This article analyzes the cryptocurrency tax system in Ethiopia, especially focusing on the types of taxes and tax rates that mining companies may be involved in.

Author: TaxDAO

Ethiopia has become the first African country to start Bitcoin mining. Although cryptocurrency trading is still prohibited in Ethiopia, it approved favorable laws for mining in 2022, allowing "high-performance computing" and "data mining." According to data from Luxor Technologies, a Bitcoin mining service company, in 2023, Ethiopia ranked fourth in the preferred destinations for Bitcoin mining equipment, following the United States, Hong Kong, and Asia. It is estimated that Ethiopia has become one of the largest recipients of Bitcoin mining machines globally. This article analyzes the cryptocurrency tax system in Ethiopia, especially focusing on the types of taxes and tax rates that mining companies may be involved in.

1. Taxation Issues Related to Mining

1.1 Concept of Mining

Mining is a way to obtain digital currency by solving complex mathematical problems in a network through computer calculations to receive rewards. In the field of cryptocurrencies such as Bitcoin, mining is widely used. In simple terms, mining is a computational process to obtain a certain digital currency.

1.2 Mining Income

Mining income refers to the rewards obtained by using computer equipment to participate in the consensus mechanism of a cryptocurrency network, either by verifying transactions or creating new units of cryptocurrency. Mining income comes from two sources: fixed block rewards, where miners receive a certain amount of cryptocurrency whenever a new block is added to the blockchain, and variable transaction fees, where miners receive a certain percentage or amount of fees for verifying each transaction. The calculation of mining income depends on the consensus mechanism used, mainly Proof of Work (PoW) and Proof of Stake (PoS).

1.3 Taxation Issues of Mining

The tax treatment of cryptocurrency mining business mainly depends on the country or region's definition and classification of cryptocurrencies, as well as the recognition and measurement of mining income and expenses. The types of taxes involved in mining income vary by country or region. The main types of taxes involved are as follows.

Firstly, direct taxes, which include income tax and capital gains tax on mining income. In most countries involved in mining business, mining income is treated as business income for enterprises or individuals, and corporate income tax or personal income tax is levied. The income tax rate is determined based on factors such as the miner's identity (individual or enterprise), income level, and place of residence.

Secondly, indirect taxes, which include value-added tax or goods and services tax on mining income. Currently, there is no unified opinion among countries or regions on whether to impose value-added tax or goods and services tax on mining income. In the European Union, most countries believe that mining business is not subject to value-added tax. Israel, based on regulations such as the 2017 tax document on virtual currency activities, treats mining business as a service and imposes a 17% value-added tax. New Zealand also treats mining business as a service and imposes a 15% goods and services tax.

Some countries, for the purpose of industry resource adjustment, may impose consumption tax on mining companies. For example, the United States, according to the "Budget Supplemental Explanation" issued by the U.S. Department of the Treasury in March 2023, proposes to impose a consumption tax in stages based on the electricity costs used in cryptocurrency mining. These companies will be required to report their electricity consumption and the type of electricity used.

2. Advantages of Mining in Ethiopia

Amid political and economic setbacks, Bitcoin miners are often attracted by governments with low electricity costs and a friendly attitude towards the cryptocurrency industry. Although Ethiopia still prohibits cryptocurrency trading, it began allowing Bitcoin mining in 2022. For all companies engaged in cryptocurrency mining, Ethiopia has become a rare opportunity. The following is a brief analysis of the advantages of mining in Ethiopia.

2.1 Resistance to Cryptocurrency Mining in Other Countries

Other countries and regions strongly resist cryptocurrency mining due to reasons such as climate change and scarce electricity. For example, a series of developing countries such as Kazakhstan and Iran initially accepted Bitcoin mining, but when their energy usage caused domestic dissatisfaction, policies began to shift to non-support and resistance. In 2021, the Chinese government also banned Bitcoin mining. Most countries prohibit cryptocurrency mining because they may deplete available electricity, leaving miners with no room for expansion. Additionally, miners may suddenly become unwelcome to the government and be forced to leave.

2.2 Low-Cost Electricity

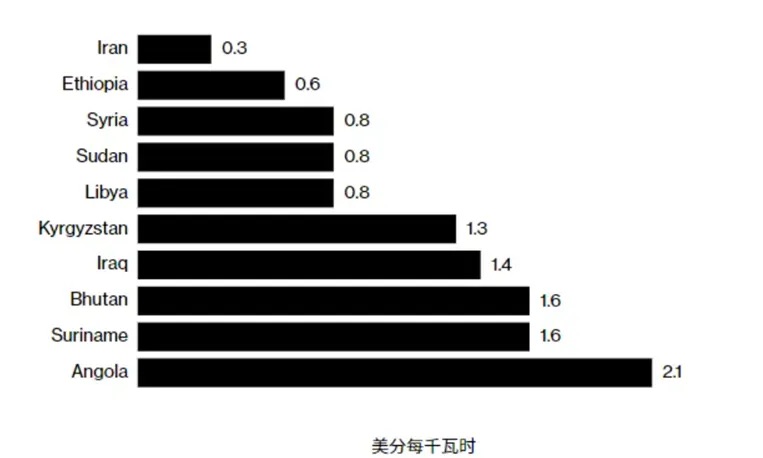

Bitcoin mining machines consume a large amount of electricity, with electricity accounting for up to 80% of mining operation costs. Therefore, obtaining cheap electricity is a key competitive advantage for mining. In 2023, Bitcoin mining consumed 121 trillion kilowatt-hours of electricity. The reliance on abundant electricity is its main weakness, as it may encroach on industrial and household electricity usage, leading mining companies to face political resistance. Ethiopia has low electricity prices, as shown in the figure (source: Statista Research Department). The Ethiopian Electric Power Corporation has stated that it has reached power supply agreements with 21 Bitcoin miners, 19 of which are from China.

2.3 Ideal Resources and Climate Conditions

Against the backdrop of global warming, Bitcoin mining is increasingly seen as a factor contributing to global warming, despite claims by miners that they are increasingly using clean energy. A study by the United Nations shows that two-thirds of the electricity used for Bitcoin mining in 2020 and 2021 came from fossil fuels.

Ethiopia can utilize its abundant surplus of green and renewable energy to provide electricity for Bitcoin mining. Ethiopia's capacity to provide electricity for Bitcoin mining may soon rival that of Texas. The completion of the GERD project will double Ethiopia's power generation capacity to 5.3 gigawatts. Ethiopia's advantage lies not only in cheap renewable energy but also in its ideal climate conditions, with the ideal temperature for mining being 5 to 25 degrees Celsius, which coincides with Ethiopia's average temperature.

2.4 Attitude of the Ethiopian Government

The Ethiopian government allows Bitcoin mining mainly because these mining companies pay for their electricity consumption in foreign currency. The power company charges Bitcoin miners a fixed rate of 3.14 cents per kilowatt-hour, which is a lucrative source of foreign exchange income. Expanding foreign exchange inflows to alleviate economic challenges and viewing the mining industry as an attractive investment opportunity to achieve this goal. According to data from Project Mano, integrating Bitcoin mining into the Ethiopian economy could contribute $2 billion to $4 billion to its GDP. Accepting Bitcoin mining can roughly block the path for mining to bypass foreign exchange controls. It can also increase employment, increase tax revenue, and reduce the waste of water and electricity during the flood season at hydroelectric stations.

3. Tax Research on Ethiopian Mining Companies

3.1 Tax System in Ethiopia

3.1.1 Tax System Structure

Ethiopia implements a system of shared taxation between the federal government and regional governments. Each region contributes a certain proportion of taxes to the federal government. The federal government allocates funds to each region based on population, economic conditions, and tax contributions.

Central taxes include customs duties and other import and export taxes; personal income tax for employees of the central government and international employers; profit tax, personal income tax, and value-added tax for enterprises owned by the central government; tax on national lottery income and other prize income; taxes on aviation, railway, and maritime activities; taxes on rental income from houses and properties owned by the central government; taxes on licenses and service fees issued or permitted by the central government.

Taxes shared between the central government and local governments include corporate profit tax, personal income tax, value-added tax, franchise fees, and land rental taxes for large-scale exploitation of oil, natural gas, and forest resources.

3.1.2 Types of Taxes Ethiopian Mining Companies May Involve

(1) Enterprise Income Tax

Any enterprise that earns income within Ethiopia is required to pay income tax. Taxpayers are divided into three categories: Class A taxpayers, Class B taxpayers, and Class C taxpayers. Enterprises subject to corporate income tax are Class A taxpayers. Based on the nature of the income, the Income Tax Law classifies it into five categories: Class A income, Class B income, Class C income, Class D income, and Class E income. The types of income involved for corporate income tax payers are Class B income (30%), Class C income (30%), Class D income (10% or 5%), and Class E income (exempt).

Value Added Tax (VAT)

The scope of value-added tax in Ethiopia includes the provision of goods and services, the import of taxable goods, and specific imported services, divided into registered and voluntary VAT taxpayers engaged in taxable transactions. VAT is calculated using the deduction method, and when input tax exceeds output tax, options include carrying forward, VAT refund, or offsetting against other taxes. The tax rate is divided into two brackets: a standard rate of 15% and a zero rate. VAT is reported on a monthly basis. Mining companies involved in the transmission or provision of electricity in Ethiopia will be subject to value-added tax.

- Capital Gains Tax

Capital gains refer to income realized from the transfer of operating assets. In Ethiopia, capital gains fall under Class D income as specified in the Income Tax Law and are subject to income tax (i.e., capital gains tax). The tax rate is 15% for buildings used for commercial, factory, or office purposes, and 30% for company shares.

- Royalty Tax

In Ethiopia, royalty tax refers to payments made as compensation for using or having the right to use any literary, artistic, or scientific work, including copyrights for films, tapes used for radio or television broadcasts, patents, trademarks, designs or models, drawings, secret formulas or processes, or any industrial, commercial, scientific equipment, or payments made as compensation for information related to industrial, commercial, or scientific experience. Royalty tax is levied at a flat rate of 5%.

3.2 Tax Analysis of Mining Companies in Ethiopia

Cryptocurrency companies operating in Ethiopia need to register with the country's Information Network Security Agency (INSA). Cryptocurrency companies that do not comply with registration requirements will face corresponding legal measures. Additionally, INSA has the authority to regulate cryptocurrency products and related transactions. Furthermore, INSA is responsible for developing operating procedures and building cryptocurrency infrastructure.

Ethiopia implements a combined principle of territorial and personal taxation. Any enterprise earning income within Ethiopia is required to pay income tax, and Ethiopian resident enterprises are required to declare and pay corporate income tax on their global income. Mining companies operating in Ethiopia are likely to be classified as Class C income or Class D income, subject to a tax rate of 30%. The specific classification for income tax or capital gains tax based on the type of income has not been clearly defined in current Ethiopian government documents. The supply of electricity, heat, gas, or water in Ethiopia is subject to value-added tax, and since mining companies heavily rely on electricity, they are effectively the actual taxpayers of electricity value-added tax. Ultimately, electricity price taxation will affect the tax revenue of mining companies. Additionally, the classification of mining activities for enterprises in Ethiopia has not been clearly defined. If classified as providing services or labor, it will also involve direct payment of value-added tax.

Regarding the timing of recognizing mining income, many believe that cryptocurrency mining represents intangible assets developed internally by mining companies. The computers, usage, and various employee costs invested by miners for construction and mining form internally developed intangible assets, so income or gains should be recognized upon the subsequent sale of the cryptocurrency. There are no clear regulations indicating that Ethiopia currently has a tax incentive system for mining companies, but mining companies may be eligible for some existing tax incentives, such as those related to employment. Additionally, if mining companies are involved in the import of mining machines, they will also be subject to customs duties, and specific regulations and related tax rates need further clarification.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。