Introduction

Welcome to the market research report for February 2024 by Greythorn. As cryptocurrencies continue to play an increasingly important role in finance, we will continue to provide readers with the latest trends and cutting-edge information on digital assets and blockchain technology.

Greythorn will continue to provide readers with monthly analysis reports on the cryptocurrency market, including detailed analysis of market trends, updates on regulatory developments, and macroeconomic factors affecting these digital currencies.

Bitcoin Analysis

Market Dynamics in February

In February, the complex interaction of economic signals, regulatory actions, and market sentiment shaped the market landscape for Bitcoin. At the beginning of the month, during the press conference after the Federal Open Market Committee (FOMC) meeting, Powell's tone significantly changed compared to previous meetings, no longer emphasizing the resilience of the U.S. banking system. This triggered a chain reaction in the financial markets, affecting different asset classes including Bitcoin in various ways.

Powell's comments suggested a reduced likelihood of interest rate cuts in March, leading to declines in both stock and bond markets. The value of Bitcoin dropped from $43,600 to around $41,800, contrasting with the situation during the banking crisis in March 2023 when Bitcoin prices rose and were seen as a safe haven in an unstable traditional banking environment.

This demonstrates the characteristics of Bitcoin market behavior. It can align with the broader financial markets as a risk asset, while during periods of economic uncertainty, it acts as a safe haven asset.

Despite the initial decline, BTC quickly rebounded, demonstrating strong demand for BTC today. This recovery is significantly driven by continued interest from institutional and retail investors.

Environmental Concerns and Bitcoin Mining

The U.S. Energy Information Administration (EIA) announced that Bitcoin miners in the U.S. must fill out a detailed survey of their energy consumption. A report released at the same time indicated that Bitcoin mining accounts for approximately 0.6% to 2.3% of the country's total electricity consumption. This finding sparked widespread discussion about the environmental impact of Bitcoin mining. However, it is worth noting that the report overlooked two key aspects: first, over half of Bitcoin mining operations use green, renewable energy. Second, the role of Bitcoin mining in improving grid stability and reducing pollution is still not fully recognized.

Regulatory Developments and Legislative Backlash

Additionally, this month we have seen legislative pushback in the U.S. against regulatory overreach in digital asset legislation, such as the bill introduced by Representatives Wiley Nickel and Mike Flood, and Senator Cynthia Lummis, to prevent federal agencies from imposing excessive capital requirements on custodied crypto assets, reflecting the recognition of the importance of clear and fair regulatory rules in promoting innovation and investment in the crypto space.

This legislative action challenges the Securities and Exchange Commission's (SEC) 2022 SAB121 guidance, which requires banks to list the value of custodied crypto assets as liabilities on their balance sheets and to maintain corresponding capital reserves. Critics argue that this requirement is flawed as these assets do not belong to the custodian and should not be recorded as liabilities. If this bill is passed, it could have a significant impact on the crypto industry, allowing regulated banks to custody crypto assets, potentially boosting institutional investment in the crypto industry.

Price Volatility, Investor Sentiment, Liquidity, and Institutional Interest in Cryptocurrencies

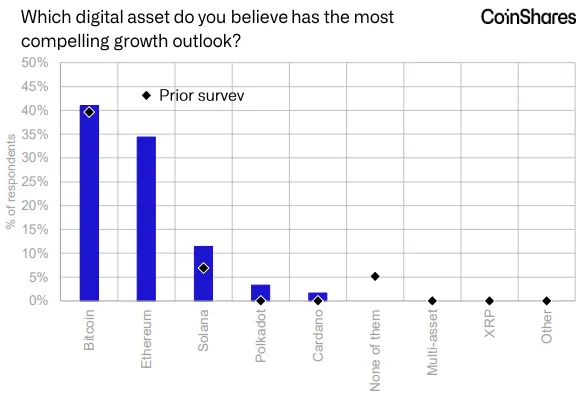

Despite concerns about regulation and volatility, sentiment towards Bitcoin remained strong in February, as evidenced by the results of the CoinShares quarterly fund manager survey, indicating continued preference for Bitcoin compared to other cryptocurrencies. The crypto asset class is becoming increasingly popular among institutional investors, with Bitcoin leading the preference list.

Source: CoinShares

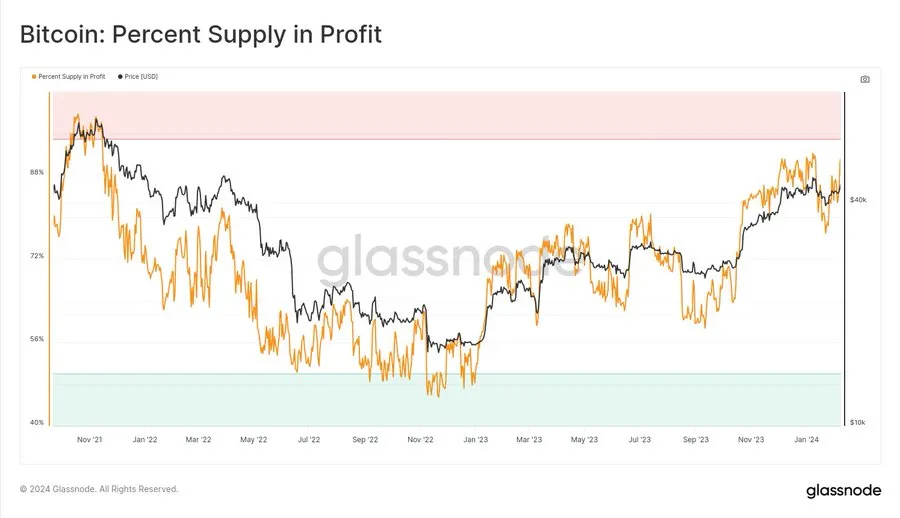

While the improvement in Ethereum market liquidity did not directly benefit from fund flows related to ETFs, significant inflows into BTC spot ETFs indicate growing institutional interest and confidence in the crypto market. This is further supported by the resilience of BTC holders, with 90% of BTC being held in addresses that have not been touched. This indicates strong holding beliefs.

Source: @_Checkmatey_

With the developments in February, the price of Bitcoin experienced significant fluctuations, breaking the $50,000 milestone on the 14th, demonstrating increased buying pressure and reduced selling pressure. The release of January CPI data showed continued inflation challenges, initially causing a sharp decline in BTC prices. However, Bitcoin quickly decoupled from traditional risk assets, rapidly rebounded, and even set new yearly highs, once again demonstrating Bitcoin's role as a hedge against risk assets and economic uncertainty.

Source: Bloomberg

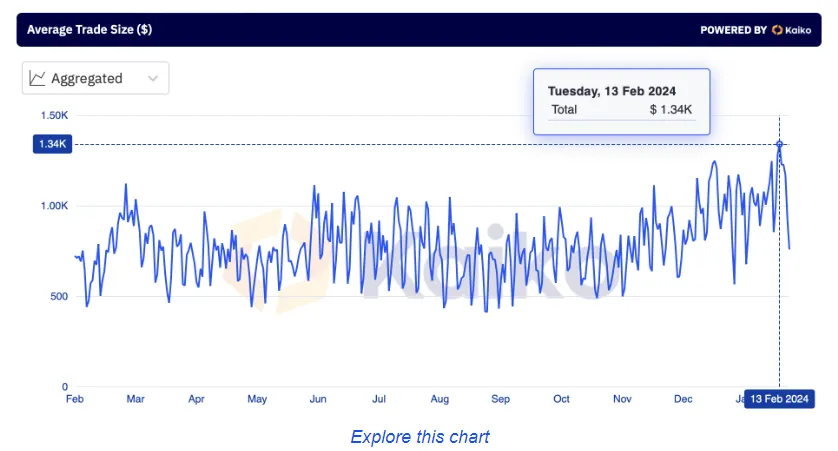

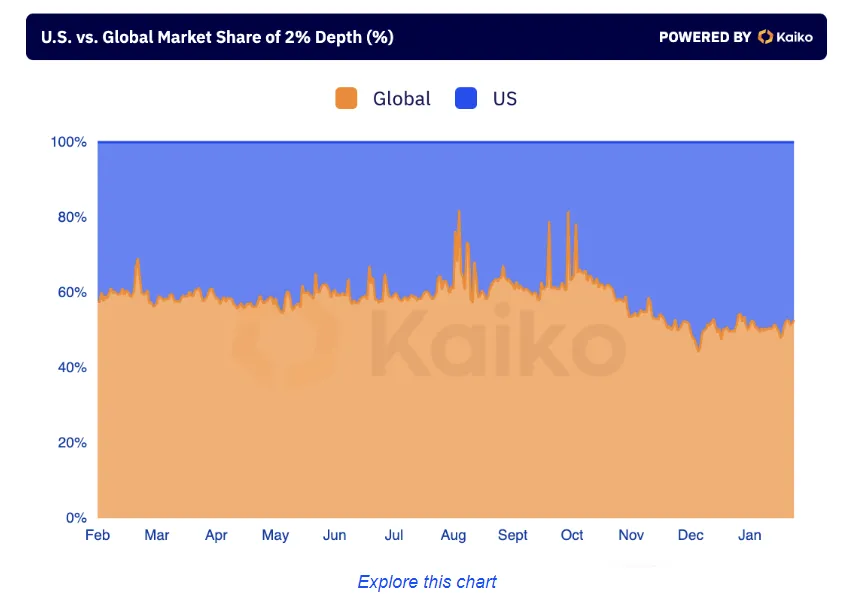

Furthermore, in the just-passed February, there are signs that the launch of BTC spot ETFs has had a positive impact on market liquidity. This is evident from the increase in BTC spot trading volume and the significant contribution of the U.S. to market depth. These trends indicate that BTC spot ETFs have had a significant impact on the market and, with growing institutional interest, as indicated by larger average BTC trade sizes, institutional participation is deepening.

Source: Kaiko

Source: Kaiko

Discussion on Ethereum Market Liquidity in February

As the end of February approaches, Ethereum has also attracted significant attention. As the second-largest cryptocurrency by market capitalization, Ethereum has been the focus of many investments and analyses due to its recent underperformance compared to Bitcoin. However, this trend has recently changed, with several factors suggesting a potential breakthrough for Ethereum: its performance has lagged behind Bitcoin in recent months, market expectations for the approval of a spot ETF later this year, and an upcoming major upgrade for Ethereum scheduled for March 13, which could impact its positioning in the market.

Bitcoin's Price Breakthrough at the End of February

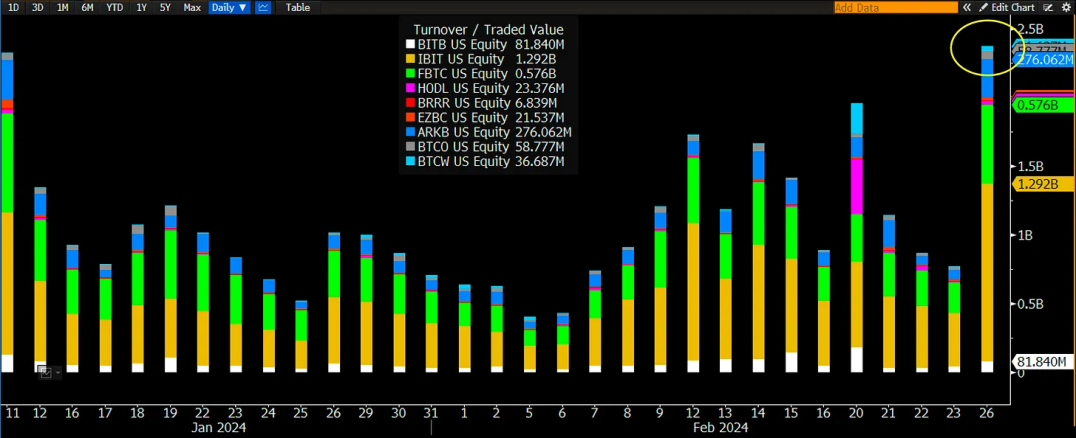

After a period of relative quiet, Ethereum has seen gains, but Bitcoin experienced a significant surge at the end of February, breaking the $60,000 mark. This momentum is primarily attributed to the surge in ETF investments and active participation from Asian investors. For example, BlackRock's IBIT product had a trading volume of nearly $1.3 billion in a single day. While this does not necessarily represent net inflows, a significant portion likely represents new investments.

Source: Eric

Source: Eric

It is worth noting that factors such as ETF investments have made this market cycle particularly prominent, expected to consolidate the market foundation. Any price pullback may be seen as an opportunity for various investors who believe that there is still room for further growth.

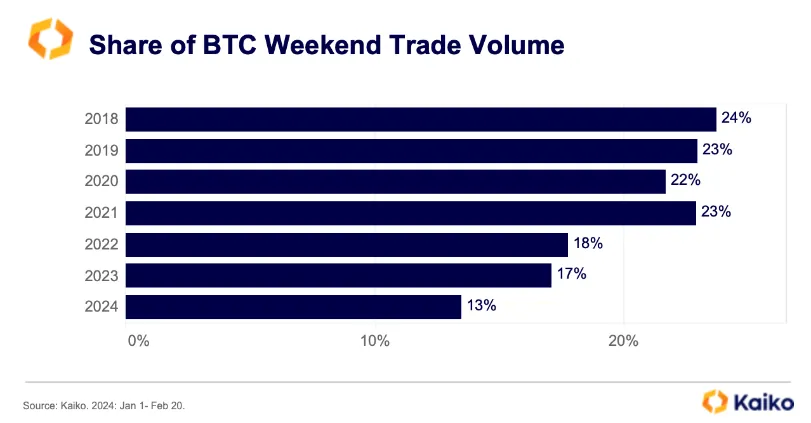

Equally important, despite the significant increase in Bitcoin prices, the weekend trading volume for Bitcoin, relative to its total trading volume, is only half of what it was six years ago.

On-Chain Analysis

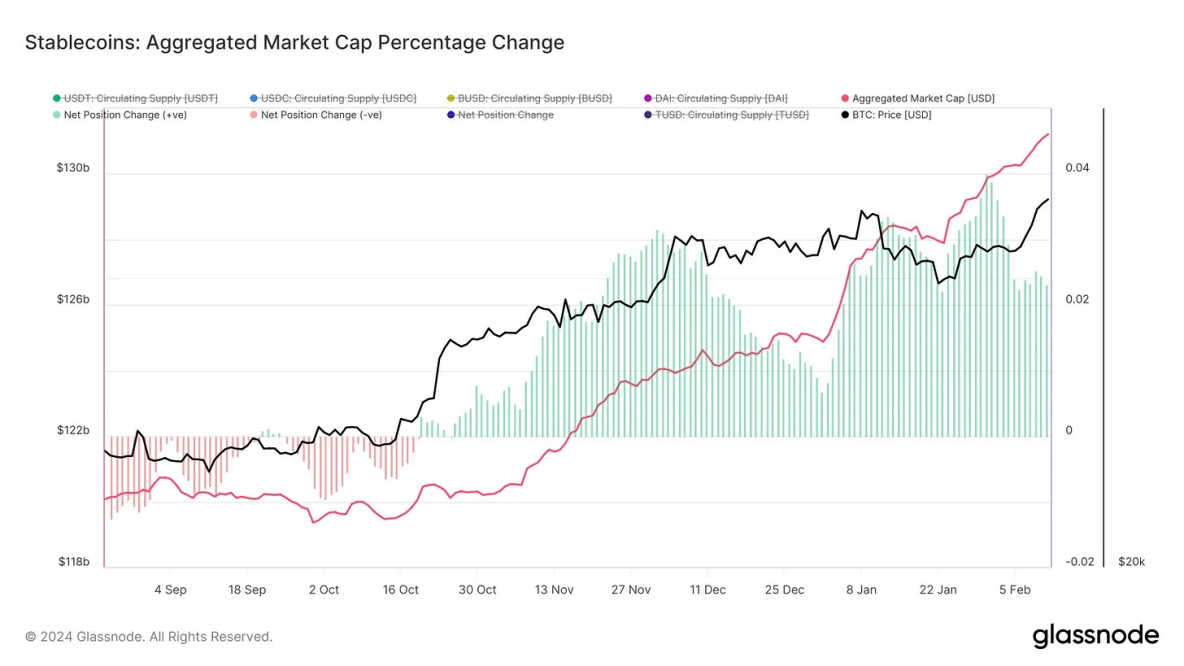

In February, the supply of stablecoins sharply increased, far exceeding the usual market fluctuations, signaling a new surge in investor confidence in the cryptocurrency space, reflected in a considerable amount of new funds flowing into the market.

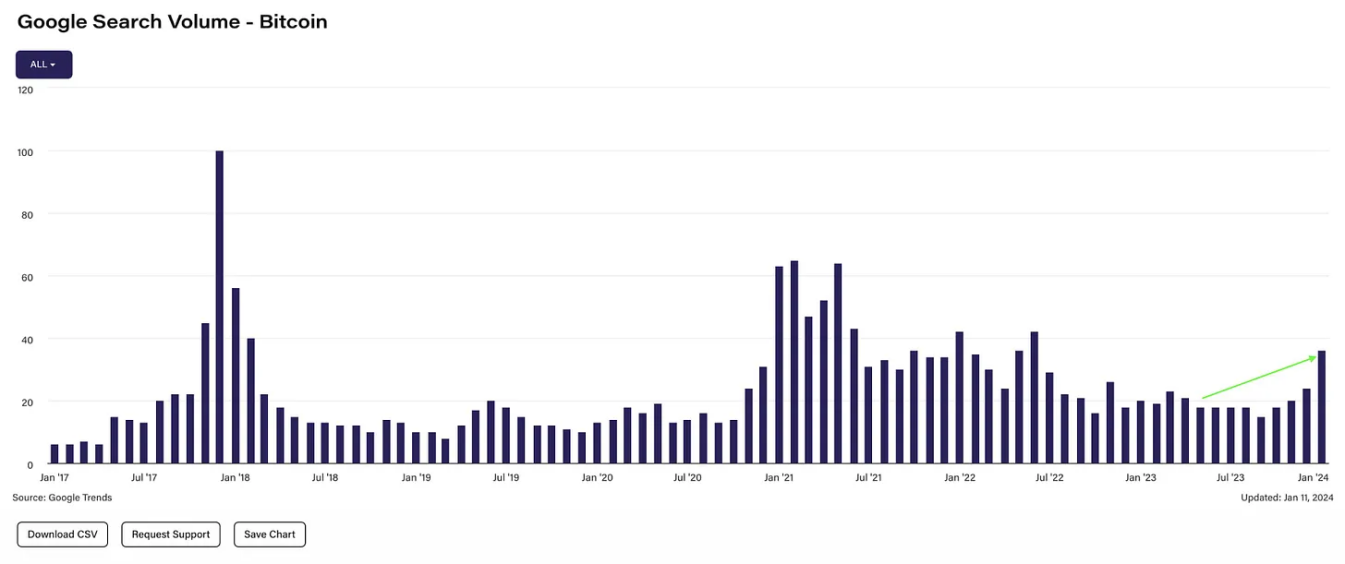

As Bitcoin approaches historical highs, public curiosity about it has significantly increased. Google search trend data shows that searches for "Bitcoin" have reached their highest point since June 2022.

Source: Google Search Volume - Bitcoin

Source: Google Search Volume - Bitcoin

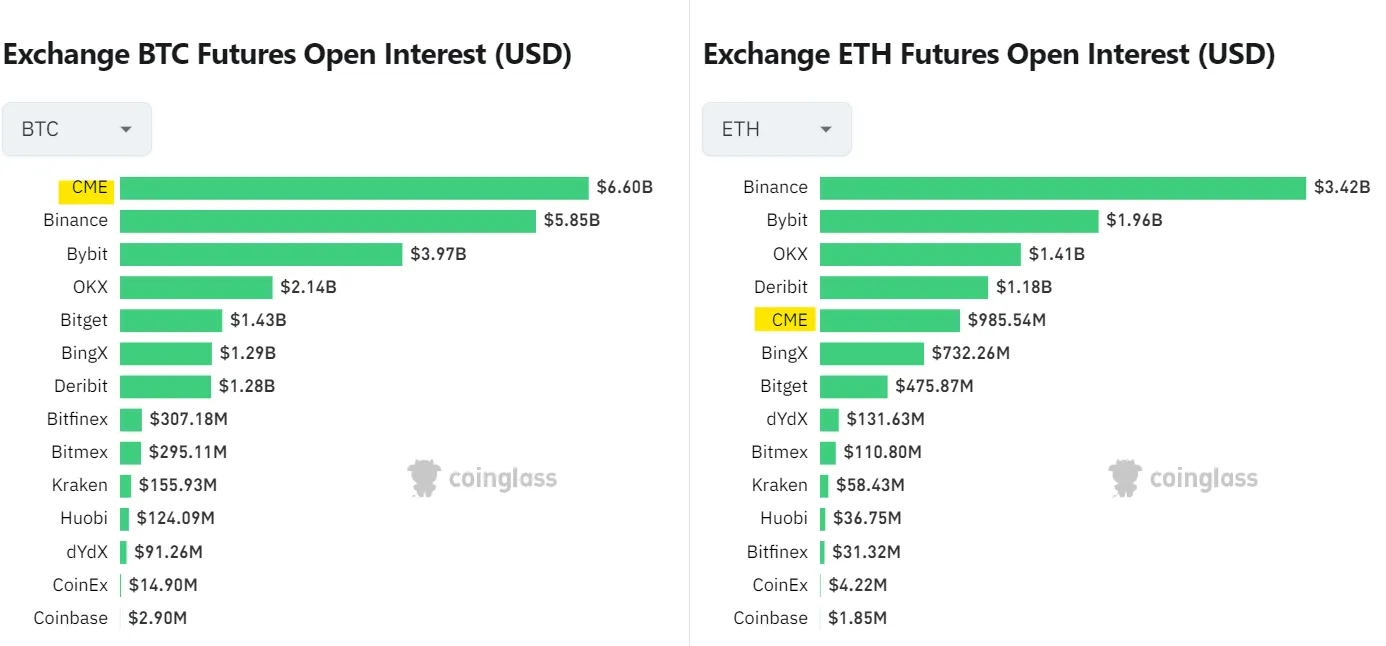

When comparing the open interest in Bitcoin futures contracts on CME with other exchanges, CME's dominance indicates strong interest from U.S. institutional investors. Currently, CME leads in open interest for Bitcoin futures contracts, even surpassing Binance, indicating increased institutional participation. However, this trend has not extended to Ethereum, where CME ranks only fifth in the Ethereum futures market.

Source: Coinglass

Source: Coinglass

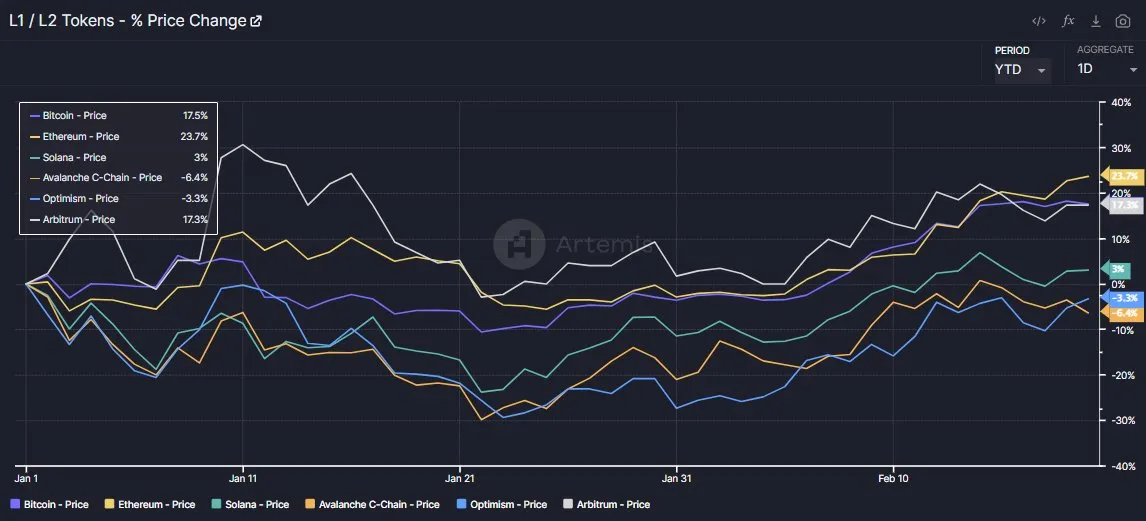

Despite a slow start in early 2023, Ethereum has quietly achieved a significant rebound, significantly outperforming Bitcoin, Solana, Avalanche, and leading layer-two solutions such as Arbitrum and Optimism since the beginning of the year.

Source: Artemis

Source: Artemis

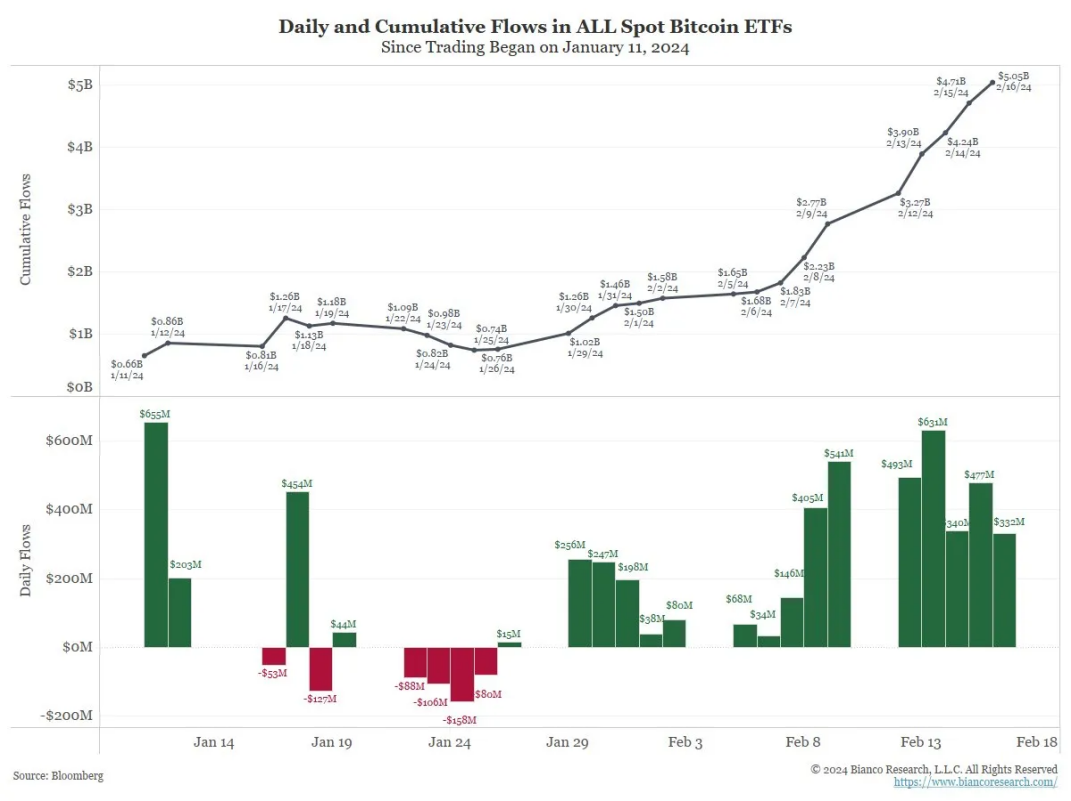

Investments in all Bitcoin spot ETFs have increased, setting unprecedented records for the ETF industry in the first few weeks of the year.

Source: @BiancoResearch

Source: @BiancoResearch

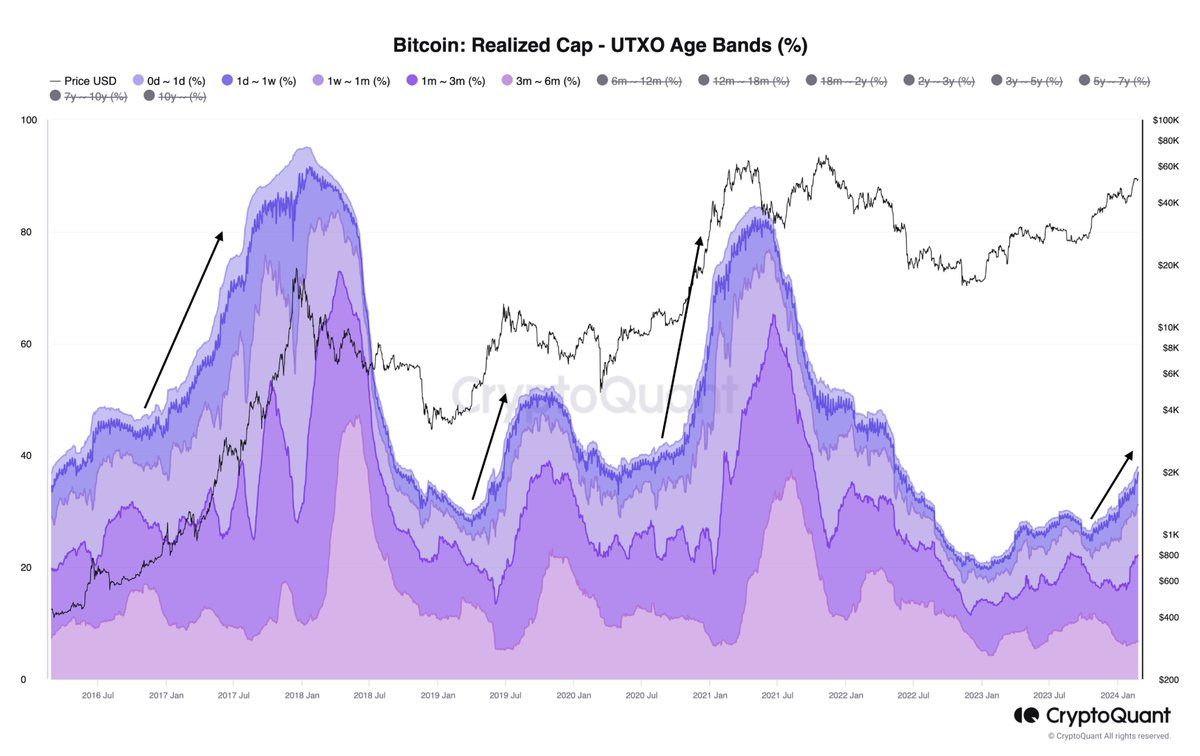

With the influx of new funds, Bitcoin seems to be entering a new phase. Currently, funds contributed by short-term investors account for 35% of the total realized value.

Source: CryptoQuant

Source: CryptoQuant

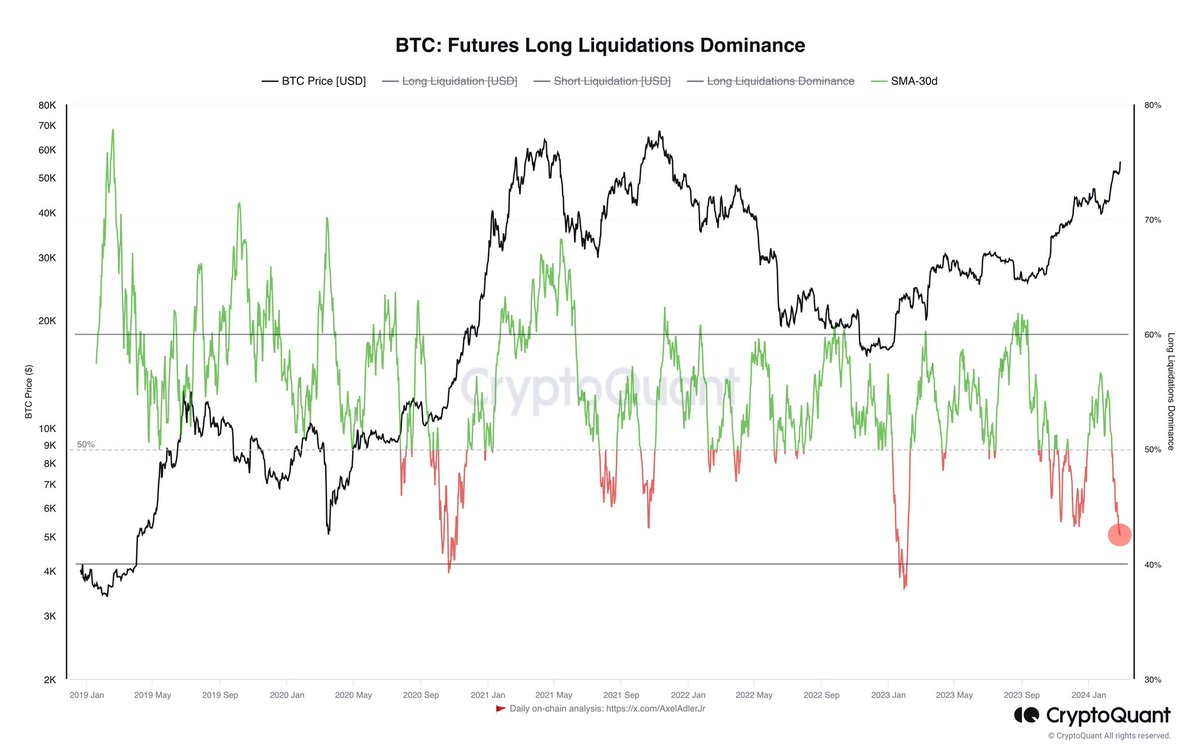

Despite the current positive market trend, short sellers continue to bet against the market and face liquidation as a result of opposing bets. It seems that the short sellers are not paying much attention to on-chain indicators.

Especially in the past week, funds that initially flowed into Sui and Solana at the beginning of the month seem to be returning to Ethereum.

Source: DeFiLlama

Source: DeFiLlama

Pandora NFT is rebounding, indicating that ERC404 may exist for the long term. Meanwhile, Pudgy Penguins NFT remains strong at a floor price of 20 ETH. However, the absence of the famous series Sappy Seals and Kanpai Pandas has also seen significant growth in their value, with Seals' floor price exceeding 1.7 ETH and Pandas' floor price exceeding 2.5 ETH.

Disclaimer: The cryptocurrency ecosystem is vast and constantly evolving, with numerous indicators of interest on a daily basis. This overview aims to highlight selected monthly indicators for brief insights and is not a comprehensive report.

Highlighted Highlights:

- As Bitcoin broke through the $60,000 mark, MicroStrategy's Bitcoin investment portfolio reached $12.4 billion.

- The U.S. Securities and Exchange Commission (SEC) accused the founder of HyperFund of a $1.7 billion fraud.

- Tether realized a profit of $2.9 billion in the fourth quarter and increased its reserves to $5.4 billion.

- FTX suspended its restart plans and committed to fully refunding user funds.

- After filing for bankruptcy, Celsius Network began distributing over $3 billion in assets to creditors and created a new Bitcoin mining company.

- Ethereum achieved a significant milestone, with 25% of ETH being staked.

- Bitcoin mining difficulty surpassed 8 trillion, reaching a new high.

- Cumulative trading volume for spot Bitcoin ETFs exceeded $50 billion.

- Ethereum's Dencun upgrade was successfully deployed on the Sepolia testnet, with plans for the mainnet launch.

- Harvest Fund focuses on the first Hong Kong spot Bitcoin ETF.

- Bitcoin mining company GRIID made its debut on Nasdaq.

- Uncorrelated Ventures launched a $315 million fund focused on crypto and software startups.

- Vitalik Buterin focuses on the synergistic prospects of cryptocurrency and artificial intelligence, supporting a new generation of leadership.

- Polygon Labs cut 19% of its workforce in a restructuring.

- Ripple co-founder's account suffered a $113 million security breach, causing a drop in XRP price.

- EigenLayer's total value locked (TVL) exceeded $6 billion, with an increase in deposit limits.

- Kraken expanded its European operations and obtained a license in the Netherlands.

- Binance decided to delist Monero (XMR), leading to a 15% price drop.

- The Solana network resumed operations after a five-hour shutdown.

- Frax Finance launched the second-layer network Fraxtal.

- Ethereum NFT trading volume approached yearly highs.

- Thailand announced the exemption of cryptocurrency gains from value-added tax.

- OKX expanded to Argentina, launching exchange and wallet services.

- Coinbase's fourth-quarter earnings exceeded expectations, with a significant increase in trading revenue.

- PlayDapp lost $290 million in tokens in a double security breach, with data support provided by Elliptic.

- Pudgy Penguins NFT surpassed Bored Ape Yacht Club in a historic floor price reversal.

- Starknet token unlocking sparked controversy between investors and the community.

- Court approved Genesis to sell $1.3 billion worth of GBTC shares.

- Ripple expands its regulatory capabilities through the acquisition of Standard Custody.

- FTX approved to sell $1 billion worth of Anthropic company shares.

- Circle ends support for USDC on the TRON network to strengthen risk management.

- OpenAI's release of the Sora text-to-video generator led to a surge in AI cryptocurrency prices.

- Trump's stance on Bitcoin softened during his campaign, hinting at open acceptance.

- Gemini reached a settlement with New York regulators, agreeing to return $1.1 billion to users.

Macro Analysis

Market Volatility and Regulatory Response in China

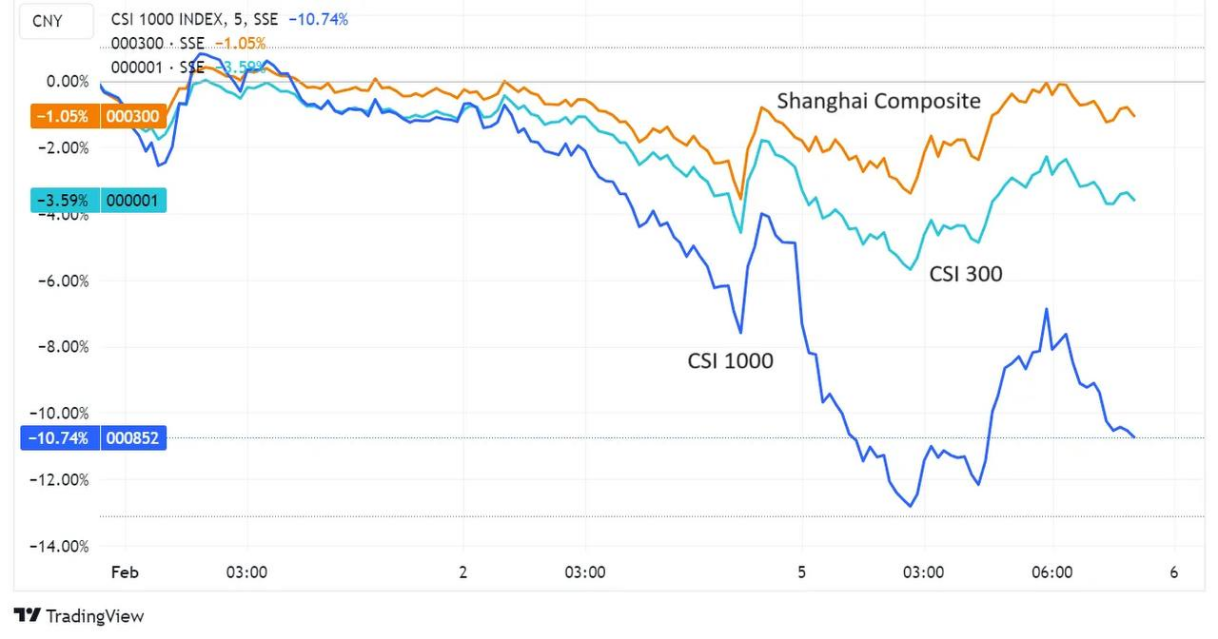

At the beginning of February, the Chinese stock market experienced a significant downturn. The CSI 1000 Index plummeted nearly 9% during trading hours, with 99% of listed companies suffering losses. The more selective CSI 300 Index also experienced a 2% decline.

In response to the rapid stock market decline, the China Securities Regulatory Commission (CSRC) swiftly took action to stabilize the market, pledging to combat "abnormal fluctuations" in stock prices and inject more "medium- to long-term funds" into the market. This intervention led to a significant rebound in the market; the CSI 1000 Index strongly rebounded, recording a nearly 7% increase. This rebound helped the CSI 300 Index close with a small gain and reduced the losses of the CSI 1000 Index, although it still closed with a 6% decline, marking nearly a 30% loss since the beginning of the year.

Additionally, the CSRC implemented additional measures to stabilize the market, including stricter short-selling rules, prohibiting certain quantitative hedge funds from executing sell orders, and guiding other funds to maintain their stock positions.

The authorities also appointed Wu Qing, known for his strong stance against financial risks and corruption, as the Chairman of the China Securities Regulatory Commission. Wu Qing previously managed the Shanghai Stock Exchange.

It is important to note that China's ability to use monetary stimulus may be limited by the vulnerability of the renminbi and inflation risks. Interest rate cuts could exacerbate these issues and have a negative impact on bank profitability. Fiscal stimulus measures are also constrained by high levels of local government debt.

Despite these challenges, Chinese investors are increasingly turning to cryptocurrency assets. The expected launch of a Bitcoin ETF in Hong Kong may facilitate this transition.

U.S. Economic Outlook: Loose Policies and Inflation Concerns

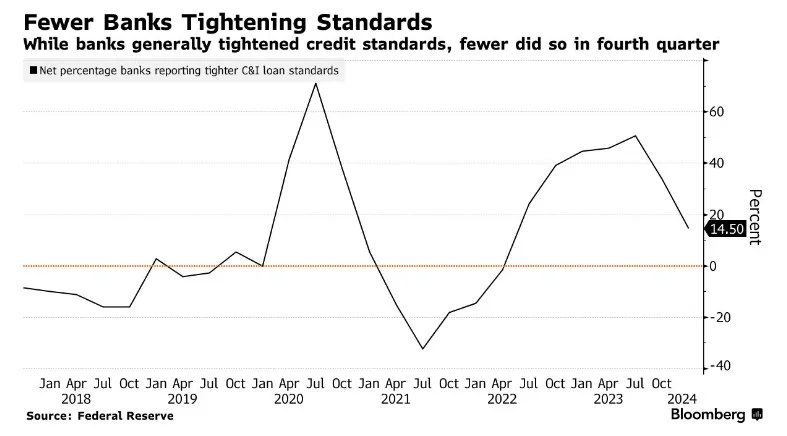

The latest survey from the Federal Reserve, the Senior Loan Officer Opinion Survey (SLOOS), shows that banks are beginning to loosen lending. This loosening trend is also reflected in the Chicago Fed's financial conditions index, showing the most accommodative financial conditions since November 2021. This shift may indicate a change in economic management, especially in the midst of the various uncertainties surrounding it.

Source: Bloomberg

Source: Bloomberg

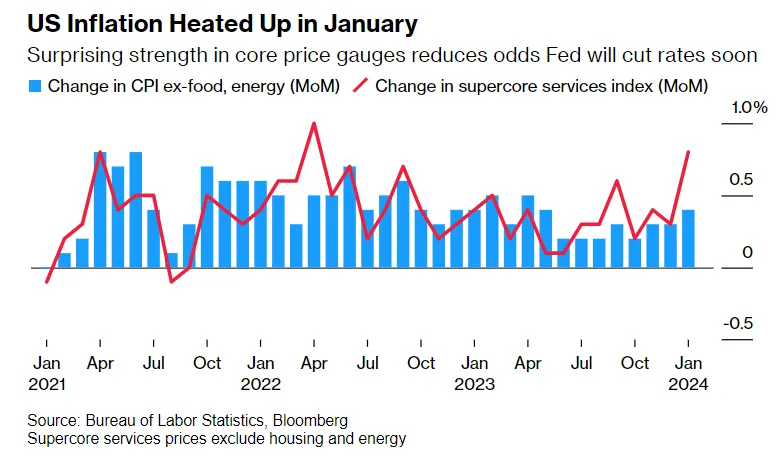

In contrast, inflationary pressures are gradually increasing. Reports from the Institute for Supply Management (ISM) and the Bureau of Labor Statistics paint a picture of rising costs for both businesses and workers. The latest data from ISM shows the largest increase in business costs since 2012. At the same time, rising wages and labor costs are sounding the alarm for inflation.

Employment data further illustrates this trend, with significant increases in average hourly earnings and unit labor costs, exacerbating concerns about inflation.

These complex signals have led to a reconsideration of the recent interest rate cut stance in the market. The rise in the yield of the 10-year U.S. Treasury bond reflects the market's response to these economic signals, particularly concerns about increasing inflation in the service industry and the Fed's focus on the sustainability of the inflation trend.

Therefore, we are currently in a challenging situation. On one hand, the economy has gained more room for activity with the relaxation of loan conditions. But on the other hand, the rising inflation has indeed raised substantial concerns. This balancing act between encouraging growth and controlling inflation demonstrates the complexity of the current economic situation.

Additionally, the Congressional Budget Office (CBO) released a report with some concerning forecasts for the U.S. economy over the next decade. The report states that government spending on interest payments is soon expected to exceed defense spending, and by 2034, these interest payments will exceed the entire budget deficit of 2023. Meanwhile, the ratio of U.S. debt to the economy may be twice as high as it has been for the past few decades. The CBO also predicts that the rising cost of borrowing could slow economic growth and exacerbate debt issues.

However, the focus on the rising cost of insuring U.S. debt has sparked increased interest in cryptocurrency as an alternative to conventional currencies. This suggests that the dollar may depreciate relative to stable investments such as gold or Bitcoin.

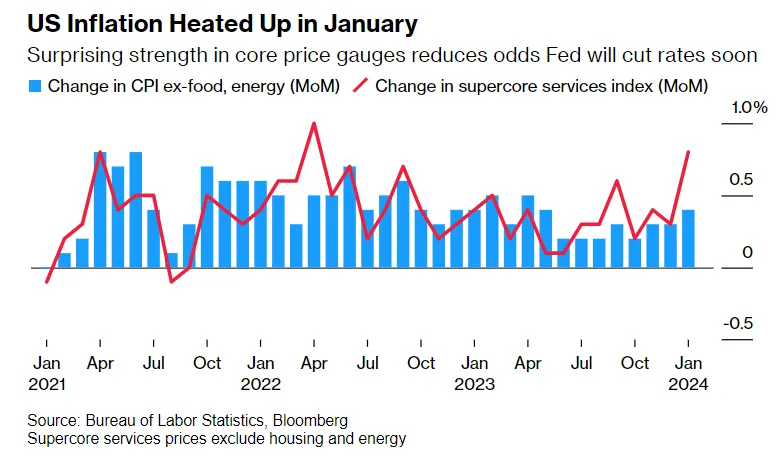

On February 14, we witnessed the inflation report for January, and indeed, the inflation rate in the U.S. has increased. The market reacted strongly to this, with the Nasdaq falling by 1.8%, and the S&P 500 and Dow Jones Industrial Average both dropping by nearly 1.4%. Bond yields such as the 10-year U.S. Treasury bond quickly rose by 15 basis points. Initially, Bitcoin also fell alongside stocks and bonds, but quickly rebounded.

Source: Bloomberg

Source: Bloomberg

Global Economic Overview

- The Japanese economy has entered a technical recession, with a decline in Gross Domestic Product (GDP) in the fourth quarter, raising concerns about the world's third-largest economy.

- The UK also faces a recession, with a larger-than-expected economic contraction in the fourth quarter, indicating widespread economic difficulties among major economies.

- The GDP growth in the European Union in the fourth quarter was almost zero, barely avoiding contraction. With the 2024 growth forecast revised downward, the EU is on the brink of recession, and Germany's weak economic outlook exacerbates the situation.

- The European Central Bank is managing expectations of a rate cut, emphasizing the need for more data before considering easing policies. This cautious approach contrasts with the economic challenges in the eurozone, such as inflation and the demand for rate adjustments, demonstrating the central bank's delicate balance in uncertain economic times.

- Nigeria has taken measures to prevent the devaluation of its currency, the naira, by restricting access to cryptocurrency exchanges to reduce capital outflows and speculative trading.

Conclusion

Despite some uncertainty in the broader economic environment, February marked a significant period of success for Bitcoin and the broader cryptocurrency market. The crypto industry seems to be entering an exciting phase of expansion, with many compelling narratives emerging, which are expected to establish a strong foothold for growth in the coming months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。