Recently, the StakeStone project has attracted attention in the blockchain community due to investments from Binance Labs and OKX Ventures. StakeStone is dedicated to establishing its STONE token as a new standard for cross-chain liquidity assets and is also building a new application layer liquidity market. In this market, on February 26, its total value locked (TVL) for the full-chain LST protocol surpassed $1 billion, reaching an astonishing $1.2 billion by March 26.

As a participant in the liquidity staking track, StakeStone's application in DeFi and Ethereum Layer 2 solutions is particularly crucial. Compared to projects like Lido and Rocket Pool in the same track, StakeStone provides users with a wider range of application scenarios and profit opportunities through its cross-chain liquidity market and innovative OPAP mechanism, demonstrating its unique market positioning.

Next, we will delve into StakeStone's technical architecture and how it stands out in the competitive liquidity staking market.

Analyzing StakeStone's Core Advantages: Non-custodial and Transparent Liquidity Staking Services Ensure User Fund Security

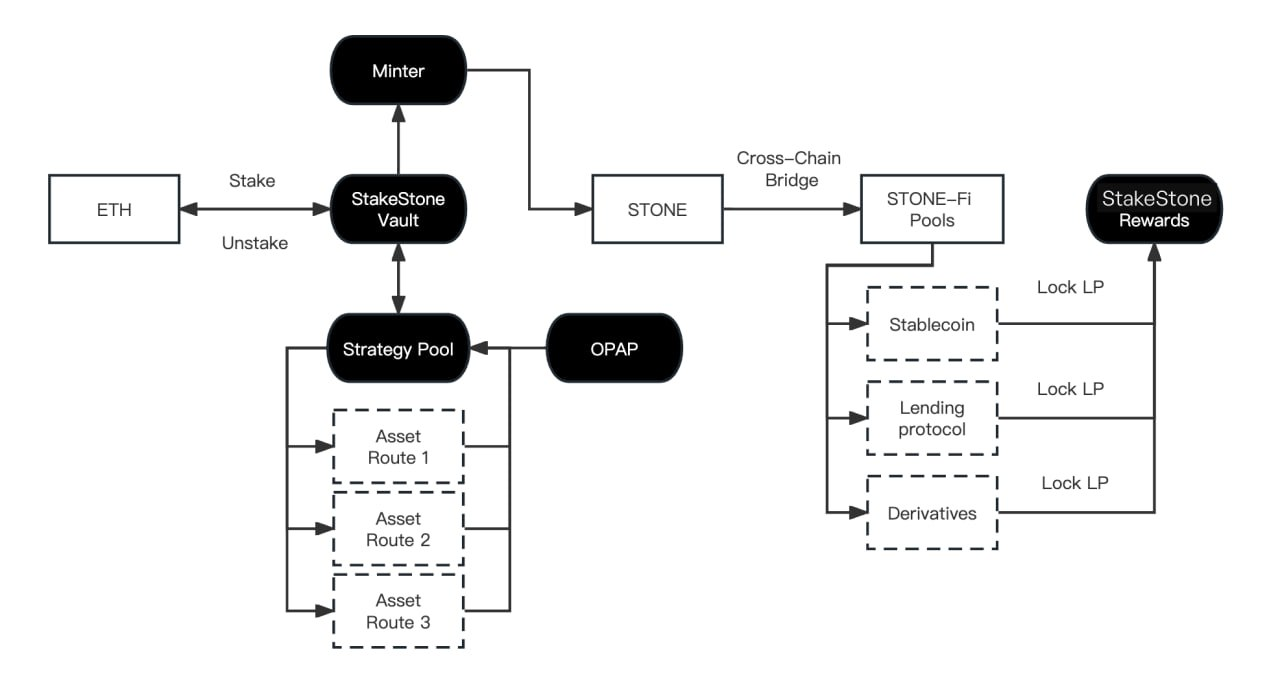

StakeStone aims to provide innovative liquidity staking solutions for the decentralized finance (DeFi) ecosystem. By introducing the concept of Yield-bearing ETH, StakeStone allows users to maintain asset liquidity while enjoying staking rewards. Its cross-chain compatibility and automatic profit optimization mechanism (OPAP) further enhance its application potential in multi-chain ecosystems, providing users with an efficient, flexible, and profit-maximizing staking platform.

The core advantage of StakeStone lies in its innovative technical architecture and user-centric design philosophy. By providing non-custodial and transparent liquidity staking services, StakeStone ensures the security of user funds and the transparency of earnings. Its STONE token based on LayerZero enables cross-chain liquidity, allowing assets to freely circulate between different blockchain networks, opening up broader market opportunities for users and simplifying the integration process for Layer2 developers.

In terms of operation, StakeStone allows users to stake ETH or other supported assets in its protocol, which are then converted into corresponding Yield-bearing ETH or other forms of LST, representing the user's staked assets and corresponding earnings rights. Through the OPAP mechanism, StakeStone can automatically adjust and optimize the allocation of underlying assets in response to market changes and the performance of staking pools, ensuring users receive the best staking rewards. Meanwhile, the profit distribution mechanism ensures that staking rewards (including transaction fees, governance rewards, etc.) are regularly distributed to STONE holders, either through direct token distribution or in the form of increasing the value of STONE.

In conclusion, StakeStone, through its innovative solutions and technological advantages, not only addresses the issue of asset illiquidity in crypto asset staking, but also provides an efficient solution for cross-chain asset management, effectively driving the development of DeFi and cross-chain liquidity.

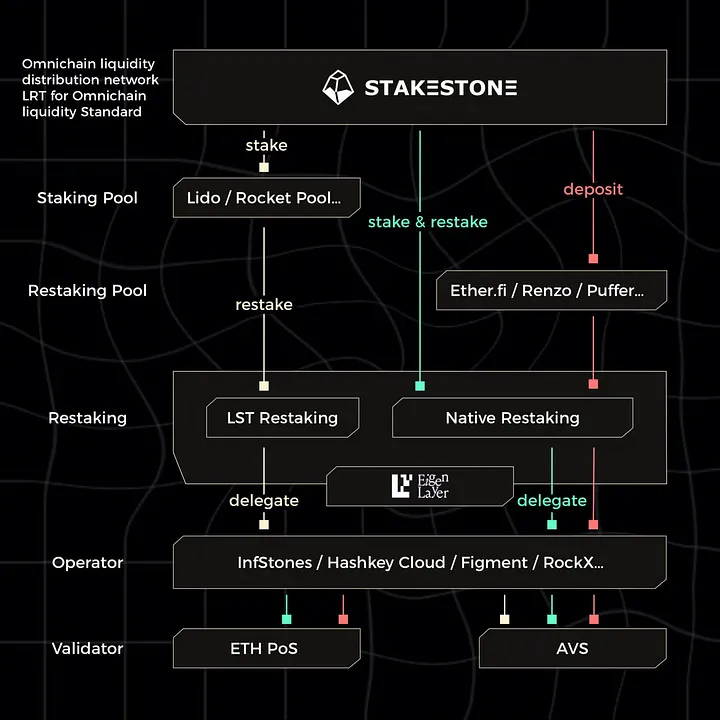

Re-staking Strategy Can Significantly Improve StakeStone's Capital Efficiency, Allowing Users to Access More Staking Opportunities

StakeStone is innovating the crypto asset staking field by introducing EigenLayer re-staking technology, aiming to enhance the capital efficiency and security of the entire ecosystem. By implementing solutions including LST re-staking, Beacon chain re-staking, and LRT integration, StakeStone aims to provide a secure and efficient re-staking platform for its users and partners. The development of this strategy benefits from the collaboration with InfStones, which provides professional node operation services for StakeStone, and Cobo's advanced security technology, which ensures the stability of the entire system. Additionally, by updating the underlying assets through the OPAP mechanism and incorporating community voting functionality, the project not only enhances transparency but also promotes community participation and governance.

The core of the re-staking strategy lies in its significant improvement in capital efficiency. By allowing assets to participate in more staking opportunities while maintaining their original staking rewards, StakeStone effectively addresses the issue of asset illiquidity in traditional staking models. Furthermore, the strategy automates the re-staking process through smart contracts, ensuring the security and efficiency of the process. For the redistribution of ETH, the strategy adopts a progressive approach to mitigate the impact on reward acquisition speed during the initial cold start period. The distribution mechanism for re-staking rewards emphasizes fairness, ensuring that participants' efforts are reasonably rewarded through the EigenLayer point accumulation and distribution strategy.

However, the re-staking strategy also brings some challenges, particularly in the withdrawal mechanism. Due to the complexity of the technology and processes involved, the processing time for withdrawal requests may be extended, especially under high system pressure. To address this issue, StakeStone is developing more flexible and efficient solutions to reduce withdrawal waiting times while ensuring the liquidity and stability of the entire system.

Through these innovative measures, StakeStone not only improves the capital efficiency of staked assets but also brings new directions for development in the crypto asset staking field. With ongoing technological improvements and deepening community participation, StakeStone is poised to play a greater role in driving crypto asset liquidity and staking reward optimization.

Overview of StakeStone Carnival Activities, Exploring Potential Wealth Opportunities

StakeStone has announced the launch of a series of full-chain carnival activities, aiming to promote community participation by offering over 6.5% of the total supply as rewards. The activities are divided into several phases, with the first wave lasting four days and providing a 15% additional bonus to early account activators.

Details of the first wave of rewards:

- Objective: Encourage depositing STONE and inviting friends;

- Prize pool: Accounts for 3% of StakeStone's total supply;

- Special offer: Early account activators can enjoy a 15% bonus boost;

- Limit: Activity stops when cumulative deposits reach 200,000 STONE;

- Operation: Activate the carnival account by obtaining an invitation code and deposit STONE to participate.

Details of the second wave of rewards:

- Objective: Enhance the cross-chain utility and capital efficiency of STONE;

- Collaboration: Collaborate with over 10 chains, ecosystems, and protocols;

- Rewards: Allocate the second wave prize pool and additional rewards based on the usage of STONE;

- Team expansion: Participants from the first wave can continue to expand their team using the invitation code and enjoy an additional 5% bonus boost.

Loyalty rewards details:

A special prize pool of 0.5% of the total supply is set aside to reward community veterans such as participants of Manta New Paradigm, Merlin's Seal, B² Buzz, and G-NFT. Through this series of activities, StakeStone aims not only to incentivize broad community participation but also to actively expand its application and influence in the crypto ecosystem.

Despite a Series of Smooth Progress, Caution is Still Needed for StakeStone's Future Development

On March 26, StakeStone announced a significant strategic partnership with blockchain infrastructure service provider InfStones. The highlight of this collaboration is the integration of EigenLayer re-staking (Restaking) technology, an innovative step aimed at enhancing the AVS operation strategy cooperation. On the same day, the staked amount of Ethereum (ETH) on the StakeStone platform had reached an impressive 350,000, with a total value locked (TVL) of up to $1.24 billion.

Through close collaboration with the ETH and BTC ecosystems, as well as other emerging ecosystems, StakeStone has accumulated over 340,000 ETH and engaged over 100,000 users in liquidity distribution activities. The project is also exploring the introduction of STONE BTC to further enhance the diversity and attractiveness of its liquidity distribution network.

With strategic investments from Binance Labs and OKX Ventures, StakeStone's market position has become more solid. These developments not only demonstrate StakeStone's efforts in driving the forefront of crypto asset liquidity but also instill confidence in its long-term growth and success within the global blockchain ecosystem. As more collaborations unfold and incentive plans are implemented, StakeStone is actively shaping a more open and diverse crypto financial world. However, whether it can sustain its success and achieve its ambitious goals still requires time to prove.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。