Author: Kevin Owocki

Translation: tiao

Source: ForesightNews

Abstract

As of January 2024, Gitcoin has held 19 rounds of Quadratic Funding (QF) donation projects, distributing over 59 million US dollars to early-stage builders and other beneficiaries.

Since early 2023, Gitcoin donation projects have been based on the Allo protocol (Gitcoin's capital allocation protocol). In this article, we delve into Allo—it is the strategic cornerstone of Gitcoin's efforts to promote a more dynamic, diverse, and inclusive funding model. Allo's architectural design is scalable and supports various allocation strategies, such as Direct Grants, Retroactive Public Goods Funding (RPGF), QF, and many future mechanisms.

By leveraging Gitcoin's momentum and building and promoting capital allocation strategies, our goal is to overcome the limitations faced by traditional capital allocation practices—lack of transparency, democratic participation, and accessibility.

As tokenization engulfs the world, our ambition is to enhance the collective capacity for financing significant causes and to create collective action in various fields. We see the Allo protocol as the engine for exploring this space. By managing a core library of best allocation strategies, rigorously audited and well-documented smart contracts, best practices, social movements using these tools, and other supportive materials, we position Allo as a key participant in the decentralized capital allocation space.

This article explores the opportunities opened up by Allo and outlines a diverse ecosystem of capital allocation tools, methods, and cultures. We envision various types of capital allocation that enable diverse combinations of people, cultures, and causes to achieve collective action.

For web3 developers and participants, the progress of Gitcoin and the launch of Allo have opened up new opportunities to pursue fairer and more effective capital allocation mechanisms.

1. Opportunities

As emphasized in the Gitcoin whitepaper, the process of capital allocation plays a fundamental role in funding things that are important to human communities, from small teams to large communities. Capital allocation makes collective action possible.

As tokenization engulfs the world, the total addressable market (TAM) for capital allocation tools in the web3 space may experience exponential growth.

We believe that traditional capital allocation methods are not suitable for the 21st century. Specifically, they have the following issues:

- Gatekeeping: A few decision-makers may become power brokers who are unwilling or unable to democratize.

- Not scalable: They cannot leverage the native advantages of the internet (convenient access, consumer-facing interfaces) and Ethereum (trust neutrality, composability, transparency, democratic decision-making, resistance to censorship).

- Not precise: They lack the ability to manage large amounts of information on a large scale and allocate capital resources precisely.

In contrast, Ethereum-based capital allocation can be:

- Democratic: Reflecting the will of the participants.

- Accessible: Participable through web pages or mobile applications.

- Transparent: Tamper-proof, with audit trails visible to anyone.

- Powerful: Capable of precisely allocating resources on a large scale.

- Evolutionary: Expandable by anyone using open-source software.

Today, we have programmable money that can integrate values into the financial system. We are building a precise, scalable, and gatekeeper-free capital allocation system that is democratic, accessible, transparent, and powerful.

Gitcoin 2.0 is leading this revolution. Through Gitcoin donation projects, we have distributed 59 million US dollars to developers and witnessed its tremendous impact. Effective funding decisions can promote ecosystem builder activities, user growth, and transaction volume—in short, donations create growth.

Based on these experiences, we are launching Gitcoin 2.0. The transformation of Gitcoin includes:

- Transitioning from a centralized platform operated by Gitcoin to modular products and protocols that anyone can use and build.

- Expanding from a single QF to multiple capital allocation mechanisms including QF, direct grants, RPGF, and others.

- Expanding deployment from Ethereum to multiple Ethereum Virtual Machine (EVM) networks such as Optimism, Arbitrum, Base, Polygon, zkSync, Scroll, Avalanche, and others.

To learn more about this opportunity space and Gitcoin 2.0, please click to read the "LXDAO Translation | Gitcoin 2.0 Whitepaper: Donations Create Growth".

2. Design Philosophy

In the design and development process of Gitcoin's technical stack, we follow a design philosophy based on key principles. These principles are crucial for capturing our broad understanding of capital allocation design, but they also maintain the flexibility needed for us and our peers to continue learning and innovating.

2.0 Security First

The Allo protocol brings capital allocation on-chain. We believe this is a revolutionary step forward for the capital allocation ecosystem—this means we can now introduce trust neutrality, resistance to censorship, and democratic decision-making into capital allocation schemes.

However, on-chain introduces new security challenges that must be responsibly addressed. Therefore, Allo has been audited and has prioritized user and fund security in its design.

2.1 Create Open Design Space as Much as Possible

In designing Allo, our goal is to maximize the possibility of various experiments. In practice, this means minimizing assumptions at the protocol level as much as possible. This philosophy is reflected in two key aspects of the protocol: allocation strategies and registries.

The goal of allocation strategies is to allow users to define on-chain who is eligible to receive funds from a pool, how to determine the funds, and the mechanism for allocating the funds. By default, the Allo protocol does not presuppose the nature of the answers to these questions, giving the community considerable freedom in designing allocation strategies.

The project registry aims to address challenges such as influence assessment, curation, and project reputation. However, it does not set specific solutions for these issues. Instead, it provides a platform for experimentation, allowing organizations to explore different approaches and letting the most effective solutions emerge through market dynamics.

For example, project reputation could be managed through tools such as attestations, soul-bound tokens, or others. Considering that each project in the registry is associated with an address (referred to as an Anchor), these methods can be incorporated into the eligibility determination strategy.

2.2 Core Simple, Periphery Rich

This is the Unix philosophy expressed in our protocol. The core of the protocol (Allo.sol) creates pools, provides funds for them, and arranges an allocation strategy for them ("Do one thing and do it well").

We anticipate (and hope) that the output values of allocation strategies will be used for various purposes, including potentially funding other pools in Allo ("Expect the output of every program to become the input to another program as yet unknown").

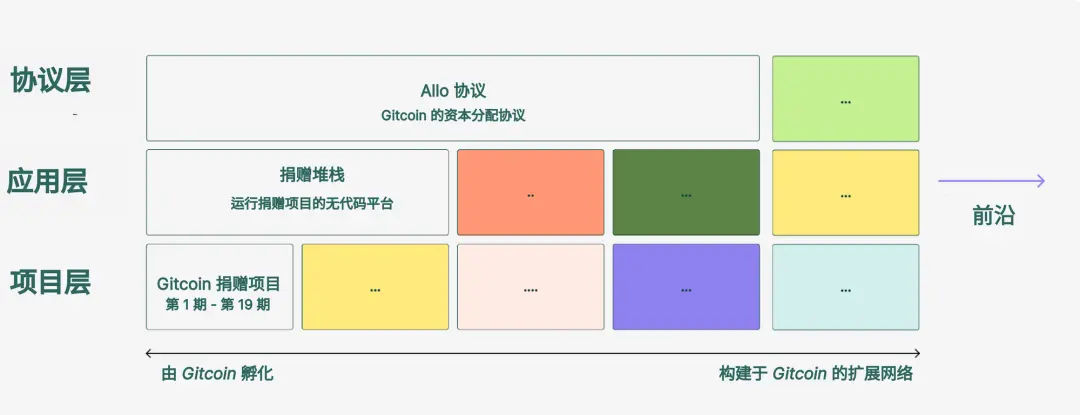

2.3 Layered Approach

Gitcoin's stack is divided into multiple layers:

- Protocol Layer: A trust-neutral capital allocation tool. Based on QF and direct grants, it gradually expands from the Gitcoin network to other mechanisms built through it.

- Application Layer: Web and mobile interfaces. Based on the Grants stack, it gradually expands from the Gitcoin network to other applications built through it.

- Project Layer: Diverse services provided by active community members. Based on Gitcoin donation projects, it gradually expands from the Gitcoin network to other projects built through it.

To delve deeper into the layers and architecture, please click to read "LXDAO Translation | Gitcoin 2.0 Whitepaper: Donations Create Growth".

3. The Core of Allo—Simple, Stable, Secure

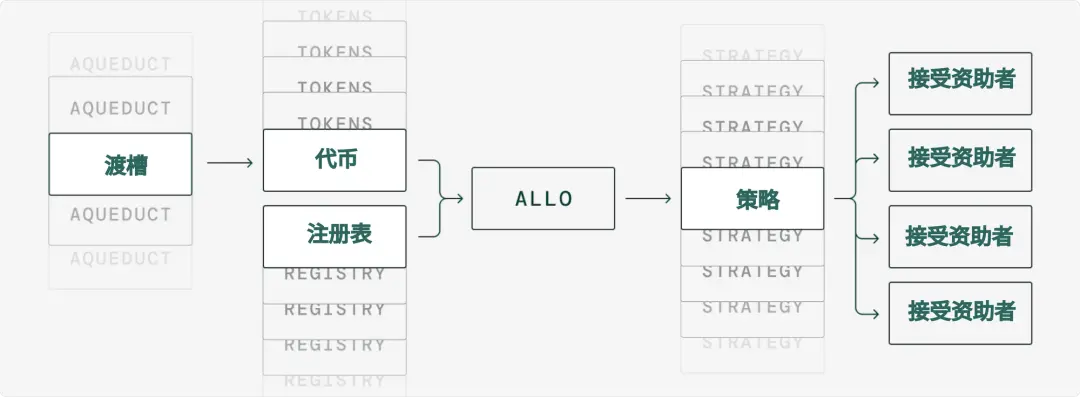

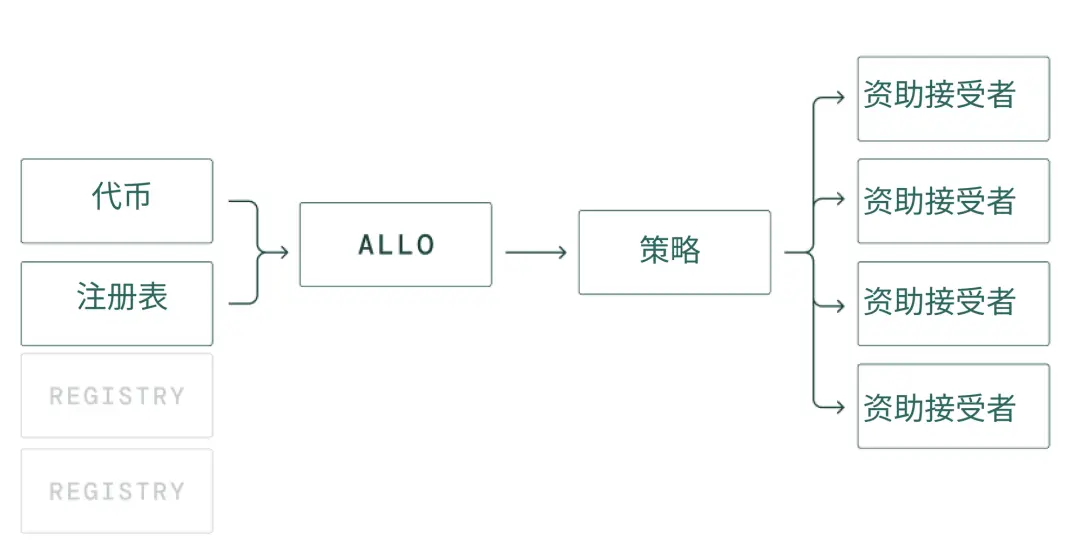

We have designed a simple, stable, and secure core for Allo, consisting of four modules.

These modules follow the Unix philosophy: do one thing, do it well, and collaborate with each other. This allows us to allocate capital effectively, precisely, and at scale.

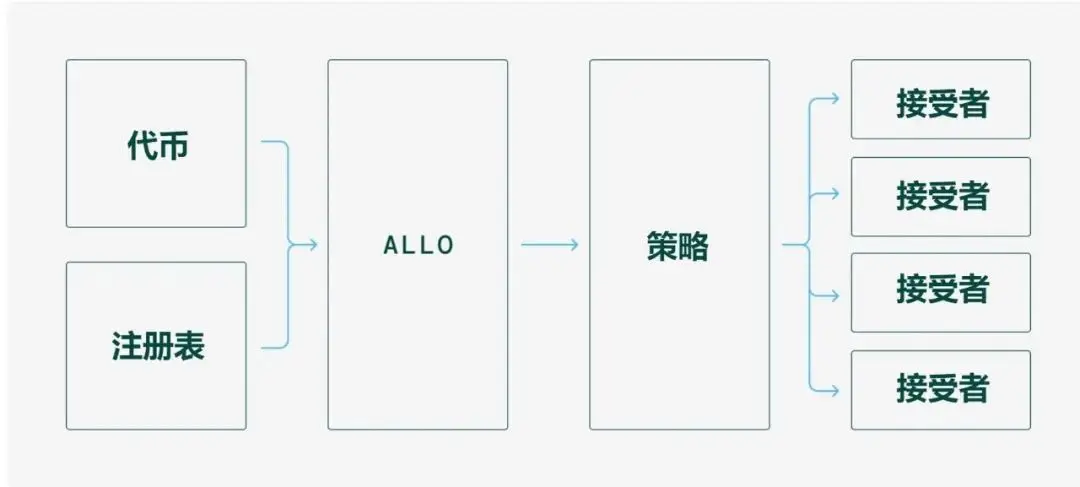

The basic modules of the Allo core are:

- Tokens digested by Allo.

- Registry—list of projects eligible for funding.

- Strategies—how to allocate capital to projects in the registry.

- Allo—the hub that brings together the above three elements.

These modules are all modifiable. This simple core enables a rich periphery. We hope that Allo will eventually support (and provide builders with ready-made) many potential combinations of capital allocation registries, tokens, and strategies.

To understand in detail how these components fit together, please refer to the "Allo Documentation".

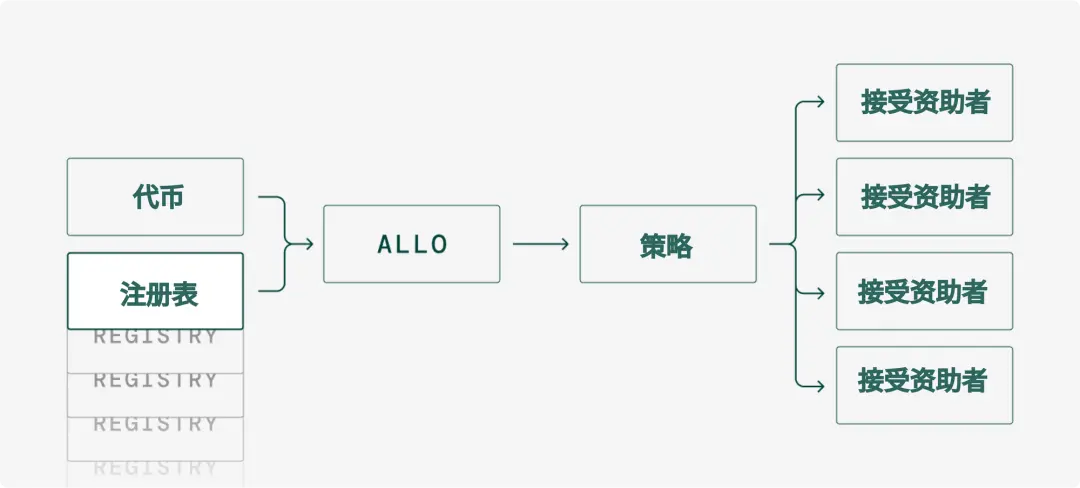

3.1 Registry

As a capital allocation protocol tailored for tokenized communities, Allo features a novel concept—the project registry. The registry is the core foundation of intelligent data about project activities, participants, reputation, and influence certifications.

For detailed information about the core components of the registry, please see the "Simple Core" section in "Appendix A: Registry" at the end of the document.

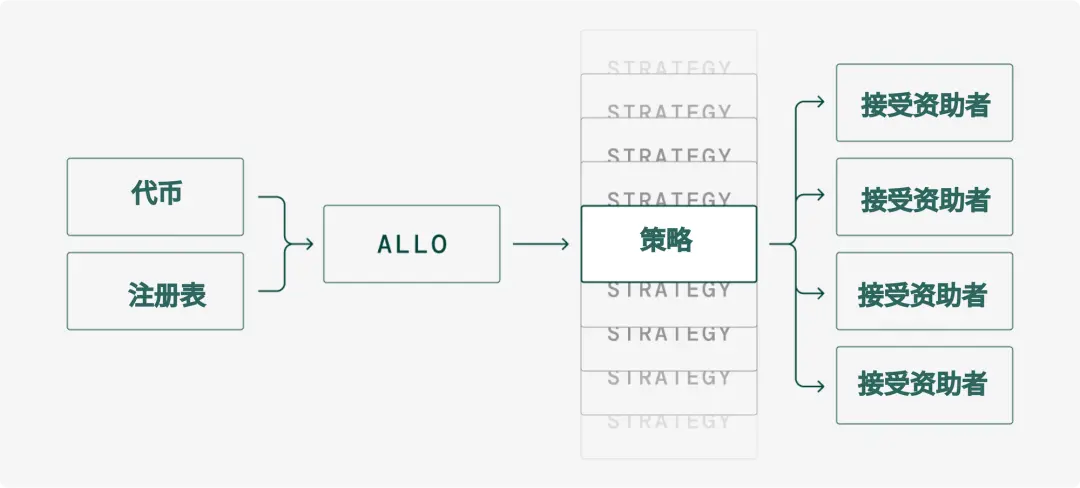

3.2 Strategies

Capital allocation strategies determine the flow of tokens—often leveraging external data, especially voting data.

The following are three strategies currently built on Allo:

- Direct Grants / Request for Proposal (RFP)

Direct grants to projects may represent the simplest form of donation. Users can easily create a donation project on Allo, specifying its name, goal, timeline, amount, and then open it to applicants. Unlike temporary donation projects using traditional web2 tools, on-chain ensures the plan's incorruptibility, transparency, and compatibility with other donation proposals. Users can initiate RFPs through direct donation projects. RFPs invite potential beneficiaries to submit proposals, detailing project requirements, selection criteria, and submission deadlines. This process helps focus community efforts on specific challenges while promoting a fair, open, and competitive environment to ensure the quality of services or products.

- QF

QF is a crowdfunding mechanism that achieves optimal matching for public goods funding based on the number of contributors rather than the contribution amount. QF amplifies the impact of small contributions, ensuring that projects favored by a larger community receive more funding. This approach encourages broad participation and democratically aligns funding with the broad preferences of the community.

- Retroactive Public Goods Funding (RPGF)

RPGF rewards public goods projects that have already demonstrated clear value and impact. This approach, contrary to the traditional upfront funding model, focuses on rewarding successful contributions that have already benefited the community or society. By providing economic incentives to successful projects that have already proven their public benefit, RPGF encourages innovation and risk-taking. The most popular RPGF projects in the world come from Optimism—we have forked it and created the product EasyRetroPGF.xyz. More details on how Allo is compatible with Optimism-style RPGF will be provided below.

Note: For the EasyRetroPGF.xyz product, see: http://easyretropgf.xyz/

4. Rich Periphery of Allo

We have designed the protocol with a simple core, allowing for the construction of rich tools around it.

4.1 Registry

As of 2024, several well-known donation registries have been created on web3 platforms.

Significant ones include:

- Gitcoin's Allo protocol

- Optimism

- Giveth

- CLRFund

- Hypercerts

The default Allo registry can be overridden to be compatible with any of these registries, allowing other funding registries to interoperate with the Gitcoin ecosystem.

4.2 Capital Allocation Strategies

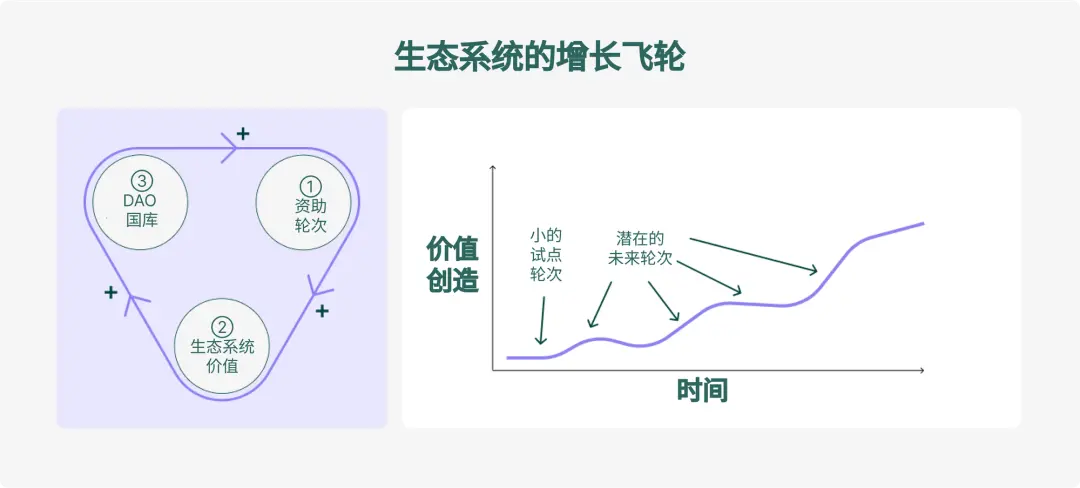

As the design space is more fully explored, we can integrate better strategies into the Allo ecosystem, enabling the community to make capital allocations that more closely align with their ecosystem needs.

We believe that the most in-depth and extensive library of capital allocation strategies will make Allo contracts a powerful tool for building capital allocation anywhere in the world.

To see the expanded list of different types of capital allocation mechanisms that can be built on top of Allo, please refer to the "Appendix B: Rich Periphery—Ideas for Capital Allocation Strategies" section.

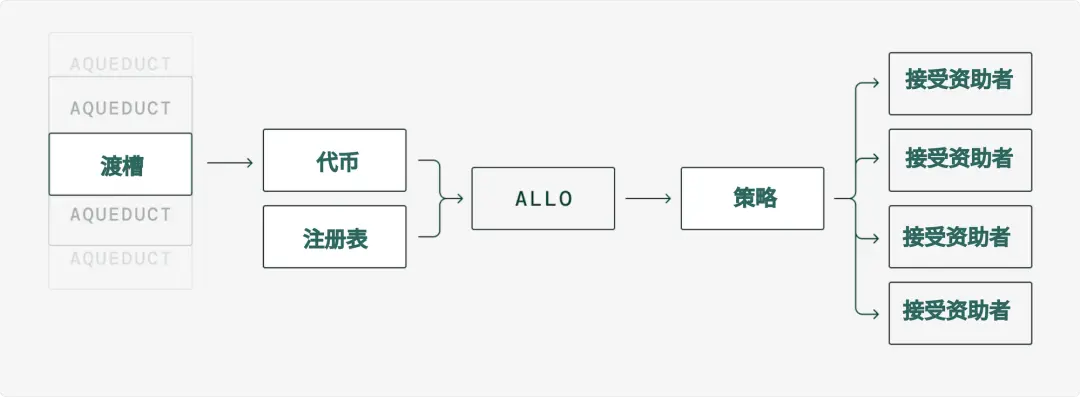

4.3 Aqueducts

In the physical world, aqueducts refer to transporting water from one place to another. In the Gitcoin ecosystem, aqueducts refer to transporting tokens from one place to another.

Capital allocation pools without funds flowing in are useless.

At the most basic level, aqueducts are a protocol for funding Allo pools. At the most complex level, they can be automated, trustless on-chain fund flows. These aqueducts provide a tool for incentivizing ecosystem growth with one line of Solidity code—depositing funds into Allo and expecting them to be allocated to the ecosystem's growth flywheel over time without trust.

As your project grows and more assets flow into its aqueducts, GitcoinDAO will begin to provide more and more value to your project's ecosystem.

To learn more about aqueducts, please read "Gitcoin Aqueduct": https://gov.gitcoin.co/t/gitcoin-aqueduct/9684.

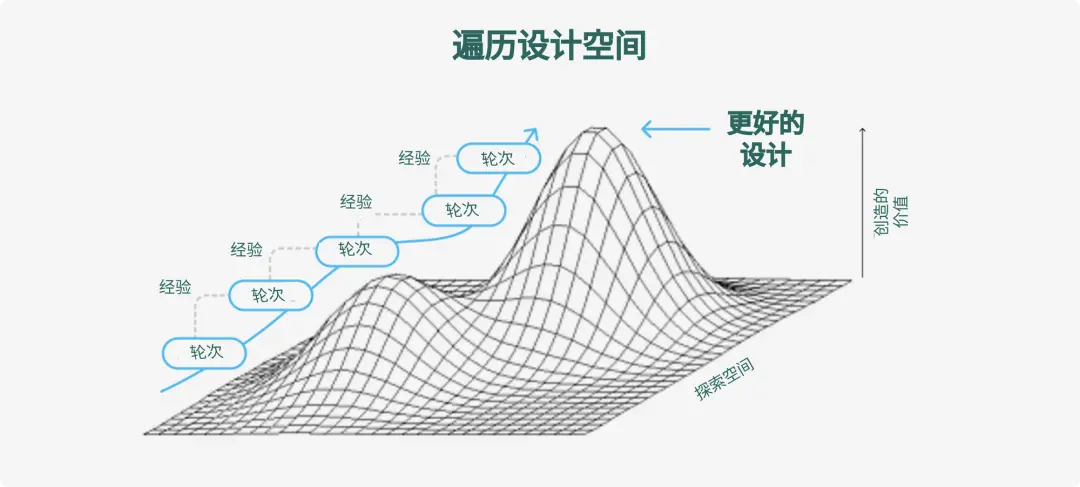

5. Exploring Design Space

5.1 Defining the Design Space

The Allo protocol has a generic architecture that can digest any donation registry, ERC20 tokens, or capital allocation strategies.

We believe that the space of possibilities in this space = (all possible aqueducts) x (all possible on-chain assets) x (all possible registries) x (all strategies).

The design space here is vast, and we expect many valuable configurations of the Allo protocol to emerge.

This design space includes:

- All possible aqueducts

- All possible tokens

- All possible project registries

- Capital allocation strategies

- Allo's current support (direct grants, RFP, QF, quadratic funding, RPGF)

- Allo's potential support (guarantee contracts, conviction voting, self-curated registries, gift circles, angel investing, direct contracts, and other yet-to-be-discovered mechanisms).

For more mechanisms that can be built on top of Allo, please refer to the "Appendix B: Rich Periphery—Ideas for Capital Allocation Strategies" section at the end of the document.

5.2 Navigating the Design Space

Instead of brute-forcing the exploration of the design space (testing every possible model permutation), we optimize strategies by running Allo funding rounds and learning from the results, using an iterative OODA loop—Observe, Orient, Decide, Act. This process has honed the Gitcoin Grants stack and Gitcoin Grants projects.

To learn how we explore this design space, see: https://gov.gitcoin.co/t/shape-rotators-guide-to-funding-what-matters/17174.

However, it is not possible for us alone to explore the design space.

Therefore, Allo empowers others to explore and share discoveries, and collaborate with Allo to disseminate those findings to a wider audience.

Initiatives like EasyRetroPGF.xyz and Superfluid's liquid QF pilots demonstrate how Allo fosters diverse funding mechanisms. These and other contributions are crucial for Allo to evolve into a core resource for developers in the field of capital allocation.

From the perspective of the Gitcoin network, these developers are:

- Decentralized explorers of the capital allocation design space.

- Those who integrate their individual incentives with Gitcoin's incentives through participation in using Allo's Citizens Grants projects or other channels that establish economic interoperability with Gitcoin.

5.3 Grants+

Based on the belief in the importance of donations for ecosystem growth, many explorations in this design space revolve around donations. Donations = growth.

Beyond donations, our vision extends to "Grants+," aiming to go beyond traditional funding models into a new realm where the transformative potential of the "value internet" redefines financial interactions and capital flows, much like the internet revolutionized information exchange.

Inspired by the evolution of the internet, "Grants+" is not just about enhancing existing patterns but reimagining capital allocation for ecosystem growth, akin to the leap from web1 to web3. This vision involves deep exploration of the non-fungible frontiers of capital allocation, assessing the vast opportunity space and its transformative power.

Just as our capacity for exchanging information is much greater and more powerful today than before the internet emerged, we believe Grants+ will provide more and more powerful ways for ecosystems to allocate capital or take collective action.

Roadmap for Grants+: https://gov.gitcoin.co/t/exploring-grants/18119.

5.4 Five Signs of Success

10-20 years from now, what would this vision look like if it were hugely successful?

Sign One: Tokenization Consumes the World

Betting on Gitcoin is betting on the Ethereum Virtual Machine ecosystem, which is betting on the tokenization of all assets. Allo is riding this wave, heading towards open skies as more and more assets are tokenized.

Sign Two: Simple and Secure Core, Richer Periphery

Allo's simple core is effective, not disrupting what works well. It maintains a focus on security and preventing user fund loss. If we achieve maximum success, the simple core will operate as it does today.

We envision a diverse ecosystem:

- Many capital allocation tools built on the Allo protocol. When the time is right, this rich periphery may include configurations of all valuable capital allocation tools of the 21st century.

- Many third-party integrations embedding Allo into other ecosystems. By allowing anyone to build Allo into their brand or app, we greatly expand the total potential market for Allo.

- Many adjacent tools. While not capital allocation tools themselves, they add value to capital allocation tools in the Gitcoin ecosystem by providing adjacent functionality.

See the end of the document, Appendices A-C, for more on the rich periphery built around Allo.

As the rich periphery continues to grow, we expect to see:

- Network effects of Allo strategies

- What OpenZeppelin has done for ERC20/721 contracts, Allo can do for capital allocation. Successfully establishing Allo as the hub for these contracts can generate a feedback loop: better contracts attract more developers, more developers create better contracts, and so on. This loop not only enhances the value of the ecosystem but also expands the tools and services in the Allo ecosystem, enhancing its network effects and competitive advantage.

- Network effects of the Allo registry

- As more projects use the Allo ecosystem to fund themselves, Allo could become the most liquid project registry in the ecosystem. It will have a rich tool ecosystem supporting the practical operation of capital allocation. This growth will drive a cycle of attracting more projects and funders, perpetuating itself.

- Network effects of the Allo social layer

- The ecosystem will also benefit from a network of skilled grant project operators who are adept at using Gitcoin tools. A supportive service provider network will further enhance Gitcoin's success.

This expansion enhances the network effects and overall utility of Allo, making it a resource for accessing project registries and capital allocation strategies, ensuring its continued growth and dominance.

Sign Three: Finding (3,3) with Other Creators

Gitcoin is known for QF, the mechanism it helped pioneer. But Gitcoin cannot invent every capital allocation strategy.

We need to enable the wider Gitcoin network to explore the design space and integrate the best mechanisms into Allo. This will allow us to integrate novel mechanisms created elsewhere— from RPGF to conviction voting, and more.

To do this, there must be strategic appeal to enable the creators of new mechanisms to collaborate with Gitcoin and expand their impact through Allo. Integration with Gitcoin provides broader distribution in the capital allocation ecosystem and amplifies Gitcoin's network effects. Gitcoin must excel in interoperability with these partners—socially, technically, and economically.

To learn what DAO-to-DAO partnerships look like for Gitcoin's DAO, please read "Three Layers to a DAO-to-DAO Partnership": https://gov.gitcoin.co/t/3-layers-to-a-dao-to-dao-partnership/10657.

Sign Four: Stacking Allo on Allo

As more projects start using the Allo protocol to fund their ecosystems, we will begin to see multi-layered flows through Allo.

This funding may look like:

As more communities do this:

- There may be more self-maintained project contributors lists from the bottom up.

- Funds will flow to lesser-known projects, leading to more long-tail public goods funding and public goods funding from cradle to unicorn.

- We will see unprecedented diversification of funding sources for many important ecosystem contributors, helping us achieve "impact = profit" in a more diverse way.

Sign Five: Gitcoin Building Allo with Allo

What sets Gitcoin apart is that it not only designs Allo, but also uses Allo to fund itself. Gitcoin builds Allo, and Allo builds Gitcoin.

Through the Gitcoin Citizens Grants projects, Gitcoin has the opportunity to build its own ecosystem with its own tools. This is called "dogfooding"—a company using its own products, which improves product quality, ensures a better understanding of the user experience, accelerates the feedback loop, and demonstrates confidence in and reliance on the product. It fosters a culture focused on user needs, promotes innovation, saves costs, and enhances brand loyalty by showing that the company believes in and relies on what it sells.

6. Conclusion

We believe that Gitcoin 2.0 has laid the groundwork for the next generation of capital allocation experiments in the tokenized community. The modular and scalable design of the Gitcoin architecture invites ongoing innovation and exploration of novel capital allocation strategies to adapt to the evolving needs of the web3 community.

The technical layer of the Gitcoin network enables the social layer, and vice versa. By embracing the opportunities embedded in Gitcoin 2.0, the community can collectively work towards more precise, fair, and robust resource allocation. By uniting around the capital allocation vision of Gitcoin, the Gitcoin network—builders, partners, and projects in the Gitcoin orbit—will guide the diversification of capital allocation strategies, registries, and adjacent tools. As more assets are tokenized and the digital community's footprint continues to expand, Gitcoin's vision—a decentralized and open capital allocation ecosystem—becomes increasingly relevant, urgent, and inevitable. This vision calls on developers, partners, and pioneers to take action and contribute to the development of a diverse and dynamic capital allocation ecosystem.

Developers' skills and passion can make significant contributions to this mission. By participating in Gitcoin 2.0, developers have the opportunity to be part of building the future—where capital allocation is not just financial distribution. It becomes a sustainable competitive advantage.

Appendix A: Registries

1. Simple Core

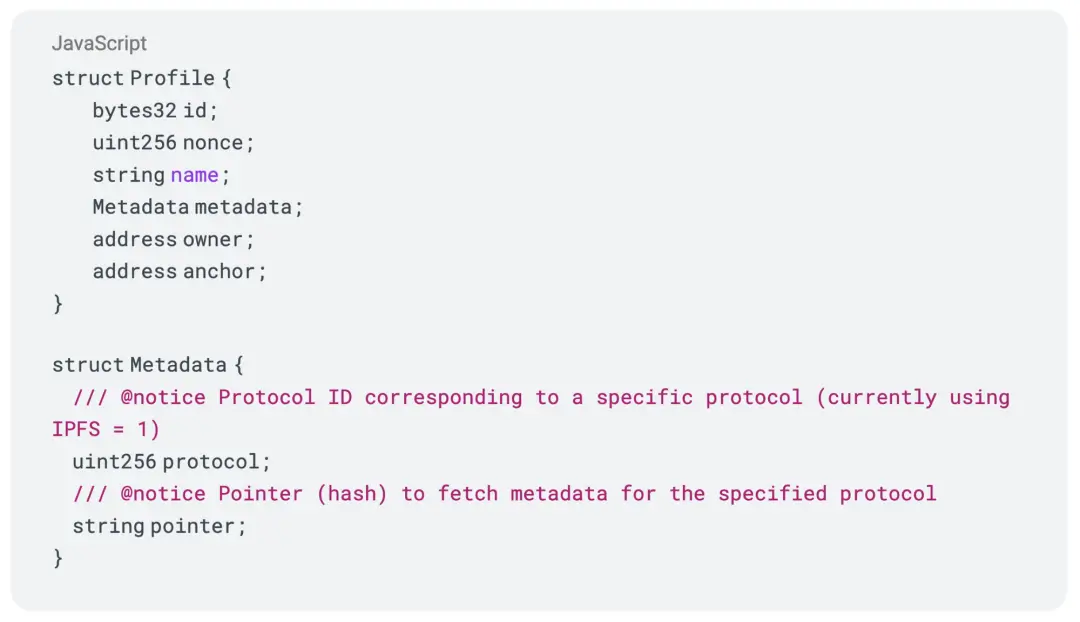

The core component of the profile registry. Profiles contain information about groups and individuals who wish to be part of the Allo ecosystem. Once a profile is created, it can be used to run or participate in funding pools. All registry data, including profiles and event details, is stored on-chain and accessible through subgraphs.

Each profile on the registry contains the following details:

Learn more about the Allo registry: https://docs.allo.gitcoin.co/project-registry

2. Rich Periphery

We have invested a lot to make the Allo registry compatible with other registries:

- Abstracting the registry as an interface IRegistry, which can be implemented with any of the above registries. This allows other parts of the Allo ecosystem to not worry about the underlying data structure of the registry.

- Making it easy to publish donations from the Allo registry to those most popular registries by building a donation "common application form (similar to a US college application)."

- Making it easy for the most popular registries outside of Allo to publish donations in the official Allo registry.

The concept of interchangeable registries is visualized in the Allo generic architecture below.

Learn more about the registry interoperability roadmap: https://gov.gitcoin.co/t/pubsub-on-allo-v2/17742

Appendix B: Rich Periphery—Ideas for Capital Allocation Strategies

1. Smart Contract Examples

1.1 Quadratic Voting on Allo (Fourth Strategy on Allo)

Check out the QV contract example built on Allo: https://github.com/allo-protocol/allo-v2/tree/main/contracts/strategies/qv-simple

1.2 Direct Grants/RFP

Check out the RFP contract example built on Allo: https://github.com/allo-protocol/allo-v2/tree/main/contracts/strategies/rfp-committee

1.3 QF

Check out the QF contract example built on Allo: https://github.com/allo-protocol/allo-v2/tree/main/contracts/strategies/donation-voting-merkle-distribution-vault

2. Rich Periphery—Strategies We Hope to See

The existing mechanisms built on Allo are already powerful, but they only represent a small part of the design space. We imagine the cutting edge of future capital allocation mechanisms built on Allo.

2.1 Assurance Contracts

The assurance contract is a crowdfunding mechanism where donations are only received if the project reaches its funding goal. This reduces the risk for supporters and ensures that funding is only achieved when the project is viable. It is suitable for public goods or community projects that require broad support.

A variant of the assurance contract, known as dominant assurance contract, offers refund rewards to early supporters if the project does not reach its goal. This incentivizes early contributions, addresses free-riding issues, and enhances the project's appeal to participants. This improvement aims to increase fundraising success by making contributions more attractive.

The Allo protocol supports the creation of strategies containing assurance contracts to facilitate innovative funding models.

2.2 Conviction Voting

Conviction voting is a decision-making process primarily used in decentralized organizations, where participants stake governance tokens to continuously support their preferred proposals. The longer the support is maintained, the greater the "conviction" and voting weight, enabling fluid, dynamic decision-making and mitigating sudden, majority-based outcomes.

The Allo protocol supports the creation of strategies allowing token holders to participate in conviction voting.

2.3 Self-Curating Registry

A self-curating registry is a user-updated address list that allows the addition and removal of entries without centralized oversight. The Protocol Guild v2 for Ethereum developers (https://protocol-guild.readthedocs.io/) demonstrates its utility in fostering consensus among contributors familiar with each other's work and identifying significant contributors. This mechanism enables funders to clearly identify and support key contributors to public goods.

The Allo protocol supports the creation of strategies allowing registry members to receive token rewards.

2.4 Gift Circles

In the gift circles mechanism, community members provide goods and services to each other without expecting direct reciprocity. Participants share their needs, contribute with their abilities or items, nurturing bonds, generosity, and a support network beyond the conventional economic system. Gift circles emphasize sharing, care, and trust, and Coordinape extends this to DAOs in web3 to achieve fair resource allocation for contributors.

The Allo protocol supports the creation of gift circle strategies.

2.5 Delegated Domain Allocation

Delegated domain allocation is a concept proposed by Questbook to enhance the efficiency of donation projects in decentralized ecosystems.

By authorizing individuals with expertise to manage donations, this approach decentralizes donations. Domain allocators are responsible for managing the budget for their respective domains. This approach aims to address issues in current grant programs, such as limitations of committee members and donor fatigue due to overwhelming applications, and decentralize decision-making to bring funds closer to ecosystem builders and contributors.

The Allo protocol supports the creation of strategies for delegated domain allocation.

Note: For more information on the concept of delegated domain allocation proposed by Questbook, see: https://blog.questbook.xyz/posts/delegated-domain-allocators/

2.6 Angel Investments

Angel investments refer to individual investors providing funding to startups in exchange for governance rights. These investors typically provide capital and sometimes offer guidance and networking opportunities to help young companies grow.

The Allo protocol supports the creation of strategies to distribute tokenized rewards to project supporters.

2.7 Prop House-Style Capital Deployment

Prop House is a funding infrastructure incubated in the Nouns DAO ecosystem. Through rounds with specific fund pools, the community can auction fixed amounts to proposers with the best ideas.

The Allo protocol supports the creation of strategies for fundraising in a Prop House-style.

2.8 Direct to Contract

The concept of direct to contract promoted by Rabbithole suggests that anyone can create incentives for any on-chain action.

In essence, the incentives are simple:

- Identify an expected outcome.

- Choose an action that can lead to the outcome.

- Provide an attractive reward to execute the action.

Building direct to contract-style fundraising on scalable infrastructure creates a modular level of innovation and experimentation in network-level incentives.

The Allo protocol supports the creation of direct to contract-style fundraising strategies.

Note: For more information on the concept of direct to contract promoted by Rabbithole, see: https://twitter.com/t__norm/status/1748417085410275791

3. Other New Strategies

3.1 Allowlist Configurability

Granting round managers the ability to fine-tune capital allocation decisions, allowing them to embed very specific capital allocation requirements into rounds. This will make the Gitcoin grants stack more configurable, capturing not only QF but also RetroPGF or other novel use cases.

Some anticipated configuration options include:

- Passport configuration: What if I want to use non-Gitcoin scorers or a specific set of stamps, or I want the passport threshold to be lower than 20?

- Use other anti-sybil resources, such as Worldcoin, brightid.

- Other options

- The simplest—upload a CSV of addresses I want to vote for.

- More advanced

- Temporary roles (Hats role)

- SAFE multisig owners

- People who own more than x amount of y tokens (I should be able to vote by token amount, or 1 vote per account, or another intermediate formula).

- EAS certification.

- Guild roles

Learn more: https://gov.gitcoin.co/t/allowlist-configurability-a-strategic-investment/17741

3.2 Privacy on Allo (MACI)

MACI, or Minimal Anti-Collusion Infrastructure, is a chain-based voting process application that gives users strong anti-collusion capabilities. A common issue in current on-chain voting processes is the ease of bribing voters to vote for specific options. This bribery often takes the form of "join our pool (vote for us), and we will give you a portion of the reward (bribe)." Without MACI, voters can easily prove to the briber which option they voted for, thus receiving a reward.

3.3 Impact Attestations

Impact attestations are formal statements or reports that verify and record the effects and outcomes of specific projects, initiatives, or investments, especially in terms of social, environmental, or economic impact. They are commonly used by organizations, investors, and social enterprises to demonstrate accountability and the positive changes they have created. These attestations are crucial for attracting investors, obtaining funding, or maintaining transparency with stakeholders.

Some exciting web3 primitives for impact attestations include:

- Ethereum Certification Service

- Hypercerts

Trust networks are a decentralized trust model primarily used in cryptography, where trust in identity or information is established through mutual endorsements within a user network, rather than through central authority. Users verify each other's identities and assign trust levels, creating an interconnected network of trust relationships. This model is often used in PGP (Pretty Good Privacy) to establish trust in someone's public key based on endorsements from others in the network, ensuring secure communication.

Over time, seeing more impact attestations built into the Gitcoin stack would be interesting. Doing so will help measure impact in a more quantitative way and assist in grounding funding decisions.

Learn more: https://gov.gitcoin.co/t/the-impact-web-of-trust-could-change-everything/17635

3.4 Sybil Resistance

Sybil resistance is a property of computer networks that prevents individuals from creating multiple false identities to gain disproportionate influence on the network. This is particularly important in decentralized systems such as peer-to-peer networks or blockchain technology, where trust and consensus need to be maintained without central authority.

Effective sybil resistance mechanisms ensure fair distribution of power and decision-making within the network, despite attempts by some to manipulate outcomes by creating a large number of identities.

Tools like Gitcoin Passport, Worldcoin, BrightId, and others can be integrated into Allo in new ways, creating space for novel and more democratic capital allocation tools.

3.5 Other Novel Capital Allocation Strategies

We believe that there is a vast design space for different capital allocation methods that will be built into Allo. As this space evolves, more data will be put on-chain, making these strategies powerful and precise beyond our current imagination.

By hosting a well-audited, fully recorded, and forkable library of capital allocation strategies that anyone can publish or read, Allo aims to become a Schelling point for discovering these mechanisms.

4. Bringing Allo into New Application Categories

4.1 "We Love the Art" and Other Visual-Centric Applications

"We Love the Art" is an online art competition taking place from late 2023 to early 2024, with a prize pool of 1,200,000 OP distributed evenly among four different categories. Up to 188 winners will be selected, with a maximum of 47 winners per category. The categories include AI Art, Generative Art, Music, and 1of1s (artworks that do not fit into the other three categories). Each category will be judged by 35 jurors.

The Allo protocol supports the creation of strategies to distribute tokenized rewards to supporters of these projects and to build stunning frontends on top of them.

4.2 Web2 / Fiat Applications

Gitcoin has conducted two non-crypto (fiat) QF events.

- FundOSS - web2 OSS FundOSS is a funding initiative launched by Gitcoin and Open Source Collective in 2021, using a new matching model called Democratic Funding to support open-source projects. This model democratizes fund allocation by matching small donations with a matching algorithm. The first FundOSS pilot raised nearly $95,000 for 55 projects, demonstrating the potential of this approach. Even small donations can have a significant impact, supporting the open-source community and initiatives.

- Downtown Stimulus The Downtown Stimulus program was a pilot project in the summer of 2020, aiming to support local businesses in downtown Boulder, Colorado through QF. This unique crowdfunding model encouraged economic activity by directly channeling funds to small businesses in need. The first experiment of the Downtown Stimulus program raised $41,500 from a $25,000 matching fund pool, with 325 unique donors making 408 contributions, averaging $40 per donation. This crowdfunding initiative aimed to strengthen the local economy and help small businesses through challenging times.

Fiat Funding: A New Market for Allo - We believe that the two experiments above indicate a need for crowdfunding experiments with fiat currencies outside the crypto ecosystem. We have the opportunity to transform the most successful Allo projects into products for non-crypto native audiences.

4.3 Beyond the Ethereum Virtual Machine

Allo can be built into other ecosystems such as:

- Bitcoin

- NEAR

- Solana, and others.

If you are integrating Allo into other smart contract ecosystems, please contact us on Twitter.

Twitter: http://twitter.com/owocki

Appendix C: Rich Periphery - Adjacent Tools

As the network effects of Allo grow, we expect to see more third parties integrate Allo into other ecosystems. While not capital allocation tools themselves, they add value to capital allocation tools in the Gitcoin ecosystem by providing adjacent functionality.

1. Current Products

As of February 2024, here are some products we are very excited about:

- Common App: A tool to move Allo projects to other grant applications.

- Crowdfund.gitcoin.co: A tool for crowdfunding matching fund pools for Allo rounds.

- Reportcards.gitcoin.co: A tool for reporting on Allo round outcomes.

- Quadratic Yeeter: A tool to launch new Allo QF rounds with just a few clicks.

- Hypercerts Grant Tool: An experimental tool that allows grant owners to attach their impact certificates (Hypercerts) to their profiles, providing certification for impact-based applications.

- Funding.Social: Easily see what friends in the Lens ecosystem are funding on Gitcoin.

- Fundpublicgoods.ai: An AI agent that provides strong incentives for public goods funding, finding projects you want to contribute to through large language models.

- AlloScan: An Allo browser that allows easy browsing of cross-chain transactions, searching profiles, and discovering fund pools.

2. Future Tools

Here are some categories of future tools we are interested in:

2.1 Developer Relations (DevRel) Tools

Tools will be launched to help developers explore the Allo ecosystem more easily.

Tools we are looking forward to:

- Software development kits / command-line interfaces (SDKs/CLIs) to stay up to date and improve developer productivity.

- No-code tools for assembling different combinations of Allo. For example, creating a new Allo app by dragging and dropping a registry, a strategy, and a token.

- Indexers for querying projects and fund pools on the Allo protocol (including cross-chain).

- Pub/Sub tools to simplify the process of publishing/subscribing to grant registries, especially for other top-level grant registries in the space.

- Discovery tools for capital allocation strategies: Building tools that help developers understand the advantages and disadvantages of different capital allocation strategies. This is particularly interesting when each strategy is accompanied by well-audited smart contracts or demos.

2.2 Data Analysis and Exploration Tools

We envision a category of applications aimed at simplifying data analysis within the Allo ecosystem. These tools will make on-chain activities more understandable to end users and round operators, creating new categories of discovery, reporting, and analysis tools.

2.3 Token Staking Tools

Certain areas of the Allo protocol will require governance by stakeholders in DAOs using Allo. By allowing members of these DAOs to stake their tokens, Allo can provide token utility for these DAOs. Some examples we hope to see:

- Staking governance tokens to boost donations' ranking in default sorting.

- Staking governance tokens to earn points for quadratic voting.

- Creating value-generating domains accessible only to specific token holders.

2.4 Dealflow Generation Apps

Gitcoin has a sustained competitive advantage in discovering the next top projects in the ecosystem. As a signal aggregator, Gitcoin can foresee emerging projects in the web3 ecosystem ahead of others.

For example, Uniswap, Yearn Finance, and 1inch exchanges were all early fundraising projects on Gitcoin. Today, they have achieved tremendous success, with each project's fully diluted valuation (FDV) ranging from $300 million to $6 billion.

What if like-minded investors could discover these projects before they achieve massive success? Gitcoin provides the ecosystem fund with the ability to find these opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。