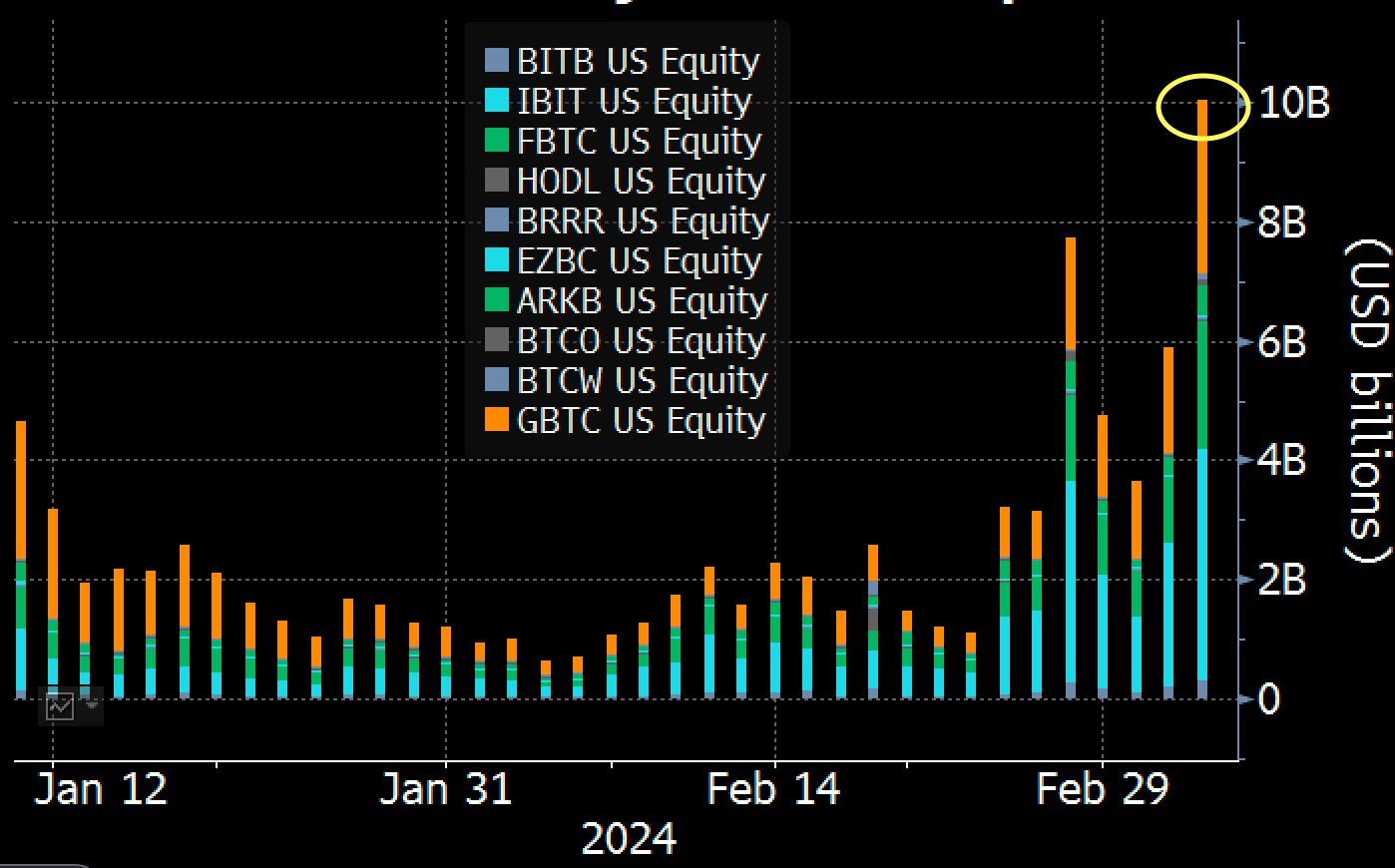

Ten spot bitcoin exchange-traded funds (ETFs) extended their record-breaking streak this week, surpassing their previous trading volume record set last Wednesday. This surge coincided with bitcoin hitting a new all-time high and subsequent price correction. Bloomberg ETF analyst Eric Balchunas shared on social media platform X Monday:

MILESTONE: the ten bitcoin ETFs did $10b in volume today, smashing prev record set last Wed … Volatility and volume go hand in hand with ETFs so not totally surprised. That said these are bananas numbers for ETFs under 2mo old. IBIT, FBTC, BITB, ARKB all w record days.

Spot bitcoin ETF trading volumes showing record day on Tuesday. Source: Bloomberg, Eric Balchunas.

The 10 spot bitcoin ETFs are Blackrock’s Ishares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), Ark 21shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), Invesco Galaxy Bitcoin ETF (BTCO), Wisdomtree Bitcoin ETF (BTCW), Vaneck Bitcoin Trust ETF (HODL), Franklin Bitcoin ETF (EZBC), Valkyrie Bitcoin ETF (BRRR), and Grayscale Bitcoin Trust (GBTC).

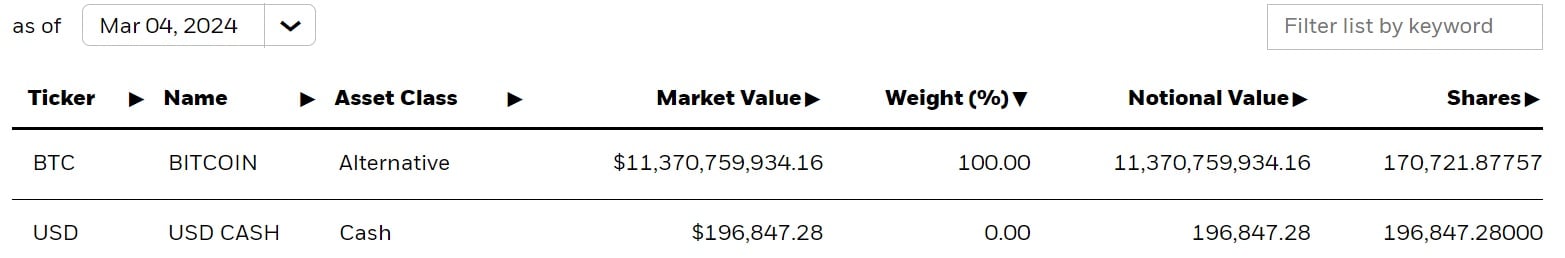

Since launch, Blackrock’s IBIT has amassed over 170K BTC as of March 4.

IBIT’s bitcoin holdings as of March 4. Source: Blackrock’s Ishares website.

Many anticipate further BTC price increases due to the high demand for spot bitcoin ETFs and the approaching Bitcoin halving. Several prominent figures in the cryptocurrency space have offered bullish predictions for bitcoin’s price this year. Bitwise’s CIO sees potential for a surge above $200,000, emphasizing that there is “too much demand and not enough supply.” Skybridge Capital’s founder believes it’s still an opportune time to invest in BTC, while Galaxy Digital’s CEO sees “tremendous global demand for bitcoin.” Veteran trader Peter Brandt also upped his price target for the current BTC bull market to $200,000, reflecting the overall optimistic sentiment. However, JPMorgan contradicts optimistic market expectations, predicting a BTC price drop to $42,000 after the halving.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。