The application is gradually devouring the infrastructure, and applications that vertically integrate and build business models based on blockchain may become the biggest winners of the current cycle.

Author: @reganbozman

Translation: Plain Blockchain

In this cycle, applications that vertically integrate and build business models based on blockchain will be the biggest winners.

As Web3 infrastructure becomes commercialized, distribution becomes crucial. Here are some ways consumer applications are quietly devouring the infrastructure.

By commodifying and vertically integrating the crypto infrastructure stack, applications will usher in their own era.

Attention, distribution, and branding become the most important factors. In these aspects, leading applications have a huge advantage.

This generally aligns with the theory of application chains, but market leaders will go further. They not only want to have their own L1/L2 solutions, but also want others to deploy on them.

There has always been a question about whether consumer cryptocurrencies can be profitable, but I think the answer is becoming increasingly clear.

Consumer applications will achieve profitability by becoming "infrastructure."

So why now?

A) The technology stack is good enough to easily build your own blockchain.

B) Top crypto applications are truly beginning to scale.

C) Disappointment with the endless infrastructure cycle.

It is now becoming easier to build your own L1/L2 solutions. Investors have been wondering where the over $1 billion in funds will flow into blockchain infrastructure, and now we are seeing the answer. The answer is that it makes launching a blockchain very simple.

1. @Blast_L2 is a typical representative

The team has built a top three NFT market and has performed well. To support new products such as NFT perpetual products, they need to deploy an L2 solution. They left OP and ARB, and then built their own L2.

Blast's biggest innovation is not in the technology. Instead of innovating in the direction of L2 solutions in the previous cycle (such as OP and ARB), they innovatively integrated Lido and Maker to achieve returns (financial innovation) and successfully leveraged Blur's excellent brand (marketing innovation).

2. @MantaNetwork

The same goes for @MantaNetwork

Introducing revenue into cross-chain bridging is a smart financial innovation.

Excellent marketing

But much of it is third-party technology (OP stack + Caldera), where technology is not the main innovative factor. It's the user's apparent liking that is key!

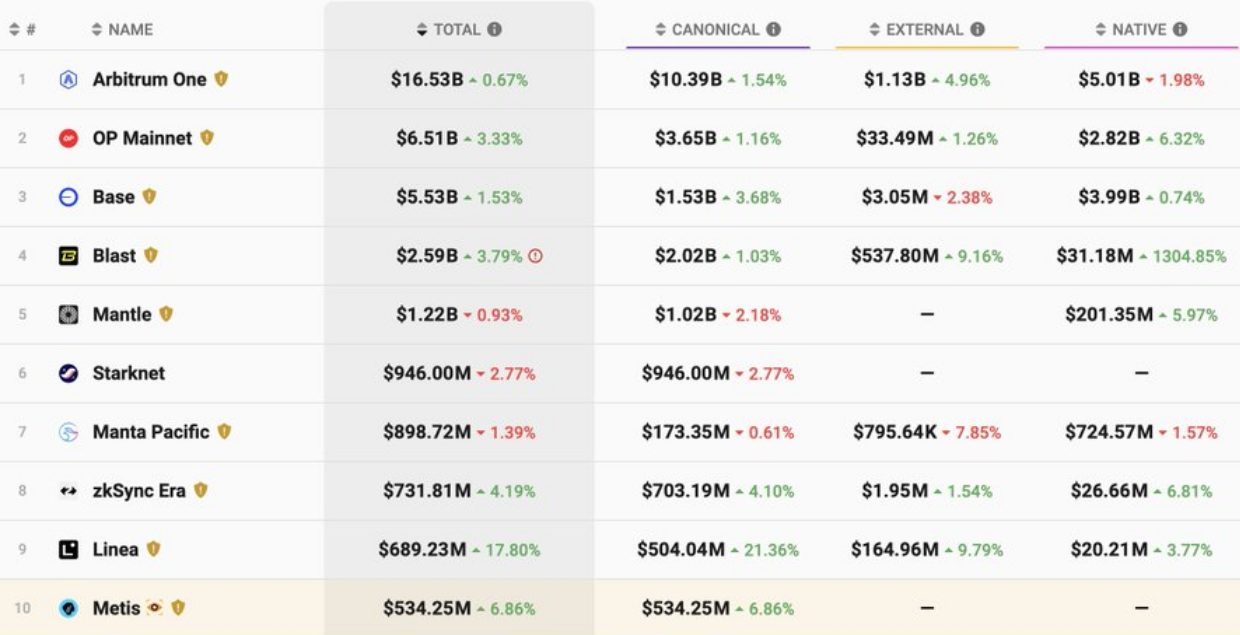

Blast and Manta are the fourth and seventh largest L2 solutions. They innovate on par with products like zkSync and Starknet.

If you combine a series of third-party infrastructures with smart proprietary incentive mechanisms, can this be considered as infrastructure?

I think so, because it constitutes a blockchain on which other third-party applications can be deployed. However, these factors are gradually redefining the concept of infrastructure.

As leading crypto applications scale, we will see more of this - they will build their own infrastructure and produce greater results than many underlying software stacks.

3. @Galxe

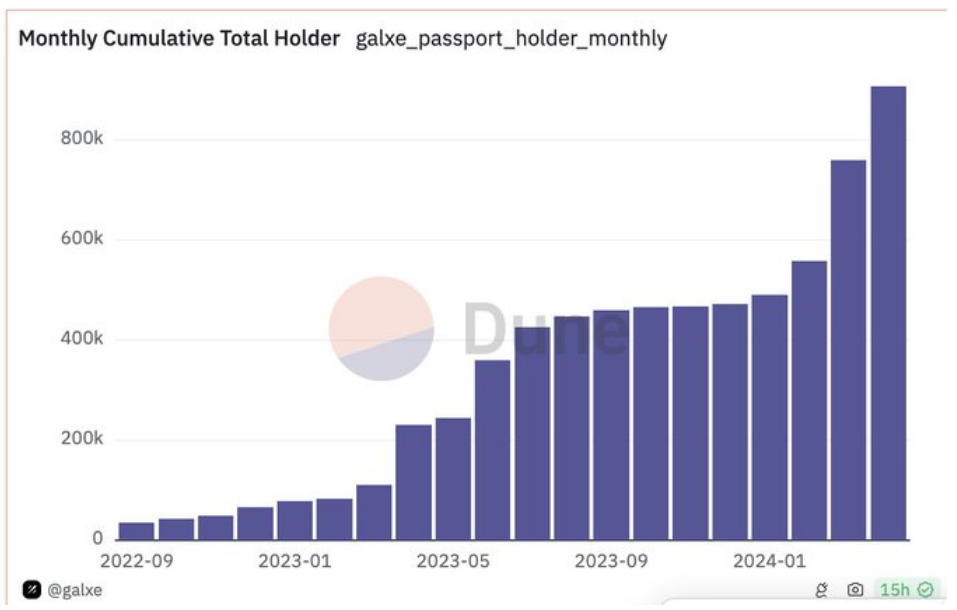

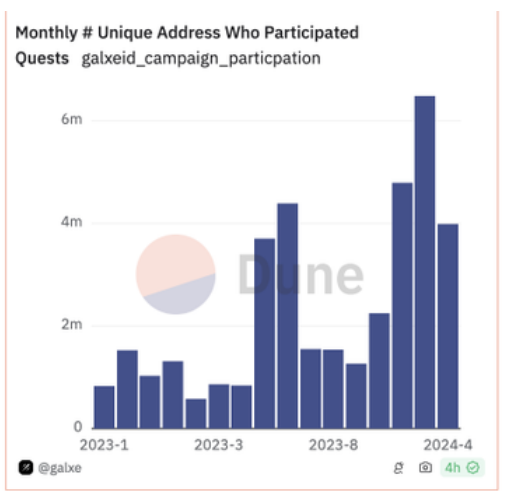

Let's take a look at @Galxe - they have built a top-tier identity protocol in the industry and have 3-5 million wallet users completing their tasks monthly. If they build their own L2, they could potentially become a top ten project in terms of user volume on day one.

Over 800,000 users have paid fees for Galxe's KYC and have generated passports.

OP has approximately 30,000-40,000 daily active users. Galxe is in a crucial position for vertical integration, and if their user base continues to grow, other consumer-facing applications will want to build on top of it.

4. @cyberconnecthq

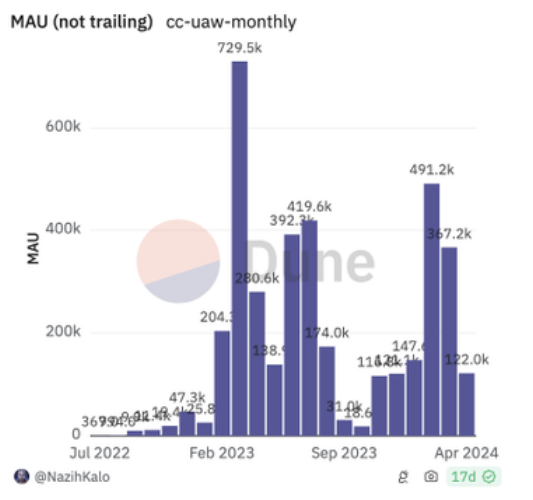

Let's take a look at @cyberconnecthq. Their social product has monthly active users (MAU) stable at the hundreds of thousands level. This is more than most general L2 solutions!

They are now launching their own social-oriented L2 solution, equipped with native AA (Account Abstraction) wallets and no need for seed phrases. This is an L2 solution designed specifically for social applications, and you can gain access to their large user base on day one. Deploying here will be an obvious choice for more social applications.

5. Layer3

Layer3 is garnering consumer attention on a large scale across chains. They have surpassed some established L2 solutions. Why not vertically integrate?

Developers will deploy applications where the users are. Users will follow flagship applications.

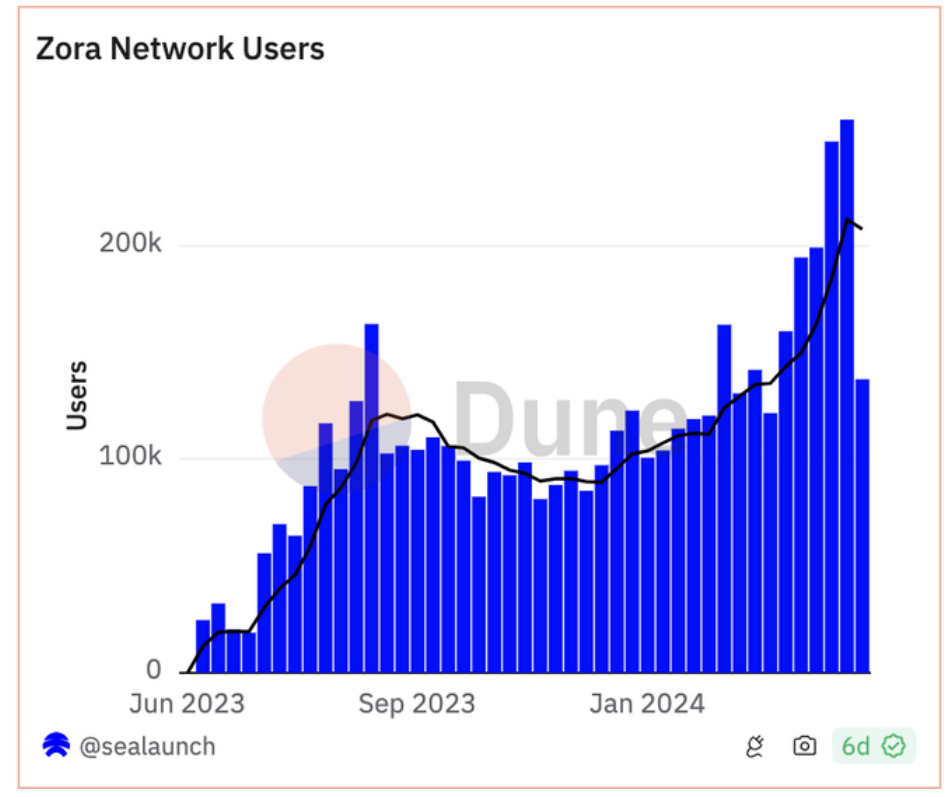

Zora is experienced in this regard, launching their own L2 solution last summer. Although I no longer live in Brooklyn and am somewhat distant from the NFT community, it seems to be performing well, so I am not very familiar with it.

As retail investors become increasingly disappointed with the endless infrastructure cycle, the phenomenon of applications gradually devouring infrastructure is occurring. Demand becomes limited for hundreds of random infrastructure tokens. This has sparked broader questions about market structure and whether the entire crypto venture capital market is experiencing issues. I think people are just tired of the fifth decentralized application solution.

This leads to debates between Memecoin investors and anti-Memecoin investors. Pro-Memecoin groups will point out that many critics of Memecoins have funded some infrastructure projects that no one uses. Funding useless infrastructure projects is the original form of Western crypto financial nihilism because liquidity token trading is good.

And now Memecoin investors have caught on to this scam and are operating more efficiently.

This market seems more selective and prefers easily conveyable stories.

Which is the better Memecoin? Is it a better L2 because we use zkEVM, which is 10 times faster than DA, etc.? Or are we a leading social application with 250,000 users?

Source: https://twitter.com/reganbozman/status/1783594075704439280

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。