Author: Terry

The stablecoin track has always been seen as one of the holy grails in the crypto world, whether it's Tether's USDT or the former Terra's UST, both have played a significant role in the industry.

In the past two months, a new project with a high-yield label has emerged and quickly risen to become the 5th largest stablecoin in the entire network: On February 19th, USDe issuer Ethena Labs launched its public mainnet, aiming to create a synthetic US dollar based on Ethereum (ETH). The supply has exceeded 2.366 billion, second only to USDT, USDC, DAI, and FDUSD.

Source: https://www.coingecko.com

Source: https://www.coingecko.com

So what kind of stablecoin project is USDe, how did it break through the ranks in such a short time, and what controversies are hidden behind it? At the same time, what new variables does the stablecoin track contain?

Rapid Rise of Stablecoin USDe

The biggest impact of USDe on the stablecoin market is undoubtedly its rapid rise from 0 to over 2.3 billion USD in total supply in just two months, driven by its high yield attribute.

According to data from Ethena Labs' official website, as of the time of writing, USDe's annualized yield is still as high as 11.6%, and it was once maintained at over 30%, reminiscent of Anchor Protocol's UST with an annualized yield of 20%.

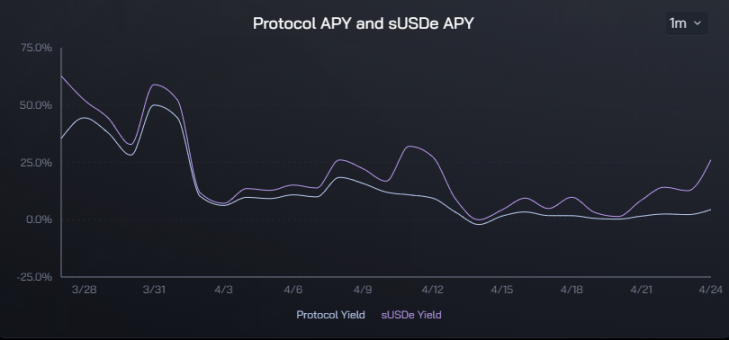

Ethena Protocol's annualized yield and USDe's annualized yield

Ethena Protocol's annualized yield and USDe's annualized yield

So what kind of stablecoin mechanism is USDe, and why does it have such a high annualized yield? This is actually an improved version of Satoshi's dollar concept mentioned by the founder of BitMEX in the article "Dust on Crust."

In short, excluding the expected airdrop income, the high yield of USDe currently comes mainly from two sources: ETH's LSD staking income and funding rate income from Delta hedging positions (i.e., funding rate income from perpetual futures short positions).

The former is relatively stable, currently fluctuating around 4%, while the latter depends entirely on market sentiment. Therefore, USDe's annualized yield is also directly dependent on the overall funding rate (market sentiment).

The key to the operation of this mechanism lies in the "Delta neutral strategy" - if a portfolio is composed of related financial products and its value is not affected by minor price changes in the underlying assets, the portfolio has a "Delta neutral" nature.

In other words, USDe will use an equal amount of spot ETH/BTC long positions and futures ETH/BTC short positions to form a "Delta neutral strategy": the Delta value of the spot position is 1, the Delta value of the futures short position is -1, and the combined Delta value after hedging is 0, achieving "Delta neutrality."

In simple terms, when the stablecoin module of USDe receives user funds and buys ETH/BTC, it will simultaneously open an equal amount of short positions, thereby maintaining the total position value of each USDe stable, ensuring no liquidation risk for the collateral position.

For example, assuming the price of BTC is $80,000, if a user deposits 1 UBTC, the USDe stablecoin module will simultaneously sell 1 BTC futures, forming a "Delta neutral" investment portfolio for USDe.

As can be seen from the example:

- If BTC is initially $80,000, the total value of the portfolio is 8+0=8 million USD, so the total position value remains at 8 million USD;

- If BTC falls to $40,000, the total value of the portfolio is still 4+4=8 million USD, so the total position value remains at 8 million USD (the same applies to an increase).

At the same time, the futures short positions corresponding to the USDe stablecoin module will receive funding rate income from the long positions (historically, the funding rate of Bitcoin has been positive for the majority of the time, which means that the overall income of the short position will be positive, and this situation is even more pronounced in a bull market with strong long sentiment).

With these combined, USDe's annualized yield can reach 20% or even higher. This also shows that when the market is extremely bullish, USDe's high annualized yield is particularly guaranteed - because Ethena Labs takes advantage of the opportunity to earn funding rates from short positions in a bull market.

Old Pangshi or New Solution?

Interestingly, the debate about ENA/USDe within the community has been growing, and many people even compare it to the old Terra/Luna, calling it a new version of Terra/UST's Pangshi play with one foot stepping on the other.

Objectively speaking, the stablecoin generation/stabilization mechanism of USDe in the first half is significantly different from Terra's play, and it does not belong to the Pangshi play. On the contrary, due to harvesting all the traders who are long in a bull market and paying funding costs for it, the high yield is supported, which is also its biggest difference from Terra.

What is worth noting is actually the latter half of Ethena - once it encounters the test of anchoring, it is really possible to follow a similar negative spiral suicide path as LUNA/USDe, leading to a run on the bank and accelerated collapse.

In other words, there may be a non-linear emotional singularity - the funding rate begins to be negative and continues to widen, the market starts to have FUD discussions, USDe's yield plummets, and it becomes unanchored and discounted, leading to a market value collapse (user redemptions):

For example, a drop from 10 billion USD to 5 billion USD, Ethena must close the short positions and redeem the collateral (such as ETH or BTC). If there are any problems during the redemption process (wear and tear due to liquidity issues in extreme market conditions, significant market fluctuations, etc.), the anchoring of USDe will be further affected.

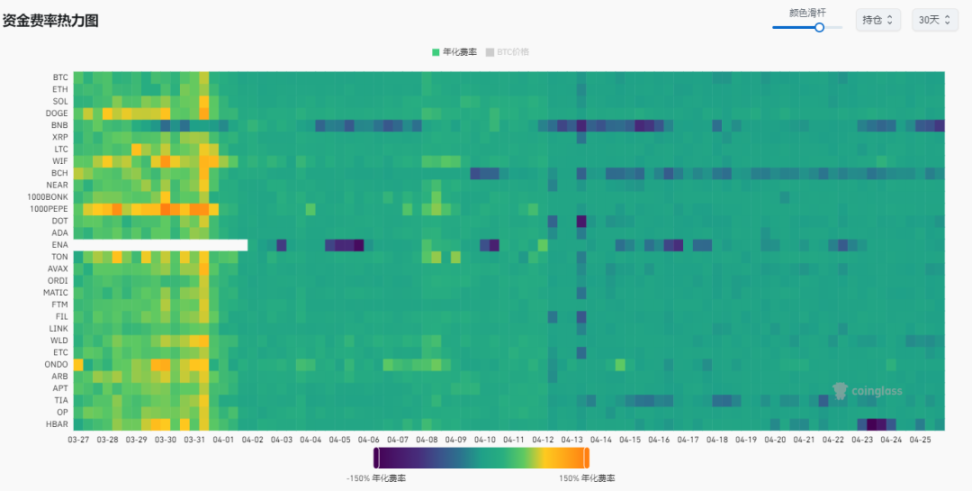

Source: coinglass

Source: coinglass

This negative feedback mechanism may be targeted maliciously, triggering this singularity, and facing a similar negative spiral dilemma as UST's collapse. Therefore, for investors, whether this "collapse singularity" will occur, when it will occur, and whether they can withdraw in time, is the key to whether they can exit the bull market game unscathed.

This requires close attention to factors such as Ethena's ETH and BTC holdings as a proportion of the entire network, the overall funding rate turning negative, and so on. It is worth noting that, with the recent significant pullback in the market, the overall funding rate for BTC and ETH has dropped significantly from an annualized rate of over 20% and even started to show a negative trend, with the latest data showing BTC at -1.68% and ETH at 0.32%.

And Ethena Labs' official website data shows that the total value of Bitcoin collateral assets for USDe exceeds 800 million USD, and the Ethereum position exceeds 1 billion USD, accounting for nearly 80% cumulatively.

Because Ethena is actually harvesting all the cryptocurrency traders who are long in a bull market and paying funding costs for it, the high yield rate is extremely dependent on the positive funding rate behind market sentiment. From this perspective, if the overall funding rate continues to turn negative, or even increases, USDe is likely to face a sharp reduction in yield.

The ebb and flow of the stablecoin track

Looking at the big picture, the stablecoin track has always been a highly profitable super big cake. In comparison, top players like Tether have a money-printing machine attribute that is not inferior to CEX:

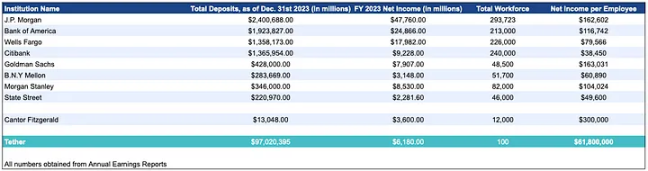

In 2023, Tether generated approximately 6.2 billion USD in net income, accounting for 78% of Goldman Sachs (7.9 billion USD) and 72% of Morgan Stanley (8.5 billion USD), while Tether has about 100 employees, compared to 49,000 and 82,000 employees for the latter two.

Net income, total number of employees, and employee income of major companies as of December 31, 2023, source: @teddyfuse

As mentioned in the article "Earning 700 million USD per quarter! Tether's silent fortune reveals why the stablecoin track is so crowded," Tether is currently one of the most profitable crypto companies apart from exchanges (CEX probably only has Binance as a stablecoin).

For Web3 projects and crypto companies that generally operate at a loss and sell tokens for subsidies, stablecoins are an elusive presence, which is one of the main reasons why the stablecoin business is so attractive.

According to CoinGecko data, among the top 5 stablecoin players, the total circulation of USDT has exceeded 109 billion USD, accounting for approximately 69% of the total stablecoin supply, firmly holding the top position.

In addition to the dominant USDT, since the U.S. regulatory authorities closed Silicon Valley Bank on March 10, 2023, the net outflow of USDC has exceeded 112 billion USD, and the total circulation has dropped to around 33 billion USD, a decrease of about 30%, currently ranking second, and significantly leading over the third-placed DAI (5 billion USD).

Furthermore, BUSD has been replaced by FUSD due to regulatory pressure, and with Binance accelerating the frequency of LaunchPool, the total supply has rapidly exceeded 3.5 billion USD. Following that is the emerging USDe, bringing in some highly anticipated new variables.

Overall, in the context of decentralized stablecoins being considered stable, and centralized stablecoins facing the "reserve + regulation" backdrop, decentralized stablecoins have become the market's biggest expectation for the "holy grail" of the stablecoin industry, which is why the high-yield USDe has been able to rise rapidly.

And currently, we are only in the early stages of the long-term competition of stablecoins. The arrival of new players like FDUSD and USDe is likely to change the competitive landscape and bring new variables to the stablecoin market, which is worth looking forward to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。