Author: Despread

Original translation: Deep Tide TechFlow

1. Introduction

Since the second half of 2023, the long-awaited Bitcoin spot ETF has been approved, leading to a large influx of institutional funds. As a result, the price of Bitcoin has returned to its highest point in four years since November 2021. During this period, the trading volume of centralized exchanges such as Binance and Upbit exceeded $1 trillion, and the popularity of CEX mobile applications has increased, indicating an increase in market participation by individual investors.

In addition, there has been an increase in investors extracting assets from CEX to earn interest on digital assets in decentralized finance or participate in airdrops. This has led to a doubling of the total locked value (TVL) in the DeFi field compared to the second half of last year according to DeFiLlama.

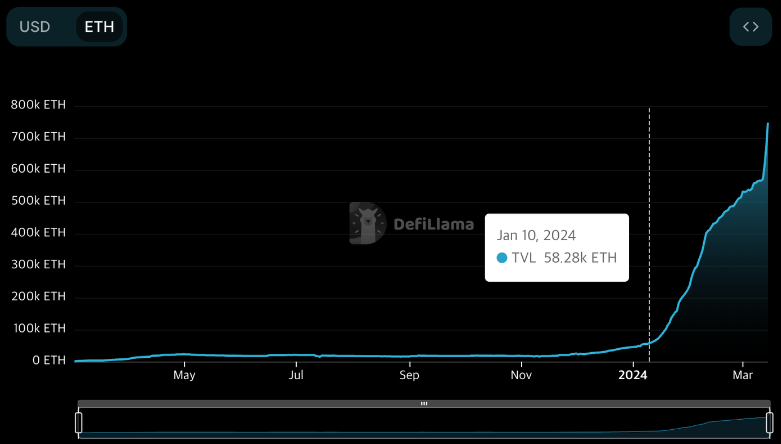

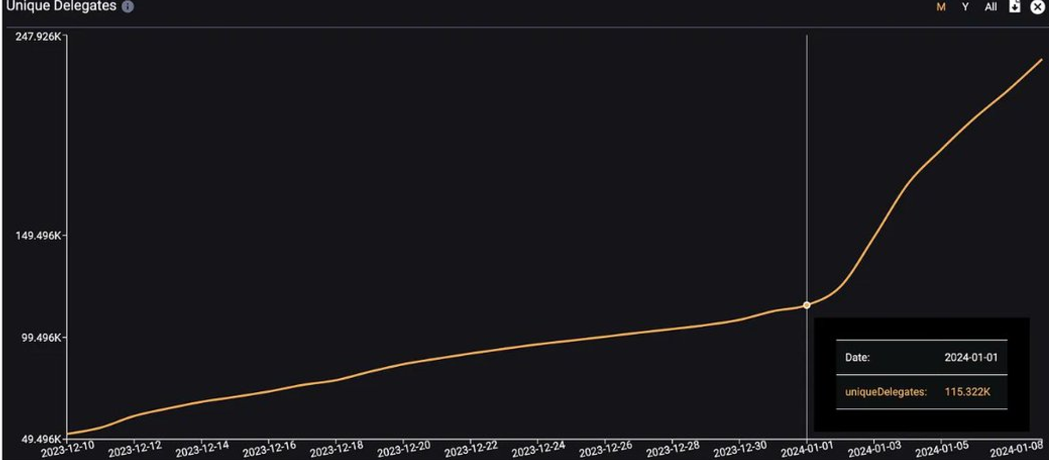

In these developments, EigenLayer, based on the Ethereum network, has increased its TVL by about ten times from the beginning of 2024 to the present, rapidly rising to the third place in the total TVL ranking of DeFi protocols. The significant growth of TVL has had a profound impact on the rise of TVL in the DeFi field.

EigenLayer proposes a re-staking function, using ETH staked for Ethereum network validation to share security with other protocols, while providing additional interest to protocol participants. Thanks to its proposal aimed at maximizing the efficiency of Ethereum network capital and security, EigenLayer has attracted investments of approximately $160 million from crypto VCs, including a16z, according to CryptoRank.

Furthermore, by effectively utilizing various point systems, airdrops have become an important part, increasing investors' expectations. Through various derivative protocols that maximize the use of point systems, EigenLayer's TVL has been on a steady upward trend from the beginning of the year to the present.

This article will cover various aspects of EigenLayer while focusing on the synergistic effects created by various derivative protocols and EigenLayer.

2. What is EigenLayer

After the Ethereum network transitioned from Proof of Work (PoW) to Proof of Stake (PoS), approximately 980,000 Ethereum validation nodes stake 32 ETH each on the beacon chain to participate in network validation. In PoS, the value staked in the network is directly linked to the network's security, meaning that approximately 31 million ETH is ensuring the reliability of the Ethereum network. Decentralized applications (Dapps) on Ethereum can deploy smart contracts on the Ethereum network, thus sharing its trust and security.

However, protocols known as Active Validation Services (AVS), such as bridges, sorters, and oracles, face significant challenges when using only the functionalities of the Ethereum network. This is because they act as intermediaries between chains or require faster synchronization times than the Ethereum network can provide. Therefore, these AVS face the task of establishing their own trust network in a decentralized manner and need to have their own consensus mechanism in the process.

AVS, eager to establish their own trust network similar to the Ethereum consensus mechanism, encountered several issues in the process of launching the network:

Lack of promotion projects and pathways to attract stakers

Stakers often need to purchase the native tokens of the AVS network, which are often volatile and difficult to obtain, leading to reduced accessibility compared to ETH

AVS must provide a higher Annual Percentage Yield (APY) than ETH to attract stakers, as stakers give up other asset management opportunities for network validation, thus incurring higher capital costs

EigenLayer addresses these issues through a function called re-staking, which allows ETH staked on the Ethereum beacon chain to be used again for AVS validation. Re-staking provides an opportunity for re-stakers to participate in AVS validation and earn additional validation rewards without the need to purchase other network tokens, using ETH or LST. For AVS, EigenLayer aims to provide an environment where they can promote their projects and build a trust network based on the liquidity recruited through EigenLayer.

2.1. Utilizing Ethereum's Security through Re-staking

Currently, validators on the Ethereum network can have up to 16 ETH of their 32 ETH stake slashed if they engage in behavior that harms network security. If their staked ETH falls below 16 ETH, they will lose their validator status. This means that if there is a way to use staked liquidity for staking elsewhere, it is possible to utilize up to 16 ETH of staking elsewhere as long as the staked balance remains above 16 ETH, allowing continuous participation in Ethereum network validation.

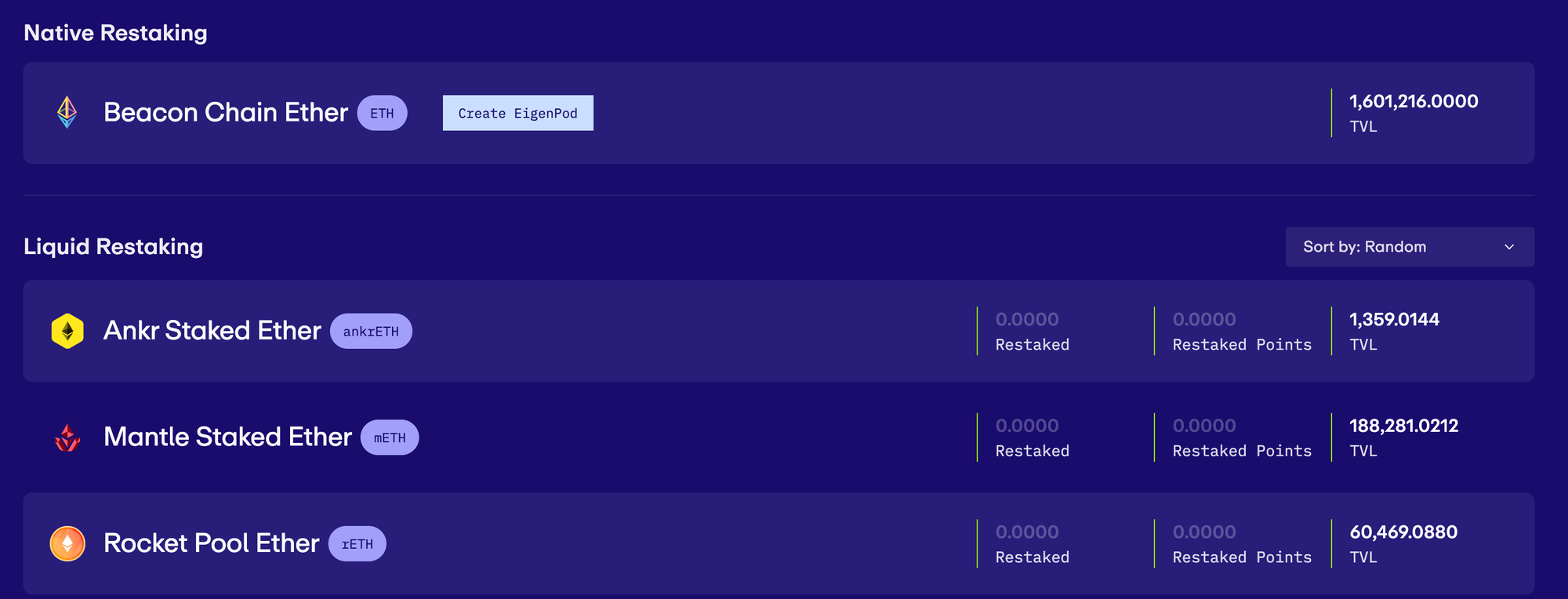

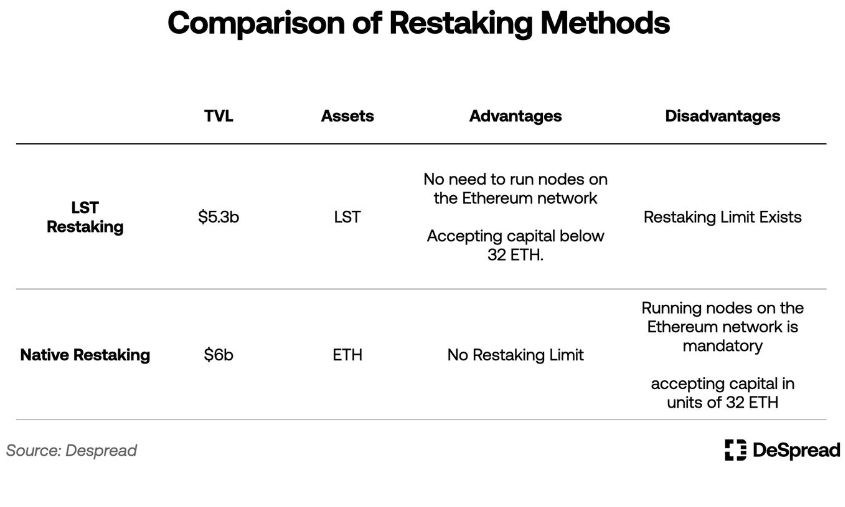

Re-staking in EigenLayer refers to using the idle portion of the validator's staked ETH as staking, by exposing it to the slashing criteria of AVS networks using the PoS consensus algorithm and using it for validation to provide security. Currently, EigenLayer supports two re-staking methods: LST (Liquidity Staking Token) re-staking and native re-staking.

LST Re-staking: Although referred to as liquidity re-staking in EigenLayer, it will be referred to as LST re-staking in this article to reduce confusion with subsequent introduced concepts.

2.1.1. LST Re-staking

LST (Liquidity Staking Token) is a deposit certificate issued by LSP (Liquidity Staking Protocol), connecting the depositor of ETH with the entity operating the Ethereum node. LSP addresses certain limitations of staking on the Ethereum network, such as:

Allowing users to participate in Ethereum network validation and receive validation rewards with less than 32 ETH capital

Allowing the use of LST in DeFi protocols to generate additional income, or effectively providing the same benefits as unstaked by selling LST in the market without waiting for the unstaking period

A well-known LSP, Lido Finance, currently has approximately 10 million ETH deposits. Many DeFi protocols have begun adopting LST issued by Lido Finance, stETH, as an asset that can be used in their protocols, making it an infrastructure in the Ethereum ecosystem.

EigenLayer provides a re-staking function involving depositing LST, issued by Lido Finance, into the EigenLayer smart contract for AVS validation and exposing it to the slashing criteria of the AVS network. This method is called LST re-staking.

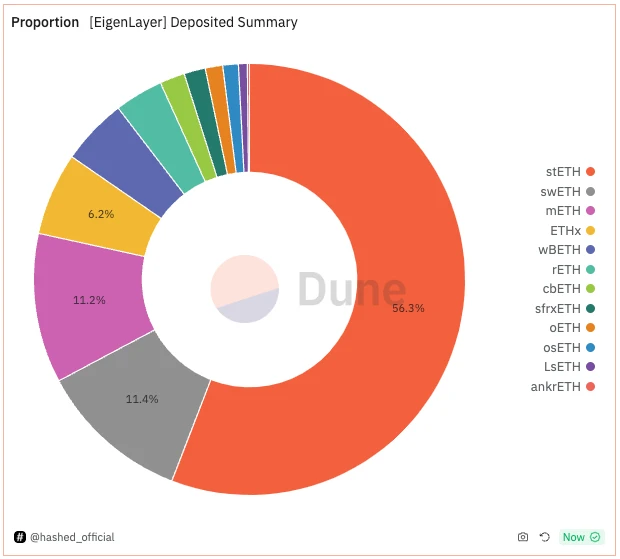

Since its mainnet launch in June 2023, EigenLayer has started supporting re-staking for stETH, rETH, and cbETH, currently supporting a total of 12 types of LST re-staking.

The EigenLayer development team strives to ensure the decentralization and neutrality of the protocol by setting restrictions for each type of LST. These measures include accepting LST re-staking deposits only during specific time periods, or limiting incentives and governance participation obtained from EigenLayer for a single LST to a maximum of 33%. To date, the restrictions on LST re-staking in EigenLayer have been increased five times, and as of the time of writing this article, there have been no further plans announced to increase the deposit limit.

2.1.2. Native Re-staking

While LST re-staking involves using LST as collateral to participate in AVS validation, native re-staking is a more direct method, where Ethereum PoS node validators connect their staked ETH in the network to EigenLayer.

Ethereum node validators can participate in AVS validation by using their staked ETH as collateral. They achieve this by setting their wallet address to receive unstaked ETH instead of the contract address called EigenPod created by EigenLayer.

In other words, Ethereum network validators forego the direct receipt of their deposited ETH and participate in native re-staking to engage in AVS validation. This exposes their staked assets not only to the slashing criteria of the Ethereum network but also to the slashing criteria of AVS, potentially earning additional rewards.

Executing native re-staking requires staking 32 ETH and directly managing an Ethereum node, providing a higher barrier to entry compared to LST re-staking. However, it is not subject to the limitations of LST re-staking.

2.2. Operators

After re-staking in EigenLayer, re-stakers have two options: either to directly operate an AVS validation node or to delegate their re-staking shares to operators. Operators represent re-stakers in participating in AVS validation and earning additional validation rewards.

Operators are granted the slashing rights to the collateral they hold or are delegated to AVS, install the software required for AVS validation, and participate in the validation process. In return, they can charge their own set fees to the re-stakers.

However, the process of sharing security with AVS is currently only running on the testnet. Therefore, at this time, there are no operators or AVS in EigenLayer, and re-stakers do not receive any additional validation rewards. Recently, EigenLayer mentioned that to launch the first AVS on the mainnet, EigenDA, and to enter the final stage of preparation for activating AVS validation in Phase 2.

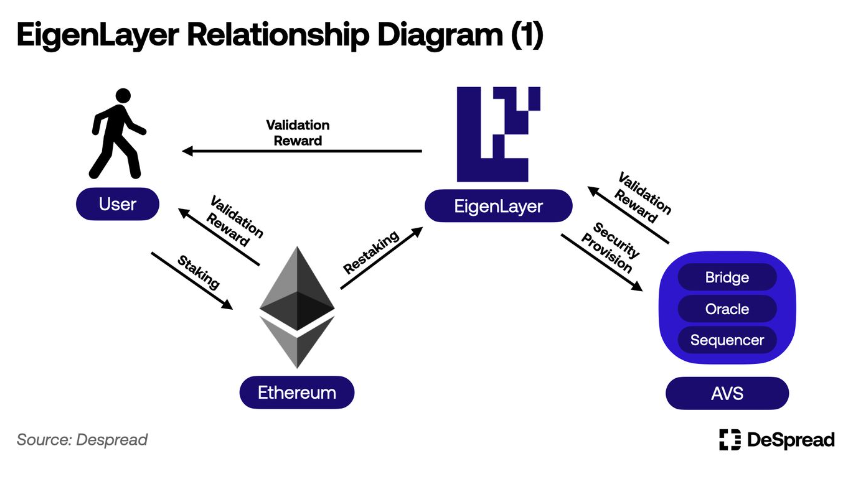

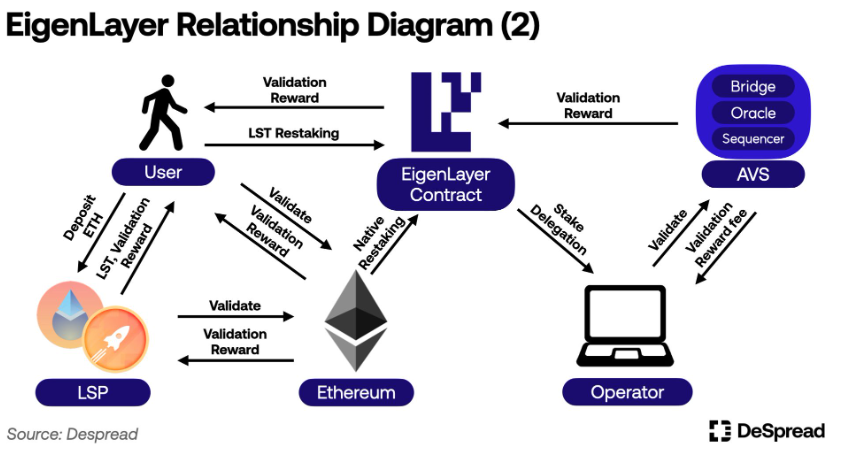

In summary, the relationship diagram of EigenLayer is as follows:

2.3. EigenLayer Points

EigenLayer grants one EigenLayer point per hour for each ETH deposited by re-stakers as a measure of contribution. Although the team has not explicitly specified the use of points or disclosed any detailed information about launching EigenLayer tokens, many users are re-staking, expecting a token airdrop based on points when it is eventually launched.

As of the time of writing this article, approximately 2.6 billion EigenLayer points have been distributed to all re-stakers, and the trading price of each EigenLayer point on the over-the-counter trading platform market is $0.18.

This allows the market to estimate the expected value of the EigenLayer token airdrop to be approximately $440 million, compared to the value of $120 million for Celestia based on the airdrop day price, showing a considerable market expectation and interest in the airdrop.

However, users re-staking for the purpose of receiving airdrop points face some inconveniences:

LST re-staking has limitations, preventing users from depositing the desired funds at will.

Native re-staking requires a capital of 32 ETH and involves directly operating an Ethereum network node.

Re-staking freezes the liquidity of EigenLayer, forcing users to forego other opportunities to generate additional income.

Canceling re-staking in EigenLayer to release locked liquidity requires a 7-day unstaking period.

To mitigate these disadvantages and make re-staking more efficient, the Liquidity Re-staking Protocol (LRP) has emerged. Utilizing LRP for EigenLayer points has become a more attractive investment option for users.

3. Liquidity Re-staking Protocol (LRP)

LRP accepts deposits of ETH or LST from users and re-stakes on behalf of users on EigenLayer. Additionally, LRP issues Liquidity Re-staking Tokens (LRT) as proof of the deposited assets, allowing users to generate additional income by utilizing these LRT in DeFi protocols or selling them in the market to bypass the waiting period for unstaking in EigenLayer to recover their deposits. In structure, LRP is similar to LSP.

LSP (Liquidity Staking Protocol): Protocol for replacing Ethereum network validation

LST (Liquidity Staking Token): Issued by LSP to depositors as proof of principal amount

LRP (Liquidity Re-staking Protocol): Protocol for replacing re-staking on EigenLayer

LRT (Liquidity Re-staking Token): Issued by LRP to depositors as proof of principal amount

Furthermore, most LRPs provide their own protocol points in addition to issuing EigenLayer points to depositors. Therefore, utilizing LRP offers several advantages over re-staking directly through EigenLayer, such as:

Creating additional value by using LRT.

Closing re-staking positions by selling LRT.

Earning additional airdrops through protocol points.

However, the EigenLayer points generated through re-staking via LRP are not in the wallet address of the deposit assets users, but in the ownership address of LRP. Therefore, LRP commits to distribute any EigenLayer token airdrops it receives to its depositors and provides a dashboard for users to check their accumulated EigenLayer points through LRP.

In the following sections, we will classify LRP based on two criteria and continue to explain in detail.

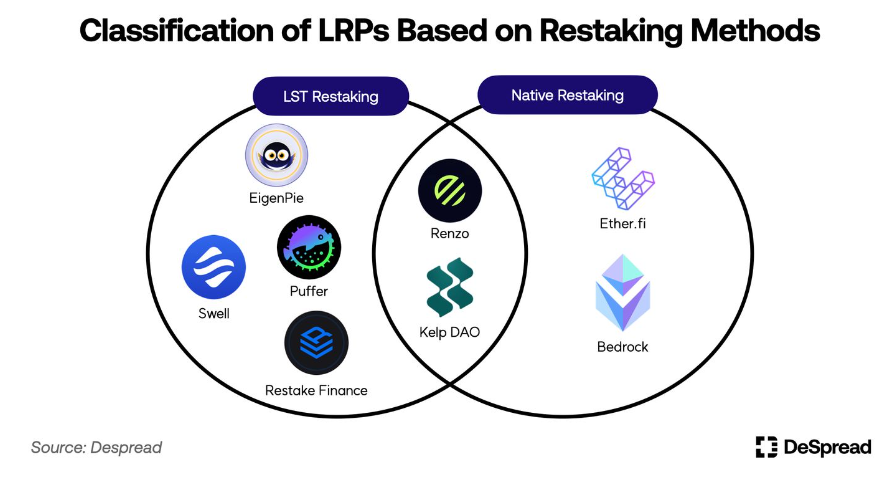

3.1. Classifying LRP Based on Re-staking Methods

As discussed earlier, EigenLayer has two re-staking methods: LST re-staking and native re-staking. These methods differ in the type of deposited assets accepted and whether they involve operating an Ethereum network node.

LRPs using the LST re-staking method can construct their protocols through a relatively simple mechanism. They accept users' LST, deposit it into the EigenLayer contract, and then issue LRT of equivalent value to the depositors. However, they are directly affected by the limitations of LST re-staking. Therefore, unless EigenLayer reopens LST re-staking, LST deposited during the restriction period will remain within the LRP protocol, and depositors will not accumulate EigenLayer points until their assets are re-staked.

On the other hand, LRPs using the native re-staking method must directly manage and operate an Ethereum network node, as they accept ETH from users. This requires more work to build, operate, and manage the protocol compared to LRPs using the LST re-staking method. However, unlike the limitations in LST re-staking, native re-staking has no restrictions, allowing depositors to start earning EigenLayer points immediately after depositing funds.

Based on these features, LRP offers re-staking methods that suit its protocol concept, and they do not necessarily need to adhere to a single re-staking method. For example, Kelp DAO initially supported LST re-staking to quickly aggregate TVL after EigenLayer's launch and subsequently adopted a strategy that provides native re-staking functionality.

3.2. Classification of LRP Based on LRT Issuance Methods

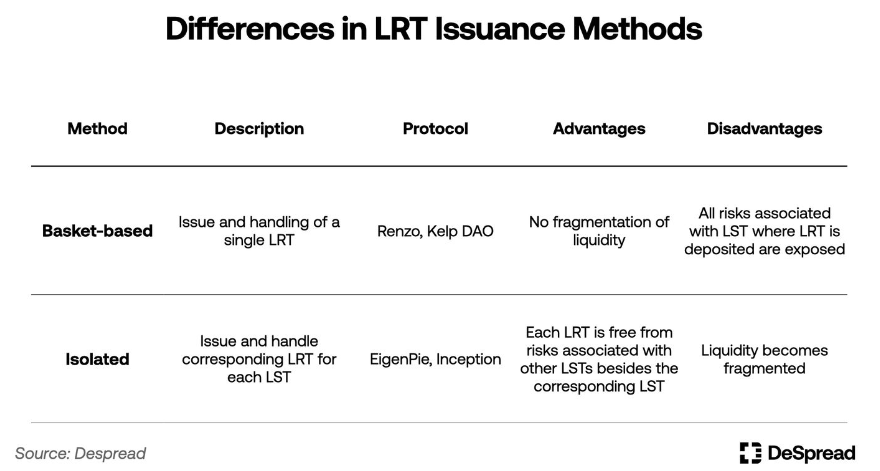

In LRPs that accept various types of LST or substitute a single asset with ETH and perform re-staking, the methods of issuing LRT can be classified into basket-style and standalone.

The basket-style method handles a single type of LRT, issuing and paying a single type of LRT regardless of the LST type deposited by users into the LRP. It is intuitive and straightforward for users, and has the advantage of not dispersing LRT liquidity. However, a drawback is that the entire LRP is exposed to individual risks of the deposited LST, requiring adjustments to the LST deposit ratio within the LRP to mitigate these risks.

On the other hand, the standalone method issues and pays different LRT corresponding to each type of LST handled by the LRP. This means that while it has the disadvantage of dispersing LRT liquidity, it also isolates the risks associated with each LST, eliminating the need to adjust deposit ratios.

Although the standalone method carries fewer risks and is relatively easier to set up and operate, most LRPs adopt the basket-style method. This method is simpler for users and promotes collaboration with DeFi protocols.

In addition to these basic features, LRP highlights its unique functionalities and market entry strategies through various examples. Let's examine these aspects in more detail through some examples.

3.3. Exploring Notable LRPs

3.3.1. Ether.fi

Ether.fi was initially an LSP, with the concept of allowing stakers to have full control over their deposited ETH, and was the first LRP to support native re-staking on EigenLayer after its launch. This allowed Ether.fi to provide an EigenLayer points farm for its depositors through native re-staking, continuously increasing its TVL even during the restricted re-staking period.

Ether.fi issues two types of LRT: eETH and weETH. eETH is the basic LRT obtained by depositing ETH into Ether.fi, utilizing a buyback mechanism where interest is reflected in the token quantity. Buyback tokens adjust the token balance in the holder's wallet when paying interest, maintaining a 1:1 value ratio with the underlying asset. However, some DeFi protocols do not support this token mechanism. To enhance the compatibility of LRT with DeFi protocols, Ether.fi provides the functionality to wrap eETH into weETH, a reward-based token reflecting interest.

Ether.fi rewards LRT holders with EigenLayer points and its proprietary protocol points, called ether.fi loyalty points. To reduce selling pressure on LRT and expand its utility, Ether.fi collaborates with various DeFi protocols, allowing users to deposit LRT into DeFi protocols to continuously accumulate EigenLayer points. Ether.fi also hosts events to increase ether.fi loyalty points for users using their LRT in DeFi activities.

Users can participate in various DeFi activities using eETH or weETH, such as:

- Providing liquidity for the weETH/WETH pool on decentralized exchanges like Curve and Balancer.

- Using weETH as collateral in lending protocols like Morpho Blue and Silo.

- Issuing over-collateralized stablecoins using weETH as collateral in protocols like Gravita.

- Using weETH in derivative product protocols like Pendle and Gearbox.

Through these activities, users can earn EigenLayer and ether.fi loyalty points while earning interest from DeFi protocols or using tokens obtained as collateral with LRT. Ether.fi recently added support for bridging LRT on Ethereum L2 Arbitrum and Mode Network, providing lower gas fees for users to use LRT in DeFi.

On March 18, Ether.fi announced the Token Generation Event (TGE) for its governance token $ETHFI, with a 6% airdrop based on ether.fi loyalty points. The second season airdrop is scheduled for June 30, with 5% of the total ETHFI supply being distributed.

Currently, Ether.fi has the highest TVL in LRP, approximately $30 billion, accounting for about one-fourth of the total re-staking liquidity on EigenLayer.

3.3.2. Kelp DAO

Kelp DAO was initially a basket-style LRP, providing LST re-staking for two assets, Lido Finance's stETH and Stader Labs' ETHx, and issuing a single LRT, rsETH.

Initially, with the increase in the LST re-staking limit on EigenLayer, a large number of users quickly filled the limit but faced high gas fees and inconvenience due to time zone differences. In response, Kelp DAO proposed a solution where users could deposit their LST into the protocol, and once the deposit limit is reached, Kelp DAO would handle the re-staking. Depositors would receive Kelp DAO's proprietary protocol points, Kelp Miles, which attracted a large user base. Like other LRPs, it designed its system to enhance Kelp Miles points when users use their LRT to participate in specific DeFi protocols, encouraging re-staking and LRT usage.

Kelp DAO has now added native re-staking to its product, providing depositors with unlimited opportunities to earn EigenLayer points. Similar to Ether.fi, it focuses on enhancing user convenience by offering re-staking on the Arbitrum network, allowing users to more easily hold and use their LRT in DeFi.

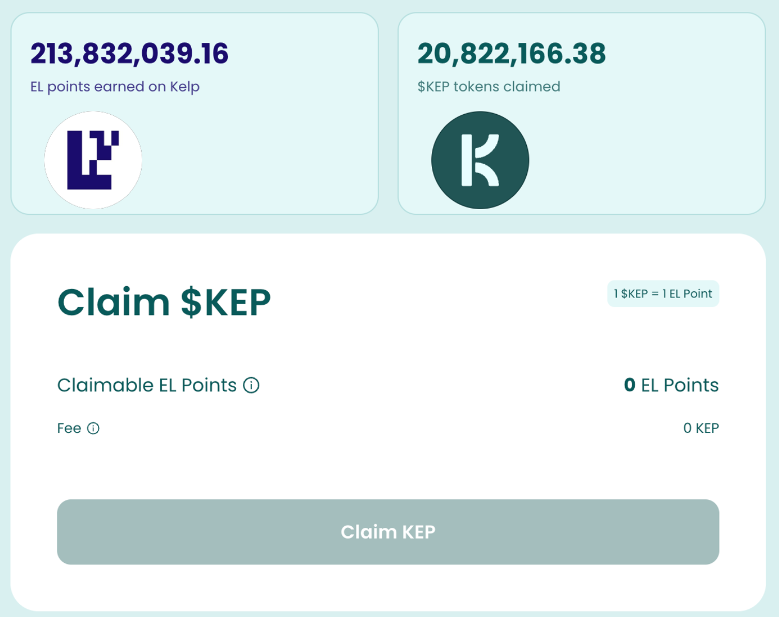

Additionally, Kelp DAO distinguishes itself from other LRPs by allowing users to convert their farm's EigenLayer points into a token called $KEP.

Users can convert their accumulated EigenLayer points into $KEP tokens by paying a 0.5% fee. They can then sell these tokens on the market, monetizing their EigenLayer points or provide liquidity on decentralized exchanges like Balancer, generating additional income and earning Kelp Miles points. Furthermore, users who have not deposited assets in Kelp DAO can also purchase $KEP on the market, effectively gaining the same benefits as accumulating EigenLayer points through Kelp DAO.

```

```

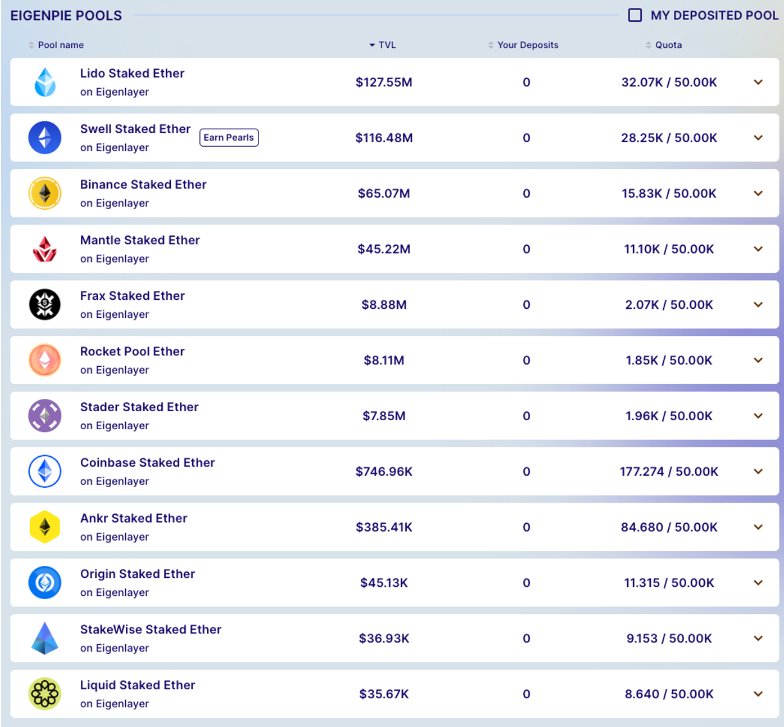

3.3.3. EigenPie

EigenPie is a sub-DAO launched within the MagPie ecosystem, aimed at aggregating governance tokens to have a significant impact on DeFi protocol decisions, especially regarding EigenLayer. It supports re-staking for all LST supported by EigenLayer and adopts a standalone method, issuing and distributing different LRT for each deposited LST.

By isolating pools for each LST, EigenPie is shielded from the risks associated with concentration of specific LST, making it easier to establish partnerships and conduct activities with specific LST protocols. For example, the LSP Swell Network collaborated with EigenPie in an event before launching its native re-staking feature, rewarding users who deposited their native LST, swETH, in EigenPie with Swell Network's proprietary points.

Depositors in EigenPie can accumulate EigenLayer points and EigenPie points simultaneously. It has been announced that users acquiring these points will have the opportunity to participate in the upcoming airdrop and IDO of the governance token $EGP, as detailed here.

However, EigenPie does not support native re-staking, limiting it to the re-staking limit of EigenLayer's LST. Additionally, due to the issuance of twelve types of LRT, its liquidity is more fragmented compared to other LRPs, resulting in relatively fewer partnerships with DeFi protocols.

4. Leveraging Points

LRP acts as an intermediary for re-staking and provides access to EigenLayer points for users through LRT. Additionally, by introducing their proprietary points system and collaborating with DeFi protocols to increase these points through activities, they have attracted a large number of airdrop enthusiasts to the EigenLayer ecosystem.

However, during the initial stages of LRP, there were few lending protocols that could collaborate with LRP to use LRT as collateral. Therefore, users participating in points enhancement activities could only honestly farm EigenLayer points based on the quantity of LRT they held.

Gravita is an over-collateralized stablecoin issuance protocol that allows users to use Ether.fi's weETH as collateral to issue stablecoins. Users can then utilize their position through a process called "cycling" – using stablecoins collateralized by LRT to purchase and deposit more LRT, thereby earning more EigenLayer points. However, high gas fees on the Ethereum network and Gravita's minimum usage requirement (at least issuing 2000 stablecoins) set significant entry barriers for many users attempting to cycle.

The situation changed on January 10, 2024, when Pendle Finance started supporting Ether.fi's eETH, allowing users to engage in leveraged points farming. This development sparked considerable interest among airdrop enthusiasts using Pendle Finance for EigenLayer points farming. As a result, the TVL of EigenLayer and LRP saw significant growth.

4.1. Pendle Finance

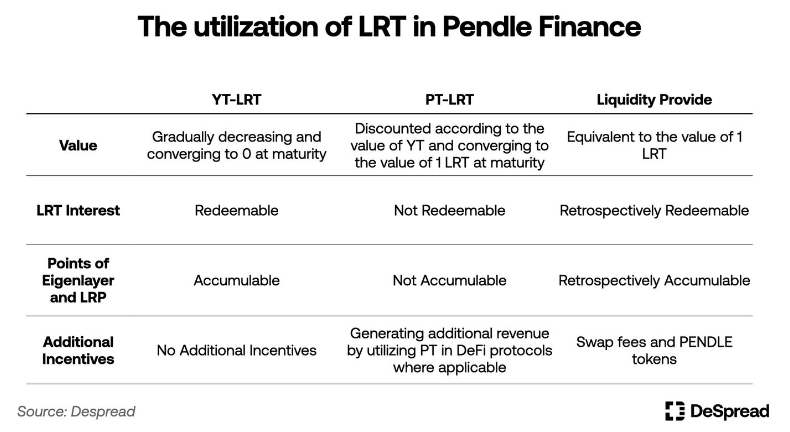

Pendle Finance is a DeFi protocol that allows tradable yield-bearing tokens, such as LST and LRT, by setting a specific maturity date and splitting them into a principal token (PT) and a yield token (YT).

The total value of YT and PT always equals the value of the underlying asset, and YT holders have the right to claim the accumulated interest from the start of holding to the maturity period. Therefore, as the maturity date approaches, the value of YT tends towards zero, while the market value of PT is discounted proportionally with the increasing demand for YT tokens.

Pendle Finance collaborated with Ether.fi to launch Ether.fi's eETH as the first available LRT on its platform. Ether.fi designed a system to allocate EigenLayer points and Ether.fi loyalty points to users holding YT tokens for eETH (YT-eETH). This allows users to purchase YT-eETH close to maturity (becoming increasingly cheaper) and accumulate interest and points until that date.

Here's an example:

The above image depicts the status of the Pendle Finance eETH product at the time of writing, with the following details:

- The product matures on June 27, 2024, approximately 103 days from the writing date.

- The 7-day average annualized yield for eETH is 3.13%, with the current price at $3,872.

- The price of YT-eETH is $196, resulting in a negative annual interest yield of -99.8% if purchased at that value.

- The price of PT-eETH is $3,676, resulting in an annual interest yield of 20.02% if purchased at that value.

At the time of writing, the exchange rate of eETH to YT-eETH is approximately 1:20. Ether.fi is running an activity to provide double Ether.fi loyalty points for users holding YT-eETH. Therefore, a user who exchanges one eETH for YT-eETH and holds it until maturity will receive the following interest and points:

- Interest for holding 20 eETH

- EigenLayer points for holding 20 eETH

- Equivalent to holding 40 eETH in Ether.fi loyalty points

However, since the value of YT-eETH will gradually decrease to zero, the actual amount that holders can recover is only the basic interest generated from 20 eETH. At the current price, this is approximately $640, about one-sixth of the value of one eETH at $3,872, indicating that users are willing to incur this loss by purchasing cheaper YT-eETH to participate in points farming activities.

Due to the highly valued use of YT-eETH for points farming, the discounted PT-eETH has also become an attractive investment option as the discount rate increases. Additionally, the demand to provide LP to the trading pool of Pendle Finance's eETH product has increased as users seek incentives. Currently, approximately one-third of all LRT issued on Ethereum is used by Pendle Finance.

After collaborating with Ether.fi, Pendle Finance continued similar partnerships with other LRPs, increasing the supported LRT and providing leveraged points farming for EigenLayer and LRT through the Arbitrum network. Recently, derivatives using the undervalued PT-eETH as collateral have emerged on Silo Finance, allowing Pendle Finance to benefit from the EigenLayer ecosystem, resulting in a tenfold increase in TVL since the beginning of the year.

4.2. Gearbox

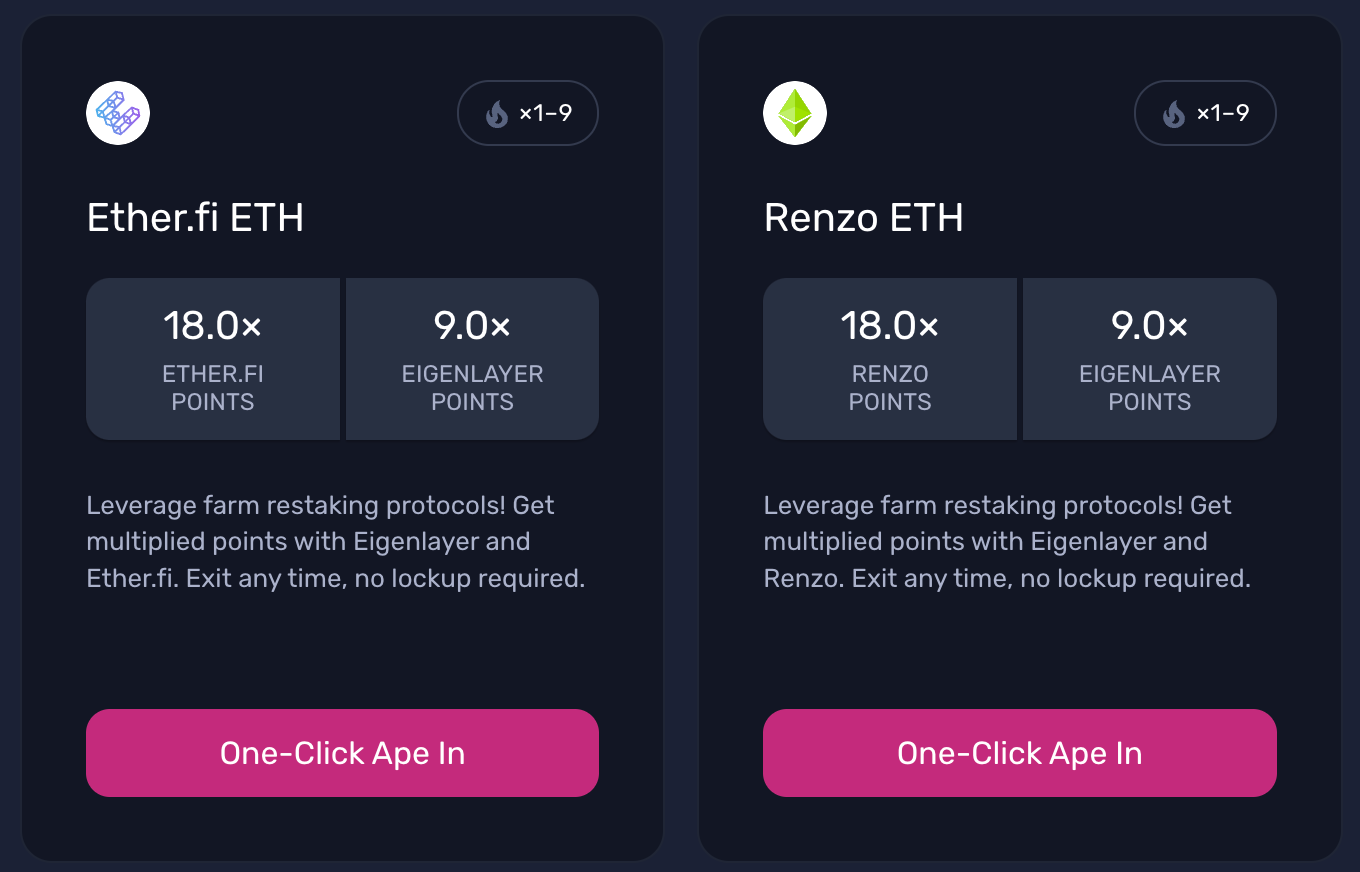

Gearbox is a leveraged yield protocol that differs from traditional lending protocols like Pendle Finance in how it attracts users.

In Gearbox, borrowers must create a smart contract called a credit account before borrowing assets. They can then leverage their positions by depositing their collateral assets and borrowed assets from the protocol into the credit account. Borrowers can then use leveraged spot assets for margin trading provided by Gearbox through the credit account, or participate in various DeFi yield farming opportunities such as Convex and Yearn Finance.

With this structure, Gearbox has launched leveraged points strategies in collaboration with LRP protocols. Gearbox allows the accumulation of EigenLayer points and LRP native points in the credit account, sending them to the borrower's wallet, providing users with up to 9x leverage points.

Gearbox leveraged points farming, source: Gearbox

Compared to Pendle Finance, Gearbox offers a more intuitive UI/UX, making leveraged points farming easily accessible even to users unfamiliar with DeFi. Within just three weeks of launching the leveraged points farming feature, Gearbox was able to increase TVL by approximately 5x.

5. Risks

Many protocols using ETH as collateral on the Ethereum network are interconnected, forming a vast ecosystem. Currently, derivative protocols using LRP, LRT, and EigenLayer points are emerging, and there are many discussions about the growth potential of the EigenLayer ecosystem. However, there are also concerns about potential risks associated with EigenLayer.

The EigenLayer whitepaper outlines fundamental risks associated with EigenLayer: collusion among AVS-secure operators to misappropriate AVS funds, and penalties due to unexpected vulnerabilities such as AVS programming errors. Improvements to address collusion among operators include implementing systems to monitor the likelihood of collusion and diversifying operators by incentivizing them to focus on smaller AVS. Improvements to address unexpected penalties include thorough AVS security audits and community veto power over penalties.

Even with these mitigated risks, there are still unobserved risks due to entrusting stakes to EigenLayer operators and the main AVS-secure functionality not yet running on the mainnet. Additionally, when using LRT and its derivative protocols, there are additional risks of vulnerabilities in various protocol contracts and oracles being exploited. Furthermore, excessive borrowing of LRT through derivative protocols could lead to significant chain liquidations even with minor penalties from EigenLayer.

Ethereum founder Vitalik Buterin also expressed concerns about EigenLayer by publishing an article titled "Don't Overload Ethereum's Consensus", hinting at the possibility of validators conducting a social consensus attack through staking on EigenLayer to hard fork the Ethereum network for their own interests.

6. The Future of EigenLayer

In the short term, EigenLayer is preparing to launch its first AVS – EigenDA, and is set to release a second phase update that will allow for secure sharing and reacquisition of interests on the AVS.

EigenDA, created by the team behind EigenLayer, is an AVS (Availability Security Sublayer) that leverages the security of EigenLayer to provide a data availability layer without an independent consensus algorithm. Currently, several second-layer chains, including Celo, Mantle, and Fluents, have mentioned using EigenDA as their data availability layer.

Furthermore, after the launch of the second phase mainnet, there are plans for a third phase test that will allow for sharing security with other AVS outside of EigenDA. Many prominent projects such as Ethos, Hyperlane, and Espresso are preparing to obtain security guarantees from EigenLayer after the launch of the third phase mainnet.

In this journey, it is uncertain whether EigenLayer will launch a token, and if so, what role the token will play in EigenLayer and what incentives it will provide to users for accumulating points. However, if EigenLayer continues with token airdrops, let's judge the mid-to-long-term future of EigenLayer based on the author's perspective.

6.1. Token Economics of EigenLayer

Assets deposited in EigenLayer are used for AVS security. Therefore, the TVL of EigenLayer not only indicates how much assets are deposited in EigenLayer, but can also be interpreted as the overall security index of AVS. However, after the airdrop, the TVL of EigenLayer may decrease as a result of airdrop enthusiasts withdrawing their re-staked liquidity. Therefore, if EigenLayer were to announce a token economics plan, it is possible to design a token economics centered around maintaining the liquidity re-staked so far, attracting more AVS based on that liquidity, and encouraging more re-staking to strengthen network effects.

Especially at the initial launch, it is expected to provide tokens as an additional incentive for operational diversification. Additionally, when multiple AVS register on EigenLayer to receive security guarantees, it is expected to distribute EigenLayer tokens as an additional incentive to operators and re-stakers providing security guarantees for AVS to achieve risk diversification.

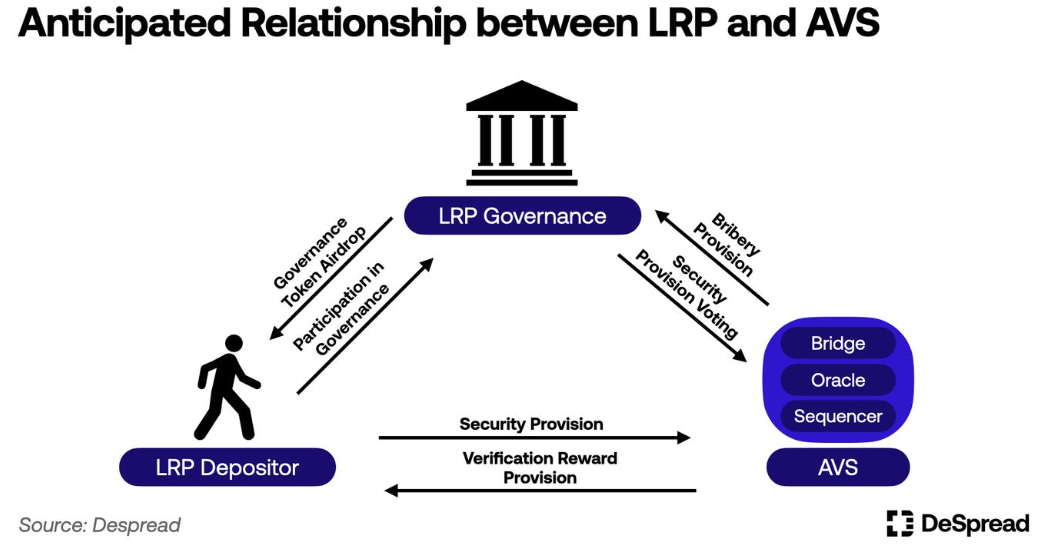

6.2. Relationship between LRP and AVS

AVS may airdrop their own tokens to re-stakers to attract more security guarantees. The RaaS (Rollup as a Service) protocol AltLayer, which is about to become an AVS on EigenLayer, has issued its own token $ALT and airdropped a portion to re-stakers on EigenLayer.

In January 2024, protocols such as Dymension and SAGA announced the adoption of Celestia as their data availability layer and revealed plans to airdrop their native token $TIA to their investors, resulting in a doubling of the $TIA quantity in the network. Similarly, airdrops for re-stakers of AVS like AltLayer could potentially drive the market narrative after the launch of the EigenLayer token.

Furthermore, from the perspective of AVS, promoting their AVS through LRPs, where re-stakers and security choices are numerous, can achieve greater impact at lower capital costs, rather than making unilateral airdrop promises and promotions to an unspecified majority. Therefore, it is expected that various collaboration announcements between LRPs and AVS will increase. For example, Omni Network, which supports cross-rollup network messaging functionality, has announced a partnership with Ether.fi and revealed receiving approximately $600 million in staking support from Ether.fi. This announcement has sparked expectations for the airdrop of Omni Network tokens to Ether.fi stakers.

Additionally, it is expected that LRPs will attempt to systematize their interoperability with AVS through token economic systems. For example, LRPs may distribute governance tokens to re-stakers, allowing them to choose which AVS to provide security for. Users voting for AVS using these governance tokens may receive rewards in the form of the native tokens of the AVS. This structure will strengthen the incentive alignment between re-stakers, LRP governance token holders, and AVS.

6.3. Evolution of LRT Utility

Currently, most re-stakers in DeFi protocols like Pendle Finance use LRT to maximize points leverage, optimizing their points farming in EigenLayer. However, the sustainability of the points system remains uncertain after the issuance of the EigenLayer token. With the expected decrease in the value of EigenLayer points among re-stakers, it may lead to a decrease in TVL for leverage points protocols.

However, LRT has the potential to offer the highest rates after providing AVS security, which may be higher than tokens pegged to the value of ETH. Therefore, DeFi protocols that previously used ETH or LST could provide higher returns to users by integrating LRT.

Currently, lending protocols like Morpho Blue and Silo Finance, as well as platforms like Gravita for over-collateralized stablecoin issuance, allow the use of LRT as collateral. Additionally, platforms like Whales Market facilitate over-the-counter trading using weETH (Ether.fi's LRT) as collateral. The utility of LRT is expanding, as seen from the recent launch of Liquid by Ether.fi, which allows Ether.fi's LRT to generate returns in various DeFi protocols.

LRPs like Ether.fi and Renzo officially support LRT bridging and native re-staking on second-layer networks such as Arbitrum, Mode Network, and Blast, allowing DeFi protocols to adopt LRT as an asset on second-layer networks. Additionally, the project Mitosis, aiming to be a modular rollup network liquidity hub, is collaborating with Ether.fi to expand the interoperability of LRT across different chains.

6.4. Superfluid Re-staking

Returning to the discussion of re-staking, the EigenLayer whitepaper introduces a method called superfluid re-staking, which exists parallel to native re-staking and LST re-staking.

Superfluid re-staking involves providing liquidity to AMM DEX pools containing ETH and LST, such as Uniswap and Curve, and re-staking the obtained LP tokens into EigenLayer. This method allows investors to earn re-staking rewards and interest from fees generated by the pool.

Although the whitepaper has not formally mentioned the possibility of EigenLayer supporting superfluid re-staking, the possibility remains open. If EigenLayer adopts this feature in the future, it may pave the way for the emergence of various derivative protocols, creating another aspect of the ecosystem.

Vector Reserve is a protocol designed with superfluid re-staking in mind, which provides various LRT and LST as liquidity to DEX pools and issues an index token vETH backed by the value of LP tokens. Vector Reserve plans to enhance its functionality after EigenLayer begins supporting superfluid re-staking.

7. Conclusion

EigenLayer has evolved from a simple concept of sharing Ethereum network security and generating additional income to expanding its ecosystem to meet the needs of infrastructure builders and investors, launching numerous derivative projects. AVSs like bridges and sorters leverage the security of Ethereum to establish their own network security, while investors see the potential to maximize capital efficiency in ETH by leveraging LRT beyond LST.

Despite the high risks associated with AVSs based on EigenLayer not yet running, many users are still participating in re-staking to acquire points with no clear purpose. Additionally, user interest in EigenLayer points has accelerated through LRPs and derivative protocols, resulting in the capital within the supported LRT in the current stage being used to build a vast empire.

EigenLayer has undoubtedly sparked interest and expectations in the infrastructure industry and the crypto market. With its full operational launch on the mainnet, it will be necessary to closely monitor whether EigenLayer will bring about the anticipated new DeFi Summer for Ethereum, or as some are concerned, exacerbate the complexity of Ethereum and potentially lead to a chain collapse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。