Original | Odaily Planet Daily

Author | Fu Ruhe

Editor | Qin Xiaofeng

After successfully converting the Bitcoin Trust into a Bitcoin spot ETF, Grayscale did not stop there. On March 5th, Grayscale announced the launch of the cryptocurrency Dynamic Income Fund (GDIF), once again bringing the emerging fund model into traditional finance, further integrating Web3 with Web2.

According to official documents, GDIF is Grayscale's first actively managed fund, composed of staking income from a multi-token asset portfolio, providing investors with a familiar tool to participate in multi-asset staking and earn income. Grayscale will distribute income to investors quarterly (priced in USD). "The purpose of creating GDIF is to provide investors with a way to obtain PoS rewards without the challenges of direct PoS investment. At the same time, investors have the opportunity to hold an investment portfolio consisting of multiple cryptocurrencies through a single investment."

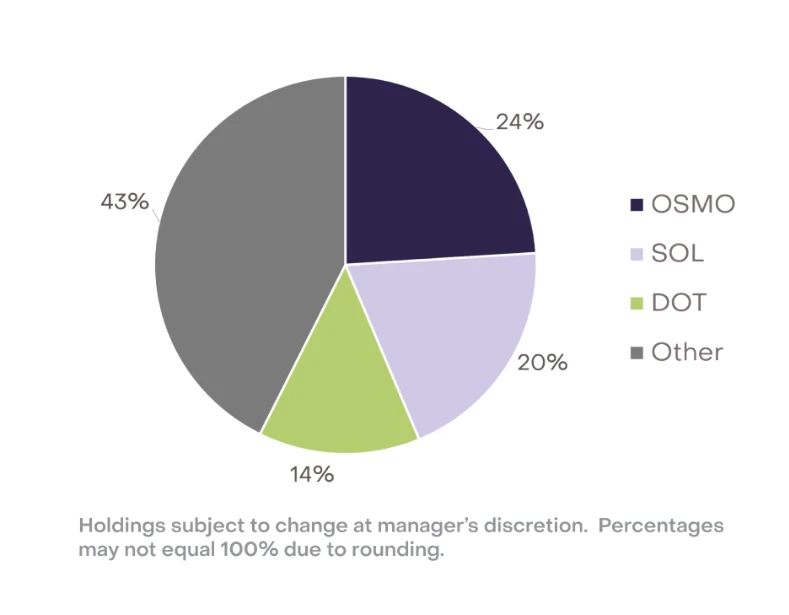

The Grayscale GDIF investment portfolio currently includes 9 cryptocurrencies: Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), Cosmos (ATOM), Near (NEAR), Osmosis (OSMO), Polkadot (DOT), Sei Network (SEI), and Solana (SOL). The following figure shows the current asset allocation of the GDIF fund, with OSMO accounting for 24%, SOL accounting for 20%, DOT accounting for 14%, and the remaining portion accounting for 43%.

The criteria for selecting the above assets by Grayscale are based on qualitative and quantitative factors to evaluate the income of the cryptocurrency assets, specifically reflected in staking rewards, market value, and liquidity. However, from the composition of the above tokens, most of them are projects that performed prominently in the previous bull market cycle (Polkadot, Near, Cosmos, Solana, Osmosis), with a few star projects that have performed well in this current cycle (Celestia, Aptos, etc.).

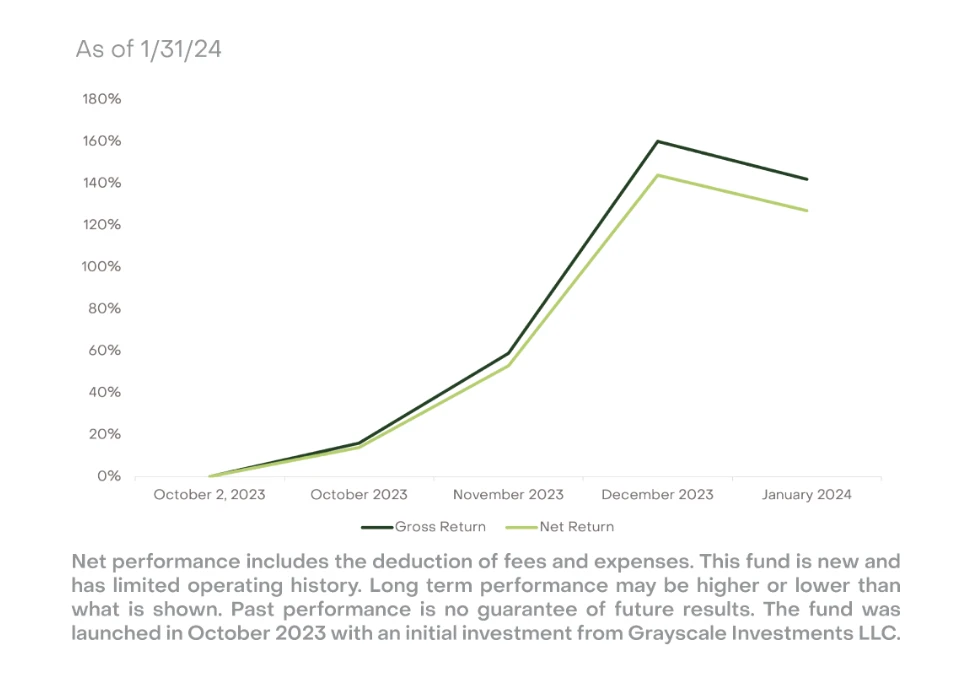

As shown in the figure below, the fund was launched in October 2023. Grayscale initially provided seed funding for the fund with internal funds, and the fund currently has a maximum gross margin of about 160%, with a net margin of 140% after deducting the corresponding fees.

However, the fund is not completely open to the public, and investors have a certain investment threshold. According to the Grayscale official website, "Qualified Accredited Investors" means that the investor's asset management scale needs to be above $1.1 million, or net assets need to be above $2.2 million.

Cosmos Ecosystem Emerges as the Biggest Winner

The composition of the GDIF fund assets was introduced above, with four projects related to Cosmos, including Celestia, Sei Network, Cosmos, and Osmosis.

(1) Osmosis (OSMO)

Osmosis uses Cosmos' IBC cross-chain technology for cross-chain asset transactions, providing LPs with high APR returns through various staking mechanisms. In addition, Osmosis provides cross-chain transactions between the Cosmos and Ethereum ecosystems and collaborates with Axelar to expand to other ecosystems. Currently, according to DefiLlama data, Osmosis ranks tenth in the overall DEX sector with a TVL of $228 million.

Osmosis accounts for a high proportion of 24% in the Grayscale fund mainly because of its high staking income in DEX and as the largest cross-chain DEX in the Cosmos ecosystem, it has a wide range of influence and is conducive to operations.

(2) Sei Network (SEI)

Sei Network is a DeFi L1 built on Cosmos, which is more like an intermediary between public chains and application chains. As the first L1 in the Cosmos ecosystem to support order books, Sei Network aims to be a high-speed chain specifically for trading, helping decentralized exchanges operate better.

(3) Cosmos (ATOM)

As an early representative project of multi-chain interoperability, Cosmos SDK has become the preferred model for building multiple new public chains and applications. Although it experienced a forking controversy last year due to staking income issues, it did not suffer significant damage overall, and the scale of the Cosmos ecosystem is second only to the Ethereum ecosystem, with its token staking rights being sought after by many users.

(4) Celestia (TIA)

As a representative project focusing on modular blockchain data availability, Celestia is built using the Cosmos SDK. Most of the team members in Celestia come from Cosmos. Since its launch last year, the TIA token has increased by over 10 times.

From the above introduction, it can be seen that the Cosmos ecosystem, whether in terms of underlying technology or ecosystem development (second only to Ethereum), is far superior to other public chains and can provide multiple staking income methods. In contrast, Ethereum, although hosting numerous layer 2 projects, has fewer projects that can obtain native staking income. Therefore, the proportion of Cosmos-related assets is relatively high in the Grayscale Dynamic Income Fund.

Perhaps influenced by the Grayscale GDIF, the tokens of Cosmos, Sei Network, and Osmosis have generally increased by around 10% in the past 24 hours: ATOM is currently at 13.7 USDT, with a 24-hour increase of 10.34%; SEI is currently at 0.81 USDT, with a 24-hour increase of 11.8%; OSMO is currently at 1.75 USDT, with a 24-hour increase of 9.72%.

Conclusion

Grayscale has launched a new fund, GDIF, gradually shifting from passively receiving cryptocurrency fluctuations to actively participating in obtaining native cryptocurrency income. For Grayscale, this is a further exploration of the sources of cryptocurrency income and a gradual introduction into traditional finance, increasing the diversity of fund management.

For the cryptocurrency market, the projects of these 9 cryptocurrency assets included may gradually move towards the mainstream market due to Grayscale's participation in staking. Compared to the trust products Grayscale launched early on, the Bitcoin Trust was successfully launched in the form of a spot ETF, and the Ethereum Trust may follow suit. Excluding BTC and ETH, the remaining cryptocurrency assets are still relatively unfamiliar to the vast traditional finance industry and still require mainstream asset management companies like Grayscale to help the cryptocurrency market move towards the mainstream as soon as possible.

Another issue is whether Grayscale's launch of the fund providing staking services will trigger regulatory concerns.

In February 2023, Kraken was sued by the US SEC for providing cryptocurrency staking services, ultimately paying a $30 million fine and suspending domestic staking services in the US, and Kraken eventually established an independent subsidiary overseas to provide staking services for non-US clients. Similarly, in July last year, Coinbase was sued by multiple states in the US for violating the 1933 Securities Act by providing staking services. Now, Grayscale's open launch of staking services challenges the SEC, and regulatory pressure may soon follow (after all, Grayscale has a deep feud with the SEC, and the outcome of their legal battles is uncertain).

However, on the positive side, Grayscale's approach may leave regulators with no room to act. After all, the staking income services provided by Coinbase and Kraken as exchanges belong to fully custodial staking business, where users deposit the relevant tokens into the cold wallet addresses of Coinbase and Kraken, and they carry out staking services on behalf of the target chain, with the relevant keys held by the exchanges.

On the other hand, Grayscale provides a fund, and investors purchase the fund in USD, and the final income is also paid in USD, without involving the transfer of cryptocurrency rights. It seems that Grayscale is deliberately avoiding regulation and seeking legal gray areas, but whether it will succeed in the end remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。