Author: Xiyu, ChainCatcher

Editor: Marco, ChainCatcher

Since the approval of the Bitcoin spot ETF on January 11th, there has been an influx of billions of dollars into the crypto world. Coupled with the approaching halving narrative and the long-term prosperity of the Ordinals ecosystem, it has helped boost the price of BTC, breaking through the high point of 2021 ($69,000) and heading straight to $80,000. The bull market in the crypto market has been completely ignited.

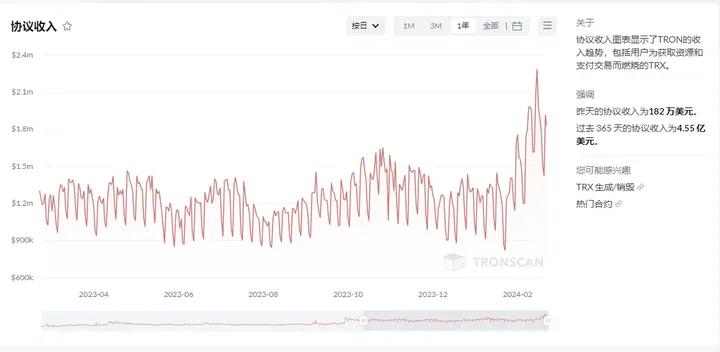

During this period, the outstanding performance of Tron (TRON) network fee income has attracted attention. On March 5th, DeFiLlama data showed that Tron's TRON network income reached as high as $2.31 million, hitting a new historical high and becoming the third highest-earning blockchain network after Ethereum and Bitcoin.

At the same time, core indicators such as the number of users, TVL, and trading volume on the Tron network have repeatedly broken historical highs. Among them, the number of Tron accounts surpassed 216 million on March 7th, ranking first in the entire public chain market in terms of daily active users.

Behind the steady growth of "fundamental" data is the thriving ecosystem of Tron, active on-chain trading demand, and strong user growth.

In the past 365 days, Tron's network income has reached as high as $450 million, ranking third among all blockchain networks, second only to Ethereum ($28.4 billion) and Bitcoin ($7.1 billion), and has been rated by users as the "biggest winner in the crypto market."

The current prosperity and activity of the Tron network are inseparable from the forward-looking decision to support the issuance of TRC20-USDT five years ago (2019). As of March 11th, the circulating supply of USDT on the Tron network has exceeded 53.8 billion, with a market share of over 50%. The average daily transfer volume of USDT in the past 30 days has exceeded $15 billion, making it the largest stablecoin trading chain in the current crypto market.

Tron's achievements in the stablecoin race are evident, but this is only the tip of the iceberg in its ecosystem.

Three months ago, when the number of Tron accounts surpassed 200 million, founder Justin Sun stated that Tron is still in the early stages of development, with the future vision of serving the global population of 8 billion. He also emphasized that continuing to increase the investment in USDT and other stablecoins to consolidate market position, while attracting more developers, community users, and institutional investors to enter the Tron ecosystem, is the key strategy for its continued growth and success.

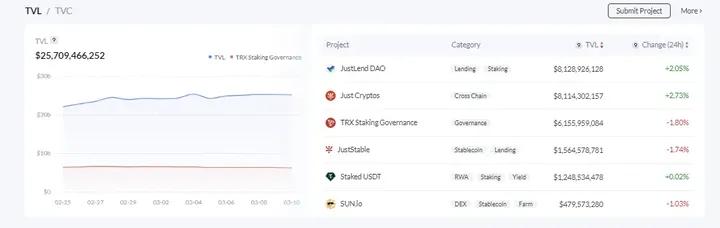

Currently, the total value locked (TVL) of encrypted assets in DeFi applications on the Tron network has exceeded $10 billion, ranking second among all public chains, second only to Ethereum ($55.6 billion).

In addition to stablecoins and the DeFi ecosystem, the Tron ecosystem is actively laying out new tracks and seeking new growth points. The RWA product stUSDT, launched last year, has locked in over $1.3 billion in less than a year. In February of this year, Tron announced the launch of a Bitcoin Layer 2 solution to enter the Bitcoin ecosystem, adding a new dimension to its ecosystem and tapping into new market growth space worth trillions of dollars.

Stablecoin Dominance Maintained, USDT Market Share Exceeds 50%

Since Tron supported the issuance of TRC20-USDT in 2019, with excellent user experience advantages such as low fees and fast arrival speed, TRC20-USDT has quickly occupied the crypto market. The issuance of TRC20-USDT has exploded in just two years, with its network circulation of USDT surpassing that of its competitor Ethereum, and has long maintained its dominant position. The TRC20-USDT contract has contributed over 90% of the activity in the Tron network.

According to tronscan data, in the past 7 days, the TRC20-USDT contract has been called over 14.3 million times, with over 2.9 million accounts applying for calls. The amount of TRX burned by the TRC20-USDT contract in the past 7 days has exceeded 88.61 million, equivalent to approximately $11.51 million, accounting for over 95% of the entire Tron ecosystem.

Stablecoins not only serve as an important bridge between fiat and the crypto world, but with the explosion of DeFi and the emergence of various on-chain applications, they have long become fundamental investment infrastructure tools, and the change in their market value has become an important indicator for judging the bull and bear markets in the crypto market.

The increase or decrease in stablecoin market value is often seen as a change in the overall currency supply in the crypto market. An increase in market value means more funds flowing into the crypto market, providing additional liquidity and contributing to on-chain trading activities.

In this current uptrend, we have also seen an increase in stablecoin market value. Since the beginning of 2024, the additional market value of USDT has exceeded $10 billion.

As USDT's market share continues to rise, TRC20-USDT has also experienced explosive growth. Since 2024, the additional circulation of TRC20-USDT has reached nearly 5 billion, with Tether issuing 1 billion USDT on the Tron network on February 24th and another 1 billion USDT on March 5th.

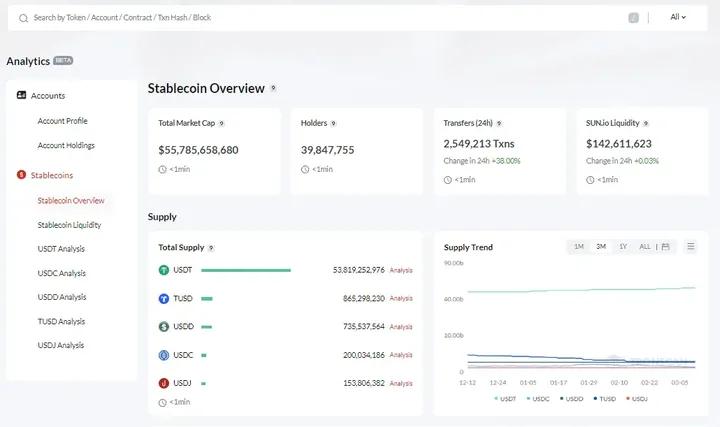

According to DeFiLlama data, on March 11th, the market value of stablecoins in the crypto market was $145.3 billion, with USDT accounting for $102.2 billion, representing over 70% of the entire stablecoin market. The circulation of TRC20-USDT on the Tron network has exceeded 53.8 billion, accounting for nearly 40% of the entire stablecoin market, with USDT's market share exceeding 50%, solidifying its position as the largest stablecoin circulation network.

Regardless of the bull or bear market, there is always a demand for stablecoin trading. As the main infrastructure for stablecoins, Tron has the largest stablecoin circulation supply in the world. The market demand for USDT indirectly translates to demand for the Tron network, with USDT demand growing, the Tron network becomes more active.

According to tronscan data, in the past 30 days, the daily average transfer volume of TRC-20 USDT has exceeded $13.1 billion.

Coin98's monthly report on Tron data shows impressive figures in February, with over 129 million on-chain transactions, nearly 5.3 million new accounts, and over 1.8 million daily active users. Tron ranks first in the entire public chain market, far surpassing Bitcoin and Ethereum.

In addition, the activity of the Tron network also affects the change in TRX supply. As more TRX is burned with the increase in on-chain transactions, the more active the network becomes. With the increase in transaction volume, the number of accounts, and the continuous expansion of the DApp ecosystem, the amount of TRX burned in the Tron network will also increase.

According to tronscan, since October 2021, TRX has entered a deflationary state, with an annual growth rate of -2.98%, and the current supply of TRX is 87.9 billion.

Cryptocurrency user KK once exclaimed that the number of daily active users in the Tron ecosystem was somewhat unexpected. Every time they convert USDT, they are directly contributing to the Tron ecosystem. Tron is truly the biggest winner in the crypto market.

Continuously Cultivating the Stablecoin Ecosystem, Aiming for a Market Value of Hundreds of Billions of Dollars

In the stablecoin layout, Tron has built a diversified stablecoin landscape consisting of centralized stablecoins such as USDT, TUSD, USDC, and decentralized over-collateralized stablecoins USDJ and USDD. Through diversified layout, Tron provides multiple stablecoin options for users with different needs, and has built a more complete stablecoin system, consolidating its leading position in the stablecoin field.

As of March 11th, the total market value of stablecoins on the Tron network is approximately $55.8 billion, with a user base of nearly 40 million and over 2.5 million transactions in 24 hours.

Success in the stablecoin race is not achieved overnight, but is the result of Tron's continuous dedication. Tron founder Justin Sun has always attached great importance to the development of stablecoins and has publicly emphasized their importance in the crypto market.

As early as the end of 2020, when major public chains were hoping to promote on-chain ecosystem prosperity through the deployment of DeFi applications, Sun predicted that a more certain trend in the crypto asset field is that stablecoins, as a payment network, will have increasingly more applications, and stablecoin transfers will become a killer application in the crypto industry.

He also emphasized that stablecoins are crucial in the public chain ecosystem, and without stablecoins, the ecosystem is incomplete. In addition to preserving value and risk mitigation, stablecoins can also meet various investment and ecosystem application participation needs, making them the largest and most critical entry point for the industry.

In March of last year, Sun stated on his personal social media that the focus of Tron's development is still on stablecoins, with a target market value of $100 billion. In a themed dialogue at the "Outlook for the Future of Cryptocurrency in the Next Ten Years" event at Token 2049 in Singapore last year, Sun stated that in the next 10 years, the biggest daily application scenario for cryptocurrencies and blockchain will still be stablecoin payment transactions.

Thanks to Sun's forward-looking predictions and high regard, Tron's development in the stablecoin field has been rapid, leading the industry forward. Today, the development of USDT and the outstanding data of Tron's TRC20 confirm Sun's predictions.

In addition to the founder's attention and persistence, Tron has its own strategy for stablecoins.

Externally, it actively promotes cooperation with crypto trading platforms to open up deposit channels and reduce the threshold for users to enter the crypto world. It also continues to expand cooperation with traditional enterprises, leveraging market opportunities in traditional finance and expanding user usage scenarios.

In January of this year, Tron partnered with the payment platform Pundi X to promote the use of cryptocurrencies in daily life consumption scenarios. The general manager of Pundi X stated that almost every Turkish crypto user is using TRC20-USDT.

Internally, Tron continues to improve product offerings to enhance user experience and has built a comprehensive product system for stablecoin users to increase their holding returns, including a suite of DeFi applications based on stablecoins, from deposits to lending to RWA.

In terms of expanding stablecoin application scenarios and returns, Tron has launched products such as the "DeFi Suite" lending product JustLend, stablecoin minting protocol JustStables, cross-chain protocol Just Cryptos, and DEX protocol SUN.io.

In addition, in July of last year, Tron's ecosystem launched the RWA-based product stUSDT, supporting users to invest USDT in short-term government bonds and other real-world assets to earn higher returns. As of March 11th, the value of USDT pledged for stUSDT has exceeded $1.3 billion, with a yield of 4.84%, ranking second in the RWA race, second only to MakerDAO.

Through this comprehensive product system, Tron has not only gained new users entering the crypto world but also solved the problem of how to retain users on the platform.

From the perspective of the Tron public chain, the issuance of USDT will continue to increase the value carried by Tron, attracting more users to enter the Tron ecosystem, making on-chain transactions more frequent, and further solidifying the Tron ecosystem.

Currently, Tron's TVL has exceeded $25.7 billion, with the asset value locked in the lending platform JustLend approaching $8.13 billion and the TVL on the cross-chain protocol Just Cryptos at $8.11 billion.

In terms of network income, in the past 365 days, Tron's network annual income has reached $452 million, ranking third among all networks, second only to Ethereum ($28.4 billion) and Bitcoin ($7.1 billion).

Through diversified layout and continuous deepening of its related ecosystem, Tron has formed its own moat advantage in the stablecoin race, aiming for a market value of hundreds of billions of dollars.

Entering the Bitcoin Ecosystem to Unlock a Trillion-Dollar New Market

While Tron continues to steadily advance in the stablecoin business, it is also actively laying out new tracks and opening up new battlefields. In February, Tron announced the launch of a Bitcoin Layer 2 solution to enter the Bitcoin ecosystem, which will open up new growth space worth trillions of dollars in the future.

Currently, Bitcoin has officially surpassed $70,000, with a market value soaring to $1.4 trillion, surpassing silver and ranking as the eighth largest asset in the world by market value.

As Bitcoin does not support smart contracts and has long existed solely as a store of value asset, trillions of dollars in Bitcoin assets have been dormant in wallets or exchanges, unable to realize their liquidity value.

However, with the development and prosperity of the Ordinals protocol and BRC20, Bitcoin, which was originally only used for value storage and exchange, can now also serve as a place for asset issuance. This not only enriches the new asset types in the Bitcoin ecosystem but also greatly expands the usage scenarios of Bitcoin, potentially unlocking trillions of dollars of dormant Bitcoin.

Since the Ordinals wave, the Bitcoin ecosystem has attracted a large amount of funds, users, and developers to enter the Bitcoin ecosystem. Faced with on-chain congestion and high gas fees on the Bitcoin network, it provides an opportunity for the development of Bitcoin Layer 2, which is expected to bring innovative DeFi applications into the Bitcoin network.

Various Layer 2 solutions in the Bitcoin market are flourishing. In addition to well-known projects such as Stacks, RSK, Liquid, and RGB, there are also new players such as BitVM, Merlin, and latecomers like Nervos, transforming or entering the Bitcoin Layer 2 is becoming a new opportunity for old and new projects.

Tron, always at the forefront of the crypto market trend, seems to be expected to enter the Bitcoin Layer 2.

According to public information, Tron's Bitcoin Layer 2 solution will be implemented through a "three-stage" roadmap of alpha, beta, and gamma, which can be understood as a progressive three-step process.

The alpha stage will bridge the asset cross-chain interoperability between the Bitcoin network and the Tron network, with TRON DAO Ventures involved in Ordinals and the Bitcoin Layer 2 solution.

The beta stage will connect with other Bitcoin L2 ecosystems, cooperate with multiple Bitcoin Layer 2 protocols, and enable cross-interoperability between Tron network assets and major Bitcoin Layer 2 solutions.

The gamma stage will integrate the Tron network, cross-chain interoperability protocol BTTC, and the Bitcoin network's Layer 2 solution to build a unified Bitcoin Layer 2 super hub.

Through the "alpha, beta, gamma three-stage strategy," Tron can not only help the cross-chain flow of Bitcoin ecosystem assets and capture value but also bring its existing 200 million users and over $55 billion in crypto assets into the Bitcoin ecosystem, injecting financial vitality into it. Tron itself can obtain a volume of new growth reaching trillions of dollars through siphoning BTC and high-quality assets within its ecosystem, opening up a new growth front after stablecoins.

Five years ago, Tron's wise decision to support the issuance of TRC20-USDT ultimately set it apart in the public chain market and achieved great success. Therefore, once the Bitcoin Layer 2 solution is successful, it will become another new track with a trillion-dollar imagination space, just like stablecoins.

On March 4th, Justin Sun announced on social media that the inscription market based on Tron developed by the NFT market APENFT is about to launch.

The Success Behind Tron

Looking back at Tron's past, it seems to have successfully seized every wave of the crypto narrative. From the forward-looking support of USDT and the layout of stablecoins five years ago, to the Just and Sun series products under the DeFi and NFT boom, as well as the RWA narrative launched last year with stUSDT, and the decision to enter the Bitcoin ecosystem this year, Tron has keenly grasped every narrative wave and delivered products that have been recognized by the industry and achieved good results.

Tron's past achievements are all due to Justin Sun's accurate positioning in the crypto industry, enabling Tron to quickly respond and make the right choices when facing each narrative wave.

Last year, at the Korea Blockchain Week, Sun stated that he had been working in the industry for 11 years, and while most of his friends had chosen to retire, he still felt excited about new things in the industry and spent three hours every day learning about new projects and industry trends.

It is because of his consistent dedication to deepening his involvement in the industry, from public chain platforms and ecosystems to DeFi, stablecoins, NFTs, and RWA, that Justin Sun has always been able to contribute to the industry's hot topics.

Whenever a new crypto narrative emerges, Tron will embark on new product trials in the new track, and it is this bold trend borrowing that has opened up new opportunities, expanded growth space, and enlarged the ecosystem.

Today, Tron has made inroads in popular industry tracks such as stablecoins, DeFi, and RWA, and its ecosystem products not only have remarkable achievements in various sectors or niche tracks, but also form a healthy rotation between products, steadily moving upward regardless of market conditions.

Tron's current success is not accidental, but rather an inevitable result.

Just as Justin Sun's 2024 gift to HODLers who remain committed to the crypto frontlines says: "In the crypto field, as long as you are willing to learn, experiment, and iterate, you will definitely succeed. Because Web3 is a place where new things emerge endlessly, and innovative gameplay is iterated repeatedly, always staying online 24/7, with two opportunities per month, twenty-four opportunities per year, you will always be able to seize one. Never be afraid of failure, because one success is enough."

This statement not only applies to investors, but Tron seems to be adopting the same strategy and completing its transformation through each product iteration and upgrade.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。