Original Author: BitMEX

Ethereum (ETH) has recently made a strong breakthrough, and the market is starting to focus on those fundamentally solid but yet to rebound altcoins. In our previous BitMEX research article, we pointed out that Pendle, Hyperliquid, and Aave have outperformed Bitcoin due to strong user growth and revenue performance. If ETH's breakthrough can be sustained, this wave of market activity may spread to tokens that are still significantly lagging in price but have solid fundamentals.

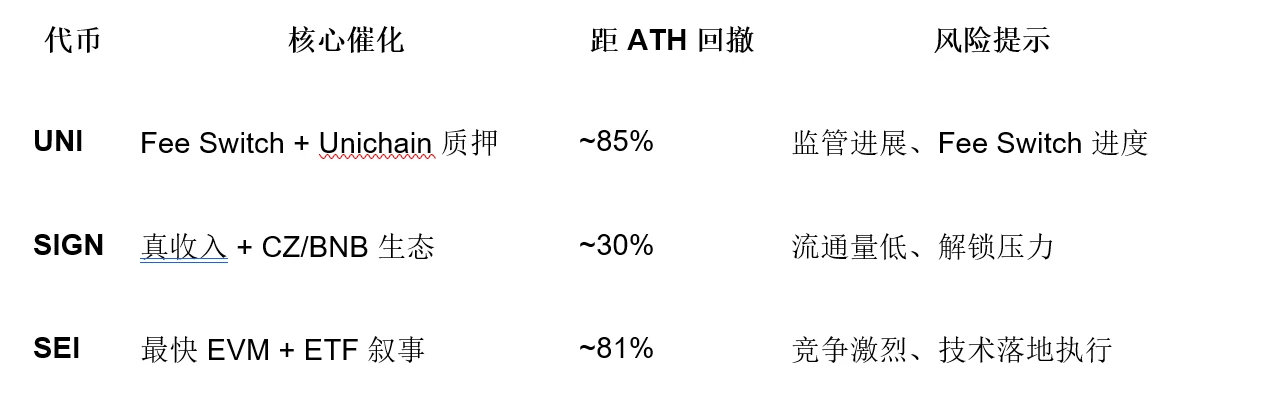

This article focuses on three tokens with clear narratives and catalysts that may welcome the "next phase of growth": $SEI, $UNI, and $SIGN. We will outline the core logic of each project, the latest market conditions (current price and drawdown from historical highs), as well as key data such as trading volume, revenue, and unlocking progress, to help traders uncover high-probability Alpha, rather than just basic education.

Disclaimer: The following content is a compilation of market information and does not constitute investment advice. Please be sure to conduct your own research (DYOR) and bear the corresponding trading risks; BitMEX is not responsible for any trading outcomes.

Uniswap (UNI): Ethereum Ecosystem Leader Welcomes Dual Catalysts

Trading Pair: https://www.bitmex.com/app/trade/UNIUSDT

If ETH is breaking through, then Uniswap's UNI is undoubtedly the first choice for "ETH Beta": it is the largest decentralized exchange (DEX) in the Ethereum ecosystem, naturally benefiting from increased on-chain activity and liquidity. However, the bullish logic for UNI goes beyond that, as two major catalysts have recently emerged:

1. Regulatory Clouds Lifted

At the beginning of 2025, the U.S. SEC withdrew its investigation into Uniswap Labs and did not propose any enforcement actions; at the same time, the U.S. Congress is pushing a bill that clarifies that token trading without equity characteristics does not fall under securities. This more favorable regulatory environment significantly reduces the "legal discount" on DEX tokens.

2. Unichain Launch & Staking Incentives

In February 2025, Uniswap Labs launched the Layer 2 network Unichain (based on Optimism OP Stack) and stipulated that validators must stake UNI on the Ethereum mainnet to participate. Stakers can share 65% of Unichain fees (base fee + priority fee + MEV). This effectively reintroduces the long-awaited "Fee Switch" model for UNI and may continue to tighten the circulating supply.

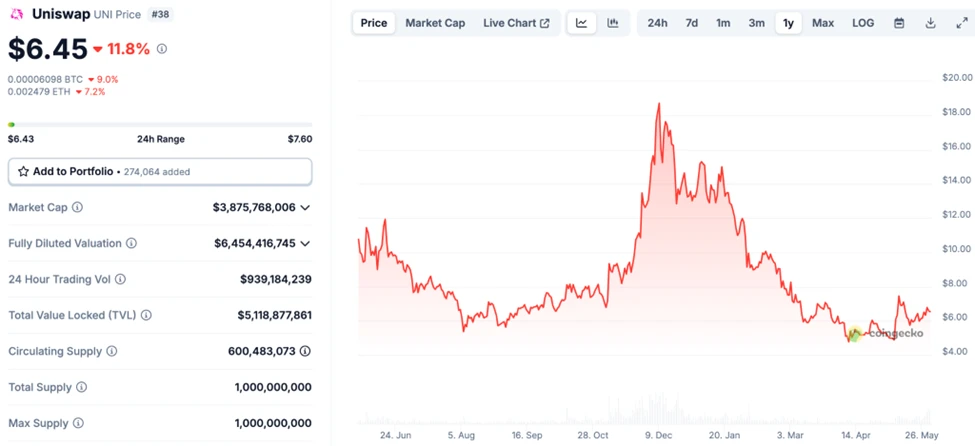

3. Fundamental Data Remains Strong

30-day trading volume: Approximately $84.5 billion

Annualized platform revenue: Approximately $929 million

Based on the current market cap, P/E is only 4.5–6.4; in contrast, Coinbase's P/E is as high as 33–42.

TVL: Approximately $5.1 billion, consistently ranking among the top two in multi-chain DEX trading volume.

Price: The current price of UNI is approximately $6–7, down about 85% from its historical high of $44.92 in 2021. If Unichain's usage expands and the mainnet Fee Switch is implemented, the supply-demand structure for UNI is expected to improve significantly.

Key Highlights

Fee Switch: Brings reduced inflation + revenue distribution

Unichain staking: Introduces new buying pressure and token utility

Regulatory benefits: Alleviates concerns about token attributes, significantly increasing the likelihood of institutional holdings

Sign (SIGN): A Newcomer in Digital Identity with Real Revenue

Trading Pair: https://www.bitmex.com/app/trade/SIGNUSDT

Sign focuses on on-chain identity and token distribution infrastructure. It only issued its token in April 2025, and while its market cap is still small, it has already demonstrated rare commercial landing and cash flow.

1. A Truly Established Revenue Model

SignPass: On-chain identity verification used by governments and enterprises (already implemented in projects like Sierra Leone residency permits).

TokenTable: Manages token issuance and ownership for over 200 projects, covering 40M+ users and $4B+ in tokens.

2024 revenue: $15 million, with the company already achieving positive cash flow.

2. CZ Leads Investment + Binance Empowerment

In January 2025, Binance founder CZ invested $16 million through YZi Labs.

In April, Binance listed SIGN and airdropped 200 million tokens to BNB holders, injecting initial liquidity and attention into the token.

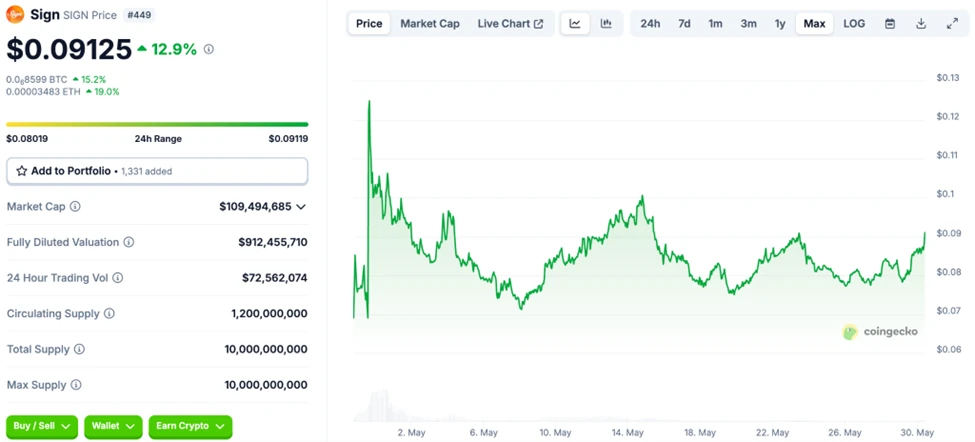

3. Market Position and Price

Circulating supply: Approximately 12% (1.2 billion in circulation / total supply of 10 billion)

Circulating market cap: Approximately $10 million; FDV approximately $100 million

Historical high: $0.126; current price $0.07–0.09, down about 30% from the high.

Small market cap + low circulation + clear demand scenarios give SIGN the characteristics of an "early growth stock." However, attention should be paid to the unlocking rhythm and project progress, as high volatility and high risk coexist.

Key Highlights

Digital identity / WLD alternative, with real users and revenue already

Binance ecosystem support, with potential for more integrations

Small market cap + low circulation, making it easy to form accelerated market movements

SEI: A "Value Gap" in the Parallel EVM Narrative

Trading Pair: https://www.bitmex.com/app/trade/SEIUSDT

SEI is a high-speed Layer-1 designed for high-frequency trading, known as the "fastest EVM chain." The Sei V2 upgrade in May 2025 will reduce transaction finality time to 0.5 seconds and achieve a throughput of 200,000 TPS, significantly lowering the barrier for seamless migration of Ethereum dApps, placing it in the parallel EVM track, alongside Monad and MegaETH.

1. U.S. Regulatory Compliance + Institutional Entry

Canary Capital has applied for a SEI staking ETF.

WLFI (Trump-affiliated DEFI project) invested $775,000 to buy 4.9 million SEI, incorporating it into their portfolio.

TVL: Increased fivefold since Q1, surpassing $500 million.

2. Valuation Comparison Highlights the Gap

Circulating market cap: Approximately $1.2 billion (current price $0.21)

FDV: Approximately $2.3 billion (circulating supply ratio 53%)

Benchmark: Monad's private placement valuation is $3 billion, and its mainnet has not yet launched.

Price: Down 81% from the historical high of $1.14.

Key Highlights

Fastest EVM, with clear technical barriers

U.S. capital / ETF narrative, supported by compliance

Valuation discount, with potential for rebound space

Conclusion

ETH's breakthrough paves the way for altcoin market activity, but selecting the right targets is the key to success. $SEI, $UNI, and $SIGN possess both clear growth drivers and valuation mispricing characteristics, making them worthy of traders' close attention:

If ETH continues to strengthen, liquidity and risk appetite will shift towards truly useful targets. Focus on the following indicators to find entry or accumulation opportunities:

SEI: Ecosystem TVL, ETF approval progress

UNI: Trading volume, staking growth rate, Fee Switch

SIGN: Government cooperation implementation, new users for identity solutions, unlocking schedule

By following sound position management, these three tokens may become the leading tier in the next market rally. The market is ever-changing, and I wish everyone smooth trading and abundant profits!

Sources:

https://www.aicoin.com/en/article/462428https://x.com/virtuals_io/status/1922788444591333778

https://www.gate.io/blog/7389/sign-token-soars-50-what-is-the-sign-project

https://fortune.com/crypto/2024/03/11/monad-paradigm-venture-capital-crypto-jump-bitcoin/

https://dropstab.com/tab/trump-related

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。