Ancient people said, "Reading ten thousand books is not as good as traveling ten thousand miles; traveling ten thousand miles is not as good as having a master to guide you." In the field of digital currency, this famous saying is even more precious. Who doesn't know that accumulating information and broadening one's knowledge is the first step to acquiring wisdom. However, the digital currency market is constantly changing, full of variables, and it is difficult to deal with the challenges of practice based solely on theory. Only when one is in the situation can they truly understand the difficulties of moving forward. Traveling ten thousand miles may be awe-inspiring or inspiring, but it is full of dangers, like walking on thin ice. However, with the careful guidance of a master, one can avoid going astray, seek opportunities, and walk alone in this vast world. Li Hui is willing to explore the mysteries of digital currency with everyone, to open up the path of investment, and not to disappoint the golden age. I hope you will pick up the banner of struggle and follow Li Hui on this challenging and opportunistic journey. Let's break through the waves together and write your own glory!

Today's learning article: Li Hui teaches you to understand some common indicators and how to use them!

First of all, Li Hui believes that technical analysis is an important tool in the currency market. By using various technical indicators, one can better analyze the trend and changes in currency prices. Among the many technical indicators, the most commonly used by Li Hui are ENE, DC, BOLL, EMA, KDJ, MA, BRAR, FundFlow, RSI, OBV, and so on. Below, Li Hui will explain in detail how to use these indicators for market analysis of currency prices.

ENE Indicator (Envelope): The ENE indicator is based on the concept of the BOLL indicator. It determines support and resistance levels by calculating the fluctuation range of currency prices. Li Hui believes that when the currency price touches the support level, there may be a buying opportunity; and when the currency price approaches or breaks through the resistance level, selling can be considered.

DC Indicator (Donchian Channel): The DC indicator, also known as the Donchian Channel, can be used to observe the breakout and pullback of currency prices. Li Hui believes that when the currency price breaks through the upper channel, it may be a buying signal; when the currency price falls below the lower channel, selling can be considered.

BOLL Indicator (Bollinger Bands): The BOLL indicator measures the fluctuation range of currency prices by calculating the standard deviation of the currency price. Li Hui believes that when the currency price enters the upper band of the BOLL, the market may be at a high level; and when the currency price approaches or enters the lower band of the BOLL, there may be a buying opportunity.

EMA Indicator (Exponential Moving Average): The EMA indicator is a smoothing indicator for currency prices, which can track the short-term and long-term trends of currency prices. Li Hui believes that when the short-term EMA line crosses above the long-term EMA line, it may be a buying signal; when the short-term EMA line crosses below the long-term EMA line, it may indicate a weakening market and selling can be considered.

KDJ Indicator: The KDJ indicator is a relative strength index that can help determine the overbought and oversold conditions of currency prices. Li Hui believes that when the K line enters the area above 80, it may indicate an overbought market, suggesting a possible adjustment; and when the K line enters the area below 20, it may indicate an oversold market, suggesting a rebound opportunity.

MA Indicator (Moving Average): The MA indicator is the moving average line of currency prices, which can smooth out the currency price and show the long-term trend. Li Hui believes that when the currency price rises above the MA line, it may be a buying signal; and when the currency price falls below the MA line, it may be a selling signal.

BRAR Indicator (BRAR): The BRAR indicator is a market strength indicator that can help determine the strength of both buyers and sellers. Li Hui believes that when the BRAR line is near the high level and begins to turn downward, it may indicate a change in market strength, signaling a selling opportunity; and when the BRAR line is near the low level and begins to turn upward, it may indicate a change in market strength, signaling a buying opportunity.

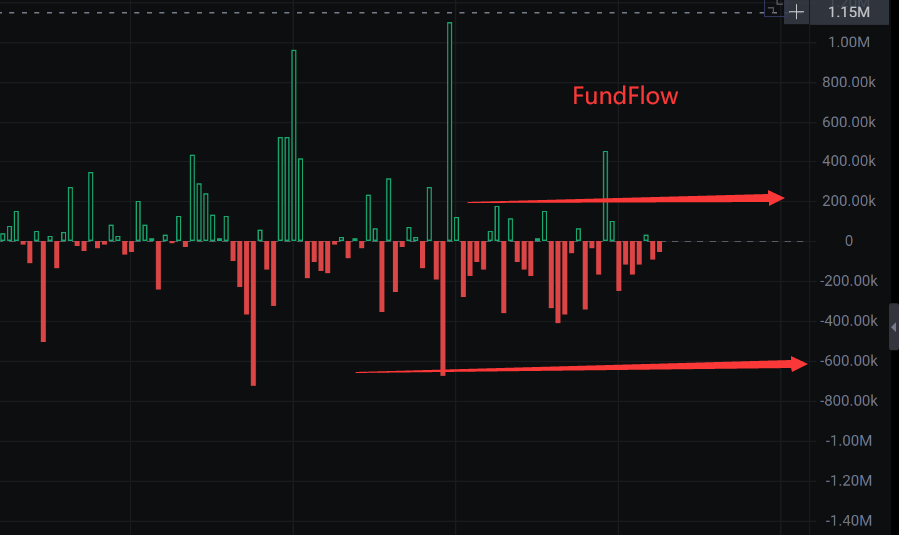

FundFlow Indicator: The FundFlow indicator is a fund flow indicator that can reflect the inflow and outflow of large funds. Li Hui believes that when the FundFlow indicator shows a large inflow of funds, there may be an opportunity for an uptrend; and when the FundFlow indicator shows a large outflow of funds, there may be a risk of a downtrend.

RSI Indicator (Relative Strength Index): The RSI indicator can help determine the overbought and oversold conditions of currency prices, and measure the strength of currency prices. Li Hui believes that when the RSI indicator is above 70, it indicates an overbought market; when the RSI indicator is below 30, it indicates an oversold market.

Li Hui integrates the above technical indicators and can guide everyone through the following steps for currency price analysis:

First, observe the long-term trend of currency prices, and use MA or EMA indicators to determine whether the currency price is in an uptrend or downtrend.

Second, observe whether the currency price is near the upper or lower band of the BOLL to determine the overbought or oversold condition of the market. At the same time, KDJ indicators can be used to judge the overbought and oversold conditions of the market.

Use the DC indicator to observe the breakout and pullback of currency prices, and look for buying or selling opportunities.

Use the ENE indicator to determine the support and resistance levels of currency prices, in order to find the right timing for buying and selling.

Observe the BRAR indicator to evaluate the strength of the market, and combine it with the FundFlow indicator to judge the inflow and outflow of funds, to assist in judging market trends.

Use the RSI indicator to determine the overbought and oversold conditions of currency prices, in order to determine the right timing for buying and selling.

Use the OBV indicator to observe changes in trading volume, judge the comparison of buying and selling forces, and predict the trend of currency prices.

Li Hui reminds everyone to pay attention that technical indicators are only auxiliary tools and should not be used as the sole basis for decision-making. In practical applications, fundamental analysis, market research, and other relevant factors should be considered comprehensively for decision-making. Li Hui believes in the old saying: it's better to have real experience than just theoretical discussions; experience is always gained on the battlefield, and that's when it feels more accomplished!

I interpret world economic news, analyze global trends in the currency circle, and have in-depth research on BTC, ETH, LTC, DOT, EOS, BAB, SOL, and other currencies during my studies in the United States. For those who are not familiar with the operations, feel free to comment and leave a message!

This article is exclusively published by "张历辉" (WeChat Official Account: Zhang Li Hui) and does not represent any official position. The release and review of the article have a time delay, and the above points are for reference only. All risks are at your own discretion! May we always carry humility and courage in this complex world of digital currency, fear no challenges, and dare to explore. Just as traveling ten thousand miles, "the road ahead is long and far-reaching, I will seek and explore." May we read ten thousand books, keep up with the times, and draw from the fountain of wisdom. Travel ten thousand miles, experience the wind and rain, witness the scenery, and understand life. May you, under the guidance of Li Hui, heed advice, play to your strengths, and create value together. May we always remember the baptism of the market, not forget our original intentions, and thus persist. In the wave of digital currency, let's hold on to our faith with Li Hui, persevere, and move forward. May we, in each other's company, jointly compose the future's brilliant chapter and share the joy of success. Let's gather in the turbulent world of digital currency, live up to the prime of our lives, and create brilliance together. Li Hui is willing to embark on this challenging and opportunistic investment journey with you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。