Coin Circle Ye Qiu: Can the short-term bearish signal of the 3.7 weekly double top be established?

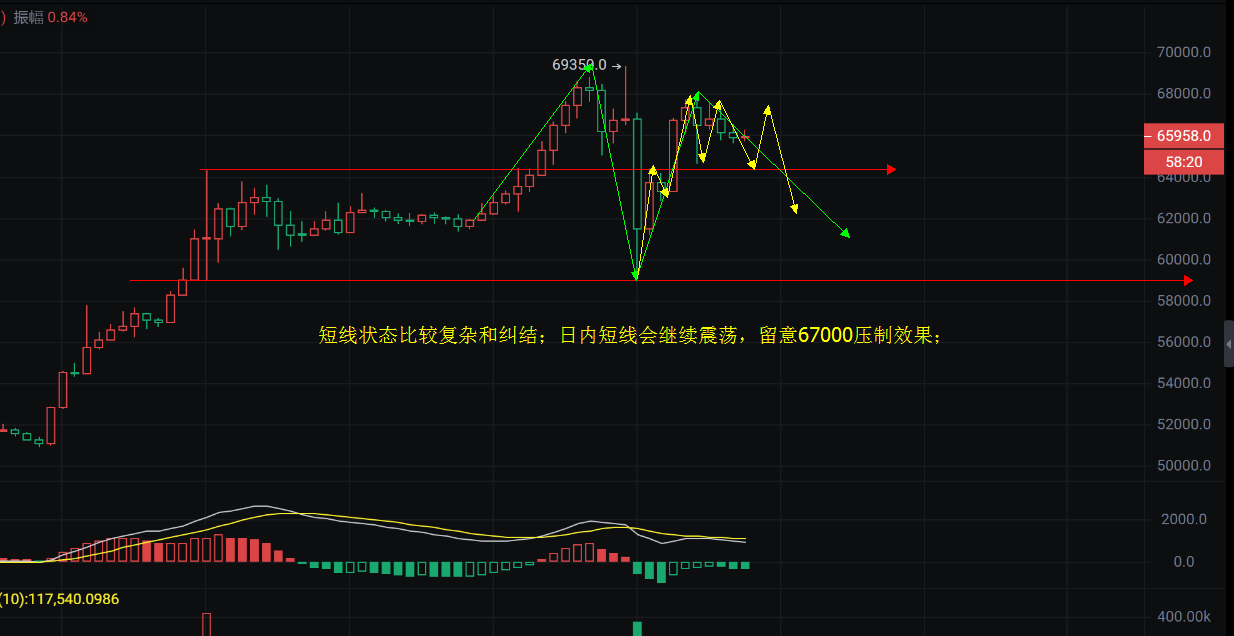

The daily line barely pulled up and broke through the moving average to form a positive line above the moving average, and the closing price showed a pattern of range oscillation at the end of the day. Last night at 8 o'clock, there was a rapid probe below 65,000, successfully activating the long position for this time, and a second pull-up to above 67,000 to around 67,500 in the evening.

Although from the perspective of trend arrangement, it is still temporarily unchanged in the bullish trend, the daily closing is above the short-term moving average. Although there was a pullback of ten thousand points, it did not completely affect the fierce bullish trend. In addition, the bullish arrangement of the moving average is obvious, and each significant pullback has a large amount of buying participation, making the strength of the recovery of the big and second pie evident. In the short term, it is still advisable to buy on dips, and it is appropriate to take advantage of the pullback near the G key pressure. Of course, for the 69,000 level above the weekly line, attention must be paid. Although the trend is forming, caution must also be exercised. Pay attention to two aspects here.

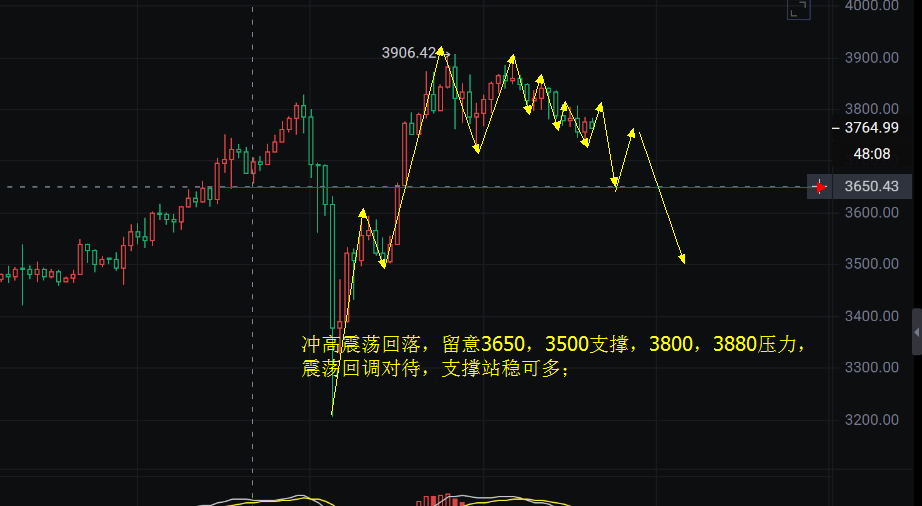

1: Whether a strong greedy trend can appear on the weekly line, that is, breaking the double top and ushering in a significant new high point. This period is very important. Pay attention to the strength of the daily line turning point in the subsequent trend.

2: The short-term technical aspect is currently in the process of forming a bearish pattern. Can there be a reversal or even a turnaround? This is a signal that appears in the stage trend. Should we believe in it or respect the trend? It is worth our deep consideration.

So overall, during consolidation at high levels, caution must be exercised. Because you don't know the mindset of the main force in the future market, nor do you know when the main force's sickle will appear. Strictly treat each operation! In short, pay attention to the turning point status at the daily line level, and make judgments based on timely candlestick trends. Pay attention to the suppression effect of the 68,000 and 69,000 areas, with short-term support at 65,500 and 63,200 moving averages. In terms of operation, operate in the range of 67,000-64,000 within the day, strictly carry a small position, set a good stop loss, and try. Personally, I tend to bearish and observe the oscillating pullback trend!!! Specifics are subject to real-time changes!!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。