Author: @0xJohnsons

Mentors: @CryptoScottETH, @ZouBlock

TL;DR

- First, the Dencun upgrade corresponds to the "The surge" part of the Ethereum development plan, aiming to improve Ethereum's scalability and modularity, enhance the security of the Ethereum network, and improve overall usability:

- The core of the upgrade is the introduction of EIP-4844, significantly reducing transaction fees for Ethereum Layer2 and increasing transaction throughput, while preparing for full implementation of Danksharding;

- Introducing a new data storage structure—Blob, specifically used to store transaction data submitted from L2 to L1, which is the core reason for the overall reduction in L2 Gas;

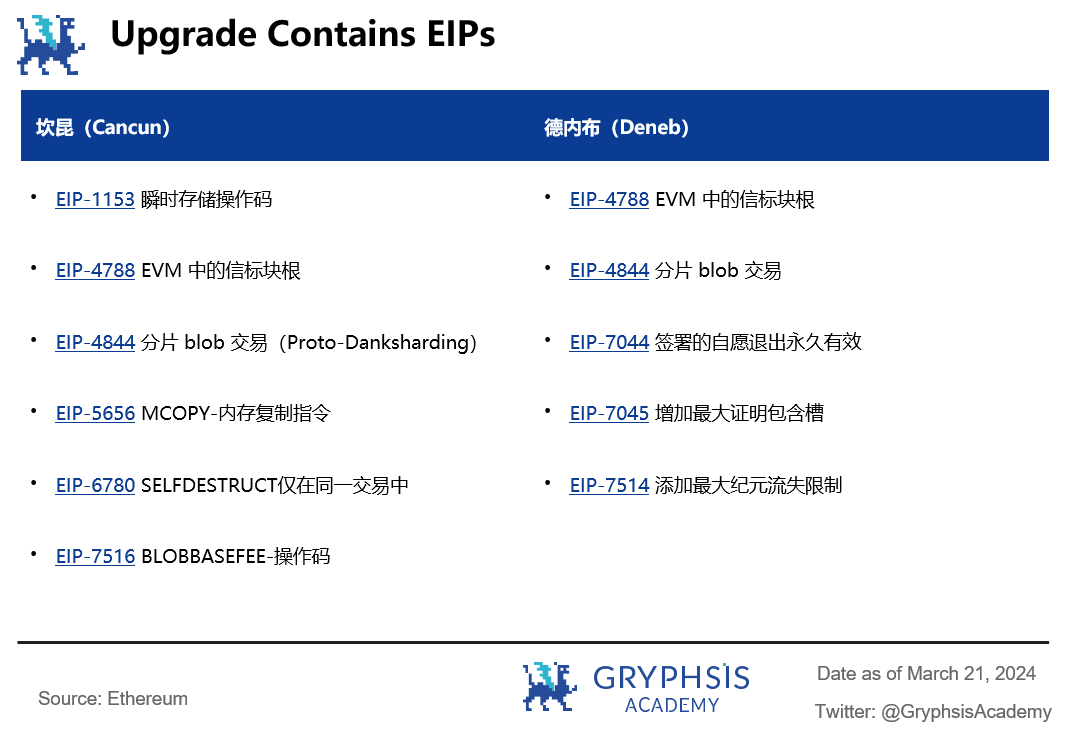

- EIP-1153 reduces storage costs and gas consumption with transient storage opcodes, EIP-4788 implements EVM and beacon chain interoperability in a minimal-trust manner, EIP-5656's MCOPY instruction fills the gap in the current EVM memory copying method, and EIP-6780 restricts the SELFDESTRUCT opcode, improving Ethereum's development stability.

- Secondly, comparing the effects before and after the upgrade from a data perspective:

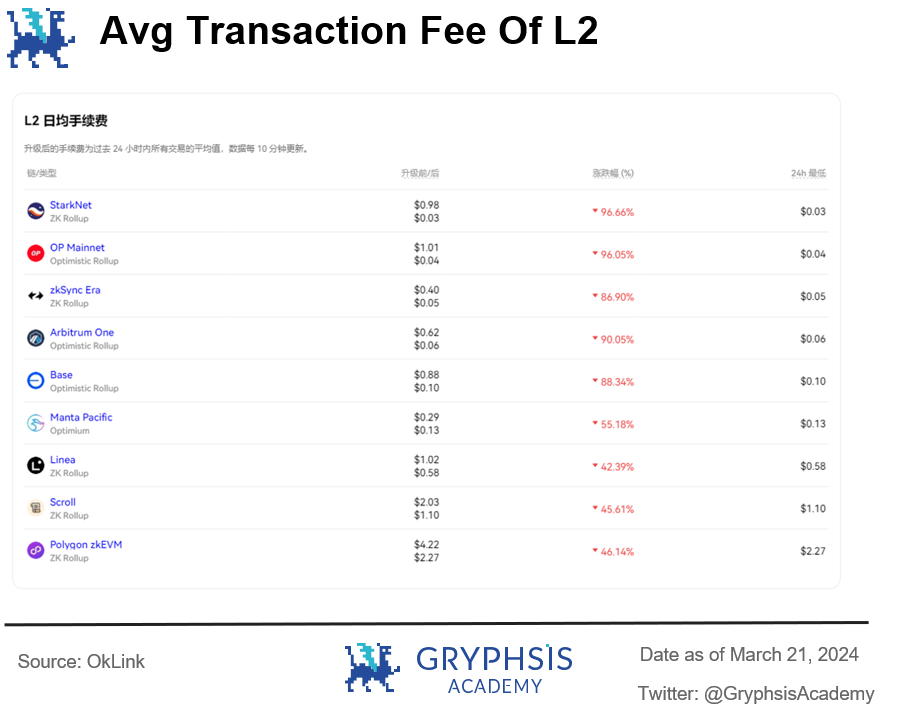

- In terms of gas fees, the reduction in L2 gas fees is significant, basically meeting the expected 90% reduction in Layer2 transaction fees before the upgrade; while Ethereum gas fees have decreased, it is not significant, and users do not feel any change in actual usage;

- In terms of transaction volume, the transaction volume of each L2 has increased after the upgrade, with the most significant increase in Base, from the previous 500,000 to 2 million, benefiting the most from the upgrade;

- In terms of TPS (throughput), the TPS of each L2 has increased after the upgrade, but not as significantly as the transaction volume. However, from the perspective of industry development, this upgrade also lays the foundation for the future, and also aligns with Ethereum's development expectations to achieve a TPS of 100,000+;

- In terms of Blob usage, the post-upgrade Blob usage is average, not reaching the expected target value of 3, but it can be seen intuitively that the average transaction cost of L2 using L1 data has significantly decreased.

- Finally, exploring the investment impact of the Dencun upgrade on Ethereum and L2:

- The author believes that this upgrade is mainly laying the foundation for the future development of Ethereum, making it closer to becoming a fully scalable, accessible global trading platform. As for ETH, as the native token of the "platform," combined with the narrative of ETH-ETF, it is more of a global asset allocation in the future, similar to the current transformation of BTC's role, more inclined towards long-term investment;

- Arbitrum and Optimism, the leaders in L2, are particularly worth paying attention to. Currently, both are developing well, each with its own moat, and this upgrade in the future is speculated to potentially increase their profit space, benefiting users and forming a positive cycle for their ecosystem development;

- Another L2 that is worth paying attention to is Base, backed by Coinbase, naturally has a large user base and fund size, and its recent data performance is outstanding, with market heat as well, which may present good alpha opportunities after the upgrade;

- For unreleased L2, continuous attention should be maintained. The significant reduction in interaction costs caused by the upgrade will attract more users to participate in the ecosystem interaction, such as ZKsync, Blast, etc.

Preface

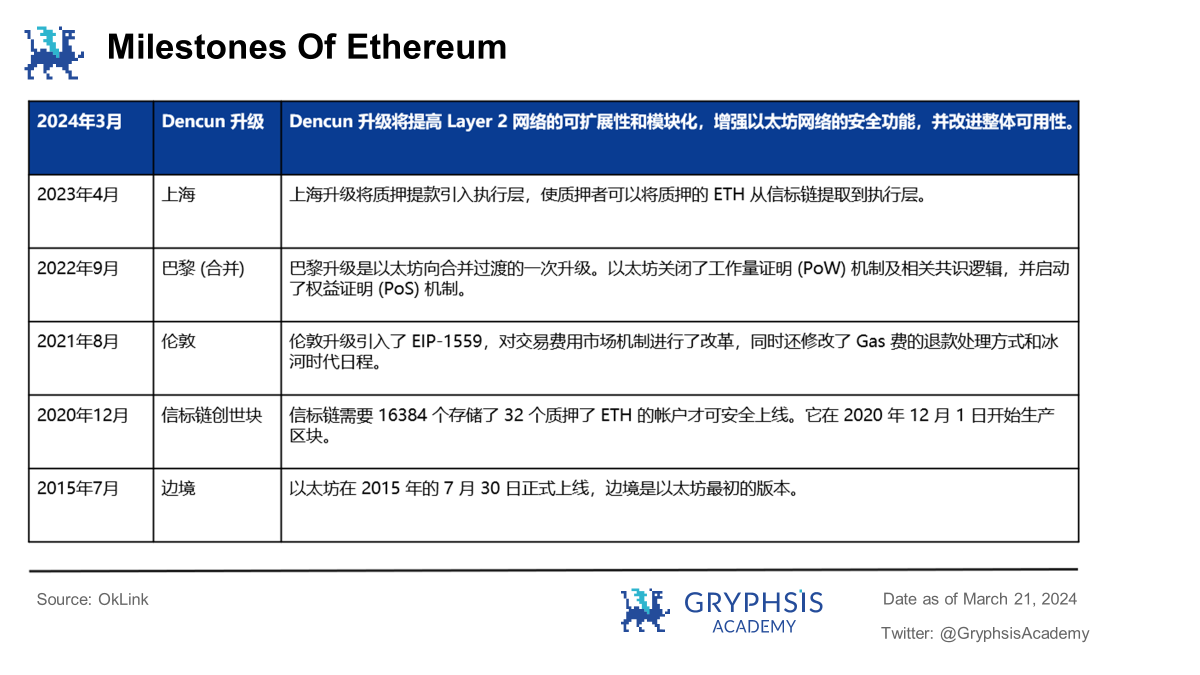

Due to the introduction of the smart contract concept by Ethereum, it has fostered the subsequent prosperity of the blockchain ecosystem. Since its official launch on July 30, 2015, Ethereum has undergone 12 upgrades, each of which has attracted much attention.

The main goal of the Ethereum Cancun - Dencun upgrade (Dencun upgrade) is to improve the scalability and modularity of the Layer 2 network, enhance the security of the Ethereum network, and improve overall usability.

1. What is the Dencun upgrade

1.1 Upgrade Introduction

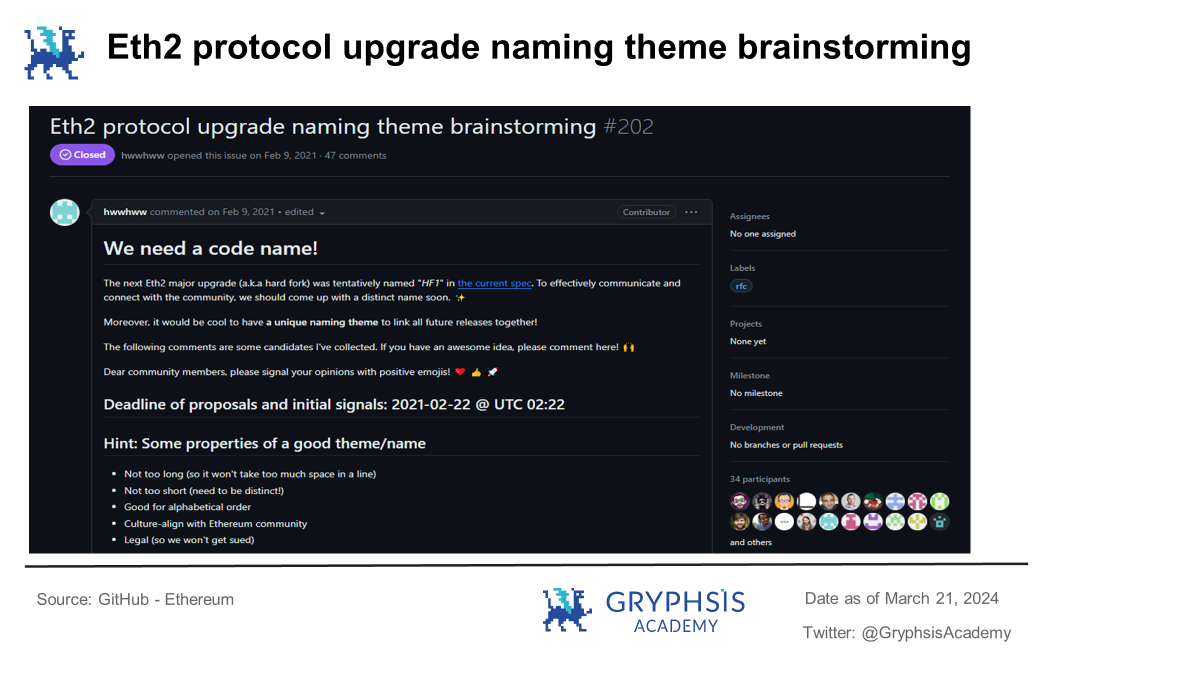

1.1.1 Origin of the Name

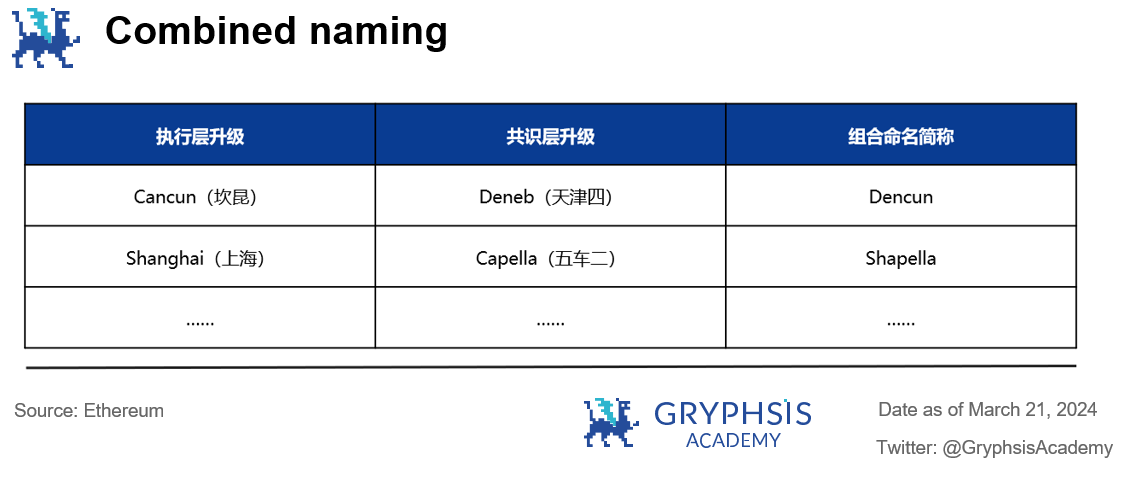

The underlying structure of Ethereum is composed of two parts, the execution layer and the consensus layer, each with different naming rules.

Since 2021, the naming rule for the execution layer upgrade has been based on the cities where Devcon (Ethereum Developer Conference) is held. For example, Berlin upgrade, London upgrade, Shanghai upgrade, etc.

The naming rule for the consensus layer upgrade is based on celestial names since the introduction of the beacon chain, named alphabetically. For example, Altair, Bellatrix, Capella, etc.

Each Ethereum upgrade name is a combination of the different upgrade names, forming the overall upgrade name. Since the Devcon location for this upgrade was in Cancun, Mexico, and the consensus layer upgrade is Deneb, this Ethereum upgrade is simply referred to as the Dencun upgrade.

1.1.2 Upgrade Background

The background of the Dencun upgrade is based on the long-term development plan of Ethereum and the core goal of enhancing the Ethereum experience, ultimately achieving a permissionless, decentralized, censorship-resistant, and open-source ecosystem.

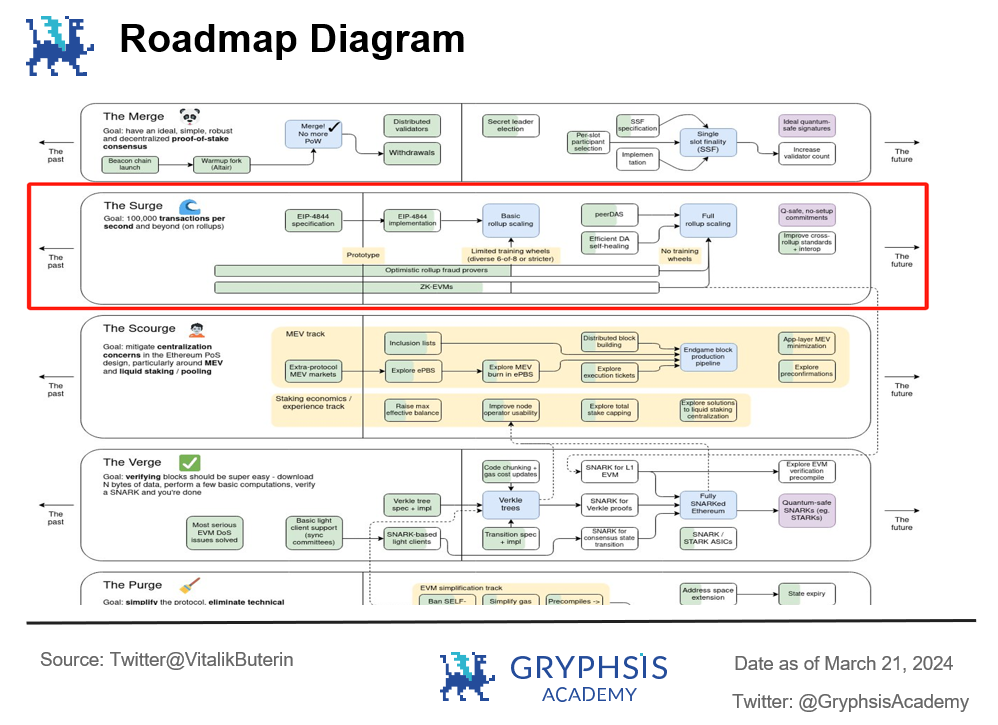

On one hand, it can be seen from the roadmap published by Ethereum's founder Vitalik Buterin on December 31, 2023, that the Dencun upgrade corresponds to part of "The surge," beginning with user experience as the top priority (e.g., improving transaction speed, reducing gas fees), aiming to improve network efficiency, reduce transaction costs, and lay a solid foundation for future development.

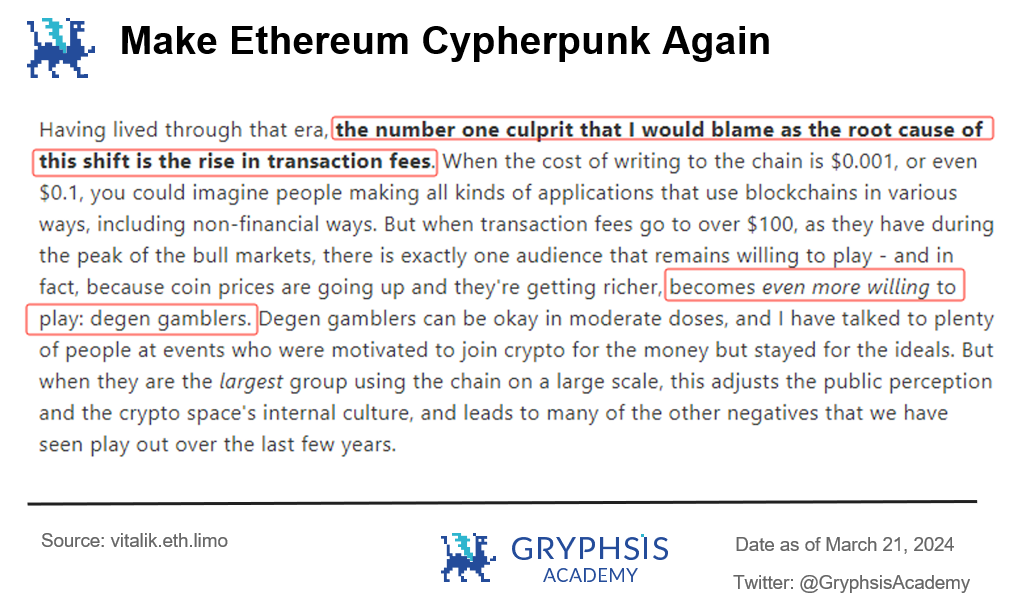

On the other hand, from Vitalik Buterin's article "Make Ethereum Cypherpunk Again" published on December 28, 2023, it can be seen that Vitalik believes that one of the core reasons causing blockchain to become increasingly limited to asset speculation is the rise in transaction fees, which has made Degen Gamblers the mainstream group, hindering the realization of the practical value of blockchain applications, so it is necessary to reduce transaction fees.

1.1.3 Upgrade Time

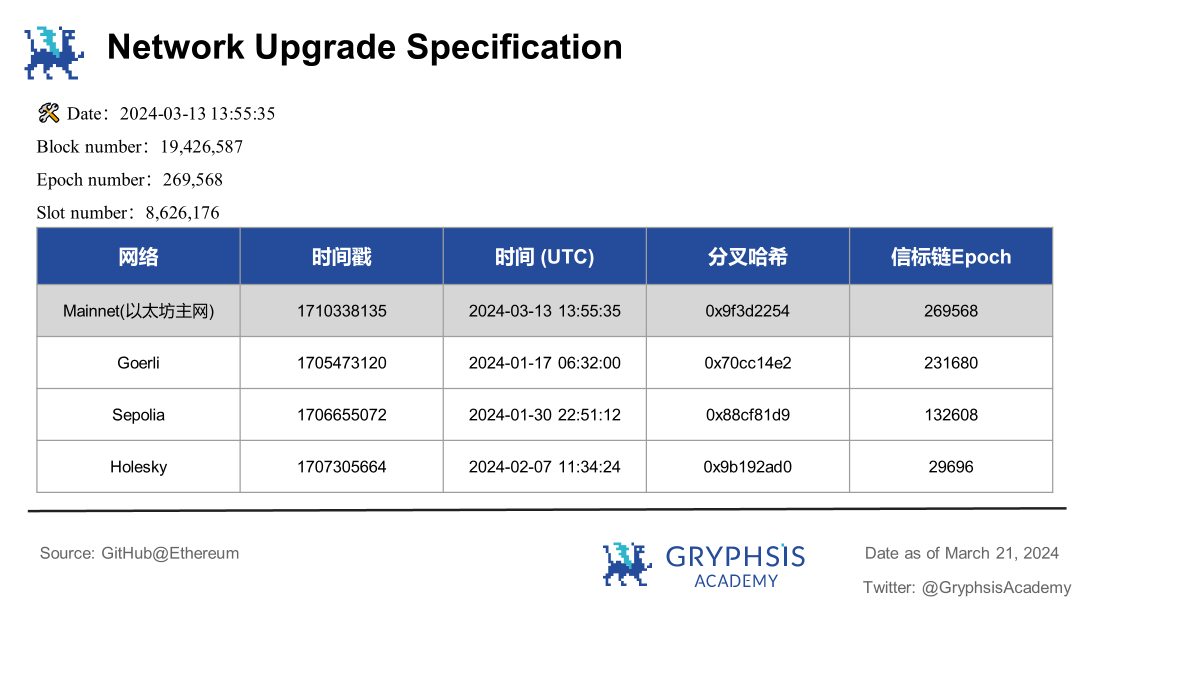

According to the Ethereum plan, the upgrade time and activation information are:

1.1.4 Content Involved

The Ethereum Cancun-Deneb upgrade made a series of improvements to the execution layer and consensus layer. Cancun (Cancun) improved the execution layer (EL), while Deneb (Deneb) enhanced the consensus layer (CL), and incorporated a series of crucial EIPs (Ethereum Improvement Proposals) essential for the development of the Ethereum network. There are a total of 9 EIPs, and we will introduce the key EIPs in the following sections.

1.2 Key Points of the Dencun Upgrade

From the above understanding, we know that the main focus of the Dencun upgrade is to improve Ethereum, and the specific implementation plan revolves around a series of EIPs. The following will provide an in-depth analysis of the core EIPs involved.

1.2.1 EIP-4844 Sharding Blob Transactions (Proto-Danksharding)

EIP-4844 is the highlight of this upgrade, aiming to reduce fees, increase transaction throughput (TPS), and scalability. Its essence is a transitional upgrade to prepare for the future, to achieve full Danksharding (the final part of the Ethereum "serenity" phase upgrade). Proto-Danksharding lays the foundation for Danksharding.

Data availability on the Ethereum main chain is provided by Calldata (data generated in contract transactions), and the data transmitted from Layer 2 to Layer 1 is stored in Calldata. Additionally, for security, each step of Calldata execution requires Gas, resulting in significant Gas costs. However, the transaction data in Calldata is not very useful after verification, and long-term data can be downloaded and verified, even without being transmitted to the execution layer. For example, looking at the historical average transaction fees of Layer2-OP chains, it can be seen that close to 80% of the fees come from L1 data fees.

Therefore, EIP-4844 introduces a new data storage structure—Blob, specifically used to store transaction data submitted from L2 to L1. After its introduction, L2 transaction data is directly submitted to Blob for storage, available for consensus nodes to fully download, and can be deleted shortly after, reducing unnecessary storage burden. This means that the introduction of Blob will greatly reduce L2 transaction fees. Additionally, Blob also effectively expands the block space for L2 and significantly increases L2 transaction throughput.

1.2.2 EIP-1153 Transient Storage Opcodes

EIP-1153 aims to save storage space and storage costs. Transient storage is discarded after each transaction, making temporary storage cheaper because it does not require disk access.

EIP-1153 is more friendly to Dapp developers, introducing new opcodes TSTORE and TLOAD in the EVM, with a gas cost of about 100 Gas for each call, which is 95% cheaper than traditional storage calls (SLOAD and SSTORE). Once the complete transaction execution is finished, this part of the storage will be cleared, reducing storage costs and gas consumption, potentially making new DeFi contracts more gas-efficient in the future.

1.2.3 EIP-4788 Beacon Block Root in EVM

EIP-4788 will enable communication between the EVM (Ethereum Virtual Machine) and the beacon chain. This feature supports various use cases, improving staking pools, restaking constructions, smart contract bridges, MEV, and more.

Previously, the EVM could not directly access Beacon data and state, and could only capture state through external trusted oracles. Therefore, it is proposed to place a parent beacon block root in each EVM block, so that the EVM can immediately obtain accurate information when the Beacon is updated.

The parent beacon block root will be stored in a circular buffer, retained for about 1 day, and once a new parent beacon block root enters and the buffer capacity reaches a critical value, the oldest parent beacon block root will be overwritten, achieving efficient and limited consensus storage. This minimizes trust and eliminates external oracle failures and malicious risks, increasing security.

1.2.4 EIP-5656 MCOPY - Memory Copy Instruction

EIP-5656 optimizes the cost of copying memory areas and improves the efficiency of moving data in the EVM by introducing the new EVM instruction MCOPY.

Memory copying is a basic operation, but implementing it on the EVM incurs expenses. For example, copying 256 bytes of memory data using the MCOPY opcode significantly reduces the cost from the previous 96 Gas (using MLOAD and MSTORE) to 27 Gas. It is expected that most developers will use MCOPY instead of MSTORE/MLOAD, and more efficient gas contracts will ultimately benefit end users.

Additionally, MCOPY fills the gap in the current method of copying memory in the EVM.

1.2.5 EIP-6780 SELFDESTRUCT Only in the Same Transaction

EIP-6780 restricts the SELFDESTRUCT opcode, where the new function only sends all funds from the account to the target without affecting code, storage, and other information, and also prepares for the future Verkle tree upgrade.

Before EIP-6780, if the SELFDESTRUCT opcode was referenced in contract creation, the funds could be sent to the target, but the code, storage, and other information would be deleted, which could pose certain risks and unexpected consequences. After EIP-6780, none of this will be affected, allowing developers to better manage projects, resulting in a more stable and predictable blockchain.

2. Impact on Data After the Upgrade

2.1 Impact on Gas Fees

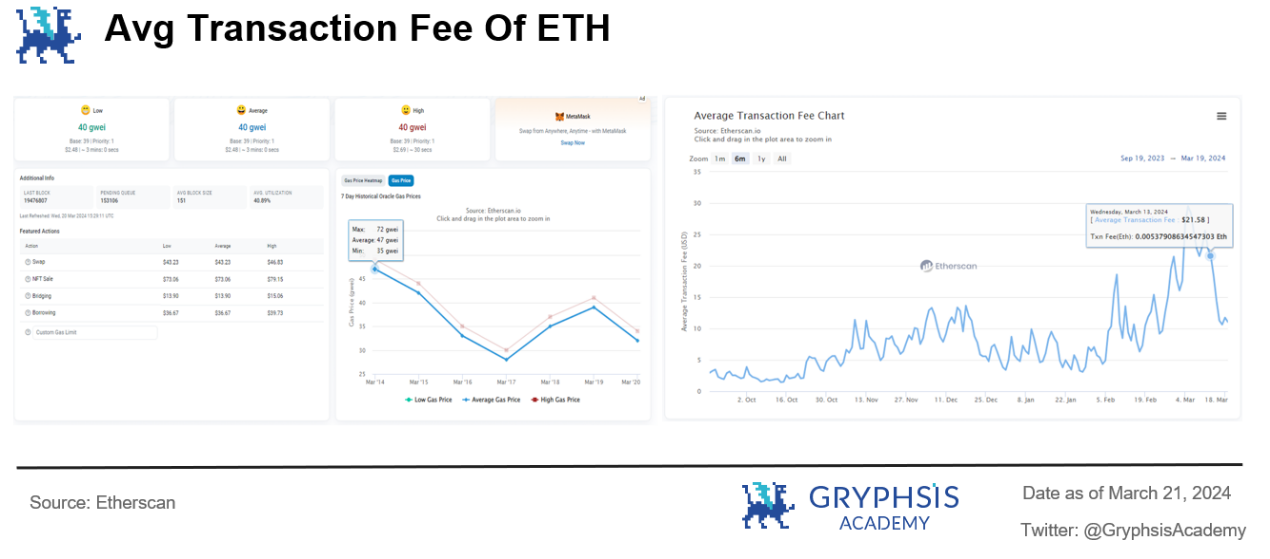

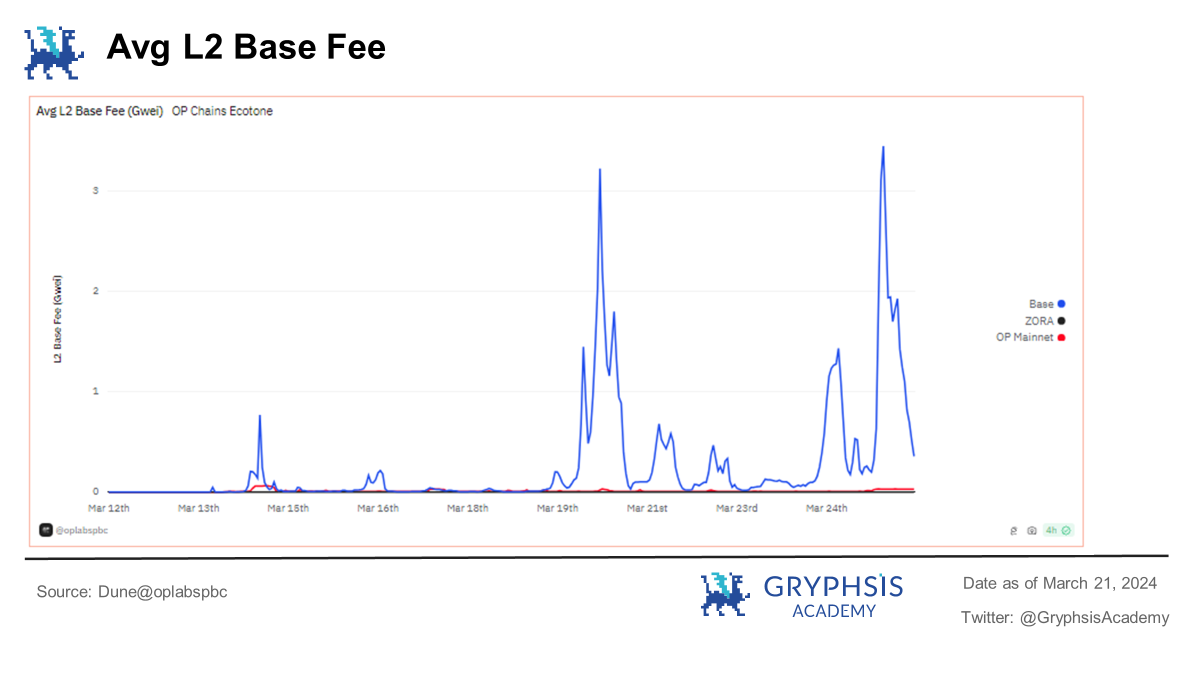

The most core and concerning aspect of this upgrade is the change in Gas fees. With the introduction of EIP-4844, the most significant beneficiaries are the Layer2, where the reduction in Gas fees is very noticeable, leading to an improved user experience. This is in line with the expectation that Layer2 transaction fees would decrease by 90% before the upgrade.

For Layer1 (Ethereum itself), the post-upgrade Gas fees have decreased, but not significantly, and users have not felt any change in actual usage.

2.2 Impact on Transaction Volume

In addition to reducing Gas fees, the upgrade aims to increase throughput, which is a key focus of Ethereum's scalability development plan.

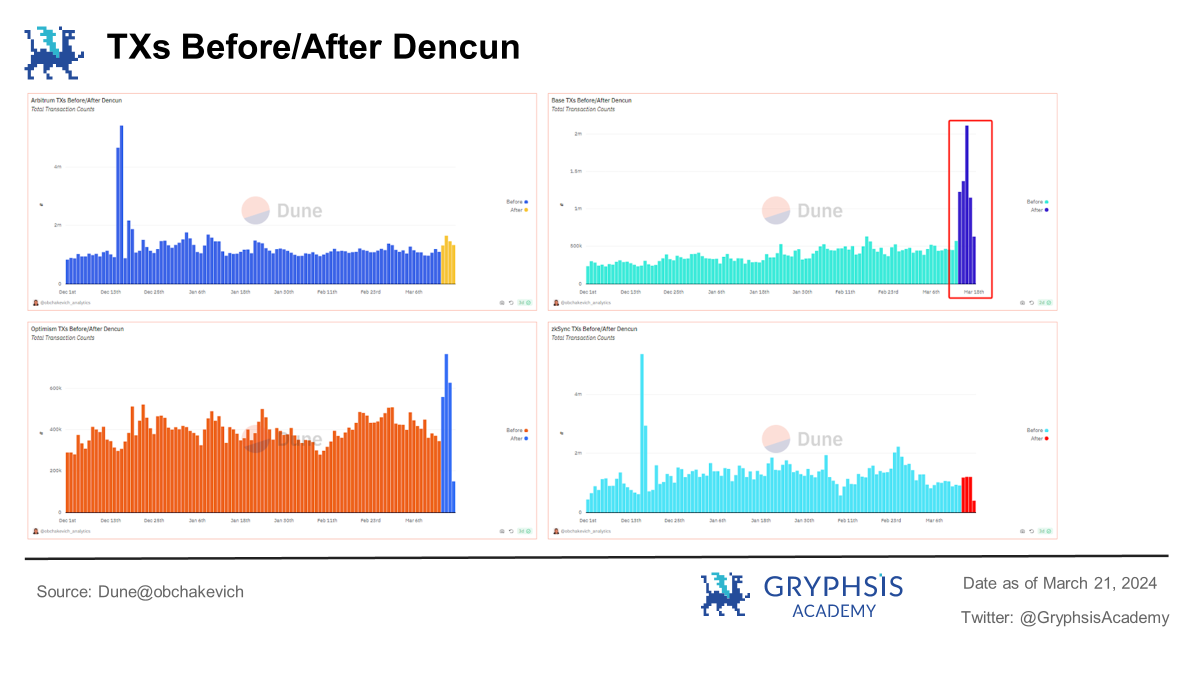

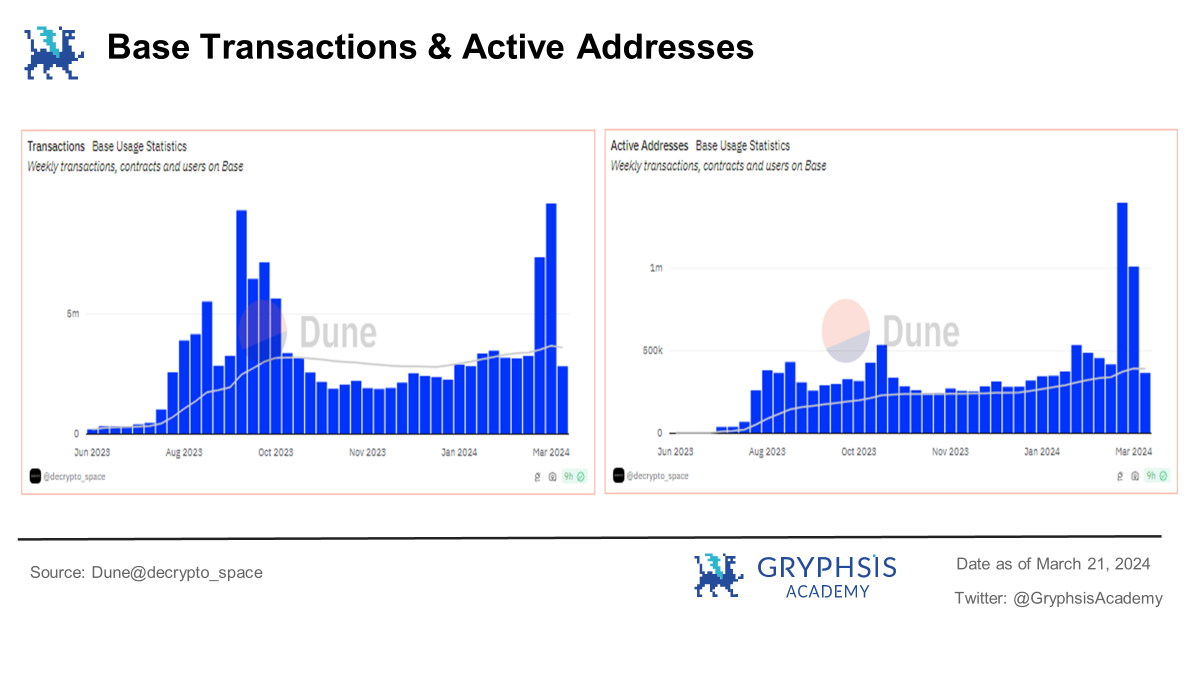

After the upgrade, the transaction volume of Base has surged and surpassed the previous bottleneck, increasing from 500,000 to 2 million, indicating a direct impact of EIP-4844 and the most significant benefit.

2.3 Impact on TPS

Optimizing TPS (transactions per second) means that developers have greater flexibility in building and deploying dApps, which is expected to lead to the creation of more complex, data-intensive applications, attracting a wider user base.

After the upgrade, the TPS of various Layer2 has generally increased, but not exceeding 30 transactions per second.

Low TPS is a common phenomenon in the current Web3 industry, different from the high TPS characteristics of the traditional Web2 industry. The TPS of Layer2 also does not exceed 500, but from the perspective of industry development, this upgrade is laying the foundation for the future and also aligns with Ethereum's development expectations of achieving 10,000+ TPS.

2.4 Usage of Blob

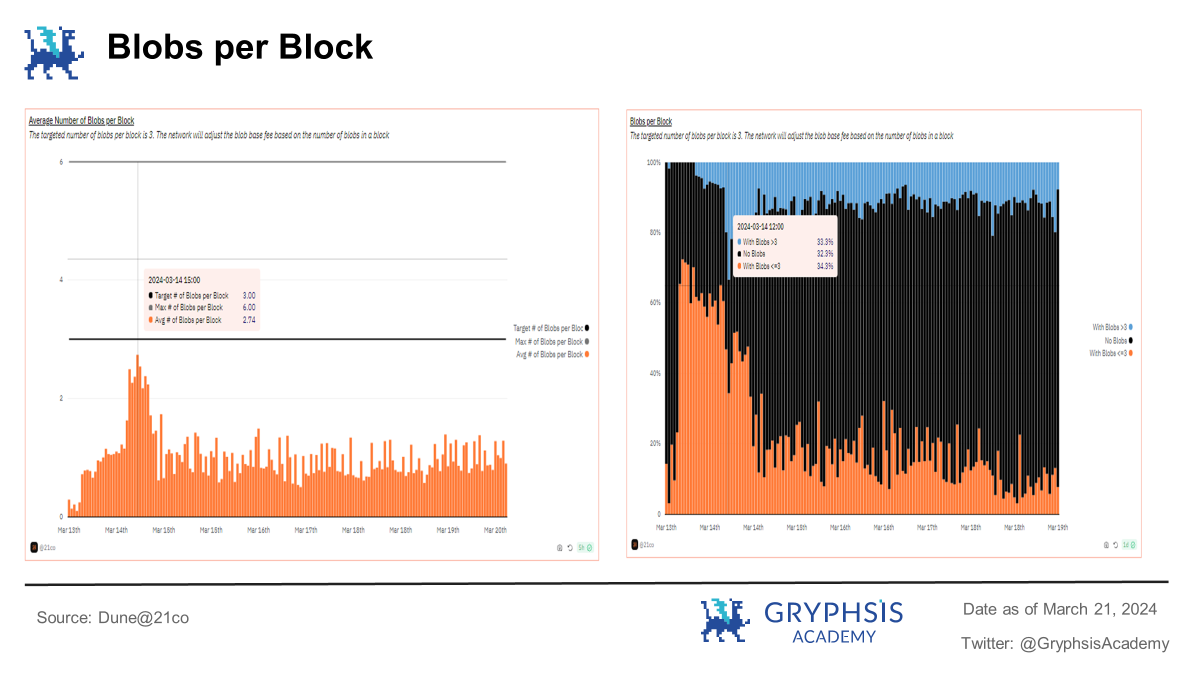

The overall decrease in Layer2 transaction fees is mainly due to the introduction of Blob type. The more Blobs used in transactions, the greater the overall throughput, laying the foundation for future Ethereum upgrades.

Initially, it was expected that achieving an average of 3 Blobs per block would nearly double the throughput of L2. If the goal of attaching 64 Blobs per block is achieved, the throughput of L2 will nearly increase by 40 times. The maximum limit for this upgrade is set at 6 Blobs.

Currently, Blobs have started to be used in transactions, but the overall usage rate is not high, and the peak usage occurred just after the completion of the upgrade, gradually declining thereafter, and has not yet reached the estimated average of 3 Blobs per block.

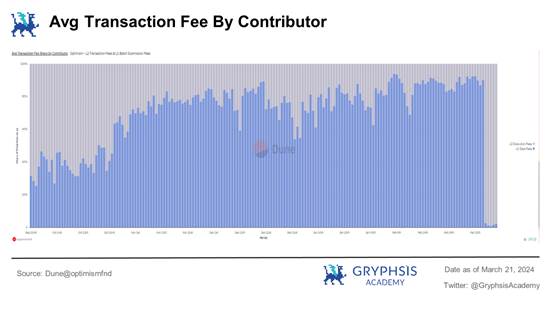

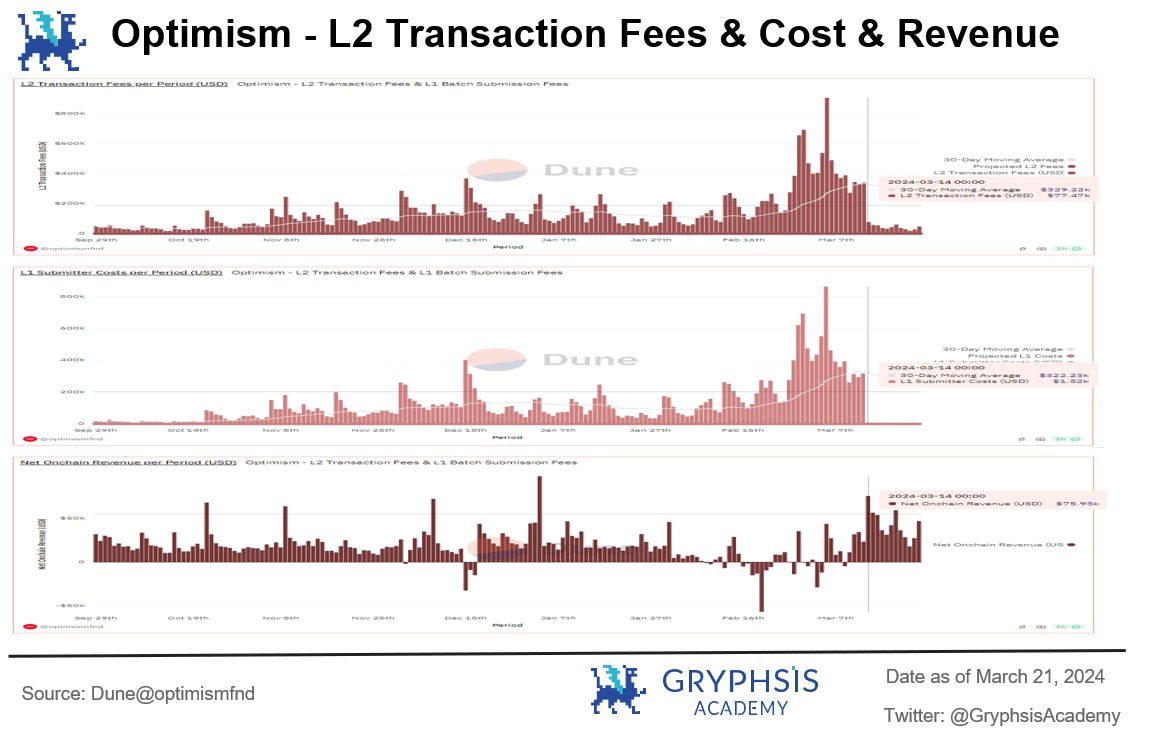

However, the introduction of Blob type has significantly improved the data fees of Layer2 on Layer1. As mentioned earlier, the average transaction fees of Layer2 using L1 data fees have significantly decreased, almost eliminated. This also suggests that the profit potential of Layer2 may increase from another perspective.

The profit model of L2 is relatively straightforward, where on-chain profit equals L2 transaction fees minus L1 payment costs. Although the upgrade has reduced both L2 transaction fees and L1 payment costs, the decrease in the two is not on the same scale due to the increase in transaction volume and user base. Transaction fees have decreased from hundreds of thousands to tens of thousands, while payment costs have decreased from hundreds of thousands to less than 1k, resulting in an increase in on-chain profit after the upgrade.

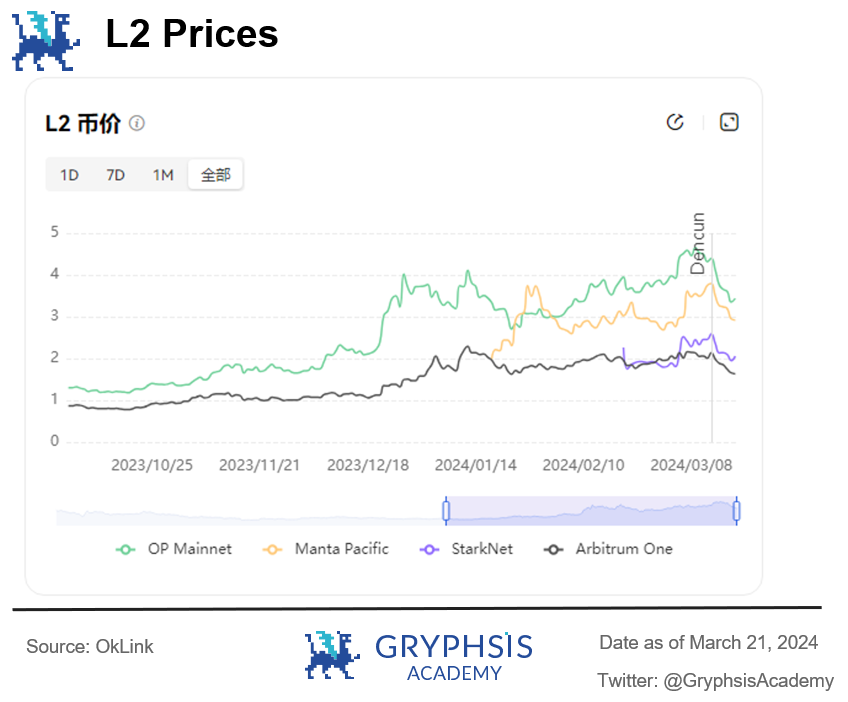

2.5 Price Impact

For this upgrade, in addition to the improved on-chain user experience, the next most concerning aspect for users is the native token prices of various L2. It can be seen that the prices of the issued Layer2 tokens have started to decline after the upgrade, which is related to industry characteristics, where good news turning into reality leads to a negative impact. The market has been speculating on Ethereum upgrade-related concepts since 2023, and looking at the price increase during this period, this upgrade can be considered as a realization of good news.

3. Impact on Investment Value

The Dencun upgrade has been the focus of attention in the 23-24 fiscal year, and the public has been making investment judgments based on a series of concepts related to the Dencun upgrade. This upgrade is bound to have an impact on the investment value of future Ethereum and L2.

3.1 Ethereum Passing the Baton to L2

The vision of Ethereum is to become more scalable and secure under the premise of decentralization.

To overcome the "impossible triangle" (proposed by Vitalik Buterin), Ethereum transitioned from POW to POS for improved security in previous upgrades. In terms of scalability, it has clearly adopted the L2 Rollup solution to increase Ethereum's throughput and significantly reduce user costs.

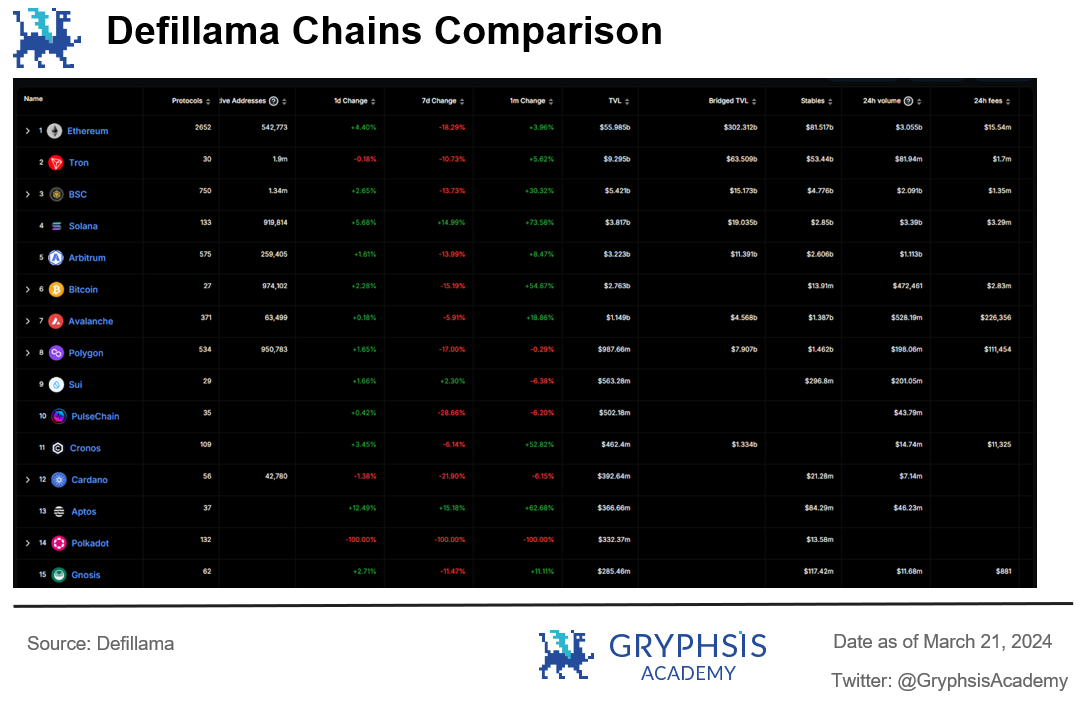

Although Ethereum's TVL is still in the lead, other L1 public chains have had a significant impact on it. For example, Solana's transaction volume has surpassed Ethereum, and in terms of active addresses, Ethereum is only in 6th place.

Furthermore, the emergence of Sui and the recent popularity of BTC L2 concepts will continue to divert users from Ethereum. A decrease in user and developer base usually leads to a decrease in its value. However, this does not mean that Ethereum will decline, but rather its development trajectory will change.

Since its launch in 2015, Ethereum has ushered in the Web3 era and has fostered industry prosperity, with the emergence of L2 being the most typical. Many L2 solutions have provided scalability for Ethereum, and the focus of the Dencun upgrade is on L2. Future Ethereum upgrades will also involve multiple aspects related to L2, and the two are becoming increasingly interconnected and complementary.

I believe that this upgrade has laid the foundation for the future development of Ethereum, bringing it closer to becoming a "fully scalable and accessible global trading platform." As for ETH, as the native token of the "platform," combined with the narrative of ETH-ETF, it is more likely to become "a global asset allocation" in the future, similar to the role transition of BTC, leaning more towards long-term investment. The future alpha opportunities will definitely be in the emergence of L2, and Ethereum will gradually pass the baton of expansion to L2, completing the role transition. Therefore, the current focus of investment should be on L2 and other tracks.

3.2 L2 Ecosystem Explosion

Undoubtedly, the biggest and most direct impact of the Dencun upgrade is on Layer2. As per the data mentioned earlier, the transaction fees of L2 have generally decreased significantly, and the throughput has also increased. This allows L2 to attract users to the ecosystem with lower prices and higher performance, further competing with other L1.

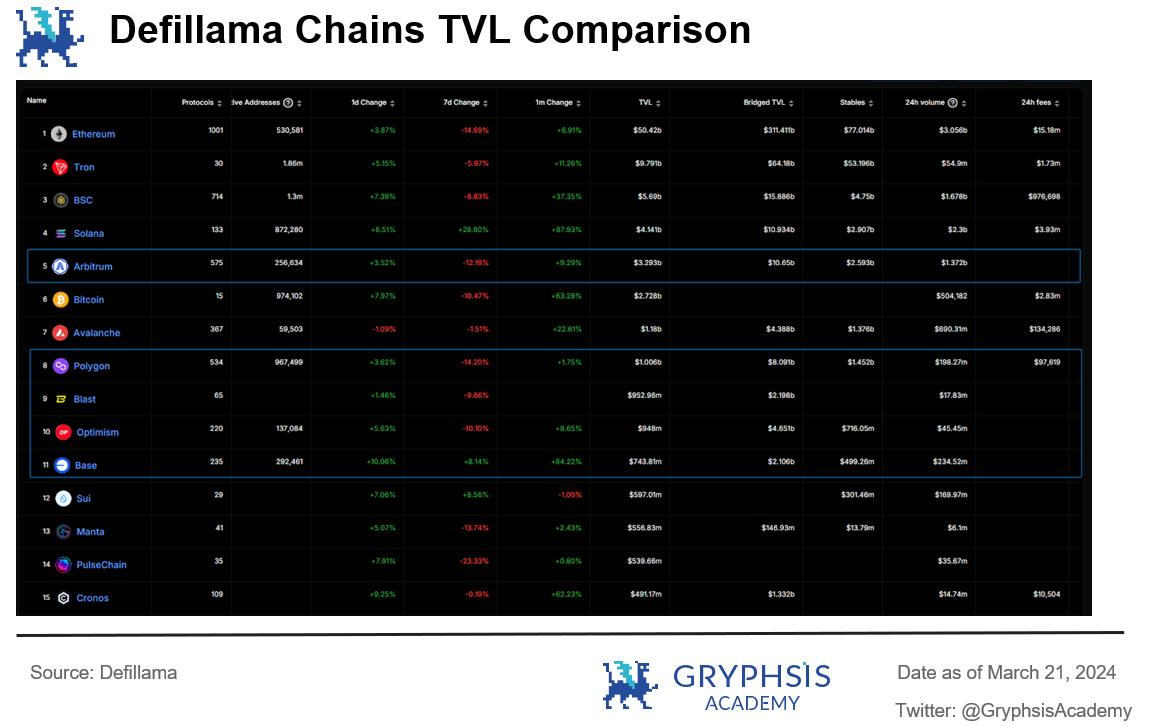

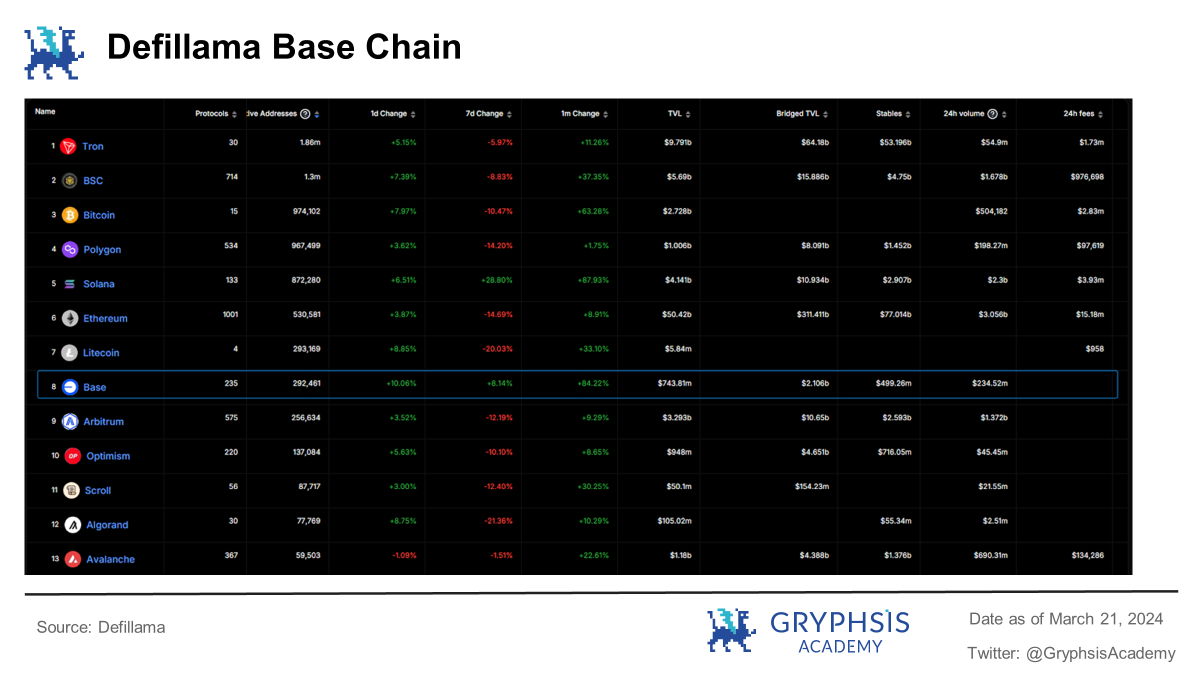

According to DeFiLlama statistics, among the top 10 TVL, there are 4 L2 (Polygon strictly counts as a sidechain, but it also has corresponding ZK Layer2 solutions, gradually embracing ETH L2). Among them, Arbitrum ranks 4th, just after BSC and Solana, and there are also emerging L2 projects like the popular airdrop project Blast and Base, backed by the abundant resources of Coinbase, which have enormous potential and need to be closely monitored.

For Layer2, the Dencun upgrade has actually reduced its own costs, which means there is an opportunity for increased profit potential in the future. Leading L2 protocols like Arbitrum and Optimism are likely to use the profits from the upgrade to enhance their own ecosystems and increase activity, benefiting users. In other words, the enhanced profitability of L2 itself will also increase the value of its tokens, which has gained market consensus. Although the price of $arb and $op has fallen after the upgrade, the market is still optimistic based on their trading volume and active users.

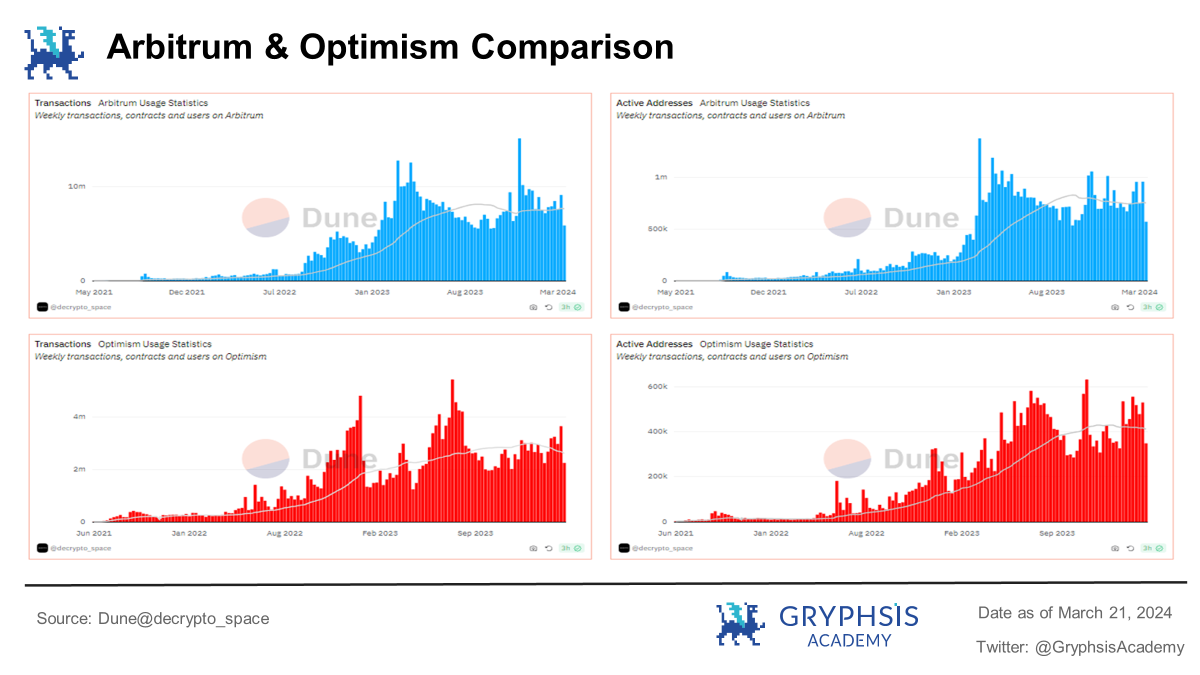

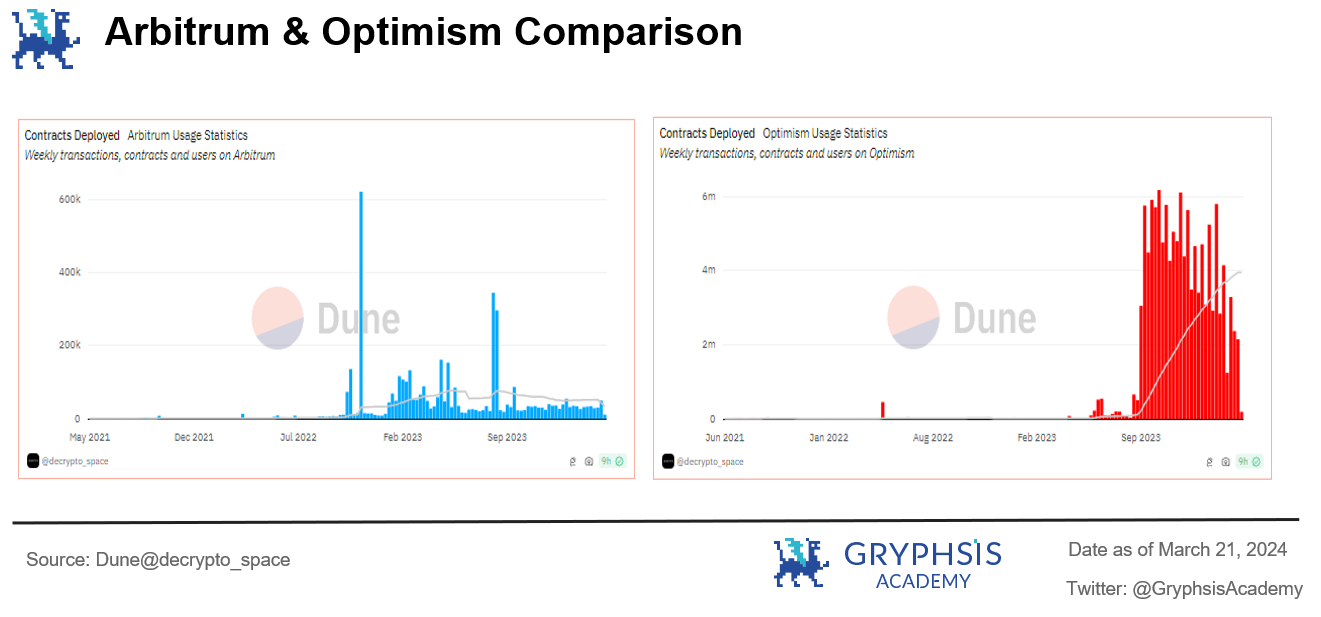

In terms of ecosystem development, we can understand the deployment of contracts for Arbitrum and Optimism. Arbitrum's contract deployment growth is lower than Optimism, but it still has the most diverse range of L2 protocols. According to DeFiLlama statistics, Arbitrum currently has 575 protocols, far more than other L2 protocols, and its TVL is also at the forefront. Since its launch, Arbitrum's data has been consistently excellent.

In 2023, Optimism proposed the Superchain strategy and began to promote the OP stack (an open-source L2 technology stack), which means that other projects wanting to run their own L2 can use it for free. Due to the technical consistency, secure, efficient, atomic-level communication and interaction of information and assets can be achieved between them, and it has already been adopted by Coinbase, launching the Base chain. In addition, there are other projects like Binance's opBNB, NFT project ZORA, and well-known on-chain data dashboard Debank.

Arbitrum and Optimism, as the leading L2 in terms of TVL and user volume, combined with the current thriving ecosystem, have formed their own moats and are the core L2 most directly affected by this upgrade. Both have a natural first-mover advantage, and their own top protocols and ecosystems should be closely monitored.

Another L2 worth paying attention to is Base, with a TVL growth of over 80% in the past month. In terms of active addresses, Base has surpassed all L2, second only to Ethereum. In terms of the number of ecosystem protocols, it has surpassed OP, ranking 7th.

Similarly, Base is one of the L2 most directly affected by the upgrade, with significant growth in transaction volume and users after the upgrade, and increased market discussion, such as the high market discussion of SocialFi (friend.tech), DeFi (Perennial), and memecoin on Base.

Base's strong ties with Coinbase naturally give it a certain scale of users and funds. With the emergence of the friend.tech project, the market's attention has been redirected to the SocialFi track. The core demand of SocialFi is high interaction frequency, low interaction costs, and the ability to accommodate a large number of users, which requires higher performance, aligning with the benefits brought by the Dencun upgrade. Perhaps in the future, there will be phenomenal projects related to this on Base.

Furthermore, there are still more L2 projects like Blast and Zksync that have not yet been launched. The Dencun upgrade can greatly reduce the cost of user interaction, further promoting the prosperity of such L2 on-chain activities.

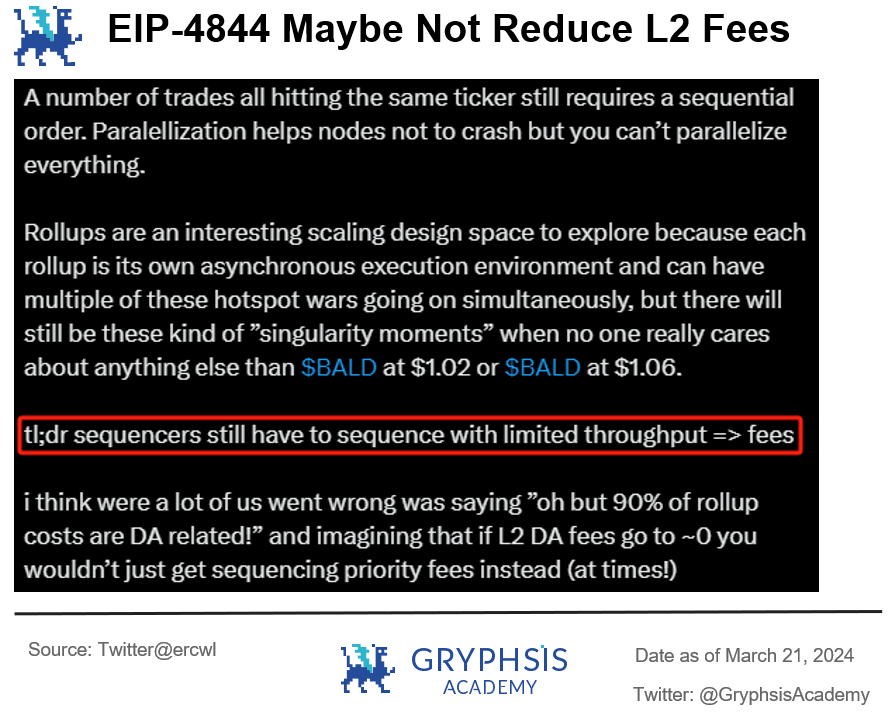

However, on the other hand, although EIP-4844 has reduced L2 transaction fees, it does not always guarantee low L2 fees. Taking the example of the Base chain, during the period after the upgrade, with the increasing popularity of memecoin on Base, transaction fees have also surged and remained at a high level.

This phenomenon was illustrated by Eric Wall, co-founder of Taproot Wizards, on Twitter, and the details can be found in the original post. In simple terms, the capacity space of L2-DA brought by EIP-4844 is not unlimited. When a large concentration of transactions occurs (increased TPS), Blob Space fees will compete and increase to achieve priority transactions, causing the sorter fees of L2 to increase, thereby affecting the increase in transaction fees. In other words, when a large number of concurrent transactions occur on the same chain, transaction fees will also increase.

Source: https://twitter.com/ercwl/status/1771156029121663082

4. Conclusion and Outlook

- The Dencun upgrade has significantly reduced the transaction costs of L2, achieving the expected 90% reduction in L2 transaction fees. However, the reduction in transaction fees for Ethereum itself is not as significant as L2. Additionally, after the upgrade, the throughput of L2 has increased to varying degrees, with Base chain showing the most impressive performance. On the other hand, if a large number of concurrent transactions occur on the same chain, transaction fees will still increase.

- This upgrade has further developed Ethereum in terms of scalability and introduced the new Blob data structure, laying the foundation for handling high concurrency in the future.

- The Dencun upgrade will further drive the prosperity of the L2 ecosystem, with particular attention to Arbitrum and Optimism as the current leaders in L2. Arbitrum has the most diverse range of protocols and has consistently performed well, while Optimism's Superchain strategy will form the "OP system." Additionally, this upgrade may increase the profit potential of both, which is likely to benefit users and create a positive cycle for their ecosystem development.

- The emerging L2 project Base also deserves attention, as it is naturally backed by Coinbase with a large user and fund base. It has shown outstanding data performance, with a TVL growth of over 80% in the past month, and the number of active addresses ranking at the forefront of L2, surpassing OP. The development of ecosystem projects on this chain is worth monitoring.

- The most noticeable improvement in user experience after the upgrade is the significant reduction in interaction costs for various L2, making users more willing to interact and creating a positive cycle for the ecosystem. Additionally, it is worth continuing to monitor L2 projects that have not yet issued tokens, such as Blast and Zksync. The reduction in interaction costs will encourage more users to participate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。