News

On March 23, according to data from Farside Investors, Valkyrie's BRRR saw a net inflow of $25.5 million yesterday. Currently, all ETF data except for Belad IBIT has been released. Belad IBIT only needs a net inflow of over $70.5 million to reverse the recent overall net outflow situation.

On March 23, Bloomberg reported, citing sources familiar with the matter, that Hack VC is raising at least $1 billion for a new fund, which will focus on seed-stage investments in crypto startups. It is reported that Hack VC raised $150 million in funds last month and has already deployed one-third of it. The company also raised $200 million in funds in 2022.

On March 23, senior ETF analyst Eric Balchunas of Bloomberg posted on social media that new ETF investors are strong, and selling pressure comes from other Bitcoin owners. In the past 5 days, approximately $1.2 billion has flowed into nine new (excluding GBTC) Bitcoin spot ETFs, but the price has dropped by 8%. GBTC did experience outflows, but it was mainly Genesis selling. However, they only exchanged GBTC shares for spot BTC, so this is a neutral event. In summary, ETFs have consistently been net buyers of BTC, and there will be more funds flowing in.

Market Review

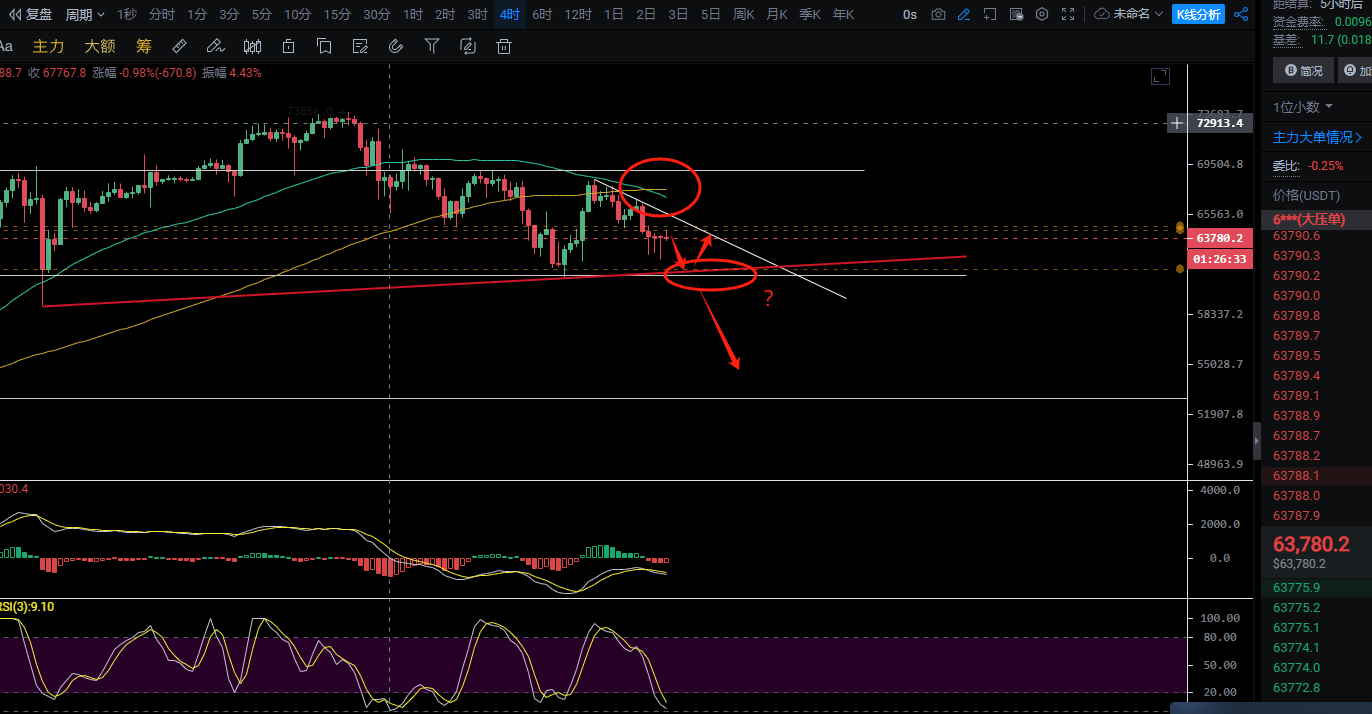

In the previous article, it was mentioned that the market might form a head and shoulders pattern, and the market still needs to make a downward move. As expected, the market has continued to decline from around 68000 to the current low near 62200. Short positions were taken near 67700 in the actual trading, and all positions were closed near the first support. As provided in the article, basically, as long as the support is reached, it means a profit of two thousand points. Congratulations to those who followed? Currently, the market is still in a state of adjustment and is about to enter the final stage. How should one operate?

Market Analysis

Macro Analysis: The Coinbase premium has been negative since March 14 when Bitcoin entered a period of adjustment, and it has continued to decline. Given the rapid rise of Bitcoin in recent months, it seems that the adjustment period will continue for some time. However, before the end of the first half of 2024, we may see another market rise, driven by purchases from US institutions and whales, leading to an increase in the Coinbase premium. Since the approval of the Bitcoin ETF, Belad has been actively engaged in OTC trading and has purchased the most Bitcoin. Therefore, despite the significant decrease in the holdings of long-term Bitcoin holders after the approval of the ETF, unlike in the past, they have not been deposited into exchanges.

The situation this week indicates that Belad's net inflow of Bitcoin continues to hit historic lows. If this is only temporary, there may not be any problem. However, if this situation continues, long-term holders may start depositing Bitcoin into exchanges as they did before. If this happens, the possibility of a price dump will increase. It is important to pay attention to the changes in Belad's net inflow and the deposit of Bitcoin into exchanges.

Looking at the four-hour chart, the market has formed a head and shoulders pattern and is currently slowly testing near the neckline. At the same time, it can be seen that the moving averages have formed a death cross pattern. Although there was a rebound near the 62200 support and it briefly reached near 44300, the timing and intensity were not right. The morning rise does not necessarily indicate a bullish trend. It is expected that the morning rise is for a better decline. In the short term, the market still lacks a test towards the neckline, which is near 61300. If it effectively falls below and cannot recover within 12 hours, there is a high possibility of falling below the 59000 level. At the same time, the market has formed a triangular oscillation and is about to enter the final stage, choosing a direction. The continued outflow of ETFs is the reason why I firmly believe in a bearish view. Before breaking the neckline, one can operate according to the oscillation, and if it breaks, hold the short position firmly. Therefore, in terms of operation, it is recommended to pay attention to the resistance levels near 64300/65170. Breaking through 65200 would disrupt the short-term structure, end the decline, and focus on the support levels below at 61800/61300-61000. If it effectively falls below 61300-61000, look towards the levels near 59000 and 53000. Specific operations are at your discretion. Details will be explained in the actual trading.

Technology is the method, and the trend is the king. The dominant force in the crypto world takes you soaring in the sea of coins.

Be cautious when entering the market, as there are risks involved.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。