Original author: Biteye, core contributor Viee

Original editor: Biteye, core contributor Crush

The rapidly emerging Karak, from announcing a $1 billion valuation financing to launching the early access staking plan, to now supporting various assets, took only about two months.

What kind of entity is Karak, considered a rising star in restaking, and how much of a splash can it make in the restaking arena? How can one participate in Karak in the early stages to have a greater chance of receiving airdrops? In this research report, Biteye will take you deep into understanding the Karak Network.

The Rapidly Emerging $1 Billion Valuation Karak

Karak Network is a restaking network, similar to Eigenlayer and other restaking projects, which also uses a point-based model to incentivize users to restake and earn multiple rewards.

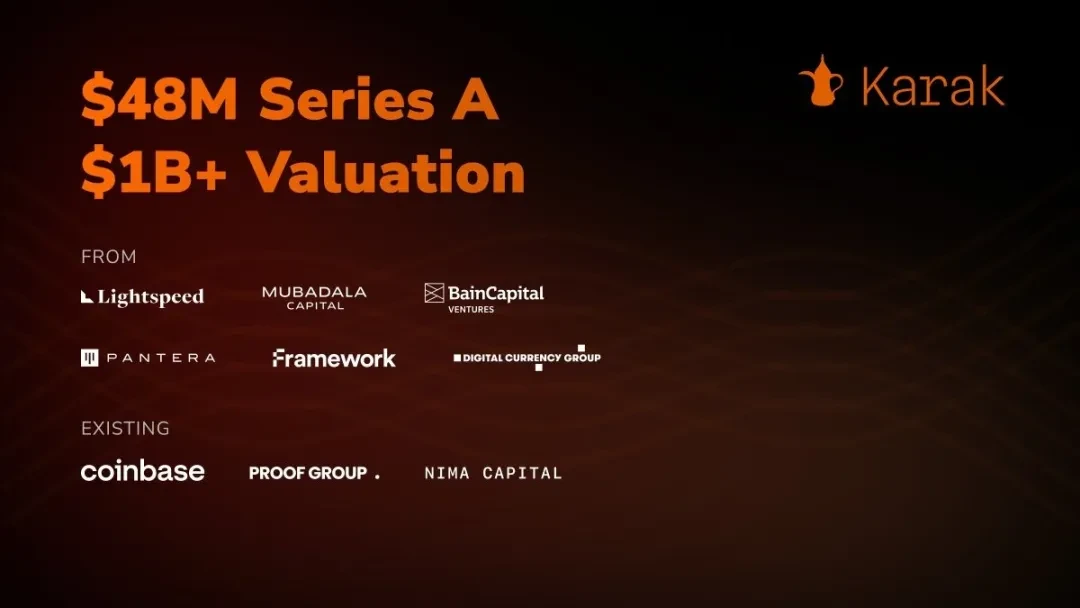

In December 2023, Karak announced a $48 million Series A financing, led by Lightspeed Venture Partners, with participation from Mubadala Capital, Coinbase, and other institutions, valuing Karak at over $1 billion.

Figure: Details of Karak's Series A financing

In February 2024, Karak announced the launch of the early access plan, allowing users to restake on Karak to earn XP points. In addition to receiving rewards from partner projects, users can also earn Karak XP. XP is distributed through the protocol and may eventually be airdropped by converting points into tokens.

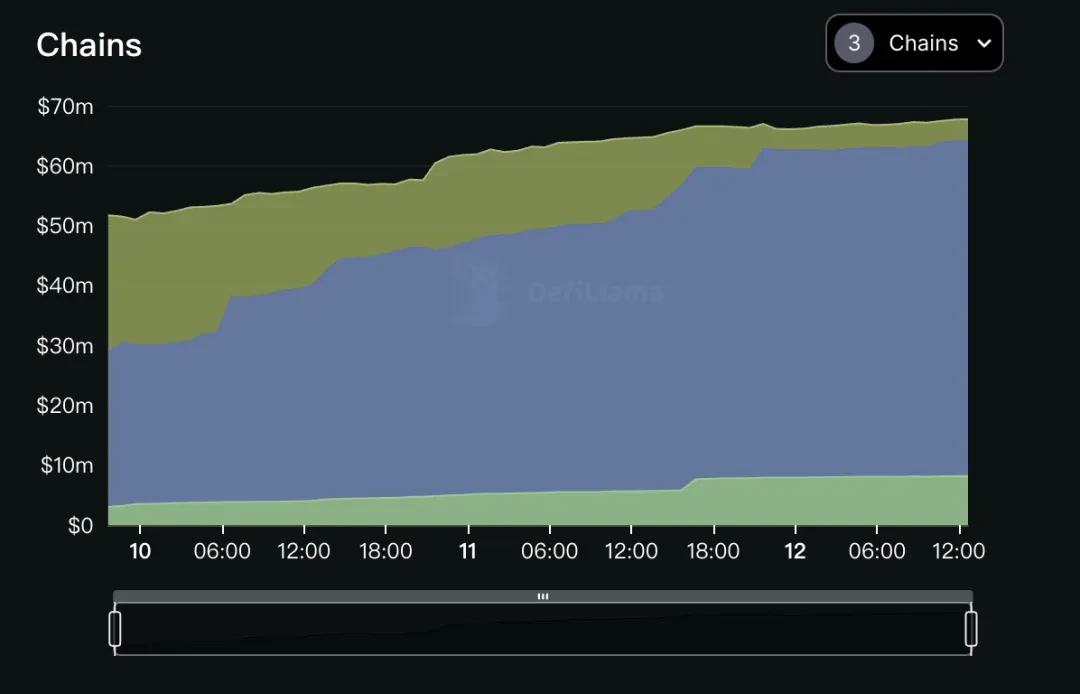

On April 8, 2024, private access was opened. As of April 12, Karak's total value locked (TVL) on different chains reached $140 million, with Karak Network accounting for the highest proportion at 48.5%, followed by Ethereum at 45.7%, and Arbitrum at 5.8%.

TVL on different chains for Karak, https://defillama.com/protocol/karak#tvl-charts

The emergence of Karak has attracted considerable market attention. Although the total TVL is still far from that of EigenLayer, it has unique technical highlights that could potentially challenge EigenLayer's dominant position in the restaking field.

Karak's Technological Path

Karak Network: A restaking layer with multi-chain support advantage

As a restaking platform, Karak, unlike EigenLayer which focuses on Ethereum, provides a diversified platform supporting various assets, including ETH, Solana, and various Layer2 tokens, enabling it to provide secure solutions in multiple blockchain ecosystems, thus having higher diversity and inclusiveness. Currently, Karak has supported networks such as Ethereum mainnet, Karak, and Arbitrum.

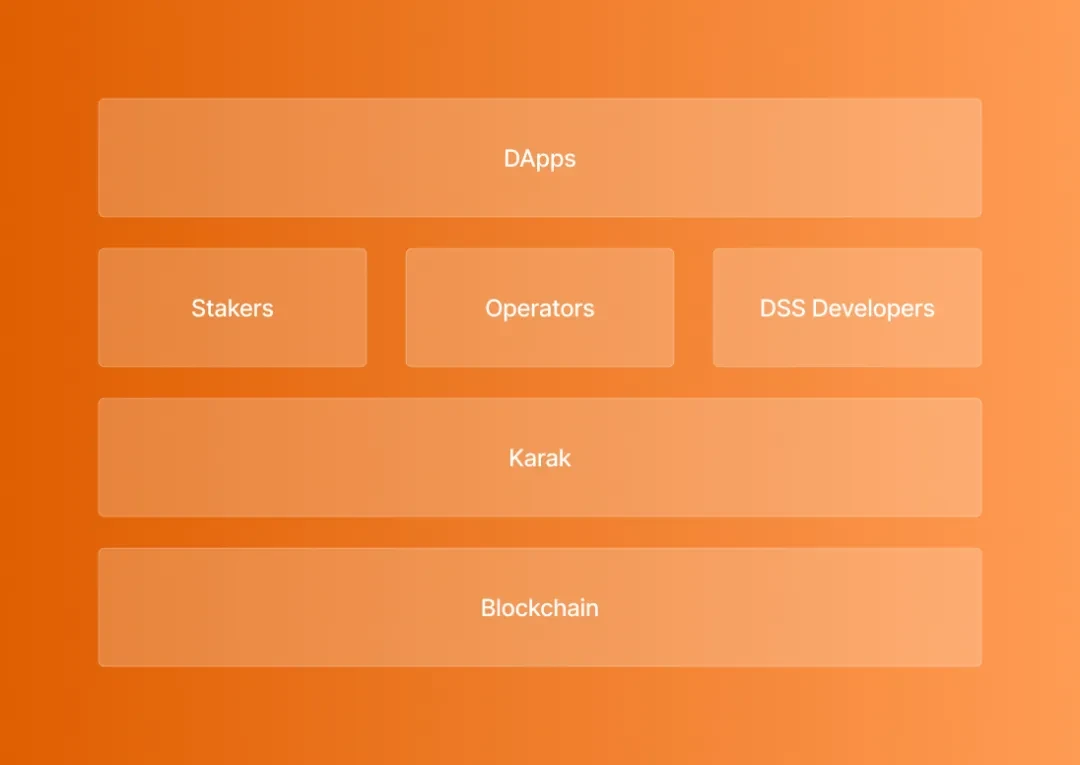

Here is a simplified breakdown of how Karak works:

- For validators, staked assets are allocated to Distributed Security Service validators on the Karak network, granting them additional execution rights over their staked assets.

- For developers, using Karak can attract validators through simple, non-dilutive incentives. This significantly reduces costs compared to building a new trust network from scratch.

Karak acts as a bridge between developers and validators. Developers can attract validators by providing non-dilutive token incentives.

The reason is that Karak eliminates the need for new protocols to use highly diluted reward mechanisms to attract and incentivize validators, which can avoid the early massive issuance of tokens to ensure network security, preventing token value dilution and damage to long-term holders' interests. This setting significantly reduces costs and complexity.

Image source: https://docs.karak.network/karak

Karak's technological path has three highlights:

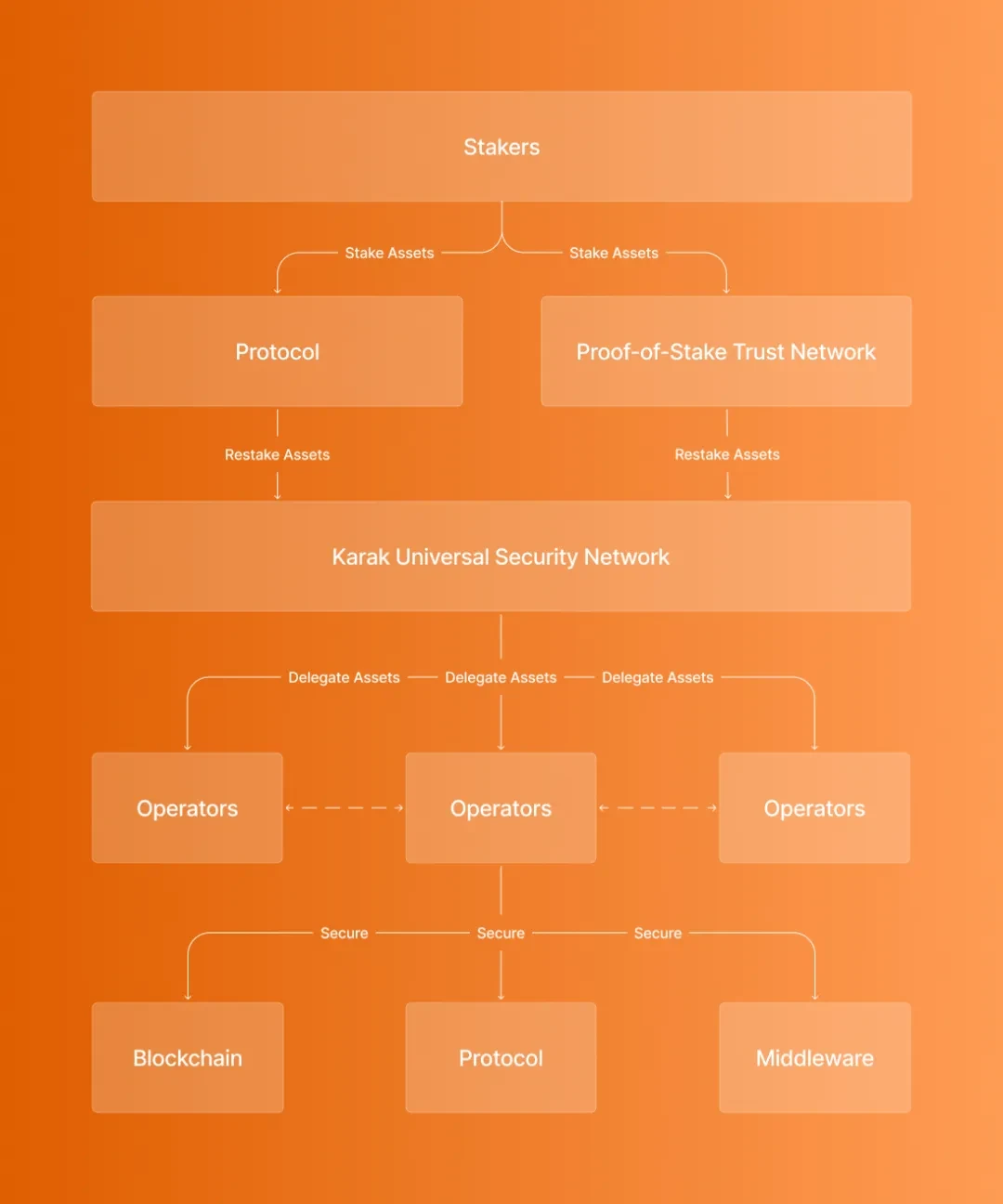

Multi-asset restaking: Karak introduces multi-asset restaking, a new security mechanism. Under this mechanism, users can restake various assets, such as Ethereum, liquidity staking tokens, stablecoins, to earn rewards. This multi-asset restaking not only increases potential returns for users but also greatly enhances the security of various Dapps, protocols, and DSS.

Restake anywhere: Karak internalizes a universal restaking concept, making secure restaking infrastructure accessible to anyone on any chain. This convenience allows developers to focus more on innovation and product development without spending a lot of time and resources on initial security measures.

Turnkey development environment: Karak enables new systems to access a strong and secure trust network from the beginning, significantly lowering the threshold for new protocols to ensure their own security, allowing these protocols to operate without complex security settings.

Image source: https://docs.karak.network/karak

In summary, Karak's innovation not only provides users with the opportunity for restaking various assets but also greatly simplifies the security assurance process for new protocols. These features collectively enhance Karak's competitiveness and attractiveness in the same arena.

Comparison between Karak and EigenLayer

Like EigenLayer, Karak is a restaking protocol, meaning it allows staked assets such as ETH to be restaked by validators across multiple networks, while enabling validators to receive additional rewards. At first glance, Karak seems to be a "copycat" of Eigenlayer, but comparing the technological paths of the two reveals some differences.

So why is it said that Karak is not a "copycat" of Eigenlayer, and what are the differences?

Reason one: The dApp on Eigenlayer is called Active Validation Service (AVS), while the dApp on Karak is called Distributed Security Service (DSS). This will be explained in detail in the next section.

Reason two: The execution layer on Eigenlayer is on the Ethereum mainnet, but Karak has its own Layer2 (called K2) for sandbox testing, allowing DSS to be developed and tested on Layer1 before deployment.

Here we need to discuss the first issue: What are AVS and DSS? What are the differences?

AVS, short for Actively Validated Services, is a concept in the EigenLayer protocol. AVS can be simply likened to "middleware," providing services similar to data and validation capabilities for end products. For example, an oracle is not an end product, but it can provide data services for DeFi, wallets, and more, making it a type of AVS.

Understanding EigenLayer's AVS can be illustrated with a simple and vivid analogy:

Imagine Ethereum as a huge shopping mall, and various Rollup L2 (Layer 2 solutions) are like stores in the mall. These stores need to pay rent to operate in the mall, which in the Ethereum world is equivalent to paying gas fees, so their transactions and state data can be packaged, verified, and stored in Ethereum's "mall" ledger.

In this analogy, Ethereum not only provides physical space for the stores (block space) but also handles security (validating the legitimacy and consistency of transactions), ensuring that all store transactions are secure and valid.

EigenLayer's AVS is like providing an affordable service for small vendors (projects) that want to set up stalls outside the mall (Ethereum ecosystem). These small vendors may not be able or willing to operate within the mall, such as mobile vendors (requiring liquidity) or street vendors (good geographical location), but they still want to use some of the mall's services. AVS can provide services for them. Although it may not have the same comprehensive security as inside the mall, meaning a reduced consensus security, it also has lower costs. This can provide a solution for Dapps that cannot be verified within the Ethereum EVM network, allowing even small-scale projects to find a place in the vast Ethereum ecosystem.

This approach is particularly suitable for applications with less stringent requirements for consensus security, such as some Dapp Rollups, cross-chain bridges, or oracles. These projects may not need the highest level of security provided by the Ethereum mainnet, so by choosing AVS, they can obtain necessary security verification services at a lower cost while still operating in a relatively secure environment.

Similar to EigenLayer, Karak also has its own version of AVS, called Distributed Secure Services (DSS). Unlike EigenLayer, which is limited to the Ethereum ecosystem, Karak introduces a new concept—providing restaking services for multiple assets, allowing anyone to use any asset on any chain.

In an Ethereum-only environment, AVS needs to compete with every opportunity that provides Ethereum rewards, and without speculative airdrop expectations, this competition is not sustainable. DSS can absorb more assets from multiple chains, using restaked assets to enhance security while reducing operating costs. Compared to ETH, the opportunity cost for many assets is lower, meaning DSS has a simpler and more feasible sustainable revenue path.

It is worth noting that the first AVS was launched and went live on the EigenLayer mainnet on April 10, and 6 AVS were subsequently released. Karak plans to launch its first DSS in the coming weeks.

Next, let's discuss the second question: What is Karak's Layer2 K2? How is it different from Eigenlayer?

K2 is a Layer2 built on top of the Karak network.

Operating on Layer1 is relatively costly for developers and users, so K2 provides a new solution. It serves as a "sandbox" environment, allowing Distributed Security Services (DSS) to be developed and tested on K2 before being deployed on L1 to ensure stability and security before actual application. In addition, by adding custom precompiles, allowing more validators to verify DSS, K2 not only improves efficiency and security but also becomes more decentralized.

Compared to Eigenlayer, which uses the Ethereum mainnet as the execution layer, Karak has created its own execution layer (K2) and is built on top of Layer2, providing faster transaction speeds and lower transaction costs without sacrificing security.

Understanding these two questions, we can see that Karak and EigenLayer have adopted differentiated technological paths, which also bring the most intuitive differences.

Karak supports a wider range of assets beyond ETH, planning to cover Solana, Tia, Arbitrum, Optimism, and other Layer2 solutions, aiming to create a cross-chain diversified restaking layer. EigenLayer focuses on the Ethereum ecosystem, using ETH as the primary asset for restaking, unlike Karak's broader inclusivity.

We can use an analogy to help understand this. Imagine Karak as an international airport connecting multiple countries, welcoming travelers (assets) from around the world, whether they are large commercial aircraft (public chain assets like Solana) or small private planes (Layer2 assets like Arbitrum). Karak's goal is to provide a convenient and secure transit hub for these travelers. In contrast, EigenLayer is more like a subway system designed specifically for a metropolis (the Ethereum ecosystem), focusing on serving residents and visitors within the city, providing professional and efficient transportation services (transactions and operations).

In other words, Karak, while similar to EigenLayer, expands the range of assets available for restaking, including Ether, various liquidity staked Ether, and stablecoins, thereby expanding the range of choices for users.

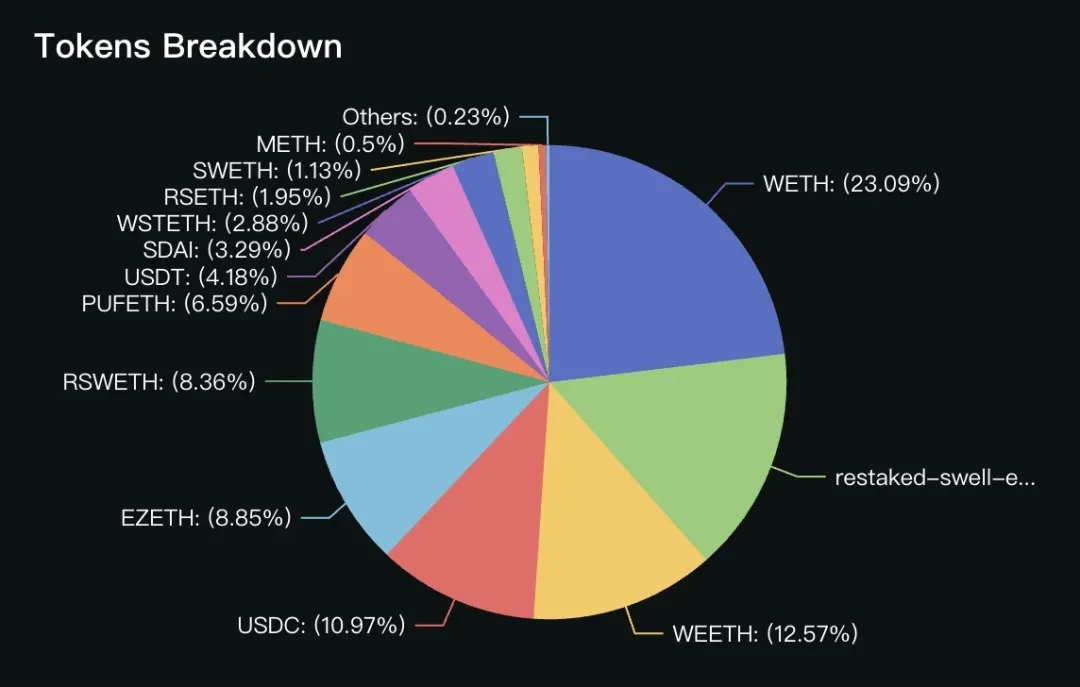

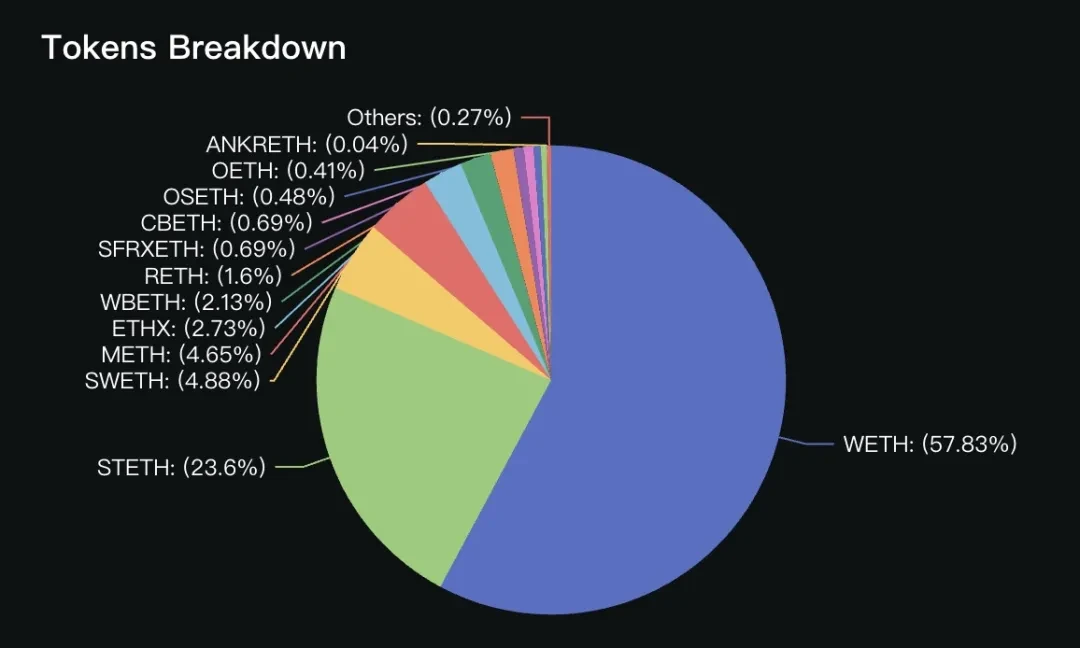

It has been proven that this approach is effective. According to DefiLlama data, for stablecoins, Karak's restaking of encrypted assets accounts for approximately 19%, while EigenLayer's restaking of encrypted assets may be less than 0.27%. The following pie charts show more differences.

Details of Karak's restaking of encrypted assets https://defillama.com/protocol/karak#tvl-charts

Details of EigenLayer's restaking of encrypted assets https://defillama.com/protocol/eigenlayer#tvl-charts

Is Karak a Vampire Attack on Eigenlayer?

Looking back at SushiSwap's vampire attack on Uniswap, what would happen if Karak were to launch its token before Eigenlayer?

First, we need to understand what a "vampire attack" specifically is. In the crypto field, a vampire attack is a strategy where a project (in this example, SushiSwap) attempts to capture users and liquidity from another similar project (such as Uniswap) by offering better incentives (e.g., higher liquidity provider LP rewards).

In simple terms, a vampire attack involves seizing liquidity shares from the target to increase its own liquidity and value, thus completing the "vampire" act.

In 2020, SushiSwap successfully attracted a large amount of liquidity by forking Uniswap's code and introducing SUSHI as its native token. As protocols with similarities, Karak and Eigenlayer cannot rule out the possibility of a vampire attack. If Karak were to launch its token first, we can speculate on the following possible scenarios:

Karak supports multiple assets, which may attract potential restaking users seeking asset diversity. If a vampire attack is executed, this will pose a challenge to EigenLayer.

Once Karak and Eigenlayer are running on the mainnet with multiple AVS/DSS, Karak may execute a vampire attack, transferring the staked Eigenlayer LRT assets from Eigenlayer to Karak. (Note: Karak allows restaking LRT assets that have already been staked with ETH on Eigenlayer, essentially allowing LRT to be restaked, which is a bit like nesting dolls.)

If Karak launches its token first, it will indeed attract the entire market's LRT. More importantly, Karak's own chain is already usable, with reasonable speed and fees. After all, one of Karak's prominent advantages is having an execution layer, which determines that it is not a subordinate of Eigenlayer, but a competitor.

How to Become an Early Participant in Karak

Currently, the Karak project is still in its early stages and can be involved by staking on the official website to earn XP rewards. In the future, Karak's airdrop will likely be conducted by converting points into tokens. The amount of XP earned may depend on the timing and duration of restaking, as well as the number of new users invited through referral codes.

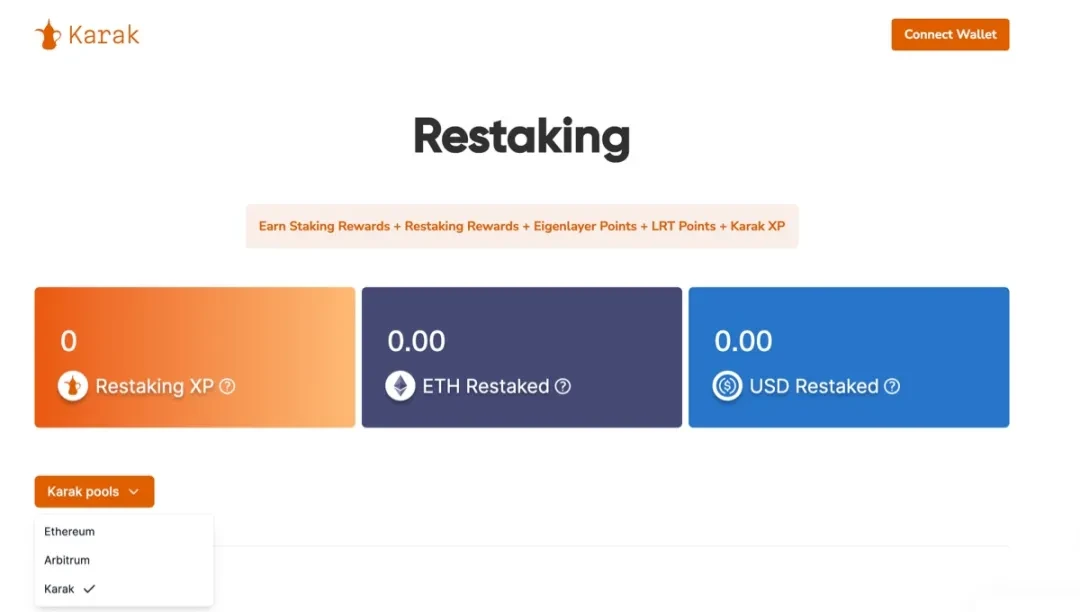

Access the Karak official website staking interface

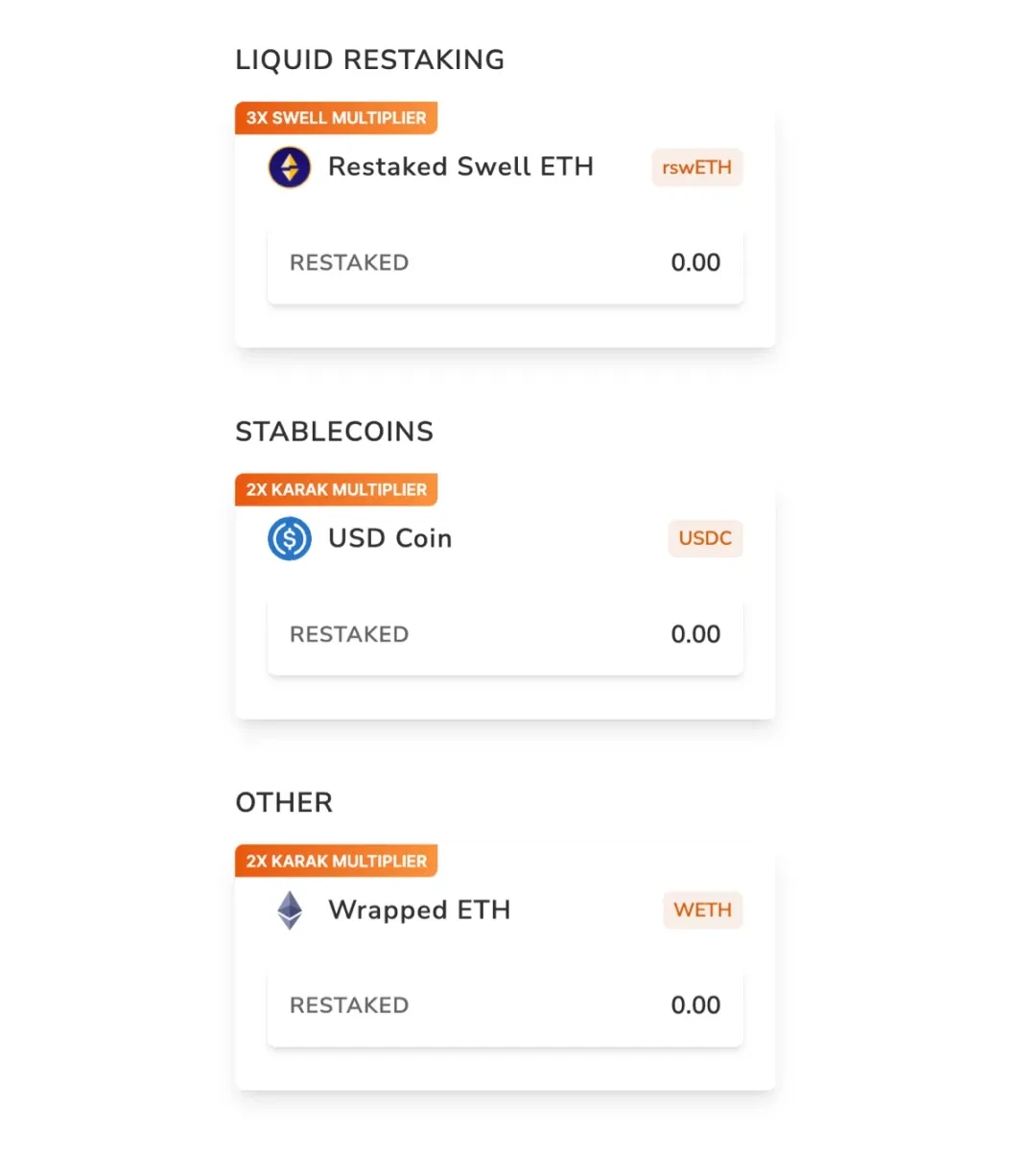

Currently supported staking networks for Karak: Ethereum mainnet, Arbitrum (L2), Karak (L2).

Supported staking assets for Karak: various LST assets such as mETH, various LRT assets such as pufETH, as well as three stablecoins: USCT, USDC, sDAI. Note that the supported tokens may vary across different networks, so please confirm carefully.

In simple terms, the points system in Karak allows participants to simultaneously receive "staking rewards + restaking rewards + Eigenlayer points + staked LRT points + Karak XP."

Currently, Karak is not similar to Eigenlayer's "one fish, multiple meals." Instead, it allows for higher returns by staking in other protocols when Eigenlayer is already "saturated," but this also comes with increased risk.

It is recommended to stake directly on the Karak (L2 network mentioned earlier) to receive double Karak points. The specific steps are as follows.

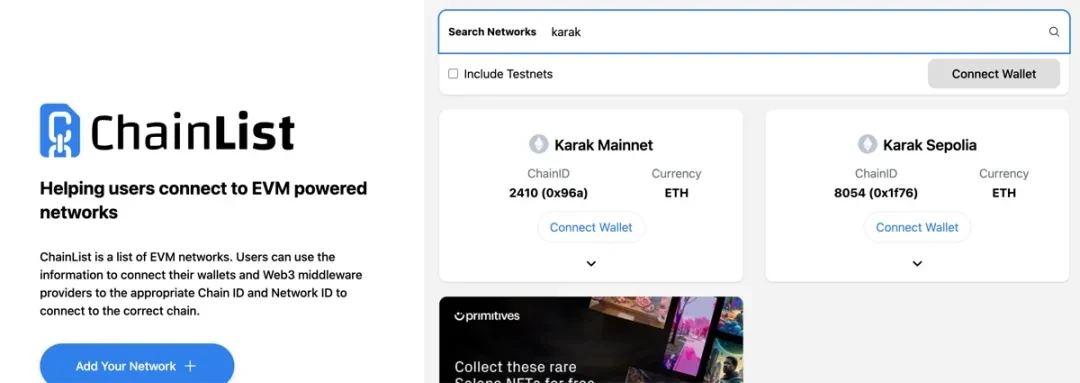

First, add the Karak network

Go to Chainlist, and select Karak Mainnet on the left

Next, transfer assets to the Karak chain. If choosing to stake on the Karak chain, it currently supports three tokens: rswETH, USDC, wETH

Staking rswETH has two scenarios

If you have rswETH, you can transfer it to the Karak chain using the official Karak bridge.

If you don't have rswETH, you can stake ETH in Swell to obtain rswETH (Swell only supports staking ETH on the mainnet, and you cannot transfer ETH to the Karak chain for staking), then transfer it to the Karak chain using the official Karak bridge.

Staking wETH also has two scenarios

If you have wETH, you can transfer it to the Karak chain using the official Karak bridge.

If you don't have wETH, you can transfer ETH from the mainnet to the Karak chain using the official Karak bridge or MiniBridge, then enable Auto-Wrap ETH when staking.

Karak official bridge and MiniBridge

Finally, complete the staking in Karak Pools.

Since the three supported tokens are non-ETH, this means that ETH is still needed for cross-chain transfers. Especially for wETH, if you transfer ETH and choose "max" for staking, the first contract function is a Deposit function, which actually wraps the ETH, resulting in the loss of ETH in your wallet and causing the staking to fail.

It is recommended to proceed as follows:

For staking rswETH and USDC, use the MiniBridge cross-chain tool to transfer a small amount of ETH for gas fees.

For staking wETH, keep a small amount of ETH and avoid clicking "max." However, if you accidentally stake the maximum amount, you can use MiniBridge to transfer a small amount of ETH.

Risk Warning

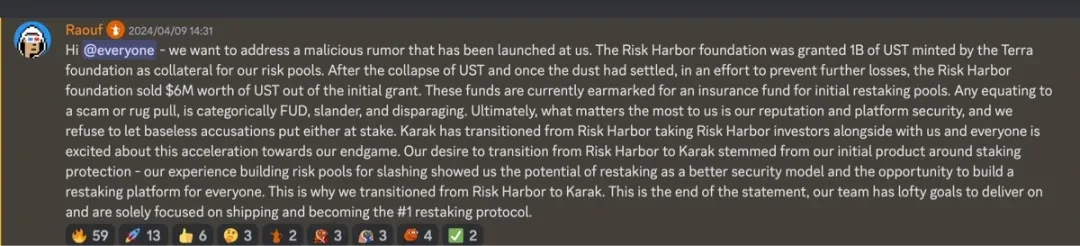

Currently, the controversy surrounding Karak mainly focuses on two aspects.

The team quickly launched the product after receiving funding at the end of 2023, and since then, there has been relatively little technical discussion, with more emphasis on marketing activities such as "point events" to capture the market.

The team's previous project's "self-preservation behavior" has been criticized by the community, and some KOLs have directly accused it of being a RUG. In response to this criticism, the team provided a response during a DC on April 9.

In summary, blockchain projects are always accompanied by contract and team risks, especially for restaking protocols that attract billions of dollars. However, in the current market environment, new users tend to favor projects with strong investment institutions and substantial funding backgrounds, while existing users pay more attention to the historical track record of the project team.

Conclusion

Balancing risk and return has always been a concern for users.

As a rising star in the restaking race, Karak's $1 billion valuation and unique technical highlights add a possibility of challenging EigenLayer's dominant position in the restaking field. Additionally, Karak supports restaking multiple LRT tokens, including but not limited to Swell, Puffer, Renzo, EtherFi, KelpDAO, which also promotes the prosperity of the Ethereum staking ecosystem.

Perhaps sensing the "crisis," EigenLayer announced the removal of all deposit limits and the reopening of deposit windows at 0:00 on April 17th, Beijing time.

The choice between sticking with EigenLayer or betting on Karak for higher returns is now in the hands of the users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。