The USDT negative premium has disappeared, and the outflow of funds has begun to slow down.

The USDT premium refers to the ratio between USDT and the US dollar. Although the exchange rate of USDT to the US dollar is 1:1, it is ultimately a stable coin issued by Tether. Once a large number of people buy USDT in a short period of time, the price of USDT will be higher than the US dollar until someone continuously exchanges USDT for US dollars, at which point the premium can be filled.

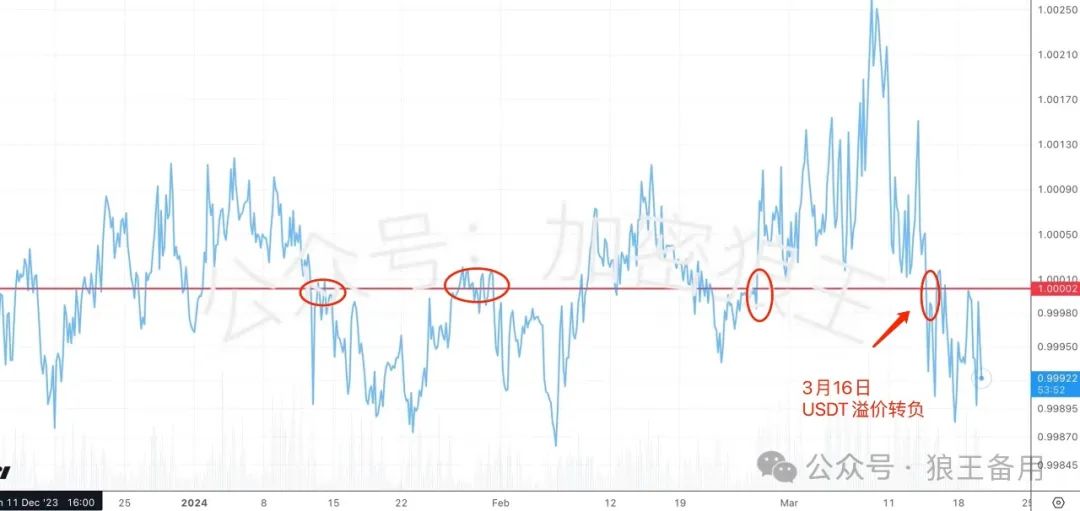

Therefore, people have found that the USDT premium can measure market sentiment and better observe the flow of funds. It can be seen that since March 16th, the USDT premium has changed from positive to negative, and BTC has made a top and fallen back. The last time this situation occurred was on February 27th when BTC surged.

The US Federal Reserve released expectations of interest rate cuts overnight, and BTC surged in sync with the US stock market, bringing the USDT back to the 1:1 level with the US dollar, achieving a balance between long and short positions. The direction of funds in the next few days will play a crucial role in the market.

BTC:

BTC retraced to the 5-day moving average, with a pin bar rebound on the hourly chart and shrinking volume on the upside. It needs to test the top multiple times. The key resistance at $68,806 formed on March 16th and 18th. BTC needs to break through $68,806 with volume in order to break the resistance and enter a new round of upward trend. Next, BTC will rise to test $68,806.

Resistance levels: $68,806, $70,493, $71,998

Support levels: $65,588, $62,994, $61,065

ETH:

There has been unusual activity in multiple whale addresses on the chain, which has had a selling expectation effect on ETH. There is a double pin bar rebound at the bottom of the hourly chart, confirming the bottom support. The key resistance point is $3,623. Only by stabilizing above $3,623 can ETH establish a bottom and strengthen, entering a short squeeze rally. Next, ETH will rise to test $3,623.

Resistance levels: $3,623, $3,756, $3,824

Support levels: $3,398, $3,185, $2,946

…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。