Two days ago, three projects in the AI sector, Fetch.ai, SingularityNET, and Ocean Protocol, which have been developing for many years, announced that they will create a decentralized artificial intelligence alliance and merge their tokens $FET, $AGIX, and $OCEAN into $ASI.

Prior to this, as three AI projects that have already been listed on the Binance trading platform, $FET, $AGIX, and $OCEAN have been important targets for market investment in the AI sector. In response to this news, SingularityNET (AGIX) saw a short-term increase of 12.56%, Fetch.ai (FET) saw a 24-hour increase of 14.7%, and Ocean Protocol (OCEAN) saw a short-term maximum increase of 35%.

Token Conversion and Potential Arbitrage Opportunities

For such "Big News," the community is most concerned about how the original tokens held by investors will be converted.

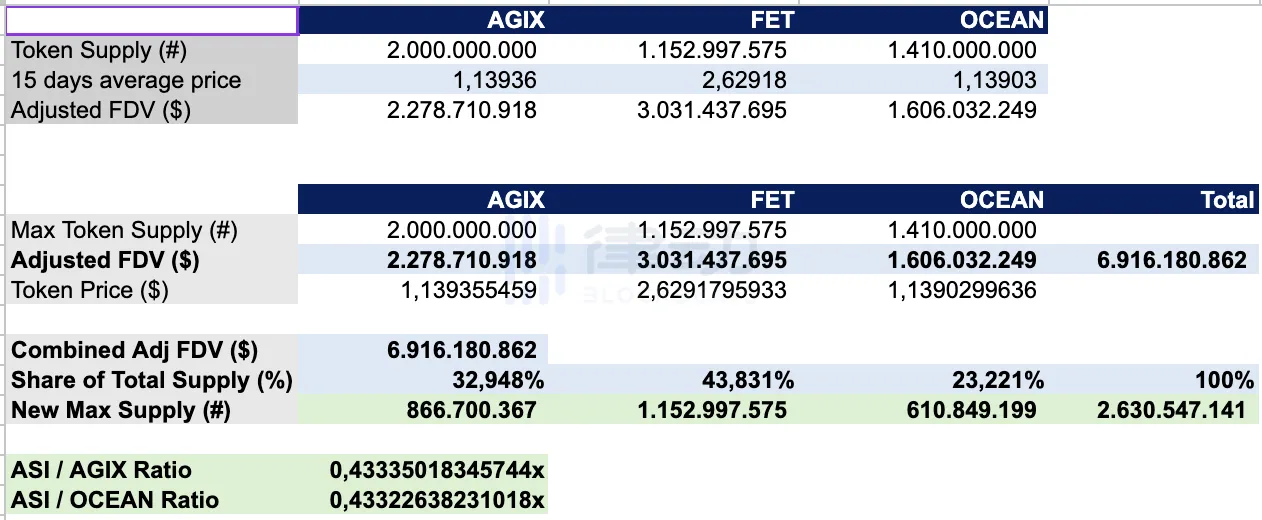

According to reports, Fetch.ai's token $FET will be converted to $ASI at a 1:1 ratio, while SingularityNET's $AGIX and Ocean Protocol's $OCEAN will be converted to $ASI at a ratio of about 1:0.433.

As the foundational token of the alliance, $FET will be directly renamed to $ASI and an additional 1.48 billion tokens will be minted, with 867 million $ASI allocated to $AGIX holders and 611 million $ASI allocated to $OCEAN token holders. The total supply of $ASI tokens will be 2.63 billion tokens. Based on the price on March 26, the total FDV of $ASI will be $7.6 billion.

Since the exchange ratio remains unchanged, there will be a price difference in the final conversion of $ASI based on the different prices of the three tokens. Therefore, the community has noticed the arbitrage opportunities here. By multiplying the price of $FET by 0.433, if the prices of $AGIX and $OCEAN are lower than the resulting number, they can be bought, and if they are higher, they can be sold.

Currently, the three projects are collaborating with centralized trading platforms, and users holding these three tokens on centralized trading platforms do not need to take any action.

What are the Expectations After the Merger?

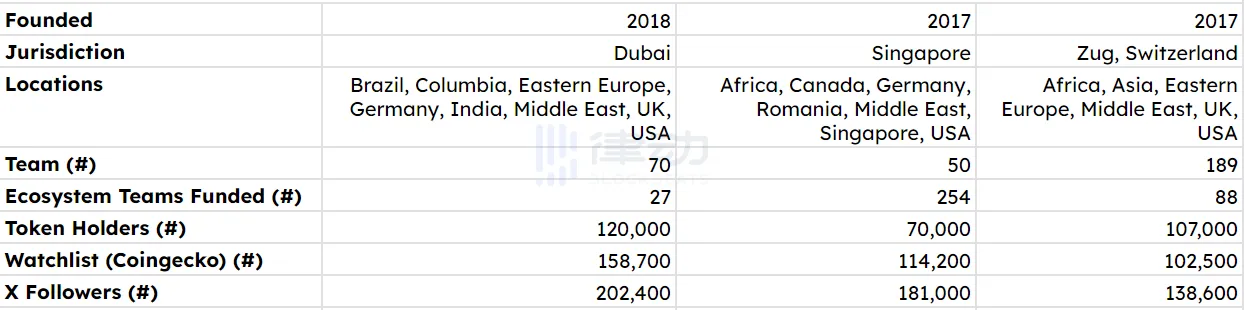

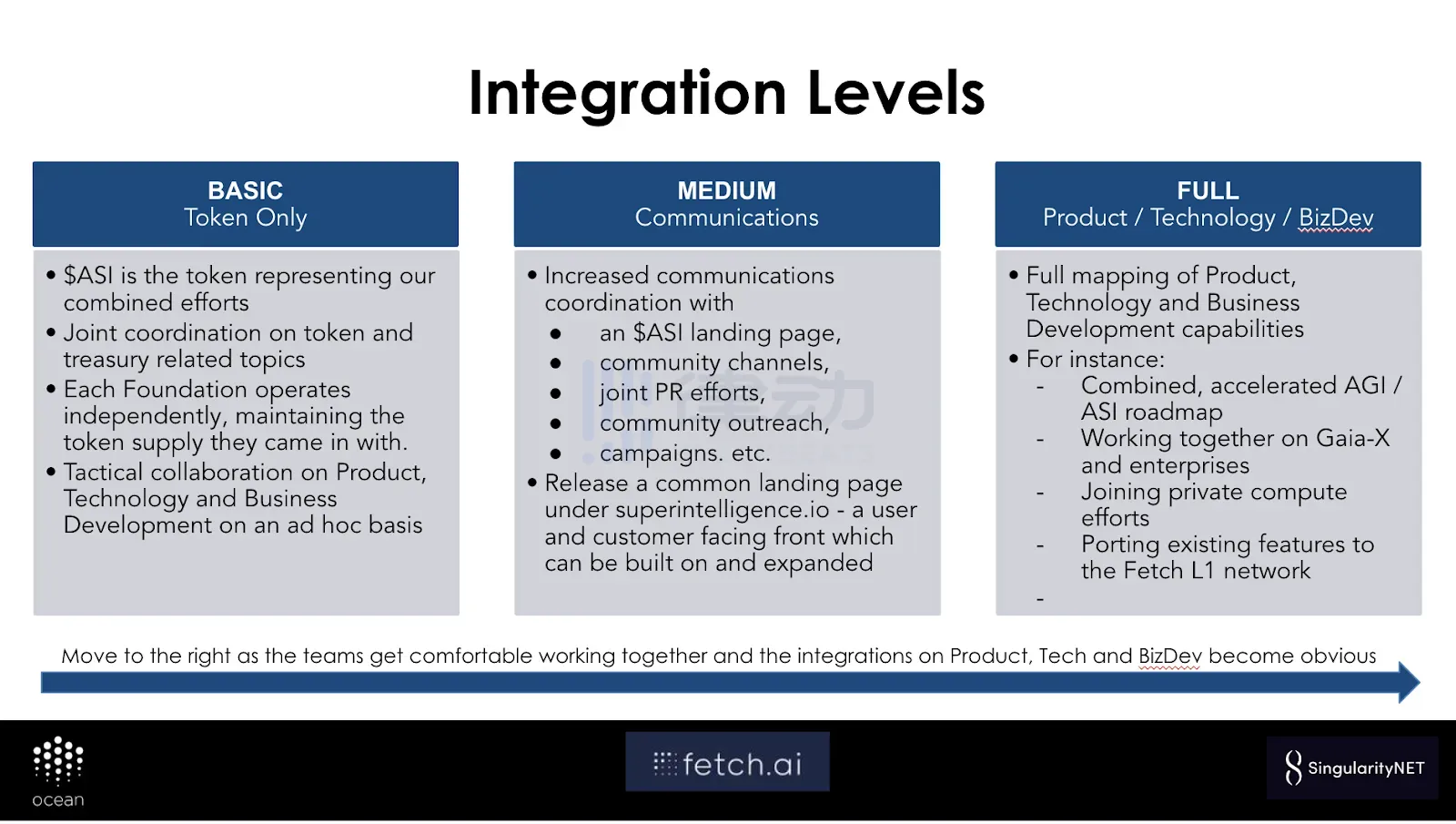

After the merger of the three projects, a team called the Superintelligence Collective will be established, with SingularityNET founder Ben Goertzel serving as the CEO. Fetch.ai, Ocean Protocol Foundation, and SingularityNET Foundation will continue to operate as independent entities but will closely collaborate in the shared $ASI token ecosystem and the operations of the Superintelligence Collective.

In the merger announcement issued by the three teams, there was not much information about the new business that will be conducted after the merger. According to Ben Goertzel's statement on his social media platform, the future direction of work after the merger will revolve around AGI and ASI, which is also the reason for naming the merged token ASI.

At the time of writing, Fetch.AI has a market value of $3.246 billion, ranking third in the AI sector, only behind Render Network ($RNDR) and Bittensor ($TAO). SingularityNET has a market value of $1.628 billion, and Ocean Protocol has a market value of $804 million. If the merger is successful, the future market value of $ASI will exceed $7 billion, jumping into the top 25 projects in the cryptocurrency field by market value, and will also be the highest valued project in the AI sector.

Prior to this, Fetch.ai already had mature experience in AI agents. On February 20, Deutsche Telekom announced a partnership with the Fetch.ai Foundation, becoming Fetch.ai's first corporate ally, and Deutsche Telekom's subsidiary MMS will also serve as a validator for Fetch.ai. Fetch also announced the launch of the $100 million infrastructure investment project "Fetch Compute" earlier this month, deploying Nvidia H200, H100, and A100 GPUs to create a platform for developers and users to utilize computing power.

Ocean Protocol has built many modular services in decentralized data sharing, access control, and payments. It is reported that its product, Predictoor, has achieved sales of over $800 million within six months of its launch.

SingularityNET was the most exploratory in the AGI direction among these three projects before the merger. Its AGI team, in collaboration with partners TrueAGI and the OpenCog community, has been focused on developing the AGI framework OpenCog Hyperon since 2020. SingularityNET will also launch a decentralized artificial intelligence platform this year to create a foundational environment suitable for running AGI systems.

It is worth mentioning that in the cryptocurrency field, the merger of strong projects is not unprecedented. In 2020, during DeFi Summer, Yearn.finance founder Andre Cronje (AC) initiated a series of acquisitions and mergers, but ultimately, his DeFi empire did not materialize as intended.

As one of the important sectors in the cryptocurrency market that will be closely watched in 2024, the AI track has recently seen the emergence of many new projects. The three strong projects that have been deeply involved in the Web3xAI field for a long time have chosen to merge and move towards the narrative of "decentralized AGI." The story that will unfold based on a market value of $7 billion remains to be witnessed over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。