The Three-Dish Theory is a cognitive model about Ponzi schemes proposed by Crypto Vedanta (@thecryptoskanda). This article explores the reasons for the three bull markets based on this theory: MEME coins are mutual aid dishes, DeFi is a dividend dish, and ICO is a split dish.

What is the Three-Dish Theory

Crypto Vedanta believes that one of the greatest values of Crypto is the first realization of Ponzi democratization and tradability.

Everyone can issue and trade dishes. Setting aside external factors, each round of the Crypto bull market is driven by fundamental innovation of Ponzi schemes. By studying the fundamental innovation of Ponzi schemes, you can find major trend-level alphas in the market.

Although Ponzi schemes are dazzling, they ultimately only have three models: dividend dish, mutual aid dish, and split dish. All Ponzi schemes are combinations of these three models. Based on this logical analysis method, he named it the "Three-Dish Model." Each dish can appear alone or in combination, each with its own advantages and disadvantages, corresponding to the logic of starting a dish, operating a dish, and collapsing a dish.

- Dividend Dish: A one-time investment of a whole sum of money, earning returns linearly over time.

- Mutual Aid Dish: A gives money to B, B gives money to C, and C gives money to A, forming a mismatch of funds, settled by each transaction.

- Split Dish: Continuously splitting an asset target into new targets. Attract incremental funds through new low-priced targets. Returns are achieved through the appreciation of the targets.

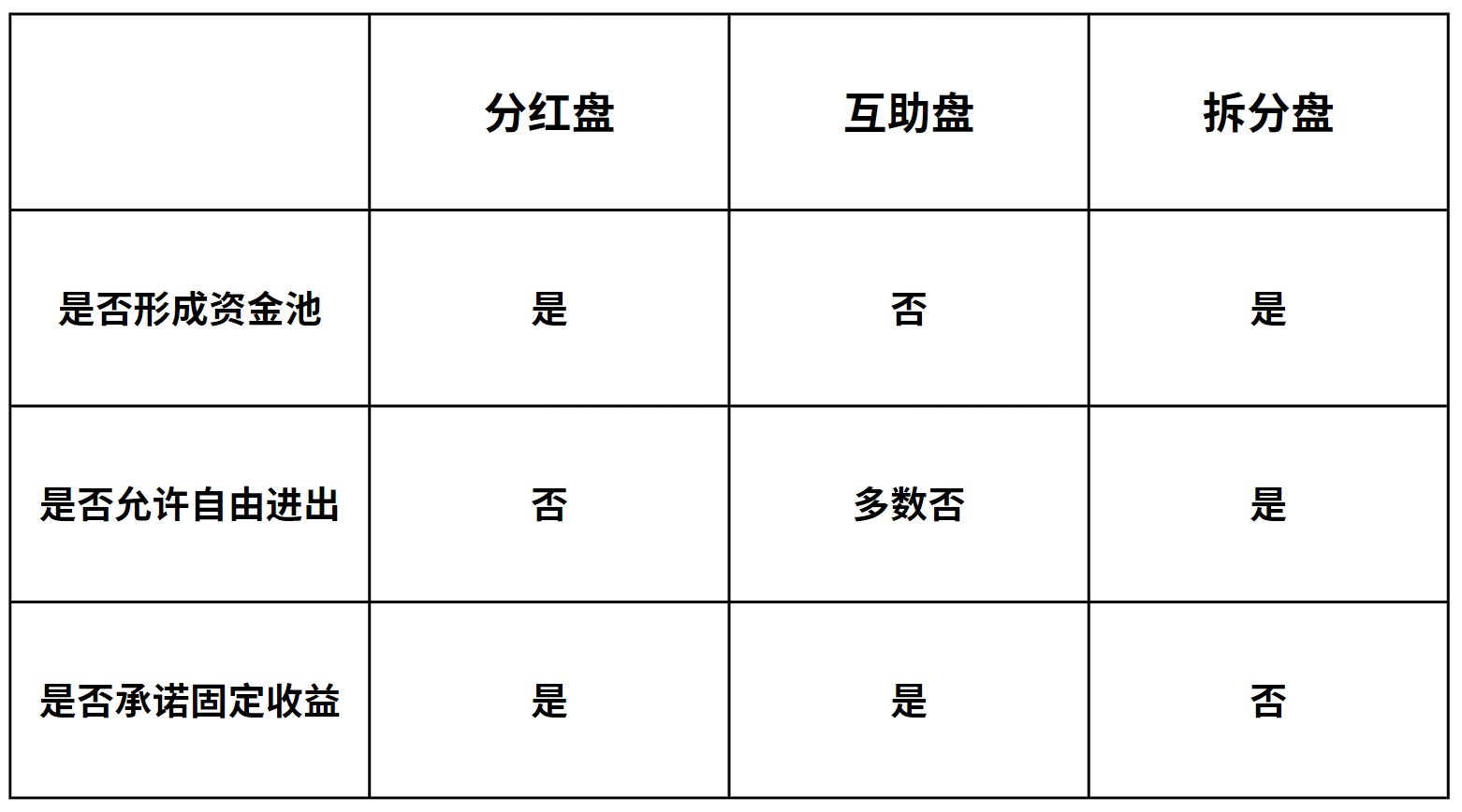

In terms of logical design, the characteristics of the three dishes are as follows:

MEME is a Mutual Aid Dish

The core of traditional mutual aid dishes lies in the mismatch of funds. This model usually involves multiple participants transferring funds in sequence, forming a fund cycle. Generally, a user who receives money from the next participant receives more than the money given to the previous participant, thus earning more money than their original investment. The project party generally earns returns through transaction fees for each transfer.

This Ponzi model is the most decentralized among the three models because once the rules are established, there is no need for "management" intervention, as the transaction fees are essentially taxes.

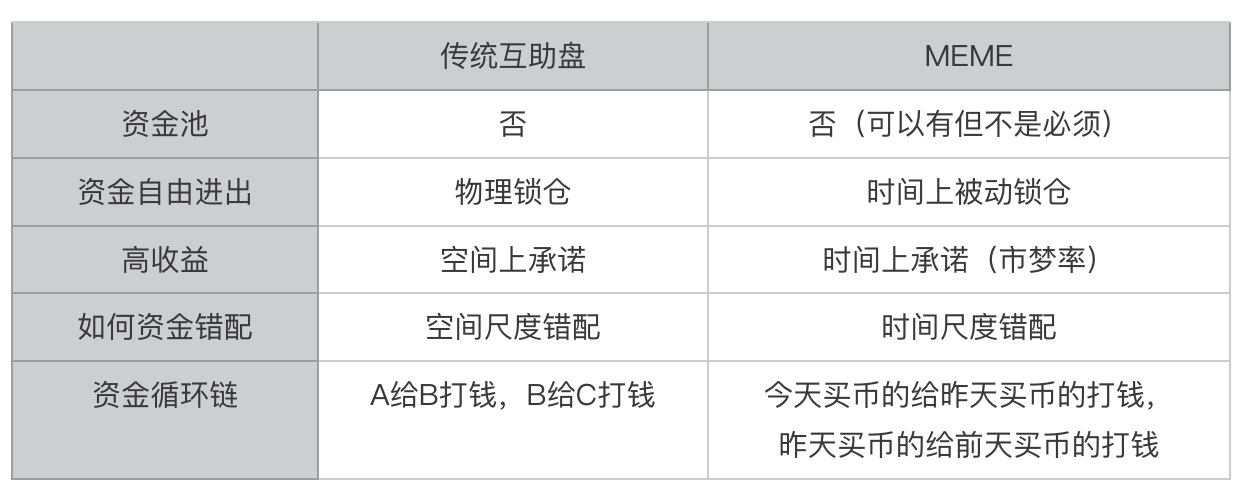

Traditional mutual aid dishes involve a spatial scale mismatch of funds, so they do not need to form a fund pool, and most funds cannot be freely withdrawn, but they must promise high returns. So why is MEME considered a mutual aid dish?

We generally believe that MEME coins have two most important attributes:

- Fair Launch: Everyone can participate (everyone can help each other)

- Fully Circulating: No need for the project party to reserve

The so-called "cultural attributes" and "very large total amount" are not necessary.

MEME coins are actually a time-scale mismatch of funds. In a certain bull market context, if a certain MEME coin continues to rise strongly, it is actually the person who bought coins at a high price today giving money to the person who bought coins yesterday, and the person who bought coins yesterday giving money to the person who bought coins at the lowest price the day before yesterday. And because of the uniqueness of time itself, it also forms "passive lock-up" (people cannot always enter the same river). So we have the following comparison:

DeFi is a Dividend Dish

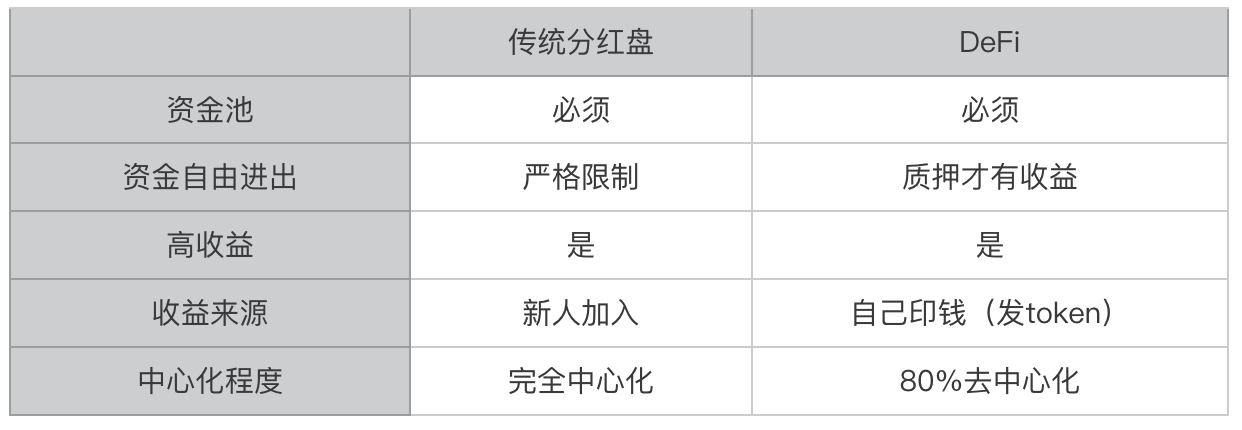

DeFi was the core narrative of the last bull market (2020). Technically, it is about writing financial rules into smart contracts (a way of combining blockchain technology with a certain field). From the perspective of token economics, it is the distribution of protocol tokens through liquidity mining: putting money into the protocol to obtain tokens.

For example, the two most important aspects of the financial field are trading and lending, which gave rise to Uniswap and Compound. In Uniswap, users put tokens A and B into a trading pair LP to earn returns. In Compound, users need to put tokens available for lending into the fund pool to earn returns. Most of the returns are in protocol tokens, with a small amount in real money (stablecoins).

DeFi is a typical dividend dish because the basic logic of a dividend dish is "a one-time investment of a whole sum of money, earning returns linearly over time," isn't it exactly the same as the above practice? We also have the following comparison:

ICO is a Split Dish

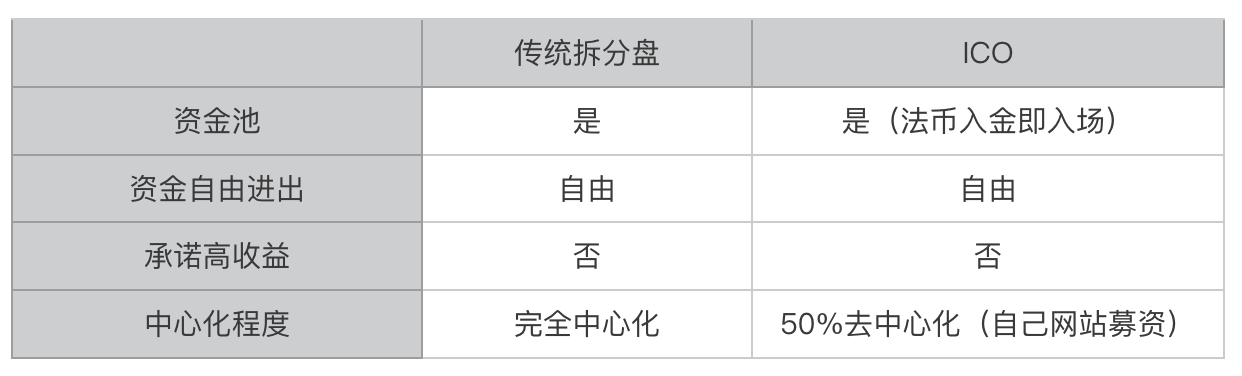

ICO was the core narrative of the previous bull market (2017). The general gameplay was to write an idea in any field into a white paper, then raise funds and issue tokens, so much so that most people mistakenly believed that the only application of blockchain was "issuing coins" (another way of combining blockchain technology with a certain field). So during that period, many strange tokens appeared, such as "doing environmental protection and issuing coins," "doing computers and issuing coins," "doing charity and issuing coins," and so on.

We know that a split dish continuously splits an asset target into new targets. Attract incremental funds through new low-priced targets. Returns are achieved through the appreciation of the targets, isn't this exactly the performance of ICOs? If we consider the cryptocurrency race at that time as a fund pool, the appearance of various ICOs is precisely the continuous splitting of the cryptocurrency asset target into new investment targets (new ICO tokens) through "new stories" to attract incremental funds. So we still have the comparison chart:

The Coin Circle is the Dish Circle

If we ignore the specific technological evolution and only consider it from the perspective of token economics, it seems that the past decade indeed represents the evolution of Ponzi models. We can even consider Bitcoin mining as a form of dividend dish (staking machines generate BTC returns).

Is the evolutionary sequence: dividend dish (BTC mining) - split dish (ICO) - dividend dish (DeFi) - mutual aid dish (MEME)? At the same time, projects are becoming increasingly decentralized.

On the other hand, if we consider MEME as a race, the appearance of more and more MEME coins is actually a manifestation of a split dish, so it can be considered that MEME is a combination of (mutual aid dish + split dish).

The mutual aid dish may be the real answer to "no one taking over" in this bull market (Restaking is a dividend dish, DePin is a dividend dish, Layer2 is a split dish, obviously, retail investors in this bull market only want to play mutual aid dishes).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。