Fjord Foundry's native token $FJO LBP successfully concluded on the 19th. The ending price of $FJO LBP was 1.91U, raising a total of 15.35 million in funds. The current price of $FJO is around 2.79U.

I also want to join in on the hype and discuss the potential of the Fjord Foundry token and my views on LBP (while also discussing another LBP protocol).

Let's dive in ⬇️

1. What is LBP?

LBP stands for Liquidity Bootstrapping Pool, which operates similarly to a Dutch auction. Fjord Foundry is an LBP platform.

In simple terms, before the LBP begins, the project participating in the LBP will determine two things: 1) the quantity of tokens to be issued; 2) the ratio of tokens in the LP and another asset (usually ETH or a stablecoin), such as 99% of tokens and 1% of a stablecoin.

Once the LBP begins, based on this dynamic pricing model, the price continuously decreases (increasing token supply). When it reaches a psychological price for users, they can buy, and when it goes up (e.g., if at a certain point users buy more and demand > supply), users can also sell.

After the LBP ends, the project will typically use some of the proceeds from token sales to add to the pool on a DEX.

2. Advantages and Some Uncertainties

For users, the advantage of LBP is fairness. In the absence of whitelists and scientists, users can purchase tokens at a psychological price.

For projects, they can participate in the LBP with a low threshold to obtain startup funds and use them to guide liquidity.

So, what are the uncertainties?

First, I personally believe that the LBP model requires a certain level of user understanding. Users need to research before participating in the LBP to buy tokens within a reasonable range. If they don't do their research, users can easily lose money in the LBP.

The LBP for 1intro is a good example. Due to a lack of understanding of the 1intro protocol and LBP model, many users purchased 1intro tokens at the beginning of the LBP (I remember the valuation was 1 billion), resulting in losses.

Second, in order to promote token sales, the protocol may announce some positive information during the LBP, such as users who buy tokens during the LBP and do not sell can receive additional benefits. Therefore, users need to stay updated on the project community + social media, and if there is positive news, they can buy and sell to profit (1intro is also an example in this regard).

Third, the project's own capabilities can also affect the token price. For example, after opening, if the project adds too little liquidity, etc. The current pool size of $FJO is 5.8M, which is still acceptable.

3. Fjord Foundry Token Economic Model and Protocol Data

The total supply of $FJO is 100 million.

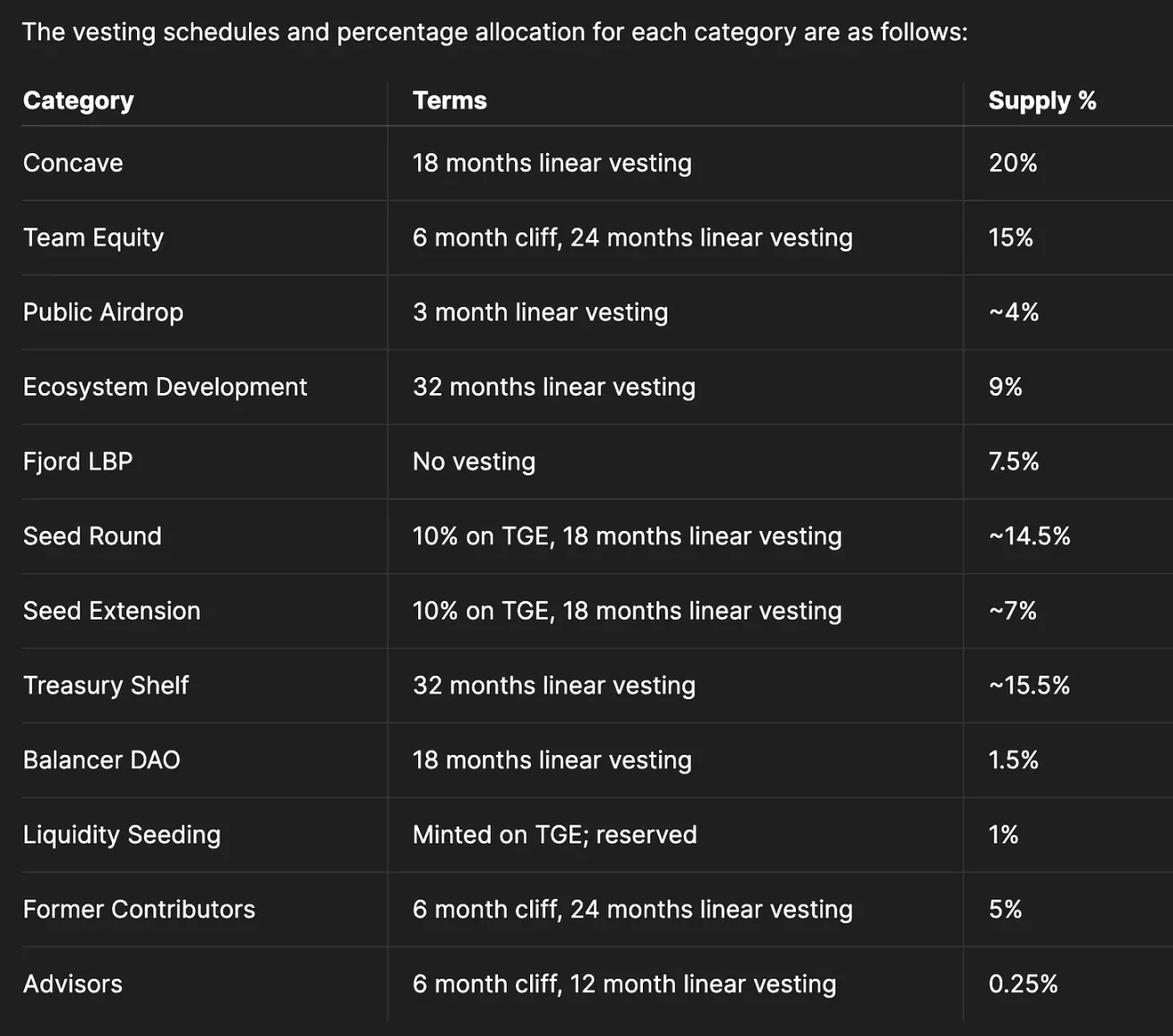

The distribution is as follows ⬇️ Initial circulation is about 10.65% (calculated by myself, corrections are welcome), and the Seed financing price is 0.2 — participants in the seed round can profit directly by selling.

Token utility ⬇️

Users can stake $FJO to receive a portion of the protocol's income for token repurchases, and $FJO Stakers will also have the opportunity to receive potential project airdrops.

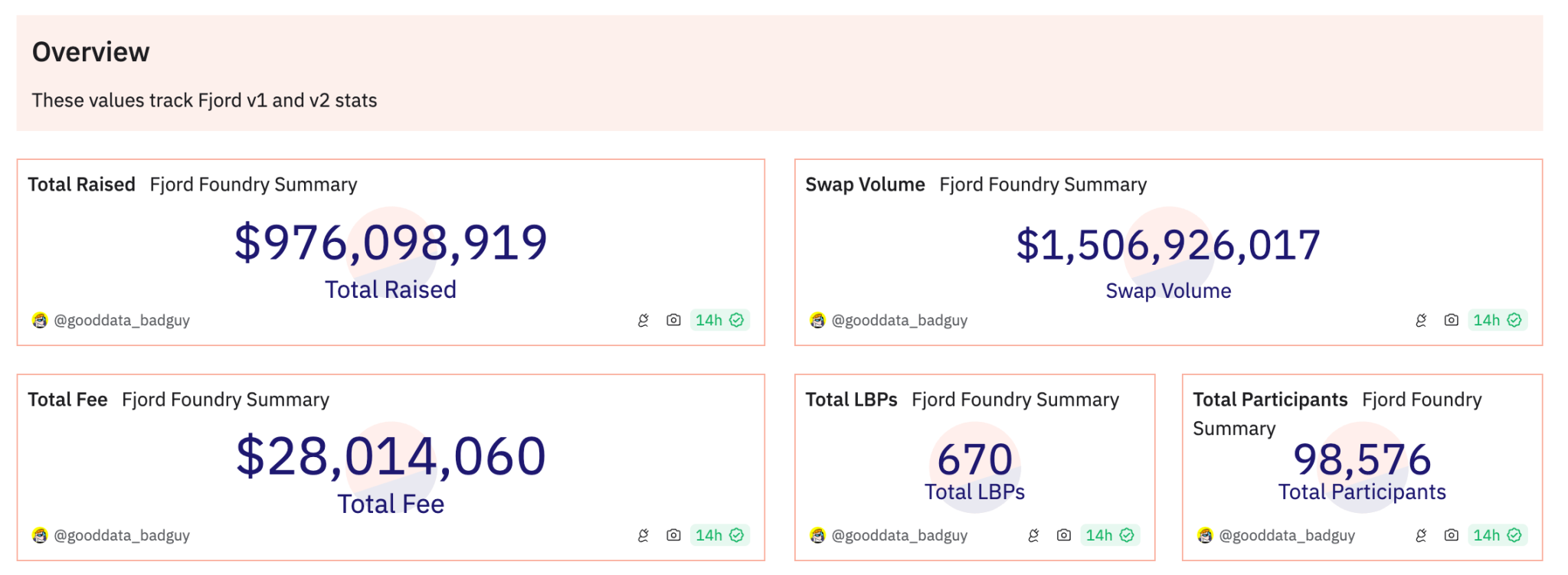

Protocol data ⬇️

The total fee income is 28M.

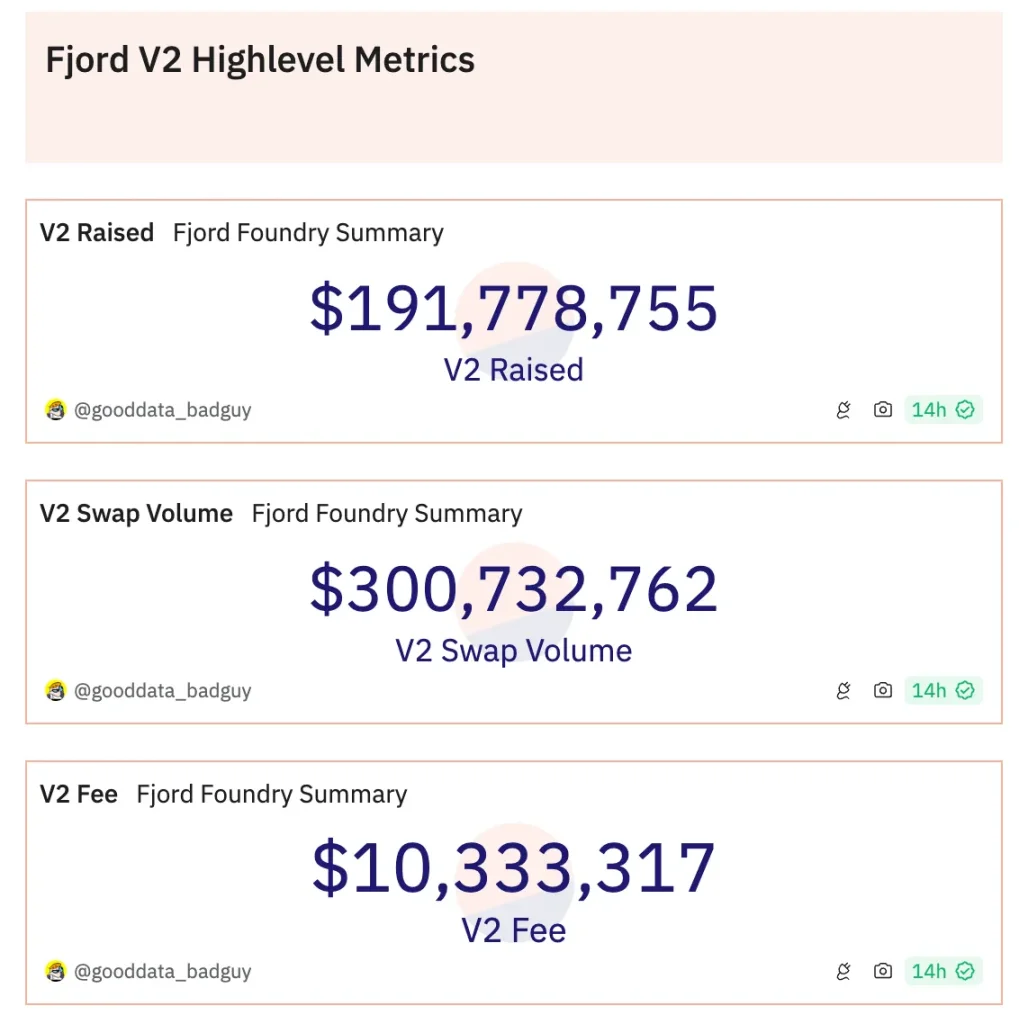

Since the launch of v2 in December, Fjord's protocol income has been 10M. So, the protocol's annualized income for this year (estimated) should be around 30M.

Conclusion

In the event of a confirmed bullish trend, many developers hope to benefit from this cycle. Therefore, Fjord's potential income opportunities are quite substantial. In the future, Fjord will also expand to other chains (such as Solana, Berachain, Fantom), and the deployment of new chains will also be a catalyst for Fjord's income growth.

The circulation of Fjord tokens is achieved by repurchasing and destroying $FJO with at least 90% of the protocol's income. So, the ultimate logic is that the higher the Fjord protocol income, the better the performance of $FJO.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。