Original | Odaily Planet Daily

Author | How is the husband

As the most important part of the RWA sector, the market size of tokenized national debt has exceeded $1 billion.

In particular, BlackRock's entry after the New Year has further driven the rapid growth of this sector. In addition, Circle announced the launch of smart contract transfer function for BlackRock's BUIDL fund, optimizing the RWA on-chain exit mechanism and addressing market concerns.

Odaily Planet Daily will elaborate on the current market situation of tokenized national debt in the RWA sector and the subsequent impact of Circle's move on RWA.

Distribution of tokenized national debt scale

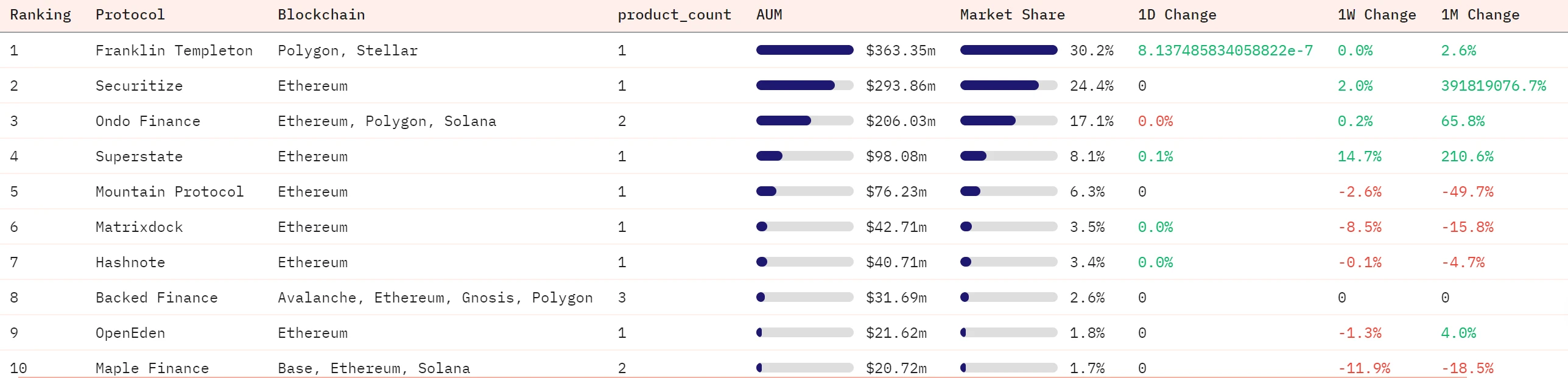

Currently, according to the data analysis on 21.co in Dune, the market size of tokenized national debt has reached $1.1 billion, with Franklin Templeton, BlackRock in partnership with Securitize, Ondo Finance, and Superstate occupying nearly 80% of the market share. They will be introduced one by one below.

Inventory of the top four projects

Franklin Templeton

Franklin Templeton was issued on the Stellar public chain in 2021 and expanded to Polygon in April 2023. As of now, the fund's assets amount to approximately $363 million, accounting for 30.2% of the current market size. As the first tokenized fund in the market, its related system is not sound, and the token BENJI representing the shares of the Franklin Templeton fund cannot be transferred between holders, leading to slow market growth over the past three years. However, according to official sources, Franklin Templeton has been providing fee discounts, with the discounts subsidized by the government, indicating a certain government factor behind it.

BlackRock Tokenized Fund BUIDL

BlackRock's tokenized fund BUIDL was officially launched on Ethereum on March 20 this year and issued in partnership with Securitize, operated and managed by BlackRock Financial Management, Inc. The fund's assets amount to approximately $294 million, accounting for 24.4% of the current market size. However, it is worth noting that the fund has been in existence for less than a month, and its market size has been growing rapidly.

BUIDL mainly invests in cash, US Treasury bills, and repurchase agreements. Investors in the fund need to meet the qualifications of "accredited investors" and will receive equivalent BUIDL tokens. Each BUIDL token is valued at $1 and can be transferred to other verified addresses through Securitize's encrypted wallet, but the recipient of the transferred BUIDL tokens must meet their verification conditions. For more details, please refer to the previous article "Raising over $240 million in 7 days, the beneficiary of BlackRock's BUIDL fund turns out to be Ondo".

Ondo Finance

Ondo Finance was initially engaged in the Laas (liquidity as a service) track and transitioned to the RWA track in January 2023, with its first products being OUSG (tokenized US bonds) and USDY (US dollar interest rates). According to the above image, the fund's assets amount to approximately $203 million, accounting for 17.1% of the total market size. It is also a leader in on-chain RWA projects.

The underlying assets of the tokenized US bond product OUSG initially consisted mostly of short-term US bond ETFs under BlackRock: iShares Short Treasury Bond ETF (NASDAQ code: SHV), with a small portion in USDC and USD for liquidity. However, when BlackRock launched the tokenized fund BUIDL, SHV was converted to BUIDL and became the largest holder of the BUIDL fund. For more details, please refer to the previous article "Detailed explanation of Ondo Finance: successful transition, TVL leaps to top three in RWA track".

Superstate

Superstate launched a tokenized US Treasury fund product on Ethereum in February this year, directly holding short-term US government bonds with the goal of providing returns consistent with the federal funds rate. Investors can make deposits in US dollars or Circle's USDC stablecoin and receive USTB tokens representing their investment in the fund. Users can self-custody the tokens or choose custody services from Superstate's partners Anchorage Digital and BitGo. The current market size of the fund is approximately $98 million, accounting for 8.1% of the total market size.

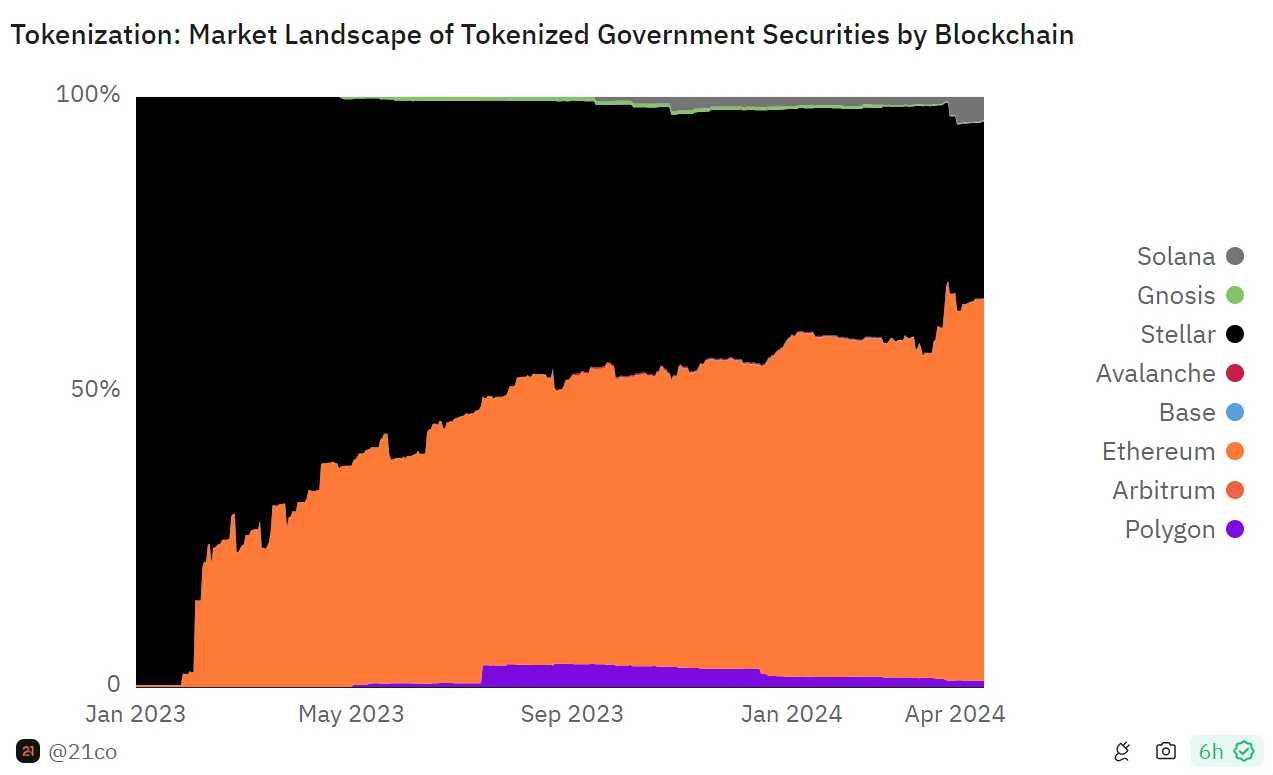

Distribution of public chains for tokenized funds

Currently, according to the data analysis on 21.co in Dune, Ethereum and Stellar occupy a larger territory, while Ondo regards Solana as its main battlefield, but in terms of market size, Solana's territory ranks third. From the image, it can be seen that Ethereum occupies the highest distribution due to the funds launched by BlackRock and Superstate this year, and Stellar is due to the accumulation of Franklin Templeton over the years. However, the RWA projects launched on-chain are mostly focused on Solana, and Solana may continue to expand in the future.

Circle embraces BlackRock, tokenized national debt may further expand

Less than 20 days after the launch of BlackRock's BUIDL fund, Circle announced the launch of a smart contract transfer function for BlackRock's BUIDL fund, allowing holders to transfer. This smart contract provides BUIDL investors with an instant and all-weather exit channel.

In other words, Circle acts as the exit channel between on-chain investors and BlackRock's BUIDL fund. Currently, the redemption mechanism for BlackRock's BUIDL fund requires fund investors to transfer the BUIDL tokens to the partner Securitize's address 0x878…200, and then transfer them to be destroyed through that address. However, this process requires related time for verification and cannot be instant, nor can it achieve a 24/7 all-weather exit without going through the review of the management company BlackRock.

Circle becomes the holder of the BUIDL fund, as BUIDL allows qualified investors to transfer tokens to each other, and Circle has officially utilized this to launch the smart contract transfer function, helping investors to convert BUIDL into USDC in advance through the contract. This not only enhances the usage scenarios of USDC but also provides a more complete process link for RWA projects and BUIDL.

Circle provides an on-chain exit mechanism, which will benefit more on-chain RWA projects, such as Ondo Finance. Ondo Finance previously converted most of its underlying asset shares into BlackRock's BUIDL fund, and Ondo also completed the first interest redemption mechanism for its own products, while also needing to pay interest for its own products. Circle's exit mechanism can further improve efficiency.

At the same time, Circle will further expand the scale of BlackRock's BUIDL fund. After Circle launched the smart contract transfer function for BlackRock's BUIDL fund, the market size of the BUIDL fund increased by over $10 million in less than a week.

From BlackRock's launch of the tokenized fund BUIDL to Circle providing the exit mechanism, the scale and process of tokenized national debt continue to expand and improve. From the current data statistics, the total market size of tokenized national debt is growing at a high rate, combined with the current returns on US bonds, more projects are expected to choose to use BlackRock's tokenized fund BUIDL as underlying assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。