Preface:

In the cryptocurrency market (coin circle), investors face significant market risks and volatility. Although many people hope to succeed in the coin circle, sometimes investment decisions may lead to liquidation. However, the key is how to deal with it and learn from it. This article will provide some practical advice on how to adjust your mindset, rebuild confidence, and start over.

- Accept the facts and face reality:

After liquidation in the coin circle, the first thing to do is to face the reality and accept the situation. Do not blame others or dwell on the wrong decisions, but take responsibility for your own actions. Recognize that failure is the mother of success and use this experience as a learning opportunity.

- Analyze the reasons for failure calmly:

To learn from the experience of liquidation, a calm analysis is needed. Examine your investment strategy, market conditions, and the reasons for the problems. Understand your own faults and identify the lessons learned to avoid similar mistakes from happening again.

- Rebuild confidence:

Liquidation in the coin circle may have a heavy impact on investors' confidence. To rebuild confidence, first realize that everyone experiences failure at some point, and do not see failure as a denial of your abilities. Identify your strengths and realize that this experience will not permanently define your abilities and value.

- Adjust investment goals and risk tolerance:

After liquidation, re-evaluate your investment goals and risk tolerance. It may be necessary to redefine your investment plan, set reasonable goals, and ensure that your risk tolerance matches your actual situation. New investment decisions should be made with more careful consideration, avoiding blindly chasing high-risk, high-return projects.

- Learning and improvement:

Learning from the experience of liquidation and continuously improving your knowledge and skills is crucial. Understand market dynamics, research investment strategies, and seek professional opinions and advice. Participate in relevant seminars, courses, or join investor communities to share experiences with other investors and gain reflection and inspiration.

- Diversification of investment and risk management:

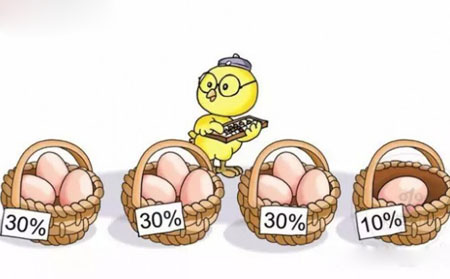

The experience of liquidation may lead investors to doubt their investments. To reduce risk, a diversification investment strategy should be adopted, allocating funds to multiple different projects. At the same time, strict risk management strategies should be implemented, setting stop-loss and take-profit points to avoid emotional decisions.

- Seek support and establish reasonable expectations:

In this process, finding support and understanding from others or communities is very important. Communicate with other investors who have experienced similar setbacks, support and encourage each other, and share experiences and lessons. At the same time, set reasonable expectations, do not have overly high expectations, and maintain a rational observation of investment returns and market fluctuations.

Conclusion:

The experience of liquidation in the coin circle is part of the investment journey. It is important to learn from it, adjust your mindset, and rebuild confidence. Accept the facts, face reality, and conduct a calm analysis. Find the reasons for failure and learn from them. Rebuild confidence, adjust investment goals and risk tolerance, and continuously learn and improve your investment knowledge and skills. Reduce risk and protect funds through diversification of investment and effective risk management strategies. Most importantly, seek support and establish reasonable expectations, communicate with other investors, encourage and share experiences. As long as you can face the setback of liquidation with the right mindset, you will be able to succeed on the road to starting over. The content above is original, and any violations will be investigated. Thank you for your respect.

Friendly reminder: The content above is created by the author only on the public account. The advertisements at the end of the article and in the comment section are not related to the author. Please discern carefully, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。