Author: 0xEdwardyw

In this bull market, restaking is expected to become a key narrative, with over ten liquidity restaking protocols competing for a total locked value of over $11 billion on EigenLayer.

This article compares six major liquidity restaking protocols, aiming to provide readers with a simple way to understand the subtle differences between various liquidity restaking protocols. Given the numerous trade-offs in different LRT designs, investors should make choices based on their personal preferences.

TL,DR, Here are the key features of each liquidity restaking protocol:

- Puffer Finance and Ether.fi are the two largest liquidity restaking protocols calculated by the market value of restaking tokens. Both focus on native restaking, with fewer risk levels compared to LST restaking. Additionally, these two protocols are also committed to promoting decentralization of Ethereum validators. Ether.fi has the most DeFi integrations.

- Kelp and Renzo protocols support native restaking and LST restaking. They accept major LSTs such as stETH, ETHx, and wBETH. It is worth mentioning that Renzo has extended restaking services to Ethereum Layer 2, providing users with the benefit of reducing gas fees.

- Swell was originally a liquidity staking protocol, with the swETH market size being approximately $950 million. Swell has introduced restaking services and launched the restaking token rswETH. It provides native restaking and swETH restaking.

- Eigenpie is a sub-DAO of Magpie, focusing on LST restaking. It accepts 12 different LSTs and issues corresponding 12 different LRTs, providing a unique isolated LST restaking model.

Different types of restaking and liquidity restaking tokens

Two types of restaking on EigenLayer

There are two types of restaking, native restaking and LST (Liquidity Staking Token) restaking. For native restaking, validators stake their $ETH natively on Ethereum's Beacon Chain and point to EigenLayer. LST restaking allows holders of liquidity staking tokens (such as stETH) to restake their assets in EigenLayer smart contracts. Native restaking is more difficult for retail users as it requires running an Ethereum validator node.

The advantage of native ETH restaking is that it is unrestricted; EigenLayer sets limits on LST restaking, only accepting deposits within a specific quantity limit or within a specified time range. Native restaking is not subject to these limitations and can be deposited at any time. In terms of security, native restaking also has an advantage as it does not involve the risks of LST protocols.

Despite these differences, both native restaking and LST restaking on EigenLayer require assets to be deposited and locked, making them unavailable for other purposes.

Liquidity restaking protocols release locked liquidity

Liquidity Restaked Tokens (LRT) are similar to liquidity staking tokens on Ethereum, representing tokenized assets deposited in EigenLayer, effectively releasing originally locked liquidity.

The services provided by liquidity restaking protocols are divided into native restaking services and LST restaking services. Most liquidity restaking protocols offer native restaking to users without the need to run an Ethereum node. Users only need to deposit ETH into these protocols, and the protocols will handle the Ethereum node operations in the background.

At the same time, the largest LST, stETH, is accepted by almost all liquidity restaking protocols, and some LRT protocols can accept multiple types of LST deposits.

It is worth noting that Puffer Finance is essentially a native restaking protocol. At the pre-mainnet stage, it accepts stETH deposits. After the mainnet launch, the protocol plans to convert all stETH to ETH and conduct native restaking on EigenLayer. Similarly, Ether.fi is a native restaking protocol, but at the current stage, it can accept multiple types of Liquidity Staking Tokens (LST) deposits.

Two types of LRT: based on a basket of LST or isolated for each LST

Most liquidity restaking protocols adopt an approach based on a basket of LST, allowing various LST deposits in exchange for the same liquidity restaking token (LRT). Eigenpie has adopted a unique isolated liquidity staking token strategy. It accepts 12 different LSTs and issues a unique LRT for each LST, resulting in 12 unique LRTs. While this approach mitigates the correlated risks of putting different LSTs together, it may lead to the dispersion of liquidity for each individual LRT.

Restaking through Ethereum Layer 2 protocols

Due to the current high gas costs on the Ethereum mainnet, several LRT protocols have been able to conduct restaking through Ethereum Layer 2, providing users with a lower-cost alternative. The Renzo Protocol has launched restaking on Arbitrum and BNB chains. Similarly, Ether.fi also plans to launch restaking services on Arbitrum.

Risks and rewards of liquidity restaking

Liquidity restaking protocols deploy a set of smart contracts on EigenLayer to facilitate user interaction, helping users deposit and withdraw ETH or LST from EigenLayer, as well as mint/destroy liquidity restaking tokens (LRT). Therefore, using LRT involves the risks of liquidity restaking protocols.

Additionally, the risk also depends on whether the liquidity restaking protocol provides LST restaking services. In native restaking, funds are deposited on the Ethereum Beacon Chain. However, when using LST restaking, funds are deposited into smart contracts on EigenLayer, introducing smart contract risks from EigenLayer. Using LST also involves smart contract risks associated with the liquidity staking protocol. Therefore, users holding LRT supported by LST will face three types of smart contract risks: EigenLayer, the specific LST used, and the LRT protocol itself.

While native restaking faces fewer smart contract risk layers, liquidity restaking protocols that provide native restaking services need to participate in Ethereum staking. They can choose to work with professional staking companies, operate Ethereum nodes themselves, or support individual independent validators.

Using mature liquidity staking tokens (such as Lido's stETH or Frax's sfrxETH) can provide reliable staking rewards. These LST protocols have spent years perfecting their Ethereum staking services and have more experience in maximizing staking rewards and minimizing slashing risks.

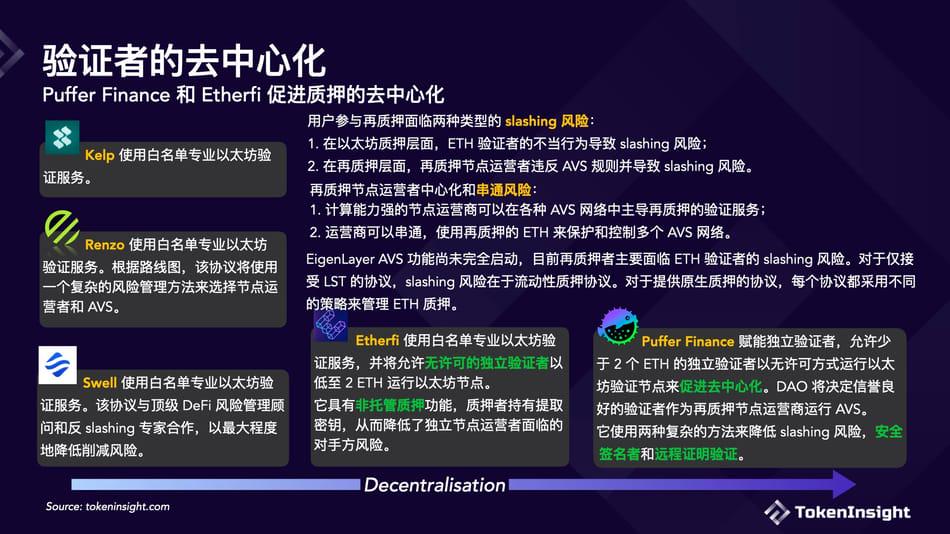

Decentralization of validators

When ETH/LST is deposited into EigenLayer, these assets will be allocated to a staking operator. The operator is responsible for performing validation services on Ethereum and on the Active Validation Service (AVS) they choose to protect. In addition to Ethereum staking rewards, stakers also receive rewards from these AVS. If the operator violates the rules set by the AVS, there is a risk of slashing the staked assets.

If the restaking market is dominated by a few large operators responsible for protecting the majority of AVS, there is a risk of centralization and potential collusion. These operators with significant computing power may dominate restaking across multiple AVS networks and collude to influence or directly control these AVS using restaked ETH.

The Active Validation Service (AVS) functionality on EigenLayer is not yet activated and initially only a limited number of AVS will be available. Most liquidity restaking protocols have not disclosed detailed information about how they will select restaking operators and AVS. At this stage, stakers primarily face slashing risks at the Ethereum level. For restaking through LST, this risk comes from the LST protocol itself. Native liquidity restaking protocols employ various methods for Ethereum staking. Some rely on large staking service providers such as Figment and Allnodes, while others are developing infrastructure to promote independent validators.

DeFi Integration

The sole purpose of Liquidity Restaked Tokens (LRT) is to unlock liquidity for use in DeFi. Each liquidity restaking protocol is striving to integrate various types of DeFi protocols. Currently, DeFi integrations mainly fall into three categories: yield protocols, DEX, and lending protocols.

Yield Protocols

Pendle Finance is a leading protocol in this area, introducing LRT pools that allow users to speculate on EigenLayer yields and points. Most LRT protocols have integrated with Pendle.

DEX Liquidity

Most LRTs have liquidity pools on major DEXs such as Curve, Balancer, and Maverick. We measure the slippage when exchanging 1K LRT for ETH on LlamaSwap as a rough measure of the liquidity for each LRT. It is important to note that this is a rough measure as most LRTs are yield-accruing tokens, and their value increases over time as staking rewards accumulate. As many LRT protocols are still in their early stages, the accumulated rewards to date are relatively small compared to the principal.

Swell's rswETH, Renzo's ezETH, and Etherfi's weETH all have sufficient liquidity on DEXs, with almost no slippage when trading 1K LRT.

Eigenpie has taken a unique approach, issuing 12 independent liquidity restaking tokens, each corresponding to one of the 12 supported LSTs. While this strategy effectively isolates the risk associated with any individual LST, it also leads to liquidity dispersion among different tokens.

Lending Protocols

LRTs have more layered risks compared to other types of assets. Therefore, lending protocols are particularly cautious when considering LRT as collateral for loans. Currently, the acceptance of LRT by lending protocols is limited. Etherfi's weETH is accepted by multiple lending protocols as it is an existing LST transitioning to LRT.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。