Author of the original text: Zackary Skelly, Chris Ahsing

Original translation: Frank, Foresight News

The cryptocurrency industry is developing rapidly, but the industry's salary data is very scarce, especially comprehensive analysis data, which may become a key stumbling block for cryptocurrency startups seeking strategic growth. Therefore, the annual salary survey conducted in this report is to fill this gap.

In short, this report will provide a more detailed dataset related to cryptocurrency compensation and hopes to provide a clear overview of cryptocurrency industry salary trends in a way that is easy to understand and useful for anyone setting, negotiating, or trying to understand compensation (whether it's a recruiting team, candidates, or industry observers).

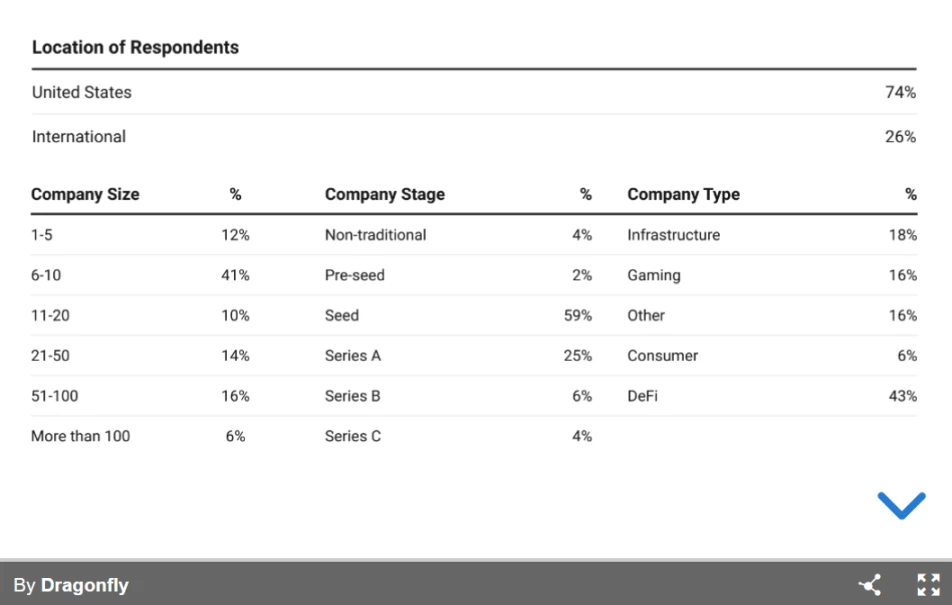

Demographic information record

The analysis in this report is based on a survey of 49 portfolio companies in 2023, and is based on available data to reflect overall trends. Further research on a larger sample size will help confirm these trends. We recommend interpreting the survey results based on the listed respondent response rates and the following points:

Roles: "Crypto Engineer" refers to engineers focused on protocol or blockchain development, "Marketing" includes sales, marketing, and business development, and compensation reflects total target income including commissions;

Reporting method: We asked companies to select preset salary ranges for employees at different seniority levels so that we can report the average minimum and maximum salary ranges. However, for founder compensation, we use the median value based on free responses in the survey;

Founder ownership: Founder compensation mainly refers to the percentage of equity/tokens owned, without distinguishing between the two;

"International" definition: "International" refers to companies not in the United States;

"Non-traditional" definition: "Non-traditional" financing companies have either conducted public token sales or are DAOs;

Rounding: Due to rounding, there may be very small errors in some numbers (e.g. demographic information);

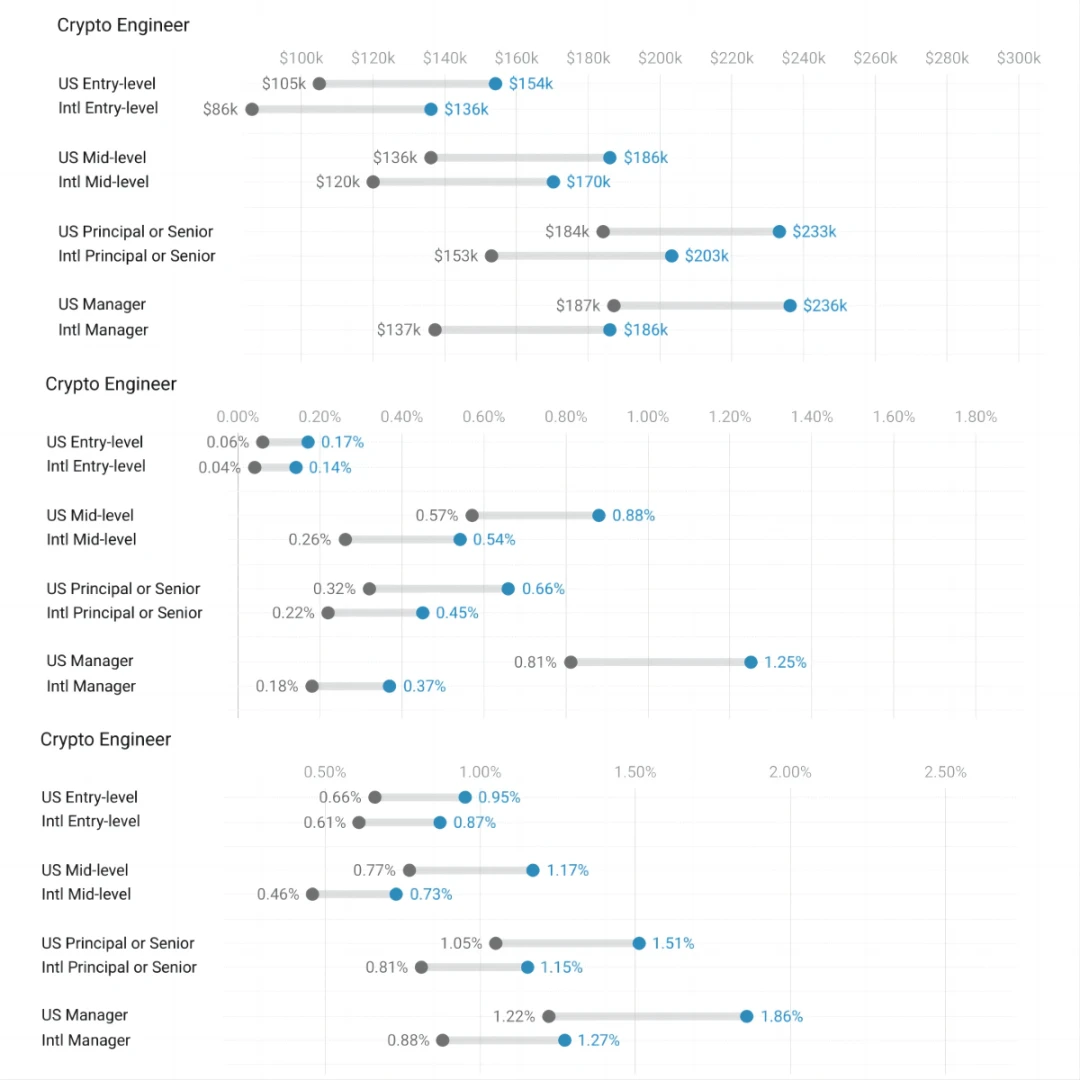

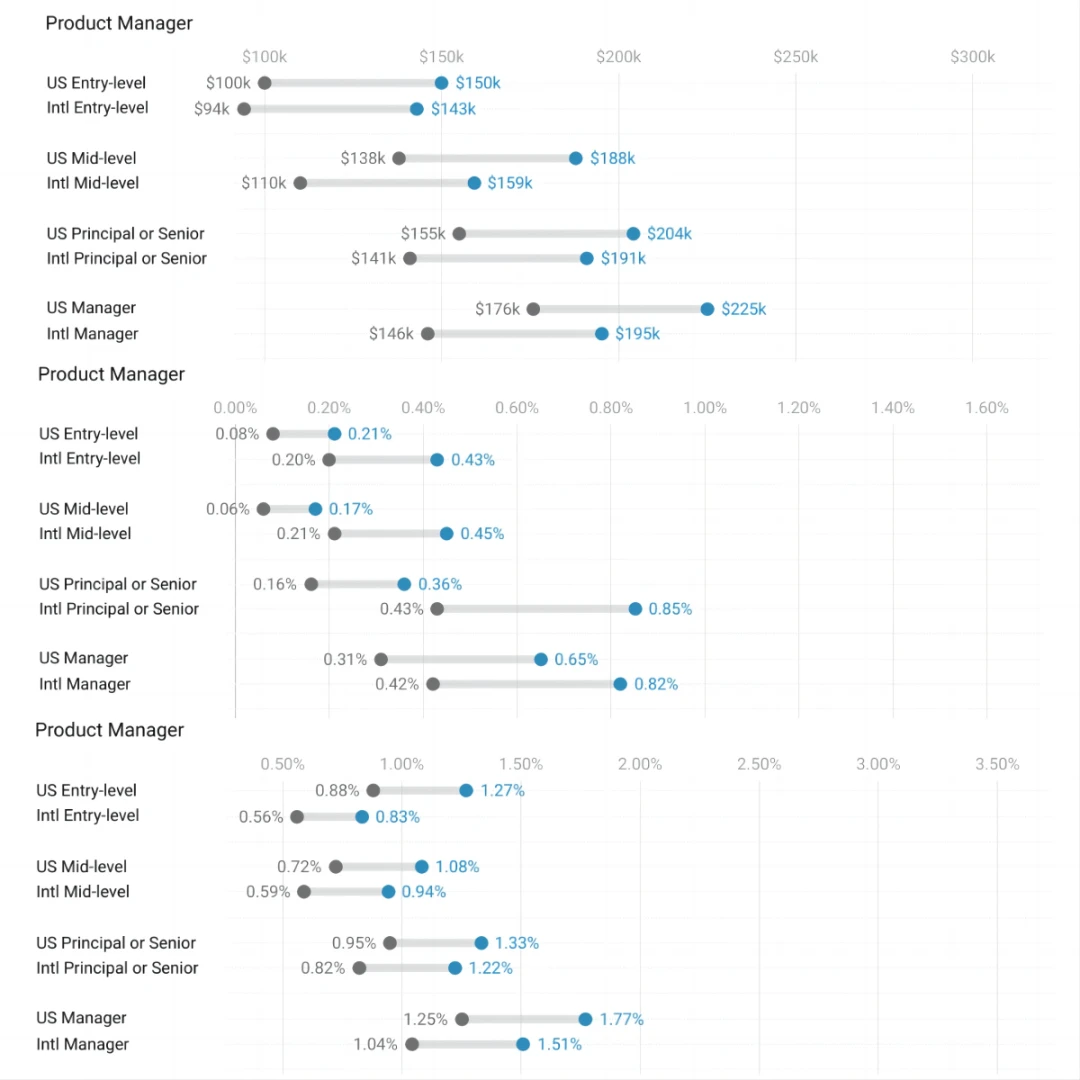

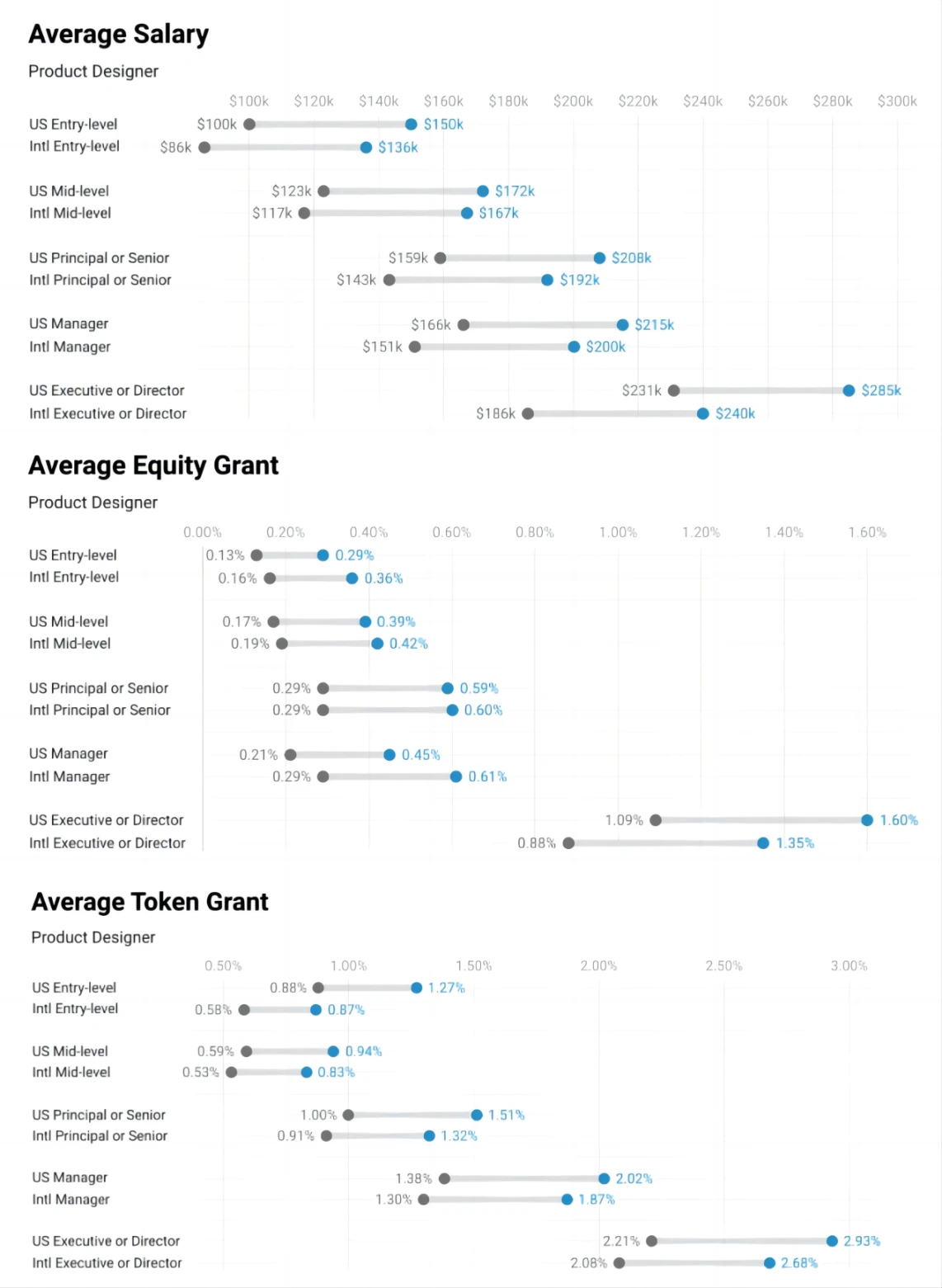

Salary, Equity, and Token Compensation Ranges

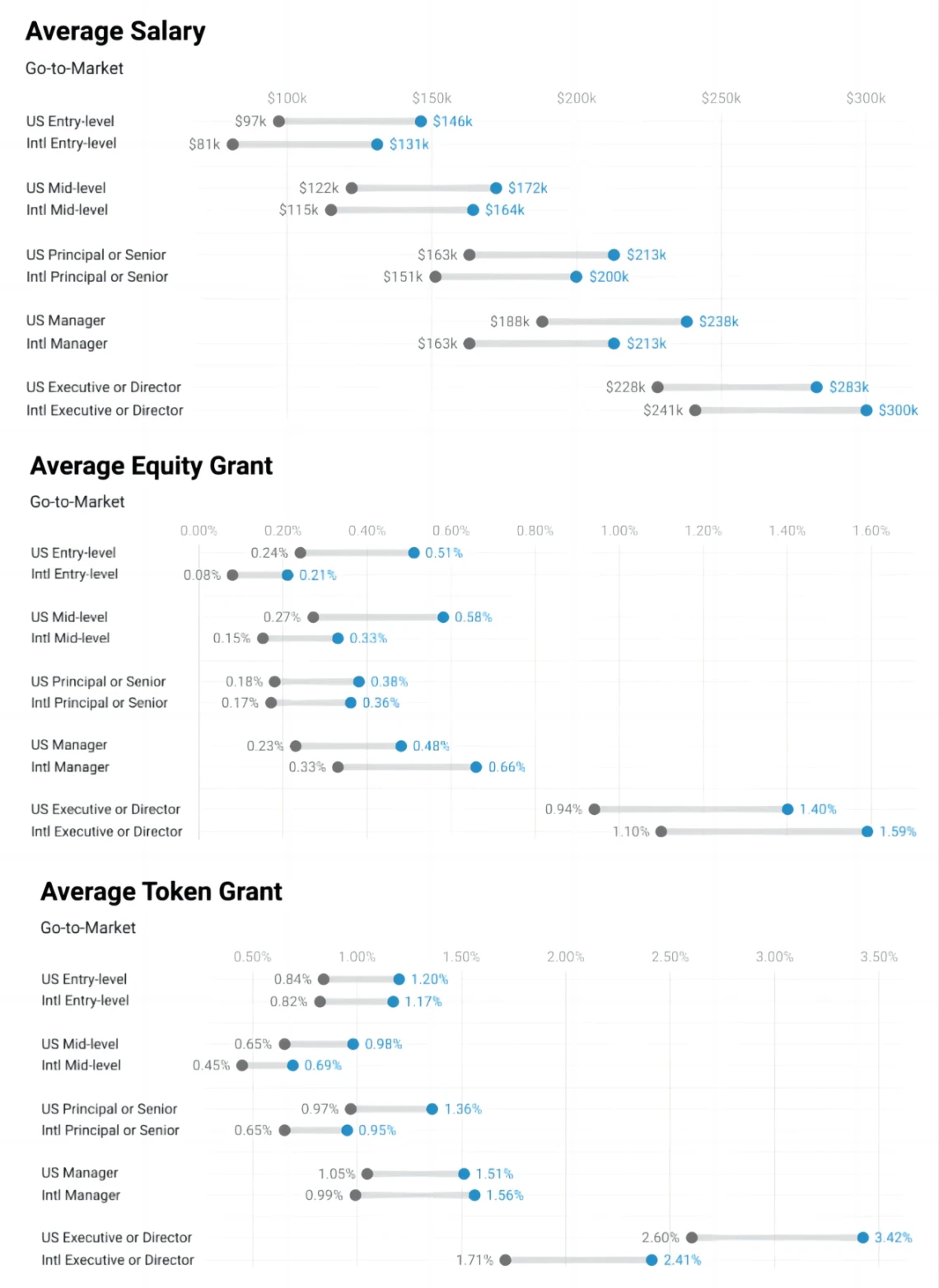

Below are the salary, equity, and token compensation ranges for different employee roles, divided into US and international companies: software engineers, crypto engineers, product managers, product designers, and marketing personnel.

Compared to international companies, almost all positions and seniority levels in the US have higher compensation. On average, US companies have roughly 13% higher compensation and about 30% higher equity and token reward plans.

Some interesting data and outliers:

The equity and token plans for product designers in international companies are closer to US data than other positions;

Product managers in international companies have significantly higher equity compensation across all levels, which is unique among all positions;

The compensation and equity for marketing personnel at the executive/director level in international companies are higher than those in similar positions in US companies;

Observations on robustness and reliability:

Observations on compensation: The data shows that compensation for different roles and seniority levels is generally reliable, especially for comparing the US and international markets;

Observations on equity and tokens: In the US, equity data is relatively reliable, and token compensation data may be more reliable, especially for international data and lower seniority levels;

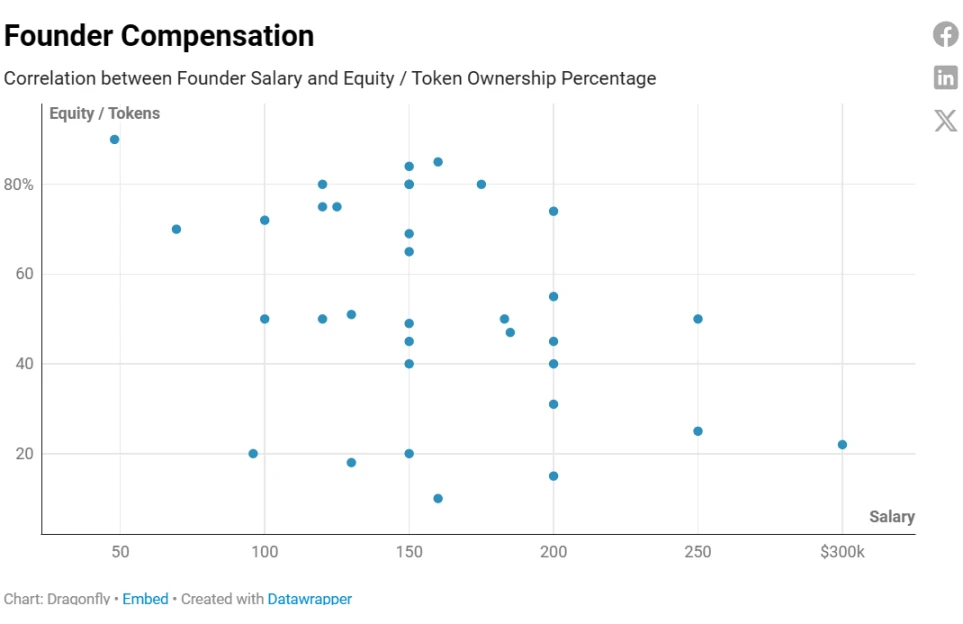

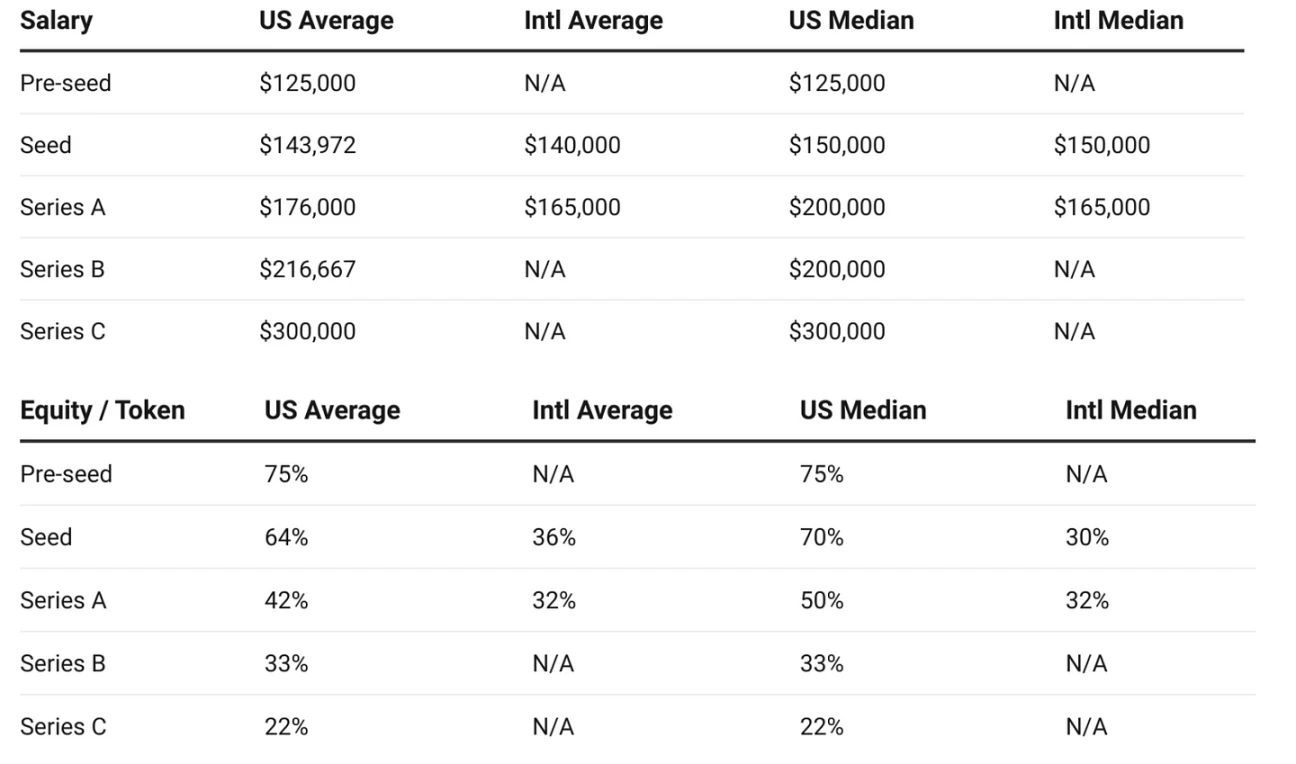

Founder Compensation

As expected, as companies raise more funds, founder compensation increases, while the percentage of equity/tokens held decreases, possibly due to dilution of shares. Most founders reported that their compensation was below average before Series B financing.

Due to the lack of international data for seed, Series B, and Series C stages, it is difficult to compare the situations of founders in US and international companies. However, it is interesting to note that when comparing seed and Series A financing stages, the compensation for US founders is usually slightly higher, but the ownership of equity is significantly higher, especially in the seed stage.

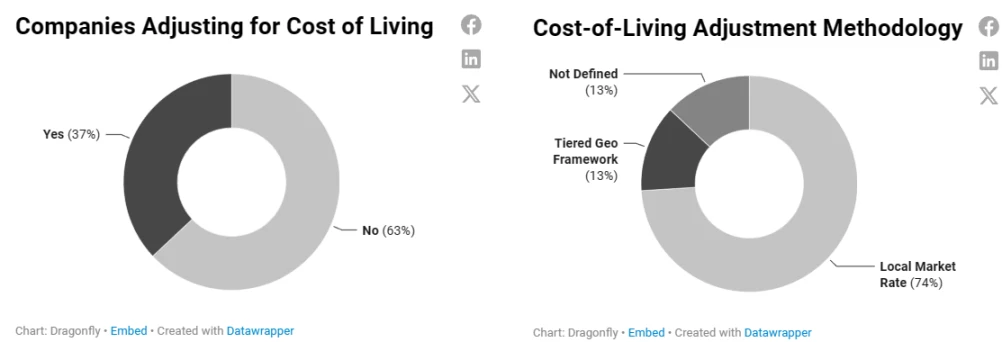

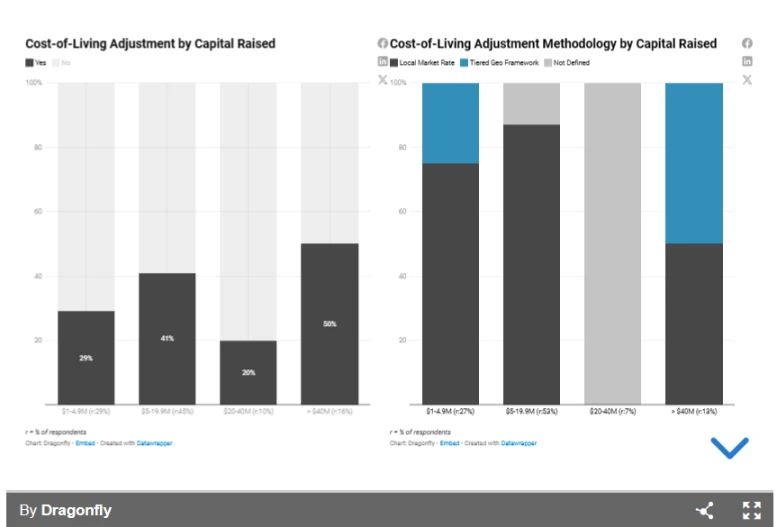

Cost of Living Adjustment and Methodology

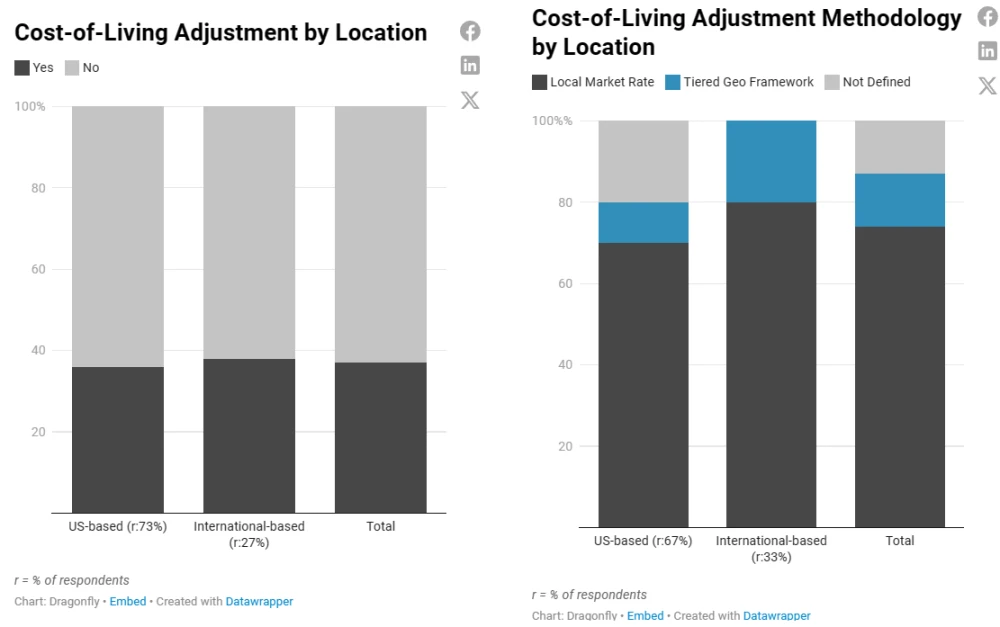

Most companies do not adjust salaries based on the cost of living (COL).

Among the companies that do make adjustments, we see two common methods:

Adjusting based on local market prices (this is a very popular method);

Or adjusting within a tiered geographic framework. With this method, companies first determine the salary benchmark from specific locations (often highly competitive areas), and then adjust each person's offer by a certain percentage based on geographic levels (sometimes using a radius from major metropolitan areas) to balance internal salary fairness and external competitiveness across different regions;

Companies that do not adjust salaries based on the cost of living typically believe that their compensation is strictly tied to the value someone creates for the company, regardless of where they are, which will continue to provide a competitive advantage in recruiting speed and attracting top talent. Nevertheless, we always encourage companies to consider the most sustainable way to build a high-performance team within their budget.

Teams may also decide not to make cost of living adjustments due to overall fairness in purchasing power across different regions of the world, as not everyone living in high-cost areas can afford to give up their lifestyle and move to cheaper places to enjoy the benefits of cost differences.

We expect to see more middle-ground situations in the future, where some companies will shift from cost of living adjustments to labor cost adjustments. You can understand it this way:

Cost of living: "We will adjust your salary based on local market rates in your area";

Labor cost: "We will adjust your salary based on the demand for your position in your area";

For example, the cost of living in some remote areas of Texas may be lower, but the demand for petroleum engineers there is high, which will drive up the salaries for these positions.

Currently, there is not enough industry data to easily adopt labor cost adjustments (especially in the crypto field, such as the demand for protocol engineers in specific cities/countries). However, many compensation experts and data providers are considering this model, and we do believe that teams can benchmark and adjust for more standardized/general roles.

Having real-time salary and hiring demand data is crucial, and supplementing with available market data and salary data collected from candidates could be helpful. We may explore trends related to this in the next salary survey, although we have not seen many teams adopt this approach yet.

In summary, we expect recruitment strategies to vary by role: for example, if you are hiring for a non-differentiated engineering position (e.g., a regular front-end engineer), you would pay the adjusted salary for that candidate; but if you are hiring for a globally competitive differentiated position (e.g., a Solidity engineer), you may need to strictly pay based on their work value.

Ultimately, this boils down to the recruitment dilemma we often discuss: speed, cost, and quality. At any given time, you may only be able to optimize two of these three factors.

In terms of adjusting for cost of living, both US and international companies show similar proportions, although international companies slightly lean towards using local market rates for adjustments.

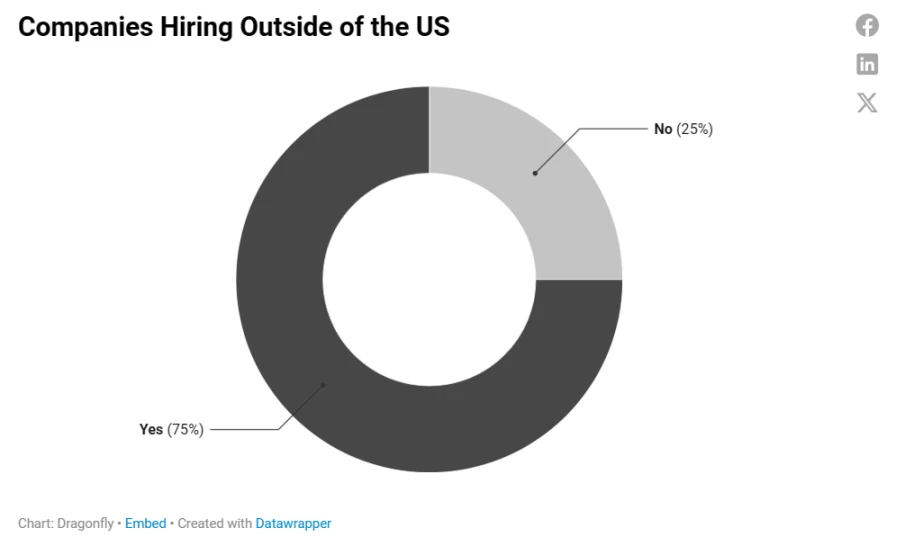

Of all surveyed companies, regardless of their size, stage, or funding situation, 75% recruit talent outside the US.

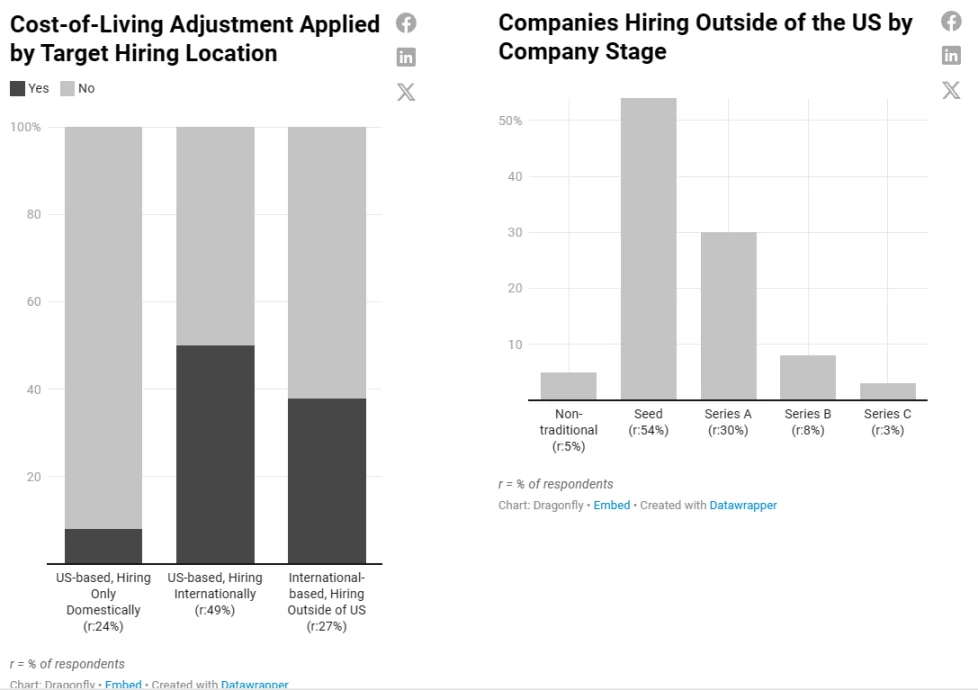

US companies recruiting only domestically are unlikely to adjust based on cost of living—this may be a statement about the competitiveness of the US recruitment market and the relative stability of cost of living compared to international locations, while US companies recruiting internationally are split in their adjustment practices.

All international companies recruit employees outside the US, and most do not adjust based on cost of living.

Companies tend to reduce recruiting outside the US in later funding stages, however, it is worth noting that most respondents in this specific analysis are located in the US.

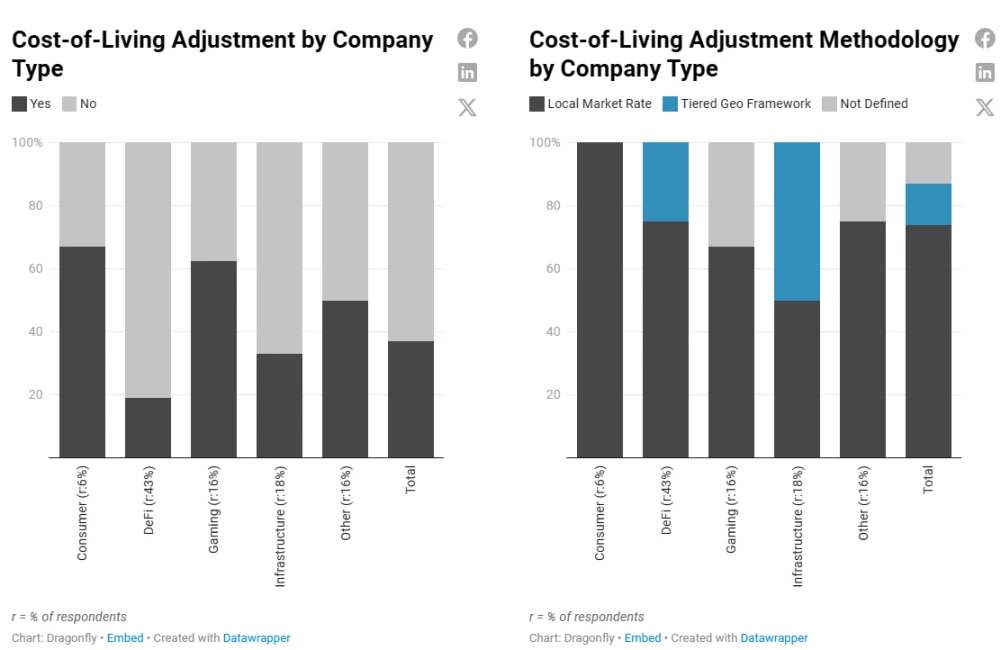

While most companies adjust based on local market rates, infrastructure companies (which all recruit internationally and are among the largest and most resource-rich companies in this survey) are most likely to use a more intensive tiered geographic approach.

There is a clear trend: most companies do not adjust based on cost of living in the early stages, but the likelihood of doing so increases as the company matures.

Seed and pre-seed companies with 1-10 employees are unlikely to adjust based on cost of living, allowing them to be more competitive in recruiting, as building a solid core team at this stage will have a profound impact on the company's entire lifecycle.

Additionally, they may lack operational expertise or resources to deploy more complex compensation structures and budget strategies, and may not be recruiting in as many locations.

By company size, the likelihood of adjusting based on cost of living increases more noticeably over time.

For almost all company sizes, stages, and funding levels, paying local market salaries is the preferred option, indicating its attractiveness as a fair, competitive cost of living adjustment method (and also the simplest method apart from ad hoc "undefined").

Note that once a decision is made on which approach to take, it is difficult to reverse the decision to adjust based on cost of living and maintain fairness, which can affect employee morale, fairness, and company branding.

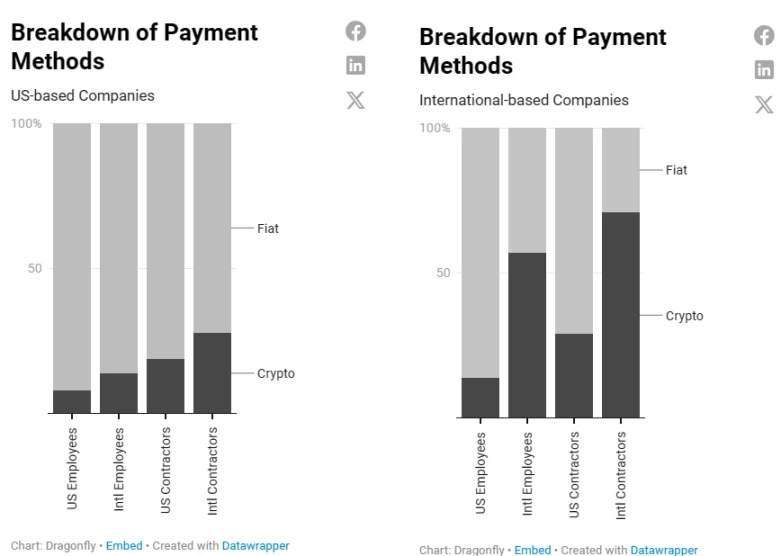

Payment Methods (Fiat Currency vs. Cryptocurrency)

In most cases, companies use fiat currency to pay salaries.

In terms of paying with cryptocurrency (e.g., USDC), international companies are leading, especially when paying international employees. Regardless of location, US companies are more inclined to use cryptocurrency to pay contractors' fees rather than employee salaries; they also prefer to use cryptocurrency to pay international employees' fees, whether they are employees or contractors.

Companies paying with cryptocurrency internationally often do so to simplify cross-border transactions, mitigate exchange rate fluctuations, and/or take advantage of tax benefits in certain jurisdictions. This is also very useful for companies with employees in areas with limited banking infrastructure or for companies requiring privacy (e.g., companies with anonymous contributors).

As cryptocurrency regulations and legal distinctions between employees and contractors continue to evolve, global employee payroll service providers (such as Liquifi) are simplifying adoption processes by incorporating compliance into their services and natively supporting cryptocurrency transactions. Over time, we would not be surprised if this has an impact.

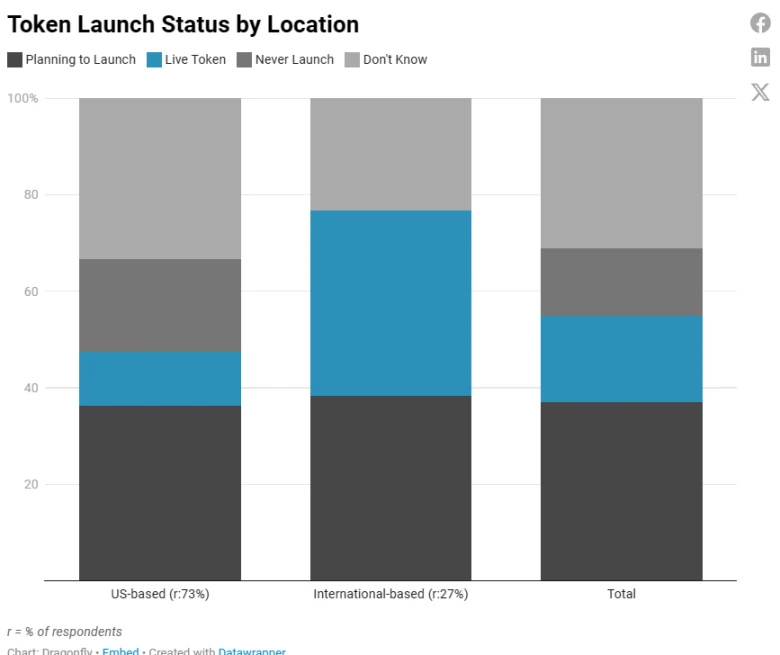

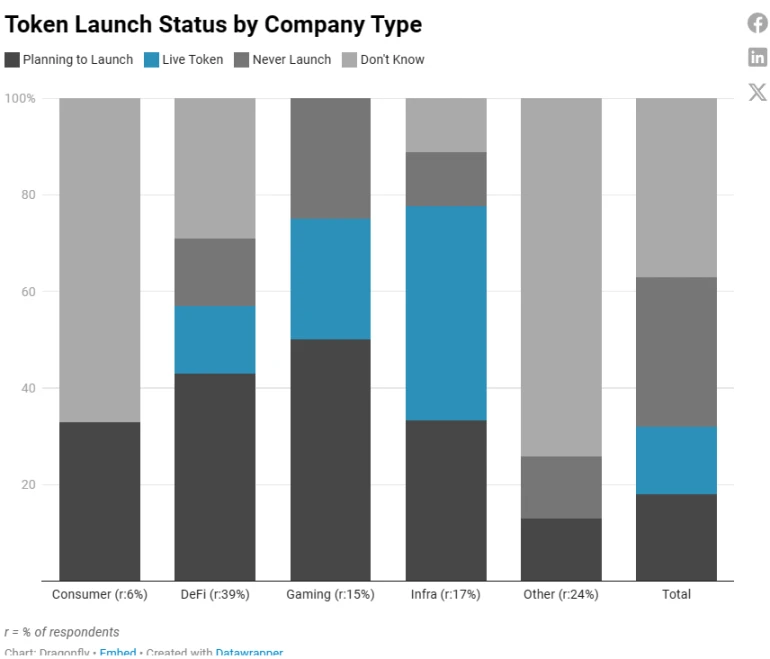

Likelihood of Companies Having Tokens

Companies in our portfolio are strongly considering adopting tokens, with only 14% explicitly stating that they will never launch tokens.

International companies are more inclined to adopt tokens, with a higher proportion of them either owning or planning to launch tokens. While some companies are uncertain about future plans, none completely rule out this possibility.

US companies may have a more diverse response due to regulatory environment, with fewer companies actually owning tokens, more teams being undecided about their plans, and more teams choosing not to adopt tokens at all.

Overall, infrastructure companies are leading in token adoption, with over three-quarters of them either owning and using tokens or planning to launch tokens. These companies may use tokens as base currency (especially on L1 and L2 blockchains).

Following closely are gaming companies, highlighting the growing importance of tokens in in-game assets, currencies, rewards, incentives, gated content (special content unlocked with tokens), and occasional governance. The DeFi sector is also prominent, with tokens closely tied to its governance, staking, and reward business models.

Consumer-oriented companies show initial interest, often integrating tokens into more traditional business models, while the "other" category presents a great deal of uncertainty.

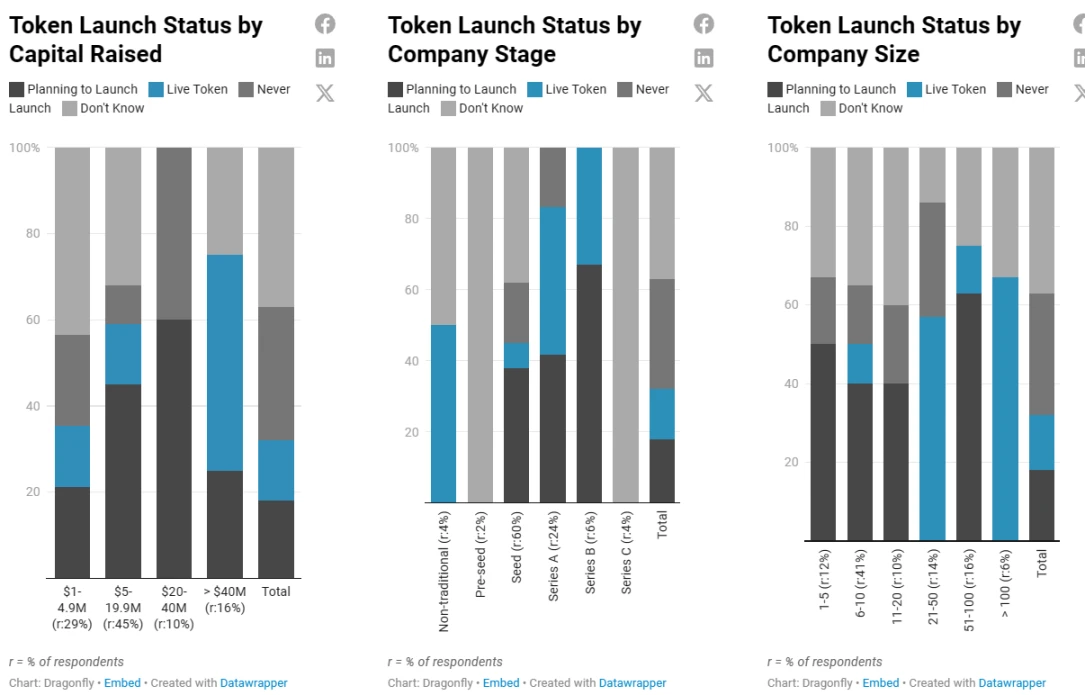

Although the data overall indicates that as funding amount, stage, and scale increase, companies are more likely to plan and launch tokens, these factors do not form a simple narrative.

Small early-stage startups, especially in the seed round with funding between $1 million and $4.9 million, are interested in exploring tokenization, but few companies launch tokens at this early stage. The trend of launching tokens becomes more apparent as the number of employees increases and more funding is secured, particularly in the A and B funding rounds.

Companies with funding amounts between $20 million and $40 million are an exception, actively planning to launch tokens, but none have actually done so. They belong to the seed, A, and B funding rounds.

For the largest companies with funding amounts exceeding $40 million and over 100 employees, the proportion participating in token activities is significantly higher. An interesting exception is the hesitation of companies in the C funding round; they may be reconsidering how tokens fit into a mature product or considering using tokens in new projects/joint ventures.

Related to this, among all companies with funding amounts exceeding $40 million (the highest funding range in the report), 75% are focused on infrastructure development, a field that inherently requires substantial funding and often integrates tokens into their products.

Token/Equity Compensation Plans

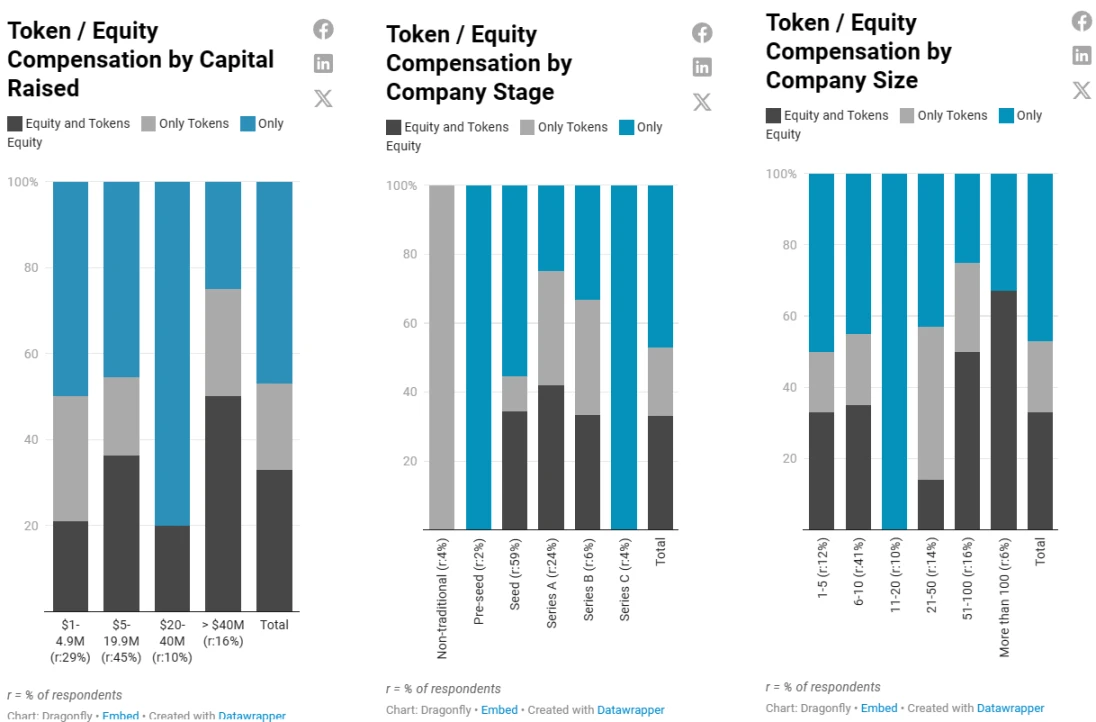

Companies typically offer salary plus equity, tokens, or a combination of both as compensation, which is crucial for founders and candidates to consider when planning compensation or evaluating offers, taking into account how the company generates value and whether that value is reflected in tokens or equity.

Close to half of the companies only issue equity as compensation. However, it is worth noting that most companies indicating a potential future token launch (but uncertain at present) currently only issue equity, while all projects with actively used tokens include tokens as part of compensation. It should be noted that those uncertain companies may eventually change their minds.

We have seen other reports mentioning a decreasing trend in companies offering tokens as compensation over time, and we are curious to see the trends as our own data accumulates.

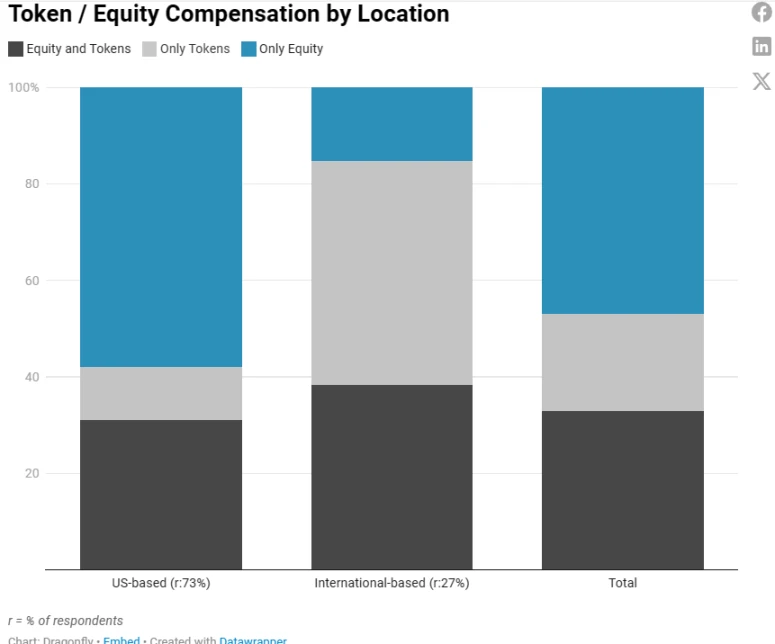

Both US and international companies have a portion that offers a combination of equity and tokens as compensation. However, preferences differ: more US companies only issue equity, while more international companies only issue tokens (overall, international companies seem to lean towards tokens).

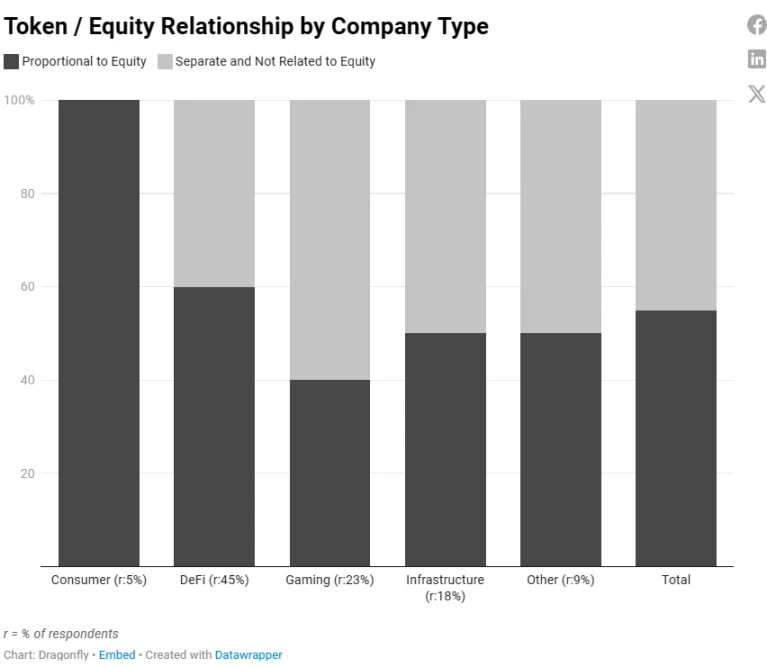

Although infrastructure companies are most likely to own or plan to launch tokens, most of them only issue equity, rather than only issuing tokens or a combination of both.

The DeFi sector (another area where tokens are more common) follows a similar trend, although the compensation methods are slightly more balanced. Gaming companies show a strong preference for offering both equity and tokens, notably, no gaming company only offers tokens.

All consumer and other types of companies either do not know if they will launch tokens or ultimately do not plan to, so it is understandable that the majority of companies only offer equity.

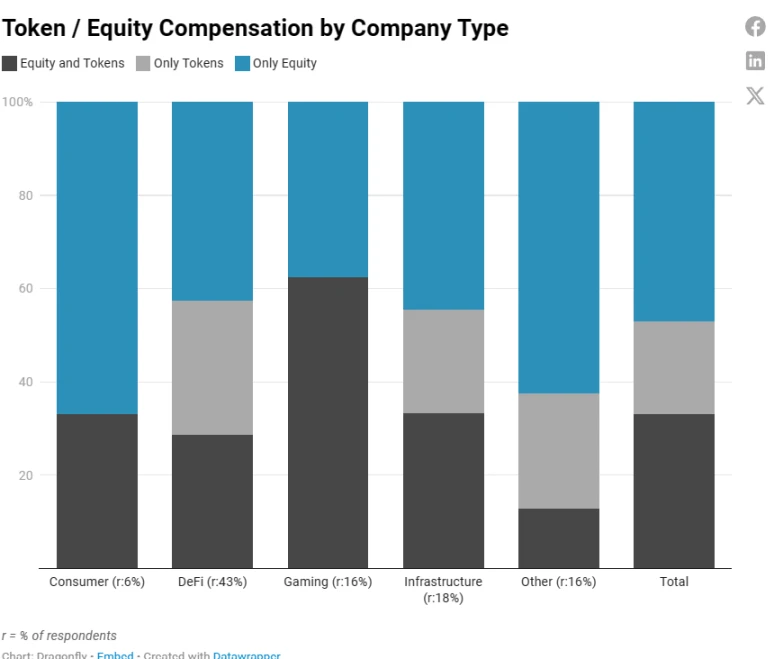

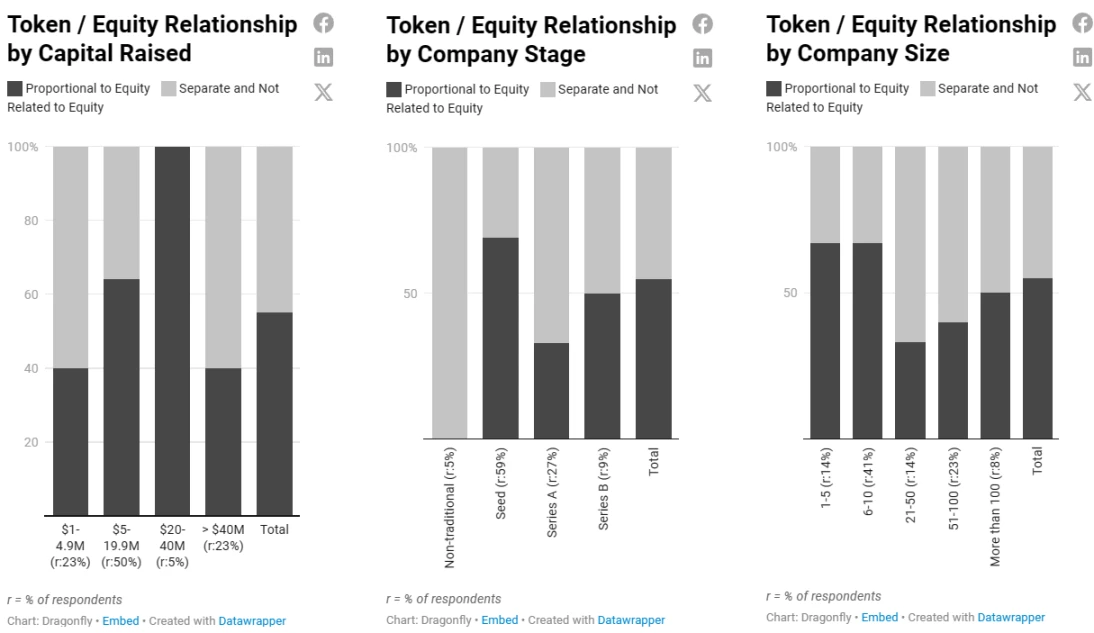

Considering factors such as funding amount, company stage, and company size, we note the following:

First, early-stage startups primarily use equity incentives, and as companies secure more substantial seed funding, their compensation strategies become more diverse.

In the Pre-Seed stage, we see that all companies only offer equity incentives (as mentioned earlier, all Pre-Seed stage companies surveyed do not know if they want to launch tokens). A few companies that raised between $1 million and $4.9 million in the seed round begin to offer token incentives, but overall, they still primarily offer equity incentives.

Companies with funding amounts between $5 million and $19.9 million typically remain in the seed round and have over 10 employees. Overall, more and more companies start to offer token incentives and also more frequently offer a combination of equity and tokens.

Second, as the number of employees grows, companies generally tend to offer a combination of equity and token incentives.

Relationship Between Tokens and Equity

Most companies' offerings of tokens are proportional to equity (which may indicate that they use the "token ratio" calculation method described below).

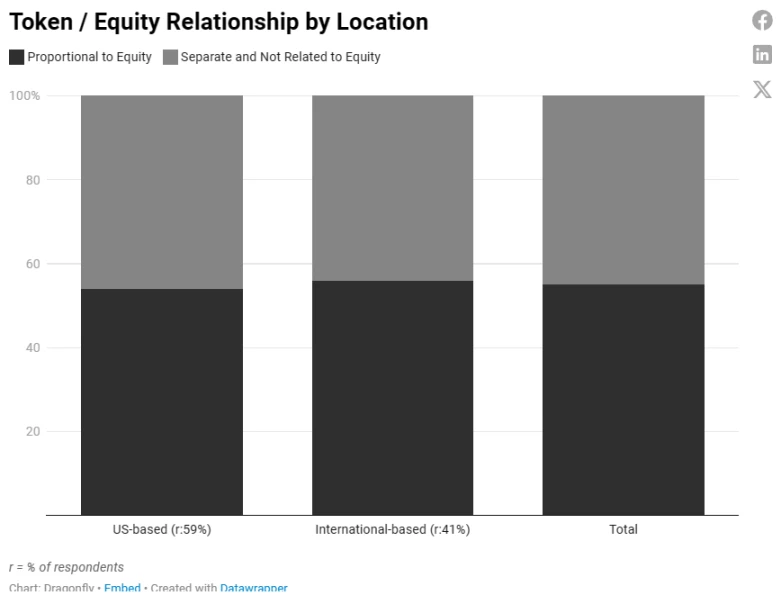

US and international companies show a balanced distribution in the proportion relationship between tokens and equity, but slightly favor the proportion relationship.

The preference for the proportion relationship also remains relatively balanced among company types, with infrastructure companies and "other" types of companies equally represented.

Early-stage smaller teams (seed round funding, 1-10 employees) tend to allocate equity and tokens in proportion (however, this trend is not consistent across all funding levels in the early-stage funding rounds).

As companies develop, the preference for the proportion relationship becomes more moderate, and there is no clear dominant strategy.

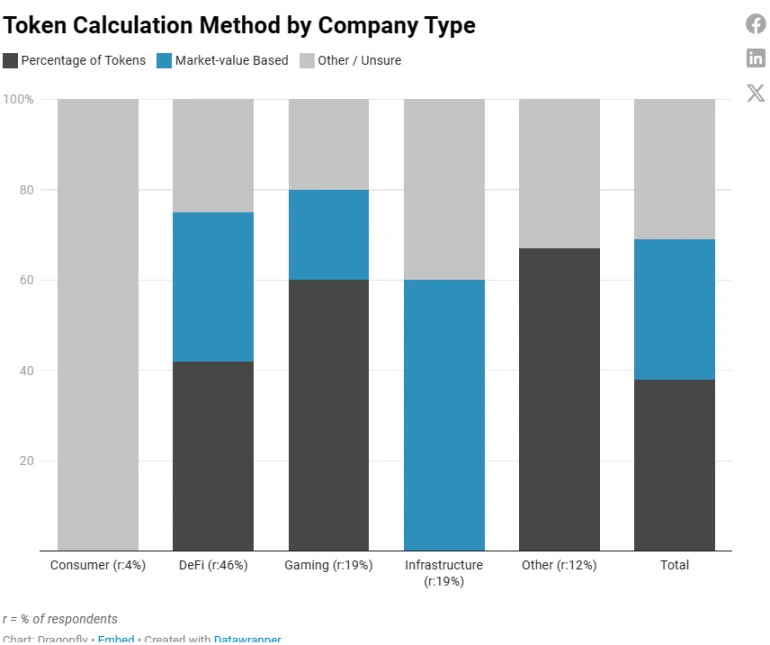

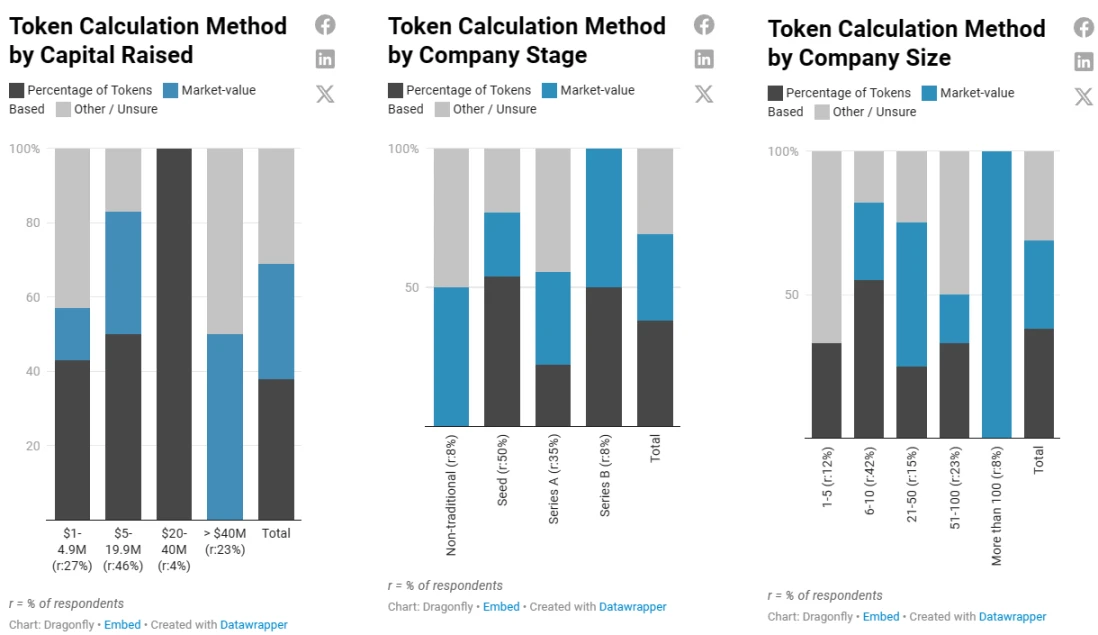

Token Calculation Methods

In a previous article, we studied and outlined the methods companies use to calculate the number of tokens issued to employees. This report is not intended to thoroughly explore the best methods, and does not cover all methods.

That being said, the most common and clearly defined method we have seen is:

Based on Market Value: Teams with active tokens use this method to first determine the total dollar value they intend to offer to employees, then calculate the number of tokens to be granted based on the fair market value of the tokens at the time of calculation, grant, or attribution. In the mentioned article, we observed that most teams prefer this method because it is simple and practical. However, we recommend using this method with caution, as the value of token grants may fluctuate significantly due to market volatility, leading to discrepancies in the token market value table. In this sense, tokens are somewhat similar to publicly traded stocks, but they lack the same protective measures and stability. For teams without active tokens, adopting this valuation method is not common. In most cases, we see them relying on verbal agreements and promising future tokens based on equity allocation ratios. Another method is to calculate the market value of future tokens locked by venture capital firms. Considering that the token price for venture capital firms is fixed, this provides a fair basis for compensation before tokens are publicly listed (interestingly, we have not heard of any company doing this).

Token Ratio: This method attempts to simulate the traditional startup company's calculation of equity-based rewards. It is the only method that takes into account market fluctuations and mitigates unfairness in employee compensation, while minimizing unnecessary token dilution and retaining asymmetric upside potential for employees. Effective use of the token ratio method requires diligent planning, ideally starting from the early stages. In summary, you can adopt the same allocation range as used for equity and adjust it based on the specific circumstances of the tokens, ultimately granting a fixed proportion of the token pool.

"Other" methods may include annual grants, performance-based bonus structures, using a sliding ratio between equity and tokens, and uncertain methods.

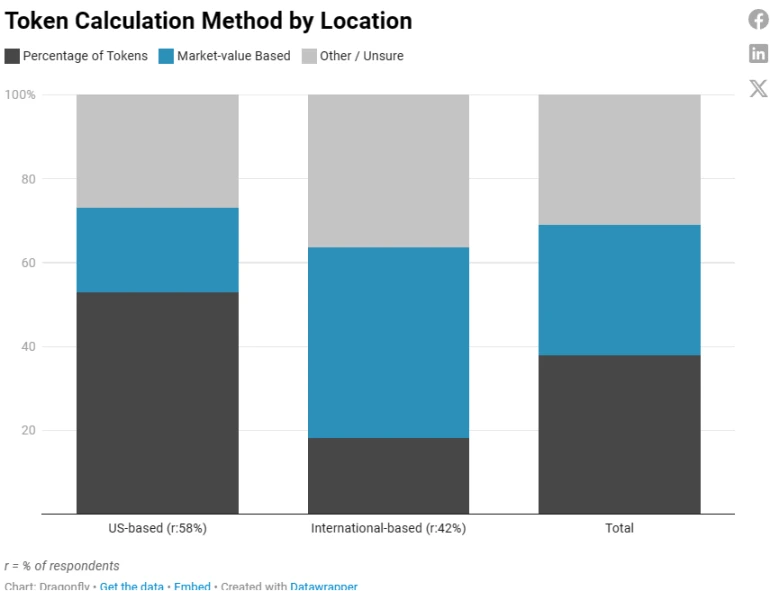

In conclusion, most companies use the "token ratio" method.

There are significant differences in regional distribution, with US teams tending to prefer the "token ratio" method.

Different industries have different preferences for token calculation methods: gaming and other types of companies tend to prefer the "token ratio" method, while infrastructure companies are more inclined to use the market value-based method.

As the scale of funding and fundraising amount increases, more companies are adopting the market value-based method.

Companies in the seed round of funding and those with funding amounts not exceeding $40 million mainly use the "token ratio" method. The market value-based calculation method becomes more favored from the A funding round onwards, especially in companies with 21-50 employees, and becomes more common in the B funding round and in companies with over 100 employees. It is worth noting that companies with funding amounts exceeding $40 million tend to balance the use of the market value-based calculation method and other less clear methods.

We recommend early-stage teams to use the "token ratio" method. While we intuitively understand why later-stage teams are more inclined towards the market value-based method (for example, once the token price is determined, its speculative nature may decrease, and more data such as time-weighted or volume-weighted averages can be used; or it can provide them with more flexibility regarding the remaining token reserve), we are researching the reasons for this trend with the teams.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。