Recently, the price of BTC is still fluctuating like a monkey market, with the essence being the decreasing trading volume and worsening liquidity. Except for the period from 1 am to 4 am, other times are like weekends, dropping a bit and then going down, pulling a bit and then going up, but the narrative of #BTC itself has not changed. Changes now are often the emotions of investors.

When the narrative does not change, the price usually does not fluctuate much, especially at this time. We have been talking about it for a long time. Early profit chips are not eager to leave, and the BTC in loss is also very limited in leaving. Even the purchasing power through spot ETF data can show a significant difference. Most investors now do not have the trading sentiment.

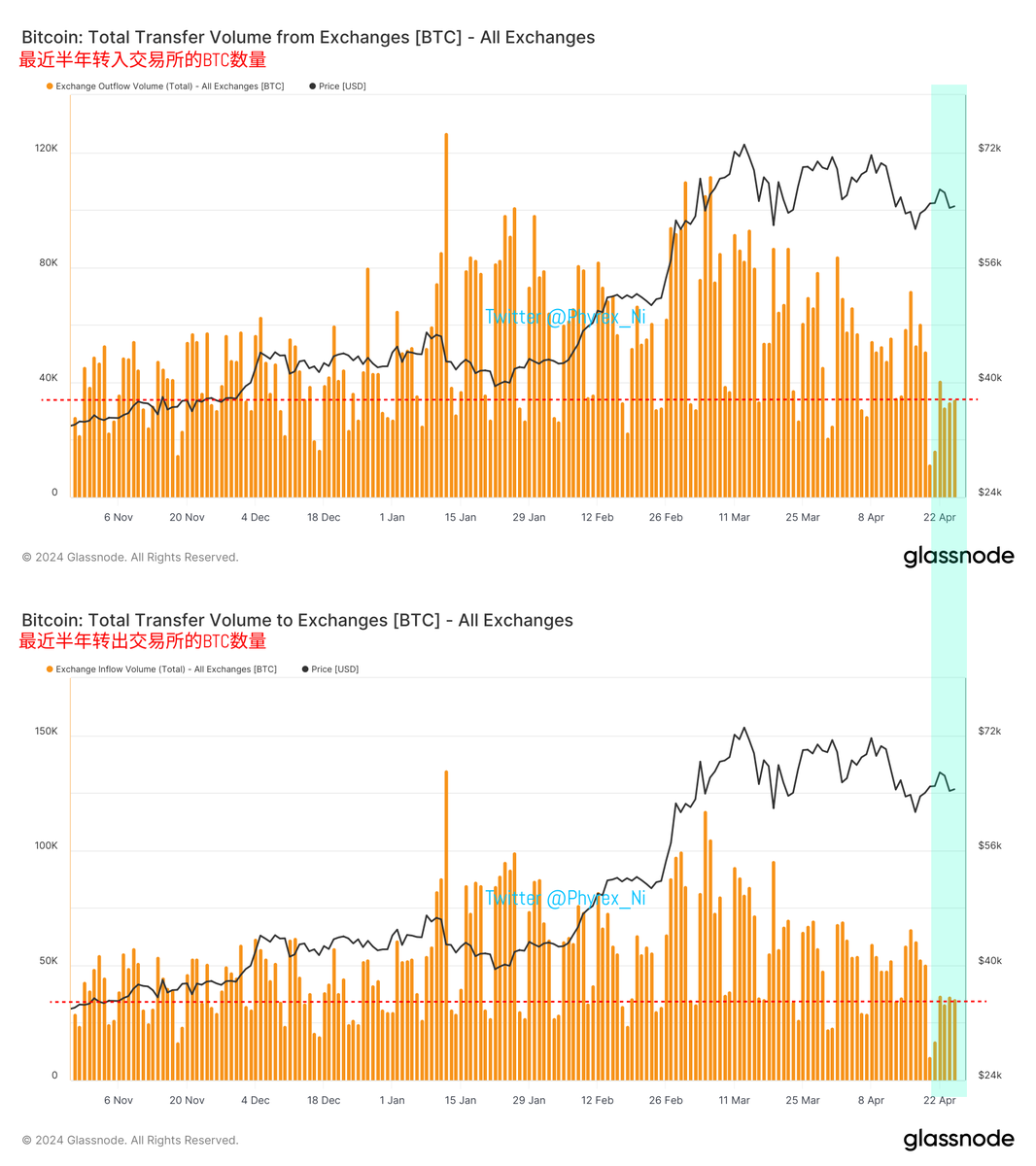

I don't need to say much about this. Whether it's from tradingview to see the daily trading volume or from the data on the recent inflow and outflow of BTC from exchanges, it can be seen that the liquidity during this period is at its lowest point in nearly half a year, even worse than the liquidity on some weekends at the beginning of the year.

In such low liquidity, it is unrealistic to say that the price can make a significant leap. This also indicates that the current trading sentiment of users is not even as good as it was when the ETF had not been approved in November and December last year. It should be noted that this is not only the buying data, but the selling data is also similarly low.

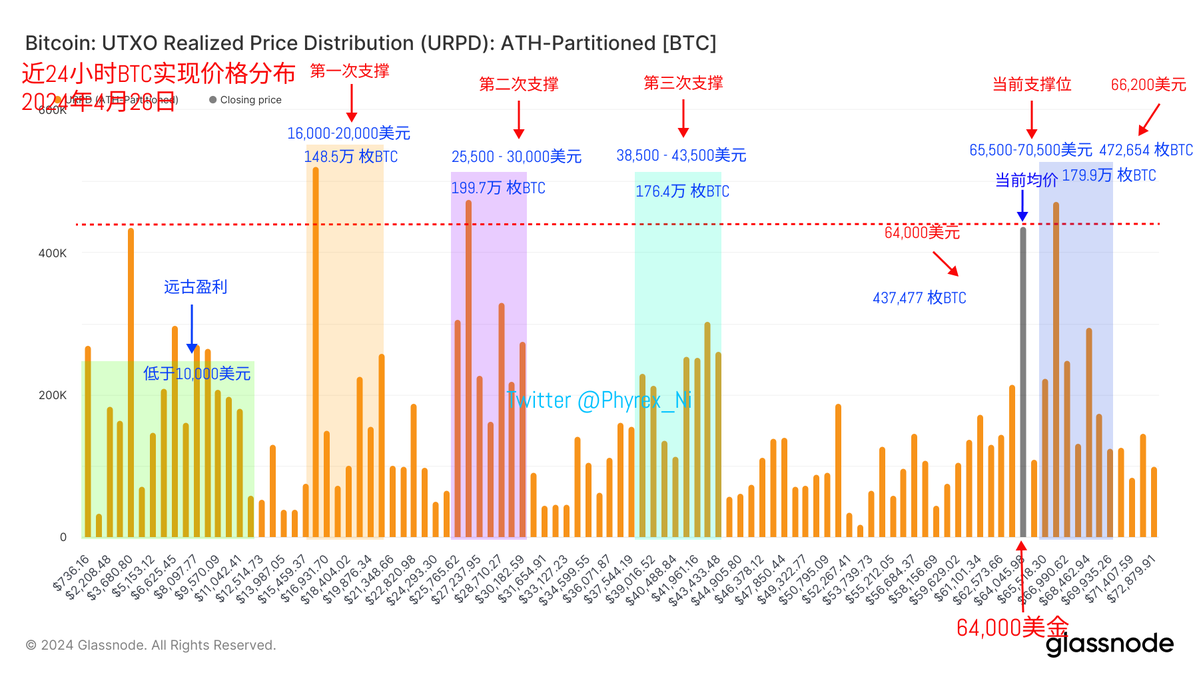

However, looking at the detailed data, something slightly fresh happened today. Nearly 160,000 BTC suddenly appeared at the $64,000 position in the past 24 hours. These BTC quantities have no direct relationship with the exchanges, neither flowing in nor out through the exchanges, just accumulating. I checked, and the amount of #BTC held by the US government and in Mentougou has not changed, and even though the BTC holdings of miners have decreased, it's only by a few hundred coins.

But as I mentioned before, many friends have witnessed that when the stock of a single price exceeds 1.2 million BTC, the direction is often chosen. The last time was at the end of February and the beginning of March, and as a result, there was a significant surge due to the financial reports of MSTR and Coinbase. Although now there are less than 500,000 BTC at both $64,000 and $66,000, next week is still the time for the financial reports of these two companies to be released. Today, with the rebound of the US stock market, the trends of $MSTR and $COIN are good, directly opposite to BTC. This is the power of the financial reporting season. As long as the financial reports are expected to be good, the price trend will not be too bad.

Although the stock of BTC at $64,000 is starting to rise, it has not broken the support at $65,000, and even $64,000 and $66,000 may form a response. However, it is uncertain whether these suddenly appearing large quantities of chips will leave in the short term, so the current view, I still maintain the previous view. Tomorrow is the weekend, and liquidity will further decline, and it's time to rely on luck.

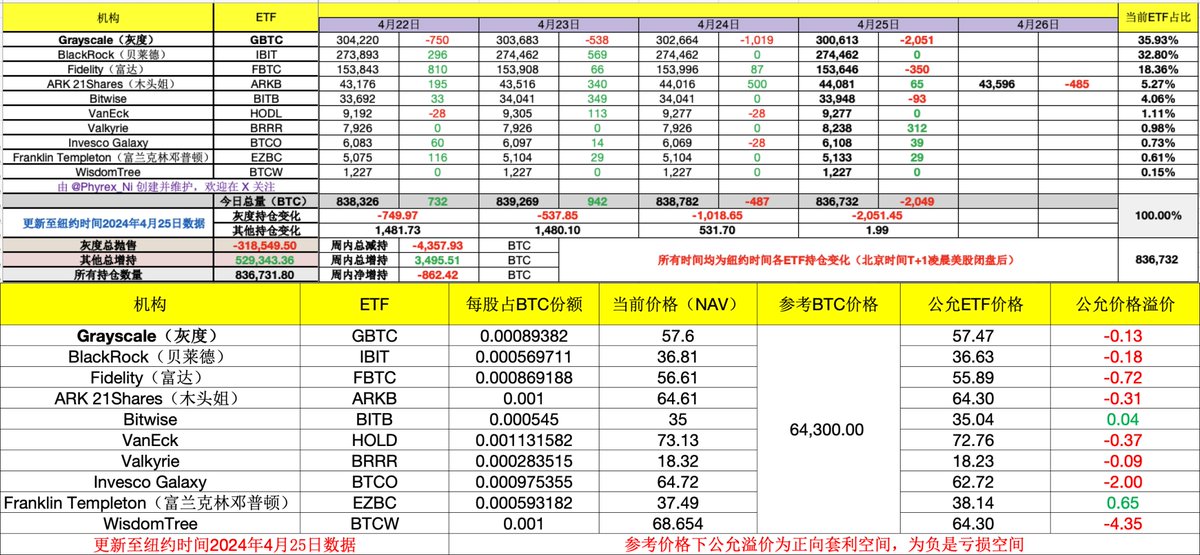

Careful friends should remember that we have said that the basic trading volume of BTC spot ETFs is usually the worst every Friday, and the purchasing power data of spot ETFs also represents the sentiment of American investors. So, at present, although the selling pressure transferred to the exchange in the past 24 hours is not much, only about 5,000 BTC, the purchasing power is ridiculously low, basically only seeing inflow, and not seeing outflow. Let's see if there will be any improvement around 3 or 4 in the morning.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。