Title: Ripple to Launch USD-Pegged Stablecoin, Entering the $150 Billion Stablecoin Market

Blockchain service company and creator of XRP Ledger, Ripple, has announced its entry into the stablecoin market with a USD-pegged stablecoin, aiming to compete in a market with a size exceeding $150 billion.

According to Ripple, the stablecoin is expected to be officially issued later this year and will be 100% backed by USD deposits, short-term US government securities, and other cash equivalents. Initially, it will be deployed on Ripple's XRP Ledger blockchain and the Ethereum blockchain, and will adhere to the ERC-20 token standard.

Despite Being Late, Why is Ripple Entering the Stablecoin Race?

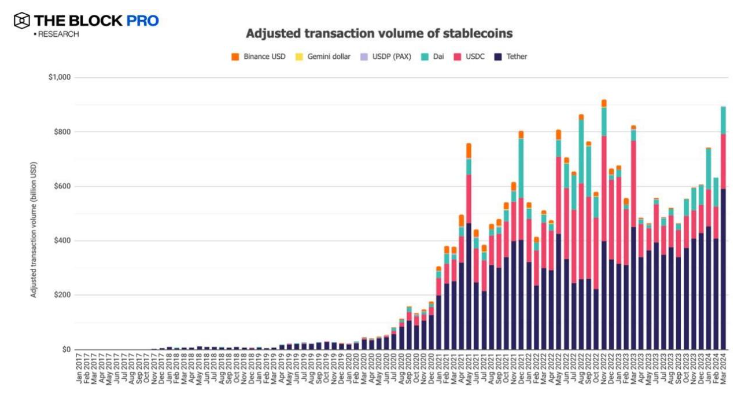

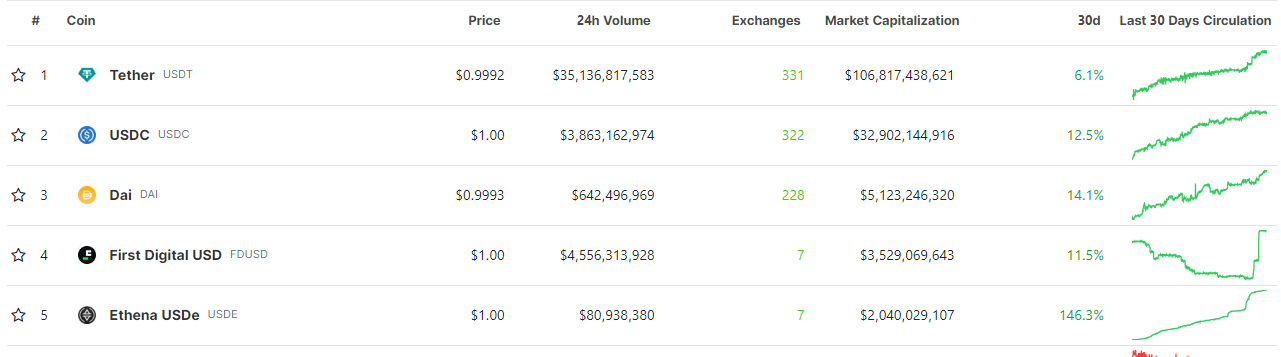

The stablecoin market has been continuously expanding. According to data from The Block Pro, the adjusted on-chain trading volume of stablecoins surged to $893.8 billion in March 2024, a 41.3% increase. The total supply of issued stablecoins also increased by 6.2% to reach $137.4 billion (rising to over $150 billion in early April). Tether and Circle have almost dominated the entire stablecoin market, with USDT holding a market share of 76.3% and USDC close to 20%, collectively accounting for over 96% of the market.

So, why is Ripple venturing into the highly monopolized stablecoin market? There are three main reasons:

Firstly, the demand for stablecoins continues to grow. In fact, stablecoins are one of the most popular types of digital assets among cryptocurrency traders, theoretically unaffected by the price fluctuations of major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). According to Ripple's assessment, the stablecoin market is expected to exceed $28 trillion by 2028, and the crypto market has a clear demand for stablecoins that can provide trust, stability, and utility, which is a key reason for their decision to enter this field.

Secondly, stablecoins help drive the development of Ripple's ecosystem. As explained by Ripple's Chief Technology Officer, David Schwartz, exploring the stablecoin market also has some "opportunistic" reasons. "After all, the stablecoin market is a growing market, and launching a stablecoin can make you a 'non-interest-bearing bank,' which seems like a pretty good business opportunity," he said. If successfully launched, it can inject more profits into the DeFi ecosystem of the XRP Ledger. Although Ripple-supported blockchain also offers DEX and other services, it must be acknowledged that the usage of the XRP Ledger is still relatively low compared to other blockchains.

Additionally, transparency will be a focus of Ripple's stablecoin issuance, targeting corporate and banking users. David Schwartz stated that Ripple will undergo a monthly public audit conducted by a top accounting firm and will take all necessary measures to achieve complete transparency. In his words, "Ripple doesn't want to squeeze out a few extra cents, we don't need to do that, Ripple's balance sheet is rock solid." Furthermore, the target audience for Ripple's stablecoin is primarily corporate clients and banks, and this specific market segment demands high compliance requirements. Therefore, Ripple will choose local US banks to hold reserve funds, ensuring that a "compliance-first mindset" is brought into the entire stablecoin market.

Can Stablecoins Redeem Ripple?

It is worth noting that Ripple's business model based on XRP has shown a certain degree of "fatigue." Austen Campbell, a professor at Columbia Business School and former manager of Paxos stablecoin fund, bluntly stated that no one uses XRP as a means of payment, just as no one truly uses BTC. Many collaborations with XRP-based cross-border payments, such as:

- One of the largest banks in the EU, Santander, decided to discontinue its partnership with Ripple after realizing that using XRP did not meet its clients' needs.

- Due to the increasing costs of XRP cross-border payments and MoneyGram's need to establish third-party relationships with decentralized cryptocurrency exchanges in various regions, the relationship between Ripple and MoneyGram came to a halt.

- The second largest bank in Oman, Bank Dhofar, had announced using RippleNet to provide payment services through Ripple for its customers, but this was the only mention on the bank's website, and many other applications (including payment apps and remittance services) did not mention Ripple at all.

It is important to note that the question of whether XRP is a security will only be truly answered after Ripple's four-year legal battle with the US Securities and Exchange Commission concludes. Faced with a potential fine of up to $2 billion from the SEC, Ripple urgently needs to find new and reliable sources of income. From this perspective, stablecoins seem to be a priority choice.

Even Late to the Game, Ripple Aims to Claim a Share of the Stablecoin Market

In the cryptocurrency field, stablecoins are considered one of the most important tools. Whether on centralized or decentralized trading platforms, in spot or futures markets, most transactions are denominated in stablecoins. Although the overall market value of stablecoins may not be very prominent in the cryptocurrency field, the profits are quite substantial, which seems to be the reason why companies such as PayPal, First Digital Trust, and Ripple are rushing to enter this field, as the potential is enormous—

Andy Bromberg, CEO of stablecoin wallet Beam, pointed out that due to the higher interest rates of US government bonds, USD stablecoins have become a "profitable business." According to disclosed US government data, the composite interest rate of so-called Class I bonds (US bonds with interest rates adjusted every six months) reached 5.27% from November 2023 to April 2024. This means that if Ripple's stablecoin reaches a scale of $1 billion, the annual income from interest alone would exceed $50 million.

It is not difficult to achieve an issuance scale of $1 billion in the stablecoin market. Taking the example of the stablecoin USDe recently launched by Ethena Labs, its market value exceeded $2 billion in less than four months, ranking among the top five stablecoins by market value.

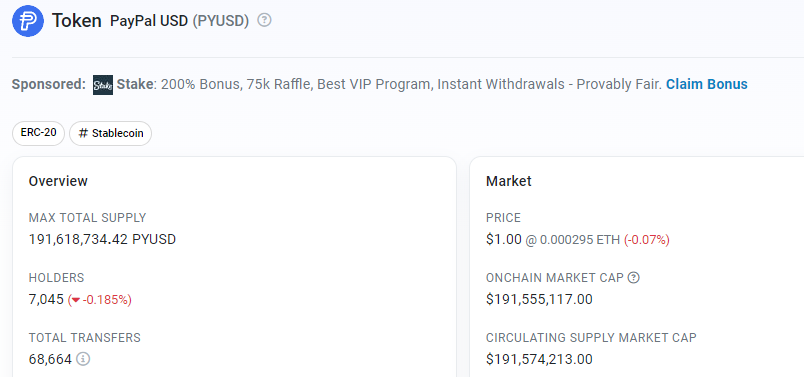

Of course, other cases in the industry are also worth Ripple's reference, such as PYUSD, which has a very similar design purpose to Ripple's stablecoin. In fact, PYUSD issued by PayPal is also 100% backed by USD deposits, short-term US government securities, and similar cash equivalents, and is also deployed on the Ethereum chain and follows the ERC-20 standard. However, since its issuance, its scale has only reached approximately $200 million, with a transaction volume of less than 70,000. One of the main reasons that PYUSD has not made significant progress may be the lack of rich practical applications. Despite being backed by PayPal, a payment giant, it has always struggled to interact better with DeFi, DEX, and other applications in the crypto field.

Frankly, the stablecoin market has not yet formed a situation where "one winner takes all," providing many new entrants with opportunities and room for development. Assuming that the overall scale of the stablecoin market grows 12 times as predicted by Ripple, this "cake" will undoubtedly become very tempting. If Ripple successfully enters the top three in the market, it will undoubtedly further consolidate its position in the crypto market.

However, whether Ripple can ultimately achieve real success in the stablecoin market may depend more on attracting end users to use and stay within its ecosystem. Let's wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。