include:

- Perp DEX: Like Hyperliquid, Perp DEX can run as a standalone L1 network. Additionally, for trading use cases, the number of transactions per block can be customized, or conditional logic can be implemented, such as integrating the execution of stop-loss orders directly into L1, ensuring their execution as state transitions, or introducing application-specific atomic logic.

- AI and DePIN: These can have a list of controlled service providers like Pyth. For example, Akash operates as a computing market through a Cosmos application chain.

- Governance application chains: The interest of MakerDAO in an SVM application chain validates the appeal of sovereign governance application chains. Cryptocurrency governance is still evolving, and having dedicated chains for forking can be a useful coordination mechanism.

- Future enterprise application chains: Potential applications include funds (such as BlackRock) or payment systems (such as Visa or CBDC).

- Gaming application chains: A casino gaming project on Solana is considering its application chain.

- Modified forks of Solana: Similar to Monad or Sei offering optimized EVM (parallelization), someone could build a more optimized version of Solana. This trend may become more common in the coming years, especially as the Solana mainnet begins to explore new design architectures.

Conceptual Solana Application Chain Stack

While building an application chain may be relatively simple, ensuring connectivity between all application chains is crucial for interoperability. Drawing inspiration from Avalanche subnets (connected through native Avalanche Warp Messaging) and Cosmos application chains (connected through IBC), Solana can also create a native messaging framework to connect these application chains.

Middleware similar to Cosmos-SDK can also be created to provide a one-stop solution for creating application chains with built-in support for oracles (such as Pyth or Switchboard), RPC (such as Helius), and messaging connectivity (such as Wormhole).

Polygon AggLayer is also an interesting approach, where developers can connect any L1 or L2 chain to AggLayer, which aggregates ZK proofs of all connected chains.

Are Application Chains Positive for the Solana Ecosystem?

While application chains do not directly increase the value of SOL, as they do not pay fees in SOL or use SOL as a gas token unless re-staked SOL is used for economic security, they do greatly benefit the SVM ecosystem. Just as there is an "EVM network effect," more SVM forks and application chains will strengthen the SVM network effect. The same logic makes Eclipse (SVM L2 on Ethereum) bullish for SVM, even though it is a direct competitor to the Solana mainnet.

Solana Layer 2

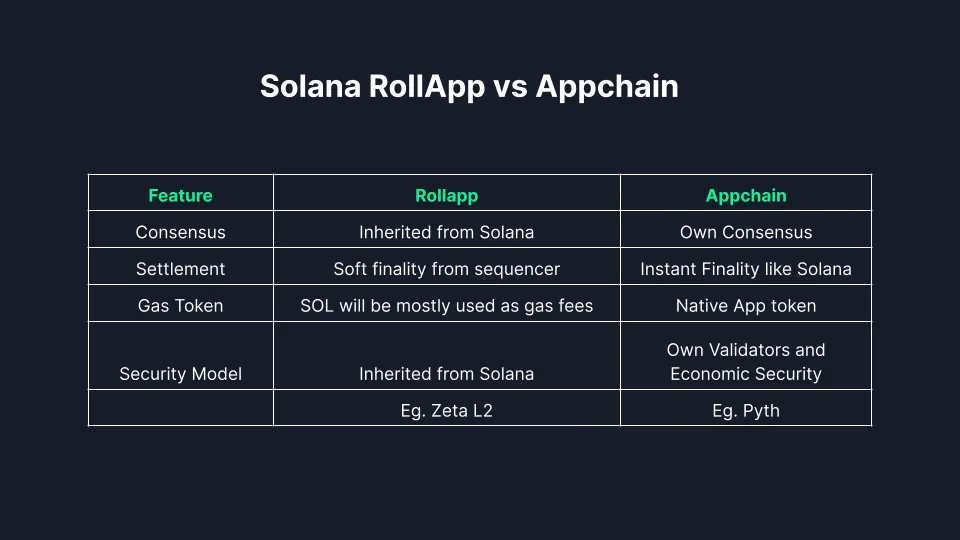

Solana's Layer 2, or Rollup, are logically independent chains that publish data to their main chain's Data Availability (DA) layer and reuse the main chain's consensus mechanism. They can also use other DA layers, such as Celestia, but then it is no longer a true Rollup. "RollApp" is a term commonly used to refer to application-specific Rollups (which most Solana applications are exploring).

Is Solana's Rollup similar to Ethereum's?

Obviously not. For Solana, Rollup is essentially abstract to end users. Ideologically, Ethereum's Rollup is top-down, with the Ethereum Foundation and leaders deciding to scale through Rollup, supporting various L2s after the CryptoKitties incident. On Solana, the demand is bottom-up, coming from application developers with significant consumer adoption. Therefore, most current Rollups are marketing strategies, more driven by narrative than consumer demand. This is a significant difference that could lead to a different future for Rollups compared to what is seen on Ethereum.

Compression = Rollup?

L2 scales the base layer blockchain (L1s) by executing transactions on L2, batching transaction data, and compressing it. The compressed data is then sent to L1 and used in fraud proofs (optimistic Rollup) or validity proofs (zk Rollup). This proof process is called "settlement." Similarly, compression unloads transactions from the mainnet, reducing contention for the base layer's state. It's worth noting that Grass L2 will utilize state compression for its Rollup.

Rollup on Solana

Currently, there are two "Rollapp-like" applications running:

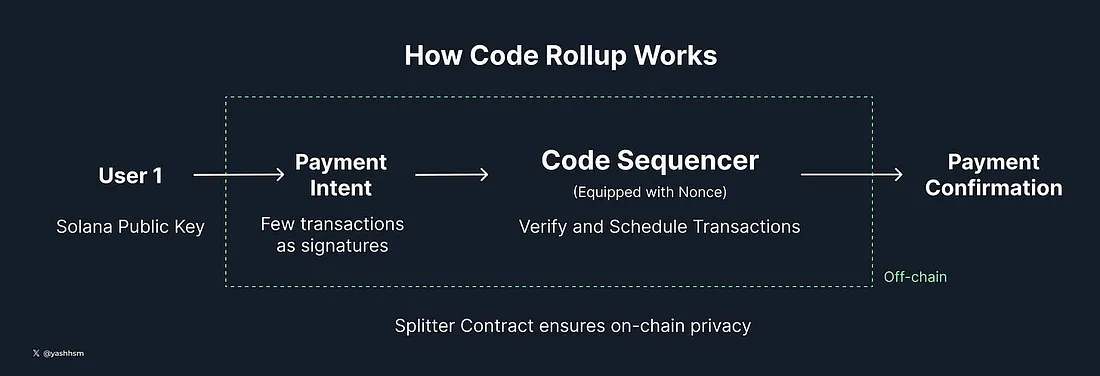

GetCode

A payment application with micro-payment SDK that enables anyone to instantly pay and receive payments, using a pseudo-Rollup for the application. It creates intents for all transactions and settles on Solana after N intervals using a sorter similar to Rollup.

Using a Rollup-like structure enables:

- Flexibility: Intents can represent various future activities, not just payment transactions. Additionally, Solana as a chain can be replaced if necessary.

- Instant and private: With the sorter's soft finality, payments are instant even during Solana congestion. While transactions are visible on-chain, the exact value and intent remain ambiguous, ensuring user privacy.

MagicBlocks' Ephermal Rollup

MagicBlocks is a Web3 game infrastructure specifically designed for games with an ephemeral (or temporary) Rollup. It uses SVM's account structure, with the game state divided into clusters. It temporarily moves the state to an auxiliary layer or "ephemeral Rollup," a configurable dedicated layer. The ephemeral Rollup runs as a specialized SVM runtime or Rollup runtime for transaction processing at increased throughput.

Using a Rollup-like structure enables:

- Customization of the specialized runtime, including gasless transactions, faster block times, and integration of a ticking mechanism (e.g., an integrated feeless transaction scheduling system, similar to clockwork).

- Developers can deploy programs to the base layer (e.g., Solana) rather than on a separate chain or Rollup. ER does not disrupt the existing ecosystem and allows for accelerated target operations without creating isolated environments. This means all existing Solana infrastructure can be leveraged.

This approach helps build a highly scalable system that can launch Rollups on demand and automatically scale horizontally to accommodate millions of users executing transactions without the typical trade-offs of traditional L2. While MagicBlock focuses on gaming, this approach can also be applied to other applications, such as payments.

Upcoming Solana Rollups

Grass: The DePIN project aims to solve AI data problems through validated web crawlers. When Grass nodes crawl AI training data from the web, validators store the data on-chain, accurately tracking the data's source and the nodes responsible for crawling the data, and rewarding them proportionally.

Grass requires 1 million network requests per second, which is not feasible on the Solana mainnet. Therefore, they plan to ZK-proof all raw data sets and settle in batches on Solana L1. They are considering using state compression from another cluster and settling on the mainnet-beta root.

This development will make Grass the base layer for a range of applications only possible on Grass (note that platforms and infrastructure typically have higher valuations, and Grass is about to launch a token).

Zeta: One of the oldest perpetual exchanges on Solana, which used to rely entirely on-chain for its perpetual options order book, now also plans to move its matching off-chain through Solana Rollup.

Perpetual exchanges have immediate PMF (product-market fit) with Rollup, as they significantly improve the user experience. Just ask anyone trading between Hyperliquid or Aevo and Solana perpetual options exchanges, and you'll find that in Solana perpetual exchanges, you have to sign for each trade, a wallet pops up, and you have to wait for about 10-20 seconds. Additionally, perpetual exchanges do not require synchronous execution and have high composability with other assets in other aspects of DeFi, especially in terms of trade matching.

Interestingly, Backpack's co-founder Armani also indicated on Twitter that they are now more inclined towards L2.

Sonic is also building a modular SVM chain (Hypergrid), which will allow games to deploy their own chains on Solana. There are also SVM-based Ethereum Rollups, such as Eclipse and NitroVM, which use SVM as the execution engine. Neon is an EVM-compatible L2 on Solana. Additionally, there are some projects in the conceptual stage, such as Molecule (an SVM Bitcoin Layer 2).

Sovereign SDK is another framework similar to node.js for building Rollups. Users bring their Rust code, and we convert it into an optimistic or ZK Rollup deployable on any blockchain. The Rust code can be your specific application logic or any virtual machine.

Several Arguments About Rollup

1. Rollup = Aligned with SOL:

The term "ETH alignment" or better "ETH asset pack preference" has become a popular meme. Why do you think Layer 2 and Restaking/EigenLayer have become the hottest narratives? It's because they increase the "currency properties of ETH," and ETH is used as the core asset. The same principle applies to Solana. The Solana community will rally around any solution that enhances their SOL holdings, it's that simple. As the Solana ecosystem expands, the once overlooked "currency properties of SOL" will become important. Remember, most Rollups are "marketing tactics," and because the market still values infrastructure over applications, they provide better token value accumulation.

2. Rollup will feel like an extension of Solana

In addition to the security benefits (i.e., inheriting security from the base layer), easy access for Solana users and assets will be a significant advantage. As Jon Charbonneau pointed out, Ethereum Rollups such as Base, Optimism, and Arbitrum feel more like extensions of Ethereum. Users retain the same wallet and address, the native Gas token is a single specification of ETH, ETH dominates in DeFi, all trading pairs are priced in ETH, social applications price NFTs in ETH and pay creators in ETH (e.g., friend.tech), and deposits into L2 are instant, and so on. Similarly, this will happen on Solana. Based on the experience learned from Ethereum, most Solana Rollapps will not make users feel like they are using a separate chain (e.g., Getcode).

3. Solana will see more "RollApps" rather than "Rollup"

Solana does not face the same scalability issues as Ethereum due to high Gas fees, as it is already highly optimized. However, some applications that require dedicated block space will create their own Rollup. While a general Rollup on Solana does not make sense to me, economically, it makes sense for projects. For example, Base generated $2 million in revenue for Coinbase in just one day! For builders, the incentives heavily favor L2. However, as observed, every EVM Rollup seems to have become a ghost chain, with only a few token airdrop transactions.

Furthermore, I believe a general L2 on Solana could lead to the same issues as seen in Ethereum before, such as centralized Rollups, congestion, and fragmented liquidity.

4. Why do some applications want to migrate to Rollapps/appchains?

Every application will initially launch on the Solana mainnet, as hosting more applications on shared infrastructure significantly reduces complexity for developers and users. However, as these applications grow, they may seek:

- Value capture: Internalizing value on a shared Solana layer for a single application is more challenging when designed. MEV capture may be another profitable option for DEX.

- Dedicated block space

- Customizability of use cases, such as:

- Privacy: For example, Getcode uses a sorter to provide private payments for its users.

- Fee market experiments

- Encrypted mempool to minimize MEV

- Custom order books

However, not all applications want to launch their own Rollup, especially those that have not yet reached a certain escape velocity (e.g., enough TVL, users, trading volume). Launching their own chain today involves pain and unnecessary trade-offs (complexity, cost, worse user experience, fragmented liquidity, etc.), and most applications, especially early-stage ones, cannot justify it for incremental gains. Solana remains the core and soul of SVM development, and many new applications are likely to deploy because of it.

For Application Builders: Solana Mainnet or Appchain or Rollup

For application builders, whether to use the Solana mainnet, Appchain, or Rollup depends entirely on the situation. If there is no strong need to combine with all other applications, moving some different components off-chain (whether it's Appchain or Rollup) makes complete sense. Users may not even need to know that they are using Rollup or Appchain. Grass, Zeta, and Getcode abstract the underlying Rollup infrastructure for their users.

Will DRiP become L2/Appchain?

Currently, DRiP uses on Solana:

- User wallet creation (can be on L2/Appchain)

- Distribution of compressed NFTs (can be on L2/Appchain)

- Transactions of compressed NFTs (can be on L2/Appchain, but requires bridging funds)

We can clearly see that apart from the technical capabilities that L2/Appchain can provide, there is no strong demand on Solana L1 for DRiP. Since DRiP's primary target has always been web2 users, it can directly lead them to their own chain, which in the long run can give it more control, as it will not leak all the value to the base chain (Solana). Additionally, DRiP has reached escape velocity (the largest consumer application on Solana) and can now move to its own chain. For DRiP, a pseudo-Rollup structure like Getcode completely makes sense.

Driving Infrastructure for Rollup and Appchain:

If the Rollapp/Appchain theory expands, existing infrastructure providers will benefit greatly, as they will enter new markets:

- Existing Rollup as a Service (RaaS) providers, such as Caldera, can easily enter the SVM market when demand arises. SVM Ethereum Rollups like Eclipse and NitroVM are also closely watching this opportunity. Additionally, Sovereign Labs provides a Sovereign SDK Solana adapter that can enable Rollup on Solana (not yet in production). Helius is another company very suitable for building infrastructure for Solana L2, as Mert has hinted multiple times.

- Shared sorters, such as Rome Protocol, and lightweight clients like Tinydancer. Shared sorters could be interesting for Rollup, as they enable activities like atomic arbitrage, MEV, and seamless bridging, reducing liquidity fragmentation.

- Wallets like Phantom, Backpack, and Solflare. Multi-signature and smart contract wallet infrastructure, such as Squads. Squads has been positioned as "explicit smart contract wallet infrastructure layer for Solana and SVM."

- SOL Restaking: The modular view also advocates for restaking, as these Rollup/Appchain may require shared security with SOL and be more aligned with Solana. This leads to:

- Early participants like Cambrian, Picaso, and Solayer

- Jito through Stakenet and LST like Sanctum for validators to increase income

Conclusion: Can Solana meet global demand?

Absolutely not. Let's be realistic: even considering Moore's Law (hardware performance will continue to improve, and Solana has already been optimized for such hardware advancements), it is still impractical. I believe all less important transactions (e.g., DRiP sending NFTs) will eventually move to their own chains, and the most valuable transactions will stay on the main chain, true composability is crucial (e.g., spot DEX).

And this does not mean that Solana has failed in the competition of singularity and composability; it will better manage use cases that depend on composability and low latency, surpassing other chains. No, Sui/Aptos/Sei/Monad, etc., currently do not have a better one, as we do not know if they have been battle-tested with high user activity.

Unlike Ethereum, the Solana mainnet is not intended to be a "B2B chain"; it has always been a consumer chain. Building a distributed system at scale is very challenging, and Solana has the best potential to become the shared ledger for the most valuable transactions globally.

Solana needs a soulmate: will Appchains and Rollup be its perfect choice?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。