Original author: Xiyu, ChainCatcher

Original editor: Marco, ChainCatcher

After the MEME token BOME (Book of Meme) set a record of over 2 billion US dollars in market value within 3 days, "issuing MEME tokens on Solana and recharging SOL to a strange address" has become a new trend. The huge beneficial effect has completely FOMOed the users in the crypto community. It is no longer surprising that a strange address can easily raise millions or even tens of millions of dollars' worth of SOL within a few hours.

The wealth effect of the MEME coin has brought huge traffic and attention to Solana, attracting a group of foreign applications to turn to the Solana ecosystem.

On March 15th, NFT card game Parallel announced the launch of the AI survival simulation game Colony on Solana; on March 17th, IDO platform DAO Maker announced its expansion to the Solana network, planning to launch 4 Solana IDO projects; on March 18th, DeFi gamified platform DEGO Finance will go live on Solana.

According to DeFiLlama data, the 24-hour trading volume on the Solana chain is approximately 23.9 billion US dollars, with captured fees of 3.94 billion US dollars, while during the same period, the trading volume on the Ethereum chain was 28.6 billion US dollars. On March 19th, the DEX trading volume on Solana was 36.2 billion US dollars, ranking first for four consecutive days, with an average of over 30 billion US dollars in the past 5 days. The daily trading volume of DEX on the Ethereum chain was 30.05 billion US dollars, ranking second.

In fact, before the MEME hype, the hotspots on the Solana chain had never stopped. From last year's DePIN to MEME Hat Dog Bonk, and the airdrops of projects within the ecosystem such as the oracle Pyth Network, DEX platform Jupiter, and cross-chain protocol Wormhole, one wave after another. As the community users say, there is never a lack of opportunities on the Solana chain; it is truly the "chain for the poor to get rich."

In addition to the MEME coin, what other opportunities on the Solana chain are worth participating in and paying attention to? This article will sort out the active representative projects on the Solana chain.

DEX Three Giants: Raydium, Orca, Jupiter

Raydium: The preferred DEX for MEME token trading

Raydium is an automated market maker (AMM) trading platform built on the Solana chain, with a working mechanism similar to Uniswap. The platform was initially created in 2021 and was known to users for integrating liquidity with the order book DEX platform Serum led by SBF. With SBF's downfall, Serum was deeply mired in a liquidity crisis, eventually shutting down and changing its official Twitter account. However, Raydium has been persistently iterating and upgrading its products and has once again become the leading DEX with the recovery of the Solana ecosystem.

Currently, Raydium's product features include DEX trading, AMM Swap exchange, liquidity mining, staking mining, and IDO launch Acceleraytor, among other functions.

During the recent MEME hype on the Solana chain, the MEME token pools such as BOME and SLERF that became popular were created on the Raydium platform, with over 90% of token trading volume occurring on this platform. It is currently the largest DEX for MEME token trading on the Solana chain.

On March 17th, the Lanchpad platform DAOMaker announced its expansion to the Solana network and will add a $2 million SOL liquidity pool on Raydium, launching 4 Solana IDO projects. Among them, the first AI e-commerce project YOUR AI was launched on Raydium on March 18th.

According to DeFiLlama data, in the past 7 days, Raydium captured trading fees exceeding $12.91 million, and during the same period, the fees captured on the Solana chain were $19.22 million, ranking the platform in the top ten in the DeFi market in terms of income.

The platform token RAY has risen by 89% in the past 30 days, with a current price of $2.04, a market value of $530 million, and a fully diluted valuation (FDV) of $1.13 billion.

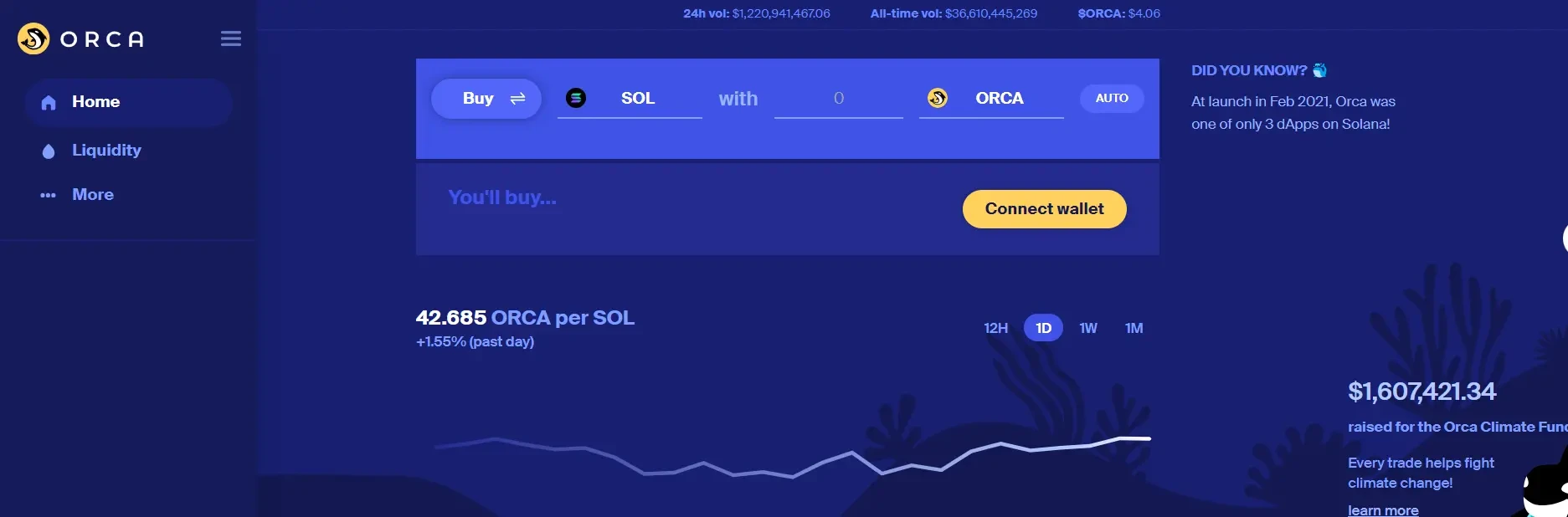

Leading DEX Orca

Orca is also a first-generation AMM DEX on the Solana chain. Unlike DEX platforms with integrated multiple functions, the platform interface is very simple, supporting only token exchange and adding liquidity pools.

According to DeFiLlama, the 24-hour trading volume on the Orca platform is $1.415 billion, ranking third in the entire DEX market, only behind Uniswap and Pancakeswap, making it the largest DEX in terms of trading volume on the Solana chain.

On March 20th, the platform token ORCA was priced at $4.03, with a market value of $190 million and an FDV of $4.01 billion.

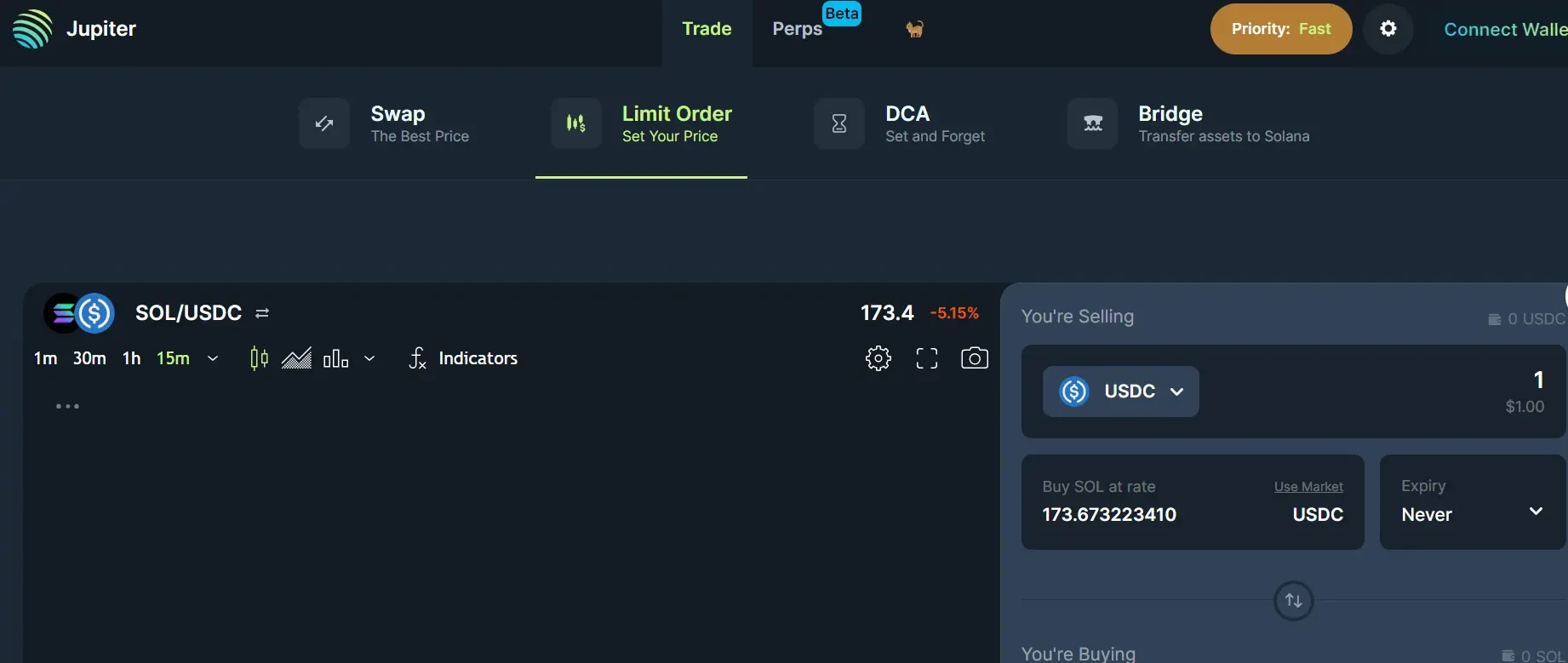

Trading aggregator Jupiter

Jupiter is a trading aggregator on the Solana chain, aiming to provide users with the best exchange rates and experience by integrating the main liquidity markets on the Solana chain.

In January of this year, Jupiter announced that it would airdrop 1 billion JUP tokens to approximately 955,000 Solana wallet addresses, making it the project with the widest coverage of airdrop addresses to date, and it was once extremely popular.

Currently, Jupiter has integrated multiple DEX paths on the Solana chain, including Orca, Raydium, Mercurial, etc. The platform not only supports SWAP but also features limit orders, dollar-cost averaging, and other functions.

In addition to spot trading, Jupiter will also launch contract functions, which are currently in the testing phase and only open for SOL, ETH, and WBTC.

Furthermore, Jupiter has launched the LFG Launchpad, aiming to help emerging and existing cryptocurrency projects raise funds, distribute tokens, and quickly launch liquidity in a decentralized and transparent manner.

On March 13th, Jupiter announced that the first round of LFG Launchpad project voting had ended, and the first batch of launch projects selected were the cross-chain communication protocol Zeus Network and the NFT lending protocol SharkyFi. Among them, the first IDO project of LFG Launchpad, Zeus Network, will start token public offering on April 4th.

On March 21st, Jupiter announced that the JUP DAO will inject 10 million USDC and 100 million JUP next week to accelerate the growth and public funding of Jupiverse.

According to Coingecko data, on March 20th, the platform token JUP was priced at $1.19, with a growth of over 120% in the past 30 days, a market value of $1.6 billion, and an FDV of $11.8 billion.

Liquidity Staking Track: Marinade, Jito, BlazeStake

Marinade

Marinade is the largest liquidity staking protocol on the Solana chain, where users can stake SOL on the platform and receive mSO as staking certificates, allowing them to earn PoS network staking rewards and participate in interactions with other DeFi applications on the chain, increasing capital utilization.

According to the official website, the amount of SOL staked on Marinade exceeds 9.98 million, with locked assets valued at $1.74 billion, ranking first in TVL on the Solana chain, with a staking annualized return rate of 8.9%.

The governance token MNDE was launched in 2021 with a total supply of 10 billion tokens. According to CoinGecko, the trading price of MNDE token is approximately $0.31, with a circulating market value of $79.95 million and a fully diluted valuation (FDV) of $3.1 billion.

MEV Liquidity Staking Protocol Jito

Jito is the second-largest liquidity staking protocol on the Solana chain, where users can stake SOL to receive staking certificates in the form of LSD tokens (JitoSOL). The platform not only provides users with PoS network staking rewards but also distributes MEV revenue rewards to staking users.

According to the official website, as of March 18th, the amount of SOL staked on the Jito platform is approximately 9 million, with a value of $16 billion, making it the second-largest application in TVL on the Solana chain.

In November of last year, Jito launched the governance token JTO, which is currently priced at $3.05, with a circulating market value of $3.57 billion and an FDV of $30.5 billion.

BlazeStake

BlazeStake is the third-largest liquidity staking protocol on the Solana chain, where users stake SOL to obtain the staking token bSOL.

According to DeFiLlama, as of March 20th, the locked asset value (TVL) on the BlazeStake platform is approximately $470 million, and the governance token BLZE is priced at $0.0018, with a total supply of 10 billion tokens.

Oracle Project Pyth Network

Pyth Network is a decentralized oracle project on the Solana chain that transmits real-world data to the blockchain world, enabling data interoperability between the blockchain and the real world, supporting the development of the next generation of DeFi. It was created by members of the Jump Trading team and is a star project within the Solana ecosystem.

In October of last year, Pyth Network announced the tokenomics of the PYTH token, with a total supply of 10 billion tokens, and airdropped 6 billion tokens to 750 million wallets, causing a stir in the crypto market.

As of March 20th, PYTH is priced at $1.02, with an FDV of $10.1 billion.

Cross-Chain Infrastructure Wormhole

Wormhole was initially an inter-chain bridge incubated and supported by Jump Crypto, focusing on asset interoperability between Ethereum and Solana. As the project developed, it evolved into a universal message-passing protocol supporting multiple chains and completed a split from Jump Crypto.

On March 7th, the cross-chain protocol Wormhole announced the tokenomics of the W token, with a total supply of 10 billion tokens, an initial circulating supply of 1.8 billion tokens, distributed in the form of ERC20 and SPL on 5 initial chains, including Ethereum, Solana, Arbitrum, Optimism, and Base, and airdropped 610 million W tokens to over 397,000 eligible addresses.

As of the time of writing, the W token has not been officially traded, with an over-the-counter market price of $1.78 on Whales Market.

Derivatives Trading Platform Drift Protocol

Drift Protocol is a DeFi derivatives trading platform built on Solana, offering various types of derivative markets, including perpetual contracts, spot and spot margin, lending, and more, established in 2022.

According to the official website, as of March 20th, the locked crypto asset value (TVL) is $2.86 billion, with open interest contracts reaching $150 million, and a trading volume exceeding $2.2 billion last week, setting a historical record. The total completed trading volume has exceeded $15.9 billion, with 159,000 users.

Currently, Drift has not issued tokens and launched a reward points program in January, allowing users to earn points by participating in platform trading.

Lending Protocols: Kamino, Marginfi

Kamino

Kamino is a lending protocol on the Solana chain that integrates lending, automated yield strategies, and leveraged trading, aiming to provide users with a unified and secure DeFi product suite.

On Kamino, users can borrow assets, provide leveraged liquidity to DEX, build automated yield strategies, and use centralized liquidity positions as collateral.

According to official data, the points incentive program will last for about 3 months, and at the end of the first quarter or the beginning of the second quarter, the platform token KMNO Genesis will be airdropped.

DeFiLlama shows that the locked asset value on the Kamino platform has exceeded $1.18 billion, ranking it as the third-largest protocol in the Solana ecosystem.

Marginfi

Marginfi is also a decentralized lending protocol on Solana, integrating Swap, LST, cross-chain bridges, stablecoins, and more, providing users with a unified account to manage their assets or build investment portfolios to improve capital efficiency of underlying trading protocols.

In February, Marginfi launched the interest-bearing stablecoin YBX based on LST assets, supporting the minting of stablecoins using Solana ecosystem LST assets (such as JitoSOL, mSOL) as collateral. Users can capture staking rewards and MEV tips on the Solana network while potentially earning more income.

Currently, Marginfi has not issued tokens and has launched an incentive points program, allowing users to earn points through staking and borrowing. The locked asset value on the platform is currently $777 million, ranking it as the fourth-largest in TVL within the Solana ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。