Original Author: Benjamin Funk

Original Compilation: Frank, Foresight News

Our brains, books, and databases are both recipients and creators of the ever-growing data trend of humanity. The internet, as the latest product of this long development, generates and stores about 2.5 quintillion bytes of data every day. While it is easy to be awed by this number, the data points themselves are not of much value. They are like scattered pieces of a huge puzzle, which need to be carefully collected, processed, and combined with context to become valuable information.

Many internet giants today have centered their entire business models around this, with Google being the most successful. Their process involves extracting a large amount of valuable raw materials, "digital waste" in the form of private data from billions of people, and inputting it through proprietary algorithmic pipelines to predict the choices individuals might make. The more data Google extracts about us and processes into information, the higher the level of insight they can provide to advertisers, leading these advertisers to bid higher in Google's ad auctions in an attempt to convert us into customers.

Through these processes, Google generates $240 billion in ad revenue annually. While Google intentionally excludes humans from this process, there may be a more powerful way to generate and profit from valuable information. By gamifying the process of information creation, search, and speculation, and inspiring our inherent desire to participate as players, from sports betting to MEV, to social deduction games like Among Us, we are naturally drawn to "information games" centered around competition and coordination, which require us to cleverly hide and reveal information.

Some information games are just games. But as we will see, other information games can be used to generate and profit from new, valuable information, and become the cornerstone of a new generation of products and business models.

However, information games have always had a fatal weakness: trust. Specifically, players need to trust that other players will not share or exploit information in ways that violate the rules of the game. If a crew member in the game Among Us can become an imposter midway through the game, or if a block producer (miner) can calculate an incorrect block root but still be accepted by validators, no one will want to play the game anymore. To address this trust issue, we turn to trusted third parties to create and host information games for us.

For low-risk games like Among Us, this is not a problem, but limiting game creation and arbitration to a centralized party restricts our trust in and experimental exploration of the information games we play, thereby limiting the types of information we can collect, utilize, and monetize.

In short, because we have not yet found a way to maintain fairness and trust in a decentralized environment, there are still many information games that have not even been attempted.

Programmable blockchains and new cryptographic primitives are solving this problem by allowing us to create and coordinate information games on a large scale without permission, without trusting third parties or each other.

In turn, information games driven by cryptographic technology can rapidly increase the quantity and quality of information globally, thereby increasing our collective decision-making capabilities and unleashing efficiency gains equivalent to the size of the global GDP. Imagine globally accessible prediction markets as tools for allocating vast amounts of internet-native fund capital. Or a game that allows individuals to collect their private health data and be rewarded for any new discoveries resulting from its use, while protecting their privacy.

However, as this article will show, information games centered around encryption may still not be suitable for these high-risk use cases. Nevertheless, by starting with smaller, more interesting information games today, teams can focus on engaging players and building trust, and then expand to create more profitable information markets.

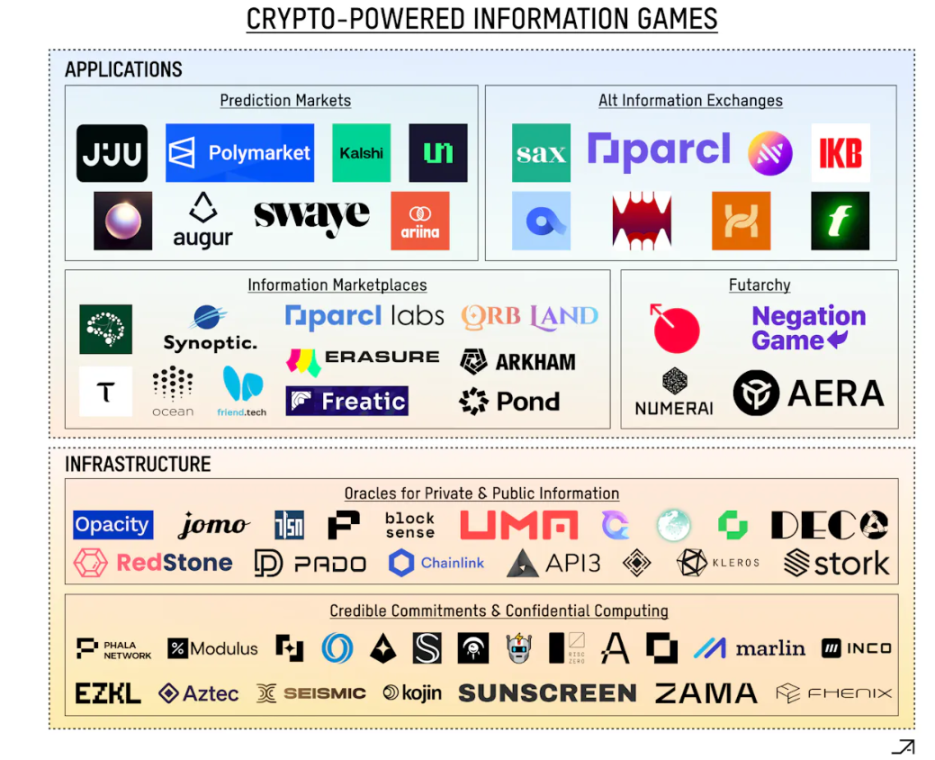

From prediction markets to game theory, oracles, and trusted execution environment networks, this article will cover the design space for creating these cryptocurrency-based information games and introduce the infrastructure necessary to realize their full potential.

Permissionless Markets: A Prerequisite for Information Games

From future-dominant applications to information market-based applications, blockchain allows developers to create customizable, automated financial tools to support permissionless, unstoppable markets. Therefore, anyone can now create mechanisms that incentivize, coordinate, and settle the exchange of value and information. This underscores the critical role that blockchain plays in enabling us to quickly experiment with how to best configure games to maximize the value of all participants.

It is very difficult to persuade centralized intermediaries to adapt at this speed or allow their users to participate in these experiments. Therefore, permissionless markets will become the medium through which edge theories and frontier research papers are realized. We have already seen this in prediction markets, where strategies to address the low liquidity of prediction markets have been implemented as Continuous Prediction Market Makers (CPMMs) on cryptocurrency networks and tested with real money.

Permissionless markets are essential drivers for creating better tools to generate new information and monetize its value.

Information Production in Information Games

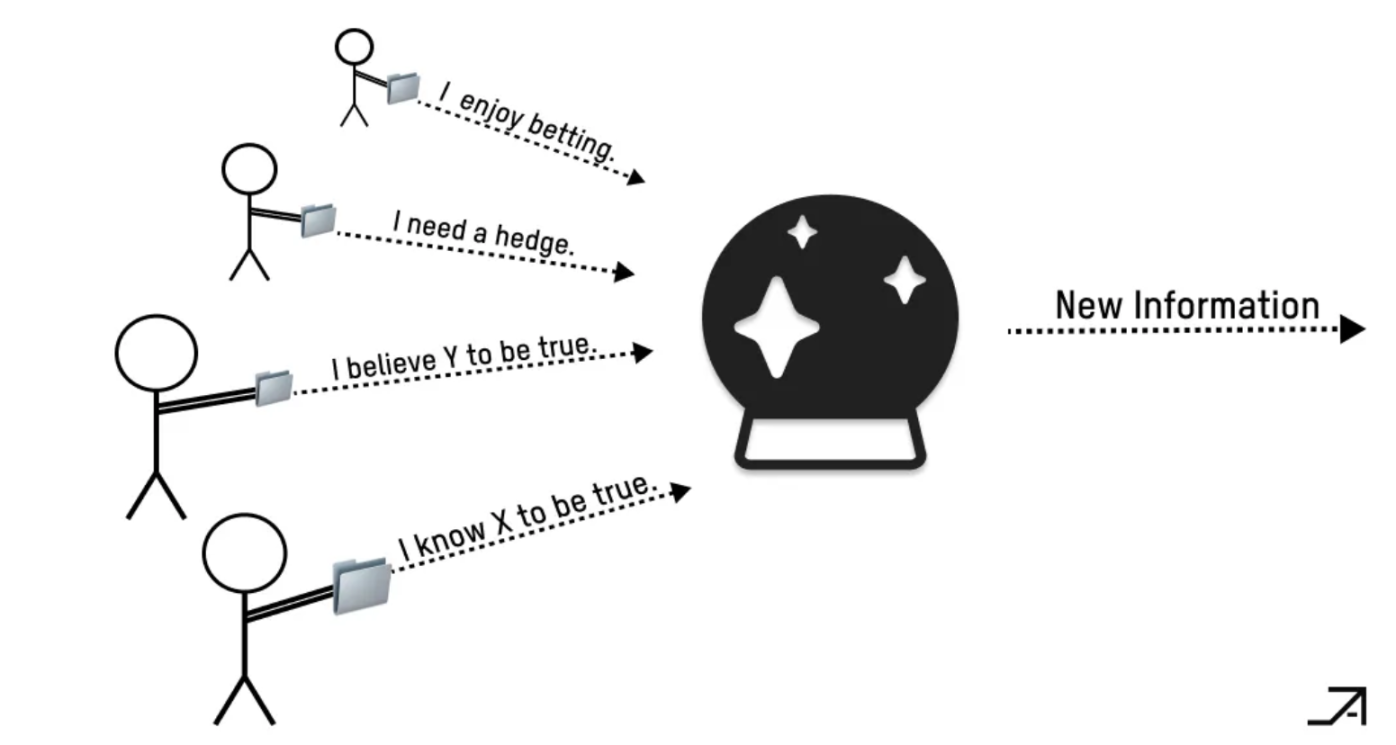

Many information games generate new information for players to make better decisions.

These information games create incentive mechanisms to extract raw materials (public and private data) from people, databases, and other sources, and then aggregate this data through the best information production machines (markets and algorithms). Ideally, this process generates new information and monetizes it by helping other players make good decisions. For example, an investment DAO uses the results of a prediction market to decide whether to invest in a new startup.

The games and tools used by the designers of information games will vary depending on the types of information they may produce, and we have a huge design space to explore different challenges and opportunities.

But let's start with the most active information game in development and discussion today—the prediction market.

Game 1: Prediction Market as a Tool for Generating Information

One of the most popular information games in the crypto space (and other fields) is the prediction market. Polymarket is the world's leading prediction market, facilitating over $400 million in cumulative trading volume (and growing rapidly).

Prediction markets operate by incentivizing players to use their own money (such as cryptocurrency) to bet on the outcomes of various events. This approach, which requires individuals to take on financial risk ("real money participation"), helps ensure that participants are truly committed to their predictions. As traders act on their insights by buying undervalued outcome shares and selling overvalued outcome shares, the market dynamically adjusts. These adjustments in market prices reflect a more accurate collective estimate of event probabilities, effectively correcting any initial mispricing.

The more people participate in betting on the market, the more they possess different but related public and private knowledge, and the more accurately the prices reflect the truth. Ultimately, prediction markets leverage "collective wisdom" by using financial risk to drive accurate information aggregation.

Unfortunately, prediction markets face several key challenges, many of which are attributed to various scalability issues.

Bottlenecks of Real Information

Keynesian beauty contests (judges try to choose the option they think other judges will also choose) are not unique to prediction markets. However, the negative impact they bring here is more pronounced than in traditional markets, as the goal of prediction markets is to create accurate information. Additionally, unlike traditional financial markets primarily driven by profit maximization, participants in prediction markets are more susceptible to personal beliefs, political biases, or vested interests in certain outcomes. Therefore, if their bets resonate with personal values or profit expectations from actions outside the market, they are more willing to bear financial losses within the market itself.

In addition, the more people perceive a market or algorithm as a source of truth, the higher the incentive to manipulate that market. This is very similar to the problems encountered in social media. The more people trust the information products generated by social media platforms, the higher the incentive to manipulate them for profit or to achieve social and political interests.

Some players may even use the signals and incentives created by prediction markets to reprice collective beliefs and encourage collective action. For example, imagine a government using a form of "quantitative easing" policy to influence critical issues such as climate change or war on a prediction market. By purchasing a large number of shares in relevant prediction markets, they can redirect financial incentives towards the expected outcomes. Perhaps they believe that the systemic risks of climate change are underestimated, so they buy a large number of "no" shares in a market predicting climate improvement by 2028. This may encourage more climate tech startups to develop technologies, allowing them to gain an information advantage on the "yes" shares and accelerate the pace of finding solutions.

While the factors mentioned above have been shown to have a negative impact on the quality of generated information, it has also been demonstrated that manipulation behavior can actually improve market accuracy, as market manipulators are noise traders, and savvy market participants can make money by trading against them.

Therefore, we can infer that the above issues are due to a lack of a sufficient number of well-funded, informed traders to help correct the market, so allowing these informed traders to borrow and short sell may be a key means of making these markets more efficient.

Furthermore, in longer-term markets, informed traders find it more difficult to counteract manipulation, as manipulators have more time to reflexively influence market sentiment and actual outcomes through trading. Implementing markets with shorter information credibility holding periods can increase people's trust in the game (thus improving the quality of its information) but also make the gameplay more appealing.

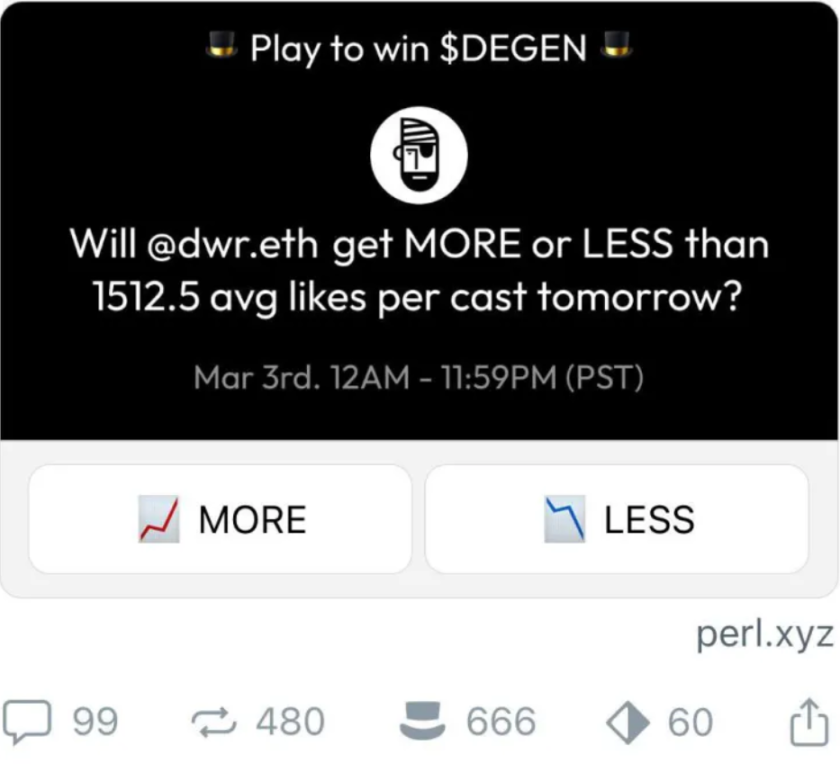

We have also seen early signs that in some cases, players enjoy information games where the information credibility holding period can be manipulated. Perl, the top account on Farcaster at the time, tended towards this pattern and created an in-app platform to predict user engagement. Prediction markets such as "Will @ace or @dwr.eth (co-founders of Perl and Farcaster, respectively) receive more likes tomorrow?" were launched, and the mischief between football teams and their fans also began. Only here, the game is asynchronous, and the metric is likes rather than "Touchdown." (Foresight News note, typically used to describe scoring actions in American football games, when the attacking team carries the football into the opponent's end zone and successfully touches down.) While Perl's game intentionally disrupted the quality of information produced by prediction markets, an interesting metagame emerged through coordinating favorable prophecies for someone.

Prediction-based games can reduce manipulation and boredom by using shorter, possibly renewable rounds. However, in low-risk games, allowing players to manipulate can increase the fun of the game and become an integral part of the gameplay.

Finding Suitable Judges and Oracles

Another challenge for prediction markets is arbitration—how to correctly resolve markets? In many cases, we can rely on reputation and collateral-backed oracles that can connect to off-chain data sources. To address this issue, the designers of prediction markets can rely on game theory and cryptographic oracles to cover a wider range of topics, including players' private information.

Game theory oracles, also known as Schelling point oracles, assume that participants (or nodes) in a network will independently converge on a single answer or result without direct communication, believing that others will also choose this answer or result. This concept was first proposed by Augur and later further developed by UMA, encouraging honest reporting and rewarding participants based on how close they are to the "consensus" answer, thus preventing collusion.

However, making these oracles reliable for arbitration with a small number of players' bets still presents many challenges, as in this case, identifying and communicating with each other to collude becomes a potential threat. While cryptographic technology is touted as a key tool to prevent collusion between voters, it can also be used as a tool to facilitate collusion and disrupt prediction markets. We can see this potential through DarkDAO's use of trusted execution environments (TEE) for programmatic bribery and coordinated price manipulation. One of the teams working to balance these incentive measures is Blocksense, which uses a secret committee for selection and encrypted voting to prevent collusion and bribery.

We can also address the oracle challenge by using on-chain data. In MetaDAO, players are rewarded for correctly predicting how a specific proposal will affect the price of its native token. This price is provided by UniswapV3 positions as an oracle for the token's value.

However, these oracles still have limitations in resolving markets based on public data. If we can resolve markets based on private data, we can unlock entirely new types of prediction markets.

We can use the results of the information game itself as an oracle, which is one way to resolve markets based on private data. Bayesian markets are an example of this, using the principles of Bayesian reasoning to derive a bettor's beliefs about their private information by allowing them to bet on the beliefs of others. For example, creating a market where people can bet on "how many people are satisfied with their lives" can reveal the bettor's beliefs about the satisfaction of others' lives. Thus, we can draw accurate conclusions about players' private information, which would otherwise be unverifiable truths in other circumstances.

Another solution is to use clever cryptographic "imports" to bring data from private Web2 APIs into oracles. Some existing oracles are showcased in the "Public and Private Information Oracles" section of the market map. Using these oracles, prediction markets can be created around some players' private information, incentivizing private information holders to verifiably resolve specific prediction markets in exchange for trading fees from players betting on that market. More generally, the ability to securely access richer personal data off-chain and bring it on-chain can be used as an identity primitive to help us identify, incentivize, and match players in information games more effectively, guiding the necessary information to make the information game more relevant to players.

Innovations in oracle design will expand the data scope available for resolving prediction markets, thus expanding the design space for information games centered around private information.

Liquidity Bottleneck

Attracting liquidity to prediction markets is very challenging. Firstly, these markets are binary, with players betting "yes" or "no" on specific topics and only receiving a fixed amount of currency reward or nothing at all. Therefore, the value of these shares fluctuates significantly with small changes in the underlying asset price, especially as the expiration date approaches. This makes short-term price trends of predicting them very important but also very challenging. To cope with the huge risks brought about by sudden changes, traders must use advanced and constantly adjusted strategies to deal with unexpected market fluctuations.

More importantly, as prediction markets expand their market scope to more topics and extend their time frames, attracting liquidity will become even more difficult. The further the market types go beyond politics and sports, and the longer the duration, the less people feel they have a clear advantage in betting. Therefore, the fewer people bet, the lower the quality of the information generated.

Prediction markets inherently face these liquidity issues because forming prices requires mining private information and betting based on that information, both of which are costly activities. Participants need to be compensated for their efforts and the risks they take (including the cost of gathering information and locking up capital). This compensation usually comes from people willing to accept worse odds, for reasons such as entertainment (e.g., sports betting) or hedging risks (e.g., oil futures), which helps drive a large amount of liquidity and trading volume. However, prediction markets with narrower subject ranges have lower commercial appeal to players, resulting in lower liquidity and trading volume.

Economic Improvements: Overlays and Diversification

We can draw on the ideas of traditional finance and other existing information games to address these issues.

It is worth noting that we can utilize the concept of "overlays" mentioned by Hasu in the article "The Dilemma of Prediction Markets." In gambling tournaments, the concept of "overlays" is similar to the subsidies proposed for prediction markets, which are additional value added to the prize pool by the house to encourage participation. "Overlays" effectively reduce the entry cost for players, making the tournaments more attractive and increasing participation from both newcomers and seasoned players.

Just as the "overlays" in gambling tournaments stimulate player participation by increasing the potential return on investment, subsidies in prediction markets incentivize participants by lowering the barriers to entry and making participation financially more attractive. Subsidies also act as a beacon, attracting a variety of perspectives and insights from informed and uninformed traders, who have the opportunity to profit by correcting errors. Teams implementing this strategy will have to systematically identify and engage with potential subsidy providers and create markets around their needs, as they are willing to provide the necessary liquidity.

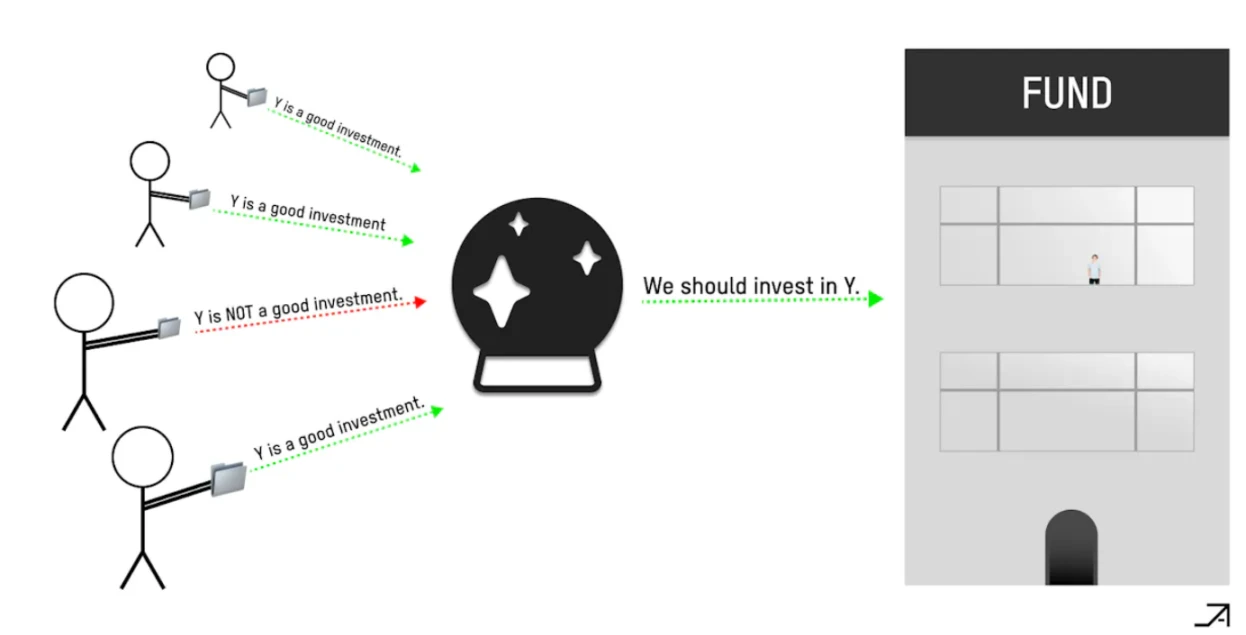

Similarly, a structure similar to a "fund" can be implemented to achieve diversification across time and industries, and increase the liquidity of prediction markets across a wider range of issues and time frames. For example, many companies may find value in markets revolving around how specific lawsuits will be resolved. These companies can lend capital to legal experts, allowing them to diversify across a wide range of markets and then reward them based on their performance over time, thus reducing the cost of legal expert participation.

In this setup, traders will be able to borrow money to make markets, and the borrowing amount can be parameterized based on the information demand and the trader's reputation in that particular topic. This can be combined with management fees as an additional "overlay" for each market.

For liquidity providers, they will have access to traders in these markets who are motivated to bet correctly and are diversified across a basket of unrelated assets with a wide range of time horizons. While the "principal-agent problem" needs to be considered, this system can increase the scale of liquidity provided by these markets and the diversity of the allocation of these liquidity pools. Additionally, the quality and variety of information products can be improved, while also creating new information about traders' skills and knowledge in different markets, accelerating the returns for liquidity providers through reputation by-products.

When players can generate significant value from information, integrating composable financial markets (such as lending and liquidity mining) into gameplay can be a key tool in lowering the barriers to entry.

Improving User Experience: Simpler Interfaces and Flexible Incentives

Today, prediction markets generally have exchange-centered UX designs and limited types of rewards, which may deter those who value other types of interfaces and incentives, further limiting liquidity. For bettors, there are many interesting ways to improve the quality of prediction markets, all of which focus on increasing coverage and accessibility to different types of players.

Firstly, we can improve the user experience of prediction markets by integrating them into larger social platforms. Perl and Swaye have shown us this by accessing Farcaster's data, allowing users to participate without having to open another standalone application, and information game designers can identify and guide players into markets that are particularly suitable for their participation (e.g., top participants in the /nyc-politics channel).

We can also attempt to expand the range of rewards allocated to bettors and lower the capital barriers for their participation. This can manifest as rewarding individual proofs, or expanding the financial reward scope to "in-app utilities" or ownership represented by points or tokens.

While monetary incentives are important for the operation of prediction markets, some literature suggests that virtual currencies can also create prediction markets of comparable quality. From a practical standpoint, this tells us that we can flexibly assume that bettors are willing to take risks and strive for "real money participation."

Additionally, there are different types of market mechanisms that can be used to make the user experience more "poll-based," further reducing friction and lowering barriers to entry. A study from the University of Cambridge evaluated this hypothesis and found that in markets with low trading activity, large bid-ask spreads, and rapid resolution, poll-based mechanisms can produce more accurate results than prediction markets. The study also found that combining poll-based prediction games with currency incentives results in higher accuracy than simply predicting market prices. Furthermore, to address potential stagnation information challenges, polls can be "updated" regularly based on some push or pull system, incentivizing dynamic replication of information based on new information.

Cryptographic information games have often hindered everyone except the most dedicated and seasoned users. Now, with reduced costs, increased availability, and richer data, we have the opportunity to develop more diverse and accessible games to attract specific audiences.

Game 2: Privacy-Preserving Computing Generates Information

Imagine a game played by Solidity developers, where players use secure multi-party computation (MPC) to disclose their salaries and calculate the average while protecting the confidentiality of their personal salaries. This would be a valuable way for cryptographic professionals to negotiate with their respective employers, while also serving as a source of entertainment.

More broadly, information games can use privacy-preserving technologies to expand the sources of information—especially private data and information that can be analyzed to generate new insights. By ensuring privacy, these tools can increase the types and tendencies of data and information shared by people, compensating data providers for the value they generate.

While this is not exhaustive, some tools used by information producers to achieve this include zero-knowledge proofs (ZK), secure multi-party computation (MPC), fully homomorphic encryption (FHE), and trusted execution environments (TEE). The core mechanisms of these technologies are different, but they all ultimately converge to enable individuals to provide sensitive information in a privacy-preserving manner.

However, for use cases requiring strong privacy guarantees, there are still many serious challenges in using software and hardware encryption primitives, which we will discuss later.

Privacy-preserving cryptography significantly expands the design space for new information games that did not exist before.

Game 3: Competition Between Models to Improve Information Production

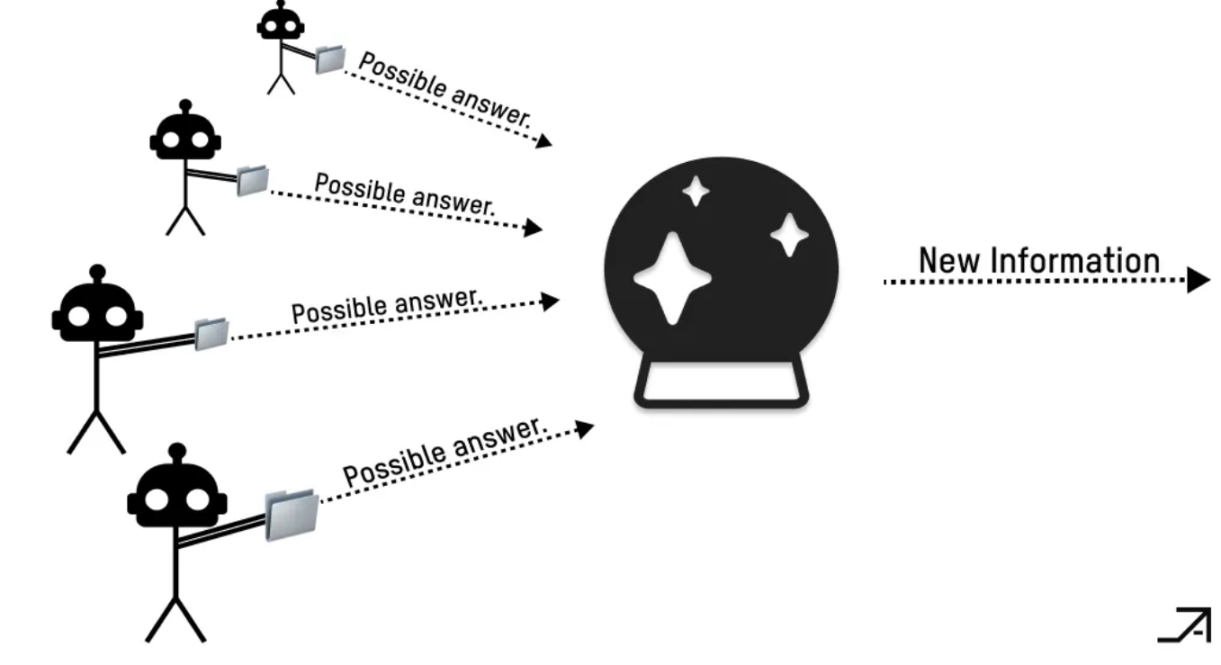

Imagine a game where data scientists compete with each other by developing and betting on decentralized hedge fund trading models. Then, the blockchain reaches a consensus on the score for a specific model and rewards or penalizes participants based on the model's predictive accuracy and its impact on fund returns. This is the approach taken by Numerai, one of the earliest information games on Ethereum. In this game, Ethereum's consensus mechanism is used for global competition between different models and their creators, effectively incentivizing artificial intelligence to participate in information games and generate valuable returns.

Furthermore, we can directly incentivize artificial intelligence to play information games for us, using their extensive knowledge to compete with each other in making predictions. While they may not play these games for fun, using intelligent machines instead of humans can significantly reduce the labor costs required for information production. Therefore, these AI models can increase the liquidity of more niche prediction markets, where humans are typically unwilling to participate. As Vitalik puts it:

"If you create a market and offer a $50 liquidity subsidy, humans won't care too much about bidding, but thousands of AIs will easily flock to it and do their best to make the best guess. The incentive for any one question may be minimal, but the incentive to create an AI that makes universally good predictions could be worth millions of dollars."

Alternatively, we can leverage consensus between machine learning models to compete around the value of information they create. Teams like Allora and Bittensor TAO are working to coordinate models and agents, broadcasting their predictions to others in the network, who are responsible for evaluating, scoring, and broadcasting their performance back to the network. In each cycle, collective evaluations between models are used to allocate rewards or power to different models based on the quality of their predictions. Therefore, entrepreneurs can use an evolving model network to improve the quality of information flowing through their markets.

It is entirely possible that there are some information markets where the quality of information generated using models is fundamentally incomparable to human information games.

Monetizable Information Games

Some information games can sustain themselves solely based on the enjoyment users derive from them. However, for those looking to monetize the value of the information they generate, more thought is required. Unfortunately, the characteristics of information as a commodity can lead to critical market failures, hindering its smooth monetization:

Information is only valued after it has been consumed, making it difficult for buyers to assess whether the seller's pricing accurately reflects the value of the information.

Information is non-rivalrous—consuming it does not diminish its availability, meaning it lacks scarcity, which makes it unattractive to buyers.

The non-excludable nature of information, coupled with low replication costs, makes it difficult for sellers to prevent unauthorized access, despite the high initial production costs.

These economic characteristics present challenges for both buyers and sellers to profit from information, potentially leading to undersupply of information. If information quickly becomes known to everyone who can use it simultaneously, buyers' opportunities to exploit information asymmetry decrease due to increased competition or their plans collapsing. Fortunately, there are some cryptographic tools that can be used to address these issues and are already in use.

Game 4: Exchanges—Monetizing Information Speculation

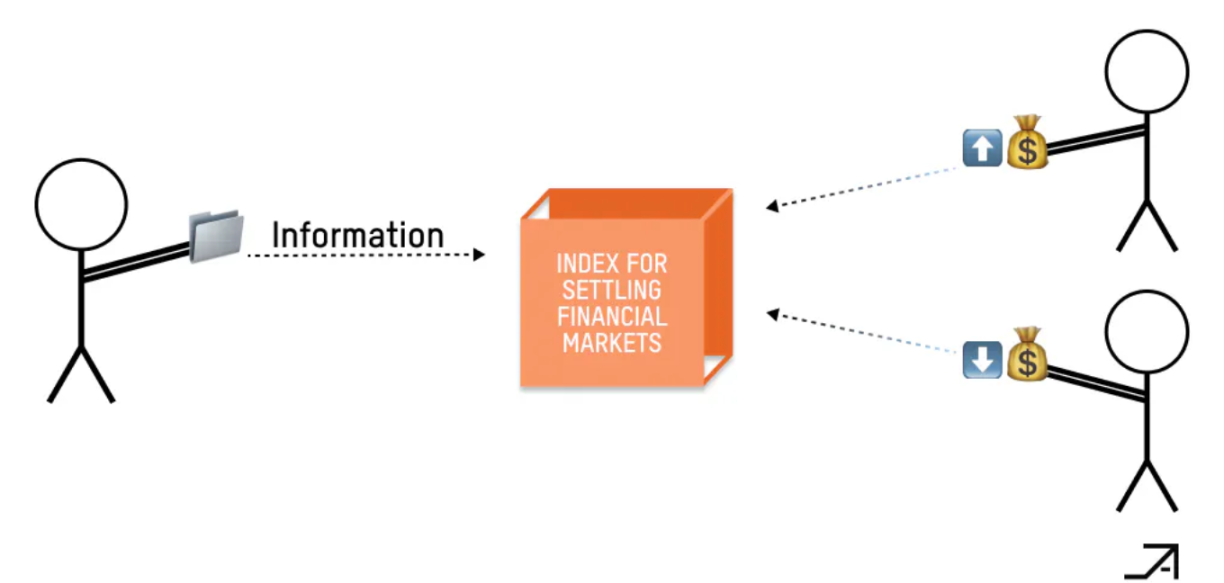

One way to monetize information production without the need for secrecy or restricting the actions that can be taken with it is to simply make the information public but create a tool for people to bet on how it changes—also known as derivatives.

One company actively doing this is Parcl, whose exchange allows users to speculate on the rise and fall of the real estate market. Parcl's markets are supported by real-time price information obtained by Parcl Labs from a vast pool of real estate data and processed through proprietary algorithms, generating more granular and accurate information than traditional real estate price indices.

While Parcl directly monetizes this information through APIs, they also create an additional layer of monetization by allowing traders to bet on how this information changes over time. Other projects, such as IKB and Fantasy mentioned in the "Alternative Information Markets" section of the market map, focus on monetizing through speculation or hedging against changes in existing public information, ranging from athlete performance to creator social engagement.

If you can sell speculative rights to the information you produce, you can monetize it without restricting buyers on how to use the information.

Game 5: Black Market for Confidential Information Discovery

Imagine a game that allows you to discover curated alpha information about the latest on-chain activities and brand-new crypto startups before the world knows. To achieve this, the information needs to remain confidential to address the non-rivalrous and excludable issues of public information. Therefore, the next generation of information markets is facilitating the exchange of confidential information while using blockchain to discover and regulate all potential participants who may pay to access this information.

Freatic's decentralized confidential information market, Murmur, is a prime example of this approach, using NFTs and queuing systems to restrict exclusive access to information. Information buyers first need to subscribe to specific topics by purchasing NFTs representing vouchers. This grants them a place in the queue to redeem confidential information from the publisher, and they can also pay additional fees to slow down its dissemination. Buyers can also vote on the quality of the information afterward. Through this process, Murmur ensures the confidentiality and value of the information without having to restrict its sale to a single entity.

In contrast, Friend.tech uses keys and binding curves to manage access to confidential information in group chats, with higher barriers to entry as demand increases. Thus, we can view Friend.tech's keys as proxies for the average value of someone's information (assuming the key market is effective). However, players always "factor in" some concept of this person's "value" when trading keys, making it difficult for buyers to assess the value of the information. Perhaps this can serve as another data point to support the claim that the most valuable "information market" to date is actually the memecoin market, which, if you squint hard enough, is actually a prediction market around the symbolic value of specific trends or personalities.

Aside from memecoin, one direction for limiting information access is to allow information sellers to design binding curves that better associate access prices with information value. For example, the pricing of rapidly devaluing information as it becomes known can be determined by reflecting the rapid devaluation of information value over time in the binding curve.

Decentralized currency exchanges are challenging due to trust issues and the coincidence of finding dual needs. Blockchain has already solved this problem for currency (Bitcoin) and will do the same for information by creating interesting games around finding hidden information.

Game 6: "Futarchy"—Monetizing Prediction Markets

A primary method of monetizing information production without explicit secrecy is to produce and sell information goods that only a single organization can and will utilize. This method is not new—many companies have already restricted access to information for specific buyers through auctions or confidentiality agreements. However, we are now seeing a new business model for selling information goods—producing public information that is relevant and valuable only to organizations making specific decisions.

In fact, we are just beginning to see prediction markets built on the crypto track to experiment with "Futarchy" as an alternative mechanism to monetize the information they produce.

"Futarchy" offers a new way to improve decision-making, leveraging the information created by prediction markets. The information generated by prediction markets is used to make decisions, and when the prediction market settles, the most accurate predictors are rewarded.

The prediction market itself is a zero-sum game for players, which limits the incentive for informed traders to participate and exacerbates existing liquidity bottlenecks. "Futarchy" can address this issue because wealth created by making better decisions can be redistributed to traders.

Decentralized native entities like MetaDAO have been experimenting with "Futarchy." When a proposal is made, such as Pantera buying governance tokens from MetaDAO, two prediction markets are created: "For" representing support and "Against" representing opposition. Participants trade conditional tokens within these markets, speculating on the proposal's impact on the DAO's value. The outcome depends on the comparison of the time-weighted average price (TWAP) of "For" and "Against" tokens after a specified period. If the TWAP of the "For" market exceeds a set threshold compared to the TWAP of the "Against" market, the proposal is approved, leading to the execution of the proposal terms and the cancellation of trades in the "Against" market. This system uses market dynamics to drive governance decisions, aligning them with the collective predictions of the market on proposal enhancements or reductions in DAO value.

In some cases, "Futarchy" still needs to be designed around confidentiality. For example, if prediction markets are used to make specific hiring decisions, the information becomes public and poses an information hazard—competitors may poach recruitment targets based on market predictions.

Another reason for keeping information confidential is its impact on incentives and organizational culture. As Robin Hanson pointed out in his "The Future of Prediction Markets" talk, Google's internal experiments faced resistance because executives were concerned that publicly available performance metrics would demotivate employees. Of course, managers are unlikely to implement something that might expose the "emperor's new clothes," as we see today. According to MetaDAO's founder @metaproph3t, some people decide not to submit proposals because they don't want to be evaluated by the market.

Both of these issues can be addressed by restricting access to prediction market information, providing it only to specific decision-makers. However, by empowering decision-makers to take action based on this information, bettors will factor these biases into their bets, thereby reducing the quality of the generated information.

In other cases, "Futarchy" may be more suitable for specific industries, where its advantages outweigh cultural influences, such as Bridgewater's hedge fund. Integrating blockchain can further enhance the credibility of "Futarchy" and prevent manipulation.

So far, the monetization of prediction markets has been limited to speculation or hedging, but by helping organizations make better decisions, prediction markets can unlock a whole new market—although the role of confidential information in this remains unresolved.

Game 7: Trustworthy Commitments in Programmable Information Games

As mentioned at the beginning of the article, Google monetizes information by leasing the right to use it to advertisers while restricting their use of the information to Google's ad auctions. Similarly, trustworthy commitments help information sellers monetize by limiting the actions buyers can take based on the information provided.

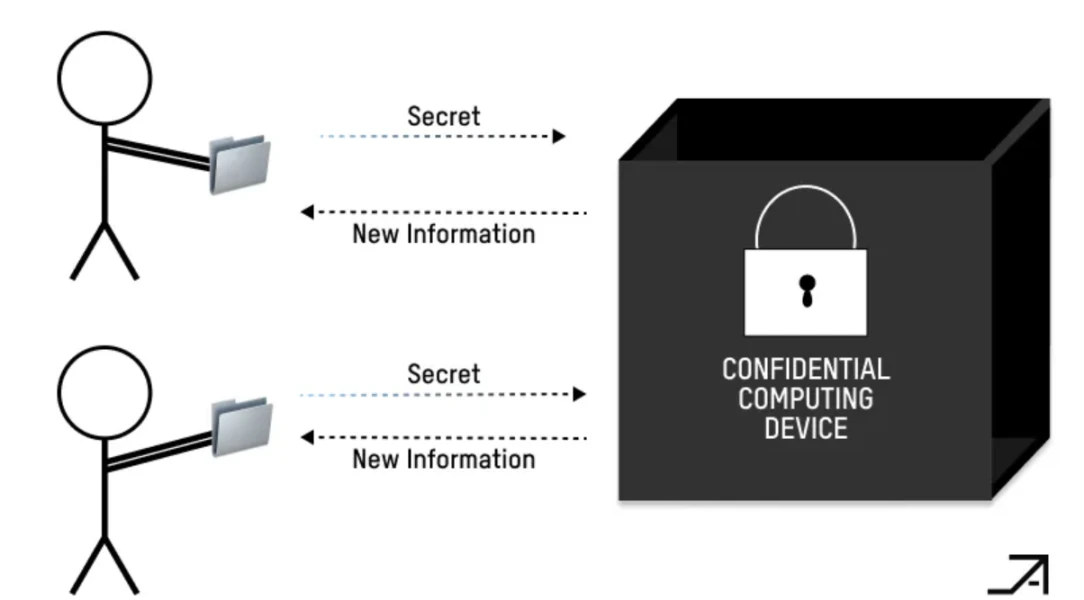

Information sellers can use cryptographic methods such as MPC, TEE, and FHE to ensure trustworthy commitments for computations based on private data by buyers. Thus, sellers can entrust their information to buyers, allowing buyers to exert specific control over their future actions based on the sellers' private information without revealing the information itself.

This primitive technology unlocks various information games. Imagine allowing traders (information sellers) to sell the right for searchers (information buyers) to order trades based on order trade history, provided that the buyers commit to only simulate order trade history a certain number of times. Furthermore, imagine allowing Netflix users to entrust others to use their accounts to watch Netflix movies, enabling them to "farm yield" from their accounts without revealing login details. In turn, buyers can unlock value from sellers' private information without sellers having to deal with the challenges of selling the information itself (non-rivalrous, non-excludable experiential goods).

Unlocking Google-Scale Monetization for Information Game Designers

TEEs currently provide a practical option for implementing such controls, although their confidentiality guarantees are limited. While not suitable for protecting large assets or sensitive data, TEEs are suitable for use cases requiring more restricted access to confidential information, such as preventing frontrunning. The Flashbots team's SUAVE project is building a TEE network that developers can use today, with the long-term vision of enabling application developers to find better ways to leverage the value of their and their clients' information.

In SUAVE's design, the integration of blockchain with TEE addresses three key limitations of TEEs critical to advancing information games. First, the blockchain eliminates the need for trust in communication between the host and players, which could be subject to review or malicious behavior. Second, the blockchain provides a secure mechanism for maintaining state, preventing rollback attacks that TEEs are susceptible to. Finally, the blockchain is crucial for ensuring the permissionless, censorship-resistant creation of TEE-based information games (SUAPP), where all players can trust their smart contracts, inputs, and outputs.

While many early uses of SUAVE in information games clearly focus on MEV, they have the potential to be used for information games far beyond trading.

Game 8: Reputation and Zero-Knowledge to Foster In-Game Markets

A key challenge in monetizing information is the inherent nature of information as an "experiential good." The value of experiential goods is only recognized after use, making it difficult for sellers to set prices in advance. When creating mechanisms to address this problem, game designers can also create interesting gameplay for users. The core gameplay of some games is to allow players to build reputation to distinguish themselves from others, such as in World of Warcraft, which can be both fun and a key way for players to decide who to collaborate with. Other games may want sellers to commit to setting a price for certain intelligence (such as the location of enemies, secret plans) without revealing the information in advance.

To overcome this problem, game designers can use cryptographic solutions such as zero-knowledge proofs (ZKPs) to verify the properties of information goods (such as the effectiveness of trading algorithms) without disclosing actual data or code. This can be achieved by creating encrypted commitments, timestamping on the blockchain, and providing zero-knowledge proofs of algorithm performance. However, this approach only applies to information goods whose value comes from their computational properties and can be tested on verifiable inputs.

For other types of information goods, reputation and identity become crucial. Consensus mechanisms among information buyers can be used to establish reputation around the value of information sellers are trying to sell.

Systems like Murmur use user voting within exclusive windows to build the reputation of publishers, elevating them from unverified to verified status based on community feedback. This process creates a transparent and immutable interaction record, establishing sellers' trusted reputation and accompanying a tight feedback loop.

Alternatively, the Erasure Bay protocol requires sellers to stake both funds and their reputation as a signal of their information reliability. The protocol determines a "fraud factor," allowing buyers to destroy a portion of the seller's stake in case of low information quality, ensuring sellers have an incentive to provide high-quality information.

To avoid market failures and maximize trading volume, game designers need to provide cryptographic tools for sellers to prove the value of their information or offer trusted, rapid mechanisms to establish the reputation of their previously sold goods.

Summary

Information games are not a new concept. However, before programmable blockchains emerged, game designers could only seek permission from centralized intermediaries, and players were limited to games mediated by trusted third parties.

Now, the significant reduction in block space costs means that anyone can create a DAO inspired by future governance or a protocol for confidential information and access a wide range of tools for verification, arbitration, monetization, and more. Lower barriers to entry and open innovation on the permissionless financial track will unlock games we can't even imagine.

This article showcases early signs and challenges of implementing this wave of new information games, as well as the potential of using cryptographic tools to address these issues. With these tools, some game designers will improve the information games we've already played, such as trading and MEV, while others will create games that didn't exist before.

However, each of these information games supported by cryptographic technology represents a small game, and they need to be combined to form a complete game. The enjoyment and excitement players derive from building reputation, collaborating with teams, and vying for influence within organizations are all part of a larger whole.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。