I originally wanted to wait for the data from the University of Michigan to come out before looking at it together, because last month when the University of Michigan's one-year inflation data came out, the market's feedback was not good. Let's look at it later.

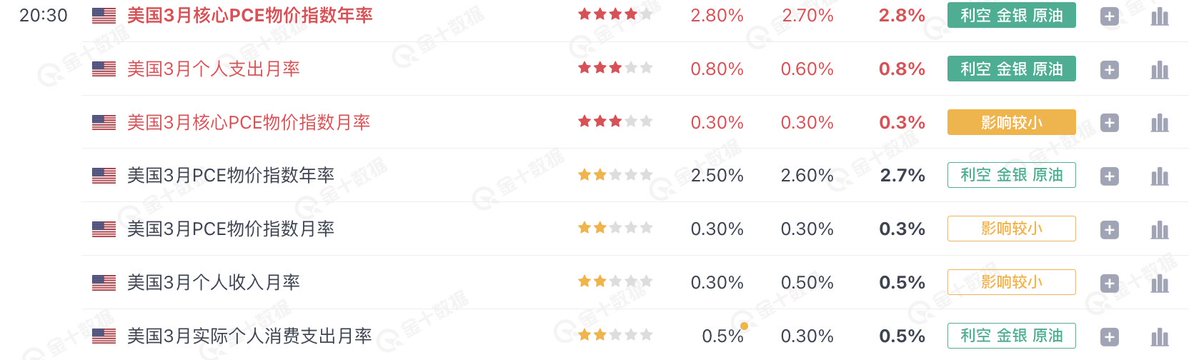

From the PCE data released today, it is indeed not a good thing. Both the core PCE, which the Federal Reserve is most concerned about, and the monthly rate of PCE are higher than expected and equal to the previous value. This is not a good signal for the risk market. If inflation does not decrease significantly, it means that the Federal Reserve will not choose to cut interest rates temporarily, assuming that the United States does not experience a major economic crisis.

From the current market perspective, the possibility of the Federal Reserve cutting interest rates before September is almost nonexistent. The most optimistic view in the market is that the Federal Reserve will cut interest rates three times in 2024 according to the March dot plot.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。